Global Construction Equipment Rental Market By Product Type (Loaders, Crawler Dozers, Cranes, Concrete Pumps, Others), By Equipment (Earthmoving, Material Handling, Road Building & Concrete), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 40457

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

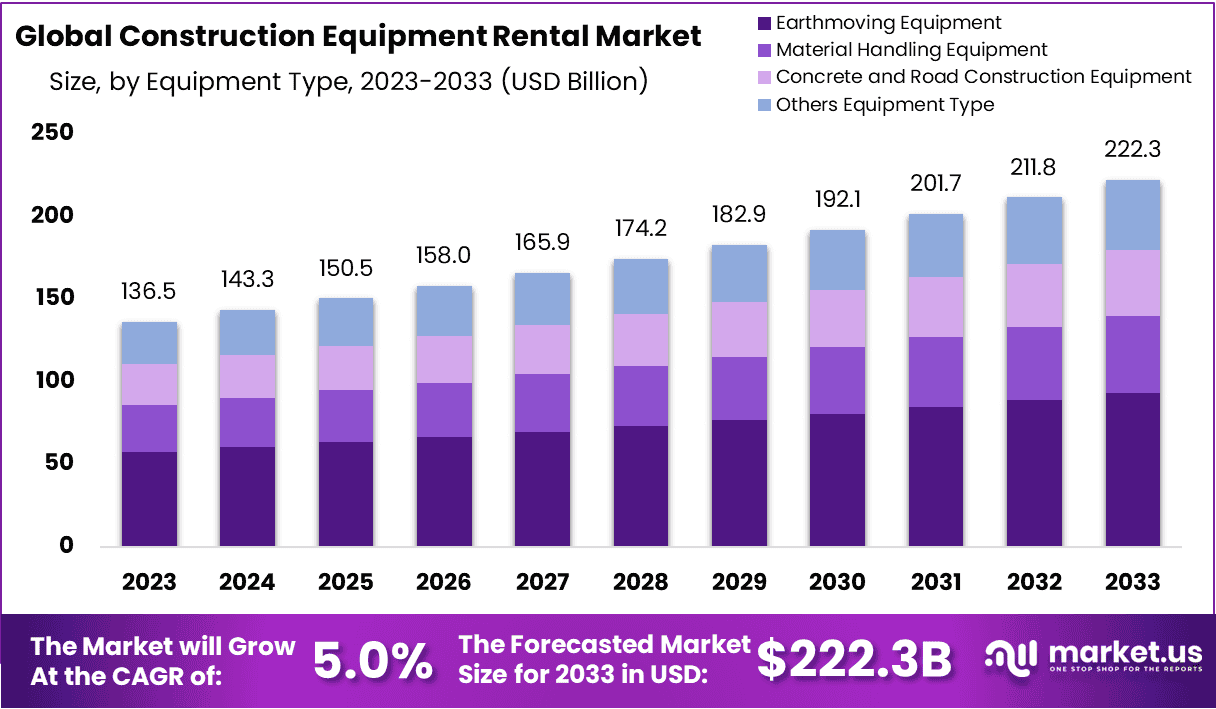

The Global Construction Equipment Rental Market size is expected to be worth around USD 222.3 Billion by 2033, From USD 136.5 Billion by 2023, growing at a CAGR of 5% during the forecast period from 2023 to 2033.

The Construction Equipment Rental Market encompasses the leasing of machinery and vehicles essential to construction projects. This market enables companies to access a diverse fleet of equipment without the financial burden of ownership.

By renting, firms benefit from lower upfront costs, reduced maintenance expenses, and the flexibility to use modern, efficient machinery suited to specific project needs. This sector is crucial for companies aiming to optimize their capital expenditure and adapt to fluctuating project demands.

The Construction Equipment Rental Market is poised for substantial growth, driven by significant infrastructural development and urbanization worldwide. This market’s expansion is largely fueled by the escalating number of infrastructure projects, such as roads, bridges, and high-rise buildings. The demand for aerial work platforms, which are crucial for construction and maintenance operations, is particularly increasing.

According to the Asian Development Bank (ADB), an estimated US$1.7 trillion needs to be invested annually in Asia’s infrastructure through 2030 to keep pace with economic growth and urbanization.

In Europe, the renovation of 35 million buildings by 2030 is set to revolutionize the construction sector. These renovations are part of a broader push towards sustainability, expected to generate up to 160,000 new green jobs. This transformative agenda in the EU not only underlines a shift towards more energy-efficient and sustainable building practices but also signals a growing need for specialized rental construction equipment that can support such green initiatives.

The Construction Equipment Rental Market is strategically positioned to capitalize on these developments. Rental providers are likely to see increased demand for their fleets, offering newer, more efficient models that comply with stringent environmental regulations and can perform a wide range of functions. For companies in this sector, the opportunity lies in optimizing their inventory to meet the specific demands of these large-scale infrastructural projects and renovations.

The market’s growth prospects are robust, underscored by ongoing global efforts to enhance infrastructure and the push towards sustainability in the construction industry. This trend indicates a promising future for the Construction Equipment Rental Market, making it a critical area for investment and attention by industry leaders and decision-makers.

Key Takeaways

- Market Growth: The Construction Equipment Rental Market displays substantial growth potential, projected to elevate from US$ 136.5 billion in 2023 to US$ 222.3 billion in 2033, showcasing a notable Compound Annual Growth Rate (CAGR) of 5%.

- Regional Dominance: Asia-Pacific emerges as the dominant market, capturing 31% of the market share, signifying a robust presence and demand for construction equipment rentals within the region.

- Segmentation Insights:

- Equipment Type: Earthmoving Equipment leads the market with a significant 42% share, indicating high demand for these specific types of machinery in construction projects.

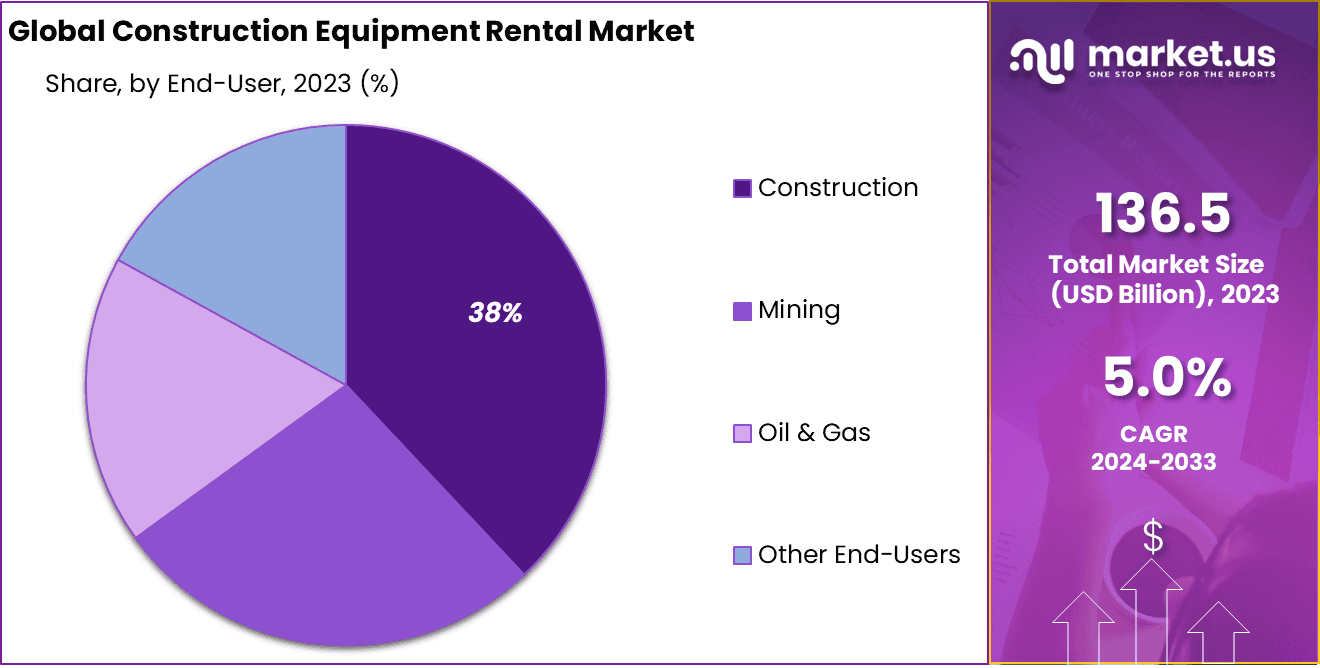

- End-User Focus: Construction remains the primary end-user segment, accounting for 38% of the market demand, emphasizing the essential role of construction activities in driving equipment rental services.

Market Dynamics and Industry Analysis:

- Regional Infrastructure Development: Asia-Pacific’s dominance aligns with rapid infrastructure development and construction activities, stimulating the demand for rental equipment in the region.

- Earthmoving Equipment Preference: The dominance of Earthmoving Equipment signifies the significance of machinery like excavators, loaders, and bulldozers in construction projects, reflecting their pivotal role in the market.

- Construction Industry Dependency: The significant share attributed to the Construction end-user segment highlights the industry’s heavy reliance on rental equipment to execute projects efficiently and cost-effectively.

Driving Factors

Increasing Infrastructure Development Projects Drive Market Growth

The global demand for infrastructure development is a pivotal driver for the Construction Equipment Rental Market. As urbanization accelerates and the need for enhanced infrastructure becomes evident, construction projects such as roads, bridges, residential and commercial buildings, and utilities are multiplying. These projects require diverse and heavy construction equipment, often only for specific stages of development, making outright purchase less economical.

Renting equipment offers a practical solution by reducing upfront capital investment, thus allowing companies to allocate resources more efficiently and undertake more and larger projects. For instance, the development of high-speed rail networks and urban transit systems heavily relies on the availability of specialized equipment that can be cost-prohibitive to purchase. By renting, firms can access the necessary machinery on-demand, supporting timely and budget-compliant project completion.

Cost-Effectiveness and Operational Flexibility Enhance Market Appeal

Renting construction equipment presents a cost-effective alternative to purchasing, particularly for projects with temporary or unique equipment needs. This affordability is crucial for companies aiming to manage budgets effectively and avoid the financial burden of maintenance, storage, and depreciation associated with owning equipment.

Rental companies cater to this need by offering flexible rental terms, allowing construction firms to scale their equipment inventory in response to project fluctuations. This flexibility not only optimizes operational costs but also enhances project adaptability, making the rental option increasingly popular among small to large-scale operators within the construction industry.

Technological Advancements and Equipment Modernization Propel Market Evolution

The rapid pace of technological advancement in construction equipment is a key growth catalyst for the rental market. As new technologies emerge, they bring about significant improvements in efficiency, productivity, and safety—attributes highly valued on modern construction sites.

Rental companies invest in updating their fleets with the latest equipment, featuring cutting-edge technologies that many construction firms may not have the capital to invest in immediately. This access to modernized equipment allows contractors to undertake more complex and technically demanding projects without the substantial capital outlay typically required for purchasing state-of-the-art machinery. As a result, the rental market becomes an essential enabler of innovation and competitiveness in the construction sector.

Restraining Factors

Cyclical Nature of the Construction Industry Restrains Market Growth

The construction industry’s cyclical nature significantly impacts the Construction Equipment Rental Market. Economic booms lead to increased construction activities and higher demand for rental equipment.

Conversely, during economic downturns, such as recessions, construction projects often slow down or are put on hold, leading to a marked decrease in equipment rental demand. This fluctuation can cause rental companies to experience volatile revenue streams and profitability challenges. The uncertainty of this cycle makes it difficult for rental companies to plan long-term investments and maintain steady growth, as they must constantly adapt to changing market conditions without compromising their financial stability.

Regulatory and Compliance Requirements Limit Market Expansion

Stringent regulatory and compliance demands place a substantial burden on the Construction Equipment Rental Market. Rental companies are required to ensure that their equipment adheres to various safety, emissions, and environmental regulations.

Meeting these standards can be both costly and time-consuming, involving regular maintenance checks, updates, and sometimes complete equipment overhauls. Non-compliance can lead to severe penalties, including fines, operational disruptions, and damage to the company’s reputation. These factors collectively increase operational costs and limit the market’s ability to expand, as companies must allocate significant resources to compliance rather than market growth initiatives.

Product Type Analysis

Cranes dominate with a significant CAGR due to their growing use in construction, representing 60-65% of the equipment rental companies’ crane fleet.

In the Construction Equipment Rental Market, the Crane segment is poised to experience the highest growth rate over the forecast period. This surge is largely driven by the increasing use of cranes in various construction activities, from high-rise buildings to large infrastructure projects. Cranes are essential for lifting, lowering, and moving materials at construction sites, making them indispensable in urban construction and major developments. The statistic that 60-65% of the equipment rental companies’ fleets are comprised of cranes underscores the crucial role they play in the market. This dominance is a clear indicator of the segment’s expanding footprint and its critical impact on the construction sector’s operational capabilities.

Other segments within the Product Type category, such as loaders, concrete pumps, crawler dozers, and others, also contribute significantly to the market. Loaders are widely used for earthmoving tasks and are essential in both construction and mining operations. Concrete pumps facilitate the transportation and pouring of concrete, essential for building foundations and other structural elements. Crawler dozers, known for their heavy-duty capabilities, are crucial in site preparation and excavation. The ‘others’ category encompasses a variety of specialized equipment that caters to specific construction needs, further enriching the diversity of the rental market.

Each of these segments addresses distinct aspects of construction work, supporting the industry’s broad spectrum of needs. While cranes lead in growth, the combined utility of loaders, concrete pumps, crawler dozers, and other equipment ensures comprehensive support for construction projects, enhancing the overall efficacy and reach of the Construction Equipment Rental Market. This diverse equipment availability allows rental companies to serve a wide range of customer requirements, making the market adaptable and resilient to varying construction trends and demands.

Equipment Type Analysis

Earthmoving equipment dominates with 42% due to its extensive use in numerous construction and infrastructure projects.

The Equipment Type segment of the Construction Equipment Rental Market is critical, with earthmoving equipment leading as the most significant sub-segment, capturing 42% of the market. This dominance is attributed to the widespread use of earthmoving machinery such as excavators, backhoes, and bulldozers in a variety of construction activities, from road building and site preparation to major infrastructure projects. The versatility and necessity of these machines in performing essential tasks that form the foundation of any construction project contribute to their high demand.

The remaining sub-segments within this category, including material handling equipment, concrete and road construction equipment, and other equipment types, also play vital roles in the market. Material handling equipment, such as cranes and forklifts, is crucial for moving large materials across construction sites, enhancing efficiency and reducing labor costs.

Concrete and road construction equipment, including mixers and pavers, are indispensable for infrastructure projects, particularly in urbanization and transportation development. The ‘others’ category, which includes a variety of specialized equipment types, supports specific needs that are not covered by the more common categories, thereby ensuring comprehensive market coverage.

Each of these sub-segments is essential for completing the spectrum of construction activities, contributing to the overall growth and dynamism of the rental market. As the industry evolves, the demand for advanced, multi-functional, and environmentally friendly equipment grows, driving the continuous update and diversification of rental fleets to meet modern construction demands.

End-User Analysis

Construction leads with 38% due to the high volume of construction projects globally.

In the End-User segment of the Construction Equipment Rental Market, the construction sector emerges as the dominant sub-segment, accounting for 38% of the market. This predominance is driven by the sheer volume of construction activities worldwide, which are fueled by global urbanization, the rejuvenation of infrastructure, and the increasing investment in residential and commercial projects. The need for diverse construction equipment to execute these projects efficiently and within budget underscores the reliance on rental solutions.

The other end-user sub-segments, including mining, oil & gas, and other industries, also significantly contribute to the market but cater to more specialized needs. The mining sector requires robust and durable equipment capable of handling harsh working conditions, which supports the rental market’s segment dealing with heavy-duty machinery. Similarly, the oil & gas industry demands specialized equipment that meets safety and environmental standards, which are often stringent in these projects.

These other sectors, although not as large as the construction sector in their demand for rental equipment, require highly specialized machinery that often comes with high acquisition costs. Renting these machines offers a cost-effective solution, allowing firms in these industries to maintain flexibility and adapt to project-specific requirements without the extensive capital outlay required for equipment purchase. This adaptability not only supports the sectors’ operational needs but also contributes to the broader growth and resilience of the Construction Equipment Rental Market.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Loaders

- Cranes

- Concrete Pumps

- Crawler Dozers

- Others

By Equipment

- Earthmoving Equipment

- Material Handling Equipment

- Concrete and Road Construction Equipment

- Others Equipment Type

End-User

- Construction

- Mining

- Oil & Gas

- Other End-Users

Growth Opportunities

Adoption of Digital Technologies and Telematics Offers Growth Opportunity

The integration of digital technologies and telematics within the Construction Equipment Rental Market presents significant growth opportunities. By incorporating advanced monitoring systems, remote diagnostics, and predictive maintenance, rental companies can greatly enhance their operational efficiencies.

These technologies not only help in optimizing equipment utilization by ensuring machines are in the right place at the right time but also reduce downtime by predicting potential failures before they occur. This capacity to offer high uptime and reliable equipment can significantly boost customer satisfaction and loyalty. Additionally, these technological enhancements allow rental companies to differentiate their service offerings in a competitive market, potentially increasing their market share and driving overall market growth.

Sustainability and Green Equipment Initiatives Offer Growth Opportunity

The shift towards sustainability in the construction industry creates substantial opportunities for the Construction Equipment Rental Market. As more construction firms seek to minimize their environmental impact, the demand for eco-friendly and energy-efficient equipment escalates. Rental companies can capitalize on this trend by expanding their fleets to include electric and hybrid-powered machinery, which are less harmful to the environment compared to traditional models.

This strategic shift not only helps rental businesses align with global environmental regulations but also attracts clients who are committed to sustainable practices. Investing in green equipment portfolios positions rental companies as forward-thinking and environmentally responsible, enhancing their brand value and opening up new market segments keen on green building projects.

Trending Factors

Increased Focus on Worker Safety and Training Are Trending Factors

The heightened emphasis on worker safety and training in the Construction Equipment Rental Market is a significant trending factor. Construction sites are known for their risks, prompting rental companies to enhance their safety protocols. By offering comprehensive training programs and certifications, these companies ensure that equipment operators are well-prepared to manage the machinery safely.

This focus not only improves safety standards across construction sites but also enhances the reputation of rental companies as responsible and reliable partners in the construction industry. As safety becomes a paramount concern for construction firms, those rental companies that provide thorough training and safety measures are likely to see increased demand and customer loyalty, making this focus a major trend in the industry.

Demand for Specialized and Niche Equipment Are Trending Factors

The increasing complexity of construction projects has led to a surge in demand for specialized and niche construction equipment, marking it as a key trending factor in the rental market. Rental companies are responding to this need by broadening their inventory to include machinery tailored for specific tasks like demolition, tunneling, and marine construction.

This adaptation not only allows rental companies to cater to a wider variety of construction needs but also opens up new market segments. By addressing the unique requirements of these specialized projects, rental firms can attract a broader customer base, diversify their offerings, and tap into potentially lucrative niches. This trend demonstrates the industry’s shift towards versatility and specialization, which is rapidly becoming a norm in the evolving construction landscape.

Regional Analysis

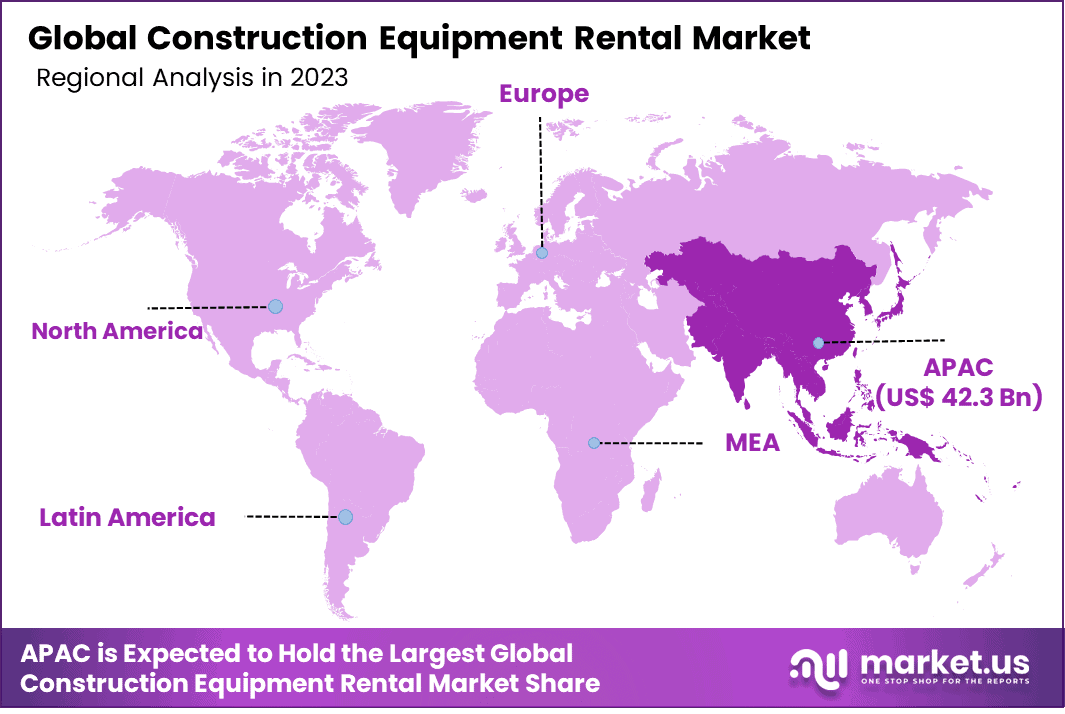

Asia-Pacific Dominates with 31% Market Share

Asia-Pacific holds a commanding 31% of the Construction Equipment Rental Market due to its rapid urbanization and significant infrastructure developments. The region’s extensive investment in public and private construction projects, such as roads, bridges, and urban centers, drives the demand for rental construction equipment. Additionally, the push towards modernizing infrastructure to support growing urban populations and expanding industrial activities fuels this need further.

The dynamics of the Asia-Pacific market are influenced by the region’s economic growth, which demands continuous construction activity. The presence of emerging economies like China and India, which are undergoing massive urban and industrial expansion, plays a crucial role in this dominance. The availability of a broad range of construction equipment for rent helps companies in these countries to efficiently manage capital expenditures and minimize project delays.

The future of Asia-Pacific in the Construction Equipment Rental Market looks promising, with expected continued growth driven by ongoing urbanization and industrialization. As these economies expand, the demand for versatile and technologically advanced construction equipment will likely increase, reinforcing the region’s leading position in the global market.

Regional Market Share Analysis:

- North America: North America accounts for 25% of the market. This region’s share is bolstered by a rebound in construction activities, particularly in the U.S., where there is a strong focus on infrastructure renewal and residential construction.

- Europe: Europe holds a 22% share, supported by the renovation of aging infrastructure and increased investment in green construction projects, which require specialized equipment that is often more cost-effectively accessed through rentals.

- Middle East & Africa: This region captures 12% of the market. The growth is driven by large-scale infrastructure projects in Gulf countries and an increasing focus on diversifying economies away from oil dependence, which requires substantial construction activity.

- Latin America: Latin America has an 8% market share. Growth in this region is primarily influenced by increasing urban development and industrialization, particularly in countries like Brazil and Mexico, which are focusing on enhancing their infrastructure.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Construction Equipment Rental Market, key players such as United Rentals Inc., Herc Rentals Inc., and Boels Rentals are significantly shaping the industry’s landscape through strategic positioning and expansive service offerings. United Rentals, as a leading figure, leverages its vast fleet and geographic reach to serve a diverse customer base, driving innovation and operational efficiency. Herc Rentals follows suit, focusing on personalized service and robust equipment options to cater to specific project needs. Boels Rentals excels in the European market with its commitment to sustainability and modernized equipment.

Emerging companies like Kanamoto Co. Ltd. and NESCO Holdings Inc. are enhancing their market presence by specializing in niche markets and investing in technologically advanced machinery, thus fulfilling regional and specialized demands. Meanwhile, entities like Maxim Crane Works L.P. and Mtandt Group focus on sector-specific rentals such as cranes and aerial work platforms, addressing unique industry requirements.

The strategic positioning of these companies, coupled with their commitment to innovation and customer service, enables them to influence market trends and dynamics profoundly. Their ability to adapt to changing market conditions and the increasing demand for diversified construction equipment solidifies their roles as key players in promoting the growth and depth of the Construction Equipment Rental Market.

Market Key Players

- Boels Rentals

- H&E Equipment Services Inc.

- Herc Rentals Inc.

- Kanamoto Co. Ltd.

- NESCO Holdings Inc.

- Maxim Crane Works L.P.

- Mtandt Group

- Ramirent AB

- Sarens n.v./s.a.

- United Rentals Inc.

- Other Key Players

Recent Developments

- On February 20, 2023, Arkema introduced a comprehensive offering for pressure-sensitive adhesives (PSAs) that leverages its three synergistic Specialty Materials segments and the recent acquisition of Ashland Performance Adhesives. This broad product range combines Arkema’s technological expertise in the adhesives market and leading acrylic value chain solutions, providing customers with unique access to sustainable high-performance solutions for the fast-growing PSA market and various demanding applications.

- Beontag, a company focusing on pressure-sensitive adhesives and smart tags, is investing in a new facility in Dayton, Ohio, to drive production for its PSA and smart tag products. The company plans to invest over US$60 million in equipment, machinery, and tenant improvements over the next two years, with the goal of creating approximately 200 new jobs and becoming fully operational by August 2024.

- In March 2023, EPS launched EPS 2133, an all-acrylic polymer made without APEO surfactants, suitable for permanent and removable PSA applications. This product offers excellent adhesive performance, making it an attractive option for various industries.

- At Labelexpo 2023, Henkel presented its pressure-sensitive adhesive technologies, showcasing its commitment to innovation and sustainability in the adhesive industry.

Report Scope:

Report Features Description Market Value (2023) USD 136.5 Billion Forecast Revenue (2033) USD 222.3 Billion CAGR (2024-2033) 5% Base Year for Estimation 2022 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Equipment Type(Earthmoving Equipment, Material Handling Equipment, Concrete and Road Construction Equipment, Others Equipment Type), End-User(Construction, Mining, Oil & Gas, Other End-Users) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Boels Rentals, H&E Equipment Services Inc., Herc Rentals Inc., Kanamoto Co. Ltd., NESCO Holdings Inc., Maxim Crane Works L.P., Mtandt Group, Ramirent AB, Sarens n.v./s.a., United Rentals Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: List the segments encompassed in this report on the Construction Equipment Rental market?Market.US has segmented the Construction Equipment Rental market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Loaders, Crawler Dozers, Cranes, Concrete Pumps, Others. By Equipments, the market has been further divided into Earthmoving, Material Handling, Road Building & Concrete.

Q: List the key industry players of the Construction Equipment Rental market?Ahern Rentals Inc., AKTIO Corporation, Caterpillar Inc., Byrne Equipment Rental, Cramo Plc, Finning International Inc., Liebherr-International AG, Kanamoto Co., Ltd., and Other Key Players engaged in the Construction Equipment Rental market.

Q: Name the key areas of business for Construction Equipment Rental?The US, Canada, Mexico, and Others., are key areas of operation for Construction Equipment Rental Market.

Construction Equipment Rental MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Construction Equipment Rental MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Boels Rentals

- H&E Equipment Services Inc.

- Herc Rentals Inc.

- Kanamoto Co. Ltd.

- NESCO Holdings Inc.

- Maxim Crane Works L.P.

- Mtandt Group

- Ramirent AB

- Sarens n.v./s.a.

- United Rentals Inc.

- Other Key Players