Connected Healthcare Market By Type (M-Health Services, M-Health Devices and E-Prescription), By Function (Remote Patient Monitoring, Clinical Monitoring, Telemedicine, Home Monitoring, Assisted Living and Other Functions), By Application (Diagnosis & treatment, Monitoring Application, Education & Awareness, Wellness & Prevention Healthcare Management and Other Applications), By End-User (Hospitals & Clinics, Home Monitoring, and Other End-Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 99712

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

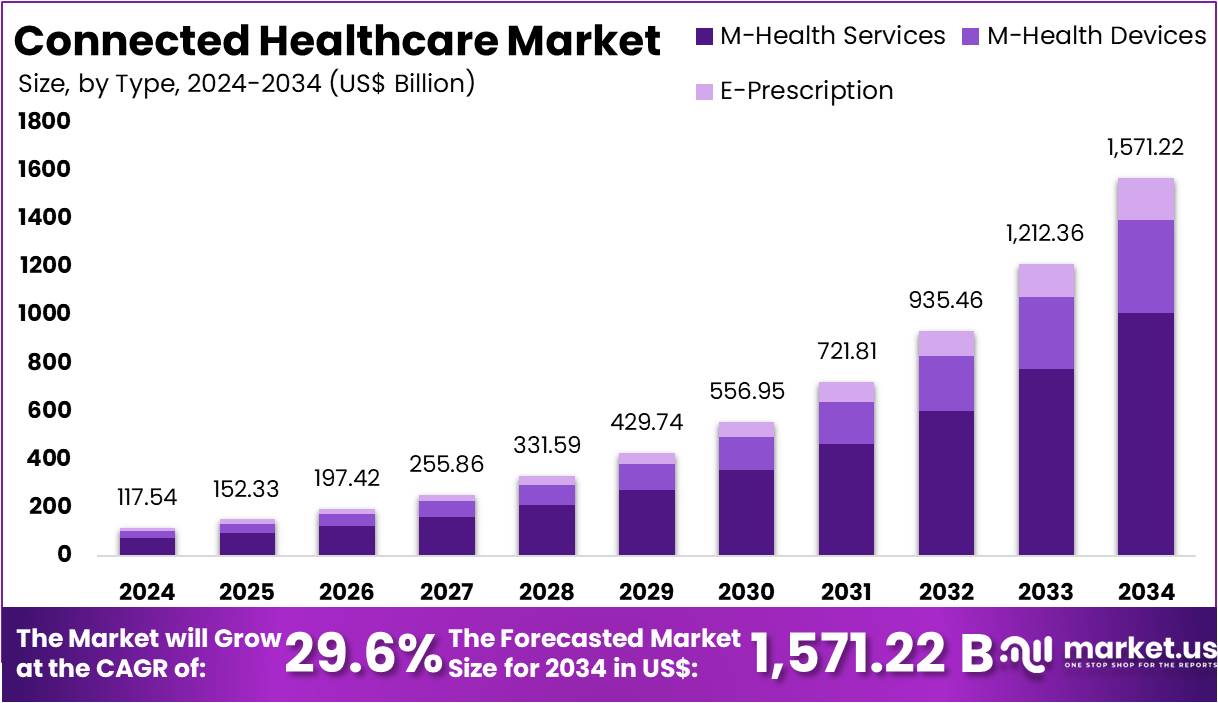

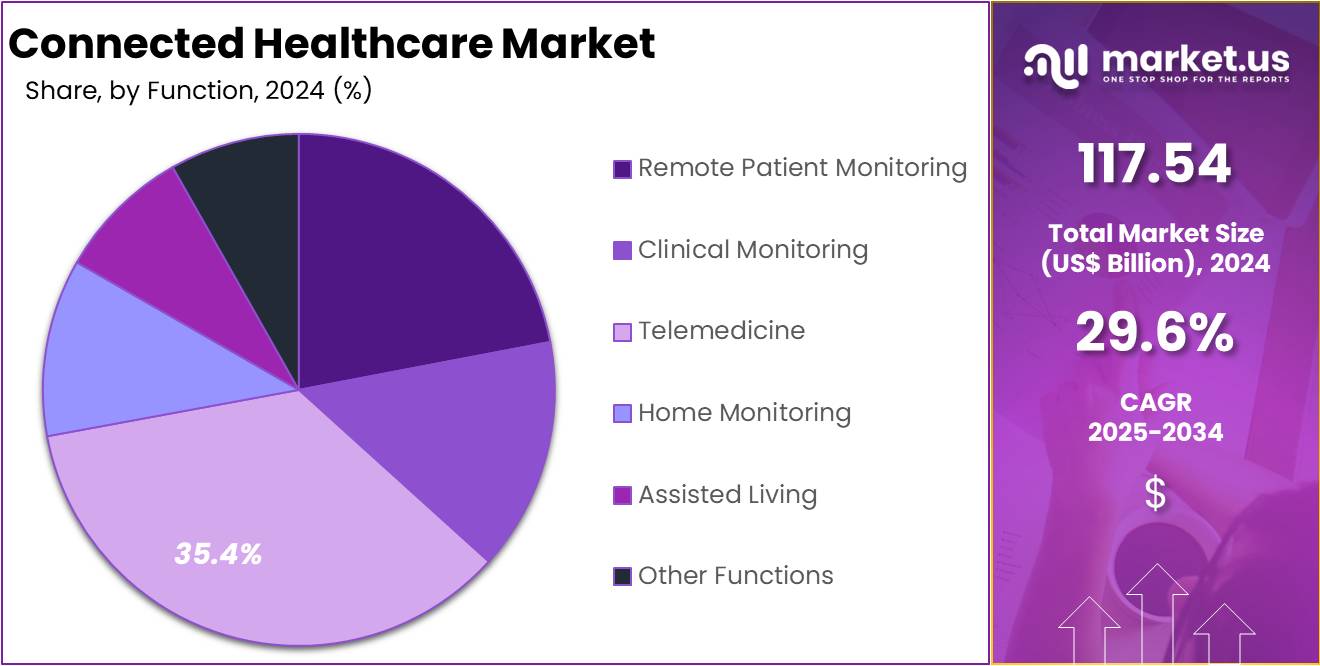

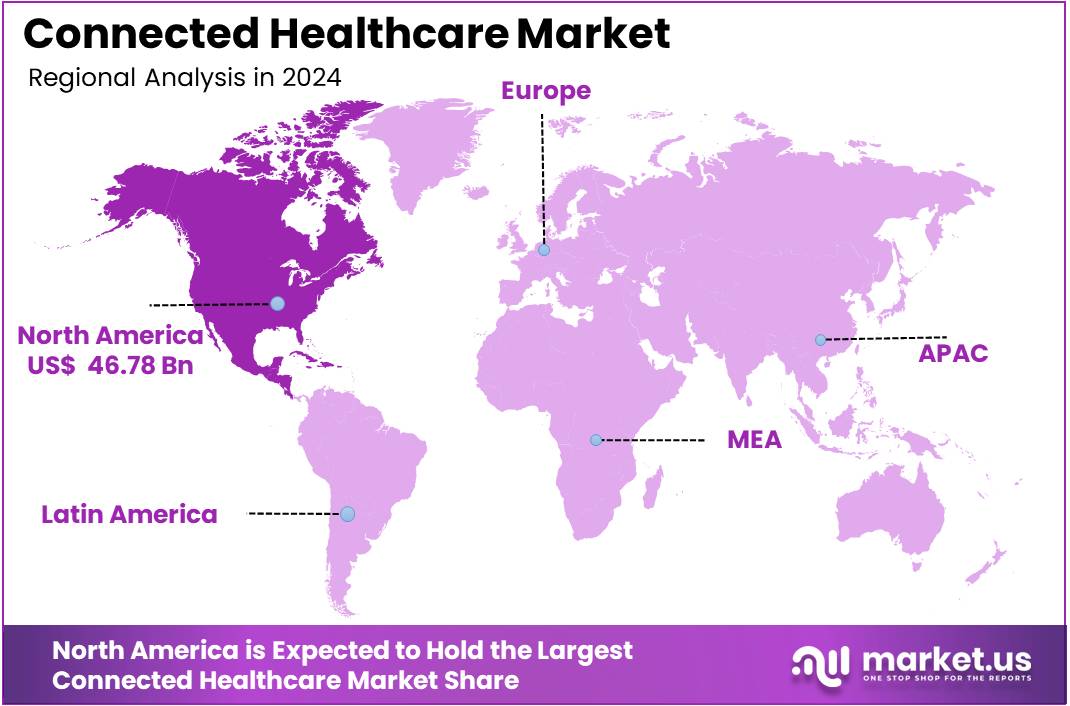

The Connected Healthcare Market size is expected to be worth around US$ 1,571.22 billion by 2034 from US$ 117.54 billion in 2024, growing at a CAGR of 29.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.80% share and holds US$ 46.78 Billion market value for the year.

Connected Healthcare is a healthcare organization that covers technology to offer services slightly. It is a type of socio-technical model for the healthcare management system. This system is mainly used to raise healthcare resources and offer customers opportunities to get attached to surgeons. Advanced technology and the rising number of healthcare services outside emerging healthcare worldwide drive the market’s growth. In addition, patients and healthcare organizations worldwide help from linked healthcare solutions.

The connected healthcare market is rapidly evolving, driven by advancements in digital health technologies such as telemedicine, remote patient monitoring, and integrated healthcare systems. These innovations are designed to improve patient outcomes, reduce healthcare costs, and streamline healthcare delivery. Increasing adoption of Internet of Things (IoT) devices, cloud computing, and AI-powered solutions are enhancing the quality and accessibility of care. Connected healthcare enables real-time monitoring of patients’ health metrics, ensuring proactive management of chronic conditions and reducing hospital readmissions.

Key factors driving market growth include the rising demand for telemedicine, the need for enhanced patient engagement, and the growing trend of personalized healthcare. The COVID-19 pandemic further accelerated the adoption of virtual care, showcasing the importance of remote consultations and digital health records. Additionally, governments and healthcare organizations worldwide are investing heavily in connected healthcare systems to support digital transformation in the industry.

Key Takeaways

- In 2024, the market for Connected Healthcare generated a revenue of US$ 54 billion, with a CAGR of 29.6%, and is expected to reach US$ 1,571.22 billion by the year 2034.

- The market segments include M-Health, M-Health Devices, and E-Prescription. M-Health services accounts for the largest share 64.3% due to its cost-effectiveness and the increasing use of smartphones to access healthcare services.

- By Function, the market is bifurcated into categorized into remote patient monitoring, clinical monitoring, telemedicine, home monitoring, assisted living, and others. Telemedicine stands out as the largest segment with a substantial 35.4% market share due to its increasing acceptance and preference among patients.

- Considering the Application, the market is classified into diagnosis and treatment, monitoring, education and awareness, wellness and prevention, and others. The wellness and prevention segment dominated market growth with 42.5% market share, driven by growing health awareness and digital health trends.

- Furthermore, concerning the End-User segment, the market is segregated into Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, and Private & Commercial Sectors. The Hospitals & Clinics stands out as the dominant segment, holding the largest revenue share of 49.9% in the Connected Healthcare market.

- North America led the market by securing a market share of 38.80% in 2023.

Type Analysis

The globally connected healthcare market is segmented into m-health services, m-health devices, and e-prescriptions. Among these, the m-health services segment held the largest share, accounting for 64.3% during the forecast period. This growth is driven by the increasing use of smartphones, which allows users to access healthcare services wirelessly. The m-health devices segment is also witnessing moderate growth due to the affordability of wearable technology and rising government health initiatives. These factors are collectively encouraging the adoption of mobile-based healthcare solutions across multiple regions.

M-health services are further classified into content solutions, mobile health apps, and services offered by healthcare providers and pharmaceutical companies. The growing use of mobile health apps helps people manage their health independently. This segment is supported by improved internet access, rising digital literacy, and the convenience of real-time health monitoring. The trend reflects a shift in consumer behavior toward proactive healthcare, where users are increasingly relying on digital platforms for medical advice, fitness tracking, and remote consultations.

The e-prescription segment is also contributing to market expansion. Its growth is supported by the rising adoption of electronic health record (EHR) software and a stronger focus on minimizing medical errors. In November 2022, ELNA Medical in Canada acquired m-Health Solutions, a leading remote diagnostics provider. The company offers wearable ECG devices, such as Holter monitors, and AI-powered cloud-based reporting systems. These technologies enable faster diagnostics and treatment for conditions like cardiovascular disease and sleep apnea. Over 4,300 physicians across 60 medical facilities in Ontario utilize these services.

Function Analysis

The global connected healthcare market is segmented by function into remote patient monitoring, clinical monitoring, telemedicine, home monitoring, assisted living, and others. Among these, the telemedicine segment is projected to grow the fastest during the forecast period, holding a 35.4% market share. This growth is driven by the rising adoption of telemedicine services. A recent survey published by MDPI journals highlights that many patients now prefer telemedicine as a suitable alternative to in-person care. This trend is expected to boost the segment’s demand further.

Remote patient monitoring is also witnessing rapid growth. This is largely due to the increasing global elderly population and the rising need for regular health monitoring at home. The segment supports real-time data collection and timely interventions, which is critical for managing chronic conditions. Additionally, home monitoring and assisted living functions are expanding due to the growing demand for personalized and accessible care solutions. These services are especially valuable for aging individuals and patients with mobility issues.

Clinical monitoring is showing faster growth owing to the increasing prevalence of chronic and acute health conditions. As the diagnosis of complex diseases rises, patients are placing higher importance on continuous health monitoring. Notably, in August 2024, Pfizer Inc. launched PfizerForAll, a digital platform aimed at simplifying healthcare access. This initiative supports disease management for conditions such as migraines, flu, and COVID-19. It also facilitates access to adult vaccinations, improving preventive care measures for a broad U.S. population base.

Application Analysis

The global connected healthcare market is segmented by function into remote patient monitoring, clinical monitoring, telemedicine, home monitoring, assisted living, and others. Among these, the telemedicine segment is projected to grow the fastest during the forecast period, holding a 35.4% market share. This growth is driven by the rising adoption of telemedicine services. A recent survey published by MDPI journals highlights that many patients now prefer telemedicine as a suitable alternative to in-person care. This trend is expected to boost the segment’s demand further.

Remote patient monitoring is also witnessing rapid growth. This is largely due to the increasing global elderly population and the rising need for regular health monitoring at home. The segment supports real-time data collection and timely interventions, which is critical for managing chronic conditions. Additionally, home monitoring and assisted living functions are expanding due to the growing demand for personalized and accessible care solutions. These services are especially valuable for aging individuals and patients with mobility issues.

Clinical monitoring is showing faster growth owing to the increasing prevalence of chronic and acute health conditions. As the diagnosis of complex diseases rises, patients are placing higher importance on continuous health monitoring. Notably, in August 2024, Pfizer Inc. launched PfizerForAll, a digital platform aimed at simplifying healthcare access. This initiative supports disease management for conditions such as migraines, flu, and COVID-19. It also facilitates access to adult vaccinations, improving preventive care measures for a broad U.S. population base.

End-User Analysis

The globally connected healthcare market is segmented by end users into hospitals & clinics, home monitoring, and others. Among these, the hospitals & clinics segment is projected to dominate, holding the highest market share of 54.5% during the forecast period. This segment accounted for a 49.9% share, driven by increased product adoption in clinical settings. The rise in digital transformation across healthcare facilities is playing a key role in this growth. Hospitals are rapidly integrating connected technologies to improve patient outcomes and operational efficiency.

The increasing implementation of digital health technologies by hospitals worldwide is boosting segment expansion. Many hospitals have adopted connected health platforms for remote patient monitoring. The widespread use of telemedicine has also supported this trend. These advancements are helping providers deliver care more effectively, especially in resource-constrained environments. Countries around the world are recognizing the value of these technologies in enhancing service quality and access to healthcare. This adoption pattern continues to support strong market performance.

In November 2024, Teladoc Health introduced AI-powered enhancements to its Virtual Sitter solution. This advancement aims to improve patient safety and reduce the workload on hospital staff. Annually, around 1 million hospital patients experience falls, with more than 30% resulting in long-term injuries. According to the CDC, falls lead to approximately $50 billion in medical costs each year. These AI-driven solutions can help mitigate risks, making connected healthcare an essential part of hospital strategies to manage patient safety and control healthcare spending.

Key Market Segments

By Type

- M-Health Services

- M-Health Devices

- E-Prescription

By Function

- Remote Patient Monitoring

- Clinical Monitoring

- Telemedicine

- Home Monitoring

- Assisted Living

- Other Functions

By Application

- Diagnosis & treatment

- Monitoring Application

- Education & Awareness

- Wellness & Prevention Healthcare Management

- Other Applications

By End-User

- Hospitals & Clinics

- Home Monitoring

- Other End-Users

Drivers

Personalized Healthcare Solutions to Expand the Market Growth

Personalized healthcare has the potential to address chronic health conditions and lifestyle disorders by using advanced technologies. These technologies evolve through current discoveries in diagnostic tools, clinical medicine, genomics, and behavioral sciences. As people become more concerned about their health and wellness, the connected health market is expected to grow. This growth will be fueled by innovations that enable better health monitoring and support. Personalized healthcare is seen as a key factor in enhancing long-term patient outcomes and reducing healthcare system burdens.

In June 2025, Welldoc, known for its AI-driven digital health solutions, partnered with Eli Lilly and Company. It announced the integration of its cardiometabolic platform into the new Lilly Health™ Personalized Health & Medicine Platform (Lilly Health app). The app aims to offer customized experiences for patients using incretin-based therapies. Initially, it will support users of Zepbound (tirzepatide) and Mounjaro (tirzepatide). These drugs are used to treat cardiometabolic conditions such as obesity, type 2 diabetes, and obstructive sleep apnea.

Connected healthcare is expected to enhance patient engagement through wearable devices and smartphones. These tools offer patients greater convenience and reduce the need for in-person visits. The low cost and accessibility of connected devices further encourage market growth. As patients become more involved in their health, they are adopting technologies that allow self-monitoring. This trend is creating new opportunities in digital health markets. Healthcare providers are also benefiting from improved patient data and real-time insights.

The use of wearable devices has significantly changed how health is monitored. Tools such as glucose meters, fitness trackers, and blood pressure monitors are gaining popularity. They help individuals track vital activities like heart rate, distance covered, and calories burned. These devices reduce the need for frequent clinical checkups. Patients can observe their own health parameters without visiting a doctor each time. As a result, the overall healthcare cost burden can be reduced while improving proactive health management.

Restraints

High-Capital Expenditure and Technological Barriers

Despite the enormous potential of connected healthcare products and services, several infrastructure and technological barriers are slowing market growth. One major challenge is the high cost of setting up virtual healthcare systems and devices. These include real-time monitoring tools that measure vital health parameters. Such installations require advanced hardware and software, which are often expensive. This creates a financial burden, particularly for smaller healthcare providers. As a result, the adoption of connected healthcare solutions remains limited in various regions, especially in low-resource settings.

Moreover, although mobile health (M-Health) apps are increasingly used, their adoption remains low in many emerging countries. This is largely due to poor internet infrastructure and limited access to high-speed connectivity. Additionally, a lack of adequate data storage and transmission capabilities hinders the smooth functioning of these digital health tools. These technical and infrastructural gaps significantly affect the scalability of connected healthcare services. As a result, many regions are unable to benefit fully from modern digital health technologies.

Opportunities

Increasing Demand for Efficient Communication Among Medical Professional

The rising need for efficient communication between healthcare professionals and patients has significantly expanded the global connected healthcare industry. This trend has reshaped the healthcare sector in recent years. Connected healthcare enables seamless data exchange, real-time patient monitoring, and faster decision-making. Hospitals and clinics are adopting digital platforms to ensure continuity of care and enhance patient engagement. These advancements contribute to improved healthcare outcomes, especially in chronic disease management and post-discharge monitoring, thereby increasing the demand for integrated digital solutions.

Furthermore, both government bodies and private organizations are making notable investments to expand connected healthcare services. These efforts aim to improve healthcare access for populations in rural and underserved regions. By leveraging technologies such as telemedicine, remote diagnostics, and mobile health apps, providers can reach patients regardless of geographic barriers. Such developments are creating new growth opportunities for companies operating in the connected healthcare market, especially those focusing on interoperability, cybersecurity, and AI-based platforms.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the connected healthcare market, shaping its growth and adoption trends. Economic pressures, such as inflation, healthcare budget constraints, and rising costs of materials, can impact the affordability of connected healthcare technologies, such as telemedicine platforms, wearable health devices, and remote monitoring solutions. These pressures may limit healthcare providers’ ability to invest in advanced technologies, particularly in regions with tighter fiscal conditions.

Geopolitical factors, including trade tensions, tariffs, and regulatory changes, also affect the connected healthcare market. For instance, international trade disputes can lead to delays in the manufacturing and distribution of medical devices, increasing costs and affecting availability. Additionally, differing healthcare regulations across regions can complicate market entry for connected healthcare solutions, as companies must navigate various compliance requirements. The global push for digital health, accelerated by the COVID-19 pandemic, faces challenges in regions where political instability or restrictive policies hinder the adoption of telemedicine and digital health technologies.

On the positive side, government initiatives in regions like North America and Europe, aimed at improving healthcare access and reducing costs, are fueling the growth of connected healthcare solutions. Similarly, geopolitical tensions may drive innovation in healthcare technologies as nations strive for self-reliance in healthcare systems, boosting investments in digital health infrastructure. These factors together will continue to shape the dynamics of the connected healthcare market.

Latest Trends

Growing Adoption of Blockchain Technology

Data security is a growing concern across all industries, especially in healthcare. Patient records are highly sensitive and require strict protection from unauthorized access or misuse. Blockchain technology is emerging as a strong solution to address these concerns. It offers a secure, transparent, and efficient method for storing and accessing health information. The decentralized nature of blockchain ensures that data cannot be altered or tampered with. As a result, healthcare providers are increasingly exploring blockchain to enhance data integrity and reduce the risk of breaches.

The healthcare industry is rapidly adopting blockchain technology to manage patient records more securely. This technology enables real-time access and traceability of medical data. It also improves interoperability among healthcare systems, allowing for better coordination and patient outcomes. Several organizations are leveraging blockchain to ensure that data sharing meets strict regulatory standards. One of the key advantages is its ability to create an unchangeable audit trail. This helps in maintaining transparency, accountability, and patient trust in healthcare systems.

BurstIQ is one of the leading companies applying blockchain in healthcare. The company offers a secure data management platform tailored for healthcare businesses. BurstIQ’s system enables healthcare firms to store, share, and license large volumes of patient data with full compliance to HIPAA regulations. This ensures that patients maintain control over who accesses their data and how it is used. The platform also supports healthcare innovation by allowing safe data exchange while protecting patient privacy at every step of the process.

Regional Analysis

North America is leading the Connected Healthcare Market

North America accounted for a significant 39.80% share of the connected healthcare market revenue during the forecast period. The region is expected to maintain its leading position, supported by strong healthcare infrastructure and high levels of consumer awareness. Widespread internet access and supportive regulatory frameworks have also contributed to the region’s dominance. The demand for connected healthcare services is further reinforced by government efforts to improve patient safety and healthcare delivery through advanced digital technologies and integration.

Europe held the second-largest position in the connected healthcare market. This is mainly due to the increasing use of smartphones by both individuals and healthcare professionals. The demand for remote patient monitoring services is also on the rise. These services enable real-time tracking of health conditions and chronic disease management. The growing adoption of digital health tools in clinics and hospitals across European countries has accelerated the uptake of connected healthcare solutions, contributing to steady market growth in this region.

Asia-Pacific is projected to witness the fastest growth in the connected healthcare market. This expansion is driven by higher approvals for smart wearable devices and the rising popularity of mobile health (M-Health) services. Countries in this region are increasingly adopting health technologies to improve access and reduce care costs. In contrast, regions such as Latin America and the Middle East & Africa are expected to grow slowly. This is primarily due to limited public awareness and a lower rate of acceptance for connected healthcare in low-income economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Connected Healthcare market includes Philips Healthcare, Siemens Healthineers, GE Healthcare, Cerner Corporation, IBM Watson Health, Medtronic, Bosch Healthcare Solutions, Honeywell Life Care Solutions, Cisco Systems, Qualcomm Life, Abbott Laboratories, Samsung Electronics, Fitbit (Google), Microsoft Corporation, Oracle Health Sciences, Allscripts Healthcare Solutions, Teladoc Health, Ericsson, Apple Inc., and Others.

Philips Healthcare is a key player in the connected healthcare market, providing innovative solutions like telemedicine, patient monitoring systems, and integrated health platforms. Their advanced technologies aim to enhance patient outcomes, optimize care processes, and support remote healthcare delivery, with a strong focus on digital transformation and patient-centric care.

Siemens Healthineers is at the forefront of connected healthcare with a comprehensive portfolio that includes AI-powered diagnostic tools, remote patient monitoring, and integrated health information systems. GE Healthcare is a leader in connected healthcare, offering a wide range of solutions including imaging, patient monitoring, and telemedicine platforms.

Top Key Players in the Connected Healthcare Market

- Philips Healthcare

- Siemens Healthineers

- GE Healthcare

- Cerner Corporation

- IBM Watson Health

- Medtronic

- Bosch Healthcare Solutions

- Honeywell Life Care Solutions

- Cisco Systems

- Qualcomm Life

- Abbott Laboratories

- Samsung Electronics

- Fitbit (Google)

- Microsoft Corporation

- Oracle Health Sciences

- Allscripts Healthcare Solutions

- Teladoc Health

- Ericsson

- Apple Inc.

- Others

Recent Developments

- In January 2025: CVS Health introduced the launch of the CVS Health app. The new features of the app aim to consolidate all of CVS Health’s offerings, making healthcare more accessible, affordable, and convenient for consumers.

- In July 2024: GE HealthCare and Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, Inc., announced a strategic collaboration to create purpose-built foundation models and generative artificial intelligence (AI) applications aimed at enhancing medical diagnostics and patient care for clinicians.

- In April 2024: The WHO announced that it will launch the new WHO/Europe app for primary healthcare for children and adolescents on 29 April. This hybrid event will take place at the Ministry of Health of Greece.

- In June 2022: Included Health, the only integrated virtual care and navigation platform, today announced the launch of a new feature that allows for deep data and app integration with select healthcare partners. This enhancement improves the shared understanding and coordination of member care, offering a more streamlined approach to healthcare management.

Report Scope

Report Features Description Market Value (2024) US$ 117.54 billion Forecast Revenue (2034) US$ 1,571.22 billion CAGR (2025-2034) 29.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (M-Health Services, M-Health Devices and E-Prescription), By Function (Remote Patient Monitoring, Clinical Monitoring, Telemedicine, Home Monitoring, Assisted Living and Other Functions), By Application (Diagnosis & treatment, Monitoring Application, Education & Awareness, Wellness & Prevention Healthcare Management and Other Applications), By End-User (Hospitals & Clinics, Home Monitoring, and Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips Healthcare, Siemens Healthineers, GE Healthcare, Cerner Corporation, IBM Watson Health, Medtronic, Bosch Healthcare Solutions, Honeywell Life Care Solutions, Cisco Systems, Qualcomm Life, Abbott Laboratories, Samsung Electronics, Fitbit (Google), Microsoft Corporation, Oracle Health Sciences, Allscripts Healthcare Solutions, Teladoc Health, Ericsson, Apple Inc., and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Connected Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Connected Healthcare MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allscripts Healthcare, LLC.

- Apple Inc.

- Mckesson Corporation

- Cerner Corporation

- Koninklijike Philips N.V.

- IBM Corporation

- Fitbit Inc.

- Omron Corporation

- General Electric Company

- NXGN Management, LLC

- Avcor Medical Health Care Products, Inc.

- BSN Medical Inc.

- Other Key Players