Global Construction Layout Robots Market By Product Type (Fully Autonomous Robots, Semi-Autonomous Robots), By Application (Commercial Construction, Residential Construction, Industrial Construction), By End-User (Construction Companies, Contractors, Surveying Firms, Others), By Technology (Laser-guided, GPS-guided, Total Station-based, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 170625

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

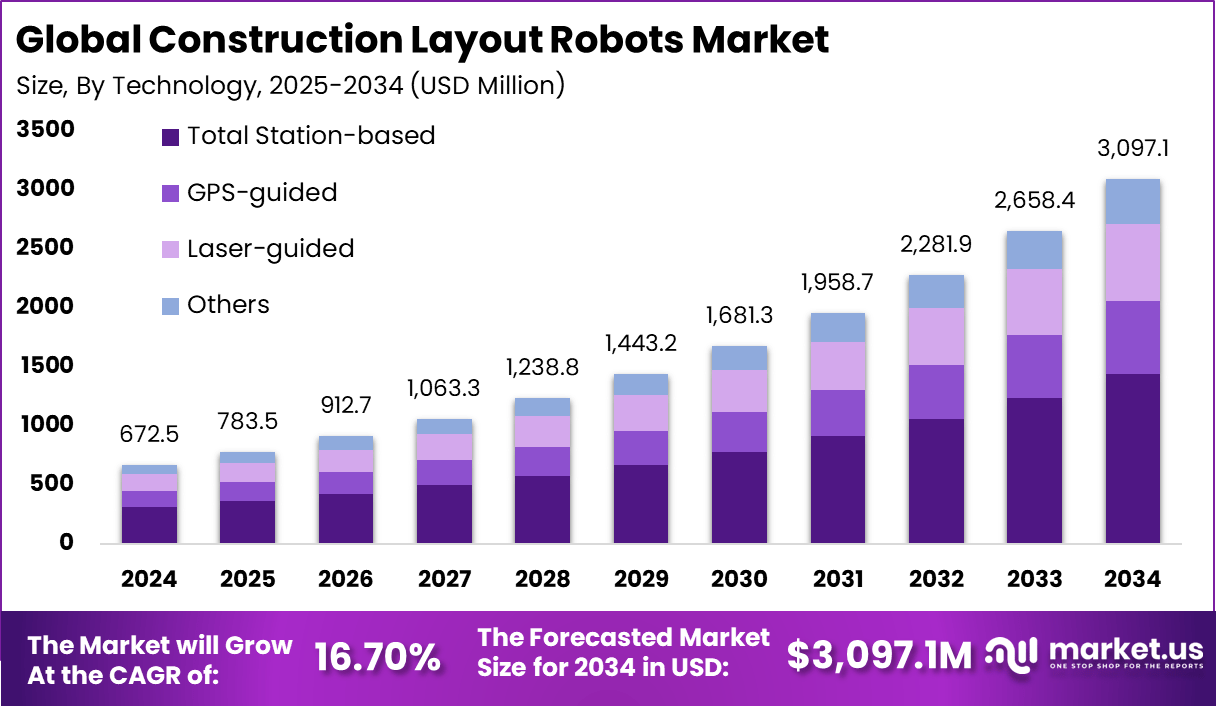

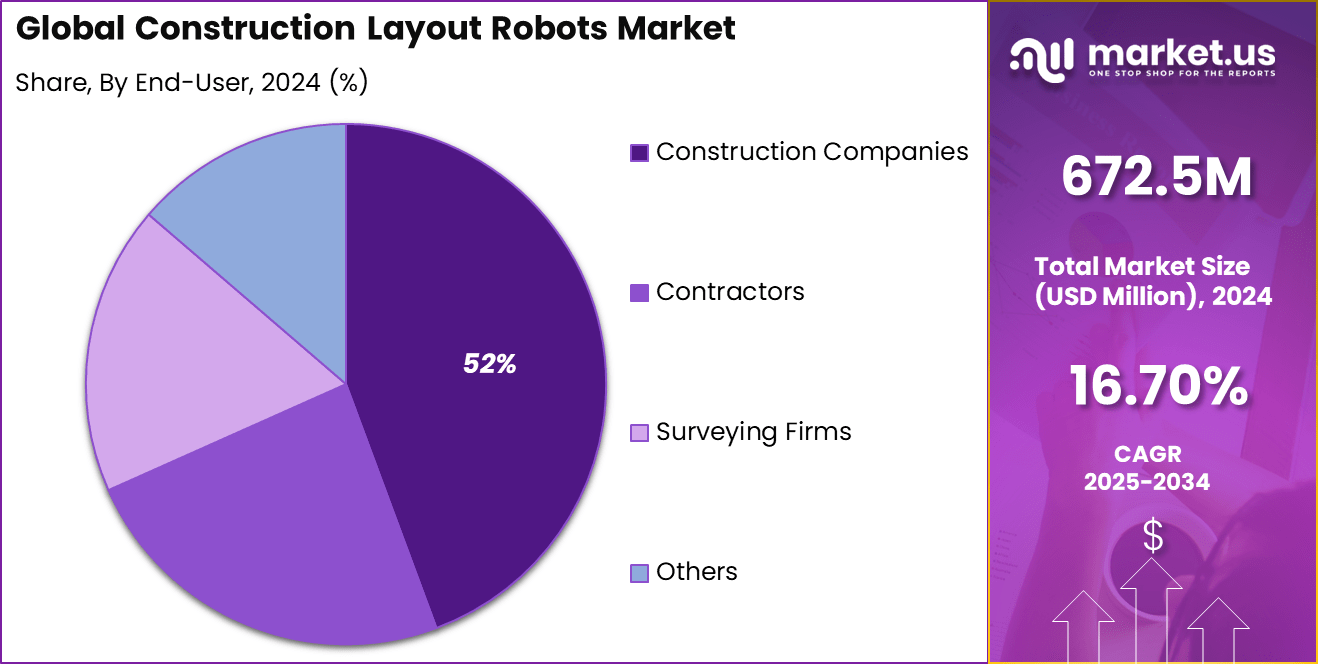

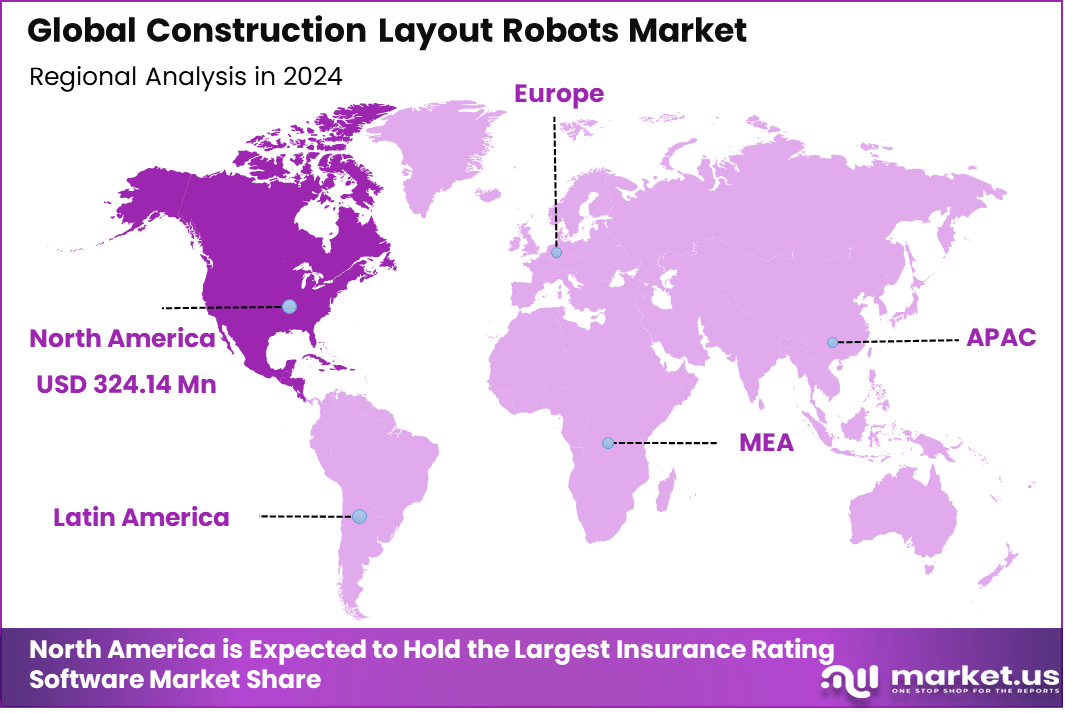

The Global Construction Layout Robots Market generated USD 672.5 million in 2024 and is predicted to register growth from USD 783.5 million in 2025 to about USD 3,097.1 million by 2034, recording a CAGR of 16.70% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 48.2% share, holding USD 324.14 Million revenue.

The construction layout robots market refers to specialized robotic systems used on building sites to automate the precise marking of foundation lines, wall positions, anchor points, and other critical spatial references. These robots replace traditional manual layout methods such as tape measures and chalk lines by using laser scanning, GPS or total station data directly from digital plans to perform accurate markings on floors and surfaces.

This market plays a crucial role in enhancing accuracy and repeatability in construction processes. Construction layout robots provide millimetre level precision for translating Building Information Modeling (BIM) data and CAD drawings into physical site marks, improving consistency and reducing rework. By automating layout, firms can also improve coordination between contractors, subcontractors, and trades, ensuring that subsequent construction steps align with design specifications.

Growth in this market is driven by persistent labour shortages, rising demand for construction efficiency, and the need for precision in built environments. As the global construction workforce ages and fewer entrants enter the sector, companies are turning to automation to maintain productivity and reduce dependency on skilled manual layout teams.

Digitalisation of project information and convergence with robotics technologies such as advanced sensors and AI navigation also support market expansion. Industry reporting highlights that construction automation tools, including layout robots, are increasingly adopted for tasks that require repeatability and accuracy, helping manage labour constraints and performance expectations.

Demand for construction layout robots is rising among general contractors, engineering firms, and surveying specialists. Commercial and infrastructure projects, with extensive layout requirements, are significant adopters due to the volume of marking work and the impact of layout accuracy on downstream activities. Residential and industrial segments are also exploring robots to standardise workflows and reduce schedule risk.

Top Market Takeaways

- By product type, semi-autonomous robots accounted for 57.3% of the construction layout robots market, offering operator oversight with automated precision for complex site layouts and error reduction.

- By application, commercial construction captured 52.6%, driven by high-rise projects and large-scale developments requiring accurate MEP and structural point placement.

- By end-user, construction companies held 51.8% share, adopting layout robots to accelerate workflows, minimize rework costs, and meet tight project timelines.

- By technology, total station-based systems represented 46.6%, valued for reflectorless measurements, long-range accuracy, and seamless integration with BIM models on job sites.

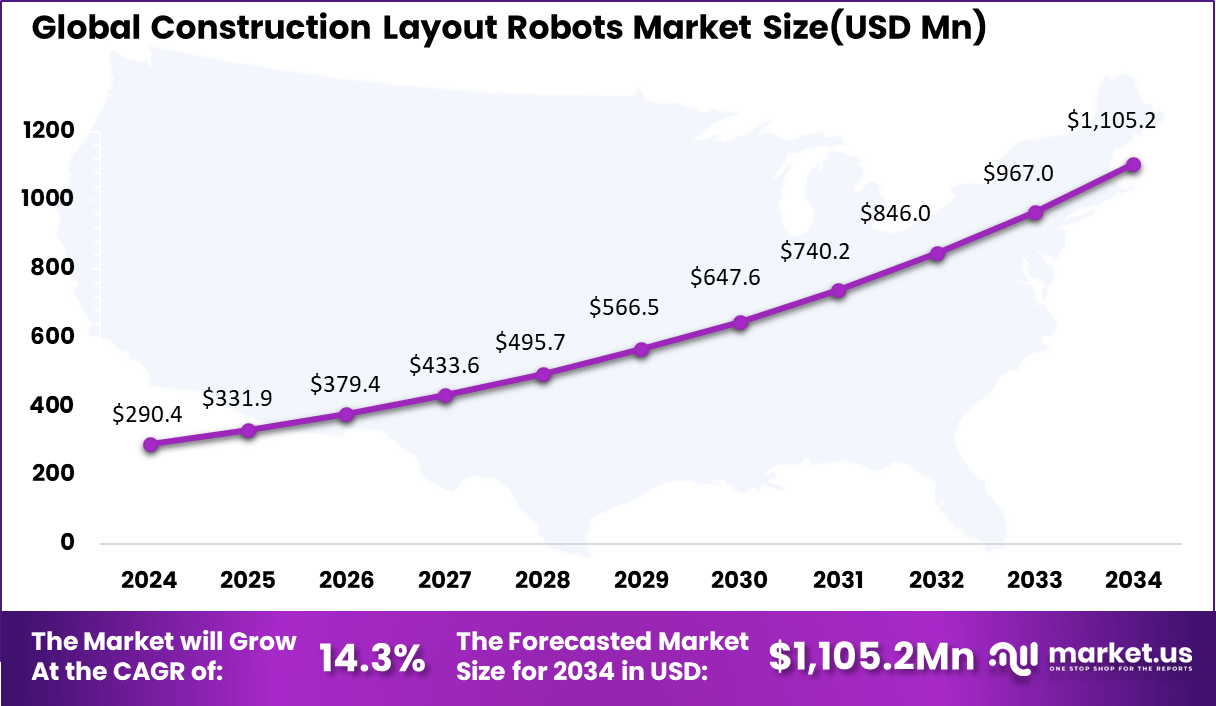

- North America dominated with 48.2% of the global market, where the U.S. reached USD 290.4 million in 2025 and projects a CAGR of 14.3% fueled by labor shortages and infrastructure investments.

Product Type Analysis

Semi-autonomous robots hold 57.3% of the Construction Layout Robots market, reflecting the construction industry’s preference for solutions that combine automation with human control. These robots are capable of performing layout marking tasks with high precision while still allowing operators to supervise positioning and final validation. This balance is important on active construction sites where conditions frequently change and full automation may not always be practical.

The strong adoption of semi-autonomous robots is also linked to ease of training and lower operational risk. Construction teams can quickly integrate these robots into existing workflows without major process changes. By reducing manual measurement errors and improving layout accuracy, these systems help minimize rework and material waste. Their market share shows that reliability and adaptability are key priorities for layout automation in construction.

Application Analysis

Commercial construction accounts for 52% of the application segment, driven by the need for high accuracy and speed in large-scale building projects. Offices, retail complexes, hospitals, and industrial facilities require precise layout of walls, utilities, and structural elements. Construction layout robots support these needs by delivering consistent and repeatable measurements across expansive floor areas.

In commercial projects, delays and rework can significantly increase costs. Layout robots help reduce these risks by ensuring that design plans are accurately transferred to the job site. Their use also supports better coordination between different construction teams working simultaneously. The strong presence of this segment reflects the growing emphasis on precision and efficiency in commercial building developments.

End-User Analysis

Construction companies represent 51.8% of the end-user segment, showing steady adoption of layout robots at the organizational level. These companies manage multiple projects and benefit from standardized layout processes that can be applied across different sites. Layout robots help construction firms maintain consistency, improve productivity, and reduce reliance on skilled manual labor for measurement tasks.

The investment in layout robots is often driven by long-term cost savings and improved project control. Construction companies use these systems to shorten layout time and improve accuracy during early project stages. This segment’s share highlights how professional builders are increasingly viewing layout robotics as a core tool rather than an optional technology.

Technology Analysis

Total station-based technology holds 46.6% of the market, making it a widely used approach for construction layout robots. This technology relies on precise optical measurement to position and guide the robot according to digital building plans. Total station systems are valued for their high accuracy and reliability, especially in projects where detailed alignment is critical.

The adoption of total station-based robots is supported by their compatibility with existing surveying equipment and digital design tools. Many construction teams are already familiar with total station workflows, which makes integration smoother and reduces training time. The strong share of this technology reflects its proven performance and continued relevance in modern construction layout applications.

Key Reasons for Adoption

- The need for higher layout accuracy is increasing as construction projects become more complex and tolerance levels become tighter

- Shortage of skilled surveyors and layout technicians is pushing firms to adopt automated layout solutions

- Pressure to reduce rework and material waste is encouraging the use of precise robotic marking systems

- Faster project timelines are driving demand for tools that can complete layout tasks with minimal manual effort

- Growing use of digital building models is making robotic layout systems easier to integrate on job sites

Benefits of Users

- Layout robots help improve accuracy across floors, walls, and structural elements

- They reduce human errors that often lead to costly corrections later in the project

- Labor productivity improves as fewer workers are needed for repetitive layout tasks

- Project schedules become more predictable due to consistent and reliable layout execution

- Overall construction quality improves through better alignment with design drawings

Usage

- Used to mark points, lines, and reference grids directly on construction surfaces

- Applied in commercial building projects where precision and speed are critical

- Utilized in residential construction to standardize layout work across multiple units

- Deployed in large infrastructure projects to support consistent site measurements

- Integrated with digital plans to ensure real time alignment between design and execution

Emerging Trends

Key Trend Description Laser Auto Mark Lines Robots use laser guidance to draw straight and accurate lines on floors and walls. AI Read Blueprints Robotic systems scan digital plans and mark locations without manual measurement. Drone Help Spot Drones inspect high or hard to reach markings and help correct errors quickly. Team with Brick Bots Layout robots work alongside brick laying robots to speed up construction flow. Cloud Share Plans Layout data is shared online so teams can review plans remotely from offices. Growth Factors

Key Factors Description Few Skilled Survey Men Worker shortages in surveying increase reliance on automated layout robots. Big Projects Grow Large buildings and infrastructure projects require fast and precise layout marking. Cut Time and Waste Accurate first time marking reduces rework and material loss. New Tech Gets Cheap Lower equipment prices allow small and mid size builders to adopt robotics. Rules Want Exact Work Construction regulations demand precise layouts to ensure safety and quality. Key Market Segments

By Product Type

- Fully Autonomous Robots

- Semi-Autonomous Robots

By Application

- Commercial Construction

- Residential Construction

- Industrial Construction

By End-User

- Construction Companies

- Contractors

- Surveying Firms

- Others

By Technology

- Laser-guided

- GPS-guided

- Total Station-based

- Others

Regional Analysis

North America accounted for 48.2% share, driven by strong adoption of digital construction practices and rising use of automation on large commercial and infrastructure projects. Contractors across the region have increasingly adopted construction layout robots to improve accuracy in marking floor plans, walls, and utility points directly from digital design files.

Demand has been supported by ongoing labor shortages and the need to reduce manual layout errors, which often lead to costly rework and schedule delays. The ability of layout robots to operate continuously and deliver consistent precision has made them a practical solution for complex and fast paced construction environments.

The U.S. market reached USD 290.4 Mn and is projected to grow at a 14.3% CAGR, reflecting strong investment in construction technology and automation. Adoption has been concentrated among general contractors and specialty trades that manage large and complex projects, where precision and speed directly affect profitability. Construction layout robots are being used to reduce dependence on skilled layout labor, lower measurement errors, and support faster installation of mechanical, electrical, and plumbing systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The Construction Layout Robots market shows strong opportunities as construction firms increasingly adopt digital tools to improve site accuracy and project efficiency. These robots support precise marking of points, lines, and elevations directly from digital design files, which reduces manual errors and rework.

Growing use of building information modeling is increasing the need for automated layout solutions that can directly translate design data into on site execution. Demand is also supported by tight project timelines, where faster layout processes help contractors keep schedules on track.

The market faces several threats that may limit adoption in some regions. High upfront costs and ongoing software subscription fees remain a concern for small construction firms. In price sensitive markets, manual layout methods are still seen as more economical, especially for smaller projects. Limited awareness of the long term cost savings from reduced rework can also slow purchasing decisions.

Competitive Analysis

The competitive landscape of the construction layout robots market is led by established surveying, positioning, and construction technology providers alongside emerging robotics specialists. Trimble Inc., Topcon Corporation, Leica Geosystems under Hexagon AB, and Hilti Group hold strong positions due to their deep expertise in layout accuracy, GNSS, total stations, and integration with BIM and digital construction workflows.

These companies benefit from existing relationships with contractors and a broad installed base, which supports faster adoption of robotic layout solutions on large commercial and infrastructure projects. At the same time, players such as Dusty Robotics and HP Inc. focus on automation of marking and printing tasks directly on site floors, addressing labor shortages and improving layout speed and consistency.

Top Key Players in the Market

- Trimble Inc.

- Topcon Corporation

- Leica Geosystems (Hexagon AB)

- Hilti Group

- Dusty Robotics

- HP Inc.

- Caterpillar Inc.

- Fujita Corporation

- Construction Robotics

- Brokk AB

- Advanced Construction Robotics

- Robotics Plus

- Ekso Bionics Holdings, Inc.

- Boston Dynamics

- Others

Future Outlook

The future outlook for the Construction Layout Robots market is expected to remain strong as construction companies look for better accuracy and faster site execution. These robots are increasingly being used to transfer digital drawings directly onto job sites, which helps reduce layout errors and rework. Growing use of BIM and digital design tools is supporting adoption, as layout robots fit naturally into data driven construction workflows. Over time, improvements in battery life, positioning accuracy, and ease of use are likely to make these systems common on medium and large projects, including residential, commercial, and infrastructure sites.

Opportunities lie in

- BIM driven construction projects: Direct integration with digital models can improve layout precision and coordination between trades.

- Skilled labor shortage solutions: Robots can support crews by handling repetitive layout tasks and reducing dependence on highly skilled surveyors.

- Expansion into renovation and retrofit work: Compact and portable systems can open demand in indoor renovation and refurbishment projects.

Recent Developments

- Septembers, 2025, Dusty announced FieldPrinter 2 with better edge coverage and multi-trade layout automation.

- November, 2025, HP upgraded SitePrint robot with faster printing and better obstacle avoidance for indoor layouts.

Report Features Description Market Value (2024) USD 672.5 Mn Forecast Revenue (2034) USD 3,097.1 Mn CAGR(2025-2034) 16.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Fully Autonomous Robots, Semi-Autonomous Robots), By Application (Commercial Construction, Residential Construction, Industrial Construction), By End-User (Construction Companies, Contractors, Surveying Firms, Others), By Technology (Laser-guided, GPS-guided, Total Station-based, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trimble Inc., Topcon Corporation, Leica Geosystems (Hexagon AB), Hilti Group, Dusty Robotics, HP Inc., Caterpillar Inc., Fujita Corporation, Construction Robotics, Brokk AB, Advanced Construction Robotics, Robotics Plus, Ekso Bionics Holdings, Inc., Boston Dynamics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Layout Robots MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Layout Robots MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trimble Inc.

- Topcon Corporation

- Leica Geosystems (Hexagon AB)

- Hilti Group

- Dusty Robotics

- HP Inc.

- Caterpillar Inc.

- Fujita Corporation

- Construction Robotics

- Brokk AB

- Advanced Construction Robotics

- Robotics Plus

- Ekso Bionics Holdings, Inc.

- Boston Dynamics

- Others