Global CNC Machines Market Size, Share, Growth Analysis By Type (Lathe Machines, Milling Machines, Laser Machines, Welding Machines, Winding Machines, Other Types), By End-User (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 16374

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

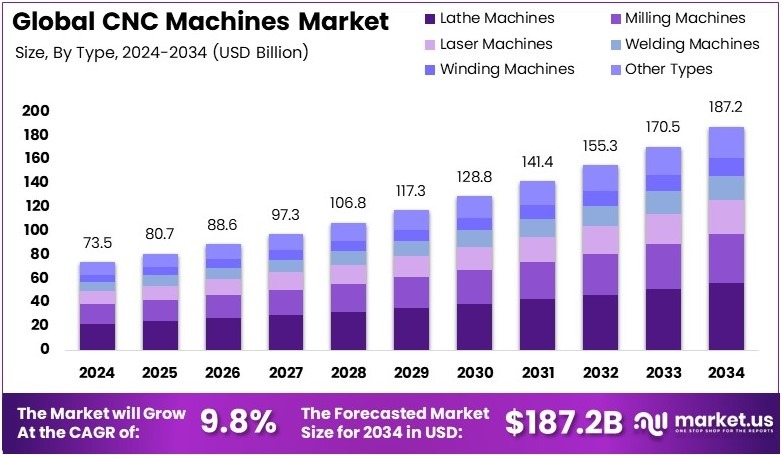

The Global CNC Machines Market size is expected to be worth around USD 187.2 Billion by 2034, from USD 73.5 Billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034.

CNC machines are automated tools that operate via computer numerical control. They perform precise cutting, drilling, and shaping of materials. These machines enhance production efficiency and quality. CNC technology is used in metal, wood, and plastic manufacturing. They reduce manual labor and improve consistency in complex manufacturing tasks across industries.

The CNC machines market involves the trading of computer-controlled manufacturing tools. It includes manufacturers, distributors, and service providers. The market growth is supported by demand for automation and precision engineering. Investments in technology and increasing production needs drive market expansion. Competitive pricing and innovation are key factors influencing the industry.

The CNC machines market is pivotal in enhancing manufacturing efficiency, particularly as many firms currently operate at only 60-80% efficiency. This underperformance is often due to the production of defective goods and the use of substandard raw materials. The adoption of CNC technology significantly mitigates these issues by ensuring precision and reducing waste.

Furthermore, the demand for CNC machines is growing as industries seek more reliable and efficient production methods. This technology not only offers substantial opportunities for manufacturers to improve output but also increases the overall competitiveness of the market. Government regulations and investments in advanced manufacturing technology further amplify this trend, highlighting a shift towards more innovative production landscapes.

Additionally, the impact of CNC machines extends beyond individual factories, influencing the broader manufacturing sector on a global scale. Locally, these machines contribute to job creation and skills development, as workers need to manage and maintain sophisticated equipment. Thus, CNC technology not only revolutionizes production capabilities but also significantly enhances economic growth in manufacturing-heavy regions.

Key Takeaways

- CNC Machines Market was valued at USD 73.5 Billion in 2024 and is expected to reach USD 187.2 Billion by 2034, growing at a 9.8% CAGR.

- In 2024, Lathe Machines led the type segment with 30%, owing to their widespread use in metal and wood processing.

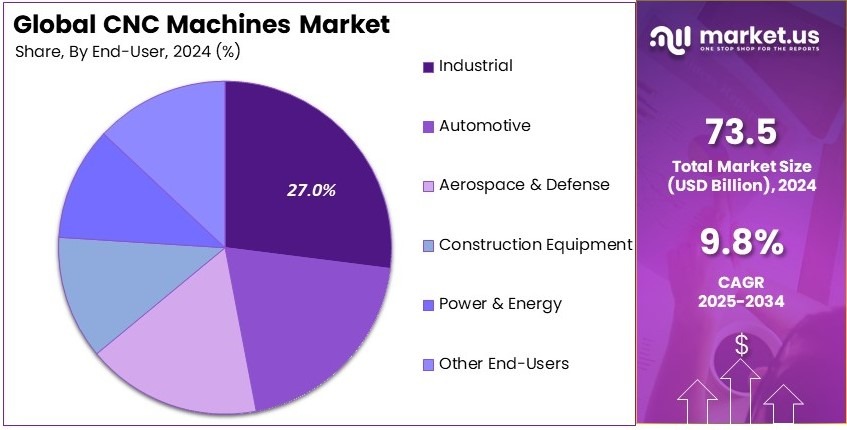

- In 2024, Industrial Applications accounted for 27% of the end-user segment, driven by automation trends and precision machining requirements.

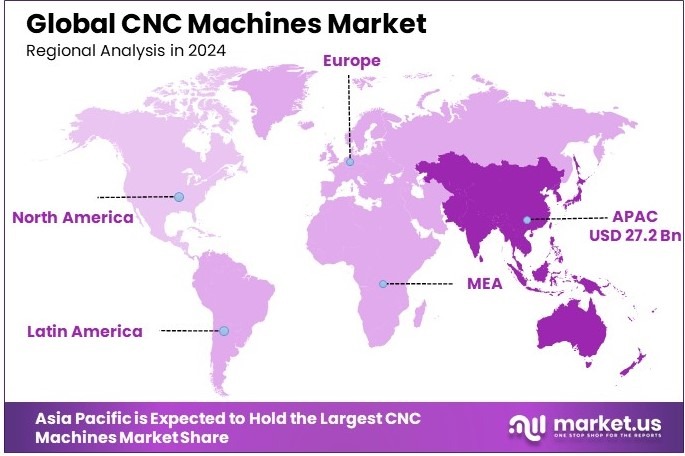

- In 2024, Asia Pacific dominated with a 37% share and a market value of USD 27.20 Billion, supported by strong industrial manufacturing growth.

Type Analysis

Lathe Machines dominate with 30% due to their versatility and precision in metal shaping.

Lathe Machines, as a significant component of the CNC Machines market, have secured a dominant position with a 30% market share in 2024. This segment’s leadership is primarily due to the essential role these machines play in precision metalworking, where they perform various operations such as cutting, sanding, knurling, and drilling, all with exceptional accuracy. The versatility of lathe machines makes them indispensable in the manufacturing of complex designs, contributing substantially to their market prevalence.

Milling Machines are critical for their ability to remove material from workpieces, making them vital for producing high-precision parts. Their adaptability to different materials and complex cutting tasks underlines their importance in growth within the CNC sector.

Laser Machines provide advanced cutting technology that offers high precision and speed, making them preferred for applications requiring fine detail and quick production times. Their contribution to the market’s expansion is marked by their efficiency and the high-quality results they produce.

Welding Machines in the CNC domain are essential for joining metal parts with precision. Their role in fabricating strong, durable joints is critical for constructions and machinery across various industries, highlighting their utility and growth influence.

Winding Machines are used to wind wire into coils, essential for electrical machinery and transformers. Their specialized application underscores their niche but vital role in the broader market landscape.

Other Types of CNC machines include grinders and routers, each serving unique functions that cater to specific needs within the manufacturing and fabrication industries. These machines support the sector’s diversity and technological evolution.

End-User Analysis

Industrial Applications dominate with 27% due to the extensive use of CNC machines in various manufacturing processes.

Industrial applications of CNC machines have emerged as the predominant segment in the end-user category, capturing 27% of the market in 2024. This dominance is driven by the broad adoption of CNC technology in manufacturing sectors due to its ability to enhance precision, reduce waste, and increase efficiency in production processes. Industries ranging from automotive to electronics rely heavily on CNC machines to meet the exacting standards of modern production lines.

Automotive uses CNC machines extensively for producing intricate and durable components. The precision and speed of CNC technology are crucial for meeting the automotive industry’s high standards and production volumes, making this a key growth area within the market.

Aerospace & Defense require the utmost precision in component manufacturing, making CNC machines indispensable for producing complex aerospace parts. This segment’s reliance on advanced machining technology underpins its significant contribution to the growth of the CNC market.

Construction Equipment benefits from the robust capabilities of CNC machines to produce heavy-duty parts. The durability and precision required in construction machinery are well-supported by CNC technologies, enhancing this segment’s growth.

Power & Energy sector utilizes CNC machines for manufacturing components that must meet high-quality standards for energy generation and distribution systems, reflecting the critical role of CNC technology in supporting infrastructure.

Other End-Users include sectors like healthcare and consumer goods, where CNC machines are increasingly used to produce specialized parts, demonstrating the versatility and expanding reach of CNC technology across different industries.

Key Market Segments

By Type

- Lathe Machines

- Milling Machines

- Laser Machines

- Welding Machines

- Winding Machines

- Other Types

By End-User

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Other End-Users

Driving Factors

Smart Manufacturing and Customization Drives Market Growth

The CNC machines market is growing steadily due to increasing demand for advanced manufacturing solutions. A key factor is the rising need for precision in sectors like aerospace and medical devices. These industries require high-accuracy components, and CNC machines offer consistent quality at scale. For example, jet engine parts and orthopedic implants often depend on CNC machining for detailed shaping.

In addition, the rise of Industry 4.0 is transforming how manufacturers operate. Many production facilities now integrate CNC machines with digital systems for real-time monitoring and control. This makes processes faster and more efficient. At the same time, more businesses are automating their metal fabrication and prototyping tasks. CNC machines play a vital role in this shift, helping reduce manual work and improve productivity.

Another driving factor is the growing focus on mass customization. Companies across automotive, consumer goods, and electronics are moving toward flexible production. CNC machines allow manufacturers to switch between product designs quickly without large retooling costs.

Restraining Factors

System Costs and Integration Barriers Restrain Market Growth

Despite strong market demand, several challenges continue to hold back the growth of CNC machines. High setup costs remain a major concern. Multi-axis CNC systems require significant upfront investment, which can be difficult for small and mid-sized firms. This limits access to the technology, especially in developing regions.

Additionally, integrating CNC machines into older manufacturing setups is complex. Many factories still use outdated infrastructure that doesn’t support advanced automation. This results in delays and additional costs during upgrades.

Cybersecurity risks also create concerns. As more CNC systems connect to the internet, they become vulnerable to digital threats. A cyberattack on a connected machine could halt production or corrupt product data. These threats demand new investments in secure software and training.

Furthermore, global supply chain disruptions are affecting machine availability. Delays in sourcing motors, control systems, and precision tools slow down delivery schedules and project timelines. For instance, during recent global shortages, many CNC suppliers reported extended lead times.

Growth Opportunities

Hybrid Tech and Remote Access Provides Opportunities

The CNC machines market is seeing new opportunities through evolving technologies and user needs. A key area is the rise of hybrid manufacturing, which blends additive and subtractive processes. CNC systems that support both types can offer faster prototyping and more flexible production. This is especially useful in aerospace and tool-making industries where complex parts are needed.

Compact CNC machines are also gaining popularity. These smaller systems are ideal for startups and small manufacturers with limited space and budget. They support local production and are easier to maintain, making them attractive for growing businesses.

Artificial intelligence is opening more doors, too. AI-powered tool path optimization is helping reduce machining time and material waste. Adaptive machining technologies can adjust settings in real time, improving output quality. For example, AI-driven software can change speeds and feeds based on real-time cutting conditions.

Another opportunity lies in cloud-based monitoring. CNC machines with remote diagnostics allow operators to check performance from anywhere. This makes maintenance easier and minimizes downtime.

Emerging Trends

Virtual Tech and Open Platforms Are Latest Trending Factor

Several emerging trends are influencing the CNC machines market. One key trend is the rise of open-source software platforms. These tools offer greater customization options, allowing users to tailor CNC functions to specific needs. This is especially useful in education and prototyping environments where flexibility is important.

Virtual reality is also becoming a training tool in CNC operations. VR-based simulations allow new operators to practice without using physical machines. This saves material, reduces machine wear, and improves safety. For instance, technical schools in Germany and the U.S. are using VR to teach CNC programming and operation.

Eco-friendly solutions are another rising trend. New coolant and lubricant systems are being designed with lower environmental impact. These systems help reduce waste and support greener manufacturing goals. As sustainability becomes a top concern, more companies are turning to these alternatives.

Smart sensors are also being added to CNC systems. These sensors provide real-time data on machine temperature, vibration, and performance. With this feedback, operators can make quick decisions to avoid errors or damage.

Regional Analysis

Asia Pacific Dominates with 37% Market Share

Asia Pacific leads the CNC Machines Market with a 37% share, amounting to USD 27.20 billion. This prominent position is primarily driven by the extensive manufacturing base in countries such as China, Japan, and South Korea.

Key factors contributing to this dominance include rapid industrialization, high adoption of advanced manufacturing technologies, and significant investments in the automotive and electronics sectors. Additionally, the availability of skilled labor at competitive costs and supportive government policies encouraging industrial automation have enhanced the region’s capacity and inclination towards adopting CNC technologies.

The future influence of Asia Pacific in the global CNC Machines Market is expected to be substantial. The region is poised to continue its leadership due to ongoing advancements in technology, increased automation in manufacturing, and expanding industrial sectors. As more companies in the region invest in high-precision tools to enhance productivity and efficiency, Asia Pacific’s market share is likely to expand further.

Regional Mentions:

- North America: North America remains a significant player in the CNC Machines Market, driven by its advanced manufacturing capabilities and technological innovation. The region’s focus on aerospace and defense industries heavily contributes to its steady demand for CNC technologies.

- Europe: Europe is a key market for CNC machines, known for its high-quality manufacturing standards and strong automotive industry. Precision engineering and adoption of Industry 4.0 technologies are crucial factors that support the market in this region.

- Middle East & Africa: The Middle East and Africa are gradually increasing their market share in the CNC Machines sector, thanks to investments in new industrial projects and infrastructure. The growth is supported by efforts to diversify economies and reduce dependence on oil revenues.

- Latin America: Latin America is experiencing growth in the CNC Machines Market, particularly in sectors such as automotive and manufacturing. Efforts to modernize industrial capabilities and increase productivity are driving the adoption of CNC technologies in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The CNC machines market is led by a few global players that have built strong reputations for precision, innovation, and global reach. The top four companies in this sector are DMG Mori Co., Ltd., Yamazaki Mazak Corporation, Okuma Corporation, and Fanuc Corporation. These players drive the market through their advanced technology and strong customer support.

DMG Mori Co., Ltd. holds a top position with its broad product range, covering milling, turning, and hybrid machines. The company focuses on smart manufacturing and digital solutions, which boost productivity for clients. It also benefits from a wide service network across key markets.

Yamazaki Mazak Corporation is known for high-speed, multi-tasking machines. It invests heavily in R&D and automation technologies. Its strong brand image and innovation in smart factory systems give it a competitive edge. The company has a strong presence in both developed and emerging markets.

Okuma Corporation stands out for its quality and durable machines. It offers integrated control systems that improve machine performance and user experience. Okuma’s focus on intelligent manufacturing and real-time monitoring systems helps customers increase efficiency and reduce downtime.

Fanuc Corporation leads in CNC controls and robotics. Its machines are known for speed, accuracy, and energy efficiency. Fanuc has a strong global network and invests in automation, AI, and Internet of Things (IoT) technologies to meet future market demands.

These four companies are shaping the CNC machines market with their strong product portfolios, advanced technology, and customer-focused solutions. Their success is built on automation, digitalization, and global service capabilities. As demand for high-precision and efficient manufacturing grows, these players are well-positioned to lead the market forward.

Major Companies in the Market

- Amada Machinery Co., Ltd.

- Amera Seiki

- DMG Mori Co., Ltd.

- General Technology Group

- Dalian Machine Tool Corporation

- Datron AG

- Fanuc Corporation

- Hurco Companies, Inc.

- Haas Automation, Inc.

- Shenyang Machine Tool Part Co., Ltd.

- Okuma Corporation

- Yamazaki Mazak Corporation

Recent Developments

- Nidec and Makino Milling Machine: On December 2024, Nidec announced an unsolicited tender offer of ¥257 billion ($1.6 billion) for Makino Milling Machine. The offer, priced at ¥11,000 per share, represented a 42% premium over Makino’s prior closing price. Nidec had not informed Makino’s board about the offer beforehand and planned to initiate the tender process on April 2025. Following the announcement, Makino’s shares surged by 19%, while Nidec’s shares rose by 4.1%.

- ACM Research: On 2024, ACM Research, a provider of semiconductor wafer cleaning systems, reported substantial growth driven primarily by its success in China, which accounted for 99% of its revenue. The company aims to expand its presence in the U.S. and other markets, focusing on the reshoring of the semiconductor industry.

Report Scope

Report Features Description Market Value (2024) USD 73.5 Billion Forecast Revenue (2034) USD 187.2 Billion CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lathe Machines, Milling Machines, Laser Machines, Welding Machines, Winding Machines, Other Types), By End-User (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amada Machinery Co., Ltd., Amera Seiki, DMG Mori Co., Ltd., General Technology Group, Dalian Machine Tool Corporation, Datron AG, Fanuc Corporation, Hurco Companies, Inc., Haas Automation, Inc., Shenyang Machine Tool Part Co., Ltd., Okuma Corporation, Yamazaki Mazak Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMADA MACHINERY CO., LTD.

- Amera Seiki

- DMG MORI CO., LTD.

- General Technology Group

- Dalian Machine Tool Corporation

- DATRON AG

- FANUC CORPORATION

- Hurco Companies, Inc.

- Haas Automation, Inc

- Shenyang Machine Tool Part Co., Ltd.

- OKUMA Corporation

- YAMAZAKI MAZAK CORPORATION.