Global Cocoa Derivatives Market Size, Share, Report Analysis By Type (Cocoa Powder, Cocoa Butter, Cocoa Mass/Liquor, Others), By Application (Food and Beverage, Personal Care and Cosmetics, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online sales, Wholesale Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156242

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

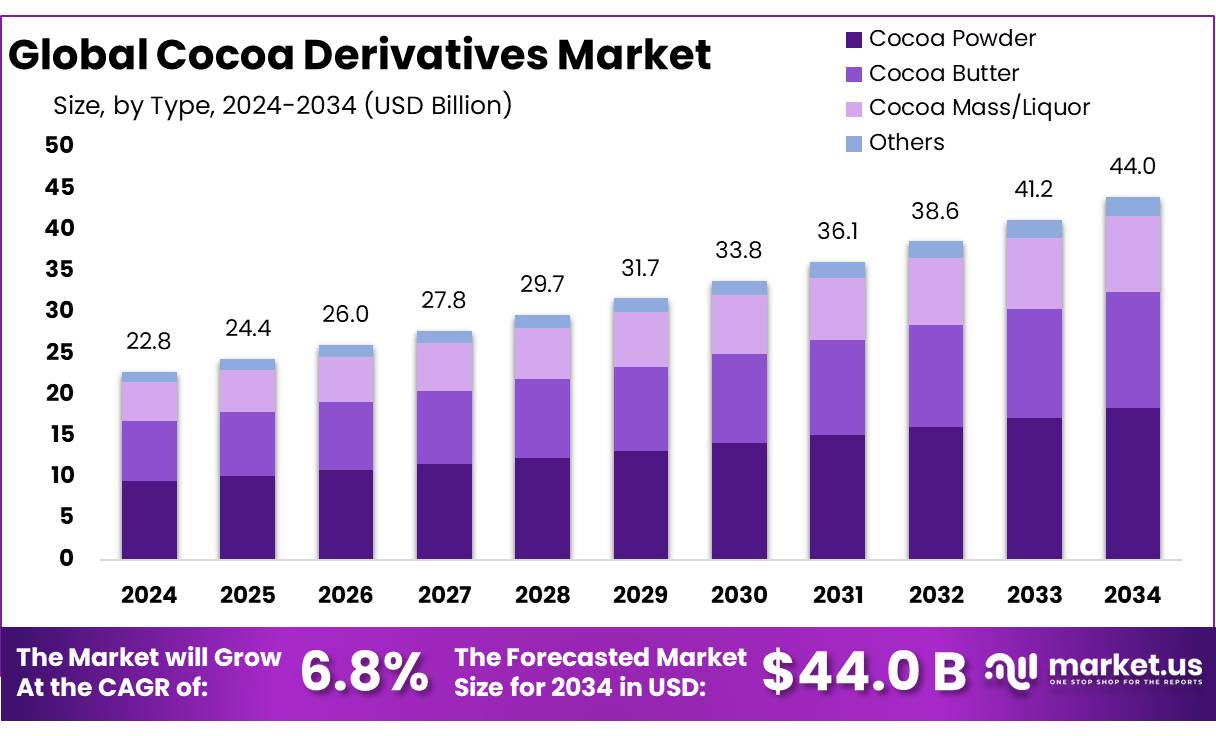

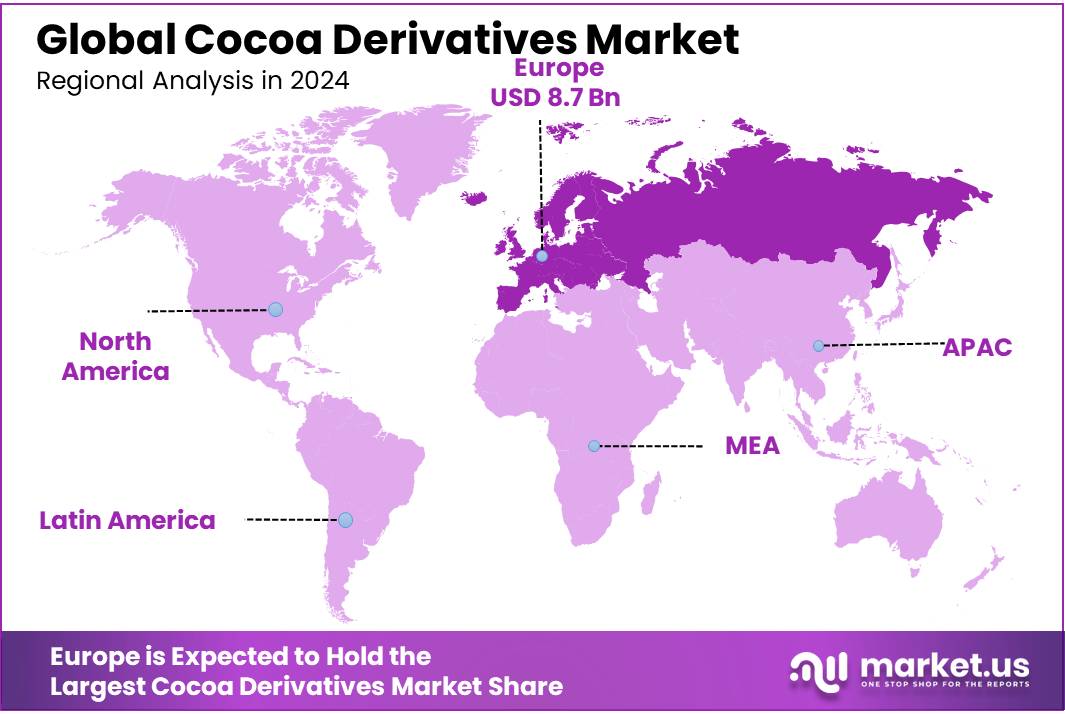

The Global Cocoa Derivatives Market size is expected to be worth around USD 44.0 Billion by 2034, from USD 22.8 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 38.5% share, holding USD 8.7 Billion revenue.

Cocoa derivatives—including cocoa butter, powder, liquor/paste, and nibs—form a critical segment within the global cocoa supply chain, underpinning food, cosmetics, and nutraceutical sectors. In 2023, global cocoa production reached approximately 5.87 million tonnes, with Ivory Coast alone accounting for ~42 percent, followed by Ghana and Indonesia. Downstream processing capacity remains concentrated in Europe and North America, with Europe responsible for some 56 percent of global cocoa imports.

Second, the move toward ethical and sustainable production is gaining momentum: for instance, the EU’s regulation on deforestation‑free products now classifies cocoa among its key monitored commodities. Third, structural price dynamics, including recent volatility—where London cocoa prices soared to $11,530 per tonne in June 2024—have prompted producing nations to coordinate via mechanisms like the Côte d’Ivoire–Ghana Cocoa Initiative (CIGCI), which, since 2019, has added a premium of US$400 per metric ton to cocoa contracts to better support farmers’ incomes.

This trend is reinforced by the growing consumer preference for functional foods and dietary supplements derived from natural and non-animal sources. In 2024, the global consumption of plant-based oils used for tocotrienol extraction, such as palm oil and rice bran oil, reached an estimated 75 million metric tons, reflecting a 3.5% year-on-year growth compared to 2023). These figures indicate a direct correlation between consumer demand for sustainable plant-based ingredients and the growth of the tocotrienol sector.

On the intergovernmental front, the International Cocoa Organization (ICCO) remains a primary statistical and strategic resource. In 2024, ICCO launched a new framework in Abidjan, signed alongside the governments of Cote d’Ivoire, Ghana, and the U.S. Department of Labor, targeting the acceleration of child labor eradication efforts in the cocoa sector. Additionally, the CIGCI’s premium‑pricing scheme has played a key role in stabilizing farmer incomes and ensuring higher retention of value within origin countries.

Key Takeaways

- Cocoa Derivatives Market size is expected to be worth around USD 44.0 Billion by 2034, from USD 22.8 Billion in 2024, growing at a CAGR of 6.8%.

- Cocoa Powder held a dominant market position, capturing more than a 41.7% share in the cocoa derivatives market.

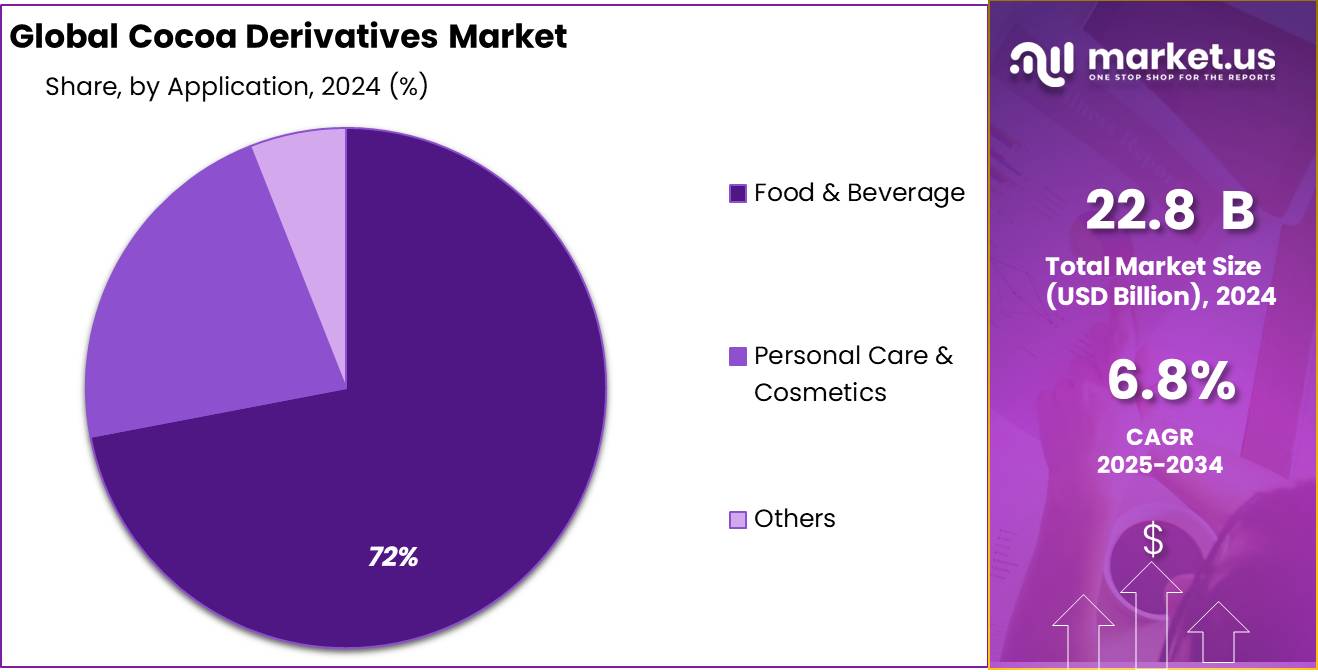

- Food & Beverage held a dominant market position, capturing more than a 72.6% share in the cocoa derivatives market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 46.2% share in the cocoa derivatives market.

- Europe stood out as a powerhouse in the cocoa derivatives market, commanding approximately 38.5% of the global share, translating to a market value of around USD 8.7 billion.

By Type Analysis

Cocoa Powder leads with 41.7% share due to strong demand in food industry

In 2024, Cocoa Powder held a dominant market position, capturing more than a 41.7% share in the cocoa derivatives market by type. Cocoa powder continued to be the most preferred form due to its versatile applications across food and beverage, bakery, confectionery, and dairy products. Its widespread use as a flavoring and coloring agent made it the top contributor to market demand during the year. The preference for natural and clean-label ingredients also supported the steady adoption of cocoa powder in health-based food and drinks.

Moving into 2025, cocoa powder is expected to maintain its stronghold as consumer interest in premium and functional food categories keeps rising. Its role in plant-based protein shakes, chocolate-flavored snacks, and instant beverages is further expanding its market reach. With more consumers opting for indulgent yet healthier options, cocoa powder is likely to remain a vital driver of growth, retaining its leading position in the cocoa derivatives landscape.

By Application Analysis

Food & Beverage dominates with 72.6% share driven by rising cocoa demand

In 2024, Food & Beverage held a dominant market position, capturing more than a 72.6% share in the cocoa derivatives market by application. The segment’s strong lead was supported by the growing demand for chocolate-based confectionery, bakery items, and dairy products where cocoa derivatives are key ingredients. Rising consumer preference for indulgent and premium food options kept the category firmly at the top. Cocoa powder and cocoa butter especially found increasing use in packaged foods and instant mixes, reinforcing their role in everyday consumption.

By 2025, the Food & Beverage segment is expected to continue its dominance as manufacturers expand offerings in health-focused snacks, fortified beverages, and plant-based alternatives enriched with cocoa. The growing culture of café-style consumption and rising household demand for bakery mixes and chocolate drinks will ensure that Food & Beverage remains the strongest driver of cocoa derivatives, maintaining its leadership well into the coming years.

By Distribution Channel Analysis

Hypermarkets & Supermarkets dominate with 46.2% share due to wide consumer reach

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 46.2% share in the cocoa derivatives market by distribution channel. Their leadership came from the strong preference of consumers to buy cocoa products like powder, butter, and chocolates during routine shopping. The availability of multiple brands under one roof, attractive discounts, and bulk packaging options made hypermarkets and supermarkets the first choice for buyers. These retail formats also allowed consumers to explore both premium and mass-market cocoa-based products, strengthening their role in market expansion.

By 2025, the dominance of hypermarkets and supermarkets is expected to remain intact, supported by urbanization and the increasing trend of organized retail chains expanding into tier-2 and tier-3 cities. As consumers continue to prefer one-stop shopping experiences and value-based purchases, this channel will retain its stronghold, ensuring steady growth for cocoa derivatives across regions.

Key Market Segments

By Type

- Cocoa Powder

- Cocoa Butter

- Cocoa Mass/Liquor

- Others

By Application

- Food & Beverage

- Personal Care & Cosmetics

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Online sales

- Wholesale Stores

- Others

Emerging Trends

Rising Demand for Plant-Based and Sustainable Tocotrienol Sources

One of the most notable trends in the tocotrienol industry is the increasing shift toward plant-based and sustainably sourced tocotrienols. Consumers today are not only seeking the health benefits of vitamin E derivatives but are also highly conscious of the environmental and ethical implications of their products. Tocotrienols, which are naturally extracted from sources such as palm oil, rice bran oil, and annatto, are experiencing higher demand because they align with the global push for plant-based nutrition and sustainable production practices.

This trend is reinforced by the growing consumer preference for functional foods and dietary supplements derived from natural and non-animal sources. In 2024, the global consumption of plant-based oils used for tocotrienol extraction, such as palm oil and rice bran oil, reached an estimated 75 million metric tons, reflecting a 3.5% year-on-year growth compared to 2023. These figures indicate a direct correlation between consumer demand for sustainable plant-based ingredients and the growth of the tocotrienol sector.

Government initiatives are also supporting this trend. For example, the Malaysian Palm Oil Board (MPOB) has been actively promoting sustainable palm oil production practices under the Malaysian Sustainable Palm Oil (MSPO) certification. In 2024, over 90% of palm plantations in Malaysia were MSPO-certified, ensuring that the extraction of tocotrienols aligns with environmentally responsible practices). This initiative not only secures the supply of sustainably sourced tocotrienols but also reassures consumers regarding ethical and ecological standards.

Drivers

Growing Consumer Awareness and Health Consciousness

One of the primary drivers propelling the tocotrienol concentrates industry is the increasing consumer awareness regarding health and wellness. As individuals become more conscious of their dietary choices and the impact of nutrition on overall health, there is a noticeable shift towards preventive healthcare measures. This paradigm shift emphasizes the importance of incorporating functional ingredients, such as tocotrienols, into daily diets to mitigate the risk of chronic diseases and promote long-term well-being.

Tocotrienols, a potent form of vitamin E, are recognized for their superior antioxidant properties compared to their counterparts, tocopherols. These compounds are naturally found in various sources, including palm oil, rice bran oil, and barley, and are increasingly being utilized in dietary supplements, functional foods, and nutraceuticals. Their unique molecular structure allows them to offer enhanced protection against oxidative stress, which is a contributing factor to the development of several chronic conditions, including cardiovascular diseases, neurodegenerative disorders, and certain cancers.

Government initiatives and regulatory bodies play a crucial role in supporting the integration of tocotrienols into consumer products. For instance, in the United States, the Food and Drug Administration (FDA) has recognized tocotrienol-rich fractions (TRFs) derived from palm oil as Generally Recognized As Safe (GRAS) for use in various food applications, including salad dressings, margarine, and functional beverages . Such endorsements facilitate the incorporation of tocotrienols into mainstream consumer products, thereby enhancing their accessibility and consumption.

Restraints

High Production Costs and Limited Consumer Awareness

Despite the promising health benefits and growing interest in tocotrienol concentrates, the industry faces significant challenges that hinder its broader adoption. One of the most pressing issues is the high cost of production. Extracting tocotrienols from natural sources such as palm oil, rice bran, and annatto involves complex processes that require specialized equipment and expertise. For instance, the extraction and purification of tocotrienols often necessitate the use of advanced chromatography techniques, which are both time-consuming and expensive. These processes can lead to a final product that is considerably more costly than synthetic alternatives.

The high production costs are further exacerbated by the relatively low yields of tocotrienols from natural sources. For example, palm oil, one of the richest sources of tocotrienols, contains only about 0.1% to 0.2% tocotrienols by weight. This low concentration means that large quantities of raw material are required to produce small amounts of tocotrienol concentrates, increasing the overall cost.

To address these challenges, there is a need for increased education and marketing efforts to raise consumer awareness about the benefits of tocotrienols. Furthermore, research into more cost-effective extraction methods and higher-yielding sources could help reduce production costs and make tocotrienol concentrates more accessible to a broader market. Until these issues are addressed, the high production costs and limited consumer awareness will continue to be significant barriers to the widespread adoption of tocotrienol concentrates.

Opportunity

Expansion into Nutricosmetics and Functional Foods

A significant growth opportunity for tocotrienol concentrates lies in their integration into the nutricosmetics and functional foods sectors. Nutricosmetics, which combine nutrition and cosmetics, are gaining popularity as consumers seek holistic approaches to beauty and wellness. Tocotrienols, with their potent antioxidant properties, are increasingly being incorporated into skincare supplements, beauty drinks, and other functional food products. This trend aligns with the growing consumer demand for natural ingredients that support both internal health and external appearance.

Government initiatives are also contributing to the expansion of the tocotrienol market. For instance, in March 2024, China approved tocotrienols as food additives, encouraging their use in fortified foods and supplements . Such regulatory support facilitates the incorporation of tocotrienols into a wide range of consumer products, enhancing their accessibility and acceptance.

Regional Insights

Europe leads with 38.5% share and a valuation of USD 8.7 billion in cocoa derivatives

In 2024, Europe stood out as a powerhouse in the cocoa derivatives market, commanding approximately 38.5% of the global share, translating to a market value of around USD 8.7 billion. This commanding position reflects Europe’s strong demand for cocoa derivatives—like powder, butter, and liquor—driven by thriving confectionery traditions, robust baking industries, and expanding uses in cosmetics and specialty foods.

Europe’s appetite for premium and certified cocoa products has further solidified its leadership. As consumer interest in single-origin chocolates, organic certifications, and sustainably sourced cocoa continues to grow, the derivatives market has benefited from healthier margins, greater innovation, and stronger consumer loyalty. Countries like the Netherlands and Germany play crucial roles in processing infrastructure, while Belgium’s famous chocolatiers—producing over 172,000 tonnes of chocolate annually—embody the high standards and cultural significance of European chocolate craftsmanship.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Altinmarka, a Turkish-based company, is a leading supplier of cocoa derivatives, chocolate, and related products. Established in 1992, the company has built strong processing capacity, producing cocoa powder, butter, and liquor for confectionery and beverage industries. With state-of-the-art facilities in Istanbul, Altinmarka supports both domestic and international markets. Its focus on sustainable sourcing and innovation has earned recognition, making it one of the key partners to global brands. Strong integration and efficient supply chains strengthen its competitive position.

Barry Callebaut AG, headquartered in Switzerland, is one of the largest cocoa and chocolate manufacturers worldwide. The company processes over 2 million tonnes of cocoa annually, supplying chocolate and derivatives to foodservice, retail, and industrial clients. With operations in more than 40 countries, Barry Callebaut emphasizes sustainable sourcing through its Cocoa Horizons program. Innovation in premium chocolate, health-focused derivatives, and plant-based alternatives enhances its market presence. Its strong global distribution and partnerships with major brands solidify its leadership in cocoa derivatives.

JB Foods Ltd, based in Singapore, is a global producer of cocoa ingredients serving confectionery, bakery, and beverage industries. With processing facilities in Malaysia and partnerships worldwide, the company manufactures cocoa powder, liquor, and butter to meet international standards. JB Foods maintains strong relationships with cocoa-growing regions, focusing on sustainability and farmer welfare. Its integrated supply chain ensures reliable sourcing and global distribution. The company’s emphasis on quality, efficiency, and sustainability has earned it a strong reputation as a reliable partner in cocoa derivatives.

Top Key Players Outlook

- Altinmarka

- Barry Callebaut AG

- Cargill Inc

- Ecuakao Group Ltd

- Indcre S.A.

- JB Foods Ltd

- Moner Cocoa SA

- Natra SA

- Olam Group Limited

- United Cocoa Processor Inc.

Recent Industry Developments

In 2024, Cargill—armed with 160,000 employees across 70 countries—kept its engine humming strong, weaving its way through bean-to-bar processing to serve food, beverage, and confectionery markets worldwide.

In the first half of 2024 JB Foods Ltd, they delivered USD 453.3 million in revenue, marking a healthy 67.2% increase over the same period in 2023—and posted a strong profit of USD 36.1 million, soaring 331% year-on-year, a clear sign that their operations and pricing strategy are firing on all cylinders.

Report Scope

Report Features Description Market Value (2024) USD 22.8 Bn Forecast Revenue (2034) USD 44.0 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cocoa Powder, Cocoa Butter, Cocoa Mass/Liquor, Others), By Application (Food and Beverage, Personal Care and Cosmetics, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online sales, Wholesale Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Altinmarka, Barry Callebaut AG, Cargill Inc, Ecuakao Group Ltd, Indcre S.A., JB Foods Ltd, Moner Cocoa SA, Natra SA, Olam Group Limited, United Cocoa Processor Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Altinmarka

- Barry Callebaut AG

- Cargill Inc

- Ecuakao Group Ltd

- Indcre S.A.

- JB Foods Ltd

- Moner Cocoa SA

- Natra SA

- Olam Group Limited

- United Cocoa Processor Inc.