Global Connected Apparel Market Size, Share, Growth Analysis By Product Type (Clothing, Top Wear, Bottom Wear, Inner Wear, Footwear), By Technology Integration (Sensor-Embedded, Bluetooth and Wi-Fi Connectivity, Data Analytics and Cloud Integration), By Consumer Group (Male, Female), By Distribution Channel (Online Retail, Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171152

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

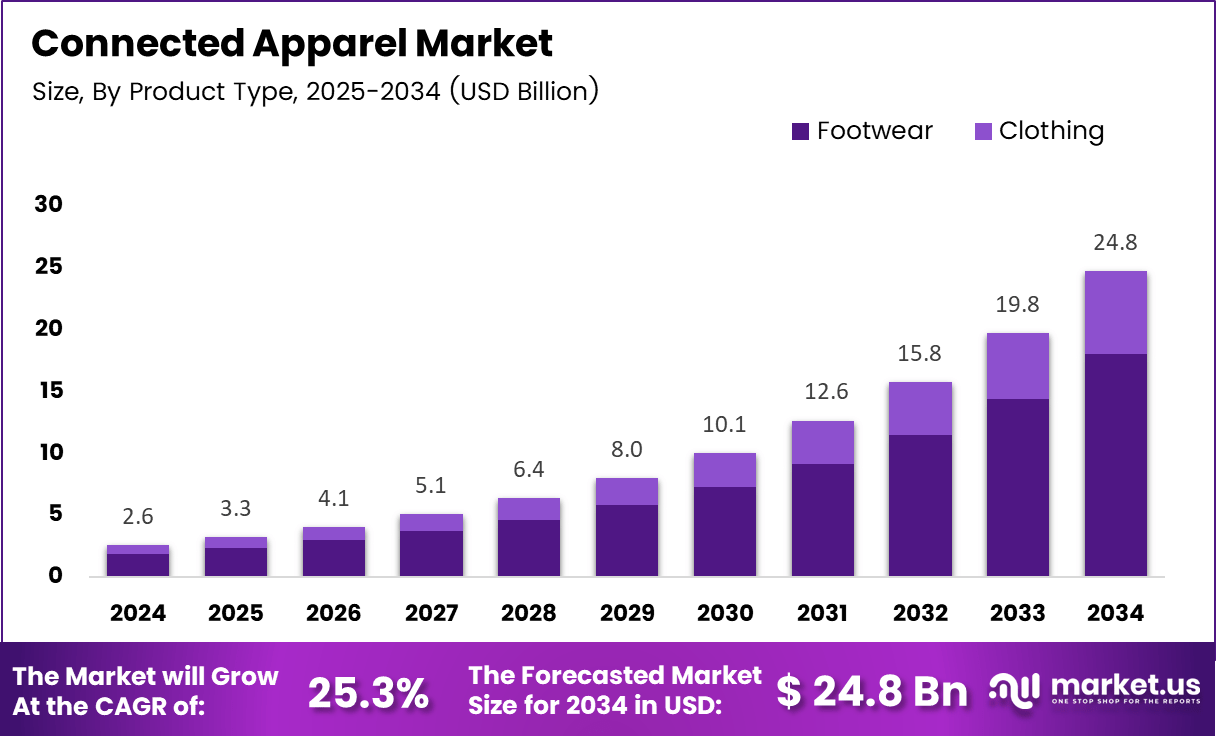

The Global Connected Apparel Market size is expected to be worth around USD 24.8 billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 25.3% during the forecast period from 2025 to 2034.

The Connected Apparel Market represents the commercial ecosystem for clothing embedded with sensors, connectivity modules, and data analytics capabilities. It spans smart clothing, sensor embedded garments, and IoT enabled wearables. From an analyst perspective, this market bridges fashion, digital health, and sports technology, supporting continuous data driven consumer engagement across daily lifestyles.

Connected Apparel refers to intelligent garments designed to collect, transmit, and analyze real time user data. Importantly, these products integrate smart textiles, Bluetooth or cloud connectivity, and mobile applications. From a business standpoint, connected apparel improves comfort, functionality, and personalization while aligning fashion aesthetics with performance monitoring and wellness tracking needs.

From a growth standpoint, increasing consumer focus on health awareness and active lifestyles strengthens adoption. Moreover, rising digital fitness ecosystems and remote health monitoring platforms accelerate demand. As a result, connected apparel solutions are increasingly positioned as affordable lifestyle upgrades rather than niche medical or professional performance tools, supporting broader market penetration.

Government involvement further supports market expansion through digital health initiatives and smart manufacturing incentives. For instance, programs promoting wearable health monitoring and smart textile innovation receive funding support. Additionally, regulatory frameworks around data transparency and consumer protection are improving trust, encouraging wider adoption of connected clothing technologies across regulated consumer markets.

Opportunities continue emerging through integration with AI driven analytics, e health platforms, and preventive healthcare programs. Consequently, connected apparel increasingly supports early health insights, posture correction, and activity optimization. As smart city and workforce safety initiatives expand, demand grows for connected uniforms and workwear aligned with compliance and occupational health monitoring standards.

From a pricing and accessibility perspective, affordability remains a critical adoption catalyst. According to brand disclosures on connected apparel retail platforms, connected apparel makes it easy to build a stylish smart wardrobe with options priced under 90, reducing entry barriers for mass consumers. This pricing strategy supports faster adoption beyond premium fitness segments.

Market momentum benefits from favorable demographics, digital infrastructure expansion, and supportive regulations. According Survey, wearable and connected clothing adoption continues rising as consumers prioritize proactive wellness. Combined with declining component costs and improved textile durability, the connected apparel market maintains a strong long term growth outlook.

Key Takeaways

- The Global Connected Apparel Market is projected to reach USD 24.8 billion by 2034 from USD 2.6 billion in 2024, registering a CAGR of 25.3%.

- Clothing emerges as the dominant product segment, accounting for a market share of 72.7% in the Connected Apparel Market.

- Sensor Embedded technology leads technology integration with a share of 49.2%, driven by demand for real time biometric accuracy.

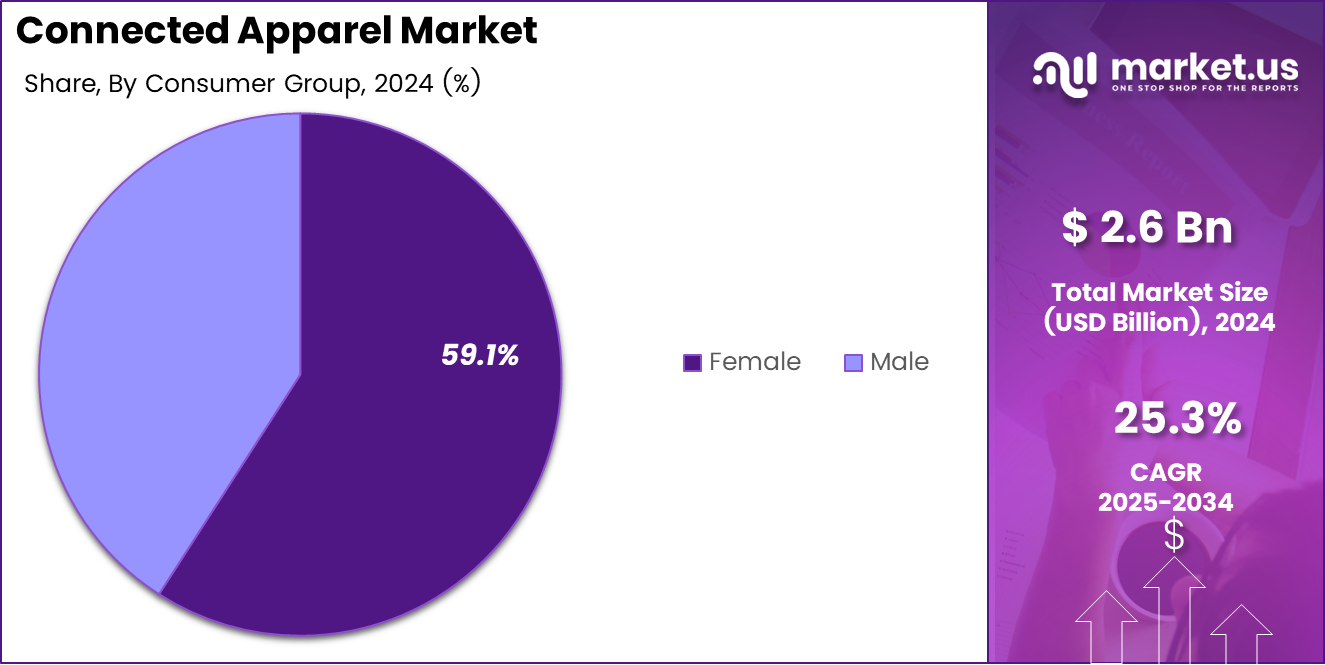

- Female consumers represent the largest consumer group, holding a market share of 59.1% due to strong wellness and lifestyle adoption.

- Online Retail dominates distribution channels with a contribution of 67.5%, supported by direct to consumer digital platforms.

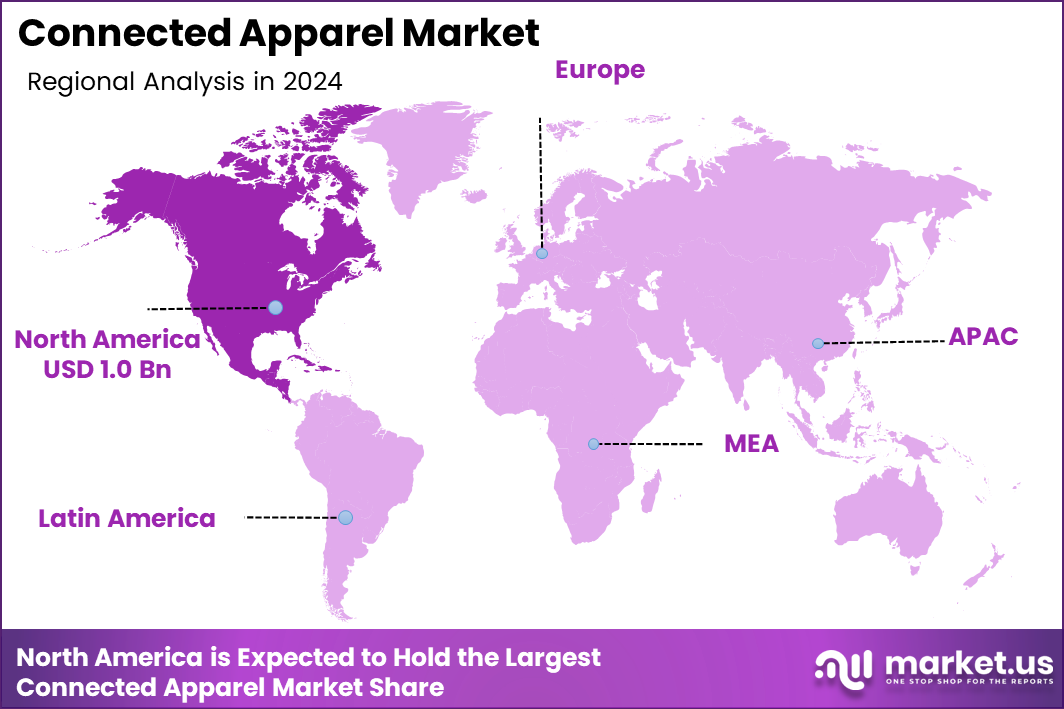

- North America remains the leading region, capturing 41.8% of the global market and generating approximately USD 1.0 billion in value.

Clothing Analysis

Clothing dominates the Connected Apparel Market with a share of 72.7%, driven by rising consumer preference for smart everyday wear.

In 2024, Top Wear held a dominant market position in the By Clothing Analysis segment of the Connected Apparel Market, supported by strong adoption of smart shirts, jackets, and sports tops. Increasing use in fitness tracking, posture monitoring, and workplace safety accelerates demand, while fashion led designs improve daily wear acceptance across urban consumers.

Bottom Wear maintained steady growth in the By Clothing Analysis segment of the Connected Apparel Market. Smart leggings and trousers increasingly support motion tracking, muscle activity monitoring, and rehabilitation use cases. As athleisure trends expand, connected bottom wear gains relevance in both fitness routines and casual lifestyle applications.

Inner Wear continued expanding in the By Clothing Analysis segment of the Connected Apparel Market. Sensor enabled undergarments support heart rate, respiration, and stress monitoring. Moreover, discreet placement of sensors enhances comfort, making inner wear suitable for long duration health monitoring and preventive wellness use.

Footwear represented an emerging segment in the By Clothing Analysis segment of the Connected Apparel Market. Smart shoes enable gait analysis, step tracking, and posture correction. Growing sports participation and workplace ergonomics awareness gradually strengthen adoption across both consumer and professional user groups.

By Technology Integration Analysis

Sensor Embedded technology leads the Connected Apparel Market with a share of 49.2%, supported by direct data accuracy and real time monitoring benefits.

In 2024, Sensor Embedded held a dominant market position in the By Technology Integration Analysis segment of the Connected Apparel Market. Direct integration of sensors into fabrics improves biometric accuracy. Consequently, healthcare, sports performance, and occupational safety applications increasingly favor sensor embedded garments over external devices.

In 2024, Bluetooth and Wi Fi Connectivity expanded steadily in the By Technology Integration Analysis segment of the Connected Apparel Market. Wireless connectivity enables seamless data transmission to smartphones and wearables. As mobile health ecosystems mature, connectivity features enhance real time feedback, personalization, and user engagement.

In 2024, Data Analytics and Cloud Integration strengthened its role in the By Technology Integration Analysis segment of the Connected Apparel Market. Cloud platforms enable long term data storage and trend analysis. Additionally, analytics driven insights support preventive health management, fitness optimization, and enterprise level workforce monitoring.

By Consumer Group Analysis

Female consumers dominate the Connected Apparel Market with a share of 59.1%, reflecting strong alignment with wellness and lifestyle trends.

In 2024, Male consumers maintained consistent participation in the By Consumer Group Analysis segment of the Connected Apparel Market. Demand arises from sports training, fitness optimization, and workplace safety monitoring. Moreover, performance oriented features and durability continue driving adoption across male consumer segments.

In 2024, Female consumers held a dominant market position in the By Consumer Group Analysis segment of the Connected Apparel Market, with a share of 59.1%. Growing interest in wellness tracking, athleisure fashion, and personalized health insights supports adoption. Additionally, design focused innovation improves comfort and aesthetic appeal.

By Distribution Channel Analysis

Online Retail leads the Connected Apparel Market with a share of 67.5%, supported by digital discovery and direct to consumer strategies.

In 2024, Online Retail held a dominant market position in the By Distribution Channel Analysis segment of the Connected Apparel Market, accounting for 67.5%. E commerce platforms enable wider product visibility, customization options, and competitive pricing. Moreover, digital channels support faster consumer education and adoption.

In 2024, Offline Retail continued contributing to the By Distribution Channel Analysis segment of the Connected Apparel Market. Physical stores support experiential trials and personalized assistance. As hybrid retail models expand, offline channels complement online growth by building consumer trust and product familiarity.

Key Market Segments

By Product Type

- Clothing

- Top Wear

- Bottom Wear

- Inner Wear

- Footwear

By Technology Integration

- Sensor-Embedded

- Bluetooth and Wi-Fi Connectivity

- Data Analytics and Cloud Integration

By Consumer Group

- Male

- Female

By Distribution Channel

- Online Retail

- Offline Retail

Drivers

Rising Adoption of Biometric Monitoring Drives Connected Apparel Market Growth

The connected apparel market continues to expand due to the rising adoption of biometric monitoring across fitness, healthcare, and preventive wellness ecosystems. Smart clothing integrated with heart rate, posture, temperature, and motion sensors helps users track health metrics continuously without relying on separate wearable devices. This seamless experience supports growing consumer interest in daily wellness monitoring and long term health management.

Another important driver is the increasing integration of smart textiles with IoT and edge computing platforms. These technologies allow real time data processing directly within garments, reducing dependence on cloud systems and improving response speed. As a result, connected apparel delivers faster insights and more reliable performance, especially in active and outdoor environments.

Growing demand for real time performance analytics in professional sports and occupational safety also supports market growth. Athletes and workers use connected apparel to monitor fatigue, muscle activity, and environmental stress, which improves performance, safety, and injury prevention. Coaches and employers value this data for training optimization and risk reduction.

In healthcare, connected apparel adoption is expanding in remote patient monitoring and rehabilitation programs. Smart garments help clinicians track recovery progress, mobility patterns, and therapy adherence outside hospitals, improving care outcomes and reducing long term treatment costs.

Restraints

High Production Costs Associated with Advanced Sensors Limit Market Expansion

One major restraint in the connected apparel market is the high production cost linked to advanced sensors and conductive fabrics. Integrating electronics into textiles requires specialized materials, precision manufacturing, and skilled labor, which increases product pricing. These higher costs limit affordability, especially in price sensitive consumer segments.

Limited battery life also restricts broader adoption. Many connected garments rely on small batteries that require frequent charging, reducing convenience for daily users. Battery replacement or charging needs may discourage long term use, particularly in fitness and healthcare applications where continuous monitoring is expected.

Durability concerns under frequent washing and daily wear further challenge market growth. Electronic components can degrade over time due to moisture, heat, and fabric stress. Consumers expect clothing to maintain performance after repeated washes, and any failure reduces trust in connected apparel products.

Data privacy and cybersecurity risks represent another restraint. Connected apparel collects sensitive personal and health data continuously. Concerns over data misuse, unauthorized access, and weak security systems make some users hesitant to adopt these products, especially in healthcare and workplace monitoring applications.

Growth Factors

High Production Costs Associated with Advanced Sensors Limit Market Expansion

One major restraint in the connected apparel market is the high production cost linked to advanced sensors and conductive fabrics. Integrating electronics into textiles requires specialized materials, precision manufacturing, and skilled labor, which increases product pricing. These higher costs limit affordability, especially in price sensitive consumer segments.

Limited battery life also restricts broader adoption. Many connected garments rely on small batteries that require frequent charging, reducing convenience for daily users. Battery replacement or charging needs may discourage long term use, particularly in fitness and healthcare applications where continuous monitoring is expected.

Durability concerns under frequent washing and daily wear further challenge market growth. Electronic components can degrade over time due to moisture, heat, and fabric stress. Consumers expect clothing to maintain performance after repeated washes, and any failure reduces trust in connected apparel products.

Data privacy and cybersecurity risks represent another restraint. Connected apparel collects sensitive personal and health data continuously. Concerns over data misuse, unauthorized access, and weak security systems make some users hesitant to adopt these products, especially in healthcare and workplace monitoring applications.

Emerging Trends

Shift Toward Washable and Flexible Electronics Shapes Market Trends

A key trend in the connected apparel market is the shift toward washable and flexible electronic components embedded at the fiber level. Manufacturers focus on integrating sensors directly into yarns and fabrics rather than attaching rigid modules. This approach improves comfort, durability, and wash resistance, making connected apparel more practical for daily use.

Flexible electronics also support better garment design and aesthetics. Consumers prefer smart clothing that looks and feels like regular apparel. Fiber level integration allows brands to maintain style while delivering advanced functionality, increasing acceptance among mainstream users.

Another important trend is the growing collaboration between apparel brands and technology platform providers. Fashion companies partner with sensor manufacturers, AI developers, and IoT platforms to accelerate product development. These partnerships help combine textile expertise with advanced digital capabilities.

Such collaborations also support faster innovation cycles and better product reliability. As ecosystems strengthen, connected apparel continues evolving from niche products into widely adopted smart lifestyle and healthcare solutions.

Regional Analysis

North America Dominates the Connected Apparel Market with a Market Share of 41.8%, Valued at USD 1.0 Billion

North America holds a dominant position in the connected apparel market, accounting for 41.8% of the global share and generating approximately USD 1.0 billion in value. The region benefits from high adoption of wearable and smart textile technologies across fitness, healthcare, and occupational safety applications. Strong digital infrastructure, widespread use of remote health monitoring, and early adoption of IoT-enabled consumer products continue to support market expansion. In addition, favorable reimbursement policies and growing awareness of preventive wellness further strengthen regional demand.

Europe Connected Apparel Market Trends

Europe represents a mature and steadily growing market for connected apparel, supported by increasing emphasis on worker safety, sports science, and digital healthcare solutions. Regulatory focus on occupational health and patient monitoring encourages adoption of smart garments in clinical and industrial environments. The region also shows strong interest in sustainable and high-quality textiles, driving innovation in washable and durable smart fabrics. Growth remains stable due to consistent investments in health technology and smart manufacturing.

Asia Pacific Connected Apparel Market Trends

Asia Pacific is emerging as a high growth region for connected apparel due to rapid urbanization, expanding middle class populations, and rising health awareness. Increased adoption of fitness tracking, smart clothing, and digital healthcare platforms supports market growth across both consumer and institutional segments. Manufacturing strength and growing integration of electronics with textiles further accelerate regional adoption. The region benefits from large scale production capabilities and increasing digital penetration.

Middle East and Africa Connected Apparel Market Trends

The Middle East and Africa market is developing gradually, driven by growing investments in healthcare infrastructure and occupational safety initiatives. Connected apparel adoption remains concentrated in defense, industrial safety, and sports performance applications. Rising interest in smart health monitoring solutions and government led digital health programs supports long term growth. However, adoption levels vary widely across countries due to economic and infrastructure differences.

Latin America Connected Apparel Market Trends

Latin America shows moderate growth in the connected apparel market, supported by increasing fitness awareness and gradual expansion of digital health services. Adoption is mainly observed in sports training, wellness monitoring, and selected clinical use cases. Improving internet connectivity and smartphone penetration contribute to market development. While price sensitivity remains a challenge, rising demand for affordable smart clothing solutions supports gradual expansion across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Connected Apparel Company Insights

In 2024, AiQ Smart Clothing continues to solidify its position as a pioneer in the global Connected Apparel Market with a strong emphasis on seamless integration of textile technology and everyday wearability. The company’s focus on embedding sensors and connectivity into garments without compromising comfort has driven adoption among fitness enthusiasts and professional athletes alike. AiQ’s innovations in smart fabric responsiveness and real-time biometric feedback have set a benchmark for how apparel can support holistic health monitoring while remaining stylish and user-centric.

Ajanta Shoes has distinguished itself by marrying advanced connectivity features with ergonomic footwear design, catering to consumers who demand comfort alongside digital interaction. The company’s development of smart insoles and connected footwear platforms enables precise gait analysis, posture monitoring, and activity tracking. Ajanta’s ability to blend traditional craftsmanship with modern wearable technology has elevated its profile among both tech-savvy users and mainstream shoppers seeking functional, engaging experiences from their connected clothing and accessories.

Baliston has made noteworthy strides in the market by focusing on versatile connected apparel that addresses both performance and daily lifestyle needs. With an emphasis on modular smart components and adaptive textiles, Baliston’s products support customizable user experiences, from climate control to interactive feedback. This adaptability has drawn interest across diverse consumer segments, enhancing the brand’s appeal in urban, active, and professional environments while reinforcing its commitment to user comfort and sustained innovation.

Hexoskin remains a prominent player through its comprehensive approach to biometric data collection and analytics embedded within apparel. By offering garments capable of continuous monitoring of heart rate, breathing patterns, and activity levels, Hexoskin positions itself as a leader in health-oriented connected clothing. Its robust data integration capabilities and focus on actionable insights have resonated with users and enterprises alike, underscoring the brand’s role in advancing smart apparel utility and personalized wellness tracking.

Top Key Players in the Market

- AiQ Smart Clothing

- Ajanta Shoes

- Baliston

- Hexoskin

- OMsignal

- Ralph Lauren

- Sensoria

- Wearable X

Recent Developments

- In Feb 2024, S P Apparels announced the strategic acquisition of Young Brand Apparel Pvt. Ltd. for INR 223 crore, strengthening its position in the branded apparel manufacturing space. The acquisition expands S P Apparels’ product portfolio and enhances its capacity to serve leading domestic and international fashion brands.

- In Dec 2025, Saat & Saat acquired Turkish apparel leader Aydinli Group, expanding U.S. Polo Assn. brand markets across Turkey, the Middle East, Eastern Europe, and North Africa. This acquisition strengthens Saat & Saat’s global apparel footprint and accelerates brand penetration across high growth international regions.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 24.8 Billion CAGR (2025-2034) 25.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clothing, Top Wear, Bottom Wear, Inner Wear, Footwear), By Technology Integration (Sensor-Embedded, Bluetooth and Wi-Fi Connectivity, Data Analytics and Cloud Integration), By Consumer Group (Male, Female), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AiQ Smart Clothing, Ajanta Shoes, Baliston, Hexoskin, OMsignal, Ralph Lauren, Sensoria, Wearable X Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AiQ Smart Clothing

- Ajanta Shoes

- Baliston

- Hexoskin

- OMsignal

- Ralph Lauren

- Sensoria

- Wearable X