Global Connected Toys Market Size, Share, Growth Analysis By Type (App-Connected Toys, Voice-Activated Toys, Screenless Connected Toys, Smart Toys with Wearable Integration, Robotics and Programmable Toys, Smart Action Figures and Dolls), By Interfacing Device (Smartphones, Tablets, Consoles and PCs, Wearables), By Age Group (0-5 years, 6-8 years, 9-12 years, Teenagers), By Technology (Wi-Fi, Bluetooth, Radio Frequency Identification, Artificial Intelligence, Augmented Reality, Virtual Reality), By Application (Entertainment, Educational, Fitness and Health, Security and Monitoring), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157287

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

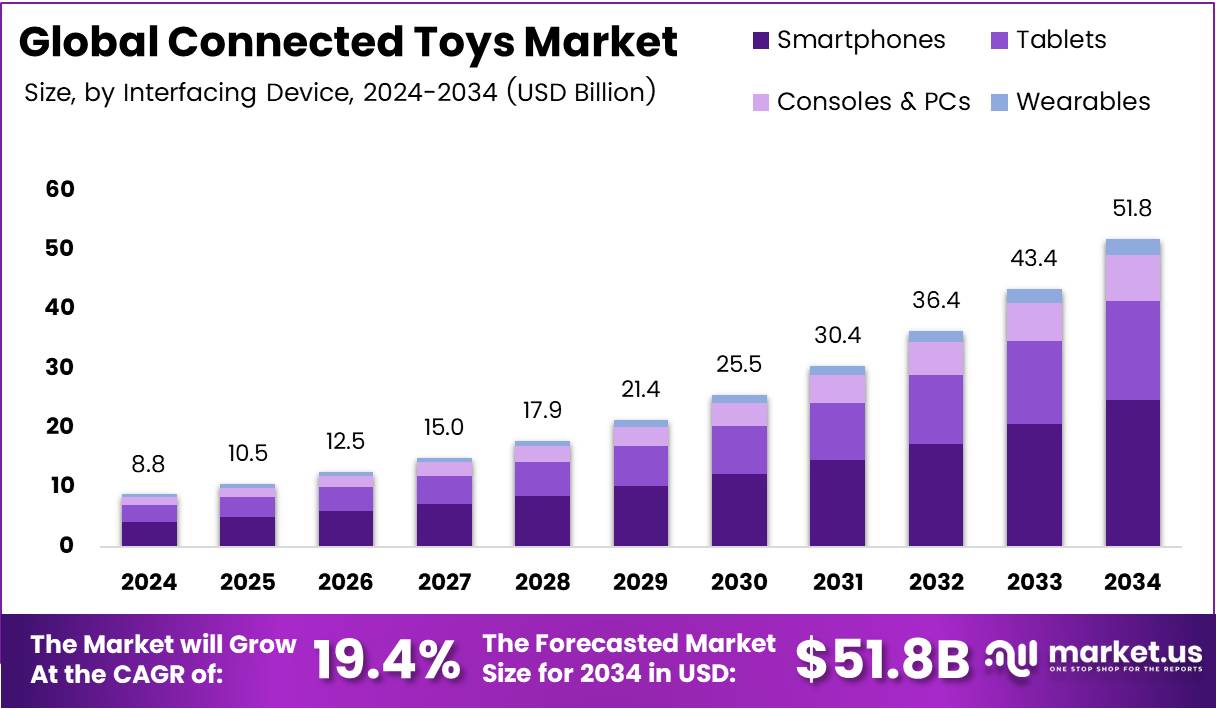

The Global Connected Toys Market size is expected to be worth around USD 51.8 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 19.4% during the forecast period from 2025 to 2034.

The Connected Toys Market represents a fast-emerging space where traditional play merges with digital interactivity. These toys use sensors, Bluetooth, Wi-Fi, and mobile applications to create personalized experiences. Companies are integrating AI-driven features and gamified learning, making playtime more engaging while enhancing children’s cognitive, social, and creative development across various age groups.

Market growth is being fueled by rising digital adoption among children, growing demand for educational entertainment, and parents’ willingness to invest in innovative learning solutions. Increasing affordability of smart devices and high internet penetration across developed and emerging economies are also expanding the potential consumer base, driving consistent revenue growth in this evolving sector.

Governments worldwide are promoting digital literacy and STEM-based learning, indirectly supporting connected toys adoption. Policies focusing on safe technology use and child data protection are setting clear regulatory frameworks. These initiatives ensure manufacturers adhere to privacy standards while still innovating, creating a favorable balance between growth opportunities and consumer trust.

Additionally, opportunities are emerging through collaborations between toy makers and edtech companies, enabling cross-sector innovation. Connected toys linked with e-learning platforms offer dual value in entertainment and education. Investors are increasingly seeing the sector as a gateway to long-term growth, especially as demand rises for smart classrooms and home-based learning solutions.

At the same time, regulations around child online safety are becoming stricter, pushing companies to design toys with compliance in mind. Compliance with GDPR in Europe and COPPA in the US is no longer optional but a necessity. This ensures safer play experiences and enhances brand reputation, building trust among parents and caregivers.

According to Common Sense Media, 51% of US children aged 0–8 own their own mobile device, creating a strong base for app-paired connected toys. Meanwhile, according to UK surveys, 96% of children aged 3–17 went online in 2024, highlighting near-universal digital access that directly strengthens the demand for connected play solutions.

Key Takeaways

- Global Connected Toys Market is expected to reach USD 51.8 Billion by 2034, growing at a CAGR of 19.4% from 2025 to 2034.

- App-Connected Toys held a dominant market position in By Type Analysis with a 29.5% share in 2024.

- Smartphones dominated the By Interfacing Device Analysis segment with a 47.8% share in 2024.

- 9-12 Years age group dominated the By Age Group Analysis segment with a 46.3% share in 2024.

- Bluetooth led the By Technology Analysis segment with a 36.8% share in 2024.

- Entertainment was the leading application in the By Application Analysis segment, with a 47.4% share in 2024.

- North America held a dominant position in the market, accounting for a 38.4% share, with revenues of USD 3.3 billion in 2024.

Type Analysis

App-Connected Toys dominate with 29.5% due to increasing adoption of smartphone-linked interactive play.

In 2024, App-Connected Toys held a dominant market position in By Type Analysis segment of the Connected Toys Market, with a 29.5% share. The growing use of mobile applications by children and parents to control and personalize toys has enhanced engagement, making this category highly preferred.

Voice-Activated Toys followed, benefiting from advancements in natural language processing. Their ability to respond to verbal commands fosters intuitive play experiences, contributing to rising popularity among younger users.

Screenless Connected Toys also gained traction as parents seek non-screen alternatives to balance digital exposure. These toys combine connectivity with traditional play, enhancing imaginative learning.

Smart Toys with Wearable Integration are expanding steadily. Integration with fitness trackers and health sensors allows interactive monitoring of children’s activity levels, appealing to health-conscious households.

Robotics & Programmable Toys captured notable interest due to STEM education demand. These toys enable coding, programming, and robotics learning, aligning with the emphasis on early technical skill development.

Smart Action Figures and Dolls maintained a niche presence, appealing to children seeking personalized storytelling and role-play features. Their emotional connection aspect is fueling gradual adoption across global markets.

Interfacing Device Analysis

Smartphones dominate with 47.8% due to their universal availability and seamless app integration.

In 2024, Smartphones held a dominant market position in By Interfacing Device Analysis segment of the Connected Toys Market, with a 47.8% share. Parents increasingly prefer smartphones to pair with connected toys as they provide convenience, familiarity, and robust app ecosystems.

Tablets represented the next major segment, driven by their larger screens and suitability for group play or learning. Their interactive capabilities made them a strong secondary interface option for connected toys in educational environments.

Consoles & PCs also contributed significantly. Gaming consoles integrated with connected toys enhanced immersive experiences through real-time interaction, especially for older children seeking advanced play formats.

Wearables showcased growing adoption as they introduced interactive features such as activity tracking and gesture-based controls. Their hands-free operation and growing integration into children’s lifestyles highlighted their potential as an emerging interfacing device.

Age Group Analysis

9-12 Years dominate with 46.3% as interactive and educational connected toys gain traction.

In 2024, 9-12 Years held a dominant market position in By Age Group Analysis segment of the Connected Toys Market, with a 46.3% share. At this age, children are highly engaged with STEM-based and programmable toys, making this group the primary consumer segment.

0-5 Years represented a smaller segment but showed steady growth. Parents preferred safe, simple, and screenless connected toys to introduce early learning concepts while avoiding excessive digital exposure.

The 6-8 Years category witnessed strong demand for interactive toys that support creativity and role-play. These toys allowed children to explore storytelling and educational applications in playful formats.

Teenagers (13-19 Years) contributed a moderate share, favoring robotics, wearables, and gaming-linked toys. This group is more inclined toward advanced functionality and immersive play experiences that align with digital-first lifestyles.

Technology Analysis

Bluetooth dominates with 36.8% due to reliable short-range connectivity and low power consumption.

In 2024, Bluetooth held a dominant market position in By Technology Analysis segment of the Connected Toys Market, with a 36.8% share. Its compatibility with multiple devices and ease of integration strengthened its leadership.

Wi-Fi technology followed closely, enabling toys to connect seamlessly with cloud platforms and deliver enhanced interactive features. High-speed connectivity supported continuous content updates and multiplayer experiences.

Radio Frequency Identification (RFID) played a supportive role by allowing toys to recognize objects and trigger personalized responses. Its use in interactive learning toys helped drive segment growth.

Artificial Intelligence (AI) continued expanding rapidly. Toys leveraging AI offered adaptive learning, speech recognition, and personalized responses, creating a more engaging play environment.

Augmented Reality (AR) integration enhanced toy experiences by blending digital layers with physical play, while Virtual Reality (VR) toys provided fully immersive gaming and learning experiences, gaining traction among tech-savvy families.

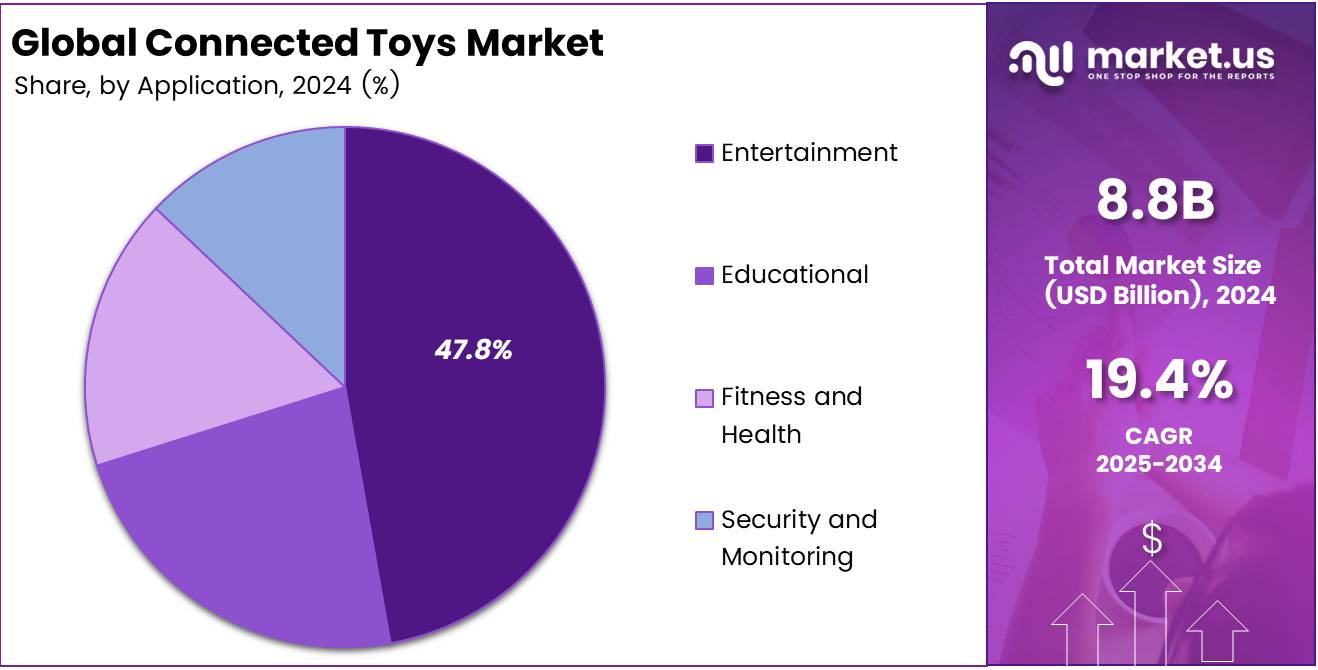

Application Analysis

Entertainment dominates with 47.4% as children prefer immersive and interactive connected play.

In 2024, Entertainment held a dominant market position in By Application Analysis segment of the Connected Toys Market, with a 47.4% share. Demand was fueled by children’s increasing inclination toward interactive play experiences supported by smart devices.

Educational applications followed closely, with connected toys being widely used to support STEM education, language development, and problem-solving activities. Parents actively invested in toys that combine fun with structured learning benefits.

Fitness and Health emerged as an attractive segment. Toys integrated with wearable technology encouraged physical activity, helping children adopt healthy lifestyles while ensuring playful engagement.

Security and Monitoring represented a smaller but rising application. Smart toys with in-built safety features reassured parents, offering tracking and monitoring functions alongside entertainment.

Key Market Segments

By Type

- App-Connected Toys

- Voice-Activated Toys

- Screenless Connected Toys

- Smart Toys with Wearable Integration

- Robotics & Programmable Toys

- Smart Action Figures and Dolls

By Interfacing Device

- Smartphones

- Tablets

- Consoles & PCs

- Wearables

By Age Group

- 0-5 years

- 6-8 years

- 9-12 years

- Teenagers (13-19 years)

By Technology

- Wi-Fi

- Bluetooth

- Radio Frequency Identification (RFID)

- Artificial Intelligence (AI)

- Augmented Reality (AR)

- Virtual Reality (VR)

By Application

- Entertainment

- Educational

- Fitness and Health

- Security and Monitoring

Drivers

Rising Adoption of IoT and AI Integration in Smart Toys

The connected toys market is strongly driven by the rising use of Internet of Things (IoT) and artificial intelligence (AI). These technologies are making toys more interactive, adaptive, and capable of providing personalized experiences for children. Smart sensors and AI-based responses create engaging playtime, enhancing both entertainment and learning.

Another important driver is the growing demand for personalized and interactive learning. Parents are seeking toys that not only entertain but also support cognitive development. Toys with adaptive learning features can adjust difficulty levels, track progress, and offer tailored challenges, making them highly attractive for educational purposes.

The increasing use of smartphones and mobile applications among children is also fueling market growth. With mobile devices widely accessible, children can easily connect toys through apps, opening doors for real-time updates, multiplayer gaming, and immersive learning. This integration strengthens the appeal of connected toys for both children and parents.

Restraints

Concerns Regarding Children’s Data Privacy and Cybersecurity Risks

A major restraint in the connected toys market is the growing concern about children’s data privacy. These toys often collect personal information, which raises worries among parents and regulators. Any misuse or leakage of sensitive data creates significant trust issues, limiting wider adoption of connected toys.

Cybersecurity risks also present challenges for manufacturers. Connected toys linked to the internet are vulnerable to hacking, unauthorized access, or malicious use. Such risks not only compromise user safety but also damage the brand reputation of toy makers, making security investment a critical factor for companies.

In addition, limited internet infrastructure in rural and underdeveloped regions slows down adoption. Many connected toys rely on constant connectivity to deliver interactive features. Poor bandwidth or unstable connections restrict access to these advanced toys, creating a gap in demand between urban and rural areas.

Growth Factors

Development of STEM-Based Connected Educational Toys

The market presents strong opportunities through the growing development of STEM-based connected educational toys. These toys are designed to promote science, technology, engineering, and mathematics learning in interactive ways. With rising demand for early skill development, such products are gaining strong attention from schools and parents alike.

Another growth opportunity lies in the integration of augmented reality (AR) and virtual reality (VR). By merging digital layers with physical play, AR and VR toys create immersive learning and entertainment experiences. This innovation expands the appeal of toys to a wider age group, encouraging both fun and skill-building.

Emerging markets are also offering untapped opportunities. Rising disposable incomes in countries across Asia, Latin America, and Africa are increasing parental spending on advanced educational products. Expansion into these regions allows companies to capture new demand while introducing affordable product versions suited to local markets.

Emerging Trends

Surge in Demand for Voice-Enabled and AI-Powered Play Companions

The connected toys market is seeing a strong trend toward voice-enabled and AI-powered play companions. These toys can respond to children’s queries, tell stories, and create conversations, making playtime more interactive. The use of natural language processing makes them more appealing to both children and parents.

Wearable connected toys are gaining popularity for health and activity tracking. Devices such as smart wristbands and interactive fitness toys encourage active play while monitoring health indicators. This trend aligns with growing parental interest in children’s well-being and balanced lifestyles.

Subscription-based toy rental and learning models are also emerging as a trend. Parents are choosing cost-effective rentals for access to multiple connected toys without heavy investment. These models also provide fresh learning experiences every month, adding convenience and variety.

Sustainability is another trending factor. Toy manufacturers are increasingly using eco-friendly and recyclable materials for connected toys. This shift supports global sustainability goals and appeals to environmentally conscious parents, boosting the long-term adoption of such products.

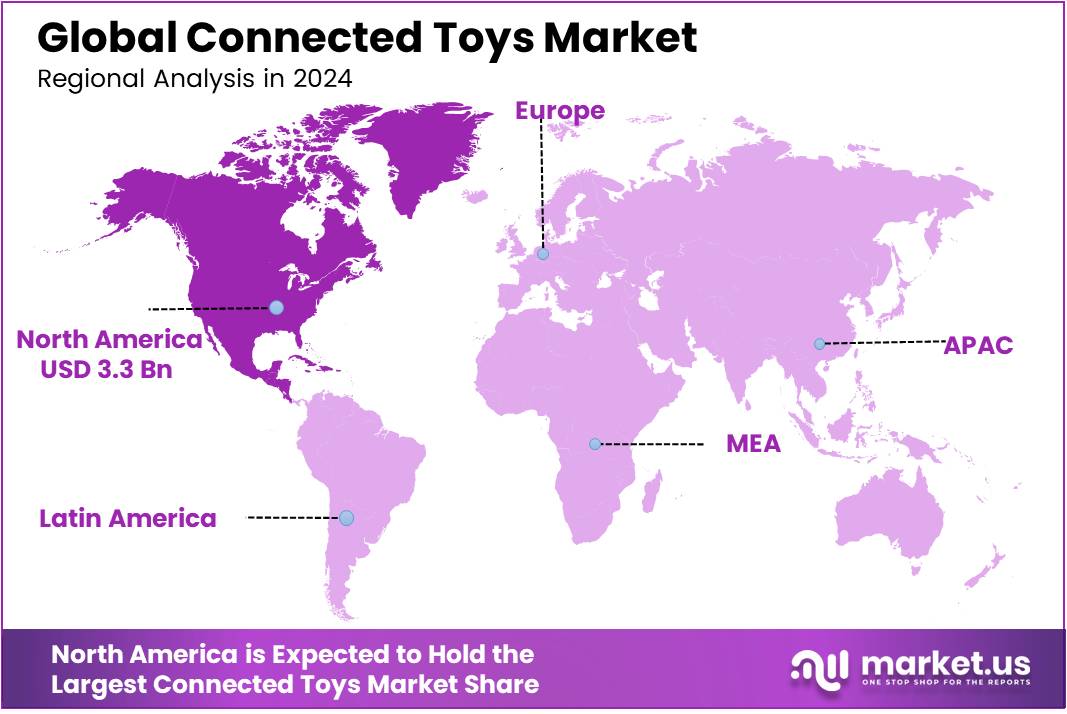

Regional Analysis

North America Dominates the Connected Toys Market with a Market Share of 38.4%, Valued at USD 3.3 Billion

In 2024, North America held a dominant position in the connected toys market, accounting for a 38.4% share with revenues of USD 3.3 billion. The region benefits from strong digital infrastructure, high smartphone penetration among children, and increasing parental acceptance of app-integrated educational toys. Government emphasis on digital learning tools further strengthens its market presence.

Europe Connected Toys Market Trends

Europe is witnessing steady growth in the connected toys market, supported by rising investments in interactive learning and stringent safety regulations. The region’s emphasis on child data protection and increased adoption of STEM-based educational toys are enhancing its market traction. Consumer demand for eco-friendly and technologically advanced toys is also shaping trends.

Asia Pacific Connected Toys Market Trends

Asia Pacific is emerging as one of the fastest-growing markets for connected toys, fueled by rapid urbanization, expanding internet access, and rising middle-class incomes. Countries like China, Japan, and South Korea are at the forefront of adopting AI-driven and IoT-enabled toys. Growing parental preference for digital learning toys is expanding opportunities in this region.

Middle East and Africa Connected Toys Market Trends

The Middle East and Africa are gradually adopting connected toys, driven by increasing awareness of digital education and improving internet penetration. While the market is still in its early stage, government-led education modernization programs are expected to accelerate adoption. Growth remains concentrated in urban centers with higher purchasing power.

Latin America Connected Toys Market Trends

Latin America shows promising potential for connected toys adoption, supported by growing e-commerce platforms and increased digital learning initiatives. Markets such as Brazil and Mexico are experiencing rising demand for interactive and affordable toys. Economic fluctuations remain a restraint, but expanding digital literacy is expected to create new growth avenues.

U.S. Connected Toys Market Trends

The U.S. plays a central role in shaping the North American connected toys market, with strong consumer spending power and advanced digital ecosystems. High adoption of smartphones and tablets among children accelerates demand for app-linked toys. Ongoing government support for digital education further strengthens the country’s position as a leading market hub.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Connected Toys Company Insights

In 2024, the global Connected Toys Market witnessed notable contributions from leading players shaping innovation, digital engagement, and learning opportunities for children.

Mattel continued to strengthen its position by leveraging established brands and integrating connected features into its toy portfolio. The company focused on combining interactive play with digital platforms, enhancing customer loyalty and extending brand influence in the smart toy ecosystem.

LEGO advanced its connected play initiatives by merging its classic building sets with digital interactivity. Through app-based integration and robotics-driven kits, LEGO expanded its educational and entertainment value, making technology-driven creativity more accessible and engaging for children globally.

Sony maintained a strategic presence by utilizing its expertise in entertainment and gaming. The company introduced interactive connected experiences that blended toys with digital ecosystems, targeting tech-savvy households and reinforcing its reputation as an innovator in immersive entertainment solutions.

VTech remained a dominant force in electronic learning toys, leveraging its established expertise in child-focused education technology. By introducing connected learning solutions, VTech expanded its product offerings to balance entertainment with skill-building, ensuring strong market penetration across diverse age groups.

Together, these key players not only expanded the scope of connected play but also set benchmarks for merging physical interaction with digital experiences. Their strategic efforts underscored a broader industry shift toward innovation, personalization, and educational enrichment in the Connected Toys Market.

Top Key Players in the Market

- Mattel

- LEGO

- Sony

- VTech

- iRobot

- Sphero

- Pillar Learning

- Wonder Workshop

- WowWee Group

- Workinman Interactive

Recent Developments

- In June 2025, Barbie-maker Mattel partnered with OpenAI to launch AI-powered toys, aiming to blend advanced generative AI with interactive play. This collaboration is expected to transform children’s toy experiences through smart, conversational, and adaptive features.

- In July 2025, Steelbird Baby Toys announced an investment of ₹10 crore to expand its infant toy range. The funding is directed toward new product development and manufacturing capacity to strengthen its footprint in India’s growing baby care market.

- In December 2024, Alliance Entertainment acquired Handmade by Robots, a collectible toy company. The acquisition strengthens Alliance’s portfolio in pop-culture merchandise and enhances its market presence in the rapidly growing collectibles segment.

Report Scope

Report Features Description Market Value (2024) USD 8.8 Billion Forecast Revenue (2034) USD 51.8 Billion CAGR (2025-2034) 19.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (App-Connected Toys, Voice-Activated Toys, Screenless Connected Toys, Smart Toys with Wearable Integration, Robotics and Programmable Toys, Smart Action Figures and Dolls), By Interfacing Device (Smartphones, Tablets, Consoles and PCs, Wearables), By Age Group (0-5 years, 6-8 years, 9-12 years, Teenagers), By Technology (Wi-Fi, Bluetooth, Radio Frequency Identification, Artificial Intelligence, Augmented Reality, Virtual Reality), By Application (Entertainment, Educational, Fitness and Health, Security and Monitoring) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mattel, LEGO, Sony, VTech, iRobot, Sphero, Pillar Learning, Wonder Workshop, WowWee Group, Workinman Interactive Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mattel

- LEGO

- Sony

- VTech

- iRobot

- Sphero

- Pillar Learning

- Wonder Workshop

- WowWee Group

- Workinman Interactive