Global Construction Robot Market By Function (Bricklaying, Material Handling, Demolition, Other Functions), By Robot Type (Robotic Arms, Traditional Robots, Exoskeletons), By End-Use (Residential Use, Commercial Use, Industrial Use), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117629

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

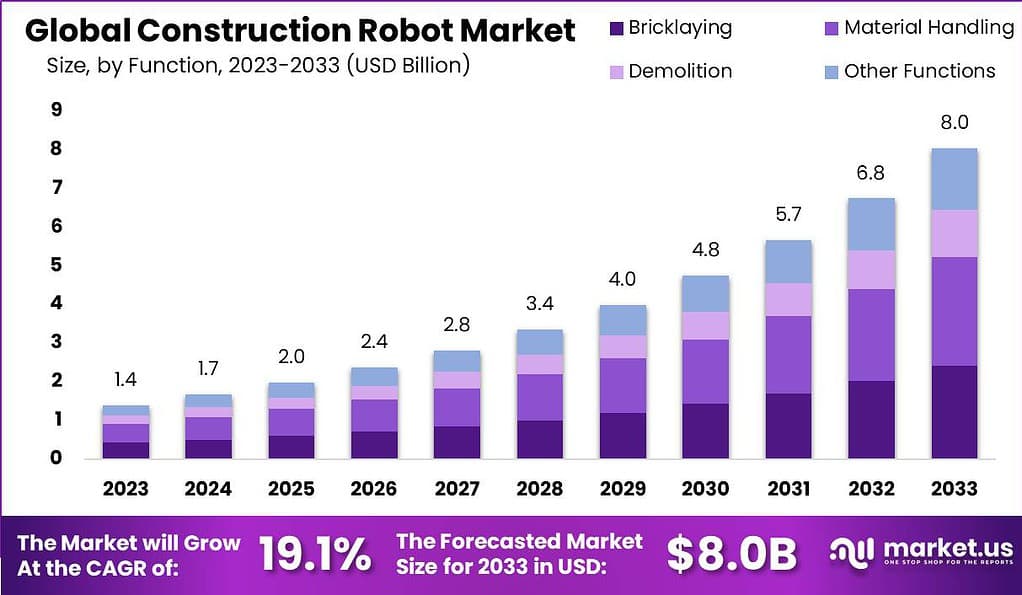

The Global Construction Robot Market size is expected to be worth around USD 8.0 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

Construction robots are automated machines designed to perform various tasks in the construction industry. These robots are equipped with advanced sensors, actuators, and artificial intelligence capabilities to carry out specific construction-related activities. They assist in tasks such as bricklaying, concrete pouring, welding, demolition, and material handling, among others.

The construction robot market has witnessed significant growth in recent years due to the increasing demand for automation and efficiency in the construction sector. These robots offer several advantages, including improved productivity, enhanced safety, and cost savings. By automating repetitive and labor-intensive tasks, construction robots can expedite construction processes, reduce human error, and complete projects more quickly.

Construction robots are designed to work collaboratively with human workers, augmenting their capabilities and improving overall project efficiency. They are equipped with safety features to ensure smooth human-robot interaction on construction sites. These robots can analyze their surroundings, adapt to dynamic environments, and perform tasks with precision and accuracy.

The construction robot market is driven by factors such as the need for increased productivity, labor shortages, and the growing emphasis on sustainable construction practices. With advancements in robotics and artificial intelligence, construction robots are expected to play a crucial role in shaping the future of the construction industry, transforming traditional construction processes, and enabling the construction of complex structures with greater speed and precision.

Key Takeaways

- The global construction robot market is estimated to reach USD 8.0 billion by 2033, exhibiting a robust CAGR of 19.1% from 2024 to 2033.

- In 2023, material handling robots held a significant market share of over 35.2%, driven by their ability to enhance safety, efficiency, and cost-effectiveness in construction operations.

- Robotic arms captured more than 70.5% of the market share in 2023, showcasing their versatility and efficiency in tasks ranging from welding to material handling.

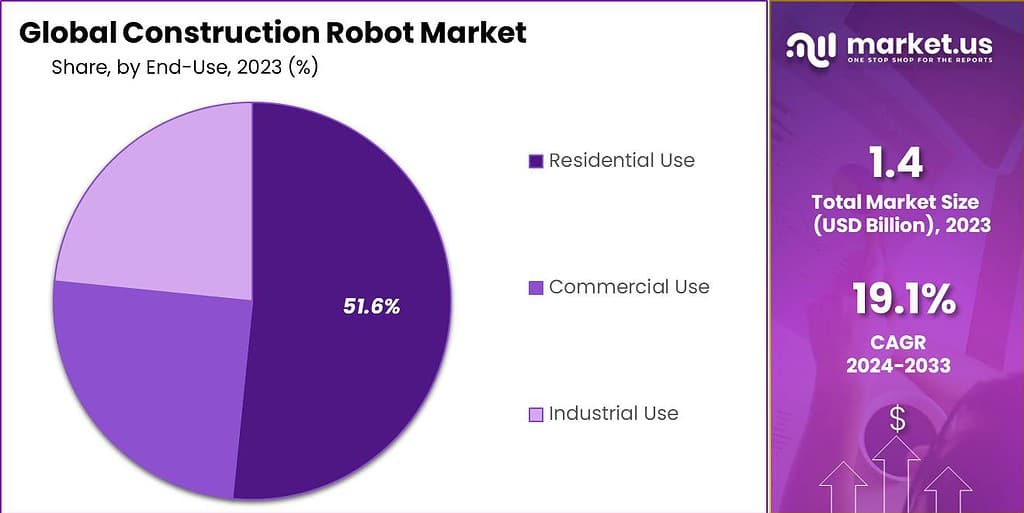

- Residential use accounted for over 51.6% of the market share in 2023, emphasizing the increasing adoption of construction robots in tasks such as bricklaying and painting to expedite construction processes.

- The global trend of urbanization, with approximately 55% of the world’s population residing in cities, is a significant driver of the construction robot market, propelling demand for efficient and sustainable construction solutions.

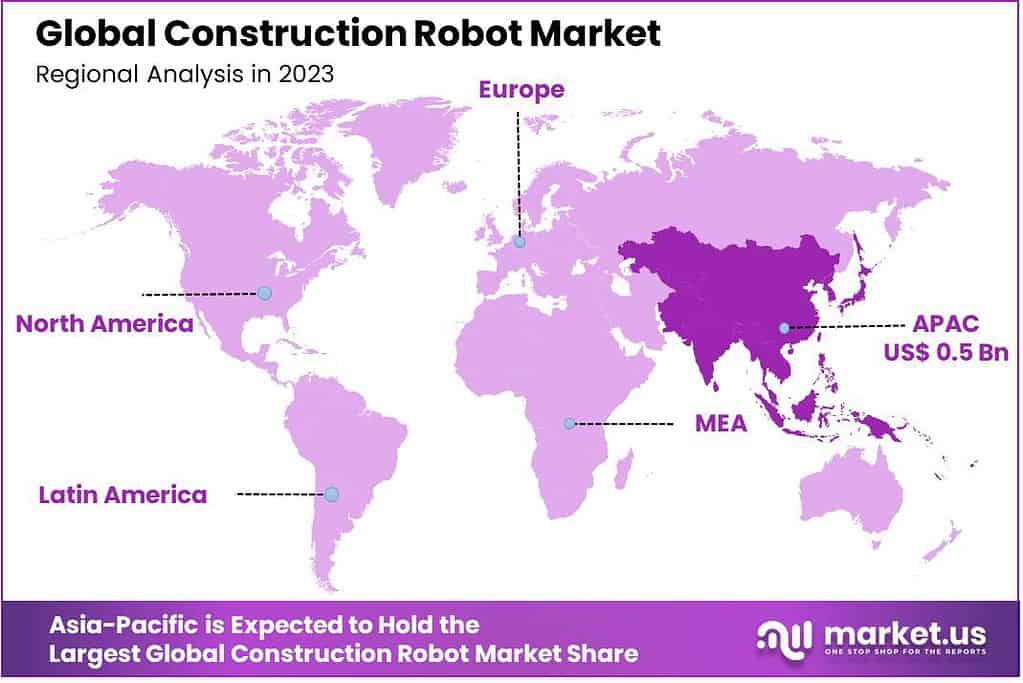

- The Asia-Pacific region emerged as a frontrunner in the construction robot market, capturing over 35.1% of the market share in 2023, driven by rapid urbanization and government initiatives promoting technological innovation.

- Over 60% of construction companies are projected to employ robotic systems for tasks such as 3D printing, concrete placement, and rebar installation.

- Approximately 65% of construction firms are expected to utilize robotic systems for tasks like welding, cutting, and surface finishing.

- 50% of major construction sites will utilize robotic systems for tasks such as bricklaying, tiling, and material handling.

- The adoption of autonomous mobile robots (AMRs) for material transportation and logistics on construction sites is expected to grow by 40% compared to 2023.

- The use of robotic demolition and deconstruction systems for selective dismantling and recycling is projected to increase by 30% year-over-year.

- Robotic systems for infrastructure inspection and maintenance, including bridges and tunnels, are expected to grow by 25% compared to 2023.

- Automated construction site monitoring, surveying, and progress tracking using robotic systems will increase by 35% year-over-year.

- Over 70% of construction equipment manufacturers will offer robotic solutions for tasks such as earthmoving, excavation, and grading.

- Robotic systems will be employed for tasks like painting, plastering, and insulation installation by 60% of construction companies.

- Over 65% of construction firms are estimated to employ robotic systems for tasks such as roofing, siding, and window installation.

- Approximately 55% of construction sites are expected to utilize robotic systems for tasks like site preparation, demolition, and waste management.

- The adoption of robotic systems for prefabrication and modular construction is projected to grow by 30% compared to 2023.

- The use of robotic systems for construction site safety and security, including surveillance and access control, is expected to increase by 25% year-over-year.

- Robotic systems for underground construction and tunneling operations are projected to grow by 20% compared to 2023.

- Over 70% of construction equipment manufacturers will offer robotic solutions for tasks such as paving, compacting, and concrete finishing.

Function Analysis

In 2023, the Material Handling segment in the construction robot market held a dominant position, capturing more than a 35.2% share. This leading segment reflects a growing recognition of the benefits that automated material handling offers to the construction industry. Key factors contributing to its dominance include the pressing need to enhance safety on construction sites, improve efficiency, and reduce operational costs.

Material handling robots are designed to transport, pick, and place materials and tools across construction sites, thereby minimizing human labor and the associated risks of injury. Additionally, these robots are instrumental in addressing labor shortages by performing repetitive and physically demanding tasks, allowing human workers to focus on more complex and skilled operations.

The adoption of material handling robots has been further propelled by technological advancements that improve their precision, versatility, and capability to operate in varied and challenging environments. Innovations such as AI, machine learning, and advanced sensors have enabled these robots to navigate complex construction sites autonomously and adapt to changing tasks and conditions.

The integration of these robots into construction operations is supported by the growing emphasis on digital transformation and smart construction practices, which leverage data analytics and IoT devices for enhanced project management and execution. Moreover, the increasing investment in infrastructure development projects globally, coupled with the rising focus on sustainable construction practices, has underscored the importance of efficient material handling.

Robot Type Analysis

In 2023, the Robotic Arms segment in the construction robot market held a dominant market position, capturing more than a 70.5% share. This impressive share underscores the crucial role robotic arms play in modernizing construction processes.

The primary drivers behind the dominance of robotic arms include their unparalleled precision, versatility, and efficiency in performing a wide range of tasks, from welding and material handling to cutting and assembly. Unlike traditional construction machinery, robotic arms offer the flexibility to be reprogrammed for different tasks, significantly reducing the time and cost associated with switching between different types of equipment on construction sites.

The leading position of the Robotic Arms segment is also a reflection of the technological advancements in robotics and automation. The integration of advanced sensors, artificial intelligence, and machine learning enables these robotic arms to perform complex tasks with high accuracy and minimal supervision. This capability not only enhances productivity but also significantly improves safety by reducing human exposure to hazardous working conditions.

Furthermore, as the construction industry continues to face skilled labor shortages, robotic arms provide an effective solution by compensating for the workforce gap and ensuring that projects can be completed on time and within budget. Another factor contributing to the growth of the Robotic Arms segment is the increasing demand for sustainable and efficient construction practices.

End-Use Analysis

In 2023, the Residential Use segment within the construction robot market held a dominant market position, capturing more than a 51.6% share. This substantial share can be attributed to the increasing demand for housing worldwide, coupled with the construction industry’s push towards efficiency and sustainability. Robots in residential construction have become indispensable for tasks ranging from bricklaying and painting to the installation of electrical and plumbing systems.

The adoption of construction robots in the residential sector is driven by the need to speed up construction processes, reduce labor costs, and mitigate the impact of labor shortages. Additionally, the precision and efficiency provided by robots contribute to higher-quality construction, with reduced waste and enhanced safety on construction sites.

The leading position of the Residential Use segment is also bolstered by technological advancements that have made construction robots more accessible and cost-effective for smaller scale projects. Innovations in modular construction and prefabrication techniques, where components are built off-site and assembled on-site, have further amplified the role of robots in residential construction. These methods rely heavily on robotic systems for precision and efficiency, allowing for faster project completion times and lower overall costs.

Moreover, the growing emphasis on energy-efficient and smart homes has led to increased use of robots for installing complex systems that require high precision, such as renewable energy solutions and advanced insulation techniques. By leveraging robotic technology, the construction industry can meet the increasing demand for residential buildings while upholding high standards of quality and environmental responsibility.

Key Market Segments

By Function

- Bricklaying

- Material Handling

- Demolition

- Other Functions

By Robot Type

- Robotic Arms

- Traditional Robots

- Exoskeletons

By End-Use

- Residential Use

- Commercial Use

- Industrial Use

Driver

Global trend of urbanization is steadily increasing

The escalating pace of urbanization globally acts as a significant driver for the construction robot market. As cities expand and the demand for residential, commercial, and infrastructural projects increases, the construction industry faces the challenge of meeting these needs efficiently and sustainably. According to the World Bank, about 55% of people worldwide, which is around ~4.2 billion folks, live in cities. This number is expected to double by 2050, with seven out of every 10 people living in cities.

Urbanization not only leads to a surge in construction activities but also necessitates innovation in construction methodologies to accommodate the limited space and fast-paced development schedules characteristic of urban environments.

Construction robots, with their ability to work with precision and efficiency, play a crucial role in addressing these demands. They enable the construction sector to keep pace with the growing urbanization, ensuring that projects are completed within tighter timelines and with fewer resources, while also adhering to the increased standards of quality and sustainability required in urban settings.

Restraint

Cost of equipment required for construction remains high

One of the main restraints facing the construction robot market is the high initial cost of equipment. Advanced construction robots, equipped with cutting-edge technologies such as AI, machine learning, and sophisticated sensory capabilities, come with a significant price tag. This financial barrier can be particularly daunting for small to medium-sized enterprises (SMEs) that operate with limited budgets.

The cost of acquiring, maintaining, and updating robotic equipment, along with the necessary training for employees, represents a significant investment that many companies find challenging. This restraint can slow the adoption of robotic technology within the industry, as companies weigh the benefits of automation against the substantial upfront and ongoing costs associated with implementing these advanced systems in their operations.

Challenge

Construction sites often have unpredictable layouts, posing logistical challenges

A notable challenge in the wider adoption of construction robots is the unpredictable and often complex layout of construction sites. Unlike manufacturing environments, where conditions can be tightly controlled and predictable, construction sites vary widely in their terrain, layout, and the nature of the tasks required.

These variables can introduce complications in the deployment of robots, which may struggle to navigate uneven ground, unexpected obstacles, or varying tasks without extensive customization or supervision. Adapting robots to efficiently handle the diversity and unpredictability of construction sites requires ongoing advancements in AI, machine learning, and robotics to enhance their adaptability, situational awareness, and decision-making capabilities in dynamic and unstructured environments.

Opportunity

Rise in automation at construction sites

The increasing trend towards automation in the construction industry presents a substantial opportunity for the construction robot market. As the sector seeks ways to improve efficiency, reduce labor costs, and address workforce shortages, the integration of robots into construction processes is becoming increasingly appealing.

Automation can enhance precision in tasks such as bricklaying, painting, and welding, and can perform repetitive, labor-intensive tasks without fatigue, reducing the risk of injuries and improving overall site safety. According to experts, construction companies might use 3D printing for 25% of their projects. This could mean needing 70% less workers and spending 90% less money. This change could help the worldwide construction robots market grow in the future.

Furthermore, the rise in smart construction technologies, including the Internet of Things (IoT) and Building Information Modeling (BIM), integrates seamlessly with robotic solutions, enabling a more coordinated and efficient approach to construction projects. This convergence of technology and demand positions the construction robot market for significant growth, as industry stakeholders embrace automation to meet the challenges of modern construction.

Growth Factors

- Technological Advancements: Continuous advancements in technology, including artificial intelligence (AI), machine learning, and sensor technology, have significantly improved the capabilities of construction robots. These advancements enable robots to perform a wider range of tasks with greater efficiency and precision, driving their adoption in the construction industry.

- Labor Shortages: The construction industry is increasingly facing labor shortages globally, a situation exacerbated by an aging workforce and a lack of new entrants. Construction robots offer a viable solution by taking over repetitive, labor-intensive tasks, thereby alleviating the impact of these shortages.

- Increased Focus on Safety: Safety concerns on construction sites are driving the adoption of robots. Construction robots can operate in hazardous conditions where there is a high risk of injury to human workers, thus improving overall workplace safety.

- Demand for Faster Construction: The global demand for faster completion of construction projects, driven by urbanization and economic growth, necessitates the adoption of construction robots. These robots can work continuously without the need for breaks, significantly speeding up construction processes and enabling projects to meet tight deadlines.

Emerging Trends

- Autonomous Construction Vehicles: The rise of autonomous or semi-autonomous vehicles, such as drones for surveying and robotic excavators for digging, is a trend that is gaining traction. These vehicles increase efficiency and reduce the need for manual labor, particularly in large-scale construction projects.

- 3D Printing in Construction: The integration of 3D printing technology with construction robotics is revolutionizing the way buildings are constructed. This trend allows for the printing of complex building structures directly on-site, reducing material waste and offering design flexibility.

- Collaborative Robots (Cobots): The development of cobots, which are designed to work alongside human workers, is an emerging trend. These robots are equipped with safety features and can perform tasks in close proximity to humans, blending the strengths of human flexibility and robot efficiency.

- Sustainable Construction Practices: As the construction industry moves towards sustainability, construction robots are increasingly being used for tasks that contribute to green building practices. This includes the use of robots for the precise application of materials, reducing waste, and optimizing resource use, aligning construction practices with environmental sustainability goals.

Regional Analysis

In 2023, the Asia-Pacific region established itself as a frontrunner in the construction robot market, securing a commanding share of over 35.1%. This significant market dominance can be attributed to several key factors, including rapid urbanization, extensive infrastructure development, and a strong emphasis on adopting new technologies in countries such as China, Japan, and South Korea.

The Asia-Pacific region’s commitment to innovation and technological advancement has spurred the integration of robotics into construction processes, driving efficiency, safety, and productivity improvements. The growing demand for construction robots in this region is further fueled by the government initiatives promoting smart city projects and the construction of environmentally sustainable buildings.

The demand for Construction Robot in Asia-Pacific was valued at USD 0.5 billion in 2023 and is anticipated to grow significantly in the forecast period. Moreover, the Asia-Pacific market benefits from a robust manufacturing base, with China being a global leader in the production of robotics technology. This advantage ensures the availability of advanced construction robots at competitive prices, enhancing the region’s market position.

Additionally, the presence of key industry players who are investing heavily in research and development activities contributes to the rapid evolution of construction robotics in the region. These efforts are focused on developing robots capable of complex tasks such as bricklaying, concrete pouring, and even intricate assembling, catering to the diverse needs of the construction industry.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the realm of construction robotics, the landscape is defined by a dynamic mix of innovators and established industry leaders, each contributing to the sector’s rapid evolution. The analysis of key players in this market reveals a competitive arena where technological advancement and strategic partnerships are paramount. These entities not only shape the direction of technological trends but also significantly impact market dynamics through their contributions to product development, automation, and the integration of artificial intelligence (AI) in construction processes.

Top Market Leaders

- ABB Ltd.

- Brokk Inc.

- Caterpillar Inc.

- Komatsu Ltd.

- Built Robotics Inc.

- Boston Dynamics

- FBR Ltd.

- Hilti Corporation

- Clearpath Robotics, Inc.

- Ekso Bionics

- Construction Robotics

- Husqvarna Group

- Other Key Players

Recent Developments

- FBR Ltd. Teams Up with M&G Investment Management: FBR Ltd., a key player in robotics, has formed a partnership with M&G Investment Management from the UK. They plan to fund the making and sending out of three new Hadrian X robots to the USA. These robots are special because they can work outside using a cool tech called Dynamic Stabilization Technology (DST).

- Launch of IronBOT by Advanced Construction Robotics Inc.: This company introduced IronBOT, a powerful robot that can lift, carry, and place rebar, which is a type of steel used to reinforce concrete. IronBOT can handle up to 5,000 pounds of rebar at once, making the job easier and safer for construction crews. It works well with TyBOT, another robot from the same company, which ties rebar together quickly, doing over 1,100 ties in an hour.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Bn Forecast Revenue (2033) USD 8.0 Bn CAGR (2024-2033) 19.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Function (Bricklaying, Material Handling, Demolition, Other Functions), By Robot Type (Robotic Arms, Traditional Robots, Exoskeletons), By End-Use (Residential Use, Commercial Use, Industrial Use) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Brokk Inc., Caterpillar Inc., Komatsu Ltd., Built Robotics Inc., Boston Dynamics, FBR Ltd., Hilti Corporation, Clearpath Robotics Inc., Ekso Bionics, Construction Robotics, Husqvarna Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are construction robots?Construction robots are specialized machines designed to automate various tasks within the construction industry. They can perform a wide range of functions, including bricklaying, welding, demolition, excavation, and more.

How big is Construction Robot Market?The Global Construction Robot Market size is expected to be worth around USD 8.0 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

What are the major factors driving the market growth?The construction robot market is being primarily driven by factors such as increasing labor costs, growing demand for automation to improve productivity and efficiency, advancements in robotics technology, and rising focus on safety in construction activities.

Which is the leading function segment in the market?In 2023, the Material Handling segment in the construction robot market held a dominant position, capturing more than a 35.2% share.

Who are the leading vendors in the market?Some key players operating in the construction robots market include ABB Ltd., Brokk Inc., Caterpillar Inc., Komatsu Ltd., Built Robotics Inc., Boston Dynamics, FBR Ltd., Hilti Corporation, Clearpath Robotics Inc., Ekso Bionics, Construction Robotics, Husqvarna Group, Other Key Players

Which region accounted for the largest construction robots market share?In 2023, the Asia-Pacific region established itself as a frontrunner in the construction robot market, securing a commanding share of over 35.1%.

Construction Robot MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Construction Robot MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Brokk Inc.

- Caterpillar Inc.

- Komatsu Ltd.

- Built Robotics Inc.

- Boston Dynamics

- FBR Ltd.

- Hilti Corporation

- Clearpath Robotics, Inc.

- Ekso Bionics

- Construction Robotics

- Husqvarna Group

- Other Key Players