Global Coffee Whitener Market By Type (Liquid Coffee Whitener, Powder Coffee Whitener), By Product (Low-fat, Medium-fat, High-fat), By Application (Coffee, Tea), By End-use (Food & Beverage, Healthcare), By Distribution Channel (Supermarkets and Hypermarkets, Departmental Stores & Groceries, Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132410

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

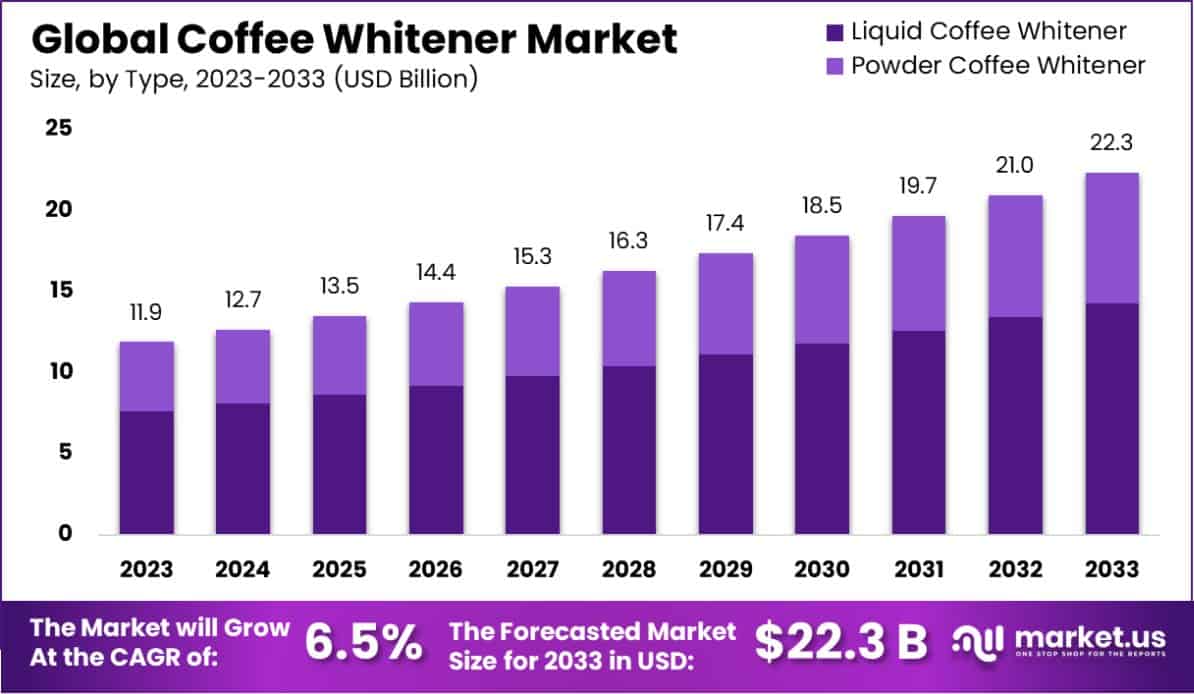

The Global Coffee Whitener Market size is expected to be worth around USD 22.3 Bn by 2033, from USD 11.9 Bn in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Coffee whitener, also known as non-dairy creamer, is a milk or cream substitute used primarily to add flavor and texture to coffee or other beverages. It is typically made from a combination of vegetable oils, glucose syrup, and various milk derivatives, providing a creamy texture without the use of dairy ingredients. Coffee whiteners are popular among those who are lactose intolerant, vegan, or seeking a longer shelf-life alternative to milk.

The coffee whitener market is expanding, driven by the increasing global consumption of coffee and growing dietary preferences for non-dairy alternatives. The market’s growth is bolstered by the convenience and variety of flavors offered by coffee whiteners, which cater to an expanding consumer base seeking lactose-free, vegan, and portable options for home and on-the-go use.

The Coffee Whitener market is poised for significant growth, driven by evolving consumer preferences and strategic industry investments. Notably, Danone’s recent $65 million investment into a new bottle production line for coffee creamers in Jacksonville, Florida, underscores the sector’s shift towards enhanced production efficiencies and sustainability initiatives.

This move reflects a broader industry trend towards integrating eco-friendly practices and technologies that cater to environmentally conscious consumers.

Moreover, in India, the Integrated Coffee Development Programme (ICDP) is injecting substantial funding into both traditional and non-traditional coffee-growing regions. The allocation of Rs. 311 crores for traditional areas and Rs. 125 crores for non-traditional areas aims to bolster development support, including value addition and export promotion.

An additional Rs. 135 crores are earmarked for research to foster sustainable coffee production practices, which is critical in an era where sustainability is paramount to consumer choices and regulatory compliance.

The government’s support extends to mechanization efforts with Rs. 80 crores dedicated to enhancing the efficiency of coffee estate operations, an essential factor in scaling production capacities.

Furthermore, Rs. 55 crores are allocated to market development efforts, focusing on improving the marketing capabilities of small growers’ collectives and cooperatives. These investments indicate a robust governmental push to elevate the coffee industry’s global competitiveness by focusing on quality improvements, operational efficiency, and market expansion.

These developments suggest a dynamic trajectory for the Coffee Whitener market, as it capitalizes on advanced production techniques and government-backed initiatives to meet the growing demand for sustainable and high-quality coffee additives. Such strategic investments not only enhance the market’s growth potential but also strengthen its position in the global beverage industry landscape.

The market is growing due to the rising awareness of lactose intolerance and the health issues associated with dairy products. Additionally, the versatility and convenience of coffee whiteners make them appealing to the fast-paced lifestyles of modern consumers, further fueling their demand.

Demand for coffee whiteners is driven by the increasing popularity of coffee culture worldwide, coupled with a shift towards plant-based and non-dairy diets. The product’s ability to enhance the sensory attributes of coffee without altering its intrinsic properties boosts its adoption among coffee enthusiasts.

The coffee whitener market holds significant opportunities for product innovation, such as the introduction of organic and natural ingredient-based whiteners. There is also potential for growth in emerging markets where coffee consumption is on the rise, and consumer preferences are shifting towards convenient, healthy alternatives.

Key Takeaways

- The Global Coffee Whitener Market size is expected to be worth around USD 22.3 Bn by 2033, from USD 11.9 Bn in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

- Liquid Coffee Whitener dominates the market, holding a 64.4% share by type.

- Medium-fat products lead, capturing 53.4% of the Coffee Whitener market by product.

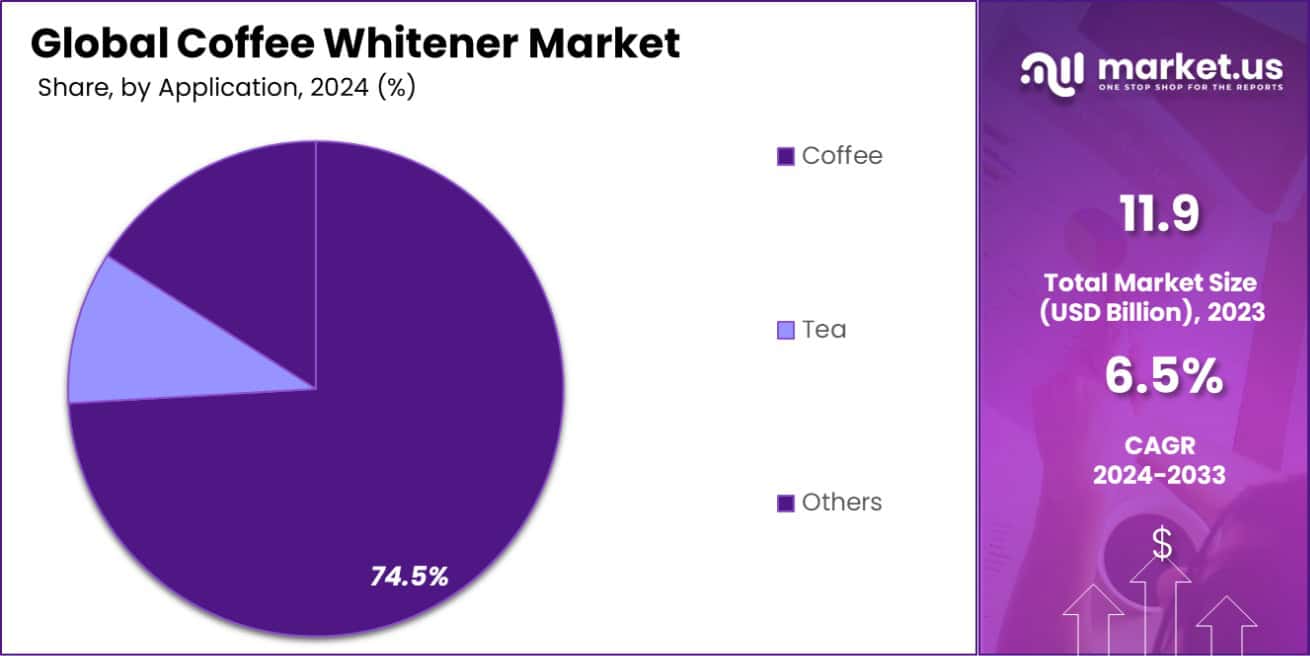

- Coffee applications command a substantial 74.5% share of the market by application.

- Food & Beverage end-use accounts for 73.3% of Coffee Whitener consumption.

- Supermarkets and hypermarkets are key distribution channels, with a 45.3% market share.

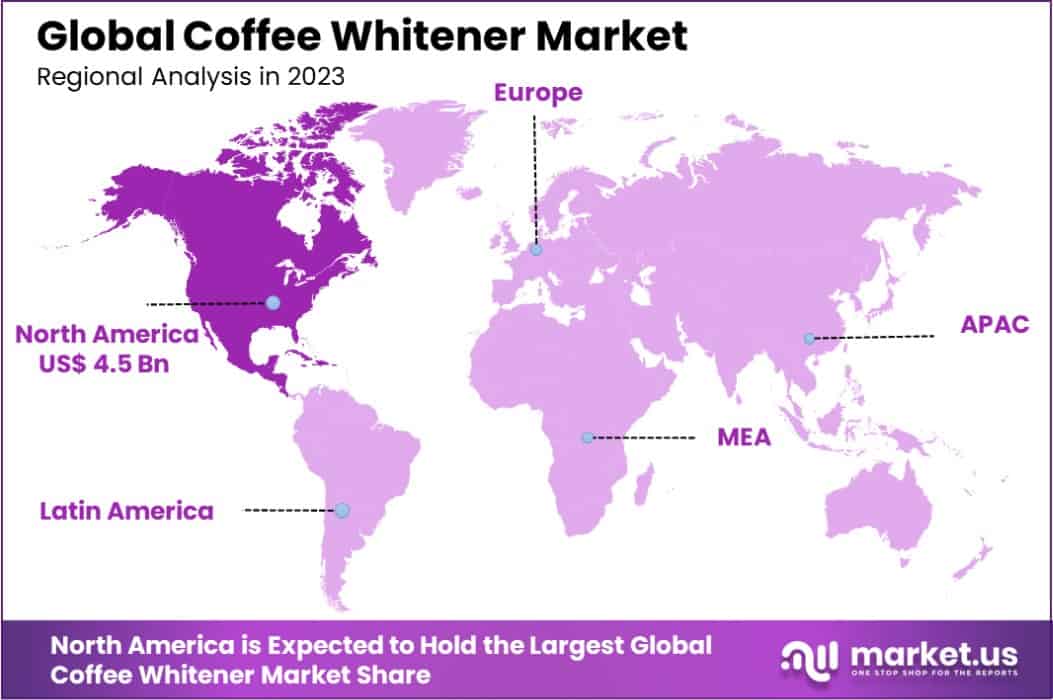

- North America accounted for 38% of the Coffee Whitener Market, valued at USD 4.5 billion.

By Type Analysis

Liquid coffee whitener dominates the market with a significant share of 64.4%.

In 2023, Liquid Coffee Whitener held a dominant market position in the By Type segment of the Coffee Whitener Market, with a 64.4% share. This preference underscores a growing consumer inclination towards the convenience and consistency offered by liquid formulations.

In contrast, Powder Coffee Whitener, though versatile, captured a smaller segment of the market, reflecting a more niche appeal to consumers who prioritize storage stability and longer shelf life.

In the By Product category, Medium-fat coffee whiteners led with a 53.4% market share, favored for their balance of flavor and reduced calorie content, appealing to health-conscious consumers. The By Application analysis reveals that 74.5% of Coffee Whitener usage is concentrated in coffee, demonstrating its integral role in enhancing the coffee-drinking experience.

Moreover, the By End-use data indicates that the Food & Beverage sector remains the largest consumer, accounting for 73.3% of the market. This sector’s dominance is driven by the widespread use of coffee whiteners in commercial settings, such as cafes and restaurants, and by individual consumers at home.

Lastly, distribution through Supermarkets/Hypermarkets was the most effective channel, holding a 45.3% share. This channel’s strength lies in its extensive reach and ability to offer a variety of coffee whitener products to a broad consumer base, facilitating easy access to the product and influencing purchasing decisions.

By Product Analysis

Medium-fat coffee whiteners lead product types, holding a 53.4% market share.

In 2023, Medium-fat held a dominant market position in the By Product segment of the Coffee Whitener Market, with a 53.4% share. This segment’s popularity can be attributed to consumers seeking a balance between taste and health consciousness, as medium-fat whiteners provide a creamier texture than their low-fat counterparts while offering fewer calories than high-fat options.

Low-fat coffee whiteners, appealing to the most health-centric individuals, captured a smaller portion of the market, indicative of a niche demographic that prioritizes calorie reduction over texture and flavor. Conversely, high-fat coffee whiteners, which are typically richer and more flavorful, also represent a smaller niche that caters to those not concerned with fat content.

The medium-fat dominance reflects broader consumer trends towards moderate dietary choices, where indulgence and health considerations meet. This trend is particularly evident in markets where consumers are increasingly aware of dietary impacts on health but are unwilling to compromise completely on taste and sensory experience.

As coffee culture continues to grow globally, the demand for medium-fat coffee whiteners is expected to remain strong, supported by both home consumers and the food service industry, which values the product’s ability to enhance the beverage’s richness and mouthfeel.

By Application Coffee Analysis

Coffee applications prominently utilize whiteners, accounting for 74.5% of market usage.

In 2023, Coffee held a dominant market position in the By Application segment of the Coffee Whitener Market, with a 74.5% share. This significant portion underscores the intrinsic link between coffee and its complementary products, with whiteners being a primary choice for consumers seeking to enhance the flavor and texture of their beverage.

Tea, as another application for whiteners, accounts for the remainder of the market. Although less traditional than milk or cream, coffee whiteners are being increasingly used by tea drinkers looking for dairy-free or vegan alternatives, which also contribute to the market’s diversification.

The dominance of coffee as the primary application for whiteners is largely driven by the global rise in coffee consumption, where consumers are not only drinking more but are also becoming more experimental with how they customize their beverages.

The availability of different formulations of coffee whiteners, including flavored and specialty varieties, has further propelled their use among coffee enthusiasts.

This trend is supported by the growing café culture worldwide, which encourages the sampling of new and diverse coffee-related products. As the market continues to evolve, the adaptability of coffee whiteners to meet consumer preferences will be crucial in maintaining their strong position within the sector.

By End-Use Analysis

The food & beverage sector is the primary end-user, making up 73.3%.

In 2023, Food & Beverage held a dominant market position in the By End-use segment of the Coffee Whitener Market, with a 73.3% share. This sector’s commanding lead reflects the integral role of coffee whiteners in various culinary and beverage applications, from coffee shops and restaurants to domestic kitchens.

The versatility and ease of integration of coffee whiteners into both hot and cold beverages have solidified their status as a staple in the food service industry.

On the other hand, the Healthcare sector, while a smaller segment, utilizes coffee whiteners for patient meals and staff cafeterias, focusing on special dietary formulations such as low-fat and lactose-free options to cater to health-specific needs.

The Food & Beverage industry’s overwhelming preference for coffee whiteners is driven by consumer demand for consistent and enhanced beverage flavors, contributing significantly to market growth. As consumers increasingly seek convenience and taste customization, the role of coffee whiteners as a creamer alternative continues to expand.

Furthermore, innovative product developments aimed at improving health profiles without compromising taste are likely to increase penetration in the healthcare sector, potentially expanding its market share in the coming years.

By Distribution Channel Analysis

Supermarkets and hypermarkets are key distribution channels, with a 45.3% share.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Coffee Whitener Market, with a 45.3% share. This prominence is attributed to their wide reach and ability to offer an extensive array of coffee whitener options under one roof, catering to a diverse consumer base.

Departmental Stores & Groceries, capturing the next significant market share, serve as convenient points for quick purchases, especially in urban areas where they are readily accessible. Online Stores, though representing a smaller portion of the market, are rapidly gaining traction due to the growing trend of digital shopping and the convenience of home delivery.

The stronghold of Supermarkets and Hypermarkets is reinforced by their strategic location and the breadth of choices they provide, from premium to budget-friendly options, meeting the needs of every segment of the population.

As e-commerce continues to evolve, Online Stores are expected to increase their market share, driven by advancements in e-commerce technology, user-friendly shopping platforms, and changing consumer shopping behaviors favoring convenience and price comparison.

The ongoing expansion of these digital platforms could reshape the distribution dynamics of the Coffee Whitener Market in the foreseeable future.

Key Market Segments

By Type

- Liquid Coffee Whitener

- Powder Coffee Whitener

By Product

- Low-fat

- Medium-fat

- High-fat

By Application

- Coffee

- Tea

By End-use

- Food & Beverage

- Healthcare

By Distribution Channel

- Supermarkets/Hypermarkets

- Departmental Stores & Groceries

- Online Stores

Driving Factors

Growing Popularity of Instant Coffee Boosts Demand

The demand for coffee whiteners is primarily driven by the increasing consumption of instant coffee worldwide. As more people seek convenience in their daily routines, instant coffee becomes an appealing choice for its quick and easy preparation.

Coffee whiteners enhance the flavor and texture of instant coffee, making them a staple in households and offices, thereby boosting market growth.

Rise in Dairy-Free and Vegan Lifestyles

The shift towards dairy-free and vegan diets has significantly influenced the coffee whitener market. Consumers seeking plant-based alternatives are driving demand for non-dairy creamers made from almond, soy, and coconut milk.

This trend is supported by a growing awareness of lactose intolerance and health-conscious behaviors, propelling the popularity of vegan-friendly coffee whiteners.

Enhanced Flavors and Varieties Attract Consumers

Manufacturers are expanding their product lines to include a variety of flavors and formulations of coffee whiteners, catering to diverse consumer tastes. This strategy not only enhances the consumer experience but also encourages trial and repeat purchases.

Flavors ranging from vanilla and caramel to exotic and seasonal options help maintain consumer interest and drive market growth.

Restraining Factors

Health Concerns Over Artificial Ingredients Limit Usage

Health-conscious consumers are increasingly wary of artificial ingredients commonly found in coffee whiteners, such as preservatives and additives. This awareness has led to a reluctance to use these products, as more people prioritize natural and organic dietary choices.

The perceived negative health impacts of such ingredients pose a significant restraint on the growth of the coffee whitener market, as consumers shift towards healthier alternatives.

Fluctuating Prices of Raw Materials Create Uncertainty

The coffee whitener industry faces challenges due to the volatility in prices of key raw materials, including sugar, oil, and dairy products. This unpredictability in costs leads to inconsistent pricing of final products, which can deter budget-conscious consumers.

The inability to maintain stable prices may restrict market growth, as consumers could hesitate to purchase or switch to other alternatives.

Competition from Fresh Dairy Products

Fresh dairy products remain a preferred choice for many coffee drinkers who value natural flavor and quality. This preference significantly restrains the market for coffee whiteners, as a portion of the consumer base opts for fresh milk or cream over processed alternatives.

The competition from these dairy products can limit the penetration and expansion of the coffee whitener market in regions where fresh dairy is readily available and culturally preferred.

Growth Opportunity

Expanding Market in Emerging Economies Offers New Frontiers

Emerging markets present significant growth opportunities for the coffee whitener industry due to rising coffee consumption and urbanization. As disposable incomes increase in these regions, more consumers can purchase coffee and coffee additives, including whiteners.

Tapping into these markets with targeted marketing and distribution strategies can lead to substantial market expansion and increased brand visibility.

Innovation in Health-Conscious Products to Meet Demand

There is a growing opportunity for innovation in developing health-conscious coffee whiteners that cater to the needs of health-aware consumers.

By creating products that are low in calories, sugar-free, or made with organic and natural ingredients, manufacturers can attract a larger segment of the market that prioritizes healthy lifestyles while still enjoying creamed coffee.

Strategic Partnerships with Coffee Brands Enhance Visibility

Forming strategic partnerships with established coffee brands can provide coffee whitener manufacturers with an advantageous market position. These partnerships can include co-branding, joint promotions, and bundled sales that enhance product visibility and appeal.

By associating whitener products with popular coffee brands, companies can leverage brand strength and customer loyalty to boost sales.

Latest Trends

Surge in Popularity of Specialty and Gourmet Flavors

The coffee whitener market is experiencing a trend towards specialty and gourmet flavors that cater to sophisticated palates. Consumers are increasingly looking for unique flavor profiles like hazelnut, Irish cream, and cinnamon spice to enhance their coffee experience.

This trend is driving manufacturers to expand their product lines to include these premium options, appealing to a broader audience seeking a luxurious coffee-drinking experience.

Increased Demand for Plant-Based and Vegan Whiteners

Reflecting broader dietary trends, there is a rising demand for plant-based and vegan coffee whiteners. These products, typically made from almond oil, coconut, oat, and soy, cater to consumers with dietary restrictions, vegan lifestyles, or those simply seeking dairy alternatives.

This shift is prompting manufacturers to innovate and expand their offerings in this category, tapping into a growing segment of the market.

Eco-Friendly Packaging Gains Market Traction

Sustainability is becoming a key factor in consumer purchases, including in the coffee whitener market. Eco-friendly packaging solutions that reduce environmental impact are increasingly popular.

Companies are investing in biodegradable, recyclable, or reusable smart packaging to attract environmentally conscious consumers, aligning brand values with consumer expectations for sustainability.

Regional Analysis

North America leads the Coffee Whitener Market, with a 38% share, USD 4.5 Bn.

The Coffee Whitener Market exhibits diverse regional dynamics, with North America leading in market share at 38%, translating to a value of approximately USD 4.5 billion. This dominance is attributed to a high consumption rate of coffee and the corresponding use of coffee whiteners in the U.S. and Canada, where consumers show a strong preference for convenience and flavor variety in their coffee additives.

In Europe, the market is driven by an increasing inclination towards dairy alternatives, with countries like the UK and Germany showing significant growth in plant-based and vegan whitener options.

Asia Pacific is witnessing rapid growth, fueled by expanding coffee culture in emerging economies such as China and India, coupled with rising disposable incomes and urbanization.

Meanwhile, the Middle East & Africa region is experiencing modest growth, largely influenced by changing dietary habits and westernization of dietary preferences, particularly in urban areas.

Latin America, though smaller in market size, shows potential due to growing local coffee consumption and an emerging cafe culture, which is gradually incorporating coffee whiteners into traditional coffee-drinking habits.

Each region’s market dynamics are shaped by local consumer preferences, dietary trends, and economic conditions, highlighting the importance of tailored marketing and product development strategies to cater to the distinct needs of consumers across the globe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Coffee Whitener Market, key players such as Nestlé, FrieslandCampina, and WhiteWave are leading the industry through strategic innovation and expansion.

Nestlé continues to dominate with its wide range of coffee whitener products tailored for both developed and emerging markets, focusing on taste enhancement and healthy options. FrieslandCampina capitalizes on its dairy expertise to offer high-quality creamers that cater to European preferences for organic and non-GMO ingredients.

Emerging players like PT. Santos Premium Krimer and Jiangxi Weirbao Food Biotechnology are making significant inroads in Asia Pacific, leveraging local manufacturing capabilities to reduce costs and enhance distribution efficiency.

These companies focus on adapting to regional taste preferences and expanding their product offerings to include non-dairy and flavored variants, which are gaining popularity in this region.

Furthermore, companies such as DEK (Grandos) and DMK (TURM-Sahne GmbH) focus on sustainability and eco-friendly practices to appeal to environmentally conscious consumers, aligning product development with global trends towards sustainable consumption.

With innovation as a core strategy, these companies are continuously improving their product portfolios to include healthier options with reduced sugar and fat content, catering to the global shift towards health-conscious food choices. This approach not only meets consumer demand but also helps companies stand out in a competitive market, driving growth in the global Coffee Whitener Market.

Top Key Players in the Market

- Amrut International

- Bigtree Group

- Caprimo

- Custom Food Group

- DEK(Grandos)

- DMK(TURM-Sahne GmbH)

- FrieslandCampina

- Fujian Jumbo Grand Food

- Hubei Hong Yuan Food

- Jiangxi Weirbao Food Biotechnology

- Nestle

- PT Aloe Vera

- PT. Santos Premium Krimer

- Shandong Tianmei Bio.

- Super Group

- Suzhou Jiahe Foods Industry

- Wenhui Food

- WhiteWave

- Yearrakarn

- Zhucheng Dongxiao Biotechnology

Recent Developments

- In 2024, PT. Santos Premium Krimer continues to lead as the premier creamer manufacturer in Indonesia, leveraging cutting-edge technology and skilled personnel to deliver top-quality products. Renowned for its innovation in the creamer industry, the company caters to a broad market, enhancing food and beverage experiences across the region.

- In 2023, Shandong Tianmei Bio continued to strengthen its position in the Coffee Whitener market by focusing on product diversity and quality. The company’s line-up of non-dairy creamers for various applications, including coffee, showcases its ongoing commitment to meeting consumer preferences for both flavor and health-conscious options.

Report Scope

Report Features Description Market Value (2023) USD 11.9 Billion Forecast Revenue (2033) USD 22.3 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid Coffee Whitener, Powder Coffee Whitener), By Product (Low-fat, Medium-fat, High-fat), By Application (Coffee, Tea), By End-use (Food & Beverage, Healthcare), By Distribution Channel (Supermarkets and Hypermarkets, Departmental Stores & Groceries, Online Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amrut International, Bigtree Group, Caprimo, Custom Food Group, DEK(Grandos), DMK(TURM-Sahne GmbH), FrieslandCampina, Fujian Jumbo Grand Food, Hubei Hong Yuan Food, Jiangxi Weirbao Food Biotechnology, Nestle, PT Aloe Vera, PT. Santos Premium Krimer, Shandong Tianmei Bio., Super Group, Suzhou Jiahe Foods Industry, Wenhui Food, WhiteWave, Yearrakarn, Zhucheng Dongxiao Biotechnology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coffee Whitener MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Coffee Whitener MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amrut International

- Bigtree Group

- Caprimo

- Custom Food Group

- DEK(Grandos)

- DMK(TURM-Sahne GmbH)

- FrieslandCampina

- Fujian Jumbo Grand Food

- Hubei Hong Yuan Food

- Jiangxi Weirbao Food Biotechnology

- Nestle

- PT Aloe Vera

- PT. Santos Premium Krimer

- Shandong Tianmei Bio.

- Super Group

- Suzhou Jiahe Foods Industry

- Wenhui Food

- WhiteWave

- Yearrakarn

- Zhucheng Dongxiao Biotechnology