Global Non-Sparking Tools Market Analysis By Raw Materials (Copper Alloys, Brass, Bronze, Others), By Product Type (General Purpose Tools, Striking and cutting Tools, Digging Tools, Other Tools), By End-users (Industrial, Construction, Residential), By Distribution Channels (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 30647

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

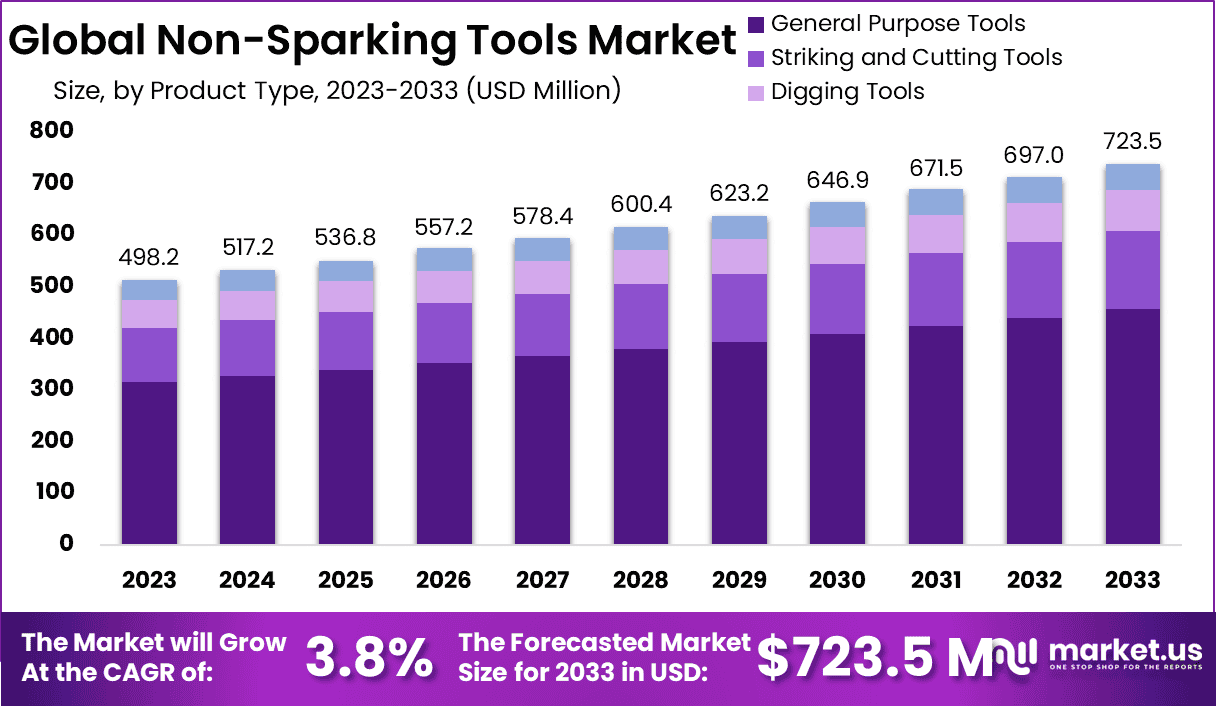

The Global Non-Sparking Tools Market size is expected to be worth around USD 723.5 Million by 2033 From USD 489.2 Million by 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

The non-sparking tools market encompasses a range of specialized tools designed to eliminate the risk of igniting flammable materials or explosive atmospheres.These tools are typically manufactured using non-ferrous metals such as bronze, brass, and copper-aluminum alloys, ensuring that no sparks are generated during use.

Non-sparking tools are essential in industries like oil & gas, mining, chemical processing, and pharmaceuticals, where environments may be exposed to combustible gases, dust, or liquids. Their application is critical in ensuring worker safety and preventing accidents, making them a vital part of operational protocols in hazardous workspaces.

The growth of the non-sparking tools market is driven by several key factors, primarily the increasing emphasis on workplace safety regulations and standards. Stricter safety norms from regulatory bodies like OSHA (Occupational Safety and Health Administration) and other industry-specific regulations have mandated the use of non-sparking tools in hazardous environments.

Additionally, the expanding industrial base in emerging markets, particularly in sectors such as oil & gas exploration and chemical processing, has further bolstered demand. As industries continue to grow, the need for safer tools that comply with safety standards becomes even more critical, providing a steady growth trajectory for the market.

Demand for non-sparking tools has shown steady growth, supported by their critical role in minimizing risks in hazardous working conditions.

The oil & gas sector remains one of the largest consumers, given the high-risk nature of extraction and refining processes. However, demand has also been rising in other industries, including pharmaceuticals, aerospace, and shipbuilding, where safety is paramount.

The rise of manufacturing and chemical industries in regions like Asia-Pacific, coupled with ongoing infrastructure projects in North America and the Middle East, has further stimulated market demand. This demand is sustained by the global focus on safety standards, reinforcing the adoption of non-sparking tools as a best practice.

The non-sparking tools market presents significant opportunities, especially with the increasing industrial activities in developing economies such as India, Brazil, and Southeast Asia. As these regions expand their oil & gas and manufacturing sectors, the need for safe working environments is becoming more pronounced, driving the adoption of non-sparking tools.

Additionally, there is growing interest in the development of new materials and alloys that can offer enhanced durability and corrosion resistance while maintaining non-sparking properties.

Technological advancements and innovation in tool design can also offer potential for differentiation among manufacturers, allowing them to cater to niche requirements in highly specialized industries. The trend towards automation and modernization of industrial processes is expected to further enhance the demand for these tools as part of comprehensive safety solutions.

The non-sparking tools market is undergoing strategic shifts as companies optimize their portfolios to focus on core strengths. The recent sale of Stanley Black & Decker’s STANLEY Infrastructure segment to Epiroc AB for $760 million highlights this trend.

The divestiture, involving a business generating $450-$470 million in revenue with a mid-to-high teens adjusted EBITDA margin, allows Stanley Black & Decker to reduce debt and enhance capital allocation toward its primary business lines.

This move aligns with the company’s strategy to maximize shareholder value through focused growth. For Epiroc, acquiring STANLEY Infrastructure presents an opportunity to drive innovation and expand its presence in the hydraulic tools market.

The transaction reflects broader industry dynamics, with key players emphasizing core competencies to better capture market opportunities in a growing non-sparking tools sector.

Demand for non-sparking measuring tools, such as calipers and micrometers, increased by 8% in 2023. Additionally, training costs for proper tool use and maintenance averaged $1,000 per employee in high-risk industries.

These trends reflect a focus on safety and precision, positioning non-sparking tools as critical for preventing ignition risks in hazardous environments.

Key Takeaways

- Market Growth: The Non-Sparking Tools Market is projected to experience steady growth, increasing from USD 498.2 million in 2023 to USD 723.5 million by 2033, with a consistent Compound Annual Growth Rate (CAGR) of 3.8%.

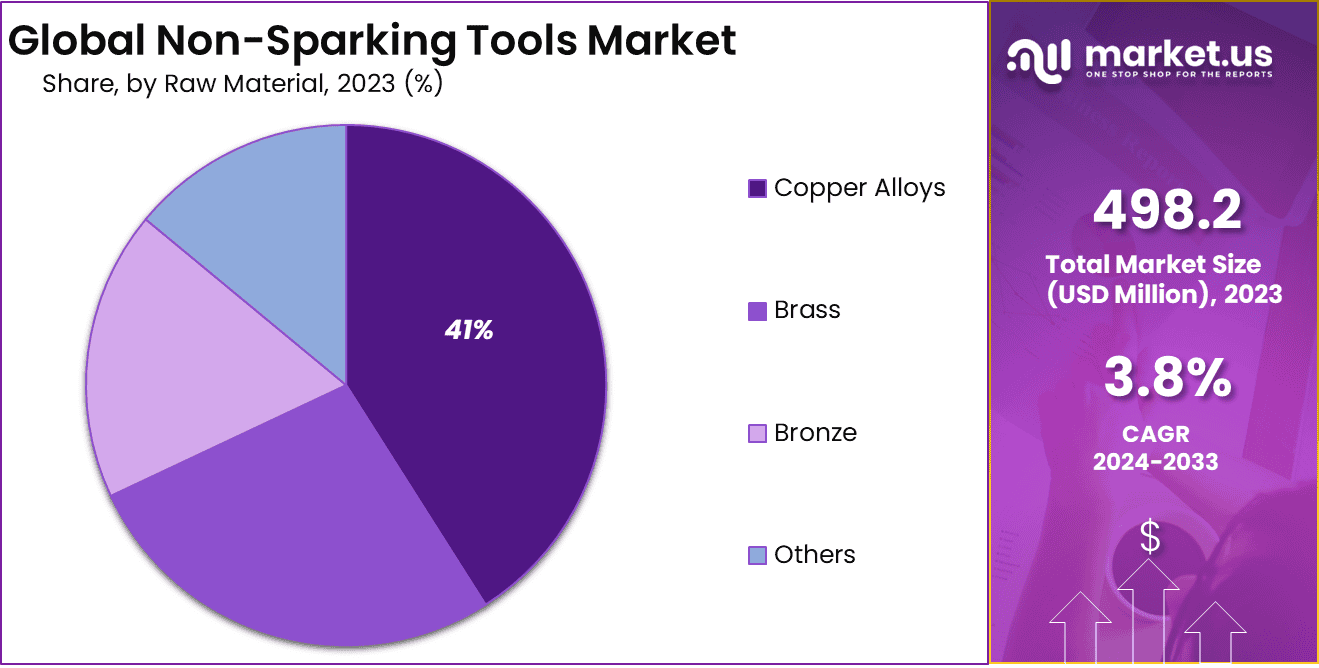

- Raw Materials Preference: Copper Alloys dominate the raw materials segment, with a 41.0% market share, underscoring their widespread use in non-sparking tool production due to their effective spark-resistant properties.

- Product Type Focus: General Purpose Tools account for 63.2% of the market, indicating their extensive application across various industrial sectors.

- End-User Specification: Industrial end-users represent 68.4% of the market share, highlighting the predominant use of non-sparking tools within industrial environments.

- Distribution Channels: Offline channels maintain a leading position, with a 73.4% share, indicating a preference for purchasing non-sparking tools through traditional retail and specialized distributors.

- Regional Dominance: The Asia-Pacific (APAC) region leads the market, holding a significant 39.7% share, reflecting strong demand and a robust market presence for non-sparking tools across the industrial landscape in this region.

By Raw Materials Analysis

Copper Alloys Dominating the Non-Sparking Tools Market with 41.0% Largest Market Share in 2023

In 2023, Copper Alloys held a dominant market position in the raw materials segment of the Non-Sparking Tools Market, capturing approximately 41.0% market share. This dominance is attributed to the superior durability and safety features of copper-beryllium alloys, making them the preferred choice in high-risk industries.

These materials are highly effective in preventing accidental sparks, which is critical in sectors like oil and gas, which itself represented 35% of the market share by end-use.

Brass remained a significant player in the market, favored for its balance between cost-effectiveness and non-sparking properties.

While it does not match the durability of copper-beryllium alloys, it serves as a viable alternative for applications with moderate risk levels. Brass tools have seen adoption across industries that require a safer, yet more affordable non-sparking solution.

Bronze has a more niche presence in the market, offering corrosion resistance and non-sparking properties suitable for specific applications.

Though not as widely adopted as copper alloys or brass, bronze maintains steady demand in environments where its anti-corrosive nature is particularly advantageous. Its role in the market is more specialized, catering to sectors that prioritize these specific characteristics.

The Others category includes various alloy blends and new materials that address unique requirements of specific end-users.

While this segment represents a smaller portion of the market, it caters to specialized needs such as custom-made tools for unique industrial conditions. Innovations in this segment could hold potential for future growth as safety standards continue to evolve and expand across industries.

By Product Type Analysis

General Purpose Tools Dominating the Non-Sparking Tools Market with 63.2% Largest Market Share in 2023

In 2023, General Purpose Tools held a dominant position in the product type segment of the Non-Sparking Tools Market, capturing more than 63.2% market share. These tools, which include commonly used wrenches, pliers, and screwdrivers, are essential for a wide range of maintenance and repair activities across industries.

Their broad applicability and vital role in routine tasks make them the preferred choice for companies prioritizing safety in hazardous environments like oil and gas, manufacturing, and chemical processing.

Striking and Cutting Tools also played a significant role in the market, widely used in activities that require impact or force, such as hammers, chisels, and axes.

While not as universally required as general-purpose tools, this segment serves critical needs in construction, mining, and oil and gas industries where safety is paramount. Their specialized application makes them an indispensable part of the toolkit for tasks involving direct material contact.

Digging Tools, which include shovels and picks, represent a niche segment of the non-sparking tools market. These tools are predominantly used in sectors such as mining, construction, and agriculture, where the risk of spark-related hazards in excavation work is a concern.

Although this segment is smaller compared to general-purpose and striking tools, it remains vital for specific end-users where non-sparking properties are crucial for safety.

The Other Tools category encompasses a range of specialized non-sparking tools designed for unique industrial applications. This segment includes custom-made or highly specific tools that meet the particular safety needs of certain industries.

While it represents a smaller portion of the market, this segment offers potential for growth as industries continue to seek tailored solutions for safety compliance and operational efficiency.

By End-users Analysis

Industrial Dominating the Non-Sparking Tools Market with 68.4% Largest Market Share in 2023

In 2023, the Industrial segment held a dominant position in the end-user segment of the Non-Sparking Tools Market, capturing over 68.4% market share. This segment includes industries such as oil and gas, chemical processing, and manufacturing, where the use of non-sparking tools is critical to preventing ignition risks in hazardous environments.

The high adoption rate in these sectors is driven by stringent safety regulations and the need to minimize the risk of workplace accidents, making non-sparking tools essential for daily operations.

The Construction segment also plays a key role in the non-sparking tools market, serving industries where sparks from metal tools could pose significant safety risks. Non-sparking tools are particularly important in building sites that involve work near flammable gases or liquids.

Although not as large as the industrial segment, the construction sector remains a critical end-user group, contributing to a steady demand for non-sparking tools to ensure compliance with safety standards.

The Residential segment, while smaller, continues to serve a niche market, focusing on applications where safety and the prevention of accidental fires are concerns. This segment typically includes non-sparking tools used in households or small workshops.

Although its market share is more limited compared to industrial and construction applications, it represents a stable demand base, especially in regions with stricter safety regulations for home and DIY activities.

By Distribution Channels Analysis

Offline Dominating the Non-Sparking Tools Market with 73.4% Largest Market Share in 2023

In 2023, the Offline channel held a dominant position in the distribution channels segment of the Non-Sparking Tools Market, capturing over 73.4% market share. This preference is driven by the need for hands-on product inspection, especially in industries where the reliability and quality of non-sparking tools are critical for safety.

Industrial buyers often rely on direct purchases through specialized distributors, physical stores, and industry-specific suppliers to ensure compliance with safety standards and access to immediate support services.

The offline channel also benefits from long-standing relationships between manufacturers and distributors, which remain crucial for bulk orders in high-risk sectors like oil and gas.

The Online channel, while smaller, has been gaining traction, offering convenience and a broader range of product options. Digital platforms allow customers to compare specifications and prices easily, making it a suitable option for smaller orders or niche tools that may not be widely available offline.

The online segment appeals particularly to small businesses and individual buyers who prioritize cost savings and flexibility. Although its market share remains lower compared to offline sales, the online distribution channel has shown steady growth as more businesses embrace digital procurement methods.

Key Market Segments

Raw Materials

- Copper Alloys

- Brass

- Bronze

- Others

Product Type

- General Purpose Tools

- Striking and cutting Tools

- Digging Tools

- Other Tools

End-users

- Industrial

- Construction

- Residential

Distribution Channels

- Offline

- Online

Driver

Safety Regulations Drive Demand

Stringent safety regulations in various industries, such as oil & gas, chemical, and mining, have been a significant driver for the non-sparking tools market. Non-sparking tools, typically made from materials like copper, brass, or bronze, are critical in environments where explosive gases, dust, or flammable liquids pose a risk.

Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and the European Union’s directives have set strict guidelines to mitigate the risks of fires and explosions in hazardous environments.

Compliance with these regulations necessitates the use of non-sparking tools, leading to increased adoption across these industries. This regulatory push is particularly strong in North America and Europe, contributing to substantial market growth.

Additionally, as safety awareness grows among companies operating in these high-risk sectors, the demand for non-sparking tools is expected to rise further.

For instance, the global oil & gas industry, which is projected to recover and expand steadily in 2024, represents a major end-user segment for these tools. This expansion directly supports the non-sparking tools market, as companies look to enhance their safety protocols to avoid costly accidents and operational disruptions.

Restraint

High Costs Limit Broader Adoption

Despite the clear safety advantages, the high cost of non-sparking tools remains a significant restraint to market growth. These tools are made from specialized alloys like copper-titanium and aluminum-bronze, which are more expensive than standard steel or iron tools.

As a result, the upfront investment for non-sparking tools can be several times higher than that for regular tools, particularly for large-scale industrial operations. Small and medium-sized enterprises (SMEs), which often operate with tighter budgets, may find these tools financially burdensome, limiting their adoption.

Moreover, in regions where safety regulations are less stringent or enforcement is weaker, companies may opt for more cost-effective alternatives, even if they are not as safe as non-sparking tools.

This price sensitivity can impact market growth, especially in emerging markets in Asia-Pacific, Africa, and Latin America, where industrialization is progressing but capital expenditure remains a key concern.

The challenge is to balance the high safety standards with affordability, which may require manufacturers to innovate in terms of material efficiency and production techniques to bring costs down.

Opportunity

Technological Innovation Unlocks New Markets

Technological advancements present significant opportunities for the non-sparking tools market. Innovations in material science, such as the development of new alloys that balance strength, durability, and non-sparking properties, have the potential to expand the use of these tools across more applications.

For example, newer materials like copper-beryllium alloys offer superior hardness compared to traditional brass or bronze, making them suitable for applications that demand both safety and durability, such as aerospace maintenance and renewable energy installations.

Additionally, the growth of automation and Industry 4.0 technologies in manufacturing and industrial operations opens new opportunities for precision-engineered non-sparking tools.

As industries like aerospace, pharmaceuticals, and electronics increasingly adopt robotic and automated systems, there is a demand for specialized tools that are compatible with these technologies, including non-sparking tools for maintenance in explosive environments.

The ongoing shift towards sustainable energy sources such as hydrogen production also represents a new market segment, as these industries require high standards of safety and non-sparking tools to minimize explosion risks. Capitalizing on these technological trends could enable manufacturers to tap into new growth areas and gain a competitive advantage.

Trends

Growing Focus on Sustainability and Eco-Friendly Manufacturing

The push towards sustainability and environmentally friendly manufacturing processes has become a key trend in the non-sparking tools market. As industries strive to reduce their carbon footprint, there is an increasing preference for tools and materials that are not only safe but also have a lower environmental impact during production.

Manufacturers of non-sparking tools are responding by optimizing their production processes to be more energy-efficient and by using recyclable materials, which can reduce the overall environmental impact.

Moreover, end-users in industries like chemical processing and petrochemicals are seeking tools that align with their broader Environmental, Social, and Governance (ESG) goals.

This trend has led to an uptick in demand for non-sparking tools that are produced with sustainable methods, such as those involving recycled alloys or using renewable energy sources during manufacturing.

Companies are positioning these products as premium offerings that appeal to environmentally conscious buyers, thereby creating a niche market segment.

As sustainability becomes an increasingly important factor in procurement decisions, this trend is expected to contribute to steady growth in the non-sparking tools market over the coming years. The alignment with global sustainability trends not only aids in market expansion but also enhances brand reputation and customer loyalty among manufacturers.

Regional Analysis

Asia-Pacific Dominates the Non-Sparking Tools Market with 39.7% Share

Asia-Pacific dominates the global non-sparking tools market, accounting for 39.7% of the market share in 2024. The region’s robust performance can be attributed to rapid industrialization, particularly in sectors like oil & gas, chemicals, and mining across countries such as China, India, and Australia.

The market value in Asia-Pacific reached approximately USD 197.7 million in 2024, driven by the increasing focus on workplace safety standards and compliance with international safety regulations.

The demand is further fueled by the region’s extensive manufacturing base and investments in infrastructure development, which require a safe working environment. With a growing awareness of safety protocols, the market in Asia-Pacific is set for steady growth in the coming years.

North America is a significant market, driven by stringent safety regulations and high standards of occupational safety. The presence of established industries, particularly in the United States and Canada, such as oil & gas, chemicals, and aerospace, contributes to a steady demand for non-sparking tools.

The North American market is supported by OSHA regulations, which mandate the use of non-sparking tools in hazardous environments. The region also benefits from the adoption of advanced materials and technologies in tool manufacturing, which supports product innovation and quality.

Europe is another key market for non-sparking tools, driven by the presence of well-regulated industries and a strong focus on workplace safety. Countries like Germany, the UK, and France have stringent safety guidelines for industries such as mining, pharmaceuticals, and chemicals, which necessitate the use of non-sparking tools.

The European market is also witnessing growth due to increasing investments in renewable energy projects, particularly in offshore wind farms, which require non-sparking tools for safe installation and maintenance operations.

Latin America and the Middle East & Africa are emerging markets for non-sparking tools, with increasing industrial activities driving demand. In Latin America, countries like Brazil and Mexico are seeing a rise in oil exploration activities, which boosts the requirement for safety equipment, including non-sparking tools.

The Middle East & Africa market is supported by large-scale oil & gas production, especially in Gulf Cooperation Council (GCC) countries.

However, the growth in these regions is somewhat constrained by economic volatility and budgetary constraints, which can affect investments in high-cost safety tools. Despite this, the need for compliance with safety standards in hazardous work environments supports steady demand across these regions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global non-sparking tools market in 2024 is characterized by a competitive landscape where established players continue to enhance their offerings, focusing on innovation, product quality, and strategic expansion.

Key companies like Ampco, Bahco, and Stanley have maintained their market presence through robust product lines and a focus on durability and safety.

Ampco, known for its extensive range of non-sparking tools, leverages its expertise in material science, particularly with copper-based alloys, to cater to high-demand industries such as oil & gas and chemicals. This specialization gives it a competitive edge, especially in regions with stringent safety regulations.

Bahco and Stanley are leveraging their global distribution networks to ensure product availability and strengthen their positions in emerging markets. Their ability to offer a wide range of non-sparking tools, combined with a strong brand reputation, makes them preferred choices among industrial buyers looking for reliable safety solutions.

Bahco’s focus on ergonomic designs adds value to its offerings, appealing to industries where user comfort and safety are paramount.

Smaller players like Eagle, FindingKing, Guardair, and Jonard contribute to market diversity by offering niche products, targeting specific applications, and providing customized solutions. Proto and Cromwell Tools are focusing on product innovation, introducing advanced materials and manufacturing techniques to enhance the durability and functionality of their non-sparking tools.

Meanwhile, Nupla is known for its specialty in industrial-grade tools, which positions it well in sectors requiring high-performance tools. Collectively, these companies drive competition, spur innovation, and support market growth, ensuring a wide variety of high-quality non-sparking tools for different industrial needs.

Top Key Players in the Market

- Stanley Black & Decker (Facom)

- Ampco Metal SA

- Snap-on Incorporated. (Bahco)

- Cs Unitec Inc.

- Jonard Tools

- FindingKing

- Q.E.P. Co. Inc. (Nupla Corporation)

- Intercon Enterprises Inc

- ACB France

- EGA Master S.A

Recent Developments

- In December 15, 2023, Stanley Black & Decker (NYSE: SWK) announced a definitive agreement to sell its STANLEY Infrastructure business, which includes attachment and handheld hydraulic tools, to Epiroc AB (Nasdaq Stockholm: EPIA) for $760 million in cash.

- In 2024, the Mister Worker™ Blog featured a discussion on non-sparking tools—also known as spark resistant, explosion proof, or ATEX tools—with AMPCO Safety Tools®, a company that specializes in the production of non-sparking, non-magnetic tools like wrenches, hammers, and screwdrivers.

- On March 18, 2024, in San Jose, California, Cisco announced it had completed the acquisition of Splunk. This acquisition aims to enhance Cisco’s ability to provide extensive visibility and insights across the digital operations of organizations.

- In 2023, on April 12, Emerson , based in St. Louis, Missouri, and Austin, Texas, announced a definitive agreement to acquire NI (Nasdaq: NATI) for $60 per share in cash, valuing the transaction at $8.2 billion. Emerson, which already held around 2% of NI’s shares, has an effective purchase price of $59.61 per share. NI is known for its software-connected automated test and measurement systems, which help companies accelerate product development and reduce costs. In 2022, NI reported $1.66 billion in revenue and served about 35,000 customers in over 40 countries, spanning industries like semiconductor and electronics, transportation, and aerospace and defense.

Report Scope

Report Features Description Market Value (2023) USD 489.2 Million Forecast Revenue (2033) USD 723.5 Million CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Materials (Copper Alloys, Brass, Bronze, Others), By Product Type (General Purpose Tools, Striking and cutting Tools, Digging Tools, Other Tools), By End-users (Industrial, Construction, Residential), By Distribution Channels (Offline, Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ampco, Bahco, Stanley, Eagle, FindingKing, Guardair, Jonard, Nupla, Proto, Cromwell Tools Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stanley Black & Decker (Facom)

- Ampco Metal SA

- Snap-on Incorporated. (Bahco)

- Cs Unitec Inc.

- Jonard Tools

- FindingKing

- Q.E.P. Co. Inc. (Nupla Corporation)

- Intercon Enterprises Inc

- ACB France

- EGA Master S.A