Complement C4 Antibody Market By Product Type (Monoclonal Antibodies, Recombinant Antibodies, Polyclonal Antibodies, and Antibody Fragments), By Application (Immunoassays, Western Blotting, Immunohistochemistry, and Flow Cytometry), By End-user (Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Clinical Laboratories, and Academic & Research Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153453

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

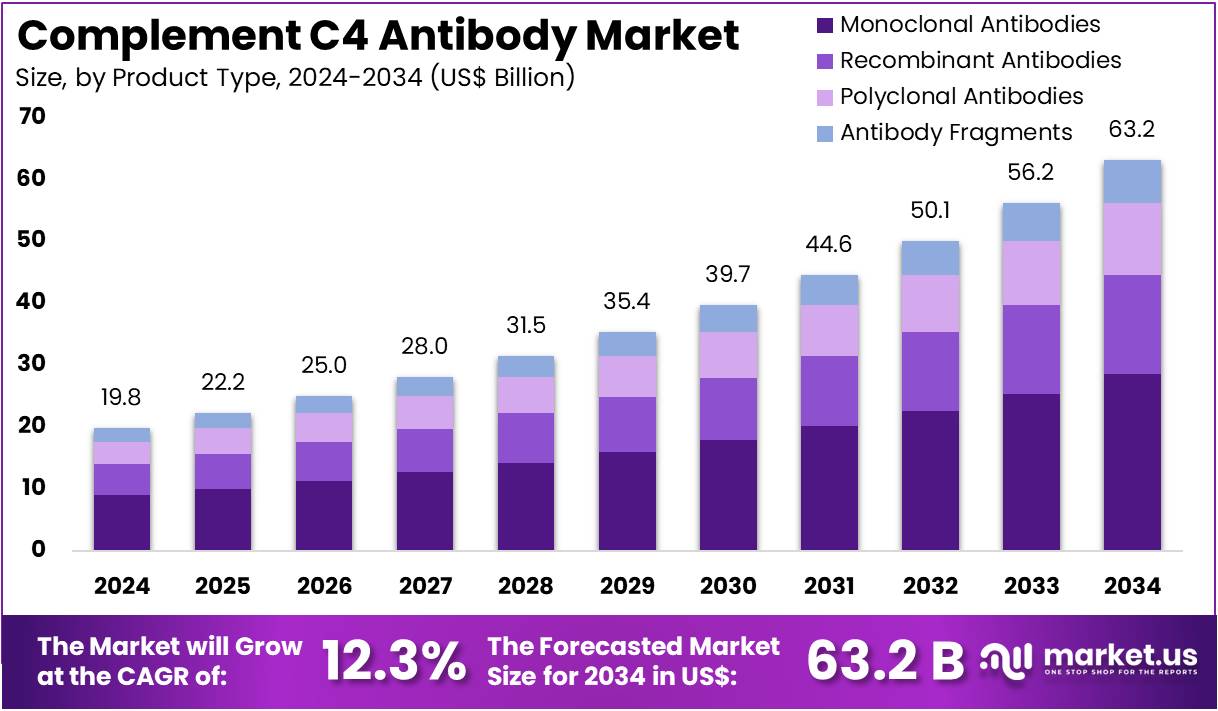

The Complement C4 Antibody Market size is expected to be worth around US$ 63.2 billion by 2034 from US$ 19.8 billion in 2024, growing at a CAGR of 12.3% during the forecast period 2025 to 2034.

Increasing recognition of the role of the complement system in various immune-related diseases is driving the growth of the complement C4 antibody market. The complement system plays a crucial role in immune responses, and imbalances can lead to a variety of diseases, including autoimmune conditions, kidney diseases, and certain types of cancer.

Complement C4 antibodies are designed to target and modulate the complement C4 protein, which can help treat diseases linked to complement system dysregulation, such as lupus, glomerulonephritis, and immunoglobulin A nephropathy (IgAN). The rising prevalence of autoimmune diseases, along with the growing demand for targeted therapies, has significantly increased the market for complement C4 antibodies. In particular, advancements in precision medicine, which aims to treat patients based on their specific genetic and molecular profiles, create new opportunities for complement-based therapies.

In August 2024, Novartis announced that the US Food and Drug Administration (FDA) granted accelerated approval for Fabhalta (iptacopan), a complement inhibitor aimed at reducing proteinuria in individuals with primary immunoglobulin A nephropathy (IgAN) who are at high risk of rapid disease progression. This approval highlights the market’s growing focus on complement inhibitors as a treatment option for patients with complement-driven diseases.

Recent trends also include increased research into monoclonal antibodies that specifically target complement components, offering more precise and effective treatments. The continuous development of complement C4 antibodies, combined with their applications in a broad range of immune-mediated diseases, presents significant growth opportunities for the market, driven by innovations in immunology and biotechnology.

Key Takeaways

- In 2024, the market for complement c4 antibody generated a revenue of US$ 19.8 billion, with a CAGR of 12.3%, and is expected to reach US$ 63.2 billion by the year 2034.

- The product type segment is divided into monoclonal antibodies, recombinant antibodies, polyclonal antibodies, and antibody fragments, with monoclonal antibodies taking the lead in 2023 with a market share of 45.2%.

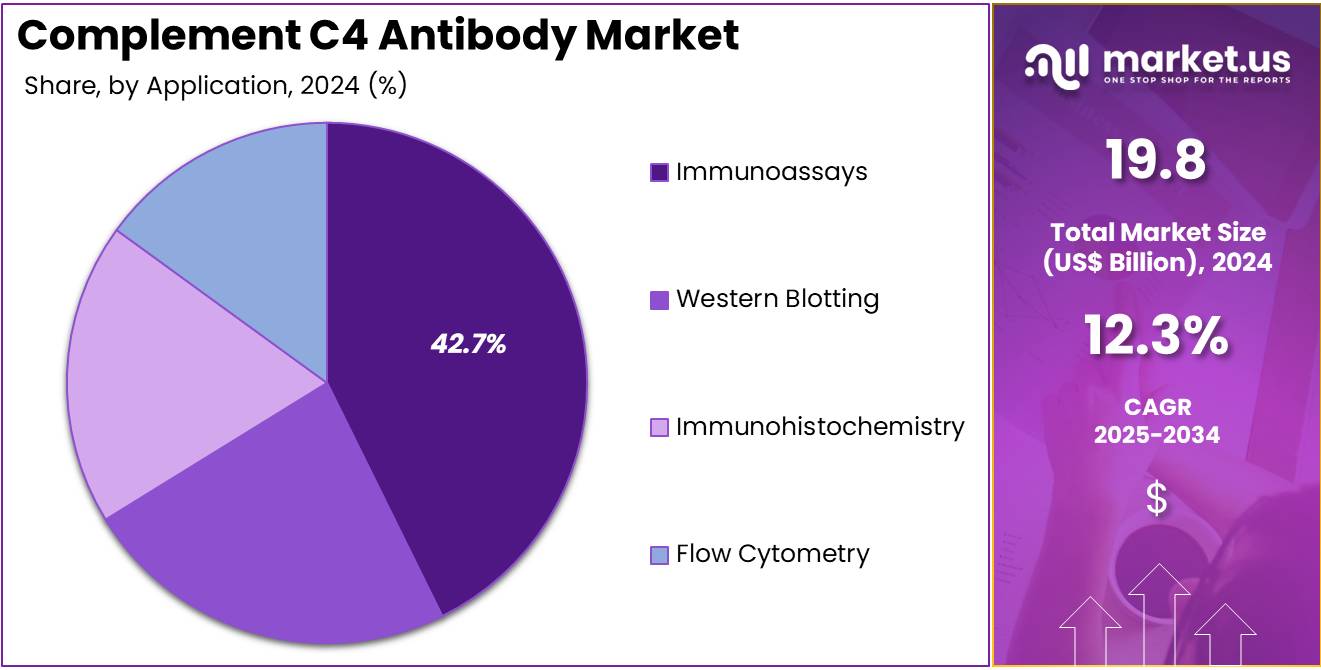

- Considering application, the market is divided into immunoassays, western blotting, immunohistochemistry, and flow cytometry. Among these, immunoassays held a significant share of 42.7%.

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies, diagnostic laboratories, clinical laboratories, and academic & research institutions. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 48.3% in the complement c4 antibody market.

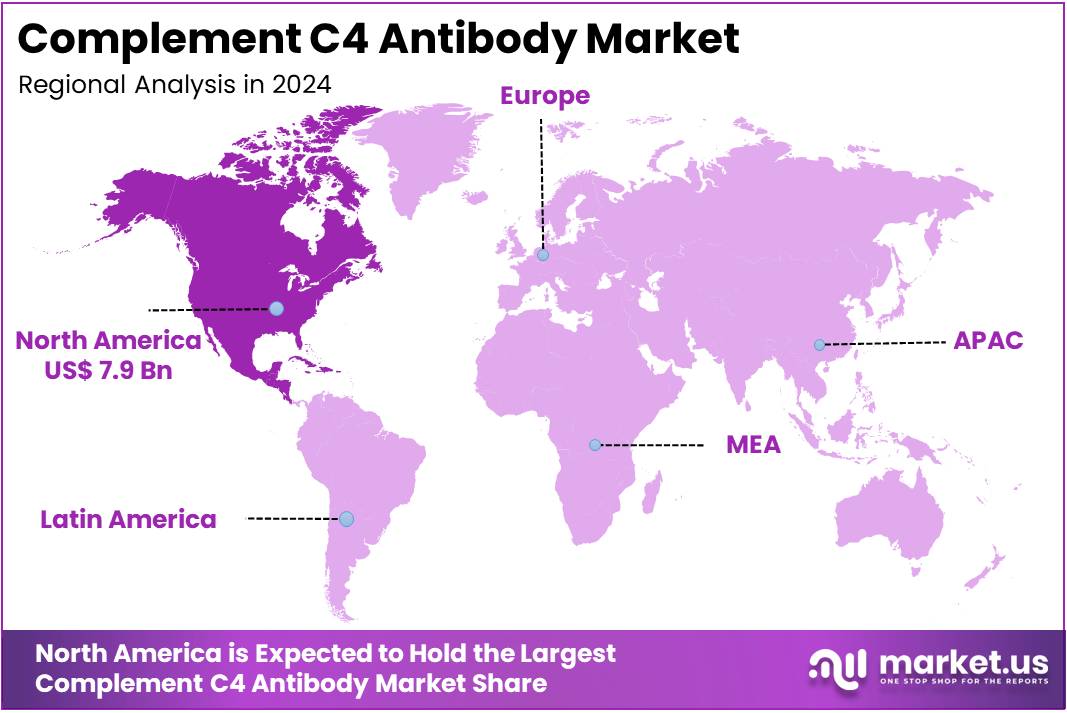

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

Monoclonal antibodies hold a dominant share of 45.2% in the Complement C4 antibody market. This growth is expected to continue as monoclonal antibodies are widely recognized for their specificity and high affinity, making them the preferred choice in a range of diagnostic and therapeutic applications. These antibodies are projected to drive innovation in the market due to their ability to precisely target and neutralize specific antigens, which is crucial in complement C4-related research and disease treatment.

The growing focus on personalized medicine, where monoclonal antibodies are tailored to specific patient profiles, is likely to boost their adoption in both diagnostic and therapeutic settings. Additionally, advancements in antibody engineering, including the development of humanized and fully human monoclonal antibodies, are anticipated to enhance their therapeutic efficacy and safety profiles, further expanding their use. As the need for highly targeted, efficient diagnostic tools and therapies increases, monoclonal antibodies are expected to remain a dominant product in the Complement C4 antibody market.

Application Analysis

Immunoassays dominate the application segment, holding 42.7% of the market share. This growth is expected to continue as immunoassays are fundamental in the detection and quantification of complement C4 levels, providing crucial information in immunology, disease diagnosis, and treatment monitoring. Immunoassays, including enzyme-linked immunosorbent assays (ELISA), are widely used in research and clinical diagnostics due to their sensitivity, specificity, and versatility.

As the demand for rapid, reliable diagnostic tests increases, especially in autoimmune diseases and complement system-related disorders, immunoassays are projected to play a pivotal role. Furthermore, the ongoing advancements in assay sensitivity, automation, and multiplexing are expected to enhance the capability of immunoassays, making them even more valuable in clinical and research settings. The increasing trend toward personalized healthcare, where diagnostic results guide tailored treatments, is likely to fuel the demand for immunoassays, ensuring this segment’s continued growth in the market.

End-User Analysis

Pharmaceutical & biotechnology companies represent the largest end-user segment, holding 48.3% of the market share. This growth is anticipated to continue as these companies are at the forefront of research and development for complement C4-related therapies and diagnostics. The use of complement C4 antibodies in drug development, particularly in immunotherapies, is projected to expand as these companies explore new avenues for treating autoimmune diseases, cancer, and complement-mediated disorders.

As pharmaceutical companies focus on developing innovative therapies, monoclonal antibodies targeting complement proteins like C4 are increasingly being incorporated into drug pipelines. Additionally, biotechnology companies are actively working on the engineering of more effective antibodies, which will further contribute to the growth of this segment.

The increasing investment in biologics and the growing adoption of precision medicine, where treatments are tailored to genetic and molecular profiles, will likely drive continued demand for complement C4 antibodies in pharmaceutical and biotechnology sectors. As research into the complement system progresses, pharmaceutical companies will continue to be key drivers in the development and utilization of complement C4 antibody-based solutions.

Key Market Segments

By Product Type

- Monoclonal Antibodies

- Recombinant Antibodies

- Polyclonal Antibodies

- Antibody Fragments

By Application

- Immunoassays

- Western Blotting

- Immunohistochemistry

- Flow Cytometry

By End-User

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Clinical Laboratories

- Academic & Research Institutions

Drivers

Increasing Prevalence of Autoimmune and Neurodegenerative Diseases is Driving the Market

The rising global prevalence of autoimmune and neurodegenerative diseases where the complement system, particularly C4, plays a pathological role, is a significant driver propelling the complement C4 antibody market. Conditions such as Systemic Lupus Erythematosus (SLE), neuromyelitis optica spectrum disorder (NMOSD), and certain forms of kidney disease involve dysregulation of the complement pathway, leading to tissue damage.

Complement C4 antibodies aim to modulate this specific pathway, offering a targeted therapeutic approach for these debilitating conditions. The Centers for Disease Control and Prevention (CDC) estimated in June 2024 that over 24 million people in the US alone live with an autoimmune disease.

While this is a broad figure, a study published in RMD Open in March 2025, analyzing a cohort of patients with systemic autoimmune rheumatic diseases (SARD) in the Mass General Brigham system, identified over 2,061 patients with a SARD diagnosis between September 2022 and March 2024, with rheumatoid arthritis (38.5%) and systemic lupus erythematosus (10.2%) being among the most common. This high and increasing burden of diseases linked to complement dysregulation creates a substantial unmet medical need, driving demand for innovative therapeutic solutions like C4-targeting antibodies.

Restraints

High Cost of Biologic Drug Development and Manufacturing Complexity are Restraining the Market

The exceptionally high cost associated with the research, development, and clinical trials of biologic drugs, combined with the inherent complexities of their manufacturing, represents a significant restraint on the complement C4 antibody market. Developing a new biologic therapy from discovery to regulatory approval is a multi-year, multi-billion-dollar endeavor, with a low success rate.

These costs are exacerbated by the need for specialized manufacturing facilities, stringent quality control, and cold chain logistics. This figure underscores the immense financial investment required before a drug even reaches patients. Furthermore, biologics, including antibodies, are produced in living cells, a process far more complex than synthesizing small molecule drugs. This complexity involves genetic engineering, cell line development, large-scale cell culture in bioreactors, and multi-step purification processes, each requiring precise control and testing.

Such intricate manufacturing can take up to 18 months for a single batch and is prone to variations that necessitate rigorous oversight. These factors collectively contribute to high production costs and longer development timelines, thereby limiting market accessibility and restraining the growth of novel complement C4 antibodies.

Opportunities

Advancements in Precision Medicine and Biomarker Identification are Creating Growth Opportunities

Significant advancements in precision medicine, particularly the improved ability to identify specific biomarkers and genetic predispositions linked to complement pathway dysregulation, are creating substantial growth opportunities for the complement C4 antibody market. As scientific understanding of the diverse roles of C4 in disease pathogenesis deepens, researchers can more accurately identify patient subgroups who are most likely to respond to C4-targeted therapies. This allows for more targeted drug development and clinical trial design, increasing the likelihood of successful outcomes.

The National Institutes of Health (NIH) actively funds research into autoimmune diseases and the complement system. The NIH Office of Autoimmune Disease Research (OADR-ORWH) reported that NIH’s investment in autoimmune disease research increased to over US$ 1billion in fiscal year (FY) 2022. This substantial funding supports foundational research that leads to the discovery of new biomarkers.

For example, advances in genomic sequencing can pinpoint specific C4 gene variants associated with heightened disease risk or progression, guiding therapeutic strategies. The ability to select patients more effectively for C4 antibody treatment based on their unique biological profiles not only enhances therapeutic efficacy but also optimizes healthcare resource utilization by reducing the “trial-and-error” approach to treatment, thereby creating significant opportunities for market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the strategic investment cycles within the pharmaceutical sector, significantly influence the complement C4 antibody market by affecting R&D budgets and market access. Inflation can increase the operational costs for pharmaceutical companies, encompassing expenses for laboratory supplies, clinical trial logistics, and highly specialized scientific talent. This may lead to higher pricing for novel biologic therapies or longer development timelines.

However, the high unmet medical need in many rare and severe autoimmune or neurodegenerative diseases often drives sustained investment in this specialized area. According to BioSpace, global pharmaceutical R&D spending saw a modest 1.5% growth in 2024, reaching nearly US$288 billion, following an 11.5% surge from 2022 to 2023. This indicates a robust, albeit sometimes fluctuating, commitment to drug discovery.

Geopolitical stability also impacts global supply chains for specialized raw materials and manufacturing components essential for complex biologic drug production. Despite economic challenges, the promise of complement C4 antibodies to address severe, chronic conditions with limited treatment options ensures continued resource allocation and fosters resilience within this specialized market.

Evolving US trade policies, including tariffs on imported biopharmaceutical components and manufacturing equipment, are shaping the complement C4 antibody market by influencing production costs and supply chain reliability. The development and manufacture of complex biologic drugs, like C4 antibodies, often rely on intricate global supply chains for specialized cell culture media, purification resins, single-use bioreactor components, and analytical instruments.

Tariffs on these critical inputs can increase manufacturing expenses for pharmaceutical companies operating in or importing into the US, potentially impacting the final price of these high-cost therapies. A perspective from WNS, published July 4, 2025, highlighted that recent changes in US trade policy, particularly new tariffs, are accelerating the urgency for operational redesign within the healthcare and life sciences sectors due to rising input costs.

While the US administration implemented a temporary deferral on some higher, country-specific reciprocal tariffs until July 9, 2025, for various goods, and has historically exempted pharmaceuticals from some broad tariffs, the overarching trade landscape still necessitates strategic planning for manufacturers. These policies, while sometimes aiming to enhance domestic production, primarily create a more complex and potentially more expensive operational environment for biopharmaceutical companies, impacting the development and accessibility of complement C4 antibodies.

Latest Trends

Increased Focus on Complement-Mediated Neuroinflammation in Drug Development is a Recent Trend

A prominent recent trend shaping the complement C4 antibody market in 2024 and extending into 2025 is the intensified focus on the role of complement-mediated neuroinflammation in the pathogenesis of various neurological and psychiatric disorders. Traditionally, complement system research largely centered on autoimmune conditions affecting peripheral organs.

However, emerging scientific evidence increasingly highlights the critical involvement of specific complement pathways, including those involving C4, in neurodegenerative diseases like Alzheimer’s, schizophrenia, and multiple sclerosis, and other conditions involving synaptic pruning abnormalities. This shift is leading to a surge in research and drug development efforts targeting complement components within the central nervous system.

A review published in Frontiers in Neurology in March 2024 discussed the significant and emerging roles of the complement system in neurodegenerative and inflammatory diseases of the central nervous system. Clinical trials are now actively exploring C4-targeting antibodies for these novel indications. While specific trial outcomes for C4 antibodies in neuroinflammation are still emerging, the broadened understanding of the complement system’s role in brain health and disease represents a pivotal expansion of potential therapeutic targets, driving innovative applications for complement C4 antibodies.

Regional Analysis

North America is leading the Complement C4 Antibody Market

The complement C4 antibody market in North America, representing a substantial 39.8% share of the global market, demonstrated significant growth in 2024. This expansion was primarily fueled by the increasing prevalence of autoimmune diseases where the complement system plays a crucial role, advancements in diagnostic techniques, and the growing focus on personalized medicine approaches.

Conditions such as systemic lupus erythematosus (SLE) and lupus nephritis, often characterized by dysregulation of the complement system including C4, necessitate precise diagnostic and therapeutic interventions.

According to a new study from Mayo Clinic researchers and collaborators, approximately 15 million people, or 4.6% of the US population, were diagnosed with at least one autoimmune disease between January 2011 and January 2022, a broad category that includes complement-mediated disorders. The development of novel antibody-based therapeutics that specifically target components of the complement cascade, like C4, further contributes to market growth.

Novartis received US Food and Drug Administration (FDA) approval in March 2025 for Fabhalta (iptacopan), a first-in-class complement factor B inhibitor, for primary C3 glomerulopathy (C3G), highlighting the regulatory support for complement-targeting drugs. While specific C4 antibody revenues are often embedded within broader portfolios, C4 Therapeutics, a company focused on protein degradation, reported total revenue of US$20.8 million for the full year 2023, reflecting ongoing investment in advanced therapeutic development.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The complement C4 antibody market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is primarily driven by the increasing incidence of autoimmune and inflammatory diseases across the region, improving healthcare infrastructure, and a rising awareness among clinicians regarding the diagnostic and therapeutic utility of complement system modulation. Countries such as China, Japan, and South Korea are witnessing a notable rise in the diagnosis of autoimmune conditions, which underscores the need for advanced diagnostic tools and targeted therapies.

Furthermore, governments in Asia Pacific are increasing their healthcare expenditure and promoting research and development in biotechnology, creating a favorable environment for the adoption of sophisticated antibody products. The OECD’s “Health at a Glance: Asia/Pacific 2024” report indicates ongoing investment in healthcare systems across the region, supporting the integration of advanced therapies.

BioSpectrum Asia reported in May 2025 that the Asia Pacific region leads global clinical development of multi-specific antibodies, accounting for over 40% of trials, which suggests a strong pipeline and adoption of advanced antibody technologies. As research into the role of complement C4 in various pathologies deepens, and as access to specialized diagnostics and treatments expands, the demand for these specific antibodies will likely increase across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the complement C4 antibody market are adopting several strategies to drive growth and expand their reach. They focus on developing high-affinity monoclonal antibodies, ensuring specificity and reliability in complement C4 detection. Companies are also investing in the advancement of multiplex immunoassays and portable diagnostic tools to enhance the speed and accuracy of complement system analysis.

Strategic collaborations with research institutions and academic organizations are integral to advancing innovation and expanding the use of complement C4 antibodies across multiple therapeutic areas. Moreover, companies are working on strengthening their distribution networks, particularly in emerging markets, to increase product accessibility. Maintaining stringent regulatory compliance and ensuring high-quality standards further support the reliability and effectiveness of these diagnostic solutions.

Abcam, a leading company in the market, specializes in supplying antibodies and proteins for life science research. It offers a broad range of complement C4 antibodies, catering to diverse research applications. The company’s extensive distribution network and expert technical support have helped it achieve a significant market presence. In 2023, Abcam was acquired by Danaher Corporation for US$5.7 billion, which strengthened its position in providing high-quality research tools for the scientific community.

Top Key Players in the Complement C4 Antibody Market

- Roche

- Pfizer

- Merck

- Glenmark

- Commit Biologics

- Amgen

- AbbVie

- 3M

Recent Developments

- In May 2025, the US FDA granted fast-track designation for ISB 2001, a novel treatment for multiple myeloma, developed by Ichnos Glenmark Innovation, the research and innovation division of Glenmark Pharmaceuticals. This investigational trispecific antibody targets BCMA and CD38 on myeloma cells and CD3 on T cells.

- In May 2024, Commit Biologics, a company specializing in complement system activation for treating autoimmune disorders and cancer, revealed its emergence from stealth mode after securing €16 million in seed funding from Novo Holdings and Bioqube Ventures.

Report Scope

Report Features Description Market Value (2024) US$ 19.8 billion Forecast Revenue (2034) US$ 63.2 billion CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies, Recombinant Antibodies, Polyclonal Antibodies, and Antibody Fragments), By Application (Immunoassays, Western Blotting, Immunohistochemistry, and Flow Cytometry), By End-user (Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Clinical Laboratories, and Academic & Research Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche, Pfizer, Merck, Glenmark, Commit Biologics, Amgen, AbbVie, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Complement C4 Antibody MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Complement C4 Antibody MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roche

- Pfizer

- Merck

- Glenmark

- Commit Biologics

- Amgen

- AbbVie

- 3M