Global Conductive Ink Market By Product (Dielectric Ink and Conductive Silver Ink), By Application (Membrane Switches, Photovoltaic, Automotive, and Displays), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 67457

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

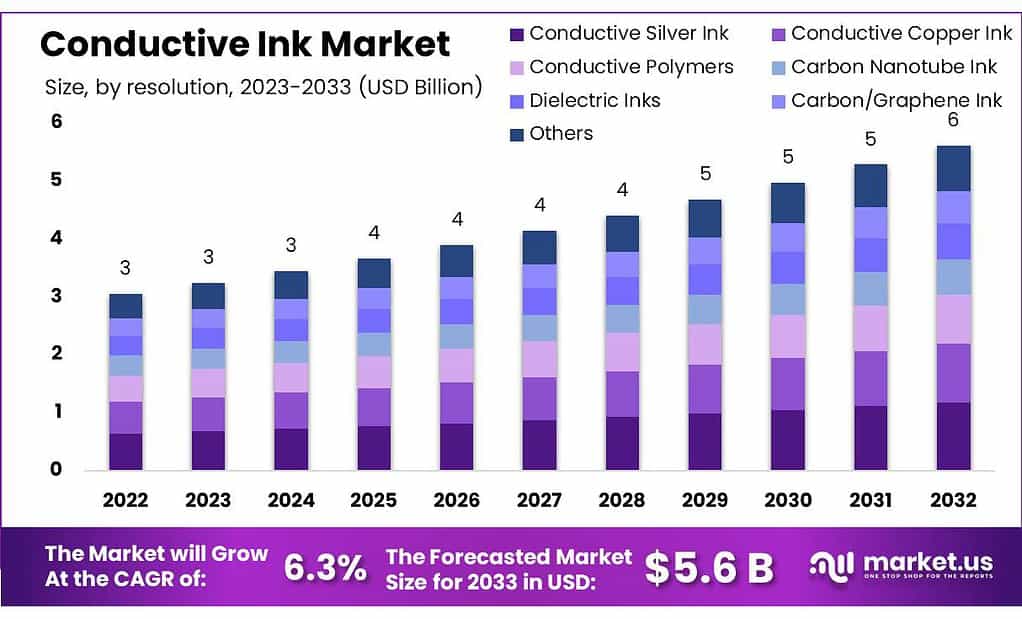

The global Conductive Ink market size is expected to be worth around USD 5.6 billion by 2033, from USD 3.5 billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2033.

Consumer electronics, as well as the growing demand for cleaner energy, have fueled the market. The industry is expected to expand over the forecast period. It will replace bulky circuits, as well as energy-consuming wires, in the coming years.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Predictions: The global Conductive Ink market is expected to grow substantially, reaching around USD 5.6 billion by 2033 from USD 3.5 billion in 2023 at a CAGR of 6.3%.

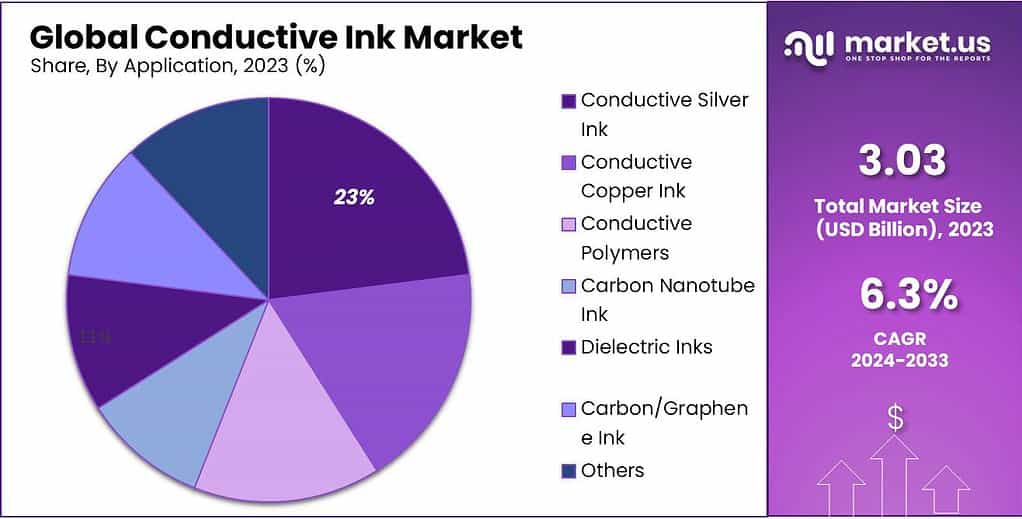

- Product Insights: Silver Ink Dominance Silver Ink held a significant market share, accounting for over 21% in 2023 due to its excellent conductivity.

- Application Trends: Photovoltaic (Solar Panels): Led the market with more than 23.2% share in 2023, with a high demand for conductive ink to enhance solar panel efficiency.

- Market Drivers: Growing demand for smaller, more efficient gadgets is pushing industries towards lighter materials, driving the adoption of conductive inks to enable smaller, lighter, and smarter devices.

- Challenges and Restraints: The rising cost of silver poses a challenge, leading companies to explore alternatives like graphene-based inks for cost-effectiveness.

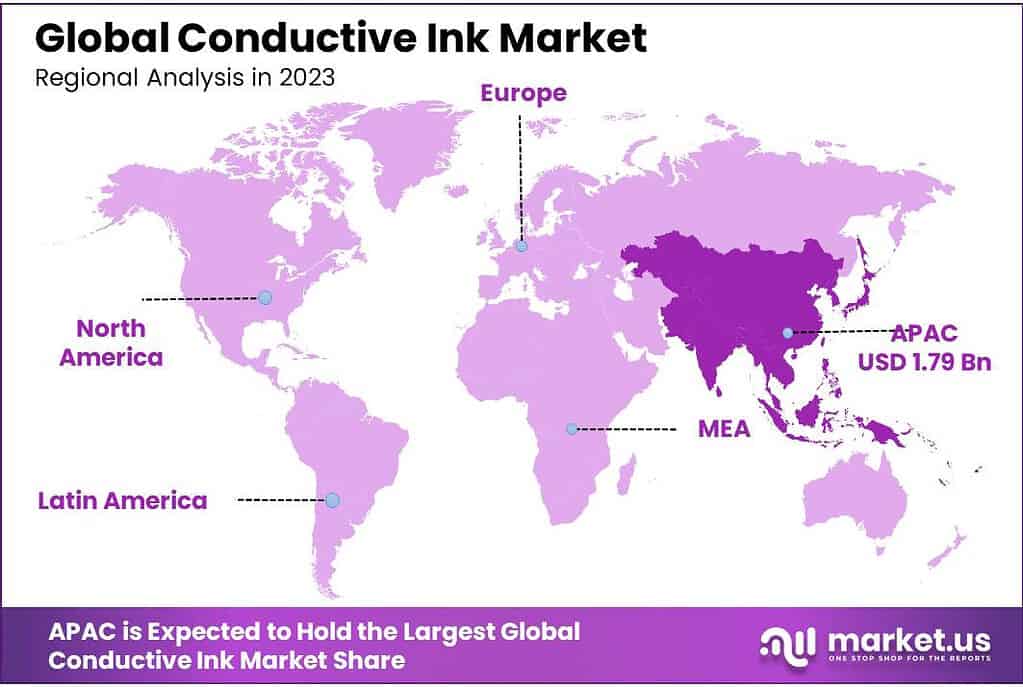

- Regional Analysis: Asia Pacific dominated the market in 2023, accounting for 58.9% of total revenues, driven by substantial investments in solar energy and growing demand for electronics.

- Industry Players and Developments: Key players like DuPont, Sun Chemical Corporation, and Henkel are making advancements in creating cost-effective alternatives and developing innovative ink solutions.

Product Analysis

In 2023, Silver Ink was a big deal in the market, grabbing over 21% of the whole market share. People were really into it! Silver Ink is great because it conducts electricity and is used in all sorts of cool stuff like printed electronics.

The conductive ink can be made with graphene or carbon base, which provides it with more flexibility and performance. Nanomaterials are made with carbon-based inks. Because of their flexibility and low cost, they are often used in complex devices such as touch screens and sensors.

These materials are used in contact pad manufacturing. They can also be found in remote control, mobile phones, printed circuit boards, and printed circuit board applications. Because of the increased use of dielectric inks for injection-molded electronics (IME), the dielectric ink market is expected to grow significantly over the forecast period. IME is used in integrating flexible circuits into three-dimensional products.

These circuit boards are also used in electronic devices such as washing machines, automobile consoles, and steering wheels. Because of its increased use in screen printing, the segment of conductive polymers is expected to grow at a CAGR of 3.6% in volume. However, screen printing, one of the oldest printing technologies, is in rapid decline and is likely not to be used in the future, which will negatively impact segment growth.

Application Analysis

In 2023, Photovoltaic applications were the rockstars of the market, grabbing more than 23.2% of the whole share. People were really into using conductive ink to make solar panels shine!

The key driver for solar plants worldwide is the expected increase in electrical demand. Photovoltaics will be in high demand in countries such as China and India.

Conductive ink is a widely used product in the automotive sector. It accounted for 15.3% of total market revenues in 2021. The growth rate of this application segment has been nearly constant in recent times. Ink traces and rear windows are two areas where innovation is possible. This could lead to market growth.

Smart packaging applications also use conductive inks. They protect against counterfeits and determine shelf life. Additionally, they track details of importers as well as exporters. Smart packaging often called active or intelligent packaging, has gained popularity in the pharmaceutical industry and food products industries. This is expected to drive the FMCG sector’s growth in the conductive ink market.

Over the forecast period, there will be a steady demand for conductive ink from the display market. As it has excellent electrical conductivity, conductive ink is expected to continue being used in electronic devices’ displays. Over the next period, research continues to be done to increase the effectiveness of conductive ink for displays.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Conductive Silver Ink

- Conductive Copper Ink

- Conductive Polymers

- Carbon Nanotube Ink

- Dielectric Inks

- Carbon/Graphene Ink

- Others

By Application

- Photovoltaic

- Membrane Switches

- Displays

- Automotive

- Smart Packaging

- Biosensors

- Printed Circuit Boards

- Others

Drivers

The demand for smaller, more efficient gadgets is going through the roof. Governments worldwide are pushing industries to use lighter materials in devices to meet environmental rules. People want electronics that are tiny and light, and that’s making companies rethink how they make stuff.

To make things lighter, they’re turning to conductive inks. These inks are like superheroes in the electronics world. They’re super efficient and reliable, taking the place of traditional wires and circuits. Using them means devices can be smaller and lighter without losing their smarts.

Conductive inks have some pretty cool perks. They make stuff less dense, which means lighter materials. Plus, they’re easier to handle. All these benefits add up to creating devices that are not only smaller but also work better.

So basically, these inks offer an unrivaled opportunity for making gadgets smaller, smarter and more eco-friendly – which explains their increased presence on the market.

Restraints

Creating conductive inks involves some tricky choices. They can be made using metals like silver and copper or with carbon particles, which are cheaper but not as good at conducting electricity. These carbon inks need a complex and costly process to work properly.

One big issue is that these inks don’t always get along well with most plastics, which is a problem when you need durability. Plus, making them stable for a long time commercially is tough, especially with the high-tech nanoparticle inks. Using these inks requires expensive tech, making things harder.

It’s a bit of a hurdle for the conductive ink market. They need to figure out better ways to work with different materials and make sure these inks stay stable for the long run. But hey, there’s hope! Companies are diving into research to find cheaper and more reliable ways to make these inks work like a charm in the future.

Opportunity

Finding cheaper alternatives to silver-based conductive inks is becoming a big opportunity. See, silver prices are climbing, so people are hunting for more pocket-friendly options. Enter graphene-based inks.

Graphene is like a single layer of super-conductive carbon atoms. It’s great because it’s superconductive, flexible, and doesn’t let metals rust. Plus, it’s cheaper than silver but does the job just as well.

The current inks use pricey stuff like silver or less efficient materials like copper. Copper might be cheaper, but it’s prone to rusting. Graphene swoops in as a game-changer. It can match Silver’s performance without breaking the bank. These inks are getting ready to compete in big applications like fancy displays and RFID tags.

However, graphene-based inks are still in their early stages and not quite ready to hit the market yet – though companies are working to bring these alternatives to fruition as soon as possible. Their aim is to produce inks with an optimal balance between price and performance that could open up an opportunity for conductive inks.

Challenges

The rising cost of silver is causing some headaches in the electronics world. Silver is a top pick for electronics because it conducts like a champ and doesn’t rust. But the price rollercoaster is making folks look for cheaper options like copper, carbon, graphene, and aluminum.

The catch is, that while these alternatives are okay, they don’t quite match up to silver’s magic. It’s tough to completely replace silver because nothing else matches its superpowers.

To cope with silver’s pricey tag, companies are trying things like using silver flakes and nanosilver inks. They give similar conductivity but use less silver. The problem is, that the technology needed to use these fancy inks is costly. So, while they’re helpful, they’re not gaining much traction yet.

Manufacturers are scrambling to find alternatives to silver-based inks as the cost of silver continues to increase, though these substitutes still lag in terms of performance compared to their counterparts. There is some hope that with some tweaking they might catch up in due time.

Regional Analysis

Asia Pacific’s conductive ink industry dominated the global market, accounting for 58.9% of total market revenues in 2023. China and India were the largest conductive ink markets. The conductive ink market has seen an increase in investments made in India and China to establish solar photovoltaics.

They are believed to produce enormous amounts of solar energy. This could lead to the substitution of non-renewable energy. The Asia Pacific region’s macroeconomic factors include the rapidly growing middle class, increasing disposable incomes, education, and changing demographics.

The region has a high demand for conductive inks for electronics. Market growth will also be boosted by the presence of key players in the Asia Pacific.

The U.S. is second in automobile production worldwide and has seen high demand for conductive inks. The U.S. market has seen a large growth due to its high market size, mass-production capability, product variety as well as high disposable incomes. The country’s presence of global companies and their manufacturing hubs have also contributed to the rise of the conductive paint market.

Germany’s established industrial sectors include transportation, packaging, labeling, and plastic parts. The market’s overall growth will be affected by the expected growth in the key end-use markets for conductive inks. This is due to the country’s favorable industrialization environment and rapid increase in demand.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global market for conductive ink is fragmented. Many companies from around the world participate and account for a significant portion of the overall market.

DuPont, Conductive Compounds Inc., and PPG Industries are forward-integrated across the value chain. These companies are involved both in product manufacturing and distribution for various applications. Because they are renewable energy sources, applications such as photovoltaics will drive market growth in the future.

Henkel developed conductive inks with minimal silver content, named Henkel ECI 1001 E&C. They can be used in automotive sensor applications as cost-effective alternatives to conductive gold inks. The product is affordable, has a lower silver content, and performs the same as traditional conductive Silk inks.

Key Market Players

- Vorbeck Materials Corporation

- DuPont

- Applied Nanotech Holdings, Inc.

- Sun Chemical Corporation

- PPG Industries, Inc.

- Creative Materials, Inc.

- Poly-Ink

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Tech

- nologies

- Fujikura Ltd.

- Heraeus Holding

- Nagase America Corporation

- Engineered Materials Systems

- Epoxies, Etc

- Voxel8

- Methode Electronics

- Novacentrix

- Johnson Matthey

Recent Development

In February 2022, Henkel Adhesive Technologies India Pvt. Ltd., a major player in adhesives and coatings, joined hands with Astronomy India and Lions Clubs International District to unveil India’s largest school-level Astronomy Observatory and Laboratory. This initiative at Maharshi Karve Stree-Shikshan Sanstha (MKSS), Pune, aimed to empower students and make a positive social impact.

Also in February 2022, DuPont, a prominent U.S. chemical company, revealed an agreement with Celanse, a global leader in material solutions. The deal involved DuPont divesting a significant portion of its mobility and materials segment.

Moving to October 2022 Sun Chemical, another U.S.-based chemical company, implemented price hikes and surcharges on inks, coatings, consumables, and adhesives in the Middle East and Africa. This strategic move was geared towards fostering growth within the market.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 5.6 Billion CAGR (2023-2032) 6.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dielectric Ink and Conductive Silver Ink), By Application (Membrane Switches, Photovoltaic, Automotive, and Displays) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Vorbeck Materials Corporation, DuPont, Applied Nanotech Holdings, Inc., Sun Chemical Corporation, PPG Industries, Inc., Creative Materials, Inc., Poly-Ink, Henkel Ag & Co. KgaA, PChem Associates, Inc., Johnson Matthey Colour Tech, nologies, Fujikura Ltd., Heraeus Holding, Nagase America Corporation, Engineered Materials Systems, Epoxies, Etc, Voxel8, Methode Electronics, Novacentrix, Johnson Matthey Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is conductive ink?Conductive ink is a type of ink that contains conductive materials like silver, copper, or carbon, allowing it to conduct electricity when applied to a surface. It's used in various applications ranging from electronics to printed circuits.

What are the primary applications of conductive ink?Conductive ink finds use in printed circuit boards (PCBs), flexible electronics, sensors, antennas, RFID (Radio-Frequency Identification) tags, touchscreens, smart packaging, and other electronic devices.

How does the conductive ink market impact the electronics industry?Conductive ink enables the production of flexible, lightweight, and innovative electronic components, driving advancements in wearable technology, smart packaging, and other electronic applications.

-

-

- Vorbeck Materials Corporation

- DuPont

- Applied Nanotech Holdings, Inc.

- Sun Chemical Corporation

- PPG Industries, Inc.

- Creative Materials, Inc.

- Poly-Ink

- Henkel Ag & Co. KgaA

- PChem Associates, Inc.

- Johnson Matthey Colour Tech

- nologies

- Fujikura Ltd.

- Heraeus Holding

- Nagase America Corporation

- Engineered Materials Systems

- Epoxies, Etc

- Voxel8

- Methode Electronics

- Novacentrix

- Johnson Matthey