Global Condensing Gas Boiler Market Size, Share, And Industry Analysis Report By Product Type (Wall Mounted Boilers, Floor Standing Gas Boilers), By Fuel Type (Natural Gas, LPG, Biogas), By End-User (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 168607

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

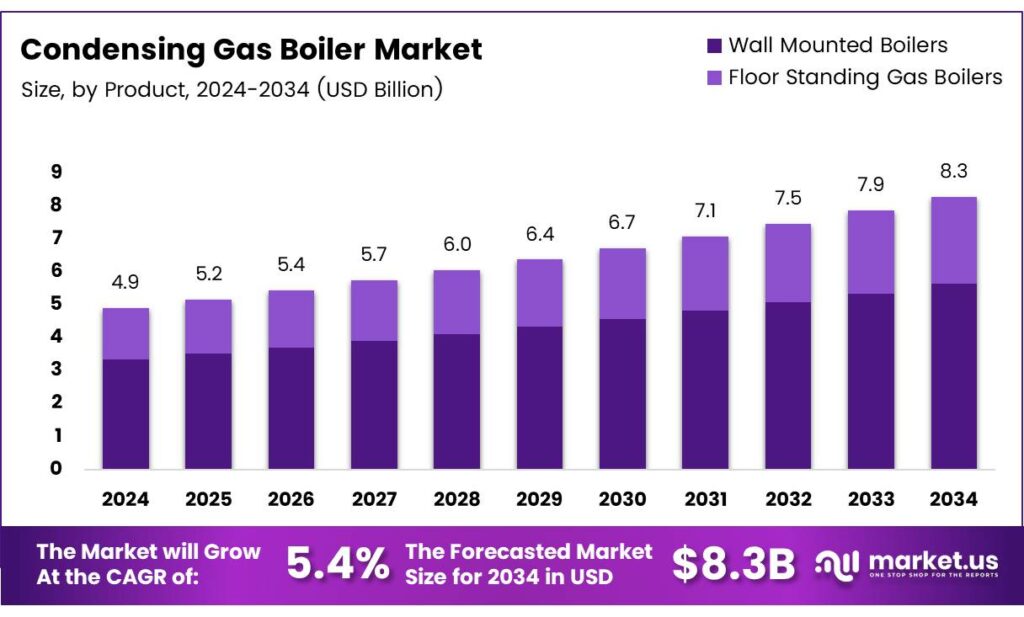

The Global Condensing Gas Boiler Market size is expected to be worth around USD 8.3 billion by 2034, from USD 4.9 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The condensing gas boiler market refers to modern heating systems that recover latent heat from exhaust gases to improve efficiency. Consequently, these systems reduce fuel consumption while supporting energy transition goals. They are widely adopted across residential and light commercial heating applications. A condensing gas boiler is a high-efficiency heating unit designed to extract additional heat from flue gases. Therefore, it delivers improved thermal output using less fuel input.

- Germany still operates approximately 2 million heating systems older than 25 years, highlighting a significant replacement opportunity. The German Heating Industry Association (BDH), upgrading to condensing gas boilers, can deliver energy savings of up to 35% when combined with solar technology.

Furthermore, these efficiency gains could address nearly 10% of Germany’s total energy demand while reducing annual carbon emissions by up to 54 million tonnes. Importantly, current condensing gas boilers can operate with gas blends containing up to 20% hydrogen, enhancing future readiness.

The market benefits from energy-efficiency renovation programs and decarbonization pathways. Additionally, compatibility with renewable integrations improves long-term value. For instance, hybrid setups combining boilers with solar thermal systems enhance savings, positioning condensing technology as a practical transition solution.

Key Takeaways

- The Global Condensing Gas Boiler Market is projected to grow from USD 4.9 billion in 2024 to around USD 8.3 billion by 2034, expanding at a steady CAGR of 5.4% as efficiency-led replacements accelerate.

- Wall-mounted boilers dominate product demand with a 67.3% share, supported by compact design, easier installation, and strong suitability for urban residential renovations.

- Natural gas remains the primary fuel choice, accounting for 71.7% of market usage, driven by widespread pipeline infrastructure and stable household supply in urban regions.

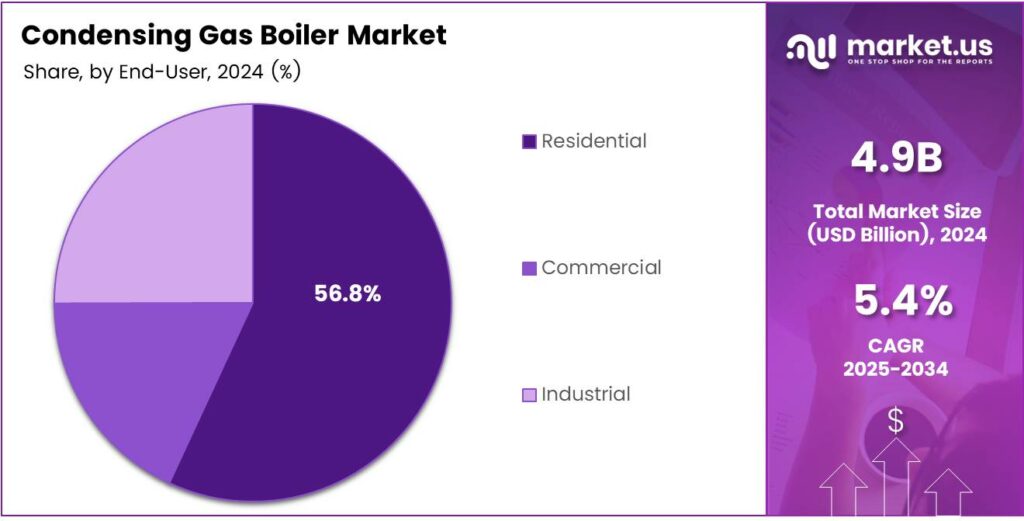

- The residential segment leads end-use adoption with a 56.8% share, reflecting rising home retrofitting activity and consumer focus on energy savings and indoor comfort.

- Asia Pacific is the largest regional market, holding 43.9% share and valued at approximately USD 2.1 billion, supported by rapid urbanisation and expanding gas networks.

By Product Type Analysis

Mounted Boilers dominate with a 67.3% share due to space efficiency and ease of installation.

In 2024, Wall Mounted Boilers held a dominant market position in the By Product Type Analysis segment of the Condensing Gas Boiler Market, with a 67.3% share. These boilers fit well in compact homes. Therefore, demand rises as urban housing prefers space-saving heating systems.

Wall-mounted units are also easy to maintain and quick to install. Residential users prefer them for renovation projects. Moreover, their quiet operation supports indoor comfort, making them suitable for apartments and modern housing layouts.

Standing Gas Boilers serve locations needing higher heating capacity. However, they require more space and structured rooms. Still, they remain important for large buildings, older infrastructure, and some commercial sites where wall mounting is not practical.

By Fuel Type Analysis

Natural Gas dominates with a 71.7% share, driven by existing pipeline availability and stable supply.

In 2024, Natural Gas held a dominant market position in the By Fuel Type Analysis segment of the Condensing Gas Boiler Market, with a 71.7% share. Natural gas is widely available in urban regions. Consequently, households prefer it for consistent heating performance.

Natural gas boilers also support cleaner combustion. Therefore, they align better with energy efficiency goals. In addition, users benefit from predictable fuel access, which reduces disruption and supports everyday heating needs.

LPG serves regions without gas pipelines. Meanwhile, biogas adoption is emerging slowly. Both fuels address flexibility challenges. However, infrastructure limitations and fuel availability keep their adoption lower compared to natural gas systems.

By End-User Analysis

Residential users dominate with a 56.8% share, supported by home heating demand.

In 2024, Residential held a dominant market position in the By End-User Analysis segment of the Condensing Gas Boiler Market, with a 56.8% share. Growing home renovation activities support demand. Consequently, households choose efficient boilers for daily comfort. Residential consumers focus on energy savings and quiet operation.

Condensing technology fits well with modern living needs. Moreover, compact designs support installation in small indoor spaces. Commercial and industrial users require higher capacity systems. However, installation complexity limits volume adoption. Still, these segments remain relevant for offices, hotels, and manufacturing facilities requiring centralised heating solutions.

Key Market Segments

By Product Type

- Wall-Mounted Boilers

- Floor Standing Gas Boilers

By Fuel Type

- Natural Gas

- LPG

- Biogas

By End-User

- Residential

- Commercial

- Industrial

Emerging Trends

Smart Heating Integration Shapes Market Trends

A key trend in the condensing gas boiler market is integration with smart heating controls. Modern boilers now connect with digital thermostats and mobile apps, allowing users to monitor energy use and adjust settings remotely. Another trend is compact and modular design. Manufacturers focus on smaller units that fit easily into apartments and renovation projects, improving installation flexibility and user convenience.

- Low-noise operation is gaining importance. Buyers increasingly value quiet heating systems for residential use, especially in multi-family buildings. Condensing boilers continue to improve acoustic design. Modern condensing gas boilers recover heat from exhaust gases that older boilers waste — this heat recovery can push thermal efficiency up to 98%, compared with roughly 70–80% for conventional boilers.

Manufacturers are also improving material durability. Enhanced heat exchangers and corrosion-resistant components extend service life and reduce maintenance needs. Compatibility with future low-carbon gases is emerging as a trend. New condensing boilers are being developed to handle blends of natural gas with hydrogen, supporting long-term energy transition goals without replacing existing systems.

Drivers

Energy Efficiency Regulations Drive Condensing Gas Boiler Adoption

Rising focus on energy efficiency is a key driver for the condensing gas boiler market. Governments across Europe, North America, and parts of Asia continue to tighten building energy rules. These policies push homeowners and businesses to replace old heating systems with high-efficiency solutions that consume less gas.

- Condensing gas boilers convert more fuel into usable heat by recovering energy from exhaust gases. This higher efficiency helps users lower gas bills while meeting energy performance standards. Cooling and building energy use — helped save thermal energy equivalent to 24.4 million tonnes of oil equivalent (Mtoe), while avoiding large electricity demand.

Urban housing growth also supports demand. Apartments and dense residential buildings require compact, wall-mounted heating systems that deliver reliable performance. Condensing boilers suit these needs well because they are smaller, quieter, and safer for indoor use.

Restraints

High Installation Cost Limits Mass Market Penetration

One major restraint for the condensing gas boiler market is the high initial cost. Compared with traditional non-condensing boilers, these systems require more advanced components, which increases product pricing. Installation complexity also creates challenges.

Condensing boilers often need plastic flue systems, drainage for condensate, and skilled installers. In older buildings, retrofitting can raise installation costs further, discouraging price-sensitive buyers. Maintenance awareness is another concern. While efficient, condensing boilers require regular servicing to maintain performance. In regions with limited technical service networks, users may prefer simpler heating options.

Fuel price uncertainty also affects adoption. Fluctuating natural gas prices make some consumers cautious about investing in gas-based heating systems, especially when electricity-based alternatives are gaining attention. Lastly, slow adoption in emerging markets acts as a restraint. In price-driven regions, low-cost conventional boilers or non-gas heating systems still dominate, limiting near-term growth for condensing technology.

Growth Factors

Boiler Replacement Programs Create Strong Growth Opportunities

The largest growth opportunity lies in large-scale boiler replacement programs. Many countries aim to improve energy efficiency in existing buildings rather than only new construction. This creates strong long-term demand for condensing gas boilers.

Residential retrofitting is a major opportunity area. Older homes with outdated heating systems can significantly reduce energy losses by switching to modern condensing boilers. This replacement cycle provides consistent sales volume for manufacturers.

Hybrid heating solutions also offer growth potential. Condensing gas boilers increasingly pair with solar thermal systems or heat pumps. These hybrids help lower gas usage while ensuring heating reliability during colder months. Commercial buildings present another opportunity. Schools, offices, and small industrial facilities seek dependable heating systems that meet efficiency standards without major infrastructure changes.

Regional Analysis

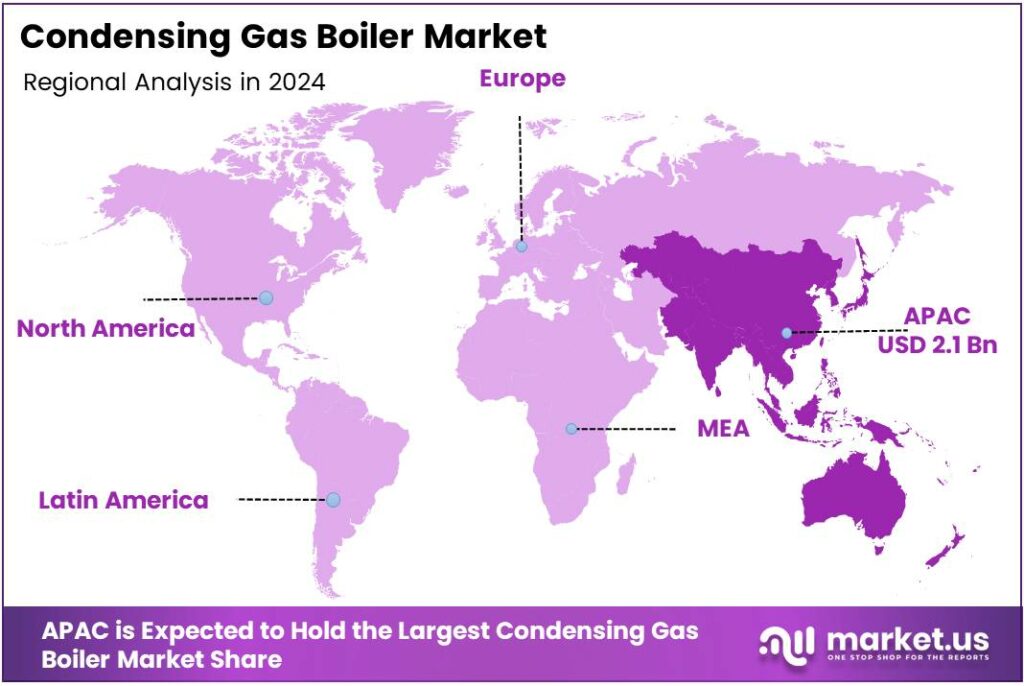

Asia Pacific Dominates the Condensing Gas Boiler Market with a Market Share of 43.9%, Valued at USD 2.1 Billion

Asia Pacific leads the global condensing gas boiler market due to rapid urbanisation and strong demand for energy-efficient heating systems in dense residential buildings. The region benefits from rising natural gas networks and government programs focused on reducing urban air pollution. Strong construction activity continues to reinforce demand, helping the region maintain its dominant 43.9% share, equivalent to about USD 2.1 billion in market value.

North America shows steady growth driven by the replacement of ageing space-heating systems in residential and light commercial buildings. Energy efficiency standards and rebates for high-efficiency boilers encourage end users to shift toward condensing technologies. Cold climates in many parts of the region further support demand for reliable and efficient heating solutions. Market growth here is stable rather than aggressive, reflecting a mature but upgrade-oriented market environment.

Europe remains an important market supported by strict building energy regulations and decarbonization policies. Many countries promote modern condensing boilers as a transition solution while renewable heating systems scale up. Rising renovation activity in older housing stock also strengthens replacement demand. The market benefits from high consumer awareness of energy savings and carbon reduction benefits.

The Middle East and Africa market is relatively smaller but gradually expanding, mainly in urban and commercial developments. Growing access to natural gas infrastructure and increased construction of hotels, hospitals, and modern housing support adoption. Energy-efficient boilers are gaining attention as governments look to manage fuel subsidies and improve energy security in selected countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global condensing gas boiler market in 2024 continues to evolve around energy efficiency, retrofit demand, and stricter emission regulations across mature economies. Analysts observe that leading manufacturers are focusing on high-efficiency product portfolios, smart heating controls, and modular designs that support both residential and light commercial applications.

A. O. Smith Corp. maintains a solid position in the condensing gas boiler market by leveraging its strong engineering background in heating technologies and efficiency-driven product development. In 2024, the company’s focus remains on durable designs and high thermal efficiency, supporting replacement demand in residential and small commercial segments. Its structured approach to quality and reliability continues to resonate with long-term buyers.

Ariston Holding NV is viewed as a growth-focused player with a strong emphasis on compact condensing systems and user-friendly heating solutions. In 2024, Ariston’s strategy centres on smart connectivity, optimised energy use, and broad product adaptability, enabling it to address both new installations and renovation markets across multiple regions.

BDR Thermea Group holds a strong analyst outlook due to its deep specialisation in condensing boiler technologies and long operating history in space heating. The group continues to prioritise system efficiency, low emissions, and application-specific solutions, reinforcing its relevance in regulation-driven European markets during 2024.

Daikin Industries Ltd. brings a technology-centric perspective to the condensing gas boiler sector, combining advanced combustion control with system integration expertise. In 2024, its positioning benefits from cross-technology knowledge in heating solutions, supporting hybrid and high-efficiency installations where performance consistency is a key purchasing factor.

Top Key Players in the Market

- A. O. Smith Corp.

- Ariston Holding NV

- BDR Thermea Group

- Daikin Industries Ltd.

- Ferroli Spa

- Hoval Group

- IBC Technologies Inc

- Ideal Heating Ltd.

- Immergas S.p.A

- MHG Heating Ltd.

Recent Developments

- In 2025, A. O. Smith Corp., a leading manufacturer of residential and commercial water heating equipment and boilers, reported several developments in its boiler. The company highlighted an 8% increase in North American boiler sales, driven primarily by strong demand for high-efficiency commercial condensing boiler products.

- In 2025, Ariston Holding NV, an Italian producer of heating systems including condensing boilers under brands like Ariston and Elco, focused on global expansion and efficiency enhancements. Ariston announced a strategic partnership with Lennox International to launch water heaters under the Lennox brand, leveraging Ariston’s manufacturing footprint and advanced heating technology for the North American market.

Report Scope

Report Features Description Market Value (2024) USD 4.9 billion Forecast Revenue (2034) USD 8.3 billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wall Mounted Boilers, Floor Standing Gas Boilers), By Fuel Type (Natural Gas, LPG, Biogas), By End-User (Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A. O. Smith Corp., Ariston Holding NV, BDR Thermea Group, Daikin Industries Ltd., Ferroli Spa, Hoval Group, IBC Technologies Inc., Ideal Heating Ltd., Immergas S.p.A., MHG Heating Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Condensing Gas Boiler MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Condensing Gas Boiler MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- A. O. Smith Corp.

- Ariston Holding NV

- BDR Thermea Group

- Daikin Industries Ltd.

- Ferroli Spa

- Hoval Group

- IBC Technologies Inc

- Ideal Heating Ltd.

- Immergas S.p.A

- MHG Heating Ltd.