Global Coated Paper Market By Coating Material(Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Kaolin Clay, Wax, Others), By Type(Coated Fine Paper, Standard Coated Fine Paper, Coated Groundwood Powder, Low Coat Weight Paper, Art Paper, Other), By Application(Packaging & Labeling, Printing, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 61804

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

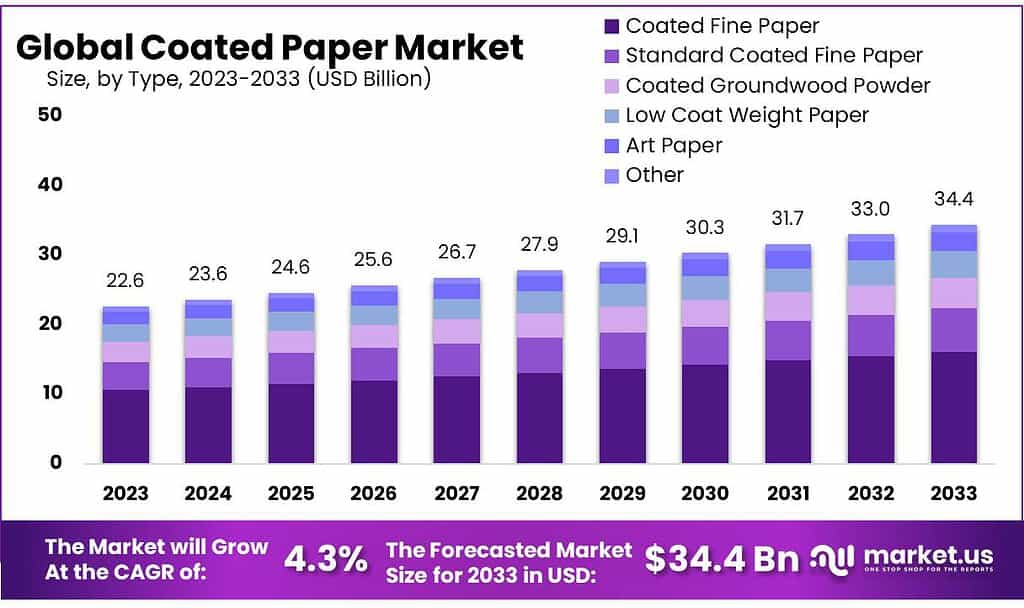

The Coated Paper Market size is expected to be worth around USD 34.4 billion by 2033, from USD 22.6 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The forecast period will see a rise in demand for packaging and advertising materials across different industries. Advertising in magazines, newspapers, brochures, catalogs, and other media has a significant impact on product demand. The market is also driven by the rise of bio-degradable packaging options.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Coated Paper Market is anticipated to grow at a CAGR of 4.3%, reaching a value of around USD 34.4 billion by 2033 from USD 22.6 billion in 2023.

- Market Drivers: High-Quality Printing Demands: Coated papers offer exceptional print quality, resisting dirt and moisture, ideal for catalogs, magazines, and ads.

- Challenges: Digital Transformation Impact: As industries shift to digital platforms, traditional paper-based mediums face declining demand.

- Opportunities: Sustainable Practices: Developing environmentally friendly coated paper options can attract eco-conscious consumers.

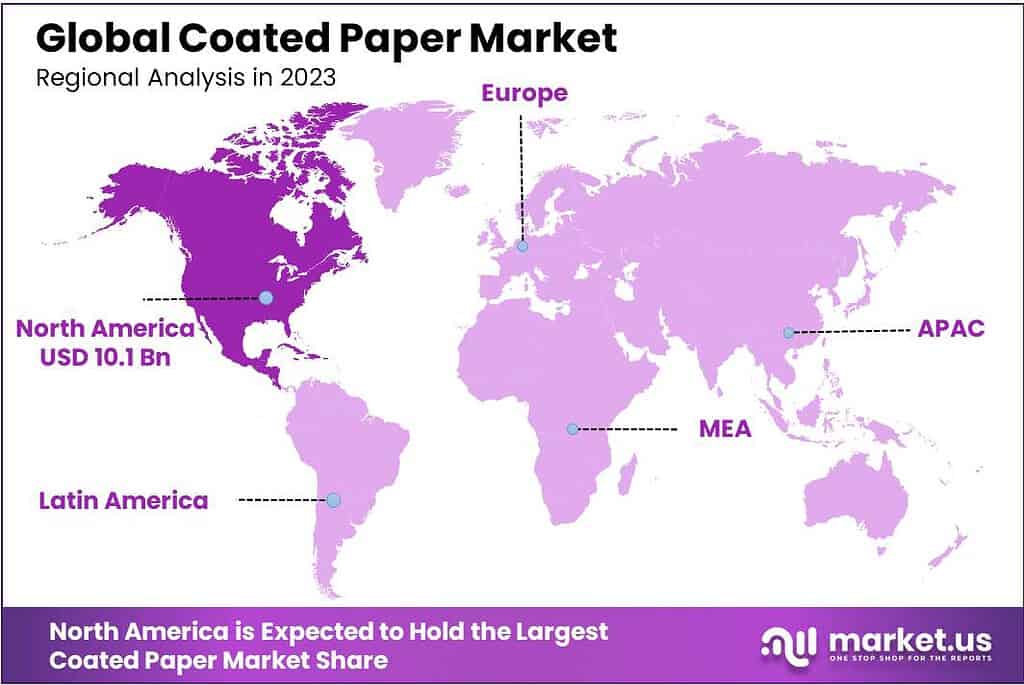

- Regional Insights: North America: Holds the highest revenue share (44.8% in 2023) due to high production rates and the presence of leading manufacturers.

- Coating Materials: Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Kaolin Clay, Wax, and others.

- Paper Types: Coated Fine Paper, Standard Coated Fine Paper, Coated Groundwood Powder, Low Coat Weight Paper, Art Paper, and others.

- Top Market Players: Leading companies like Oji Holdings Corporation, Stora Enso Oyj, Asia Pulp & Paper, Sappi Limited, and others are focusing on product innovation to retain market interest and increase their share.

By Coating Material

Ground Calcium Carbonate (GCC) is a popular choice for coating paper due to its brightness and smoothness. GCC coatings improve the paper’s printability and provide excellent ink receptivity. Precipitated Calcium Carbonate (PCC) is Another form of calcium carbonate, PCC coatings offer high brightness and opacity to paper. They improve the paper’s surface properties and print quality.

Kaolin Clay is Known for its fine particle size and platy structure, kaolin clay coatings enhance paper smoothness, ink receptivity, and brightness. They also contribute to improving print quality. Wax coatings provide specific functionalities to paper, such as water resistance, grease resistance, or barrier properties. They’re commonly used in packaging materials where moisture or oil resistance is required.

Other categories might include various materials like starch, titanium dioxide, talc, and other minerals or polymers used in specialized coating formulations to impart specific characteristics to the paper, such as improved strength, gloss, or barrier properties.

The choice of coating material depends on the desired properties of the paper, such as print quality, smoothness, brightness, opacity, and functional characteristics like water resistance or barrier properties. Market trends and environmental considerations also influence the selection of coating materials in the paper industry.

By Type

In 2023, Coated Fine Paper took the lead in the market, holding over 46.9% of the share. This type of paper is known for its high quality and is widely used in printing magazines, catalogs, and high-end brochures due to its excellent printing surface and brightness.

Standard Coated Fine Paper also made a significant mark, holding a substantial share in the market. It’s a popular choice for various printing applications, offering good printability and a balanced mix of quality and cost-effectiveness.

Coated Groundwood Paper emerged as another notable segment. This type of paper is favored for its eco-friendly nature and is commonly used in publishing and commercial printing, offering a balance between quality and affordability.

Low Coat Weight Paper gained attention due to its lightweight yet sturdy characteristics, suitable for packaging and labeling applications where durability and cost-efficiency matter.

Art Paper, distinguished by its superior quality and texture, found its niche in the market, often used for premium print products like art books, posters, and high-end publications.

Other segments encompassed diverse specialty papers catering to specific needs, such as barrier coatings for packaging, specialty finishes, or papers designed for specific printing technologies. These segments collectively contributed to the varied landscape of the coated paper market, meeting specific industry requirements and preferences.

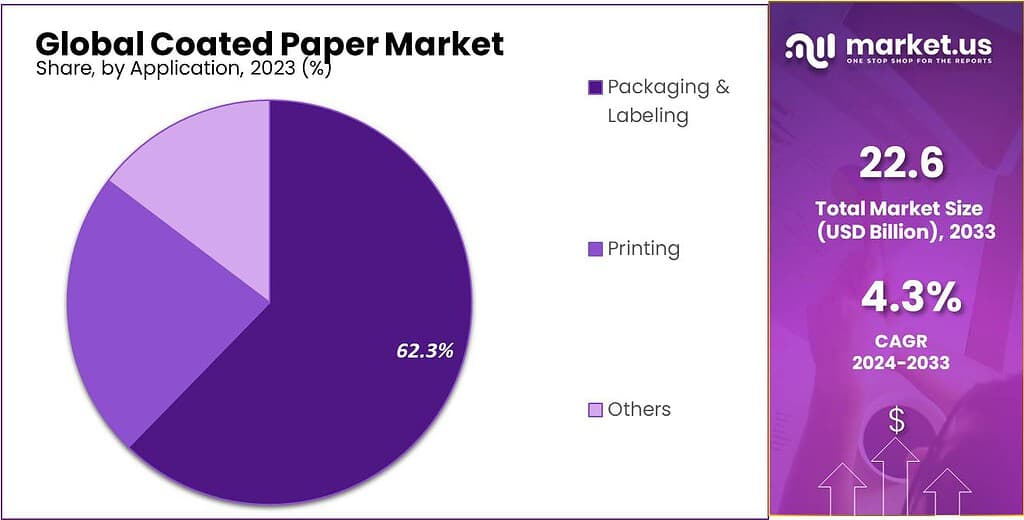

Application Analysis

In 2023, Packaging and labeling were at the forefront, securing over a 62.3% share in the coated paper market. This segment thrived due to the increasing demand for attractive and functional packaging materials across various industries like food, beverages, cosmetics, and pharmaceuticals. Coated paper’s ability to offer durability, printability, and protective features made it a top choice for packaging solutions.

Printing emerged as another significant application segment, holding a notable share in the market. Coated paper’s smooth surface and excellent printability made it a preferred option for high-quality printing purposes in magazines, brochures, catalogs, and promotional materials.

The “Others” category encompassed diverse applications, including uses in specialty products such as wallpapers, cards, and artistic prints. These specialized segments contributed to the market by catering to specific needs where coated paper’s unique properties were particularly valuable.

Overall, the dominance of Packaging and labeling underscored the pivotal role of coated paper in providing functional and visually appealing packaging solutions, while Printing and other specialized applications continued to fuel the market’s growth and diversity.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Coating Material

- Ground Calcium Carbonate (GCC)

- Precipitated Calcium Carbonate (PCC)

- Kaolin Clay

- Wax

- Others

By Type

- Coated Fine Paper

- Standard Coated Fine Paper

- Coated Groundwood Powder

- Low Coat Weight Paper

- Art Paper

- Other

By Application

- Packaging & Labeling

- Printing

- Others

Drivers

High-Quality Print Demands: Coated papers create sharp and vivid images because they reflect light well. They’re smoother than uncoated papers, leading to top-notch printing. These papers resist dirt and moisture, needing less ink to print, thanks to their non-absorbent nature. Coatings like wax, clay, and titanium oxide make the paper shine and enhance picture quality. They’re used in catalogs, magazines, and ads for their glossy or matte finish, perfect for sharp and detailed images.

Weight and Finishing Perks: Coated papers are heavier than uncoated ones, giving prints a substantial feel. Their smoothness and ink resistance make them ideal for special finishes like varnish, boosting print quality. Many big players in the paper market make these high-quality coated papers, meeting various printing needs.

Food Industry Demand: Coated papers are a big deal in the food industry. They’re used globally to wrap food items. As the world shifts away from plastic, coated papers offer a more eco-friendly option. They’re crucial for maintaining food quality and performance without reacting with the food.

Types for Different Foods: Waxed paper is great for foods like fish, meat, and chocolates due to its resistance to wetness and grease. It’s perfect for direct contact with cheeses and chocolates, helping keep them fresh. Resin-coated papers suit fresh, oily, and wet foods and are safe for food-grade bags.

Safe Food Packaging: Polyethylene-coated papers are safe for direct food contact, ensuring freshness, and protection, and meeting strict hygiene standards. They’re used in supermarkets and butcher shops to wrap meats and cheeses. These papers act as a protective shield against moisture and odors, ensuring food stays fresh.

Restraints

Shift to Digital Platforms: Industries across the board are embracing digital platforms for their operations. The convenience and ease offered by digital solutions are prompting many businesses to opt for this route. As the world undergoes a massive digital overhaul, sectors are adopting technology to ensure they stay ahead in the global market. For instance, digital businesses have expanded beyond simple online transactions, leveraging networks to create continuous value.

Online Dominance: The shift to digital means industries are providing services and information solely through websites. Manufacturers are moving towards e-brochures, online magazines, and digital annual reports. This shift from traditional paper mediums to online platforms has negatively impacted the coated paper industry. Advertisements now predominantly occur online, on television, and through social media, diminishing the growth of paper-based media.

Opportunity

Sustainable Practices: Embracing sustainability offers a significant opportunity. Developing and promoting environmentally friendly coated paper options can attract eco-conscious consumers and businesses. Innovations in recycling, use of renewable materials, and eco-friendly coatings present avenues for growth.

Specialized Applications: Exploring niche markets and specialized applications can be lucrative. Coated paper’s unique properties make it suitable for specific uses like packaging for high-end products, artistic prints, or specialized industrial applications. Targeting these segments can unlock new opportunities.

Digital-Print Synergy: Leveraging the synergy between digital and print media presents an opportunity. Integrating coated paper with digital technologies, like augmented reality or interactive print, can enhance consumer engagement and create unique user experiences.

Functional Coatings: Developing coatings that offer additional functionalities beyond print quality can open new markets. Coatings providing antimicrobial properties, smart packaging features, or interactive elements can expand the utility of coated paper in various industries.

Emerging Markets: Exploring emerging markets and regions where the demand for quality printed materials is growing presents a substantial opportunity. Tailoring coated paper products to suit the needs and preferences of these markets can drive significant growth.

Brand Differentiation: Coated paper offers opportunities for brands to differentiate themselves. Creating unique textures, and finishes, or incorporating innovative design elements can attract consumers seeking distinct and premium printed materials.

Challenges

Digital Transformation: The widespread shift to digital platforms across industries poses a significant challenge. As businesses increasingly rely on digital mediums for advertising, communication, and information dissemination, the demand for traditional paper-based media, like coated paper, diminishes. Adapting to this digital shift while maintaining relevance is a substantial challenge for the coated paper market.

Environmental Concerns: The paper industry, including coated paper production, faces scrutiny due to environmental concerns. Despite efforts to adopt sustainable practices and use eco-friendly materials, the industry grapples with issues related to deforestation, energy consumption, and waste management. Balancing the demand for paper products with sustainable practices remains a significant challenge.

Competing Materials: Coated paper competes with alternative materials such as plastics, films, and digital displays. These materials offer different functionalities and environmental benefits, presenting a challenge for coated paper to demonstrate its unique value proposition and maintain its market share.

Cost Pressures: Fluctuating raw material prices, energy costs, and global economic conditions can impact the production costs of coated paper. Maintaining cost-effectiveness while meeting quality standards is a persistent challenge faced by manufacturers.

Changing Consumer Preferences: Evolving consumer preferences and behaviors, such as a growing emphasis on digital content consumption, influence the demand for printed materials. Understanding and adapting to these changing preferences is crucial for sustaining market relevance.

Regional Analysis

North America held the highest revenue share at over 44.8% in 2023. This is due to the country’s high production rates. Many of the world’s leading manufacturers are also located here, which has allowed for large-scale production.

North America is projected to see a 3.5% annual growth rate in revenue from 2023-2032. Corporation profit is a key contributor to the U.S. Economy. Therefore, businesses heavily rely on paper products which offer significant growth potential.

The Asia Pacific is expected to show a revenue-based growth rate of 3.7% between 2023-2032, due to increased production and consumption in the global market for coated paper. It is home to some of the most important paper-consuming countries, such as India and China. This has increased the potential for the product to be used in many industries. The region’s booming e-commerce sector has also fueled product demand for printing and packaging goods. Advertising and print media are also growing markets.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

To retain consumers’ interest and increase market share, the top players have focused on product innovation. Players have a lucrative opportunity to capitalize on the increasing preference for biobased papers across the majority of regions.

Key Market Players

- Oji Holdings Corporation

- Stora Enso Oyj

- Paradise Packaging Pvt. Ltd

- Asia Pulp & Paper

- Sappi Limited

- UPM-Kymmene Corp

- Minerals Technologies Inc.

- Nippon Paper Industries Co. Ltd

- Shree Krishna Paper Mills & Industries Ltd

- Emami Group

- NewPage Corporation

- Burgo Group SpA

- JK Paper Ltd

- Arjowiggins SAS

- Ballarpur Industries Limited

Recent Development

July 2022: BASF completed the installation and start-up of a state-of-the-art acrylic dispersions production line in Dahej, India, serving the coatings, construction, adhesives, and paper industries for the South Asian markets.

June 2022: Confoil and BASF cooperated to develop a certified compostable and dual ovenable food tray based on paper. The paper tray is coated on the inside with BASF’s ecovio PS 1606, a partly bio-based and certified compostable biopolymer especially developed for coating food packaging made of paper or board.

Report Scope

Report Features Description Market Value (2023) USD 22.6 Billion Forecast Revenue (2033) USD 34.4 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Material(Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC), Kaolin Clay, Wax, Others), By Type(Coated Fine Paper, Standard Coated Fine Paper, Coated Groundwood Powder, Low Coat Weight Paper, Art Paper, Other), By Application(Packaging & Labeling, Printing, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Stora Enso Oyj, Paradise Packaging Pvt. Ltd, Asia Pulp & Paper, Sappi Limited, UPM-Kymmene Corp, Minerals Technologies Inc., Nippon Paper Industries Co. Ltd, Shree Krishna Paper Mills & Industries Ltd, Emami Group, NewPage Corporation, Oji Holdings Corporation, Burgo Group SpA, JK Paper Ltd, Arjowiggins SAS, Ballarpur Industries Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is coated paper?Coated paper is a type of paper that has been coated with a surface layer or layers of minerals, polymers, or compounds to enhance its properties, such as smoothness, gloss, and printability.

Can coated paper be recycled?Yes, many coated papers are recyclable, but the recycling process might differ from standard uncoated paper. Some coatings may require specialized recycling methods.

What industries commonly use coated paper?Printing and Publishing: Magazines, brochures, and high-quality catalogs. Packaging: Boxes, cartons, and labels for consumer products. Advertising and Promotional Materials: Posters, flyers, and promotional literature.

-

-

- Oji Holdings Corporation

- Stora Enso Oyj

- Paradise Packaging Pvt. Ltd

- Asia Pulp & Paper

- Sappi Limited

- UPM-Kymmene Corp

- Minerals Technologies Inc.

- Nippon Paper Industries Co. Ltd

- Shree Krishna Paper Mills & Industries Ltd

- Emami Group

- NewPage Corporation

- Burgo Group SpA

- JK Paper Ltd

- Arjowiggins SAS

- Ballarpur Industries Limited