Global Construction Cyber-security Market Size, Share, Growth Analysis By Component (Solutions, Services), By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Data Security), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Project Management Data Protection, Connected Jobsite & IoT Security, Supply Chain & Vendor Security, Design & BIM Data Security), By End-User (General Contractors, Specialty Trade Contractors, Engineering Firms, Owners/Developers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170095

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Cybersecurity

- Industry Adoption

- Emerging Trends

- US Market Size

- By Component

- By Security Type

- By Deployment Mode

- By Organization Size

- By Application

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint factors

- Growth opportunities

- Trending factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The Construction Cybersecurity Market is expanding rapidly as digital transformation accelerates across global construction operations. With increasing adoption of Building Information Modeling (BIM), IoT-enabled equipment, cloud-based project management tools, and connected jobsite technologies, the construction sector faces rising exposure to cyber risks.

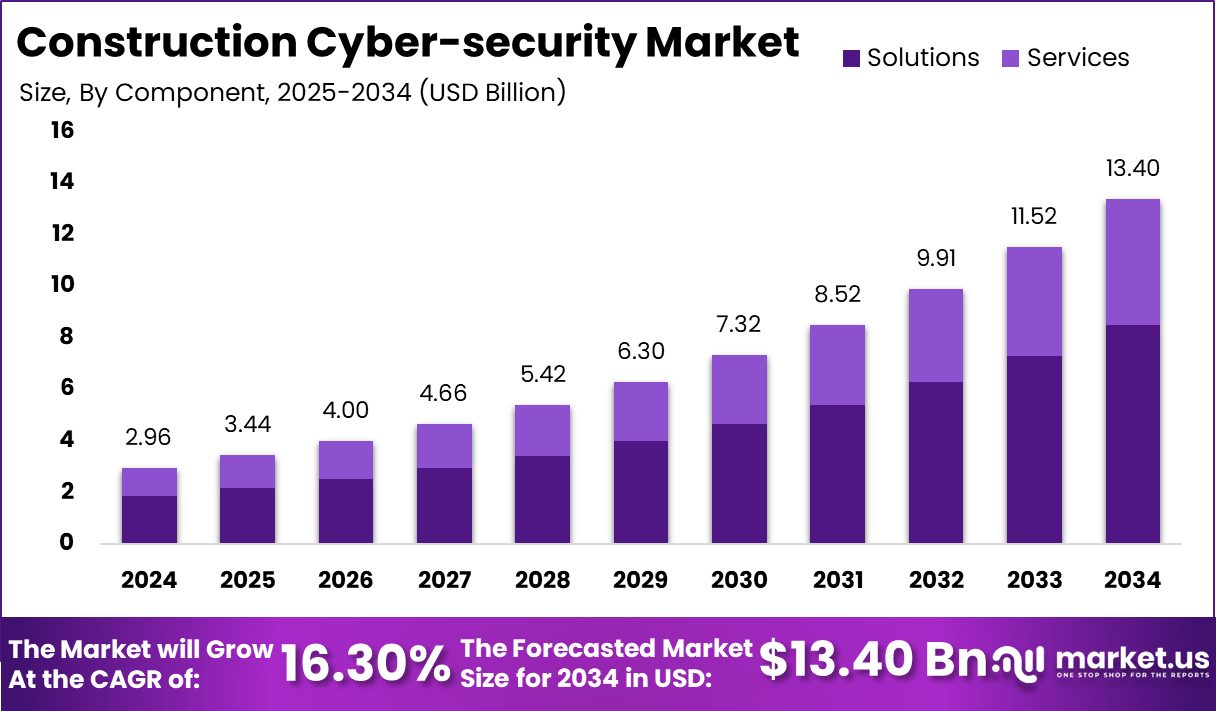

In 2024, the market reached USD 2.96 billion, driven by growing awareness of ransomware threats, data breaches, and operational disruptions targeting contractors, engineering firms, and infrastructure developers. As construction companies integrate drones, autonomous machinery, RFID tracking, and digital twins, the need for comprehensive cybersecurity frameworks becomes critical to protect sensitive project data and maintain operational continuity.

The market is projected to grow at a strong CAGR of 16.30%, reaching USD 13.40 billion by 2034 as organizations invest in network security, identity management, endpoint protection, and real-time threat intelligence.

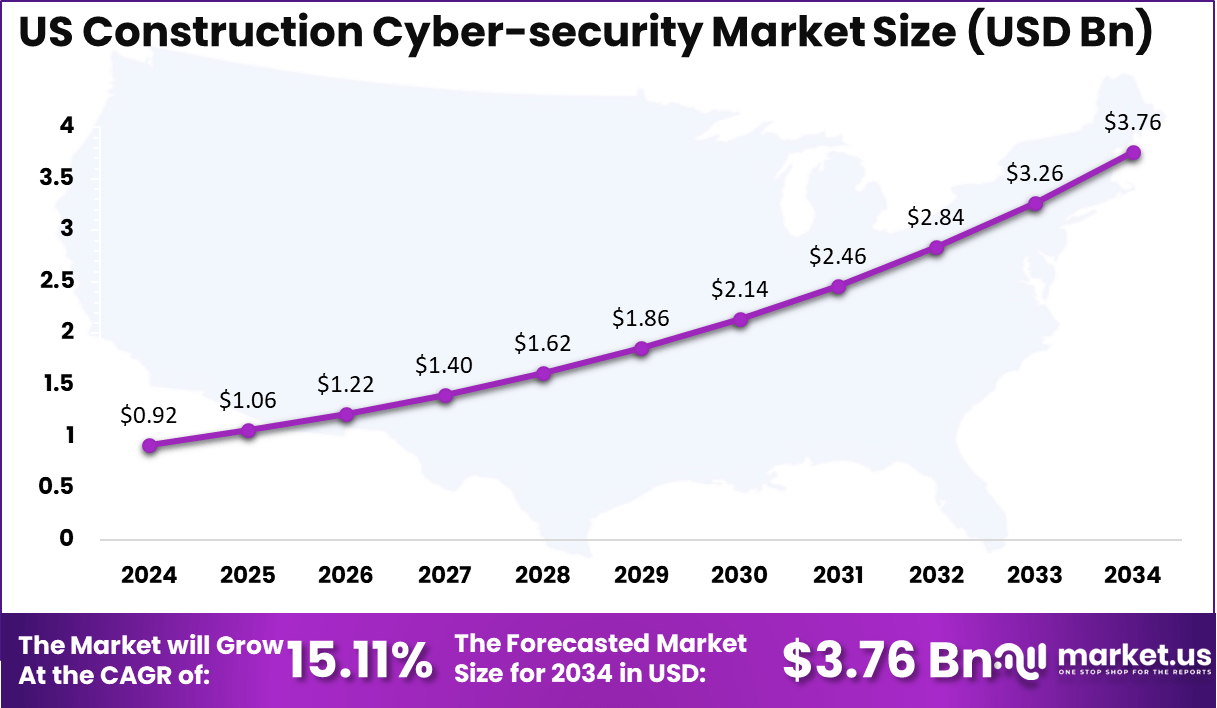

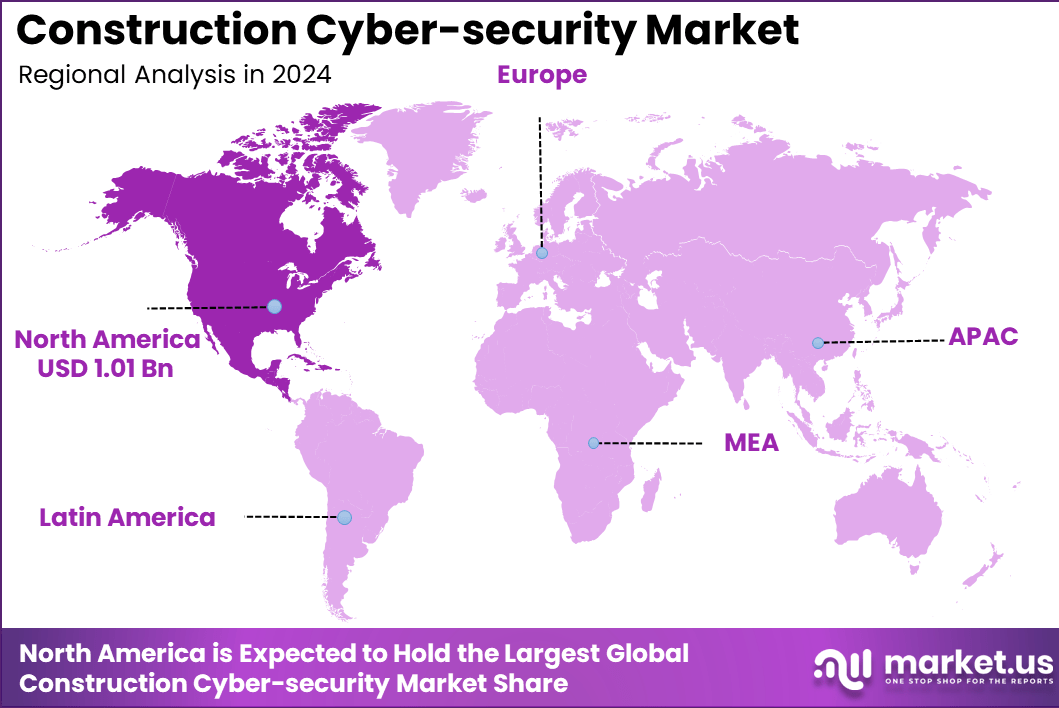

North America accounted for 34.3% of the market in 2024, valued at USD 1.01 billion, supported by stringent regulatory requirements and the rapid adoption of cloud collaboration tools in large-scale infrastructure projects. The US alone contributed USD 0.92 billion and is expected to reach USD 3.76 billion by 2034 at a 15.11% CAGR, reflecting increasing cyber-attacks on critical infrastructure and heightened investment in advanced construction cyber-defense solutions.

The construction industry is undergoing a significant digital transformation, adopting technologies such as Building Information Modeling (BIM), Internet of Things (IoT) sensors, cloud collaboration platforms, and autonomous machinery to improve productivity and project outcomes. However, this increased connectivity also exposes construction firms to a growing volume of cybersecurity threats.

Cyber-attacks targeting construction operations, including ransomware, phishing, and data breaches, can halt project workflows, compromise sensitive client data, and result in millions of dollars in financial losses. With an estimated 60–70% of construction companies experiencing at least one cybersecurity incident in recent years, robust cyber defenses are becoming essential rather than optional.

Construction cybersecurity encompasses solutions such as network protection, secure remote access, identity and access management, endpoint security, and real-time threat intelligence. Adoption of multi-factor authentication and encrypted communication protocols helps protect project plans and financial systems from unauthorized access. As jobsite connectivity increases, with drones, wearable sensors, and GPS-enabled machinery transmitting data continuously, security solutions must scale accordingly to defend against sophisticated threats.

Government regulations and industry standards are also driving investment, with strict compliance requirements for protecting critical infrastructure and client data. Real-time monitoring and incident response platforms are increasingly deployed to detect anomalies, reduce breach dwell time, and maintain business continuity. As cyber threats evolve, construction firms are prioritizing security strategies that combine technology, training, and governance to safeguard digital assets and operational integrity.

Key developments include Rockwell Automation’s $183 million acquisition of Verve Industrial Protection in November 2023, which bolsters protections for industrial control systems used in construction sites. In June 2025, Honeywell launched Connected Solutions, an AI-powered platform that enhances building management security and operational efficiency amid smart city pushes.

Government funding plays a major role, with CISA and FEMA announcing over $100 million in FY2025 grants, $91.7 million via the State and Local Cybersecurity Grant Program, and $12.1 million through the Tribal program, to aid local defenses, including hiring experts and network upgrades relevant to construction resilience. India’s Union Budget 2025 allocated ₹1,900 crore ($227 million) for cybersecurity, including ₹255 crore for CERT-In threat response and ₹782 crore for digital infrastructure tools that support secure construction tech.

Key Takeaways

- The Construction Cybersecurity Market reached USD 2.96 billion in 2024 and is projected to grow at a 16.30% CAGR to USD 13.40 billion by 2034.

- North America accounted for 34.3% of the market in 2024, valued at USD 1.01 billion.

- The US contributed USD 0.92 billion in 2024 and is expected to reach USD 3.76 billion by 2034 at a 15.11% CAGR.

- By Component, Solutions: 63.4%, driven by increasing adoption of threat detection, identity management, and endpoint security tools.

- By Security Type, Network Security: 32.7%, reflecting rising risks from connected machinery, cloud platforms, and jobsite networks.

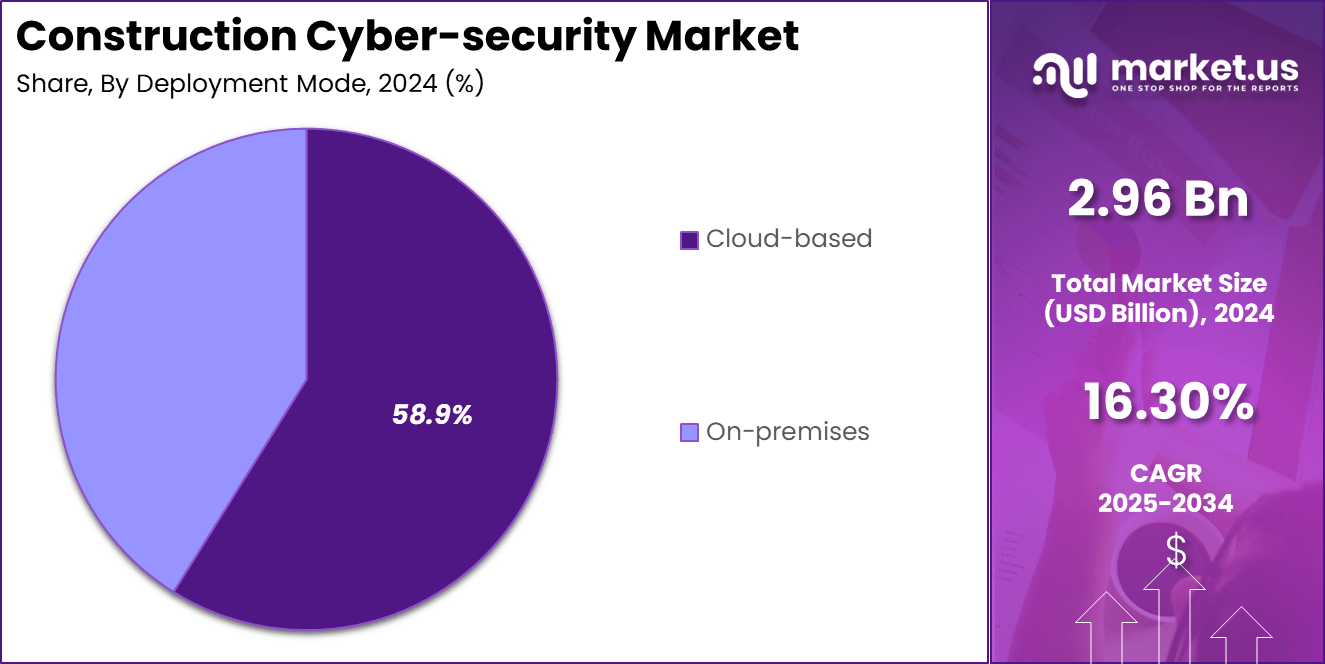

- By Deployment Mode, Cloud-based: 58.9%, supported by growing demand for remote collaboration and scalable cyber-defense systems.

- By Organization Size, Large Enterprises: 71.5%, due to broader digital footprints and higher vulnerability across large infrastructure projects.

- By Application, Project Management Data Protection: 38.6%, driven by the need to secure BIM files, financial data, and cloud-based workflows.

- By End-User, General Contractors: 48.3%, as they manage multi-party data exchange and increasingly digitalized construction operations.

Role of Cybersecurity

Cybersecurity plays a critical role in the construction industry as digital adoption accelerates across project planning, execution, and asset management. With more than 70% of construction companies leveraging cloud platforms, BIM models, IoT sensors, drones, and connected machinery, the sector faces increasing exposure to cyber threats.

Cybersecurity ensures the protection of sensitive project data, including architectural designs, financial records, client information, and proprietary workflows that, if compromised, could lead to significant financial losses and project delays. Ransomware attacks alone have surged across the industry, with reports showing operational shutdowns lasting 7–10 days on average when adequate protections are not in place.

Securing IoT-enabled construction sites is another essential responsibility, as connected equipment and wearables collect continuous data for productivity and safety monitoring. Without strong cybersecurity controls, these devices can become entry points for attackers.

Cybersecurity frameworks help reduce unauthorized access, prevent manipulation of equipment, and safeguard real-time communication across job networks. Advanced identity and access management solutions, supported by multi-factor authentication, reduce insider threats by up to 50%.

Cybersecurity also supports regulatory compliance, especially for firms working on critical infrastructure where strict data protection standards apply. By adopting robust threat detection, encryption, and incident response strategies, construction companies enhance resilience, maintain operational continuity, and build trust with clients and stakeholders in an increasingly digital environment.

Industry Adoption

Industry adoption of cybersecurity solutions in the construction sector has accelerated as stakeholders recognize the growing risks associated with digital transformation. Recent surveys indicate that over 65% of large construction firms have implemented formal cybersecurity policies, up from less than 40% just a few years ago.

This rise aligns with broader adoption of cloud-based project management tools, Building Information Modeling (BIM), IoT sensors, and connected heavy equipment, which collectively expand the attack surface for cyber threats. Construction companies are increasingly investing in network security, endpoint protection, and identity access management to counteract rising ransomware incidents and data breaches targeting critical project data.

Cloud-based cybersecurity platforms are particularly prevalent, accounting for a significant portion of deployments as firms prioritize scalable, remotely managed protection. Organizations leveraging cloud security report faster incident detection and response times—often improving detection by 30–50% compared with traditional on-premises systems. Larger enterprises with complex project portfolios and multiple stakeholders are ahead in adoption, driven by stringent compliance requirements and heightened risk exposure.

Mid-sized contractors are also increasing cybersecurity investments, often partnering with managed security service providers to bolster defenses without expanding internal IT teams. Across the industry, adoption of real-time monitoring, threat intelligence, and multi-factor authentication is becoming standard practice, reflecting a shift from basic IT security to comprehensive cyber resilience strategies that protect critical infrastructure and sensitive project workflows.

Emerging Trends

Emerging trends in the construction cybersecurity market reflect the industry’s rapid digitalization and growing complexity of threats targeting connected jobsite technologies. One major trend is the integration of AI-driven threat detection and response platforms, which analyze network behavior in real time and reduce average incident response times by up to 40% compared with traditional methods. Machine learning models are increasingly used to identify previously unseen attack patterns in IoT-enabled equipment, BIM systems, and cloud collaboration tools.

Another key trend is the widespread adoption of zero-trust security architectures, especially among large enterprises managing multi-partner construction ecosystems. Zero-trust models, which enforce strict identity verification for every access request, reduce the risk of lateral threat movement within networks by 50–60%. Cloud security is also gaining traction; more than 55% of construction firms now deploy cloud-native security solutions to protect remote project data and distributed teams.

Cyber-insurance offerings tailored to construction are emerging as well, incentivizing companies to adopt stronger defenses to lower premiums. Regulatory developments around data privacy and infrastructure protection are driving compliance-focused cybersecurity investments.

Additionally, training and awareness programs are expanding, with many firms reporting 30–45% fewer successful phishing attempts after employee education initiatives. These trends highlight how advanced technologies, risk management strategies, and policy frameworks are shaping cybersecurity practices across the construction industry.

US Market Size

The US Construction Cybersecurity Market is expanding rapidly as the construction sector undergoes a major digital shift driven by cloud collaboration tools, IoT-connected machinery, drones, and Building Information Modeling (BIM). In 2024, the market reached USD 0.92 billion, reflecting heightened awareness of ransomware, phishing, and data breaches targeting contractors, engineering firms, and infrastructure developers.

As cyber-attacks increasingly disrupt project timelines, compromise sensitive data, and impact financial systems, US construction companies are accelerating investment in advanced security solutions such as identity management, network protection, endpoint monitoring, and threat-intelligence platforms.

The market is projected to grow to USD 3.76 billion by 2034 at a strong 15.11% CAGR, driven by a rising need to secure connected jobsites and protect large volumes of BIM files, cloud-based designs, and digital project documentation.

Government-led infrastructure programs also contribute to growth, requiring contractors to meet strict cybersecurity standards when working on transportation, energy, and public-sector projects. Additionally, the adoption of IoT devices, now present on more than half of major construction sites, creates new vulnerabilities that necessitate continuous monitoring and encryption.

With expanding digital footprints and increasing regulatory pressure, US construction firms continue to prioritize cybersecurity as a core component of operational resilience and project risk management.

By Component

Solutions accounted for a dominant 63.4% share of the Construction Cyber-security Market, driven by the rapid digital transformation of construction workflows and the rising need to protect sensitive project data. As construction firms adopt BIM platforms, cloud-based collaboration tools, IoT-connected machinery, drones, and digital twins, cybersecurity solutions such as threat detection, identity and access management, endpoint protection, and network security have become essential.

These tools help safeguard architectural files, financial records, project schedules, and proprietary engineering data from unauthorized access, manipulation, and ransomware attacks. Advanced threat-intelligence platforms also provide real-time monitoring across distributed job sites, reducing breach detection times and strengthening overall resilience.

Services, including consulting, managed security, training, and incident response support, play a growing role as many construction companies lack dedicated cybersecurity teams. These services help firms assess vulnerabilities, implement compliance standards, and respond quickly to cyber incidents. However, solutions continue to dominate because they form the core security infrastructure required for protecting digital assets across large and complex construction ecosystems.

With the increasing adoption of connected equipment and cloud-based project management tools, demand for comprehensive cybersecurity solutions remains high. As cyber threats evolve, construction companies increasingly prioritize robust, scalable, and automated security systems to maintain operational continuity and safeguard critical project data.

By Security Type

Network security accounted for a leading 32.7% share of the Construction Cybersecurity Market, driven by the expanding use of connected technologies across modern construction sites. As firms adopt cloud collaboration platforms, BIM systems, IoT-enabled machinery, drones, and remote monitoring tools, the construction network environment has become more complex and vulnerable.

Network security solutions help safeguard internal and external communication channels, prevent unauthorized access, and block malicious traffic attempting to infiltrate jobsite networks or corporate systems. Firewalls, intrusion detection systems, secure VPNs, and network segmentation are widely used to ensure continuous protection as data flows between offices, jobsites, and cloud platforms.

Endpoint security is also critical as devices such as tablets, wearables, sensors, and autonomous equipment become standard in project workflows. Application security gains importance with increasing reliance on BIM software, project management tools, and digital documentation systems. Cloud security continues to grow rapidly as more than half of construction companies operate their core project workflows in cloud environments. Data security remains essential for protecting sensitive architectural designs, financial information, and stakeholder records.

Despite advancements across all areas, network security leads because it forms the foundation of defense across multi-layered construction ecosystems, ensuring secure connectivity and safeguarding the expanding digital infrastructure of construction operations.

By Deployment Mode

Cloud-based deployment accounted for a dominant 58.9% share of the Construction Cyber-security Market, driven by the industry’s accelerating shift toward digital collaboration and remote project management. As construction firms increasingly rely on cloud platforms for BIM modeling, scheduling, documentation, cost estimation, and multi-stakeholder coordination, securing cloud environments has become a top priority.

Cloud-based cybersecurity solutions offer scalable protection, real-time threat monitoring, automatic updates, and centralized visibility across multiple job sites, making them well-suited for the dynamic and distributed nature of construction operations. These solutions also reduce the burden on in-house IT teams, enabling faster deployment of security tools and improved resilience against evolving cyber threats.

On-premises security remains relevant for firms handling highly confidential infrastructure projects or for organizations with legacy systems requiring direct internal control. However, on-premises deployments often involve higher maintenance costs, slower scalability, and limited flexibility compared to cloud-based systems. As construction companies adopt IoT devices, drones, field tablets, and connected machinery, the need for secure cloud integration continues to intensify.

The rapid growth of digital workflows, combined with the rise of hybrid work environments and remote engineering teams, strengthens the dominance of cloud-based cybersecurity. Its ability to protect data across multiple locations and devices makes it the preferred deployment mode for modern construction enterprises.

By Organization Size

Large enterprises accounted for a dominant 71.5% share of the Construction Cybersecurity Market, driven by their extensive digital infrastructure, complex project portfolios, and higher exposure to cyber threats. These organizations typically manage multiple large-scale construction sites, numerous subcontractors, and extensive data flows across BIM platforms, cloud collaboration tools, IoT-enabled equipment, and digital documentation systems.

As a result, they require advanced cybersecurity frameworks that include identity and access management, network and endpoint security, real-time threat intelligence, and incident response capabilities. Large enterprises also handle sensitive client information, public infrastructure plans, and high-value contracts, making them prime targets for ransomware and data breaches.

Small and medium-sized enterprises (SMEs) are increasingly adopting cybersecurity solutions as digital transformation spreads across the sector. However, SMEs often face budget constraints and limited in-house IT resources, leading many to rely on managed security service providers for essential protections. While adoption is rising, SMEs typically implement more basic cybersecurity measures compared to the comprehensive systems used by larger firms.

Despite this, large enterprises remain the leading segment due to their broader technology adoption, stringent compliance requirements, and greater financial capacity to invest in robust, scalable cybersecurity solutions. Their prioritization of digital resilience continues to shape overall market demand.

By Application

Project management data protection accounted for a leading 38.6% share of the Construction Cyber-security Market, driven by the industry’s increasing reliance on digital platforms for planning, coordination, scheduling, and documentation. Modern construction projects generate vast amounts of sensitive information, including financial records, contract details, architectural drawings, cost estimates, timelines, and stakeholder communications.

As firms adopt cloud-based project management systems, collaborative BIM tools, and mobile field applications, protecting this data from unauthorized access, manipulation, or ransomware attacks becomes essential to maintaining operational continuity. Cybersecurity solutions safeguard critical documents, ensure secure file sharing, and prevent disruptions that could delay projects or compromise client trust.

Connected jobsite and IoT security is also growing rapidly as construction sites integrate drones, sensors, GPS-enabled machinery, and wearable devices. These systems enhance productivity and safety but introduce new cyber risks.

Supply chain and vendor security are gaining importance as projects involve numerous subcontractors and suppliers, creating potential entry points for cyber threats. Design and BIM data security protects highly detailed 3D models and engineering files that, if breached, can expose proprietary information or compromise project integrity.

Despite the rising relevance of all categories, project management data protection remains dominant due to its central role in day-to-day decision-making and multi-stakeholder collaboration across construction projects.

By End-User

General contractors accounted for a dominant 48.3% share of the Construction Cyber-security Market, reflecting their central role in coordinating large, multi-phase construction projects involving numerous subcontractors, suppliers, and technology platforms. As primary project managers, general contractors oversee scheduling, budgeting, procurement, and quality control, all of which rely heavily on digital tools such as BIM platforms, cloud-based collaboration systems, and project management software.

This extensive digital footprint increases exposure to cyber risks, making strong cybersecurity frameworks essential to protect sensitive project data, financial records, architectural plans, and communication channels. General contractors also face heightened vulnerability due to frequent data exchange with multiple stakeholders, creating more potential entry points for cyberattacks.

Specialty trade contractors are increasingly adopting cybersecurity solutions as they integrate IoT-enabled equipment, field tablets, and digital work-order systems into daily operations. Engineering firms depend on cybersecurity to protect high-value designs, simulations, and intellectual property, especially when collaborating on infrastructure and public-sector projects. Owners and developers prioritize cybersecurity to safeguard investment data, ensure regulatory compliance, and maintain the integrity of sensitive contract and design documents.

Despite growing adoption across all groups, general contractors lead the market because they manage the majority of project workflows, handle the largest volume of digital information, and bear primary responsibility for protecting multi-stakeholder construction environments.

Key Market Segments

By Component

- Solutions

- Services

By Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Data Security

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Project Management Data Protection

- Connected Jobsite & IoT Security

- Supply Chain & Vendor Security

- Design & BIM Data Security

By End-User

- General Contractors

- Specialty Trade Contractors

- Engineering Firms

- Owners/Developers

Regional Analysis

North America held a dominant 34.3% share of the Construction Cyber-security Market in 2024, reaching a market size of USD 1.01 billion. The region’s leadership is driven by rapid digital adoption across construction workflows, strong regulatory expectations, and rising cyber threats targeting critical infrastructure projects.

US and Canadian construction companies increasingly deploy cloud-based project management systems, BIM platforms, IoT-enabled equipment, drones, and connected jobsite technologies, all of which require advanced cybersecurity solutions to safeguard sensitive data and maintain operational continuity. The high volume of large-scale commercial, residential, and infrastructure developments in the region further expands the need for robust cyber defense systems.

North America also experiences a higher frequency of ransomware attacks and data breaches compared to other regions, prompting construction firms to invest heavily in threat detection, identity management, endpoint protection, and network security. Government-driven infrastructure modernization programs and public-sector construction mandates reinforce cybersecurity requirements, especially for transportation, energy, and defense-related projects.

Additionally, the region benefits from a strong presence of cybersecurity technology providers, managed security service companies, and innovation in AI-driven threat intelligence. As digital transformation accelerates, North America continues to lead in implementing advanced cyber frameworks that protect construction ecosystems, multi-stakeholder collaboration, and cloud-based project operations.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Key driving factors for the Construction Cyber-security Market include rapid digitalization of construction workflows, increasing use of cloud platforms, and widespread adoption of BIM systems and IoT-enabled machinery.

As more than half of construction firms now rely on connected devices, drones, and real-time project management tools, the attack surface has expanded significantly. Rising ransomware incidents targeting architectural files, financial records, and project schedules further accelerate cybersecurity investments.

Government infrastructure programs and regulations requiring secure data handling also strengthen demand. The need to protect multi-stakeholder collaboration environments, where general contractors, subcontractors, and engineering teams exchange sensitive information daily, reinforces the importance of advanced cyber defenses.

Restraint factors

Despite strong demand, several restraints limit wider adoption. High implementation and maintenance costs of advanced cybersecurity solutions pose challenges for smaller firms operating with tight budgets. Many construction companies lack dedicated IT and security teams, making it difficult to manage complex cyber frameworks.

Legacy systems and outdated software remain common in the industry, increasing vulnerability and complicating integration with modern security tools. In addition, limited awareness of cyber risks among field workers leads to unsafe practices such as weak passwords and unencrypted device use. Fragmented supply chains involving multiple subcontractors also make consistent cybersecurity enforcement difficult across projects.

Growth opportunities

Significant growth opportunities arise from the expansion of IoT-enabled jobsites, where sensors, wearables, and GPS-enabled machinery require continuous protection. Adoption of digital twins and AI-driven project analytics creates new demand for secure data environments. Cloud migration offers further opportunity, as more companies shift core operations to remote platforms requiring advanced encryption and identity management.

Public-sector infrastructure initiatives create a strong potential for cybersecurity providers due to strict compliance requirements. Increased investment in smart cities, renewable energy projects, and large-scale transportation developments also expands the market. Partnerships between construction firms and managed security service providers offer additional growth potential, enabling mid-size companies to enhance security without major in-house investments.

Trending factors

Key trends shaping the market include the adoption of AI- and machine-learning-based threat detection that enables early identification of anomalies within BIM platforms, cloud systems, and IoT networks. Zero-trust architectures are becoming widely implemented to enforce strict user verification across multi-party construction ecosystems. Cybersecurity awareness training is another major trend, reducing the success rate of phishing attacks and social engineering attempts.

The growth of mobile and remote construction management tools increases demand for secure communication channels. Regulatory developments, including data privacy laws and infrastructure protection standards, continue to influence investment priorities. Additionally, cyber-insurance adoption is rising as contractors seek risk mitigation strategies aligned with evolving cyber threats.

Competitive Analysis

The competitive landscape of the Construction Cybersecurity Market is shaped by a diverse range of cybersecurity vendors, technology integrators, cloud solution providers, and specialized construction software companies. Leading cybersecurity firms compete by offering comprehensive platforms that integrate network protection, endpoint security, identity management, and real-time threat intelligence tailored to construction workflows.

These companies focus on securing BIM models, cloud-based collaboration environments, and IoT-connected jobsite equipment, ensuring seamless protection across distributed project teams and remote environments. Cloud service providers play a major role by embedding advanced security layers within project management and collaboration tools widely used by construction firms.

Their offerings emphasize encrypted data sharing, secure user authentication, and automated threat monitoring. Meanwhile, construction-focused software providers differentiate themselves by integrating cybersecurity features directly into project management platforms, design tools, and digital twin environments. This creates a competitive advantage as contractors increasingly prefer unified, security-enhanced digital ecosystems.

Managed security service providers (MSSPs) are expanding their presence by offering outsourced monitoring, compliance support, and incident response—particularly valuable for mid-size construction firms without in-house IT teams. The market also sees growing competition from niche companies specializing in IoT security, drone protection, and secure equipment telematics. Overall, competition is driven by innovation, integration capabilities, and the ability to deliver scalable security solutions suited to complex construction environments.

Top Key Players in the Market

- Palo Alto Networks, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Check Point Software Technologies, Ltd.

- Broadcom, Inc. (Symantec)

- IBM Corporation

- Microsoft Corporation

- Trend Micro, Incorporated

- McAfee Corp.

- CrowdStrike Holdings, Inc.

- Sophos, Ltd.

- Tenable Holdings, Inc.

- Rapid7, Inc.

- Qualys, Inc.

- CyberArk Software, Ltd.

- Others

Recent Developments

- November 2025: Industry reports highlight a continuing surge in cyber threats targeting the construction and engineering sectors, with ransomware and supply chain attacks increasing as connected project tools and IoT-enabled jobsite systems proliferate. These evolving threats are prompting firms to strengthen endpoint protection and network defenses across digital construction environments.

- October 2025: As the construction industry rapidly digitizes, sector advisors emphasize enhanced focus on cybersecurity and resilience, urging firms to adopt comprehensive cyber hygiene practices, employee training, and risk mitigation strategies to protect digital assets and project data from breaches.

- June 2025: Cybersecurity authorities and standards bodies are promoting zero-trust architecture models to replace traditional perimeter defenses, encouraging construction enterprises to implement continuous verification and strict access controls across cloud and IoT systems. This shift supports stronger protection of project management platforms and connected jobsite devices.

Report Scope

Report Features Description Market Value (2024) USD 2.96 Billion Forecast Revenue (2034) USD 13.40 Billion CAGR(2025-2034) 16.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solutions, Services), By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Data Security), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Project Management Data Protection, Connected Jobsite & IoT Security, Supply Chain & Vendor Security, Design & BIM Data Security), By End-User (General Contractors, Specialty Trade Contractors, Engineering Firms, Owners/Developers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Palo Alto Networks, Inc., Cisco Systems, Inc., Fortinet, Inc., Check Point Software Technologies, Ltd., Broadcom, Inc. (Symantec), IBM Corporation, Microsoft Corporation, Trend Micro, Incorporated, McAfee Corp., CrowdStrike Holdings, Inc., Sophos, Ltd., Tenable Holdings, Inc., Rapid7, Inc., Qualys, Inc., CyberArk Software, Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Construction Cyber-security MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Cyber-security MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Palo Alto Networks, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Check Point Software Technologies, Ltd.

- Broadcom, Inc. (Symantec)

- IBM Corporation

- Microsoft Corporation

- Trend Micro, Incorporated

- McAfee Corp.

- CrowdStrike Holdings, Inc.

- Sophos, Ltd.

- Tenable Holdings, Inc.

- Rapid7, Inc.

- Qualys, Inc.

- CyberArk Software, Ltd.

- Others