Global Computing Power Market by Component (Servers, Software, Services, and Other Components), By Deployment Mode (On-Premise, Cloud), By End-Users (BFSI, Gaming, Media & Entertainment, Retail, Transportation, Government & Defense, Education & Research, Manufacturing, Healthcare & Bioscience, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: March 2024

- Report ID: 104374

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

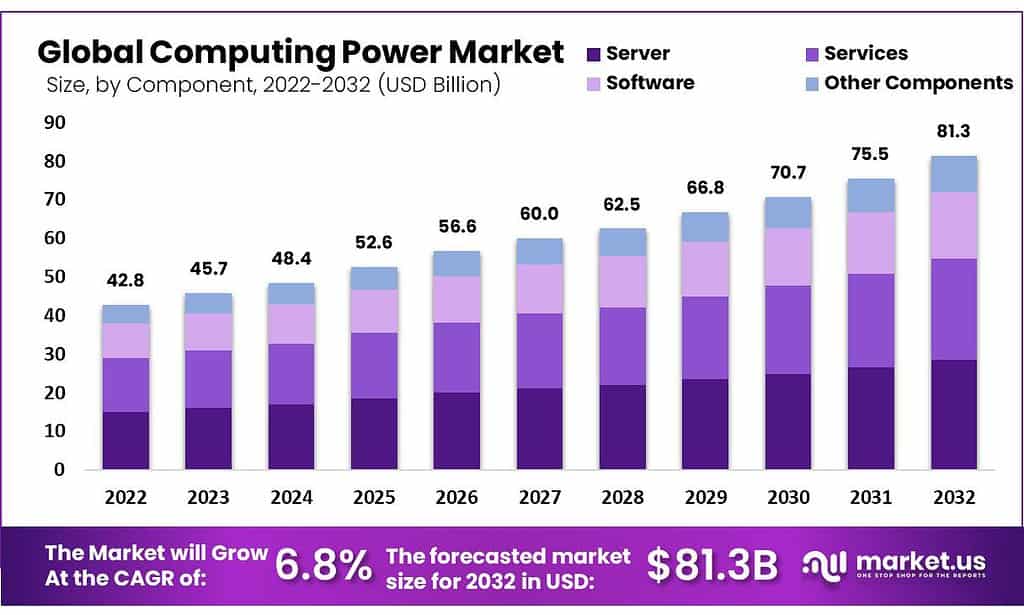

The Global Computing Power Market size is expected to be worth around USD 81.3 Billion by 2033, from USD 45.7 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Computing power refers to the capability of a computer or computing system to perform tasks and process data effectively and efficiently. It is a measure of the computational resources available, including the processing power, memory, storage, and network bandwidth. Computing power plays a crucial role in enabling various digital technologies and applications.

The computing power market refers to the industry that provides and caters to the demand for computing power solutions and services. It encompasses a wide range of products, including servers, data centers, high-performance computing systems, cloud computing platforms, and related hardware and software components. The market serves diverse sectors such as business, research, entertainment, and technology, among others.

In recent years, the computing power market has experienced significant growth due to the increasing reliance on digital technologies and the demand for data-intensive applications. Businesses and industries require powerful computing systems to handle complex tasks such as data processing, modeling, analysis, and artificial intelligence. The expansion of cloud computing has further fueled the market’s growth, as organizations seek scalable and cost-effective computing resources.

However, the computing power market also faces challenges. One major challenge is the need for continuous innovation and hardware upgrades to keep up with evolving technologies. Companies must invest in research and development to stay competitive and meet the growing demands of customers. Additionally, ensuring efficient cooling and energy management in high-performance computing systems remains a significant challenge, as it affects operational costs and environmental sustainability.

Despite the challenges, the computing power market offers opportunities for new entrants. The increasing demand for specialized computing solutions in emerging fields like artificial intelligence, machine learning, and edge computing presents avenues for innovation and niche players. Moreover, the rising adoption of edge computing and the Internet of Things (IoT) opens up possibilities for localized computing power solutions.

Key Takeaways

- The Computing Power Market was valued at USD 45.7 billion in 2023 and is projected to reach USD 81.3 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% between 2023 and 2032.

- By 2023, the world’s computing power is estimated to hit 1.1 zettaflops, fueled by AI and high-performance computing growth.

- In 2024, the demand for computing power in AI applications is expected to see a 50% increase over 2023.

- Quantum computing adoption is anticipated to rise by 40% year-over-year in 2024, thanks to progress in quantum hardware and algorithms.

- By 2023, over 60% of global computing power will likely be devoted to powering large language models and other AI systems.

- The use of specialized AI accelerators and TPUs for AI tasks is projected to increase by 35% in 2024, compared to 2023.

- It’s predicted that more than 70% of the world’s top supercomputers will utilize accelerated computing technologies like GPUs and FPGAs by 2023.

- In 2024, edge computing and IoT device adoption is expected to boost the demand for low-power computing solutions by 25%.

- Adoption of quantum-safe cryptography and post-quantum computing solutions is forecasted to jump by 45% in 2024, driven by cybersecurity concerns.

- The use of HPC systems for computational fluid dynamics simulations in the aerospace and automotive sectors is projected to grow by 20% in 2024, compared to 2023.

Component Analysis

Based on components, the market for computing power is segmented into Servers, Storage, Networking Devices, Software, Services, Cloud, and Other Components. The servers segment dominates the computing power market with a significant market share owing to the increasing number of data centers and small as well as mid-size enterprises (SMEs). Various businesses are actively participating in the process of investing in colocation infrastructure and on-premises to support the increasing demand for public cloud services.

Moreover, the services segment is the second dominating segment of the computing power market. HPC vendors provide services such as maintenance, management, and support. Support is required during the installation of HPC systems and their initial use. Upgrading existing systems and troubleshooting is a part of maintenance services.

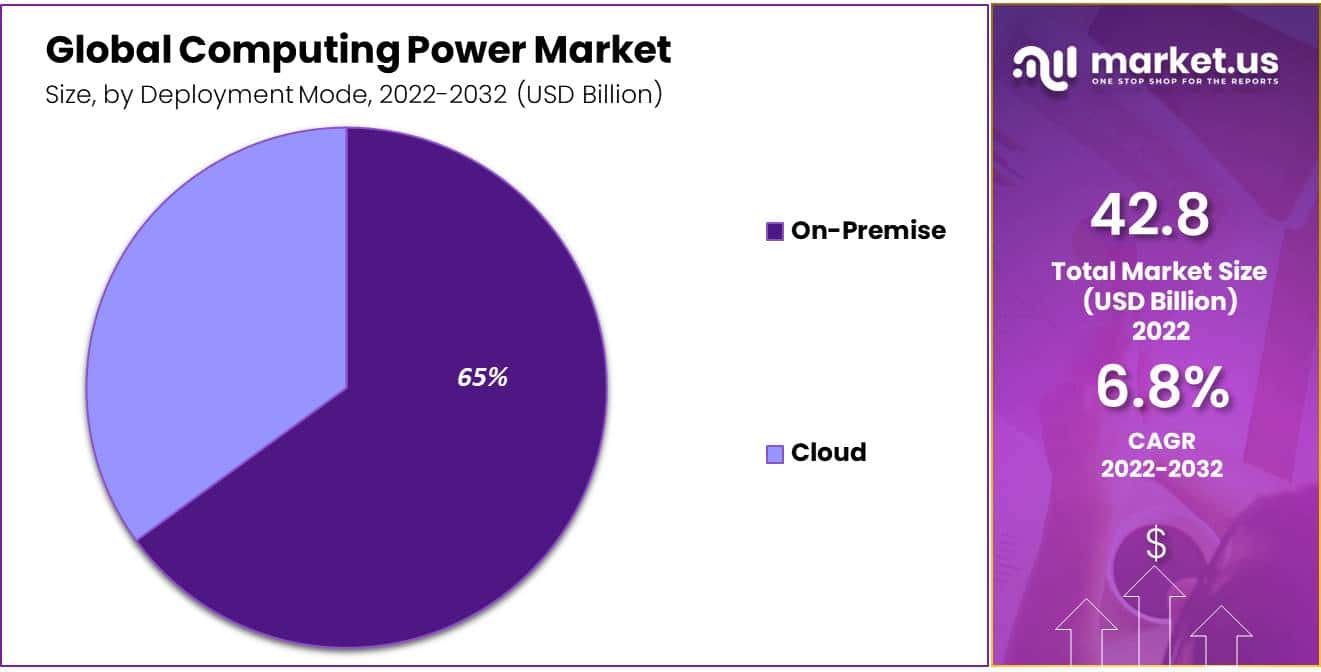

Deployment Mode Analysis

Based on deployment mode, the market for computing power is segmented into On-Premise and Cloud. Among both, the On-Premise segment dominates the market during the forecast period. The reason behind this is the security concerns about data safety. Enterprises have several concerns about the safety of their respective organizational data, as the government seems eager to secure sensitive data related to national security and citizens.

Hence, On-Premise infrastructure is preferable over cloud-based infrastructure. The cloud segment is expected to grow significantly during the forecast period. Reducing operational costs regarding the zero requirements of extra in-house computing resources is all possible by cloud deployment. Increased efficiency and cost-effectiveness are some other advantages of the computing power market.

Note: Actual Numbers Might Vary In The Final Report

End-User Analysis

The computing power market is segmented based on end-users into BFSI, Gaming, Media & Entertainment, Retail, Transportation, Government & Defense, Education & Research, Manufacturing, Healthcare & Bioscience, and Other End-Users. The manufacturing segment dominates the market for computing power. These processes tend to be time-consuming and computation-intensive. Hence, stimulation and CAD software, along with HPC systems, are adopted by officers of the manufacturing industry.

HPC systems can be used explicitly for computational fluid dynamics, structural mechanics, and electromagnetics. This contributes to enhanced performance, improved computational speeds, and quick data access. To improve computing efficiency, defense agencies adopt progressive IT solutions to improve computing efficiency. Government agencies are expected to adopt HPC to support digitization initiatives and contribute to economic development.

Key Market Segments

By Component

- Servers

- Software

- Services

- Other Components

By Deployment Mode

- On-Premise

- Cloud

By End-Users

- BFSI

- Gaming

- Media & Entertainment

- Retail

- Transportation

- Government & Defense

- Education & Research

- Manufacturing

- Healthcare & Bioscience

- Other End-Users

Driver

Increased Demand for AI and Machine Learning Capabilities

The exponential growth in the demand for artificial intelligence (AI) and machine learning (ML) capabilities across various industries serves as a significant driver for the computing power market. As businesses and organizations strive to harness the power of data for decision-making, predictive analytics, and customer insights, the need for robust computing infrastructure has surged.

AI and ML models require extensive computational resources to process and analyze vast amounts of data in real-time. This demand has led to advancements in processor technology, cloud computing services, and specialized hardware designed to accelerate AI and ML tasks. Consequently, the push for more intelligent and autonomous systems is driving the development and adoption of high-performance computing solutions, fueling market growth and innovation.

Restraint

High Costs Associated with Advanced Computing Systems

The development, deployment, and maintenance of advanced computing systems entail significant financial investments, acting as a primary restraint in the computing power market. High-performance computing (HPC) systems, necessary for processing complex datasets and running sophisticated AI algorithms, require costly hardware, software, and energy resources.

Small and medium-sized enterprises (SMEs) often find it challenging to allocate the requisite capital for these technologies, limiting their ability to compete with larger corporations that can afford such investments. Furthermore, the ongoing need for upgrades to keep pace with technological advancements adds to the total cost of ownership, deterring potential users and slowing down the market’s expansion.

Opportunity

Edge Computing in IoT Applications

Edge computing presents a significant opportunity in the computing power market, especially with the proliferation of Internet of Things (IoT) applications. By processing data near its source, edge computing reduces latency, decreases bandwidth usage, and improves response times, making it ideal for real-time applications such as autonomous vehicles, smart cities, and industrial automation.

This approach not only enhances efficiency and performance but also addresses concerns related to data privacy and security by minimizing data transmission. As the number of IoT devices continues to grow exponentially, the demand for edge computing solutions is expected to rise, offering new revenue streams and market expansion opportunities for companies in the computing power sector.

Challenge

Scalability and Energy Consumption

A significant challenge facing the computing power market is balancing scalability with energy consumption. As the demand for computing power escalates, data centers and computing facilities consume an increasingly large amount of electrical power, contributing to higher operational costs and environmental concerns.

The challenge lies in developing computing architectures and technologies that can scale efficiently to meet growing demands without proportionately increasing energy consumption. Innovations in energy-efficient processors, cooling technologies, and renewable energy sources for data centers are being explored. However, achieving a sustainable balance remains a complex issue, with implications for cost, performance, and environmental impact

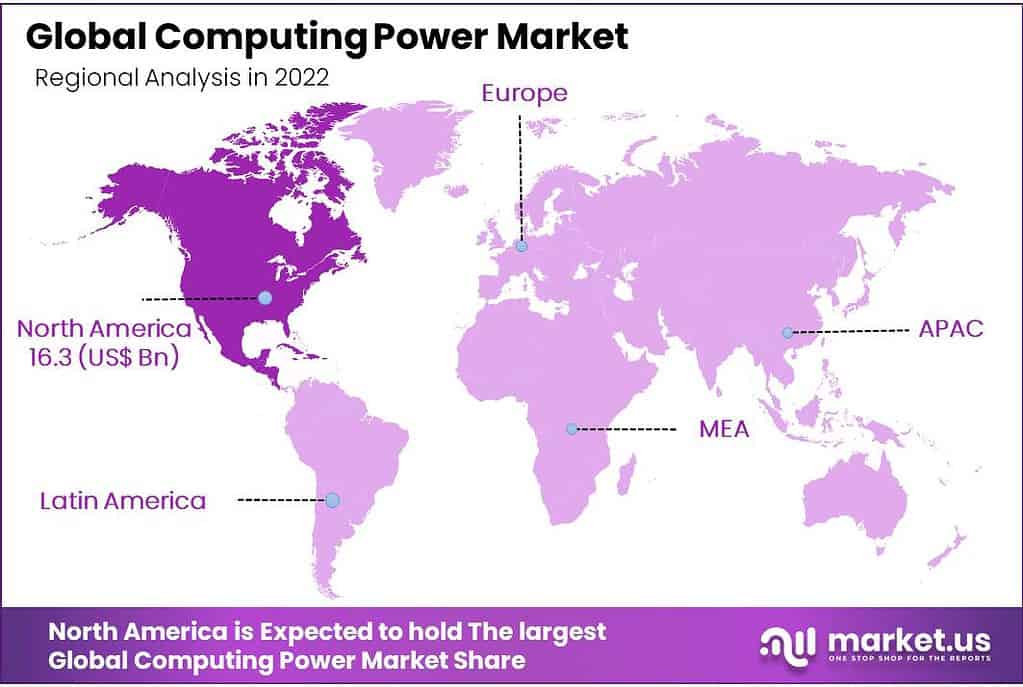

Regional Analysis

North America dominated the computing power market with the largest market share of 38.1% revenue share. North- America is the biggest market for technologically based solutions. It is a key player in the global economy, significantly developing and implementing new technologies. A robust security measure is required for processing large volumes of raw data. Thus, the surging need for the latest technological implementation encourages the adoption of HPC systems.

North America region is considered the center of the largest global enterprises, such as Boeing and General Motors, coupled with SMEs, that adopt HPC systems to ease technical restraints. Hence, computing power is growing in North America. Asia Pacific is the second-largest growing region during the forecast period for weather forecasting and scientific research, among others.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Emerging key players are focused on various strategic policies to develop their respective businesses in foreign markets. Several manufacturers have been pivotal in shaping the computing power market for decades. Furthermore, businesses in the computing power market are developing various new products and expanding their product portfolio. In addition, several key players are now focusing on different marketing strategies, such as investments, mergers, and acquisitions which can boost the market’s growth.

Market Key Players

With the presence of several local and regional players, the market for companion diagnostics is fragmented. Market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

- Atos SE

- Advanced Micro Devices, Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Cisco Systems, Inc.

- Fujitsu

- Intel Corporation

- IBM

- Microsoft

- Amazon Web Services, Inc.

- Other Key Players

Recent Developments

- Atos SE: In November 2023, Atos, a technology company, announced that it acquired a leading edge computing company. This acquisition aimed to enhance Atos’ capabilities in providing high-performance computing (HPC) solutions. Edge computing focuses on processing data closer to its source, enabling faster analysis and improved privacy.

- Advanced Micro Devices, Inc. (AMD): In March 2024, AMD, a semiconductor company, introduced its next-generation EPYC Milan-X processors. These processors were specifically designed for data centers and high-performance computing applications. The Milan-X processors offered improved performance and efficiency, enabling faster and more efficient data processing.

- Dell Inc.: In February 2024, Dell, a computer technology company, launched the Dell EMC PowerEdge XE8545 server. This server was optimized for high-performance computing workloads, catering to the needs of industries that require powerful computing capabilities. The PowerEdge XE8545 server provided enhanced performance to handle demanding tasks and data-intensive applications.

- Cisco Systems, Inc.: In April 2024, Cisco, a networking solutions provider, expanded its portfolio of high-performance computing networking solutions. This expansion aimed to address the growing demand for faster data transfer and low-latency communication in HPC clusters. These networking solutions were designed to improve the efficiency and performance of high-performance computing systems.

Report Scope

Report Features Description Market Value (2023) US$ 45.7 Bn Forecast Revenue (2032) US$ 81.3 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component- Servers, Software, Services, and Other Components; By Deployment Mode- On-Premise, Cloud; By End-Users- BFSI, Gaming, Media & Entertainment, Retail, Transportation, Government & Defense, Education & Research, Manufacturing, Healthcare & Bioscience, and Other End-Users Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Atos SE, Advanced Micro Devices, Inc, Hewlett Packard Enterprise Development LP, Dell Inc., Cisco Systems, Inc., Fujitsu, Intel Corporation, IBM, Microsoft, Amazon Web Services, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Computing Power Market?The Computing Power Market refers to the global marketplace where computational resources, such as processing power, storage, and network bandwidth, are bought and sold among individuals, businesses, and organizations.

How big is Computing Power Market?In 2023, the Global Computing Power Market was valued at USD 45.7 Billion and is expected to reach 81.3 Billion by 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 6.8%.

What drives the growth of the Computing Power Market?The growth of the Computing Power Market is primarily driven by the increasing demand for computing resources from various industries, including but not limited to artificial intelligence, big data analytics, cloud computing, and internet-of-things (IoT) applications.

How does the Computing Power Market impact businesses and industries?The Computing Power Market enables businesses and industries to access scalable and cost-effective computing resources, thereby empowering them to efficiently manage and process large volumes of data, develop innovative technologies, and stay competitive in the digital landscape.

What is an example of a computing power?An example of computing power can be a high-performance server equipped with multiple CPUs (Central Processing Units) or GPUs (Graphics Processing Units) capable of processing complex calculations, running large-scale simulations, or handling massive data sets efficiently.

What is the purpose of computing power?The purpose of computing power is to enable the execution of various computational tasks, ranging from simple calculations to complex data analysis, machine learning algorithms, and simulation of scientific phenomena. It empowers individuals and organizations to process information quickly and efficiently, facilitating innovation, problem-solving, and technological advancements across different industries.

-

-

- Atos SE

- Advanced Micro Devices, Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Cisco Systems, Inc.

- Fujitsu

- Intel Corporation

- IBM

- Microsoft

- Amazon Web Services, Inc.

- Other Key Players