Global Conversation Intelligence Software Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-based, On-Premises), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Conversation Channel (Voice, Video Meetings, Digital, Omnichannel), By Application (Sales & Revenue Optimization, Customer Support & Experience, Compliance & Risk Management, Other Applications), By Industry Vertical (BFSI, Healthcare, Retail & E-commerce, IT & Telecom, Travel & Hospitality, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156006

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Investment & Benefits

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Conversation Channel Analysis

- Application Analysis

- Industry Vertical Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

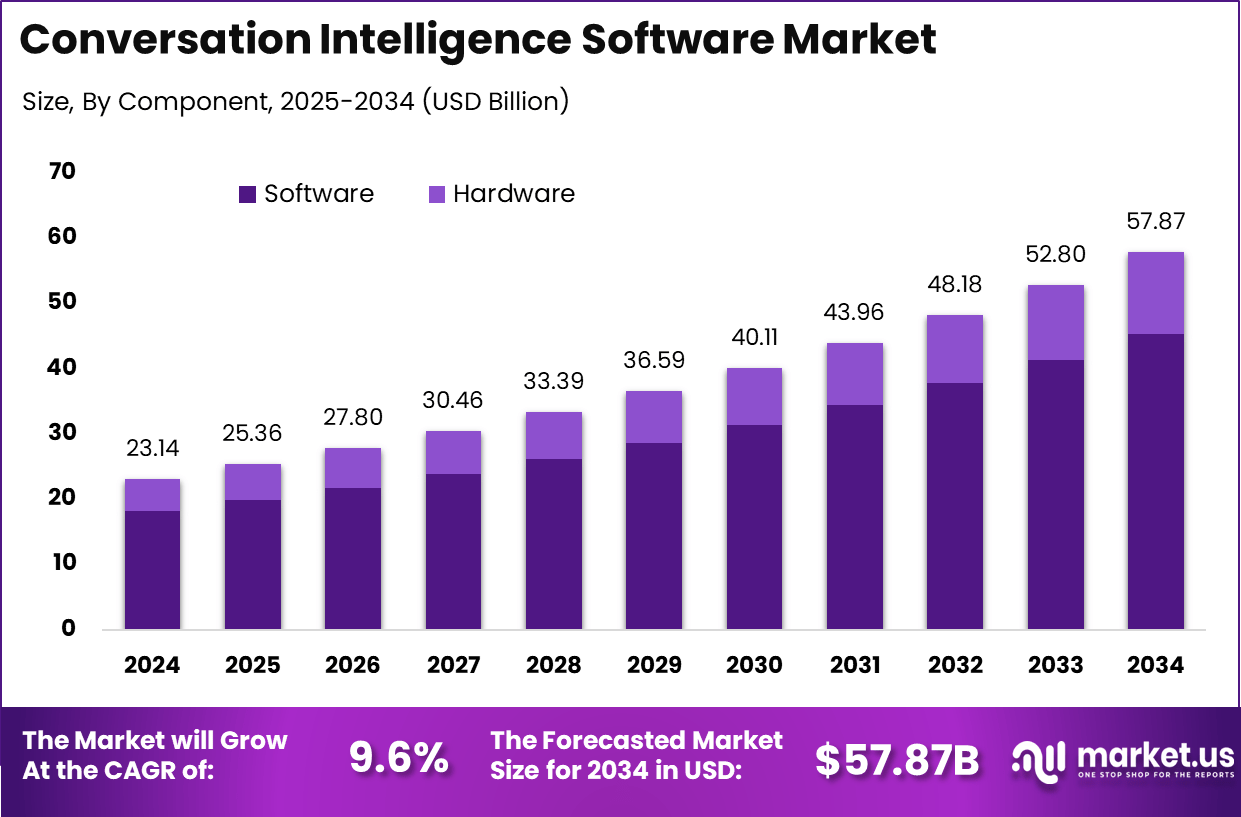

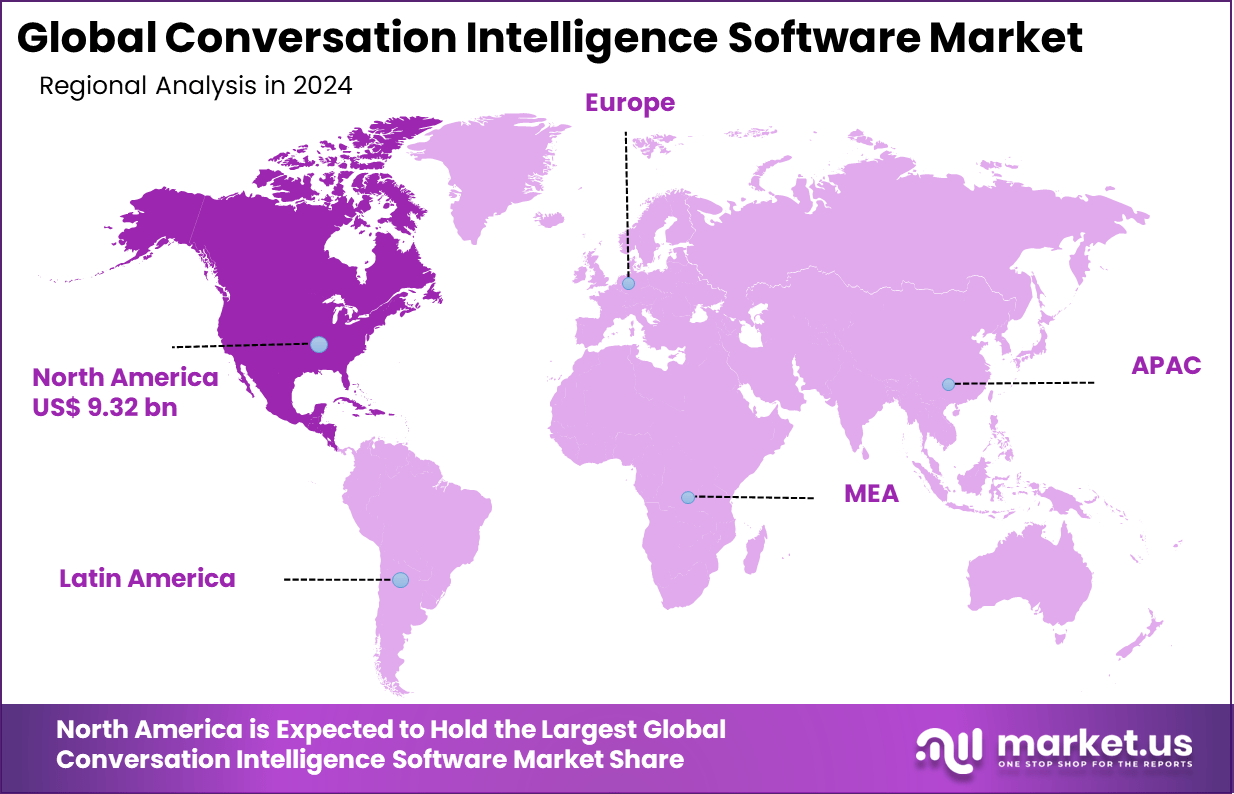

The Global Conversation Intelligence Software Market size is expected to be worth around USD 57.87 billion by 2034, from USD 23.14 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share, holding USD 9.32 billion in revenue.

The conversation intelligence software market focuses on tools that analyze customer conversations across calls, emails, and chats using technologies such as artificial intelligence, speech recognition, and natural language processing. These tools convert unstructured conversations into meaningful insights, helping businesses improve customer experience, compliance, and internal performance.

Top factors driving this market include the growing need for businesses to enhance customer experience and improve agent performance. Conversation intelligence software enables real-time monitoring and coaching, allowing sales and support teams to respond effectively and personalize their interactions. The increasing reliance on AI and automation is also a key driver, helping companies reduce human errors, increase productivity, and make data-driven decisions.

For instance, in August 2025, Contentsquare announced its acquisition of Loris AI to further enhance its conversation intelligence capabilities. This acquisition enables Contentsquare to deepen its AI-driven analytics, providing more sophisticated insights into customer interactions across digital platforms. It aims to offer businesses more powerful tools to optimize customer engagement, improve conversion rates, and enhance overall user experience.

Key Takeaway

- 78.3% share was held by the Software segment, establishing it as the primary growth driver of the market.

- 86.4% of adoption came from Cloud-based deployment, reflecting a clear preference for flexible and scalable solutions.

- 58.1% share was contributed by Large Enterprises, showing stronger adoption among organizations with extensive sales and customer operations.

- 46.8% of the market was captured by the Voice segment, highlighting the importance of voice-driven insights in business strategies.

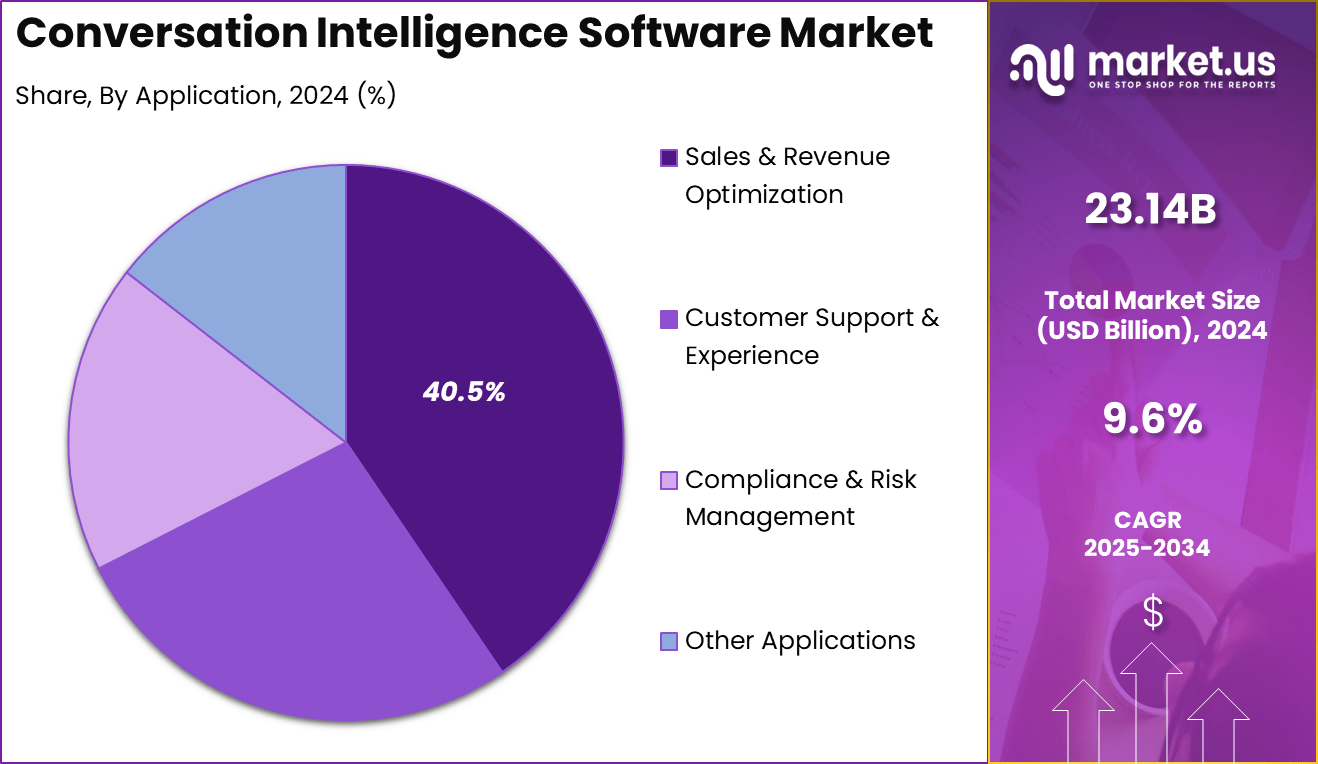

- 40.5% share was held by Sales & Revenue Optimization applications, underlining its role in improving performance and outcomes.

- 22.7% share came from the BFSI sector, marking it as a leading industry vertical in leveraging conversation intelligence.

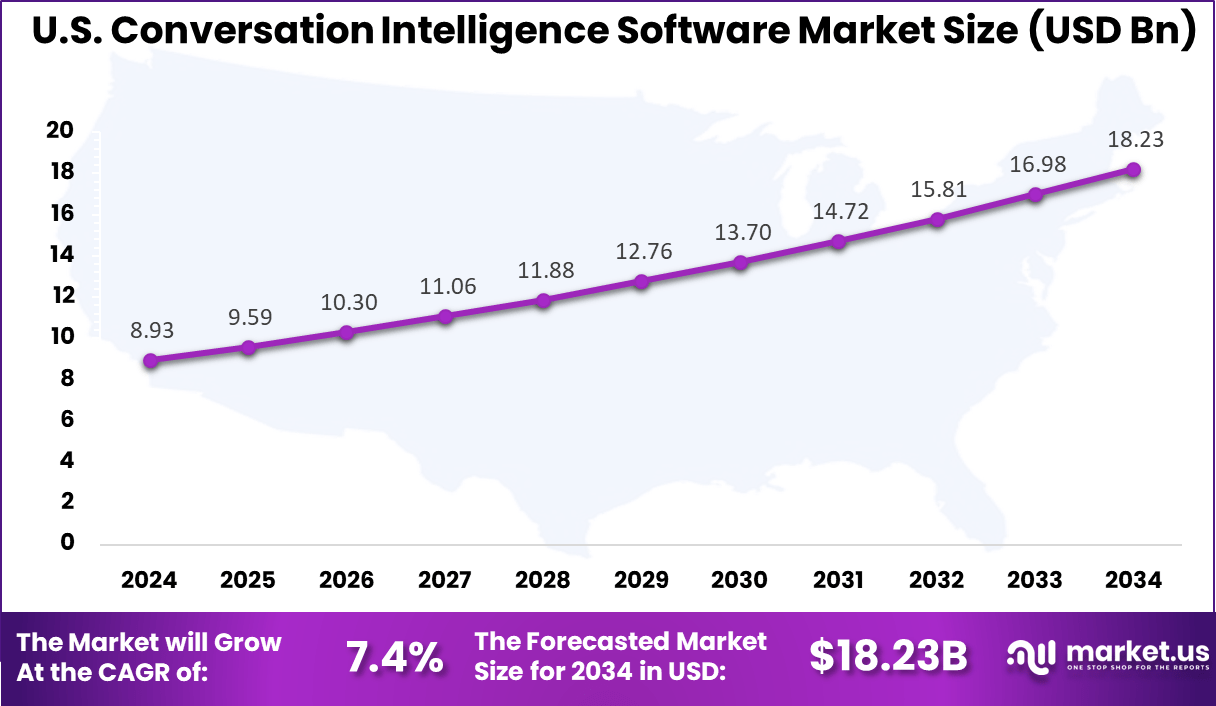

- The U.S. market was valued at USD 8.93 Billion in 2024, supported by a 7.4% CAGR, reflecting steady long-term growth.

- North America led globally with 40.3% share, owing to advanced digital infrastructure, strong enterprise adoption, and investment in AI-driven business tools.

According to llcbuddy, customer service leaders are prioritizing digital-first strategies to strengthen customer loyalty and retention, with 31% ranking this as their top goal. AI is seen as a game-changer, with 86% believing it will transform customer experience and 71% planning to increase investments in AI chatbots. Already, 55% of customers prefer self-serve options, making AI chatbots and live chat the most widely used service channels in 2025.

Investments are also expanding into mobile and analytics, with 34% of leaders planning their first customer service mobile app and 45% focusing on customer journey analytics. At the same time, 85% report improved ability to scale operations with business growth. For complex issues, 54% believe a human assisted by AI is the best approach, while 46% of customers expect more personalized communication to build trust.

Omnichannel service delivery is becoming critical, with 79% of leaders agreeing it should be available across all customer touchpoints. However, challenges remain, as 22% struggle to understand customer needs and 21% find it hard to meet rising expectations. Looking ahead, 77% of leaders expect AI to handle the majority of customer tickets without human agents by 2025, showing a rapid move toward automation-driven support.

Investment & Benefits

Investment opportunities in this market are strong as companies continue to adopt AI-powered communication tools. Startups and established providers are developing solutions that integrate seamlessly with CRMs and enterprise communication systems. The ability to scale analytics, provide omnichannel support, and offer real-time insights makes these platforms attractive for investors looking to tap into the digital transformation of customer interactions.

Businesses benefit from conversation intelligence software by gaining a deeper understanding of what customers want and improving their sales techniques. For example, these tools help identify customer pain points, improve conversion rates, and enhance customer retention. They also allow managers to coach agents effectively using comprehensive analytics rather than relying on manual reviews. This leads to better customer satisfaction, increased operational efficiency, and optimized marketing and sales strategies.

The regulatory environment emphasizes data privacy and security, especially since these platforms handle sensitive customer conversations. Compliance with regulations like GDPR and CCPA requires robust encryption, user access controls, and audit trails to protect personal data. Companies deploying conversation intelligence software must ensure adherence to these standards to maintain trust and avoid legal risks.

U.S. Market Size

The market for Conversation Intelligence Software within the U.S. is growing tremendously and is currently valued at USD 8.93 billion, the market has a projected CAGR of 7.4%. The market is growing tremendously due to the increasing adoption of AI and machine learning technologies across industries.

U.S. businesses are prioritizing customer experience and data-driven decision-making, driving demand for tools that analyze customer interactions in real time. Additionally, the rise of remote work and digital customer interactions has amplified the need for automated solutions to enhance sales and support operations.

For instance, in June 2025, the U.S. government announced plans to build its own AI chatbot with assistance from a former Tesla engineer. The initiative aims to enhance government services by leveraging conversational intelligence software to streamline interactions and improve public communication. This AI chatbot will be designed to handle a variety of inquiries, providing real-time responses and assisting with administrative tasks.

In 2024, North America held a dominant market position in the Global Conversation Intelligence Software Market, capturing more than a 40.3% share, holding USD 9.32 billion in revenue. The dominance is due to its strong technological infrastructure and early adoption of AI-driven solutions.

The region’s businesses, especially in sectors like sales, customer support, and marketing, are increasingly utilizing conversation intelligence software to improve operational efficiency and customer experience. Additionally, the presence of major software providers, coupled with favorable investment conditions and a high rate of digital transformation, further fueled the market’s growth in North America.

For instance, in August 2025, SoundHound AI announced that three major global automotive brands had rolled out its advanced Chat AI assistant in North America. This expansion highlights North America’s dominance in the Conversation Intelligence Software market, driven by the region’s strong technological infrastructure and early adoption of AI solutions.

Component Analysis

In 2024, the Software segment held a dominant market position, capturing a 78.3% share of the Global Conversation Intelligence Software Market. This dominance is due to the increasing reliance on AI-powered solutions that enhance real-time analysis of customer interactions.

Businesses are adopting these software solutions to improve sales, customer support, and marketing strategies. The software’s ability to integrate with CRM systems, automate workflows, and provide actionable insights has made it essential for companies aiming to optimize operational efficiency and customer experience.

For Instance, in November 2023, LivePerson launched a suite of conversational intelligence solutions designed to accelerate digital and contact center transformation. These AI-powered tools provide businesses with deep insights into customer interactions, allowing them to enhance service efficiency and customer experience.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing an 86.4% share of the Global Conversation Intelligence Software Market. The dominance is due to the increasing preference for scalable, cost-effective, and flexible solutions.

Cloud-based platforms allow businesses to access real-time insights and data from anywhere, facilitating seamless collaboration and faster decision-making. Additionally, the cloud model offers enhanced security, easy integration with other enterprise systems, and lower upfront costs, making it a preferred choice for many organizations.

For instance, in March 2024, Salesforce introduced a new cloud-based conversational intelligence solution for its Service Cloud platform. This solution leverages AI to analyze customer interactions in real time, providing businesses with actionable insights that enhance customer service and support. The cloud-based model allows organizations to scale easily and access data from anywhere, streamlining workflows and improving overall efficiency.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 58.1% share of the Global Conversation Intelligence Software Market. This dominance is due to the vast scale and complexity of operations in large enterprises, which require advanced solutions to manage high volumes of customer interactions.

These organizations invest heavily in conversation intelligence software to improve sales, customer service, and overall operational efficiency. Furthermore, the ability to integrate these tools with existing enterprise systems, such as CRM and ERP, drives efficiency and supports data-driven decision-making.

For Instance, in July 2025, Contentsquare announced its acquisition of Loris AI to enhance its conversation analytics capabilities, catering particularly to large enterprises. This acquisition highlights the growing demand for advanced conversation intelligence solutions in large-scale organizations, which require sophisticated tools to manage and analyze vast amounts of customer data.

Conversation Channel Analysis

In 2024, the Voice segment held a dominant market position, capturing a 46.8% share of the Global Conversation Intelligence Software Market. The dominance is due to the growing use of voice-enabled devices and virtual assistants in customer interactions.

Businesses are increasingly leveraging voice analytics to gain real-time insights, improve customer service, and enhance sales processes. The ability to analyze tone, sentiment, and context in voice conversations has made voice-based conversation intelligence essential for delivering personalized and efficient customer experiences.

For instance, in March 2025, Twilio introduced Generative Customer Operators, a new feature designed to pull insights from customer calls, enhancing its voice-based conversation intelligence software. This innovation leverages generative AI to analyze voice interactions in real-time, enabling businesses to gain deeper insights into customer behavior, sentiment, and needs.

Application Analysis

In 2024, the Sales & Revenue Optimization segment held a dominant market position, capturing a 40.5% share of the Global Conversation Intelligence Software Market. The dominance is due to the growing need for businesses to enhance sales performance and maximize revenue potential.

Conversation intelligence tools analyze customer interactions to identify buying signals, optimize sales pitches, and improve lead conversion rates. This enables sales teams to make data-driven decisions, personalize engagement, and close deals more effectively, fueling demand in this segment.

For instance, in March 2023, RingCentral launched RingSense for Sales, a conversational intelligence solution aimed at optimizing sales productivity. This tool helps sales teams enhance their performance by analyzing customer interactions in real-time, extracting valuable insights that improve engagement strategies.

Industry Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing a 22.7% share of the Global Conversation Intelligence Software Market. The dominance is due to the increasing reliance on AI-driven solutions to enhance customer service, streamline operations, and improve compliance in the highly regulated BFSI sector.

Conversation intelligence software helps these organizations analyze customer interactions, detect potential issues, personalize services, and improve overall customer satisfaction, making it essential for businesses in this vertical to stay competitive.

For instance, in March 2025, Zocks secured $13.8M in Series A funding to enhance its AI-driven conversation intelligence platform, specifically designed for financial advisors. This investment aims to refine the way financial institutions engage with clients by leveraging conversation intelligence to gain deeper insights from client interactions.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-Premises

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Conversation Channel

- Voice

- Video Meetings

- Digital

- Omnichannel

By Application

- Sales & Revenue Optimization

- Customer Support & Experience

- Compliance & Risk Management

- Other Applications

By Industry Vertical

- BFSI

- Healthcare

- Retail & E-commerce

- IT & Telecom

- Travel & Hospitality

- Others

Drivers

Increased Demand for Enhanced Customer Experience

The growing focus on improving customer experience is a key driver for the adoption of conversation intelligence tools. Businesses are increasingly focusing on delivering personalized services and higher-quality interactions.

Conversation intelligence software helps by analyzing customer conversations to uncover insights into consumer preferences, pain points, and behavior patterns, allowing businesses to better understand and meet customer needs. This enhanced customer-centric approach strengthens customer loyalty, drives satisfaction, and improves overall business performance.

For instance, in August 2025, Alvaria and CallMiner announced a strategic partnership to enhance operational efficiency and customer experience through advanced AI and conversation intelligence. By integrating CallMiner’s conversation analytics with Alvaria’s customer engagement solutions, the partnership aims to provide businesses with deeper insights into customer interactions, improving decision-making and overall performance.

Restraint

Privacy and Data Security Concerns

As conversation intelligence tools process sensitive customer data, privacy and security concerns become significant barriers to adoption. Stricter regulations like GDPR and other data protection laws place limitations on how companies can utilize such software.

Businesses must ensure compliance with these regulations to avoid penalties and maintain consumer trust. The complexity of safeguarding personal data while extracting actionable insights can slow down the deployment of conversation intelligence tools, particularly in industries dealing with high volumes of sensitive information.

For instance, in January 2025, DeepSeek, a new Chinese AI chatbot, raised significant privacy and security concerns. As the conversation intelligence software becomes more advanced, platforms like DeepSeek, which process vast amounts of user data, face scrutiny over how they handle sensitive information.

Opportunities

Integration with Voice Assistants and Chatbots

The increasing use of voice assistants and chatbots presents a significant opportunity for conversation intelligence software. By integrating these tools with AI-powered voice and text platforms, businesses can gain deeper insights into customer interactions.

Conversation intelligence software can enhance virtual assistant capabilities, providing actionable insights that help companies improve customer engagement. This integration creates a more seamless, efficient way to analyze multi-channel interactions, allowing businesses to better understand customer needs and enhance overall communication strategies.

For instance, in November 2024, Apple introduced a game-changing upgrade to Siri, enhancing its conversational intelligence capabilities. This update integrates advanced AI-driven insights, enabling Siri to provide more personalized and contextually aware responses. By expanding its functionality to work seamlessly with voice assistants and chatbots, Apple’s upgrade sets a new standard for multi-channel communication.

Challenges

Competitive Market Dynamics

The market is highly competitive, with rapid innovation and a growing number of new entrants challenging established players like Gong.io, Chorus.ai, and Salesloft. This intense competition forces vendors to continuously innovate and differentiate their offerings.

Advanced features, such as deeper AI-driven analytics and integrations with various CRM systems, are essential for standing out in the market. Vendors must focus on improving their products while maintaining high-quality customer service to sustain their competitive edge amidst growing market pressure.

For instance, in May 2025, Twilio updated its conversational intelligence platform, expanding its Customer Data Platform (CDP) to offer more comprehensive insights. This move underscores the competitive dynamics in the conversation intelligence market, where companies like Twilio are continually enhancing their offerings to stay ahead.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Conversation Intelligence Software Market, leading cloud and CDN providers such as Akamai Technologies, Cloudflare, Amazon Web Services (AWS) CloudFront, Fastly, Google Cloud CDN, Microsoft Azure CDN, Edgio, Imperva, StackPath, and Tencent Cloud CDN play a vital role. These players ensure faster data delivery, security, and reliability, which are essential for handling high volumes of conversational data.

The market is also shaped by specialized conversation intelligence firms, including Gong.io, SalesLoft, Chorus.ai, ExecVision, CallRail, DialogTech, VoiceOps, People.ai, Kreato CRM, Tethr, and Invoca. These companies focus on capturing, analyzing, and interpreting customer conversations across channels.

Additionally, other niche vendors and emerging providers continue to expand the competitive landscape. These players focus on advanced features such as predictive analytics, real-time call monitoring, and integration with customer relationship management systems. Their innovations are addressing specific business needs like compliance, call attribution, and revenue intelligence.

Top Key Players in the Market

- Akamai Technologies

- Cloudflare, Inc.

- Amazon Web Services (AWS) CloudFront

- Fastly, Inc.

- Google Cloud CDN

- Microsoft Azure CDN

- Edgio (formerly Limelight Networks)

- Imperva

- StackPath

- Tencent Cloud CDN

- Gong.io

- SalesLoft

- Chorus.ai

- ExecVision

- CallRail

- DialogTech

- VoiceOps

- People.ai

- Kreato CRM

- Tethr

- Invoca

- Others

Recent Developments

- In June 2025, Google Cloud introduced AI-powered tools like the Statement of Work (SOW) Analyzer and Bot-Assisted Live Chat. These tools aim to increase partner efficiency and provide more intelligence, supporting the development of advanced conversation intelligence solutions.

- In January 2025, Google and Mercedes-Benz announced a partnership to integrate conversational artificial intelligence (AI) into Mercedes vehicles. This collaboration aims to enhance the in-car experience by allowing drivers to interact with the vehicle through voice commands powered by Google’s AI technology.

Report Scope

Report Features Description Market Value (2024) USD 23.14 Bn Forecast Revenue (2034) USD 57.87 Bn CAGR(2025-2034) 9.6% Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-Premises), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Conversation Channel (Voice, Video Meetings, Digital, Omnichannel), By Application (Sales & Revenue Optimization, Customer Support & Experience, Compliance & Risk Management, Other Applications), By Industry Vertical (BFSI, Healthcare, Retail & E-commerce, IT & Telecom, Travel & Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Akamai Technologies, Cloudflare, Inc., Amazon Web Services (AWS), CloudFront, Fastly, Inc., Google Cloud CDN, Microsoft Azure CDN, Edgio (formerly Limelight Networks), Imperva, StackPath, Tencent Cloud CDN, Gong.io, SalesLoft, Chorus.ai, ExecVision, CallRail, DialogTech, VoiceOps, People.ai, Kreato CRM, Tethr, Invoca, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Conversation Intelligence Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Conversation Intelligence Software MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akamai Technologies

- Cloudflare, Inc.

- Amazon Web Services (AWS) CloudFront

- Fastly, Inc.

- Google Cloud CDN

- Microsoft Azure CDN

- Edgio (formerly Limelight Networks)

- Imperva

- StackPath

- Tencent Cloud CDN

- Gong.io

- SalesLoft

- Chorus.ai

- ExecVision

- CallRail

- DialogTech

- VoiceOps

- People.ai

- Kreato CRM

- Tethr

- Invoca

- Others