Global Control Valves Market By Component (Valve Body, Actuators, Others), By Size (Less than 1, Between 1 to 6, Between 6 to 25, Between 25 to 50, More than 50), By Product (Linear, Gate, Diaphragm, Others, Rotary, Ball, Butterfly, Plug), By Application (Oil & Gas, Chemicals, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 35290

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

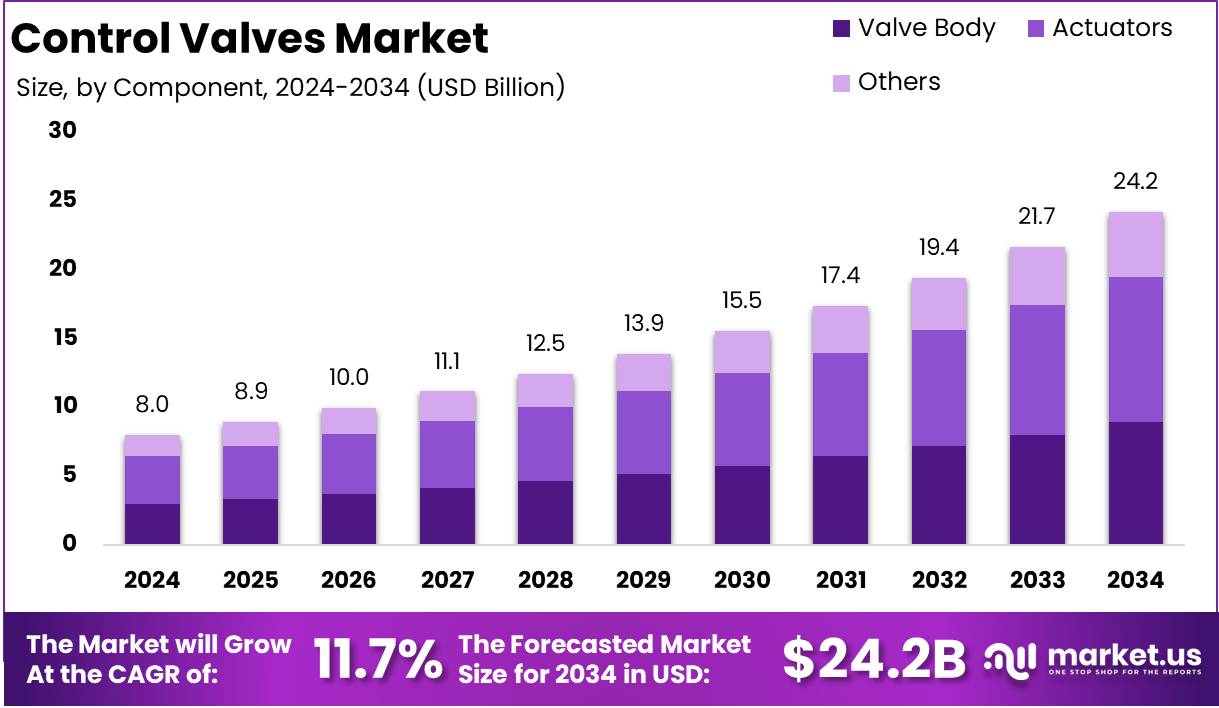

The Global Control Valves Market size is expected to be worth around USD 24.2 Billion by 2034 from USD 8.0 Billion in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034.

Control valves are precision-engineered mechanical devices used to regulate the flow, pressure, temperature, or level of fluids within a system. By adjusting the size of the flow passage, these valves ensure optimal process control across a wide range of industrial applications. Integrated with actuators and positioned as key components within automated systems, control valves receive signals from controllers and modulate fluid dynamics accordingly.

Their deployment spans critical industries such as oil & gas, power generation, water and wastewater management, chemical processing, food & beverages, and pharmaceuticals, where consistent process parameters are essential for operational safety, efficiency, and product quality.

The control valves market refers to the global industry involved in the manufacturing, distribution, and integration of control valve systems and associated technologies. This market encompasses a variety of valve types such as globe, ball, butterfly, and diaphragm valves—each tailored for specific industrial functions and process requirements.

The sector is closely aligned with automation and smart manufacturing trends, as advancements in control systems, sensors, and digital interfaces enhance the performance, efficiency, and diagnostics capabilities of valve systems. Market participants include valve manufacturers, automation solution providers, and system integrators working across diverse industrial verticals. The control valves market plays a foundational role in enabling real-time control and process optimization in both established and emerging industrial infrastructures.

The growth of the control valves market can be attributed to increasing industrial automation, rapid expansion of smart manufacturing practices, and rising investments in infrastructure development. Modern industrial processes demand high levels of accuracy and reliability, driving the adoption of advanced flow control solutions.

Robust demand for control valves continues to emerge from sectors such as oil & gas, chemicals, and power generation, where operational continuity and process integrity are paramount. The push toward renewable energy infrastructure, including solar and wind power plants, has also contributed to the expanding use of control valve systems to manage fluid dynamics in auxiliary and storage processes.

Significant market opportunity lies in the integration of smart valve technologies, including predictive maintenance, wireless control, and cloud-based performance analytics. As industries transition toward Industry 4.0, there is a growing requirement for intelligent control systems capable of supporting remote operations and automated fault diagnostics.

According to Instrumentation Tools, control valves with equal percentage characteristics require a differential pressure (DP) of 30–35% of the total dynamic drop, while linear characteristics may demand up to 50% DP; however, over 15% DP is typically adequate for most control applications. Effective valve control occurs between 25% to 60% valve opening, with approximately 65% of the Cv rating ensuring sufficient control margin.

Additionally, optimal valve performance is achieved even when utilizing only 3–4% of the valve’s rated capacity. These operational parameters underline the strategic importance of control margin engineering and valve sizing in process optimization, directly supporting the Control Valves Market’s projected growth trajectory across industrial automation and flow regulation segments.

Key Takeaways

- The Global Control Valves Market is projected to expand significantly, reaching approximately USD 24.2 billion by 2034, up from USD 8.0 billion in 2024, driven by a strong CAGR of 11.7% over the forecast period (2025–2034).

- In 2024, actuators emerged as the leading component, accounting for over 43.4% of the total market share.

- Control valves sized between 1 to 6 inches held a dominant position in the market by size in 2024, capturing more than 32.4% of the share.

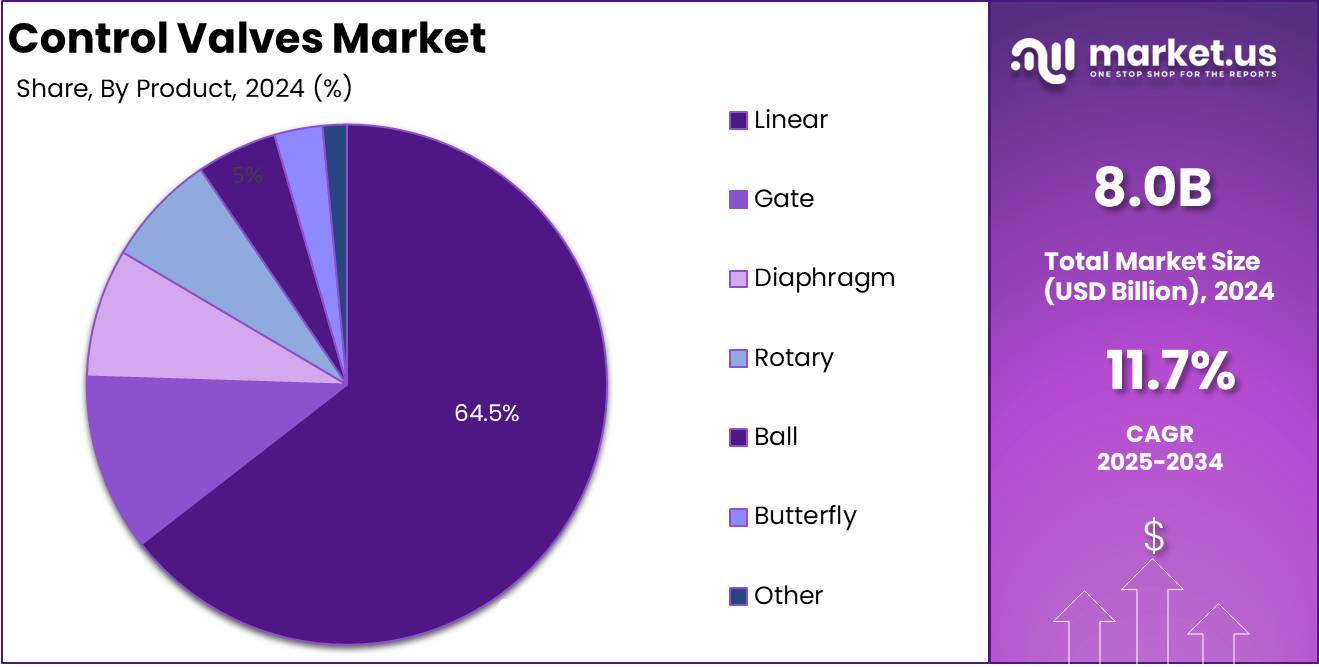

- Linear control valves represented the largest share by product type in 2024, contributing to over 64.5% of the total market.

- The oil & gas industry remained the dominant end-use sector in 2024, securing 24.2% of the global market share.

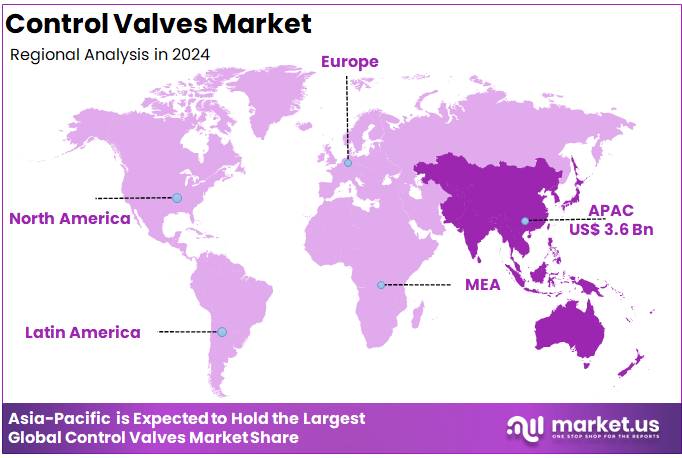

- Asia-Pacific led the global control valves market in 2024 with a commanding 45.8% share, equivalent to USD 3.6 billion in market value.

By Component Analysis

In 2024, Actuators Held a Dominated the Control Valves Market, Capturing More Than 43.4% Market Share

In 2024, Actuators held a dominant market position in the By Component segment of the Control Valves Market, capturing more than 43.4% of the total market share. This leadership can be attributed to the widespread adoption of actuators across multiple industries such as oil & gas, water treatment, and power generation, where automation and precision control are essential. Actuators are critical in translating control signals into mechanical movement, enabling real-time adjustments in valve operations, which significantly enhances process efficiency and safety. Technological advancements, such as the integration of smart sensors and digital control, have further strengthened the demand for advanced actuators in industrial settings.

The increasing trend toward industrial automation and smart manufacturing is expected to continue driving the growth of the actuator segment. Compact designs, enhanced durability, and energy-efficient models are gaining popularity, especially in industries focused on minimizing downtime and maximizing productivity.

The robust demand from the chemicals and pharmaceuticals sectors, where precise flow control is vital, also supports the dominance of this segment. As global industries modernize, the role of actuators in delivering responsive, reliable, and remote-controlled valve operations remains indispensable.

In 2024, the Valve Body segment held a substantial position in the By Component classification of the Control Valves Market. The prominence of this segment can be attributed to the valve body’s critical function as the main pressure-retaining part that houses internal components and facilitates fluid flow control.

Its application is vital in demanding operational environments such as oil and gas, thermal power, and marine industries, where resilience under extreme conditions is essential. The growing preference for corrosion-resistant and durable materials has led to increased adoption of advanced alloys and high-grade metals in valve body manufacturing.

Expansion in global infrastructure and the rising deployment of fluid management systems across developing economies are further expected to boost demand for valve bodies. Industries are placing greater emphasis on long-term performance, minimal maintenance needs, and compatibility with complex systems.

In 2024, the Others segment, encompassing auxiliary components such as trims, stems, seals, gaskets, and positioners, maintained a notable presence within the Control Valves Market by component. While it comprises a smaller share compared to primary elements like actuators and valve bodies, this segment plays an essential supporting role in enhancing the overall functionality and integrity of control valve assemblies.

As industrial processes become more intricate, the need for precise flow control and leak prevention has led to a rising demand for high-quality secondary components. Innovations in internal valve design and sealing technologies are helping optimize performance while minimizing energy losses and operational risks.

By Size Analysis

In 2024, Between 1 to 6 size Held a Dominated the Control Valves Market, Capturing More Than 32.4% Market Share

In 2024, the Between 1 to 6 size segment held a dominant market position in the By Size classification of the Control Valves Market, capturing more than 32.4% of the total market share. This segment’s prominent share can be attributed to the widespread application of valves in industries where moderate flow control is required.

Commonly used in sectors such as water treatment, power generation, and chemicals, valves in the 1 to 6-inch range offer an ideal balance between compact design and efficient performance. The moderate size of these valves makes them versatile, offering a wide range of flow control options for various system pressures and temperatures.

This size range has seen increasing demand due to its compatibility with numerous industrial automation systems, especially those where space constraints are a consideration. Additionally, the growing need for more energy-efficient and cost-effective fluid control systems has further fueled the demand for valves in this size category. Industries looking to optimize operational efficiency while maintaining system reliability are increasingly opting for 1 to 6-inch control valves, ensuring that this segment will maintain a significant position in the market in the coming years.

In 2024, the Less than 1 inch size segment held a significant position in the Control Valves Market. Valves in this range are used in applications requiring precise control of small fluid flows, such as medical devices and small-scale chemical processes. The growing demand for efficient and compact valves in niche sectors is driving the segment’s growth. With the ongoing trend of miniaturization and advanced technologies in industries like pharmaceuticals and food processing, the Less than 1 inch segment is expected to expand further.

In 2024, the Between 6 to 25 inches size segment held a prominent position in the Control Valves Market. These valves are commonly used in large-scale industrial applications, such as oil and gas, power plants, and manufacturing, where reliable flow control is essential. The segment’s growth is driven by the increasing global demand for energy and infrastructure expansion. As industries require precision in large systems, the adoption of 6 to 25-inch control valves is anticipated to rise.

In 2024, the Between 25 to 50 inches size segment held a notable share in the Control Valves Market. Valves in this range are crucial for high-demand sectors, including petrochemicals and water treatment, where large fluid volumes need to be controlled precisely. The segment is expected to grow, driven by the expansion of large infrastructure projects and the increasing demand for energy and water resources. The ongoing industrial expansion in emerging markets is also contributing to the growth of this segment.

In 2024, the More than 50 inches size segment represented a smaller but essential portion of the Control Valves Market. These valves are designed for industries with extremely high-flow requirements, such as oil and gas extraction and power plants. Despite being a niche segment, its growth is sustained by the rising demand for energy and large infrastructure projects. Technological advancements and the need for efficient fluid management in large-scale systems are expected to continue supporting the growth of this segment.

By Product Analysis

In 2024, Linear Held a Dominated the Control Valves Market, Capturing More Than 64.5% Market Share

In 2024, Linear control valves held a dominant market position in the By Product segmentation of the Control Valves Market, capturing more than 64.5% of the total market share. Linear control valves are preferred in applications that require precise regulation of flow rates, making them essential in industries such as oil and gas, power generation, and water treatment. These valves are primarily used for throttling, allowing for more accurate control of fluid flow through a linear motion mechanism. Their popularity can be attributed to their reliability and efficiency in a wide range of process control applications.

The demand for Linear control valves is growing as industries continue to seek solutions that provide greater precision and flexibility in fluid management. The versatility of these valves in a variety of applications, combined with their ability to handle a wide range of pressures and temperatures, ensures their continued dominance in the control valves market. Moreover, technological innovations, such as improved actuator systems and materials, are expected to further strengthen the growth of the Linear segment.

In 2024, the Gate valve segment represented a notable portion of the Control Valves Market. These valves are primarily used in applications requiring either full open or full closed positions, ideal for industries such as oil and gas, water treatment, and chemical processing. The Gate valve’s strength lies in its ability to handle large flow rates with minimal pressure drop, making it essential in high-pressure systems. As industries seek reliable and efficient flow control, the demand for gate valves is expected to remain robust, with growth driven by their ability to provide tight seals and operate under harsh conditions.

In 2024, the Diaphragm valve segment was an important contributor to the Control Valves Market. These valves are typically used in industries where maintaining purity and sanitary conditions is essential, including pharmaceuticals, food processing, and biotechnology. The flexible diaphragm design offers excellent sealing and minimizes leakage, making these valves ideal for controlling corrosive fluids. With growing regulatory pressure for hygiene and product integrity, particularly in the food and pharmaceutical industries, the Diaphragm valve segment is expected to see continued demand.

In 2024, the Rotary valve segment accounted for a significant share of the Control Valves Market. Rotary valves, such as ball and butterfly valves, are widely used for both on/off and modulating flow control. These valves excel in handling large fluid volumes in industries like oil and gas, chemical processing, and power generation. Their reliability and ease of operation make them a popular choice for industrial processes, where fast and precise control is essential.

In 2024, the Ball valve segment contributed to the Control Valves Market, especially for industries requiring precise flow control and tight shut-off capabilities. Commonly used in oil and gas, chemical, and pharmaceutical sectors, Ball valves are known for their durability and ability to handle both high and low-pressure environments. Despite holding a smaller share in the market, their versatility and performance in critical applications ensure steady growth.

In 2024, the Butterfly valve segment played a role in the Control Valves Market, driven by its compact design and ability to function efficiently in space-constrained applications. Widely used in HVAC systems, water treatment, and the food and beverage industries, these valves provide excellent flow regulation and isolation. The Butterfly valve segment is expected to grow as industries look for space-saving and cost-effective flow control solutions. The continued development of advanced butterfly valves with improved sealing and automation features will further bolster the segment’s expansion.

In 2024, the Plug valve segment was a niche but significant part of the Control Valves Market. Plug valves are typically used in applications requiring tight shut-off and throttling control, especially in sectors like oil and gas, chemical processing, and pharmaceuticals. Their simple design, combined with the ability to handle high-pressure and high-temperature conditions, ensures their demand in critical systems.

In 2024, the Others segment, which includes specialized valve types such as pinch, pressure relief, and check valves, played a smaller yet vital role in the Control Valves Market. These valves are essential in niche applications across industries like water treatment, power generation, and HVAC. Despite holding a smaller market share, the need for tailored solutions in specialized applications continues to drive demand. The segment is expected to expand further as industries focus on process optimization and the use of innovative valve designs to meet specific operational needs.

By Application Analysis

In 2024, Oil & Gas Held a Dominated the Control Valves Market, Capturing More Than 24.2% Market Share

In 2024, the Oil & Gas sector held a dominant market position in the Control Valves Market, capturing more than 24.2% of the total market share. Control valves in this segment are critical for managing the flow of fluids and gases in upstream, midstream, and downstream operations. They play a key role in ensuring the safe and efficient operation of pipelines, refineries, and production systems, where precise control over high-pressure environments is required.

As the demand for oil and gas continues to rise globally, especially in emerging markets, the need for reliable and high-performance control valves is expected to sustain growth in this segment.

The growth in the Oil & Gas sector is driven by increasing investments in exploration and production activities, particularly in regions with rich natural resources. Technological advancements in valve design and automation, along with a focus on reducing operational risks, are expected to further fuel demand for control valves in the sector.

In 2024, the Chemicals sector represented a significant share of the Control Valves Market. The demand for control valves is driven by the need for precise flow control in the production of chemicals, petrochemicals, and specialty chemicals. These valves are essential in managing corrosive and pressurized chemicals, ensuring safety, efficiency, and regulatory compliance. As the chemical industry continues to grow, especially in emerging markets, the need for advanced control valves to optimize processes is expected to rise.

In 2024, the Energy & Power sector captured a significant share of the Control Valves Market. Control valves in this sector are vital for regulating steam, gas, and water in power plants, ensuring safety and efficiency in energy production. With rising global energy demand and the transition to cleaner energy sources, the need for high-performance control valves is expected to grow, especially in renewable energy facilities.

In 2024, the Water & Wastewater Treatment segment played a crucial role in the Control Valves Market. Control valves are used to regulate the flow of water and chemicals in treatment processes, ensuring water quality and environmental compliance. As urbanization and industrialization increase, the demand for reliable water treatment systems is expected to rise, fueling further growth in the control valves market.

In 2024, the Food & Beverages sector accounted for a significant portion of the Control Valves Market. Control valves are essential for maintaining consistency and quality in food and beverage production, ensuring precise flow control. The demand for these valves is driven by the need for automation and stringent food safety regulations. As the sector expands, particularly in emerging markets, the demand for reliable and efficient control valves is expected to grow.

In 2024, the Pharmaceuticals sector represented a significant share of the Control Valves Market. Control valves in this sector are essential for regulating liquids and gases in highly regulated environments, such as in drug and vaccine production. These valves help maintain hygienic standards and ensure product quality. As the pharmaceutical industry grows, particularly in biologics and personalized medicine, the demand for accurate and reliable control valves is expected to rise.

In 2024, the Others segment, which includes specialized applications across industries like HVAC, mining, and marine, accounted for a smaller but important share of the Control Valves Market. This segment benefits from custom solutions for unique flow control needs. As industries seek specialized valves for demanding environments, the development of new valve technologies and materials is expected to drive growth.

Key Market Segments

By Component

- Valve Body

- Actuators

- Others

By Size

- Less than 1

- Between 1 to 6

- Between 6 to 25

- Between 25 to 50

- More than 50

By Product

- Linear

- Gate

- Diaphragm

- Rotary

- Ball

- Butterfly

- Plug

- Others

By Application

- Oil & Gas

- Chemicals

- Energy & Power

- Water & Wastewater Treatment

- Food & Beverages

- Pharmaceuticals

- Others

Driver

Expanding Demand for Automated Process Control in Industrial Operations

The global control valves market is being significantly driven by the increasing integration of automation in industrial processes. As industries across sectors such as oil and gas, chemical, power generation, and water treatment transition toward smart manufacturing and process optimization, the reliance on control valves for precise flow regulation has intensified. Automated control systems demand high-performance valves capable of maintaining stable pressure, temperature, and fluid levels in real-time.

This need is particularly pronounced in high-risk industries where even minor deviations in process variables can lead to costly downtime or safety hazards. As a result, advanced control valves are being adopted to facilitate remote operations, reduce human intervention, and improve overall plant efficiency. The growing preference for automated process controls is creating sustained demand for highly responsive and reliable control valve systems.

In 2024, the integration of Industrial Internet of Things (IIoT) and smart sensors in valve systems has further amplified this trend. Modern control valves embedded with digital diagnostics and real-time monitoring capabilities are being increasingly deployed to improve predictive maintenance and operational transparency. This has led to a notable surge in demand for smart and intelligent valve solutions across process industries.

Additionally, the growing emphasis on energy efficiency and emission reduction is contributing to wider adoption of precision control technologies. These advanced control mechanisms support energy conservation by minimizing wastage in flow systems and ensuring optimal use of resources. Collectively, these factors have positioned automated control requirements as a dominant force accelerating the global control valves market’s growth trajectory in 2024.

Restraint

High Capital and Maintenance Costs Associated with Advanced Control Valves

Despite the market’s strong growth prospects, one of the primary restraints affecting the adoption of control valves, particularly in developing economies, is the high initial investment and ongoing maintenance costs. Advanced control valves, especially those integrated with smart diagnostics and remote monitoring features, tend to carry a significantly higher price tag compared to conventional valves. For cost-sensitive industries or small and medium enterprises, this upfront expenditure can pose a considerable barrier.

Moreover, the procurement of high-quality materials to withstand extreme temperatures, pressures, and corrosive substances further elevates costs. These pricing concerns often delay purchasing decisions, particularly when short-term capital preservation outweighs long-term efficiency considerations.

Additionally, the requirement for regular maintenance and calibration to ensure consistent valve performance further compounds operational expenditures. Control valves operating in demanding environments are subject to wear and tear, requiring frequent inspection and part replacements to avoid unplanned downtimes. The maintenance of electronically integrated valve systems also demands specialized technical expertise, increasing dependence on skilled labor or third-party service providers.

This ongoing cost and skill dependency hinder the scalability of smart valve deployment across industries. Consequently, despite the proven benefits of advanced control valves, their high lifecycle cost remains a significant limiting factor that could restrict broader market penetration, especially in regions with constrained industrial budgets.

Opportunity

Accelerating Investments in Water and Wastewater Treatment Infrastructure

The global emphasis on sustainable resource management is creating a lucrative growth opportunity for the control valves market, particularly through rising investments in water and wastewater treatment infrastructure. Governments and municipal authorities across developed and developing nations are prioritizing infrastructure modernization to meet the growing demand for clean water and to address the challenges of water scarcity, pollution, and regulatory compliance.

Control valves play a vital role in these systems by regulating the flow, pressure, and direction of fluids in pipelines and treatment units. Their application is essential for process control in filtration, desalination, and chemical dosing processes, making them indispensable to the efficiency and safety of water treatment facilities.

In 2024, countries experiencing rapid urbanization and industrial growth are witnessing significant project rollouts in the water treatment sector. As an example, large-scale smart city initiatives are incorporating automated water management systems that rely heavily on real-time valve control to optimize usage and reduce waste. Moreover, stricter environmental standards regarding wastewater discharge have necessitated the deployment of advanced flow control technologies to ensure compliance.

The global market is therefore benefiting from both public and private sector spending in this domain. As these investments continue to rise, particularly in Asia-Pacific and Middle Eastern regions, the demand for precision-engineered control valves with corrosion-resistant materials and remote operability is projected to grow, offering a sustained avenue for market expansion.

Trends

Rising Integration of Digital Twin Technology in Valve Monitoring and Simulation

A notable trend shaping the control valves market in 2024 is the growing integration of digital twin technology in valve monitoring and simulation processes. Digital twins enable the creation of real-time digital replicas of physical valve systems, facilitating predictive analysis, performance optimization, and failure forecasting. This technology is gaining rapid traction across industries that operate in high-risk or high-cost environments, such as oil & gas, power generation, and chemical processing. By simulating different operational scenarios, digital twins help engineers and operators anticipate potential malfunctions and proactively schedule maintenance, thereby minimizing downtime and extending valve life cycles.

This trend is aligned with the broader shift toward Industry 4.0 and the increasing digitization of industrial infrastructure. As more companies adopt smart manufacturing strategies, the deployment of interconnected systems including control valves linked to digital twins is becoming a strategic imperative. In 2024, this technological shift is contributing to improved asset management and real-time decision-making capabilities.

Additionally, the use of digital twins supports sustainability objectives by enabling energy-efficient system designs and reducing material wastage. The convergence of digital technologies with valve hardware is thus setting a new benchmark for performance and reliability, making digital twin integration a transformative trend that is expected to redefine how control valves are operated, monitored, and maintained in the years ahead.

Regional Analysis

The Control Valves Market Asia-Pacific Dominates with 45.8% Market Share and US$ 3.6 Billion in 2024

The Control Valves Market is experiencing robust growth across various global regions, with Asia-Pacific holding the dominant position. In 2024, Asia-Pacific is expected to account for 45.8% of the global market share, equating to a market value of US$ 3.6 billion. The region’s dominance can be attributed to significant industrial expansion, particularly in countries like China, India, and Japan, where rapid industrialization, urbanization, and growing energy demands are driving increased investments in infrastructure and manufacturing sectors. This makes Asia-Pacific the largest market for control valves, not only in terms of revenue but also in market development and adoption rates.

North America follows as a key player in the control valves market, with steady growth anticipated over the forecast period. The North American market is driven by the increasing demand for automation and control systems across key industries such as oil and gas, chemicals, and water treatment. Technological advancements in valve automation and the push towards operational efficiency in industrial processes contribute significantly to this region’s growth. While not as dominant as Asia-Pacific, North America’s market value remains substantial and continues to expand due to innovation and infrastructure modernization projects.

Europe, with its advanced manufacturing capabilities, is another important region in the global control valves market. The European market is characterized by a strong presence in sectors like energy, automotive, and pharmaceuticals. However, its growth rate is somewhat slower compared to Asia-Pacific and North America due to a more mature industrial landscape. That said, Europe remains a key player, particularly in adopting sustainable technologies and energy-efficient solutions within industrial operations.

The Middle East & Africa region, while smaller in market share compared to Asia-Pacific and North America, is seeing a gradual increase in demand for control valves, particularly in the oil and gas sector. With large-scale infrastructure projects and the drive towards modernization in energy production, the Middle East & Africa region is becoming a growing market for control valves, albeit with slower growth compared to other regions.

Finally, the Latin American market is expected to experience moderate growth, primarily driven by the expansion of industrial activities in Brazil, Mexico, and Argentina. Despite challenges such as political instability and economic fluctuations, the demand for control valves is steadily increasing, particularly in the energy, mining, and manufacturing sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global control valves market is being significantly shaped by the strategic contributions of several key players, many of whom originate from the broader aluminum and component manufacturing sectors, leveraging their advanced material capabilities and supply chain control. Companies such as Alcoa Corporation, UACJ Corporation, Norsk Hydro ASA, Constellium, Rio Tinto Group, and Jindal Aluminium Ltd play a vital role in the upstream supply of high-grade aluminum and metal alloys, which are essential in manufacturing corrosion-resistant, lightweight, and high-performance control valves.

Their integration of advanced smelting technologies, sustainable mining practices, and material innovation supports the growing demand for energy-efficient and durable valve components, especially in high-pressure and high-temperature industrial environments such as oil & gas, power, and chemical processing.

Simultaneously, companies such as Aleris Corporation, Kaiser Aluminium, and Lorin Industries enhance the market’s competitiveness through specialized downstream processing, including coil coating, sheet production, and alloy customization tailored to control valve manufacturing. These players contribute to precise engineering tolerances, surface treatment advancements, and weight optimization, thereby elevating product performance and lifecycle.

Furthermore, industrial component suppliers like Autoneum Holding AG, Dana Holding Corporation, and ElringKlinger AG, traditionally focused on automotive and thermal management systems, are leveraging their engineering expertise to develop metal-integrated valve parts and gaskets, strengthening innovation in control valve sealing and assembly mechanisms. These collaborations across the value chain—from raw material supply to finished component integration—are reinforcing the global control valves market’s resilience, efficiency, and adaptation to evolving industrial automation standards.

Top Key Players in the Market

- Alcoa Corporation

- UACJ Corporation

- Norsk Hydro ASA

- Constellium

- Rio Tinto Group

- Aleris Corporation

- Autoneum Holding AG

- Dana Holding Corporation

- ElringKlinger AG

- Jindal Aluminium ltd

- Kaiser Aluminium

- Lorin Industries

Recent Developments

- In 2024, Flowserve Corporation announced the acquisition of Mogas Industries for $290 million. The deal includes a possible earnout of $15 million and is expected to close in the last quarter of the year. Mogas specializes in high-performance severe service valves, which will add strong aftermarket value to Flowserve’s offerings.

- In 2024, May River Capital confirmed its acquisition of Cashco, a manufacturer of precision-engineered pressure control products. This marks May River’s first investment under its new Flow Control Solutions platform, aiming to scale industrial flow technologies.

- In 2024, Crane Engineering shared news of acquiring Geiger Pump & Equipment Company. Geiger brings strong distribution capabilities in fluid process systems across Maryland and Pennsylvania, enhancing Crane Engineering’s regional service network.

- In 2023, Rotork Plc completed the acquisition of Hanbay, Inc., a Canadian company known for miniature electric actuators. This move broadens Rotork’s product range by adding compact and high-torque actuators for small and instrument valve applications.

- In 2023, Emerson introduced the ASCOTM Series 262 and 263, the first valves certified for biodiesel blends in commercial and industrial boilers. These new valves support cleaner energy use, helping customers cut down emissions while staying compliant with green regulations.

Report Scope

Report Features Description Market Value (2024) USD 8.0 Billion Forecast Revenue (2034) USD 24.2 Billion CAGR (2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component(Valve Body, Actuators, Others), By Size(Less than 1, Between 1 to 6, Between 6 to 25, Between 25 to 50, More than 50), By Product(Linear, Gate, Diaphragm, Others, Rotary, Ball, Butterfly, Plug), By Application(Oil & Gas, Chemicals, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Pharmaceuticals, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Emerson Electric Co., Flowserve Corporation, Schlumberger Limited, General Electric Company, Honeywell International Inc., Metso Corporation, IMI plc, Spirax-Sarco Engineering plc, Crane Co., Velan Inc., Samson AG, Rotork plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alcoa Corporation

- UACJ Corporation

- Norsk Hydro ASA

- Constellium

- Rio Tinto Group

- Aleris Corporation

- Autoneum Holding AG

- Dana Holding Corporation

- ElringKlinger AG

- Jindal Aluminium ltd

- Kaiser Aluminium

- Lorin Industries