Global Construction Software Market By Application(Project Management and Scheduling, Inventory Management, Contract Management, Risk Management, Others (Cost Control, Customer Management, etc.)), By Deployment Model (Cloud-based Solutions, On-premises Solutions), By End-User (Builders and Contractors, Construction Managers, Architects and Engineers, Others (Owners, Government, etc.)), By Software Type (Accounting Management, Field Service Management, Design and Estimation Software), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 49623

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Application Analysis

- Deployment Model Analysis

- End-User Analysis

- Software Type Analysis

- Enterprise Size Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenges

- Key Market Trends

- Key Market Segments

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

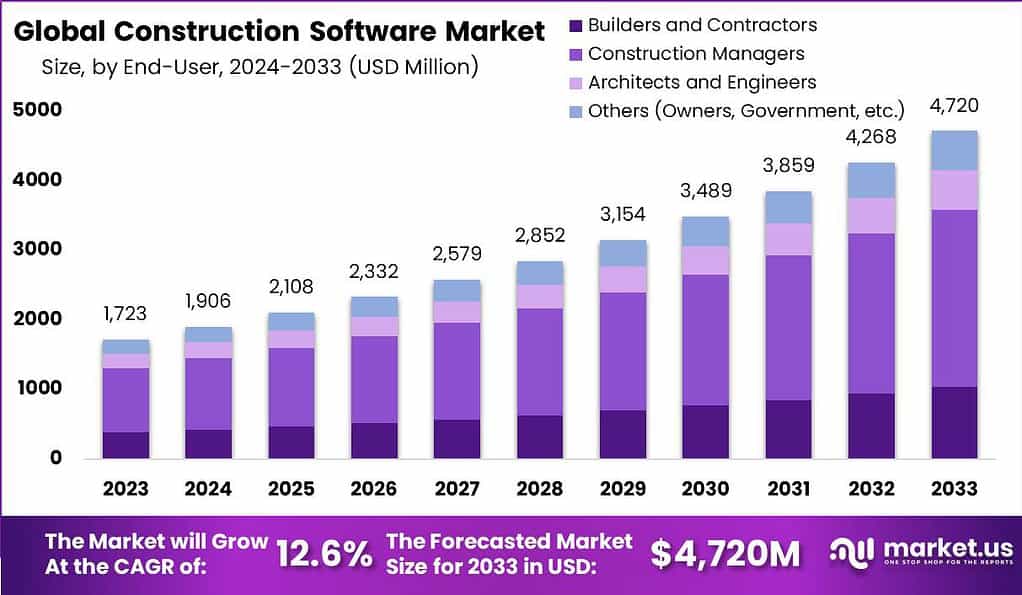

The global Construction software market is expected to expand at a 12.6% CAGR during the forecast period 2024-2033. The construction software industry is anticipated to be worth USD 1,723 Million in 2023 and exceed USD 4,720.0 million by 2033.

Construction software is a digital solution created to assist with all stages of the construction project management cycle, from initial planning and design through final execution. It also refers to the various software solutions and programs designed to help construction companies and contractors improve productivity, efficiency, and collaboration across construction projects.

The global construction software market is made up of software vendors providing solutions for functions like CAD and BIM modeling, project management, accounting and cost management, contract management, resource scheduling, field service management, and more. The construction software market has experienced robust growth in recent years, driven by increasing construction activity worldwide as well as the need for more advanced software tools to deal with rising complexity in construction projects.

Note: Actual Numbers Might Vary In Final Report

With mega projects and massive investments planned in infrastructure over the coming decade, especially in developing economies, the addressable market size for construction software vendors continues to expand. Construction software typically features tools for project planning and cost estimation that allow efficient allocation of resources and timely completion of tasks. Furthermore, cost estimation tools provide accurate insights into material costs, labor expenses, equipment charges and any other expenditures relating to a particular expenditure – providing better budget management and cost control throughout the lifecycle of a project.

Key Takeaways

- Market Growth: The global Construction Software Market is projected to grow at a rate of 12.6 percent over the timeframe from 2024 until 2033. In 2023 the market was valued as USD 1,723 million. it is projected to reach USD 4,720 million in 2033.

- Construction Software Definition: Construction software refers to digital solutions designed to facilitate various aspects of construction project management. It aids in project planning, scheduling, cost estimation, and collaboration, contributing to enhanced efficiency and productivity in construction projects.

- Diverse Application Segments: The Construction Software Market encompasses various application segments, including Project Management and Scheduling, Inventory Management, Contract Management, Risk Management, Cost Control, and Customer Management, among others. Each segment plays a critical role in streamlining construction operations.

- Deployment Models: Two primary deployment models are prominent in the market – On-premises Solutions and Cloud-based Solutions. On-premises solutions offer greater control over data, while cloud-based solutions provide scalability and accessibility advantages.

- End-User Influence: Builders and Contractors hold a dominant position in the market due to their essential role in construction projects. Construction Managers, Architects, and Engineers also significantly contribute to the adoption of construction software.

- Software Types: Accounting Management software stands out as a dominant segment, crucial for financial oversight in the construction industry. Field Service Management and Design and Estimation Software are also vital components, catering to specific needs within the construction workflow.

- Enterprise Size Matters: Large Enterprises lead in the adoption of construction software, given the complexity of their projects. Small and Medium-sized Enterprises (SMEs) are increasingly recognizing the value of these software tools for improved project management.

- Driving Factors: Key factors driving the adoption of construction software include digital transformation initiatives, efficient project management, regulatory compliance requirements, and the rise of remote work and collaboration.

- Challenges: Challenges faced by construction companies in adopting construction software include integration complexities, cost concerns, data security and privacy issues, and resistance to change within the industry.

- Growth Opportunities: Emerging markets, the integration of IoT and real-time monitoring, customization services, and the emphasis on sustainable construction practices present significant growth opportunities for construction software vendors.

- Market Trends: Key market trends include the increasing adoption of cloud-based solutions, integration with Building Information Modeling (BIM), the significance of mobile construction apps, and the impact of AI and automation on construction processes.

- Leading Players: Top players in the construction software market include Sage Group PLC, Autodesk, Inc., Roper Technologies, Inc., Trimble Inc., Oracle Corporation, Procore Technologies Inc., and more.

Application Analysis

In 2023, the Project Management and Scheduling segment asserted its dominance in the Construction Software market, capturing a substantial share of the market. This segment’s prominent position can be attributed to its pivotal role in streamlining construction projects, optimizing resources, and ensuring timely project completion.

Project Management and Scheduling software solutions empower construction professionals to plan, execute, and monitor construction projects efficiently. These tools offer features like project planning, scheduling, resource allocation, and progress tracking, enabling project managers to stay organized and make informed decisions.

Another noteworthy application within the Construction Software market is Inventory Management. This segment plays a crucial role in ensuring that construction projects have the necessary materials and equipment at the right time and in the right quantity. Efficient Inventory Management software helps construction companies avoid delays, reduce excess inventory costs, and enhance overall project efficiency.

Contract Management is yet another vital segment in the Construction Software market. It addresses the complexities of contract creation, negotiation, compliance, and documentation within the construction industry. Contract Management software enables construction firms to streamline contract-related processes, track contract milestones, and manage legal and financial aspects effectively.

Risk Management software solutions also hold a significant share in the market. Given the inherent risks in construction projects, Risk Management tools provide essential support in identifying, assessing, and mitigating potential risks. These solutions help construction companies minimize project delays, cost overruns, and legal disputes by proactively managing and mitigating risks.

Furthermore, there are other applications such as Cost Control and Customer Management, which are crucial for the construction industry. Cost Control software assists in monitoring project expenses, tracking budgets, and ensuring financial transparency. On the other hand, Customer Management solutions facilitate client interactions, improve communication, and enhance customer satisfaction, a critical aspect of the construction business.

As the Construction Software market continues to evolve, these diverse application segments cater to the multifaceted needs of the construction industry. While Project Management and Scheduling remain at the forefront due to their fundamental role in project execution, Inventory Management, Contract Management, Risk Management, and other specialized software solutions contribute to the overall efficiency, transparency, and success of construction projects. The adoption of these software tools is expected to rise further as construction firms seek to optimize their operations and deliver projects on time and within budget.

Deployment Model Analysis

In 2023, the On-premises Solutions segment established its dominance in the Construction Software market, capturing a significant share of the market. This segment’s remarkable position can be attributed to the preference of certain construction companies for on-premises software deployment.

On-premises solutions involve the installation and operation of software on the company’s local servers and infrastructure. This approach provides construction firms with greater control over their data and software, making it particularly attractive for those with stringent security and compliance requirements.

On the other hand, Cloud-based Solutions, while gaining ground, face competition from the established on-premises model. Cloud-based solutions offer the advantages of scalability, accessibility, and reduced IT infrastructure costs. They allow construction professionals to access software and data from anywhere with an internet connection, facilitating collaboration and remote project management. However, some companies remain cautious about migrating to the cloud due to concerns about data security and reliance on third-party service providers.

End-User Analysis

In 2023, the Builders and Contractors segment firmly held a dominant market position in the Construction Software market, capturing a substantial share. This segment’s commanding presence can be attributed to the integral role that builders and contractors play in the construction industry.

Builders and contractors leverage construction software to efficiently manage projects, streamline workflows, and ensure timely and cost-effective project delivery. These software solutions provide essential features such as project scheduling, resource allocation, budget management, and collaboration tools, empowering builders and contractors to oversee complex construction projects with precision.

Furthermore, Construction Managers also play a significant role in the adoption of construction software. They rely on these solutions to oversee multiple projects, monitor progress, and make informed decisions to optimize project performance. The software aids in project planning, budget tracking, and communication among various stakeholders, making it an indispensable tool for construction managers.

Architects and Engineers, on the other hand, utilize construction software to streamline design and planning processes, ensuring that projects are structurally sound and meet design specifications. These professionals benefit from software that supports 3D modeling, blueprint creation, and collaboration with other stakeholders, enhancing the design and engineering phases of construction projects.

Additional end-users in the Construction Software market, such as Owners and Government entities, also contribute to the diverse landscape of the industry. Owners utilize software to track project progress and budget compliance, while government agencies leverage it for regulatory compliance, infrastructure management, and public construction projects.

Software Type Analysis

In 2023, the Accounting Management segment firmly held a dominant market position in the Construction Software market, capturing a significant share. This segment’s prominence can be attributed to its crucial role in financial oversight and management within the construction industry.

Accounting Management software solutions empower construction firms to efficiently handle financial transactions, track expenses, manage budgets, and ensure compliance with accounting standards and regulations. These tools provide essential features such as payroll management, invoicing, financial reporting, and cost control, enabling construction companies to maintain financial transparency and make informed financial decisions.

Additionally, the Field Service Management segment plays a pivotal role in the construction software landscape. It addresses the challenges of managing field operations, including workforce scheduling, equipment tracking, and task assignment. Field Service Management software enhances efficiency by optimizing resource allocation, reducing downtime, and improving communication between field teams and the office.

Design and Estimation Software is another significant segment in the Construction Software market. It caters to architects, engineers, and construction professionals involved in project design and planning. These software solutions offer features like 3D modeling, blueprint creation, and estimation tools, facilitating accurate project design and cost estimation.

As the construction industry continues to evolve and embrace digital transformation, each of these software segments caters to specific needs within the construction workflow. Accounting Management ensures financial stability and compliance, Field Service Management enhances operational efficiency, and Design and Estimation Software supports accurate project planning and design. The adoption of these software types is expected to grow further as construction companies seek comprehensive solutions to streamline their operations, reduce costs, and improve project outcomes.

Enterprise Size Analysis

In 2023, the Large Enterprises segment firmly held a dominant market position in the Construction Software market, capturing a substantial share. This segment’s significant presence can be attributed to the extensive and complex nature of projects undertaken by large construction firms.

Large enterprises in the construction industry leverage construction software to manage multiple projects simultaneously, optimize resource allocation, and ensure efficient project execution. These software solutions offer comprehensive features such as project planning, budget management, collaboration tools, and reporting capabilities, which are essential for handling the scale and intricacy of large construction projects.

Small and Medium-sized Enterprises (SMEs) also play a vital role in the adoption of construction software. As technology becomes more accessible and tailored solutions for SMEs become available, smaller construction companies increasingly recognize the value of these software tools. SMEs utilize construction software to streamline project management, improve communication among project stakeholders, and enhance overall project efficiency. The scalability and affordability of modern construction software make it an attractive option for SMEs looking to compete effectively in the construction industry.

Driving Factors

- Digital Transformation Initiatives: The construction industry is increasingly adopting digital transformation strategies, driving the demand for construction software. Companies seek to enhance project efficiency, collaboration, and data-driven decision-making, fueling the adoption of software solutions.

- Efficient Project Management: Construction software streamlines project management processes, enabling better resource allocation, project scheduling, and communication among stakeholders. This efficiency leads to cost savings and improved project outcomes, motivating adoption.

- Regulatory Compliance: Stringent regulatory requirements in the construction sector necessitate accurate documentation and compliance. Construction software aids in ensuring adherence to regulations, reducing compliance-related risks for construction companies.

- Remote Work and Collaboration: The rise of remote work and collaboration trends in the construction industry has created a need for software that allows teams to work seamlessly from different locations. Construction software provides the necessary tools for remote project management and collaboration, supporting the industry’s changing work dynamics.

Restraining Factors

- Integration Challenges: Integrating construction software with existing systems and workflows can be complex and time-consuming. Compatibility issues and data migration challenges can hinder adoption and implementation.

- Cost Concerns: While construction software offers long-term benefits, the initial investment can be a barrier for some smaller construction companies. Cost-conscious firms may hesitate to adopt these solutions.

- Data Security and Privacy: Concerns about data security and privacy persist in the construction industry, particularly when using cloud-based solutions. Ensuring robust data security measures and compliance with regulations is essential to address these concerns.

- Resistance to Change: Construction professionals may resist adopting new technologies and software due to a preference for traditional methods. Overcoming resistance to change and ensuring user buy-in can be a challenge in promoting software adoption.

Growth Opportunities

- Emerging Markets: Emerging markets present significant growth opportunities for construction software vendors. Countries with booming construction industries, such as India and China, offer untapped potential for software adoption.

- IoT and Real-time Monitoring: The integration of Internet of Things (IoT) technology for real-time monitoring of construction sites and equipment creates new growth avenues. Construction software that harnesses IoT data for insights and decision-making is in high demand.

- Customization Services: Offering tailored software solutions and customization services to cater to the unique needs of construction companies presents a growth opportunity. Customized software can address specific project requirements and workflows.

- Sustainable Construction: The growing emphasis on sustainable construction practices opens doors for software solutions that support environmentally friendly building processes. Software that helps track and manage sustainability metrics aligns with this trend.

Challenges

- Data Quality and Accuracy: Ensuring the quality and accuracy of data used in construction software can be challenging. Incomplete or inaccurate data can lead to flawed insights and decisions.

- Interoperability Issues: Construction software must seamlessly integrate with various systems, which can be complicated due to interoperability issues. Compatibility and data flow between different software and platforms need to be addressed.

- Scalability Challenges: As construction companies grow, their software needs to scale accordingly. Ensuring that construction software can handle growing data volumes and project complexity is a challenge.

- Change Management: Implementing software-driven changes within construction organizations requires effective change management strategies. Resistance to change, cultural shifts, and skill gaps can hinder successful adoption.

Key Market Trends

- Cloud-Based Solutions: The adoption of cloud-based construction software solutions continues to rise. Cloud platforms offer scalability, accessibility, and cost-efficiency, making them a key trend in the industry.

- BIM Integration: Building Information Modeling (BIM) integration with construction software is gaining traction. BIM software enhances project planning, design, and collaboration, and its integration with construction software streamlines project workflows.

- Mobile Construction Apps: Mobile construction apps are becoming essential tools for on-site management and reporting. These apps enable real-time data collection, communication, and project monitoring from mobile devices, enhancing productivity.

- AI and Automation: Artificial intelligence (AI) and automation are transforming construction processes. AI-driven insights, automated project scheduling, and predictive analytics are becoming integral to construction software, increasing efficiency and accuracy.

Key Market Segments

By Application

- Project Management and Scheduling

- Inventory Management

- Contract Management

- Risk Management

- Others (Cost Control, Customer Management, etc.)

By Deployment Model

- Cloud-based Solutions

- On-premises Solutions

By End-User

- Builders and Contractors

- Construction Managers

- Architects and Engineers

- Others (Owners, Government, etc.)

By Software Type

- Accounting Management

- Field Service Management

- Design and Estimation Software

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Regional Analysis

In 2023, North America maintained its stronghold in the Construction Software market, capturing a significant market share. This continued dominance can be attributed to several key factors shaping the construction software landscape in the region. North America has witnessed robust construction activity driven by infrastructure development projects, residential and commercial construction, and technological advancements in the construction sector. As a result, construction companies and contractors in North America have increasingly turned to construction software solutions to streamline project management, enhance collaboration, and improve overall efficiency.

Furthermore, the region’s strong focus on regulatory compliance, safety standards, and project timelines has further propelled the adoption of construction software. These solutions offer features like project scheduling, budget management, and resource allocation, allowing construction firms to meet stringent regulatory requirements while delivering projects on time and within budget. The emphasis on sustainability and green building practices has also driven the use of construction software for managing eco-friendly construction projects.

North America’s mature IT infrastructure and widespread digitalization across industries have created a conducive environment for the adoption of advanced construction software solutions. The region’s construction software market has witnessed significant investments in research and development, leading to the introduction of innovative tools, including Building Information Modeling (BIM) and cloud-based project management software. These technologies have revolutionized the construction industry by improving collaboration, reducing errors, and enhancing project outcomes.

Despite North America’s dominant position, the construction software market is experiencing growth in other regions like Europe, APAC, Latin America, and the Middle East and Africa. Each of these regions is adapting construction software to address their unique construction challenges, regulatory requirements, and market dynamics. As a result, the global construction software market continues to evolve, offering opportunities for both established players and new entrants.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The construction software market has experienced significant growth in recent years, driven by the increasing adoption of technology to improve project management, collaboration, and efficiency in the construction industry. Construction software solutions help streamline processes, automate tasks, and enhance communication among project stakeholders.

Top Key Players

- Sage Group PLC

- Autodesk, Inc.

- Roper Technologies, Inc.

- Trimble Inc.

- Oracle Corporation

- Comprotex Software Inc.

- Procore Technologies Inc.

- Constellation Software Inc.

- BIMobject AB

- RIB Software SE

- BuilderMT, LLC.

- PlanGrid, Inc.

- Heavy Construction Systems Specialists

- Jonas Construction Software Inc.

- ECI Software Solutions Inc.

- Other Prominent Players

Recent Developments

- Autodesk announced in October 2022 the release of Construction Cloud, its latest construction software platform. The platform provides tools to manage projects efficiently while also supporting collaboration and building design processes.

- Procore Technologies announced its purchase of Fieldwire, a construction software company offering tools for field management and collaboration, on September 20, 2022.

- Trimble officially unveiled their construction software solution, Trimble Connect, in August 2022. This suite of tools provides project management, collaboration and building design functions.

Report Scope

Report Features Description Market Value (2023) US$ 1,723 Mn Forecast Revenue (2033) US$ 4,720 Mn CAGR (2024-2033) 12.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Project Management and Scheduling, Inventory Management, Contract Management, Risk Management, Others (Cost Control, Customer Management, etc.)), By Deployment Model (Cloud-based Solutions, On-premises Solutions), By End-User (Builders and Contractors, Construction Managers, Architects and Engineers, Others (Owners, Government, etc.)), By Software Type (Accounting Management, Field Service Management, Design and Estimation Software), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sage Group PLC, Autodesk, Inc., Roper Technologies, Inc., Trimble Inc., Oracle Corporation, Comprotex Software Inc., Procore Technologies Inc., Constellation Software Inc., BIMobject AB, RIB Software SE, BuilderMT, LLC., PlanGrid, Inc., Heavy Construction Systems Specialists, Jonas Construction Software Inc., ECI Software Solutions Inc., Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is construction software, and how does it benefit the construction industry?Construction software refers to digital solutions designed to streamline various aspects of project management in construction projects, such as planning, scheduling, cost estimation and collaboration. Construction software helps the industry by improving operational efficiency, improving project coordination and supporting improved resource allocation.

How big is Construction software market?The global Construction software market is expected to expand at a 12.6% CAGR during the forecast period 2024-2033. The construction software industry is anticipated to be worth USD 1,723 Million in 2023 and exceed USD 4,720.0 million by 2033.

Who are the leaders in the construction software market?Some of the major players operating in the construction management software industry are Sage Group PLC, Autodesk, Inc., Roper Technologies, Inc., Trimble Inc., Oracle Corporation, Comprotex Software Inc., Procore Technologies Inc., Constellation Software Inc., BIMobject AB, RIB Software SE, BuilderMT, LLC., PlanGrid, Inc., Heavy Construction Systems Specialists, Jonas Construction Software Inc., ECI Software Solutions Inc., Other Prominent Players

What are the key features to look for in construction software?Considerations when selecting construction software include project planning and scheduling tools, cost estimation/budgeting capabilities, document management systems, cloud-based accessibility, integration with BIM/CAD models and mobile compatibility for on-site management.

What are the challenges faced by construction companies in adopting construction software?Common challenges facing construction companies can include high initial implementation costs, the complexity of certain software solutions and resistance to change within their industry. Furthermore, data security and integration between systems may present unique obstacles to overcome.

Construction Software MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Construction Software MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Sage Group PLC

- Autodesk, Inc.

- Roper Technologies, Inc.

- Trimble Inc.

- Oracle Corporation

- Comprotex Software Inc.

- Procore Technologies Inc.

- Constellation Software Inc.

- BIMobject AB

- RIB Software SE

- BuilderMT, LLC.

- PlanGrid, Inc.

- Heavy Construction Systems Specialists

- Jonas Construction Software Inc.

- ECI Software Solutions Inc.

- Other Prominent Players