Coagulation Markers Market By Product (D-dimer assays, Fibrinogen assays, Prothrombin time (PT) / Activated partial thromboplastin time (aPTT) assays, Thrombin generation assays, Others), By Sample Type (Plasma, Serum, Whole blood, Others), By End-User (Hospitals, Diagnostic laboratories, Specialty clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166930

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

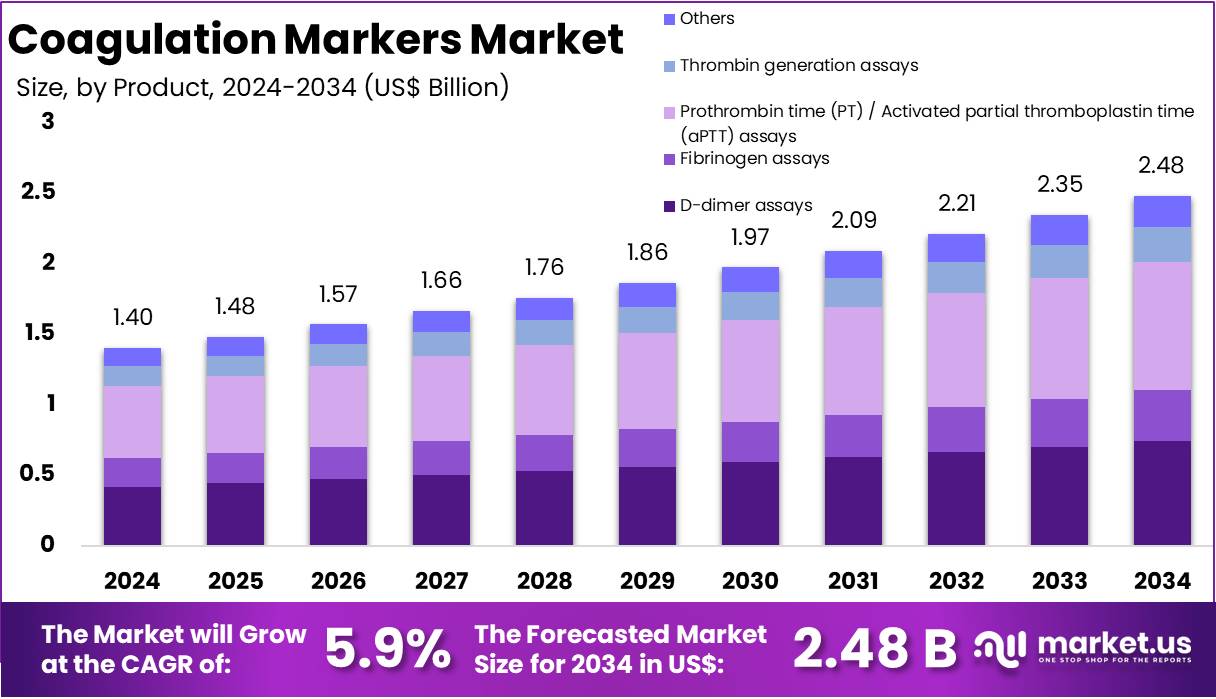

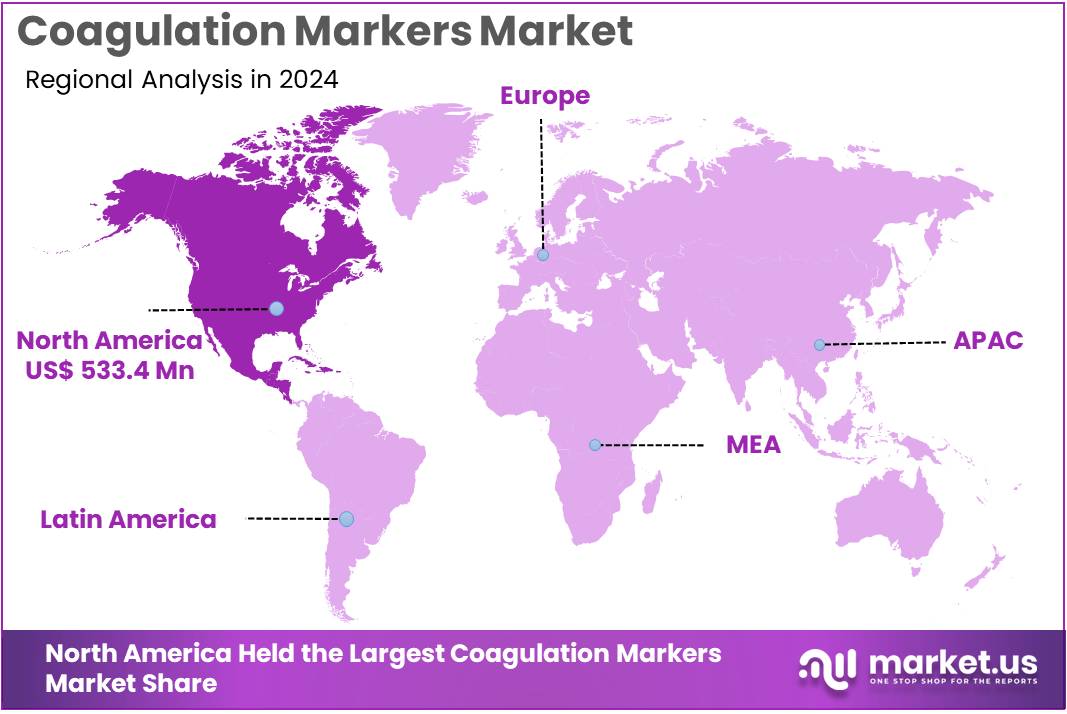

The Coagulation Markers Market size is expected to be worth around US$ 2.48 billion by 2034 from US$ 1.40 billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.1% share and holds US$ 533.4 Million market value for the year.

The Coagulation Markers Market represents a critical segment of the global diagnostics industry, focused on evaluating abnormalities in blood clot formation, bleeding risk, and thrombotic complications. Coagulation biomarkers such as D-dimer, fibrinogen, prothrombin fragments, thrombin-antithrombin complexes, and PT/aPTT indicators are widely used across hospitals, emergency departments, and diagnostic laboratories to guide clinical decision-making.

Rising cases of venous thromboembolism (VTE), deep vein thrombosis (DVT), pulmonary embolism (PE), cardiovascular disorders, and surgical bleeding complications continue to expand demand for precise clotting assessments. For instance, D-dimer assays are routinely used as a frontline test in emergency units to rule out DVT and PE, while fibrinogen levels are measured during major surgeries, trauma care, and obstetric emergencies to monitor bleeding risk.

Technological advancements, including high-sensitivity immunoassays, point-of-care (POC) coagulation devices, and automated coagulation analyzers, are strengthening market adoption by improving test speed and analytical reliability. Portable coagulation monitors used by patients on warfarin or DOAC therapy further illustrate the shift toward decentralized testing models. During the COVID-19 pandemic, D-dimer became an essential prognostic marker for assessing disease severity, reinforcing global awareness of coagulation indicators. Growing oncology cases also contribute to market growth, as cancer patients frequently experience hypercoagulability requiring continuous monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 40 billion, with a CAGR of 5.9%, and is expected to reach US$ 2.48 billion by the year 2034.

- The Product segment is divided into D-dimer assays, Fibrinogen assays, Prothrombin time (PT) / Activated partial thromboplastin time (aPTT) assays, Thrombin generation assays, and Others, with Prothrombin time (PT) / Activated partial thromboplastin time (aPTT) assays taking the lead in 2024 with a market share of 36.5%.

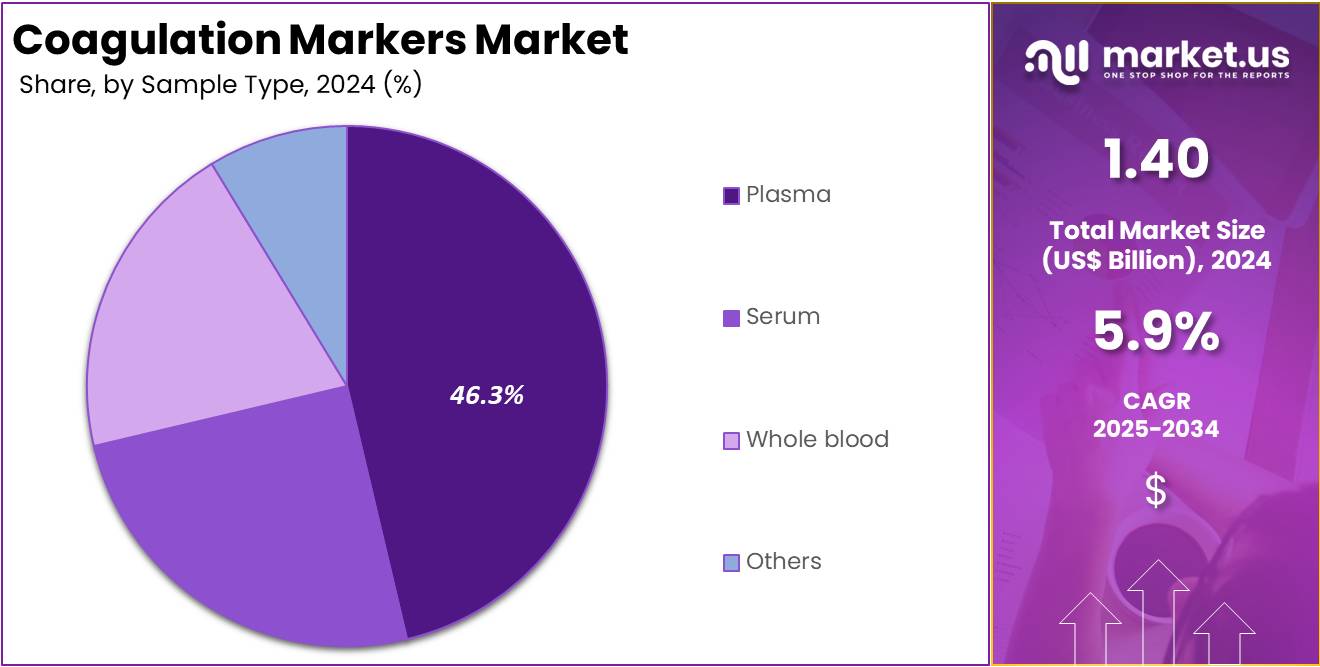

- The Sample Type segment is divided into Plasma, Serum, Whole blood, and Others, with Plasma taking the lead in 2024 with a market share of 46.3%

- The End-User segment is divided into Hospitals, Diagnostic laboratories, Specialty clinics, and Others, with Hospitals taking the lead in 2024 with a market share of 52.4%

- North America led the market by securing a market share of 38.1% in 2024.

Product Analysis

PT and aPTT assays dominated the coagulation markers market with accounting for 36.5% market share because they serve as the fundamental screening tools for assessing clotting function across diverse clinical settings. These tests are routinely used in hospitals for evaluating bleeding disorders, monitoring anticoagulant therapy, and determining surgical readiness, making them essential components of coagulation profiling. Their dominance is strongly supported by widespread clinical adoption and long-established usage guidelines that position PT/aPTT as the first-line assessment for patients at risk of abnormal coagulation.

Additionally, the tests are relatively affordable, available on nearly all automated analyzers, and produce rapid results, supporting their integration in emergency medicine, critical care, and perioperative workflows. Conditions such as liver disease, inherited bleeding disorders, and treatment monitoring for warfarin require frequent PT/aPTT measurement, further contributing to market share. Hospitals rely on these assays daily, generating high test volumes that surpass more specialized markers. Their relevance was highlighted during the COVID-19 pandemic, when clinicians used PT/aPTT values to monitor coagulopathy progression and guide anticoagulant dosing.

Sample Type Analysis

Plasma dominated the coagulation markers market with 46.3% market share because most coagulation assays require plasma-derived samples to ensure accurate measurement of clotting factors and related biomarkers. Plasma contains fibrinogen, coagulation proteins, and enzyme complexes necessary for evaluating thrombotic or bleeding risk, making it the preferred matrix for D-dimer, fibrinogen, PT/aPTT, and thrombin generation assays.

Laboratories worldwide rely on plasma due to its stability, reproducibility, and compatibility with automated analyzers, which form the backbone of modern coagulation testing. Plasma samples enable standardized testing conditions, minimizing variability that can arise from whole blood or serum. Specialty tests used in surgical monitoring, trauma care, or disseminated intravascular coagulation assessment also depend on plasma because it preserves clotting factor integrity better than other sample types.

Plasma’s dominance extends to high-throughput lab workflows where efficiency and precision are essential for processing large volumes of diagnostic tests. The widespread use of plasma in transfusion medicine and hematology further strengthens its relevance. As clinical demand for advanced coagulation markers continues to grow, plasma remains the preferred sample type due to its compatibility with next-generation immunoassays, microfluidic platforms, and automated analyzers, reinforcing its leading market position.

End-User Analysis

Hospitals dominate the coagulation markers market covering about 52.4% share because they represent the primary point of care for patients with acute or complex clotting disorders requiring immediate diagnostic evaluation. Emergency departments, intensive care units, and surgical theaters rely heavily on coagulation testing for rapid decision-making in situations such as suspected pulmonary embolism, trauma-related coagulopathy, perioperative bleeding, or cardiovascular events.

Hospitals perform the highest test volumes, covering routine PT/aPTT monitoring, D-dimer screening, fibrinogen assessment during major surgeries, and comprehensive coagulation panels for high-risk patients. Their ability to integrate advanced automated analyzers enables faster turnaround times, which are essential for managing time-sensitive conditions like deep vein thrombosis or disseminated intravascular coagulation.

Hospitals also manage patients on anticoagulant therapies, including warfarin and direct oral anticoagulants, requiring frequent coagulation monitoring. Large inpatient populations, expanded diagnostic capabilities, and the presence of multidisciplinary care teams contribute to the consistent demand for coagulation marker tests within hospital settings.

Key Market Segments

By Product

- D-dimer assays

- Fibrinogen assays

- Prothrombin time (PT) / Activated partial thromboplastin time (aPTT) assays

- Thrombin generation assays

- Others

By Sample Type

- Plasma

- Serum

- Whole blood

- Others

By End-User

- Hospitals

- Diagnostic laboratories

- Specialty clinics

- Others

Drivers

Rising Burden of Thrombotic Disorders and Cardiovascular Events

The rising global burden of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), atrial fibrillation-related stroke risk, and coronary artery disease continues to act as a major driver for the coagulation markers market. With more people developing conditions linked to abnormal clot formation, clinicians increasingly rely on biomarkers such as D-dimer, fibrinogen, prothrombin fragments, and thrombin-antithrombin complexes to guide diagnosis, risk stratification, and monitoring.

For example, D-dimer tests are routinely used in emergency departments worldwide to rule out life-threatening PE and DVT, which has driven recurring demand for rapid, high-sensitivity assays. Aging populations further accelerate this trend because elderly individuals are more prone to coagulopathy due to chronic diseases, reduced mobility, surgical interventions, and comorbidities such as cancer or infections.

The COVID-19 pandemic reinforced the need for coagulation markers when elevated D-dimer levels became a key prognostic indicator for severe disease progression. This created widespread adoption of point-of-care (POC) coagulation tests in hospitals and critical-care units for continuous monitoring.

Governments and healthcare organizations increasingly recommend early screening protocols for clotting disorders in high-risk groups, boosting test volumes. Moreover, the growing adoption of anticoagulant therapies (warfarin, DOACs) requires routine coagulation assessment to ensure patient safety. As chronic disease prevalence and cardiovascular events continue to rise, coagulation markers remain central to early detection, treatment planning, and clinical decision-making, supporting sustained market growth.

Restraints

Limited Standardization and High Variability Across Assay Devices

One of the major restraints in the coagulation markers market is the lack of global standardization across testing platforms, reagents, and methodologies. Coagulation biomarker assays—particularly D-dimer, fibrinogen, and PT/aPTT tests—often produce varying numerical values depending on the manufacturer, instrumentation, and calibration processes. This variability complicates clinical interpretation, especially for conditions requiring precise thresholds.

For instance, different D-dimer kits use distinct measurement units (e.g., FEU vs D-dimer units), making it difficult to compare results across laboratories. In emergency medicine, this can delay accurate diagnosis of DVT or PE, reducing clinician confidence in test results. Another standardization challenge occurs in fibrinogen assays, where Clauss method results may differ significantly from immunoassay-based measurements due to differences in reagent composition.

Laboratories managing anticoagulation therapy monitoring also struggle with variability in PT/INR values due to differences in thromboplastin reagents, potentially affecting dosing decisions. Smaller healthcare centers face additional burdens because advanced platforms with standardized protocols are costly to adopt. High costs associated with laboratory automation, maintenance, and reagents limit adoption in low-income regions.

Training requirements add another layer of complexity, as incorrect handling or calibration directly affects assay accuracy. Without harmonized testing protocols, clinical guidelines remain harder to implement consistently across countries. Regulatory bodies have recognized these disparities, but achieving universal assay harmonization remains a slow process. Association for Diagnostics & Laboratory Medicine (ADLM) released new guidance on coagulation testing in patients on blood-thinners, clarifying recommended protocols for monitoring patients taking direct oral anticoagulants (DOACs).

Opportunities

Expansion of Point-of-Care (POC) Coagulation Testing in Emergency and Home-Based Care

A major growth opportunity exists in the rapid expansion of point-of-care coagulation testing, driven by the shift toward decentralized healthcare, emergency medicine needs, and home-based disease management. POC coagulation devices allow clinicians and patients to obtain immediate results without requiring a central laboratory, enabling faster medical decisions. This is particularly valuable in emergency rooms, ambulances, outpatient clinics, military settings, and remote or resource-limited locations.

For example, handheld D-dimer analyzers help emergency teams quickly assess suspected pulmonary embolism cases, reducing waiting times and improving triage accuracy. Patients on warfarin or other anticoagulant therapies can monitor PT/INR levels at home using portable devices, improving adherence while reducing hospital visits. This is beneficial for elderly patients with mobility challenges. Surgical centers and trauma units also rely increasingly on POC tests to monitor real-time clot formation and bleeding risk during operations.

Governments and healthcare systems investing in telemedicine and home-monitoring ecosystems further fuel demand for easy-to-use coagulation test devices. The rise of chronic cardiovascular conditions and cancer therapies—which both require coagulation monitoring—supports this shift. Manufacturers have an opportunity to innovate with cartridge-based, AI-integrated, and Bluetooth-enabled POC diagnostics that sync results with electronic health records or patient apps. As healthcare moves toward convenience, speed, and decentralized diagnostic solutions, POC coagulation testing stands out as one of the most promising revenue and technology expansion opportunities in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a notable influence on the trajectory of the coagulation markers market, shaping demand patterns, supply-chain stability, and technological adoption across regions. Economic fluctuations, particularly in developing markets, affect healthcare spending and limit the ability of hospitals and laboratories to invest in advanced coagulation analyzers, high-sensitivity assays, and automated platforms.

During periods of inflation or currency devaluation, procurement of imported diagnostic equipment becomes more expensive, slowing market penetration for premium coagulation systems. Health systems with constrained budgets often rely on basic PT/aPTT assays rather than adopting specialized testing such as thrombin generation or multiplex panels, resulting in uneven global adoption.

Geopolitical instability—such as regional conflicts, trade restrictions, and sanctions—further impacts manufacturing and distribution networks. Many coagulation reagents, microfluidic cartridges, and analyzer components are produced in geographically concentrated hubs. Disruptions in these regions can delay supply availability, increase shipping costs, and create shortages of critical diagnostic consumables. For example, conflict-driven interruptions in raw material supplies or restricted cargo routes can disproportionately affect low-income nations dependent on imported diagnostic products. These challenges also highlight the importance of localized production, encouraging governments to strengthen domestic diagnostic manufacturing capabilities.

Pandemic-scale events, such as COVID-19, demonstrated both vulnerability and opportunity. Sudden surges in demand for D-dimer tests placed pressure on global supply chains while simultaneously accelerating investment in automated testing, critical-care diagnostics, and point-of-care coagulation devices. Geopolitical collaborations, such as cross-border research partnerships and harmonization of regulatory pathways, also shape innovation cycles.

Latest Trends

Adoption of High-Sensitivity and Multiplex Coagulation Biomarker Panels

A key trend shaping the market is the adoption of high-sensitivity and multiplex coagulation marker panels, reflecting the industry’s shift toward precision diagnostics, personalized therapy, and integrated disease profiling. Instead of performing single biomarker tests—for example, only D-dimer—clinicians increasingly prefer combined panels that assess several markers simultaneously, such as fibrinogen, thrombin generation, prothrombin fragments, plasmin-antiplasmin complexes, and P-selectin. This helps build a more comprehensive picture of a patient’s coagulation status.

Multiplex panels are particularly valuable in complex disorders like sepsis-induced coagulopathy, trauma-associated bleeding, cancer-related thrombosis, and peri-operative risk assessment. High-sensitivity assays improve early detection, especially in patients with mild or borderline presentations where traditional tests may miss subtle abnormalities. Advances in immunoassay technology, microfluidics, and mass spectrometry-based proteomics have enabled manufacturers to design smaller, faster, and more accurate systems.

For instance, next-generation chemiluminescent assays deliver lower detection limits and improved reproducibility. Many hospitals now integrate automated coagulation analyzers into larger laboratory information systems, allowing real-time analytics and decision-support tools to guide treatment. AI-driven interpretation algorithms are emerging, helping clinicians predict clot risk based on combined biomarker profiles rather than relying on single test values.

Regional Analysis

North America is leading the Coagulation Markers Market

In 2024, North America held a dominant market position, capturing more than a 38.1% share and holds US$ 533.4 Million market value for the year.. North America represents the largest regional market for coagulation markers due to its well-established healthcare infrastructure, high diagnostic testing volumes, and strong clinical adoption of advanced coagulation assays.

Hospitals and emergency care centers across the United States routinely perform D-dimer, PT/aPTT, and fibrinogen tests as part of standard diagnostic protocols for cardiovascular diseases, trauma care, and thrombotic events. The region’s aging population and increasing prevalence of chronic diseases, including cancer and obesity-related clotting complications, further increase demand for continuous coagulation monitoring.

High surgical procedure rates also contribute to elevated usage of coagulation markers during perioperative risk assessment. The strong presence of leading diagnostic manufacturers enables early adoption of automated analyzers, high-sensitivity immunoassays, and point-of-care coagulation devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the coagulation markers market, driven by rising healthcare investments, expanding diagnostic laboratory networks, and increasing awareness of thrombotic disorders. Countries such as China, Japan, and South Korea are experiencing rapid growth in the incidence of cardiovascular diseases, diabetes, stroke, and cancer, all of which require frequent coagulation monitoring.

The expansion of emergency care systems and higher surgical rates across urban centers are also accelerating adoption of PT/aPTT and D-dimer assays. Many Asia Pacific nations are modernizing laboratory infrastructure with automated coagulation analyzers to improve diagnostic accuracy and turnaround time. Additionally, large population bases and growing health insurance coverage create significant testing demand. The region is also investing in domestic production of diagnostic reagents and devices, reducing dependence on imports and shortening supply chains.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific Inc., Werfen (Instrumentation Laboratory), Beckman Coulter Inc. (Danaher), Helena Laboratories, Nihon Kohden Corporation, Diagnostica Stago S.A., Quidel Corporation, CTK Biotech Inc., and Other key players.

Roche Diagnostics plays a major role in coagulation testing through advanced immunoassays and automated analyzers used for D-dimer, PT/aPTT, and fibrinogen assessment. Its high-sensitivity platforms support emergency medicine, cardiovascular diagnostics, and integrated laboratory workflows worldwide. Siemens Healthineers leads the coagulation markers space with comprehensive hemostasis systems and reagents, including PT/aPTT, D-dimer, and specialty assays.

Its automation-focused platforms enhance diagnostic accuracy, workflow efficiency, and high-volume processing for hospitals and centralized laboratories globally. Abbott Laboratories contributes significantly through point-of-care coagulation devices and laboratory immunoassay solutions enabling fast D-dimer and PT/INR testing. Its portable systems support decentralized care, while its clinical analyzers strengthen coagulation monitoring across emergency, outpatient, and chronic disease management settings.

Top Key Players in the Coagulation Markers Market

- Roche Diagnostics

- Siemens Healthineers

- Abbott Laboratories

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Werfen (Instrumentation Laboratory)

- Beckman Coulter Inc. (Danaher)

- Helena Laboratories

- Nihon Kohden Corporation

- Diagnostica Stago S.A.

- Quidel Corporation

- CTK Biotech Inc.

- Other key players

Recent Developments

- In March 2025: Werfen announced the North American commercial launch of the ACL TOP Family 70 Series Hemostasis Testing Systems following FDA 510(k) clearance and Health Canada licensure.

- In February 2024: Roche announced the launch of three new coagulation tests designed specifically for monitoring oral Factor Xa inhibitors apixaban, edoxaban and rivaroxaban in CE-marked countries. These anticoagulants were added to the WHO Model List of Essential Medicines in 2019, reflecting their clinical importance. The new tests expand Roche’s coagulation testing menu, enabling more precise monitoring of patients on these anticoagulants and addressing growing demand for tailored therapeutic monitoring in anticoagulant-treated populations.

- In April 2024: Siemens Healthineers announced that it and Sysmex Corporation are distributing the combined hemostasis testing portfolio under their respective brands in the U.S. and Europe.

Report Scope

Report Features Description Market Value (2024) US$ 1.40 billion Forecast Revenue (2034) US$ 2.48 billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (D-dimer assays, Fibrinogen assays, Prothrombin time (PT) / Activated partial thromboplastin time (aPTT) assays, Thrombin generation assays, Others), By Sample Type (Plasma, Serum, Whole blood, Others), By End-User (Hospitals, Diagnostic laboratories, Specialty clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific Inc., Werfen (Instrumentation Laboratory), Beckman Coulter Inc. (Danaher), Helena Laboratories, Nihon Kohden Corporation, Diagnostica Stago S.A., Quidel Corporation, CTK Biotech Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Roche Diagnostics

- Siemens Healthineers

- Abbott Laboratories

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Werfen (Instrumentation Laboratory)

- Beckman Coulter Inc. (Danaher)

- Helena Laboratories

- Nihon Kohden Corporation

- Diagnostica Stago S.A.

- Quidel Corporation

- CTK Biotech Inc.

- Other key players