Global Consumer Electronics Semiconductor Market Size, Share, Industry Analysis Report By Device Type (Discrete Semiconductors, Optoelectronics, Sensors and MEMS, Integrated Circuits), By Business Model (IDM, Design/Fabless Vendor), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025–2034

- Published date: Dec. 2025

- Report ID: 165983

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

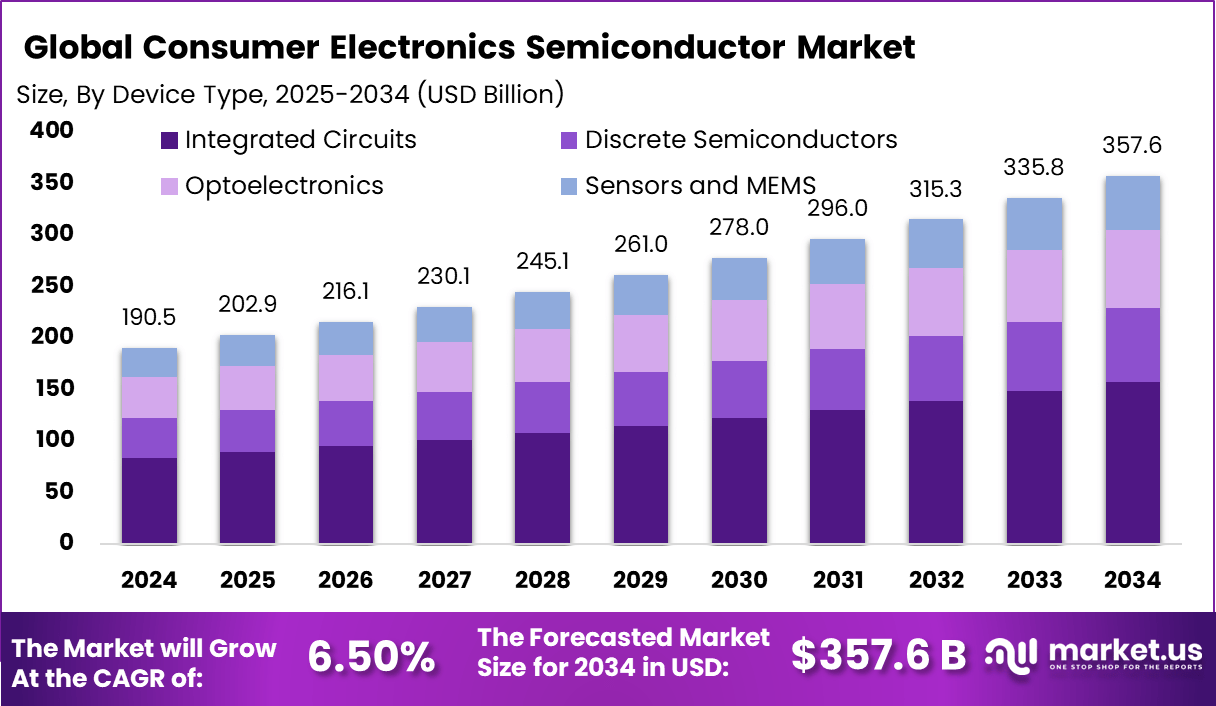

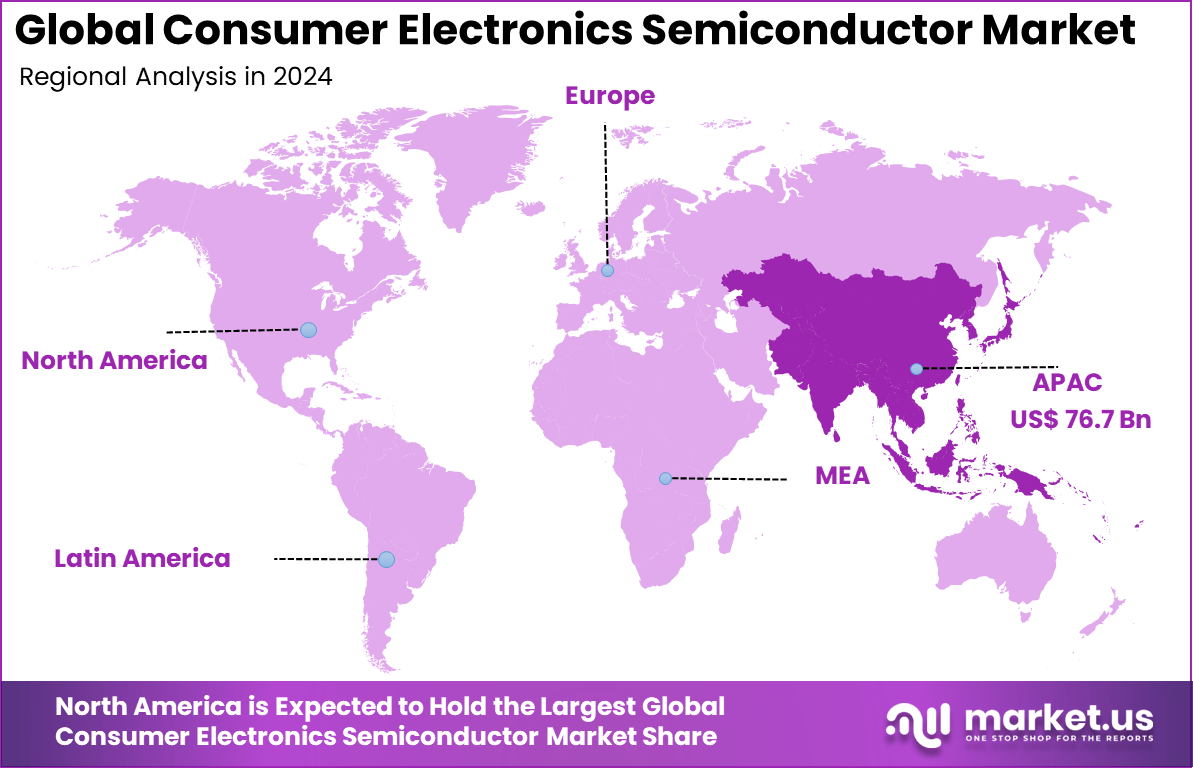

The global consumer electronics semiconductor market size generated USD 190.5 Billion in 2024 and is predicted to register growth to about USD 357.6 Billion by 2034, recording a CAGR of 6.5% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 40.3% share, holding USD 76.7 Billion revenue.

The consumer electronics semiconductor market refers to the segment of the semiconductor industry that supplies chips and related components specifically for consumer devices such as smartphones, televisions, laptops, wearables, gaming consoles, and smart appliances. Semiconductors in these products perform essential functions such as processing, memory storage, connectivity, and power management.

Demand in this segment is influenced by consumer spending, rapid product refresh cycles, and the ongoing integration of advanced technologies such as artificial intelligence and 5G. Global semiconductor sales have shown consistent increases in recent periods, with data indicating double digit year-on-year growth in several months of 2025 driven by broad chip demand including consumer use.

This market plays a crucial role in enabling innovation and performance improvements in everyday electronic devices. Semiconductors determine how efficiently a device operates, how long its battery lasts, and how quickly it can process data. As consumer electronics become more feature rich with high resolution displays, advanced cameras, and connected functions, the complexity and quantity of chips per device have increased.

The Semiconductor Industry Association reported that global semiconductor sales reached USD 72.7 billion in October 2025, up 4.7% from USD 69.5 billion in September 2025 and 27.2% higher than USD 57.2 billion in October 2024. These figures, compiled by the World Semiconductor Trade Statistics organization, reflect a three month moving average and highlight continued strength in global chip demand.

Key drivers include the growing penetration of connected devices, rising consumer expectations for performance, and increasing demand for high speed connectivity such as 5G. The global increase in smart products and the Internet of Things has contributed to rising demand for semiconductors in consumer applications. Overall demand for semiconductors is increasing significantly year-on-year, with some downstream organizations expecting demand to grow by double digits in the near term.

Key Takeaways

- The consumer electronics semiconductor market reached USD 190.5 billion in 2024 and is expected to rise to USD 357.6 billion by 2034 at a 6.50% CAGR.

- Integrated Circuits dominated the device type segment with a 44.2% share, supported by high demand for processors, memory and logic components in modern electronics.

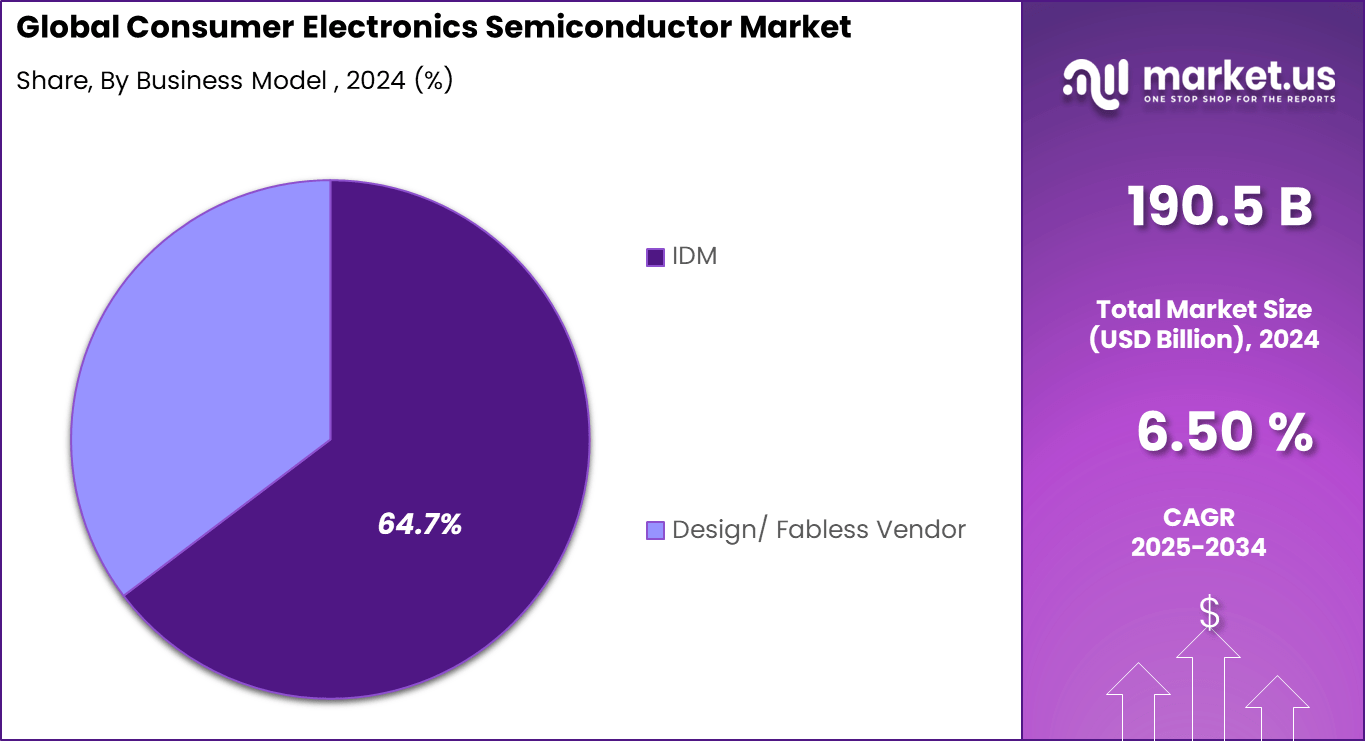

- The IDM business model held the largest share at 64.7%, reflecting strong integrated manufacturing capabilities among major semiconductor producers.

- Asia Pacific led the global market with a 40.3% share and USD 76.7715 billion in regional revenue.

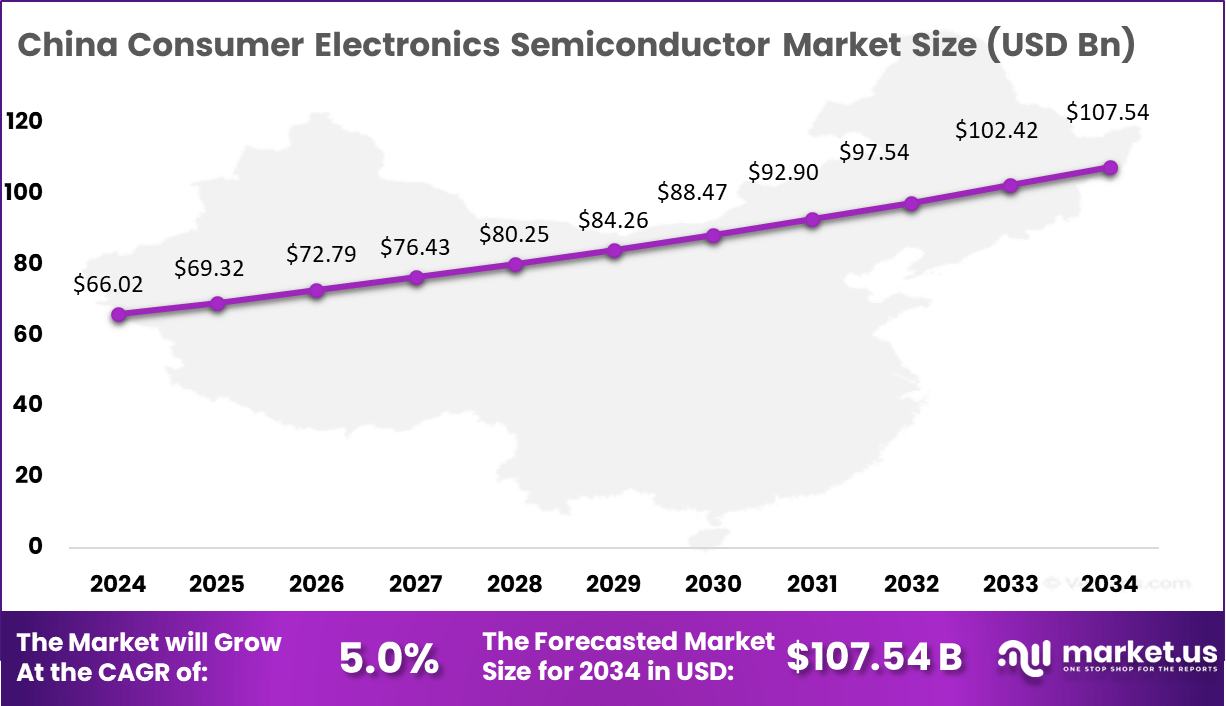

- China, valued at USD 66.02 billion in 2024 and growing at a 5.0% CAGR, remains the leading national market for consumer electronics semiconductors.

China Market Size

China continued to lead the global consumer electronics semiconductor landscape with a market value of USD 66.02 billion in 2024. Growth is supported by its dominant position in electronics assembly, large-scale manufacturing of smartphones, televisions, wearables and smart appliances, and its extensive domestic supply chain for key semiconductor components.

Consumer demand for AI-enabled devices, intelligent displays, home automation systems and connected appliances remains strong across urban and rural areas alike. With a 5.0% CAGR, China’s semiconductor consumption is expected to rise steadily, supported by both domestic technology companies and international manufacturers operating within the region. Continued investments in advanced packaging, memory technologies, power devices and logic chips will further support China’s growth trajectory.

Asia Pacific held a significant 40.3% share of the global market, generating USD 76.7715 billion in revenue from consumer electronics semiconductor demand in 2024. The region remains at the center of global electronics production, supported by advanced fabrication plants, skilled labor, strong component supply chains and high-volume manufacturing infrastructure.

The region benefits from continuous growth in large energy-efficient display technologies, integration of high-performance processors, and the increasing use of MEMS sensors in wearables and health-monitoring devices. Asia Pacific’s leadership will likely continue over the next decade as demand for smart living solutions, IoT connectivity and AI-powered home electronics expands across major markets.

Increasing Adoption Technologies

Technological adoption in this market includes advanced system-on-chip designs, low power memory, integrated connectivity components, and AI capable processors embedded within consumer devices. Chips that support efficient power usage and enhanced user experiences are increasingly used in wearables and smart appliances. Sensors and MEMS components for motion tracking, environmental detection, and health monitoring are also becoming more prevalent.

Device manufacturers adopt advanced semiconductor technologies to deliver better performance, longer battery life, and enhanced connectivity. Integration of connectivity standards such as 5G and Wi-Fi 6 in consumer devices requires sophisticated radio frequency and processing chips. Consumer expectations for faster response times and richer media experiences push manufacturers to use more capable semiconductor components.

Investment and Business Benefits

Investment opportunities exist in design innovation, advanced packaging, and localized semiconductor fabrication to support consumer electronics demand. The trend toward diversified manufacturing capacity and investment in fab expansion reflects interest in ensuring stable supply for consumer applications. Government and private investment in semiconductor ecosystems, including fabrication and assembly, create long term opportunities for supporting consumer markets.

For consumer electronics companies, high quality semiconductors improve product performance and user satisfaction. Better chips enable faster processing, improved graphics, and extended device lifespans. Efficient semiconductor design can also reduce power consumption, leading to better battery performance. These benefits support brand competitiveness and can drive repeat purchases in a market where consumer preferences evolve quickly.

By Device Type

Integrated circuits (ICs) represent the largest segment by device type, commanding about 44.2% of the consumer electronics semiconductor market. ICs combine multiple electronic components into a single chip, delivering enhanced processing power, miniaturization, and energy efficiency. Their dominance reflects the critical need for high-performance processors, memory chips, and sensor interfaces in modern consumer gadgets.

Discrete components such as diodes, transistors, power transistors and rectifiers remain essential for power regulation and switching functions in consumer electronics. These devices ensure stable voltage control, energy efficiency and protection mechanisms in appliances, televisions, charging systems and portable devices.

Optoelectronic components including LEDs, laser diodes, image sensors and optocouplers play a critical role in displays, smartphone cameras, lighting systems and digital imaging products. With rising demand for high-resolution cameras, OLED displays and advanced sensing features, optoelectronics continues to be a fast-evolving device type.

This segment includes pressure sensors, magnetic field sensors, accelerometers, gyroscopes, temperature sensors and related MEMS components. Sensor adoption is expanding rapidly due to increased use in wearables, smart home devices, AR/VR systems, and intelligent appliances that rely on motion detection and environment monitoring.

By Business Model

The Integrated Device Manufacturer (IDM) business model holds a commanding 64.7% share of the market. IDMs control the entire semiconductor production value chain, from chip design and fabrication to testing and packaging. This end-to-end control offers advantages in quality assurance, supply chain stability, and innovation speed.

IDMs are pivotal in meeting the high-volume and high-reliability demands of consumer electronics. Their comprehensive capabilities help maintain consistent supply while enabling rapid adaptation to changing technology trends and consumer preferences. IDM players benefit from strong control over production, quality, materials and supply chain processes, making them key suppliers to major consumer electronics brands.

Fabless semiconductor companies focus on design and innovation while outsourcing chip manufacturing to foundries. This model continues to grow due to its flexibility, lower initial investment requirements and the ability to bring specialized chips to market quickly. The segment is gaining traction due to rising startup activity in AI chips, sensors and power electronics.

Key Market Segments

By Device Type

- Discrete Semiconductors

- Diodes

- Transistors

- Power Transistors

- Rectifier and Thyristor

- Other Discrete Devices

- Optoelectronics

- Light-Emitting Diodes (LEDs)

- Laser Diodes

- Image Sensors

- Optocouplers

- Other Device Types

- Sensors and MEMS

- Pressure

- Magnetic Field

- Actuators

- Acceleration and Yaw Rate

- Temperature and Others

- Integrated Circuits

- Microprocessors (MPU)

- Microcontrollers (MCU)

- Digital Signal Processors

- Logic

- Memory

By Business Model

- IDM

- Design/ Fabless Vendor

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand for Personal Devices

A major driver is the rapid increase in personal device adoption worldwide. Smartphones, tablets, smart watches, and wireless audio products require multiple semiconductor components for processing, memory, connectivity, and power control. As users expect faster performance and longer battery life, manufacturers turn to more advanced semiconductors. Growing adoption of smart devices in emerging markets adds further momentum.

Expansion of Smart Home Electronics

Another driver is the wider use of semiconductors in home electronics. Smart televisions, speakers, security systems, and household appliances rely on chips for display control, audio processing, and energy-efficient operation. As smart home adoption grows, demand for semiconductors designed for low power and high reliability continues to rise.

Restraint Analysis

Supply Chain Instability

A key restraint is the ongoing instability in semiconductor supply chains. Production of chips requires steady access to wafers, substrates, and packaging materials. Delays or shortages in these materials can affect manufacturing schedules for consumer devices. Smaller manufacturers often face more difficulty in securing dependable supplies.

High Manufacturing Costs

Another restraint is the rising cost associated with advanced chip production. Fabrication of modern semiconductors requires costly machinery, strict process control, and frequent upgrades. These expenses limit the ability to produce large volumes at competitive prices, slowing adoption of new technologies in certain device segments.

Opportunity Analysis

Growth in Wearables and Health Devices

A strong opportunity lies in the expanding market for wearables and personal health technologies. Smart watches, fitness trackers, and health monitoring tools depend on compact processors, advanced sensors, and power-efficient chips. As consumers show greater interest in health-focused electronics, the semiconductor sector can benefit from increased demand for specialized low-power components.

Demand for High-Performance Multimedia Chips

Another opportunity is growing interest in gaming, streaming, and mobile content creation. Devices now require stronger processors and graphics engines to support demanding applications. Semiconductor suppliers focusing on advanced imaging, graphics, and performance-optimized architectures can capture growth in this area.

Challenge Analysis

Rapid Technology Cycles

The consumer electronics sector changes quickly, placing pressure on semiconductor makers to update chip designs frequently. Short product cycles increase development costs and reduce the time available to recover investment. Companies that cannot innovate rapidly risk losing their competitive position.

Balancing Performance and Power Efficiency

Another challenge is achieving higher performance without increasing power consumption. Consumers expect fast devices with long battery life, which requires constant innovation in chip materials, layouts, and architecture. Maintaining this balance increases design complexity and production difficulty.

Key Players Analysis

Advanced Micro Devices (AMD) has expanded its footprint in the consumer electronics semiconductor space with its Ryzen and Radeon chip-sets that deliver robust processing and graphics performance. AMD focuses on integrating AI capabilities directly into consumer devices, enabling smarter and more adaptive electronics. Their continuous advancements in 7nm and 5nm process technology support efficient power consumption and enhanced performance for PCs, gaming consoles, and smart devices.

Intel Corporation remains a major player supplying chips for a broad range of consumer electronics including laptops, wearable, and IoT devices. Intel’s investments in semiconductor manufacturing, including partnerships to boost foundry capabilities, allow it to offer advanced process nodes and packaging technologies that improve the power efficiency and performance of consumer devices.

Together, Nvidia, AMD, and Intel lead the growth in consumer electronics semiconductors by delivering powerful, energy-efficient chips and integrating AI capabilities that meet the rising expectations of users world wide.

Top Key Players in the Market

- Nvidia Corporation

- Advanced Micro Devices Inc.

- Intel Corporation

- Samsung Electronics Co., Ltd. (Device Solutions)

- SK hynix Inc.

- Micron Technology Inc.

- Broadcom Inc.

- Marvell Technology Inc.

- Ampere Computing LLC

- Qualcomm Technologies Inc.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

- STMicroelectronics N.V.

- GlobalFoundries Inc.

- Taiwan Semiconductor Manufacturing Company Ltd. (TSMC)

- Graphcore Ltd.

- Cerebras Systems Inc.

- Tenstorrent Inc.

- Others

Recent Developments

- In 2025, Nvidia positioned GeForce RTX AI PCs as a consumer platform for on device generative AI tasks such as image creation, video editing, and virtual assistants, using Tensor Cores originally designed for DLSS. The company is also working with Intel to integrate RTX graphics chiplets with future x86 CPUs, aiming to deliver combined CPU and GPU system on chip designs for thin and light AI PCs later in the decade.

- In September 2025, Qualcomm introduced the Snapdragon 8 Elite Gen 5 smartphone SoC and the Snapdragon X2 Elite PC platform, both positioned as Gen AI ready solutions. These platforms feature high on device NPU performance to support multimodal assistants, advanced camera processing, and offline generative AI tasks.

Report Scope

Report Features Description Market Value (2024) USD 190.5 Bn Forecast Revenue (2034) USD 357.6 Bn CAGR(2025-2034) 6.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Device Type (Discrete Semiconductors, Optoelectronics, Sensors and MEMS, Integrated Circuits), By Business Model (IDM, Design/Fabless Vendor) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nvidia Corporation, Advanced Micro Devices Inc., Intel Corporation, Samsung Electronics Co. Ltd. (Device Solutions), SK hynix Inc., Micron Technology Inc., Broadcom Inc., Marvell Technology Inc., Ampere Computing LLC, Qualcomm Technologies Inc., Texas Instruments Incorporated, Renesas Electronics Corporation, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., GlobalFoundries Inc., Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), Graphcore Ltd., Cerebras Systems Inc., Tenstorrent Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Consumer Electronics Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Consumer Electronics Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-