Global Cocktail Shakers Market Size, Share, Growth Analysis By Material (Steel, Plastic, Glass, Acrylic, Aluminium, Ceramic, Others), By Capacity (Medium (20-28 ounces), Small (8-20 ounces), Large (Above 28 ounces)), By Product Type (Cobbler Shakers, Boston Shakers, French Shakers, Others), By Application (Individual, Commercial, Bars & Pubs, Restaurants, Hotels, Catering Services, Others), By Distribution Channel (Hypermarkets & Supermarkets, Online, Specialty Stores, Department Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159395

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

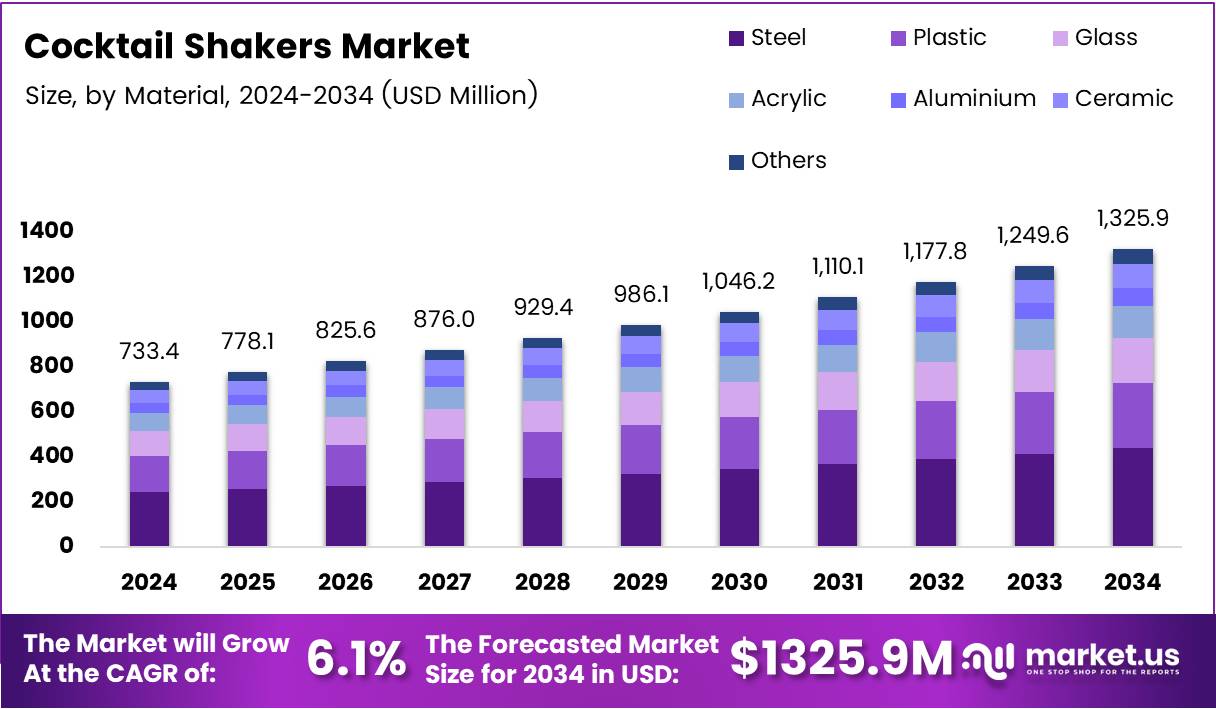

The Global Cocktail Shakers Market size is expected to be worth around USD 1325.9 Million by 2034, from USD 733.4 Million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Cocktail Shakers Market is witnessing steady growth driven by increasing consumer interest in mixology and at-home cocktail preparation. As more people embrace home entertainment, the demand for cocktail accessories, including shakers, continues to rise. This market is expected to grow due to the rising trend of home bartending, especially during festive seasons.

Additionally, the market presents ample opportunities due to the growing influence of social media platforms and bartending influencers. Consumers are increasingly looking for high-quality, durable cocktail shakers to enhance their mixology experience. As a result, premium brands with innovative designs are gaining traction among enthusiasts and professionals alike.

Government investment and regulations also play a significant role in shaping the Cocktail Shakers Market. Various nations are encouraging the growth of the hospitality and foodservice industries, which indirectly boosts the demand for bartending tools. With this support, there is an increased need for businesses to comply with safety and quality standards, which contributes to product innovation.

The market also benefits from the growing trend toward sustainability. More consumers are choosing eco-friendly products, and manufacturers are responding with sustainable materials, such as stainless steel and recyclable plastic. This shift aligns with broader environmental goals, attracting conscious consumers who prioritize sustainability.

Key Takeaways

- The Global Cocktail Shakers Market is expected to reach USD 1325.9 Million by 2034, growing at a CAGR of 6.1% from 2025 to 2034.

- In 2024, Steel dominated the By Material segment with a 56.3% share, known for its durability and rust resistance.

- In 2024, Medium (20-28 ounces) led the By Capacity segment with a 56.6% share, balancing portability and functionality.

- In 2024, Cobbler Shakers held the largest share in the By Product Type segment with 46.8%, preferred for their built-in strainer.

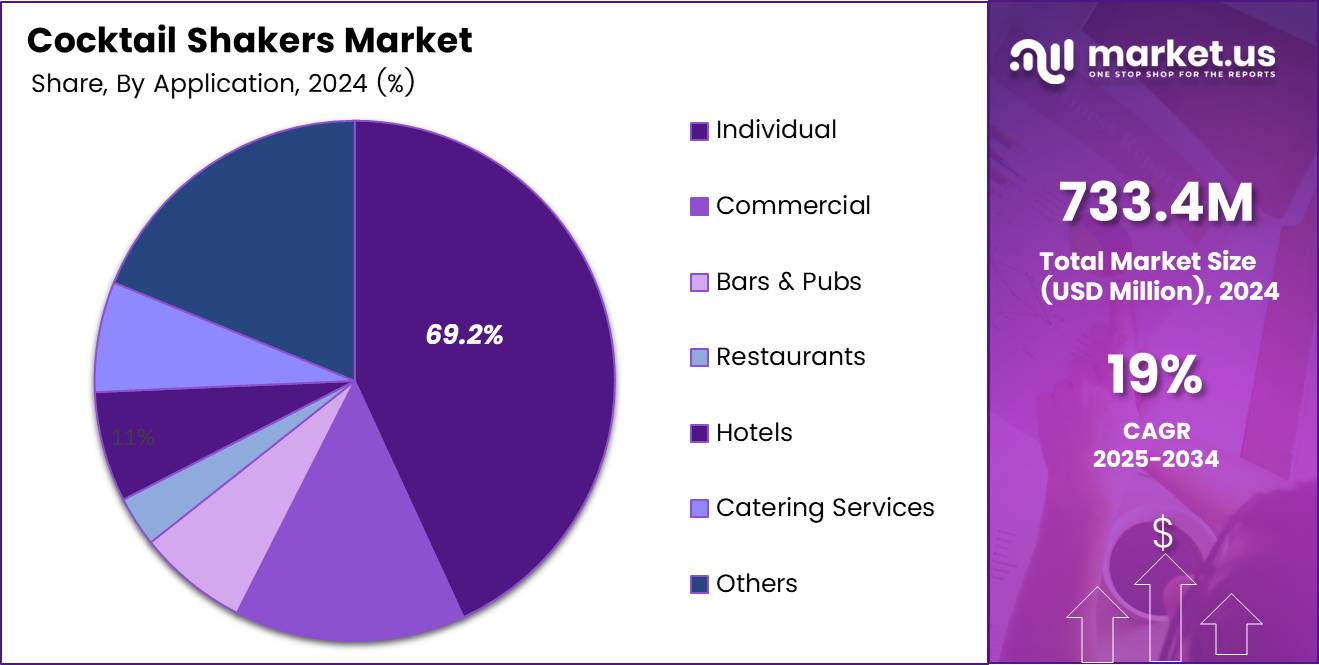

- In 2024, Individual dominated the By Application segment with a 69.2% share, fueled by the rise in DIY cocktail making.

- In 2024, Hypermarkets & Supermarkets led the By Distribution Channel segment with a 48.9% share, offering convenient in-person purchasing.

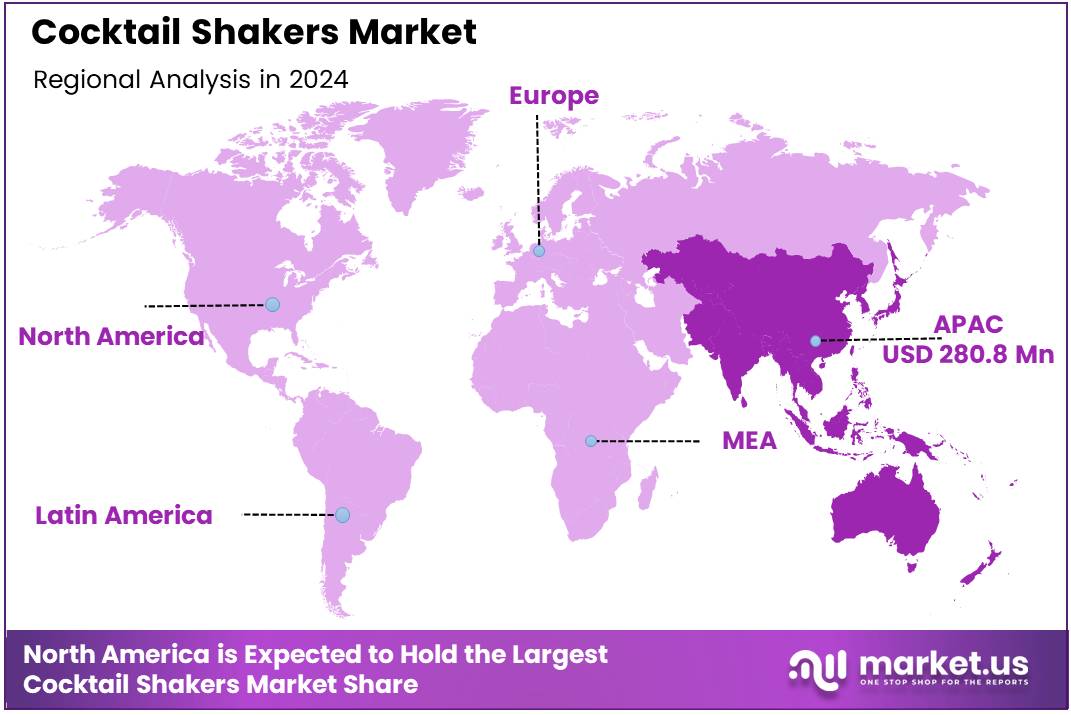

- In 2024, North America held the largest market share of 38.3%, valued at USD 280.8 million, driven by high demand for premium cocktail accessories.

By Material Analysis

Steel dominates with 56.3% share due to its durability, corrosion resistance, and ease of cleaning.

In 2024, Steel held a dominant market position in the By Material Analysis segment of the Cocktail Shakers Market, with a 56.3% share. Steel is widely preferred for cocktail shakers as it offers longevity and maintains its appearance over time. Its robustness and resistance to rust make it the material of choice for both home and commercial use.

Plastic, though not as popular as steel, is gaining traction in the market. Its lightweight nature and cost-effectiveness appeal to consumers looking for affordable alternatives. Plastic shakers are frequently used in casual settings and by budget-conscious consumers.

Glass cocktail shakers provide an elegant look, making them ideal for those who prefer aesthetics along with functionality. However, they are more fragile, which limits their use in busy bars and commercial environments. Glass shakers are often chosen for their visual appeal, particularly in high-end establishments.

Acrylic shakers are durable and lightweight but not as robust as steel or plastic. They are often used in commercial settings where the focus is on practicality. Acrylic is appreciated for its ability to mimic glass at a lower price point.

Aluminium, while lightweight and durable, is less common. It provides a unique aesthetic but does not match the popularity or longevity of steel shakers.

Others, such as ceramic, cater to niche preferences. Ceramic shakers are more ornamental than functional and are generally purchased for decorative purposes.

By Capacity Analysis

Medium (20-28 ounces) dominates with 56.6% share due to its versatility and widespread use in both home and commercial settings.

In 2024, Medium (20-28 ounces) held a dominant market position in the By Capacity Analysis segment of the Cocktail Shakers Market, with a 56.6% share. This size is widely favored as it strikes a balance between portability and functionality, making it ideal for both individual and professional use.

Small (8-20 ounces) shakers are typically used for personal or casual settings. Their compact size makes them convenient for home use, but they are less suitable for high-demand commercial environments. The smaller capacity also limits the number of drinks prepared per shake, making them less versatile.

Large (Above 28 ounces) shakers are often employed in bars and restaurants where large batches of cocktails are made. Though less common in personal settings, their larger capacity makes them more efficient for commercial purposes. They cater to high-volume establishments where quick service is essential.

By Product Type Analysis

Cobbler Shakers dominate with 46.8% share due to their ease of use and popularity in both home and professional settings.

In 2024, Cobbler Shakers held a dominant market position in the By Product Type Analysis segment of the Cocktail Shakers Market, with a 46.8% share. Their design, featuring a built-in strainer, makes them convenient and efficient for both novices and professionals alike.

Boston Shakers are also popular but require additional tools like a strainer to complete the cocktail-making process. Their versatility and use in professional bars make them a top choice for experienced bartenders, though they are less user-friendly than Cobbler Shakers.

French Shakers, with their sleek design and two-piece construction, are chosen for their aesthetic appeal and are preferred by bartenders who prioritize style. While they offer a clean, minimalist look, they are not as widely used as Cobbler or Boston Shakers.

Other types of shakers cater to niche markets or unique designs. These options may be preferred by collectors or individuals looking for specialized cocktail-making equipment.

By Application Analysis

Individual dominates with 69.2% share due to the growing popularity of home mixology and cocktail preparation.

In 2024, Individual held a dominant market position in the By Application Analysis segment of the Cocktail Shakers Market, with a 69.2% share. The rise of home-based cocktail making and the popularity of DIY mixology have led to a surge in individual purchases of cocktail shakers.

Commercial applications, including bars, pubs, and restaurants, represent a smaller portion of the market. While these establishments rely heavily on cocktail shakers for efficient service, the individual market still outpaces commercial use in terms of volume.

Hotels and catering services require cocktail shakers as part of their beverage service, but the segment remains niche compared to the broader consumer demand. These establishments typically use high-quality, durable shakers for professional purposes.

Bars & Pubs use cocktail shakers frequently, but their market share is dominated by other commercial applications. These establishments often use larger-capacity or more durable shakers to keep up with high-volume demands.

Others include niche or specialized applications such as in event catering, where cocktail shakers are used for specific services or themed events.

By Distribution Channel Analysis

Hypermarkets & Supermarkets dominate with 48.9% share due to their wide reach and convenience for consumers.

In 2024, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Cocktail Shakers Market, with a 48.9% share. These stores provide easy access to cocktail shakers for consumers, especially those looking for quick, in-person purchases.

Online platforms have become increasingly popular for purchasing cocktail shakers, offering the convenience of home delivery and a wider range of product options. While online sales are growing, they still represent a smaller portion of the market compared to physical retail outlets.

Specialty Stores cater to consumers looking for high-end or unique cocktail shakers. These stores often carry premium brands or designer products, making them an attractive option for aficionados and professionals who require specific equipment.

Department Stores are another important distribution channel, offering a mix of products from different categories. Though not as dominant as hypermarkets and supermarkets, they provide additional convenience for customers looking for various household goods in one place.

Others, including smaller retailers and niche outlets, account for a minimal share in comparison to the major distribution channels, though they do serve specific consumer needs.

Key Market Segments

By Material

- Steel

- Plastic

- Glass

- Acrylic

- Aluminium

- Ceramic

- Others

By Capacity

- Medium (20-28 ounces)

- Small (8-20 ounces)

- Large (Above 28 ounces)

By Product Type

- Cobbler Shakers

- Boston Shakers

- French Shakers

- Others

By Application

- Individual

- Commercial

- Bars & Pubs

- Restaurants

- Hotels

- Catering Services

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Online

- Specialty Stores

- Department Stores

- Others

Drivers

Rising Home Bartending Culture Drives Market Growth

The cocktail shakers market is experiencing strong growth driven by several key factors. Home bartending has become increasingly popular as more people want to create professional-quality drinks at home. This trend has grown especially after people spent more time at home and developed new hobbies during recent years.

The premium cocktail accessories market is expanding rapidly as consumers are willing to spend more on high-quality bar tools. People now view cocktail making as a luxury experience and want tools that match this expectation. Premium shakers made from stainless steel or copper are becoming more common in home bars.

Consumers are also seeking personalized products that reflect their style and preferences. Custom engraved shakers and unique designs are gaining popularity as people want their bar tools to be both functional and decorative. This personalization trend is creating new opportunities for manufacturers.

The global expansion of bars, restaurants, and cafes is another major driver. As the hospitality industry grows worldwide, the demand for professional cocktail equipment increases. New establishments need reliable shakers to serve quality drinks to customers. This commercial demand provides steady growth for the market and encourages innovation in shaker designs and materials.

Restraints

Limited Product Awareness Creates Market Challenges

The cocktail shakers market faces several restraints that limit its growth potential. Many consumers have limited knowledge about different types of cocktail shakers available in the market. Most people are only familiar with basic shaker designs and don’t understand the benefits of specialized options like Boston shakers or cobbler shakers.

Competition from alternative cocktail-making tools poses another challenge. Electric mixers, blenders, and other automated devices are attracting consumers who want convenience over traditional shaking methods. These modern tools often promise faster results and easier cleanup, making them appealing to busy consumers.

Product durability and maintenance issues also restrict market growth. Many cocktail shakers, especially cheaper models, suffer from problems like denting, tarnishing, or seal failures. Consumers become frustrated when their shakers break quickly or require extensive cleaning and maintenance.

The lack of proper education about shaker care and usage further compounds these problems. Without understanding how to properly maintain their shakers, consumers may experience premature wear or poor performance. This leads to negative experiences that can discourage future purchases and limit word-of-mouth recommendations for cocktail shakers.

Growth Factors

Online Retail Growth Creates New Market Opportunities

The cocktail shakers market has significant growth opportunities driven by emerging trends and expanding markets. Online retail platforms have made cocktail accessories more accessible to consumers worldwide. E-commerce allows customers to browse extensive product selections, read reviews, and compare prices easily, leading to increased sales.

Hotels and resorts are increasingly adopting high-quality cocktail shakers to enhance their beverage service offerings. The hospitality industry recognizes that premium bar tools contribute to better guest experiences and can justify higher drink prices. This trend creates steady demand from commercial buyers.

The growing focus on sustainability presents opportunities for eco-friendly cocktail tools. Consumers are becoming more environmentally conscious and seek products made from recycled materials or sustainable manufacturing processes. Companies developing green alternatives can capture this growing market segment.

The Asia-Pacific region offers tremendous growth potential as beverage culture expands in countries like China, India, and Southeast Asian nations. Rising disposable incomes and growing interest in Western-style cocktails are driving demand for quality bar equipment. Local manufacturers and international brands are both positioning themselves to capitalize on this expanding market opportunity.

Emerging Trends

Smart Technology Integration Shapes Market Trends

Several trending factors are reshaping the cocktail shakers market and influencing consumer preferences. Smart technology integration is becoming more common in modern shaker designs. Some manufacturers are developing shakers with built-in timers, measurement guides, or connectivity features that help users create consistent drinks.

Minimalist and modern design aesthetics are gaining popularity among consumers who value sleek, contemporary bar tools. Clean lines, geometric shapes, and sophisticated finishes are replacing ornate traditional designs. These modern shakers appeal to younger consumers who want their bar equipment to match contemporary home decor.

Social media and influencer marketing have significantly impacted the market. Cocktail shakers frequently appear in lifestyle posts, recipe videos, and bar tutorials on platforms like Instagram and TikTok. This exposure increases brand awareness and drives consumer interest in premium shaker products.

There’s also a noticeable shift toward professional-grade tools among amateur bartenders. Home enthusiasts now want the same quality equipment used in commercial establishments. This trend has led to increased demand for heavy-duty shakers with professional features, even though they cost more than basic consumer models. Manufacturers are responding by offering commercial-quality products designed for home use.

Regional Analysis

North America Dominates the Cocktail Shakers Market with a Market Share of 38.3%, Valued at USD 280.8 Million

In 2024, North America held the largest share of the Cocktail Shakers Market, with a market value of USD 280.8 million and a dominant market share of 38.3%. This growth is driven by the region’s robust presence of bars, restaurants, and a high consumer demand for premium cocktail accessories.

The market’s expansion is also fueled by the increasing trend of home mixology and the rising popularity of cocktail culture in urban areas. North America is expected to maintain its dominance due to steady consumer spending on luxury and functional kitchenware, particularly in the United States.

Asia Pacific Cocktail Shakers Market Trends

Asia Pacific is witnessing rapid growth in the Cocktail Shakers Market, with an increasing number of consumers embracing cocktail culture and mixology. As disposable incomes rise, more individuals and bars are investing in cocktail accessories, including high-quality shakers. The region’s expanding hospitality industry, especially in China, Japan, and India, is contributing to market growth. The rising popularity of home bars is also driving demand for premium cocktail shakers, positioning Asia Pacific as a key player in the global market.

Europe Cocktail Shakers Market Trends

Europe is expected to see steady growth in the Cocktail Shakers Market, supported by a strong hospitality sector and a growing interest in craft cocktails. In 2024, the region continues to experience a strong demand for premium and stylish cocktail accessories, driven by consumers in countries like the UK, Germany, and France. The region’s established cocktail culture and the increasing number of high-end bars and restaurants contribute to the rise in demand for quality shakers, further fueling market expansion.

Middle East and Africa Cocktail Shakers Market Trends

The Middle East and Africa region is seeing a growing demand for cocktail shakers, driven by urbanization, an increase in tourism, and the rise of high-end restaurants and bars. In cities like Dubai, the luxury market is experiencing rapid growth, with upscale venues leading the way in cocktail consumption. Although the market is still emerging, it is expected to grow steadily as Western beverage culture becomes more ingrained and luxury bars continue to proliferate.

Latin America Cocktail Shakers Market Trends

The Cocktail Shakers Market in Latin America is gradually expanding, driven by a growing middle class and an increasing trend toward cocktail bars and home mixology. In countries like Brazil and Mexico, there is a rise in demand for cocktail accessories as the drinking culture evolves. While the market remains smaller compared to other regions, the popularity of cocktails and social gatherings is expected to increase the demand for cocktail shakers in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Cocktail Shakers Company Insights

In 2024, Alegacy Alessi continues to be a prominent player in the global Cocktail Shakers market, offering high-quality, durable products. Known for its classic and innovative designs, the brand attracts professional bartenders and home enthusiasts alike, driven by the growing demand for premium cocktail equipment.

Barfly by Mercer has made significant strides in the market with its focus on ergonomic design and exceptional durability. Its range of cocktail shakers is preferred by many professionals for their reliable performance and aesthetic appeal, positioning it as a go-to brand for bartending tools.

Blomus focuses on combining elegance with functionality in its cocktail shaker offerings. The German brand’s designs emphasize modern aesthetics and quality craftsmanship, appealing to consumers seeking stylish and durable products for both home use and bars, contributing to its increasing market share.

Cocktail Kingdom remains one of the leading brands, known for its wide range of high-end, professional-grade cocktail tools. The brand’s extensive selection of cocktail shakers caters to both home enthusiasts and professional bartenders, making it a top choice in the premium segment. The company is positioned to capitalize on the rising popularity of craft cocktails and mixology culture.

Top Key Players in the Market

- Alegacy Alessi

- Barfly by Mercer

- Blomus

- Cocktail Kingdom

- Crafthouse by Fortessa

- Final Touch

- Libbey

- Norpro

- Rabbit

- True Brands

Recent Developments

- In March 2024, MG Destilerías expanded its ready-to-drink (RTD) portfolio by acquiring Coppa Cocktails, enhancing its position in the premium cocktail market. This strategic acquisition supports MG Destilerías’ goal of diversifying its product offerings and increasing market reach in the growing RTD sector.

- In March 2024, OXO launched a new stainless steel cocktail shaker, designed to offer improved performance and durability for bartenders and cocktail enthusiasts alike. The launch reflects OXO’s continued commitment to enhancing user experience with high-quality, innovative products in the beverage accessories market.

- In June 2024, Libbey announced a strategic distribution partnership with Cocktail Kingdom, aiming to expand the availability of high-end cocktail tools in key markets. This collaboration positions Libbey to strengthen its presence in the premium cocktail industry, catering to both professional and home bartenders.

Report Scope

Report Features Description Market Value (2024) USD 733.4 Million Forecast Revenue (2034) USD 1325.9 Million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Plastic, Glass, Acrylic, Aluminium, Ceramic, Others), By Capacity (Medium (20-28 ounces), Small (8-20 ounces), Large (Above 28 ounces)), By Product Type (Cobbler Shakers, Boston Shakers, French Shakers, Others), By Application (Individual, Commercial, Bars & Pubs, Restaurants, Hotels, Catering Services, Others), By Distribution Channel (Hypermarkets & Supermarkets, Online, Specialty Stores, Department Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alegacy Alessi, Barfly by Mercer, Blomus, Cocktail Kingdom, Crafthouse by Fortessa, Final Touch, Libbey, Norpro, Rabbit, True Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alegacy Alessi

- Barfly by Mercer

- Blomus

- Cocktail Kingdom

- Crafthouse by Fortessa

- Final Touch

- Libbey

- Norpro

- Rabbit

- True Brands