Global Cloud Workload Protection Market By Component (Solutions, Services), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Workload Type (Virtual Machines, Containers, Serverless Functions, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171795

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Component Analysis

- Organization Size Analysis

- Workload Type Analysis

- End-User Industry Analysis

- Increasing Adoption Technologies

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

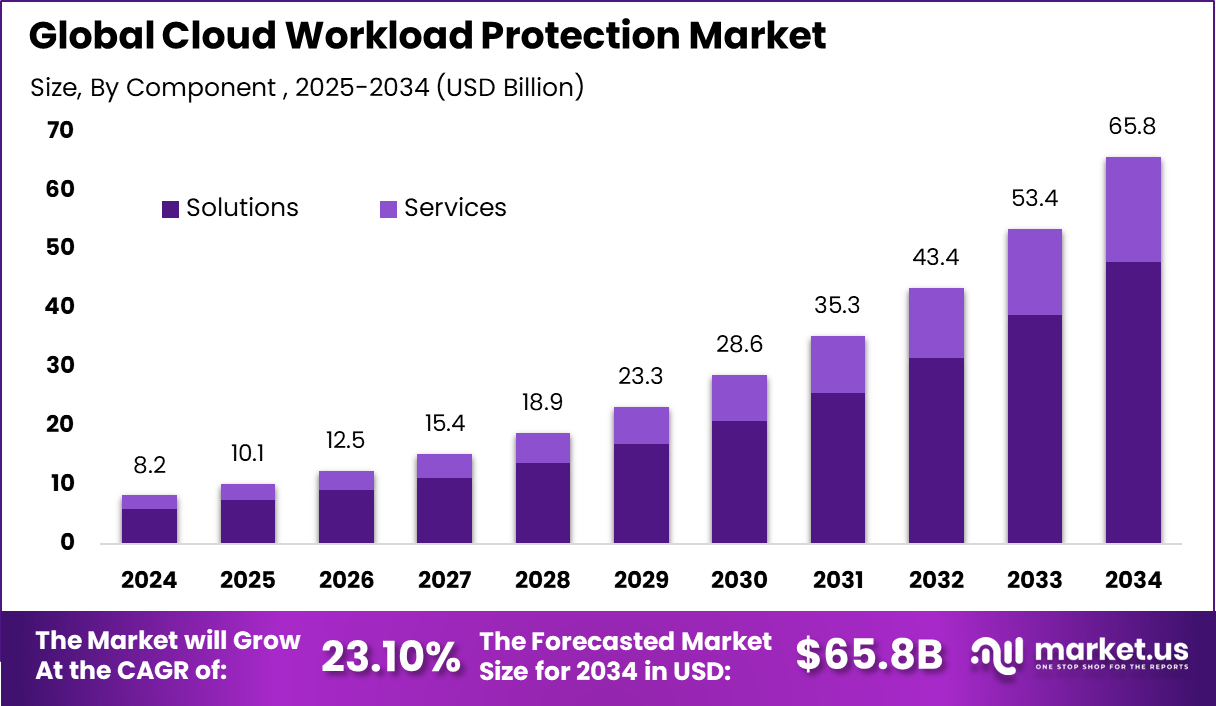

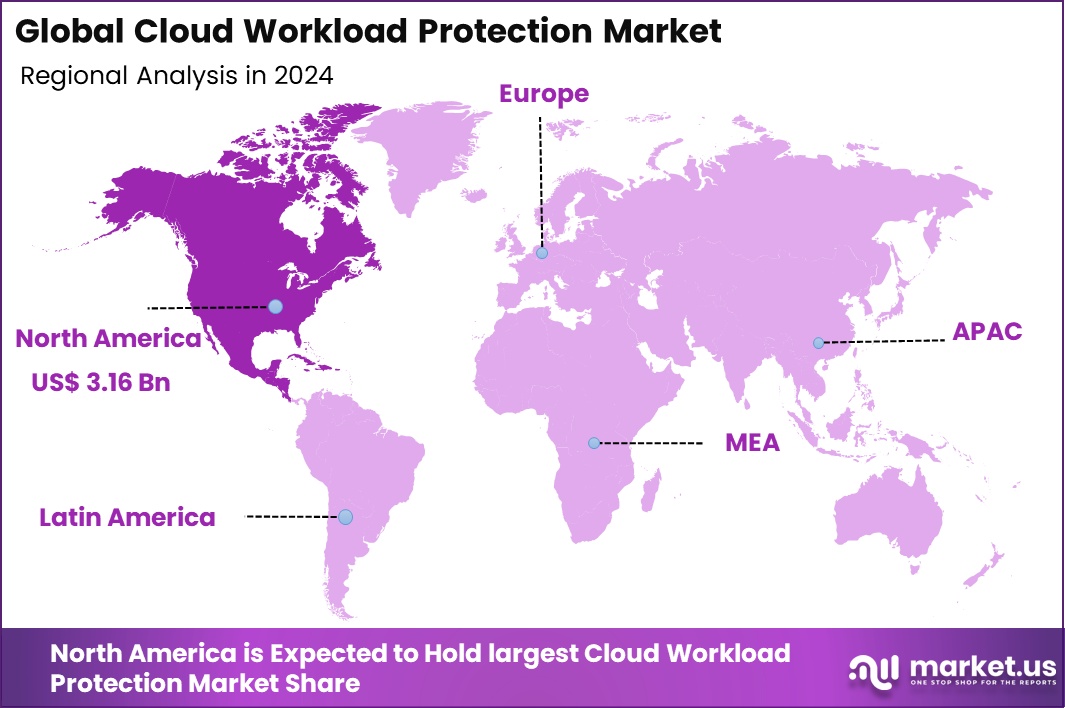

The Global Cloud Workload Protection Market generated USD 8.2 billion in 2024 and is predicted to register growth from USD 10.1 billion in 2025 to about USD 65.8 billion by 2034, recording a CAGR of 23.10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 3.16 Billion revenue.

The Cloud Workload Protection Market focuses on security solutions designed to protect workloads running in cloud environments. Cloud workloads include virtual machines, containers, serverless functions, and applications deployed across public, private, and hybrid clouds. Cloud workload protection platforms monitor these environments to detect threats, misconfigurations, and unauthorized activities. The market supports secure cloud adoption by addressing risks specific to dynamic and distributed cloud infrastructures.

As organizations shift critical operations to the cloud, traditional security tools become less effective. Cloud workloads are highly dynamic and scale rapidly, requiring continuous visibility and protection. Cloud workload protection solutions are built to adapt to this changing environment. They provide security controls that align with modern cloud-native architectures.

The main driving factors for the cloud workload protection market are the rapid adoption of cloud computing and the increasing frequency of cyber threats. As companies shift more operations to the cloud to improve scalability and reduce IT costs, they face new vulnerabilities created by complex cloud architectures.

Traditional security tools are often not designed for the dynamic nature of cloud workloads, which change frequently and can span multiple environments. This has created a need for specialised protection that can adapt to cloud-native technologies and provide continuous monitoring. Regulatory requirements for data privacy and compliance also push organisations to invest in stronger cloud security solutions.

Demand analysis shows that the need for cloud workload protection continues to grow because organisations want to secure their cloud assets without slowing down operations. Cloud-based applications and services are now key parts of business processes, and any security breach can lead to financial loss, reputational damage, and regulatory penalties.

Sectors such as banking, healthcare, retail, and technology are investing in these tools to protect sensitive data and maintain service uptime. Small and medium sized enterprises are also adopting cloud workload protection as cloud use becomes more widespread and affordable. As cyber threats evolve and cloud adoption grows, investment in cloud workload protection is expected to remain strong across industries.

Top Market Takeaways

- By component, solutions and platforms took 72.9% of the cloud workload protection market, as they provide full security for cloud apps and data.

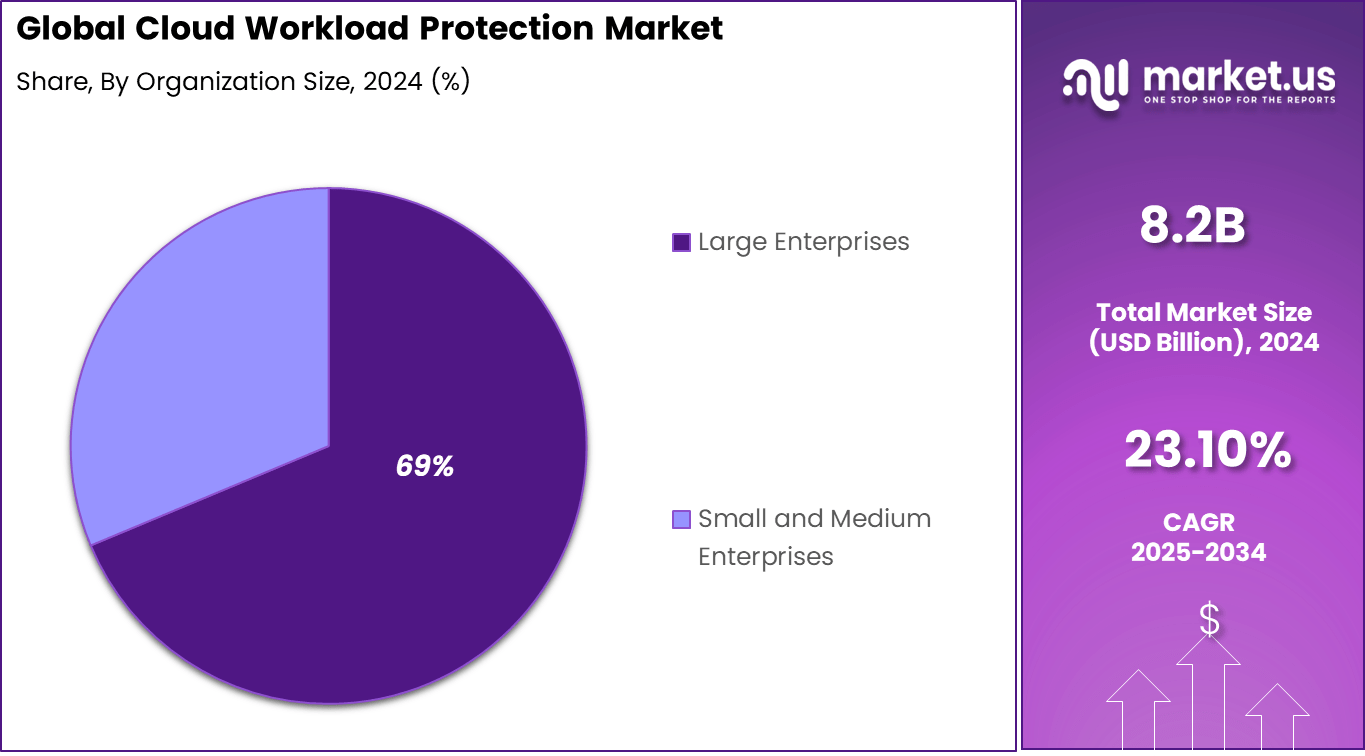

- By organization size, large enterprises held 68.7% share, needing strong protection for their big cloud setups.

- By workload type, containers captured 41.3%, used widely in modern apps for easy scaling and deployment.

- By end-user industry, BFSI led with 34.6%, protecting sensitive financial data from cyber threats.

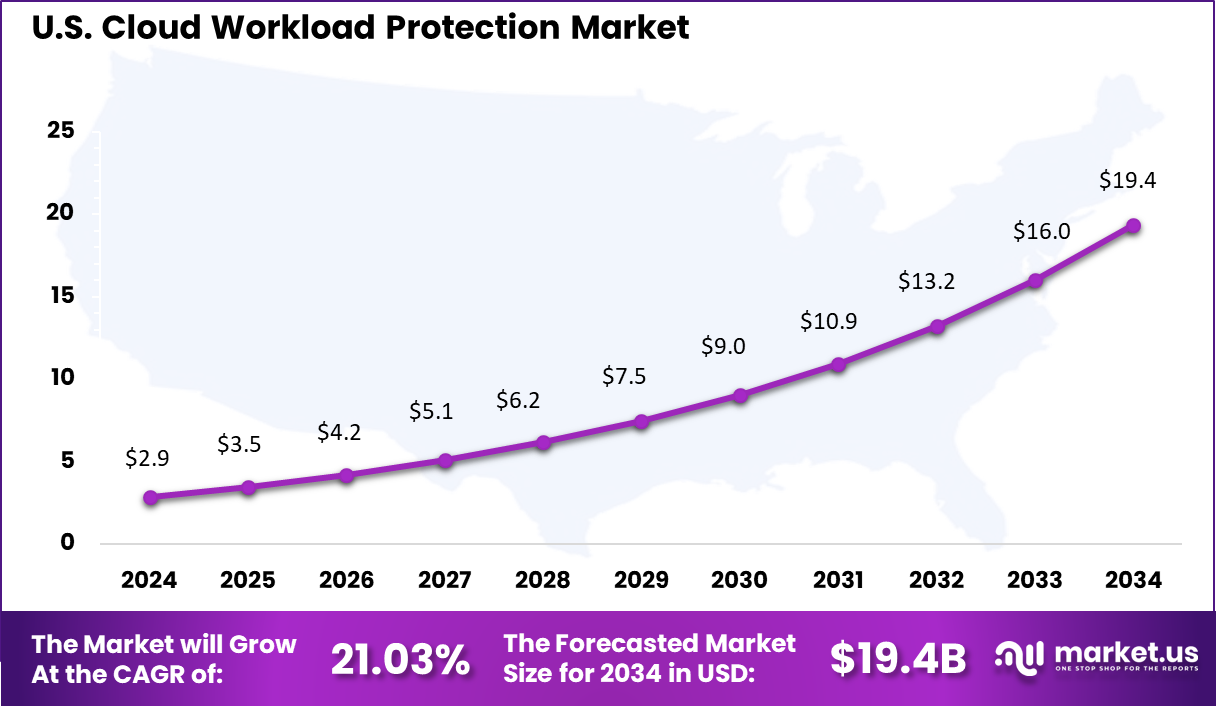

- North America had 38.5% of the global market, with the U.S. at USD 2.87 billion in 2025 and growing at a CAGR of 21.03%.

Quick Market Facts

Critical Security Vulnerabilities and Costs

- Neglected cloud assets remain a major risk, with nearly one-third classified as unmanaged by late 2025, and 89% of organizations exposing at least one such asset to the internet.

- The financial impact of breaches continues to rise, as the average cost of a public cloud–related data breach reached USD 4.68 million.

- Configuration weaknesses are the leading cause of incidents, responsible for 68% of cloud security issues, followed by unauthorized access (58%) and insecure interfaces (52%).

Emerging Technology Trends

- Agentless cloud workload protection is gaining momentum, growing at a 32.1% CAGR, as organizations seek lighter security footprints, even though agent-based approaches still hold about 64% market share.

- Serverless security is the fastest-expanding workload category, increasing at a 34.9% CAGR due to rising adoption of function-based architectures.

Component Analysis

Solutions and platform components account for 72.9%, showing that comprehensive security platforms form the core of cloud workload protection. These platforms monitor workloads, detect threats, and enforce security policies across cloud environments. Organizations rely on unified platforms to manage protection from a single interface. Centralized solutions improve visibility across applications and data. This reduces security gaps.

The dominance of platforms is driven by the growing complexity of cloud workloads. Enterprises prefer integrated solutions rather than fragmented security tools. Platforms support automation and continuous monitoring. They also simplify compliance and reporting processes. This supports long-term adoption.

Organization Size Analysis

Large enterprises account for 69% of the market, driven by their large-scale cloud adoption and complex IT environments. These organizations run multiple workloads across different cloud providers and regions, which increases exposure to security risks. Cloud workload protection platforms help large enterprises maintain consistent security standards and reduce operational risk.

Large enterprises also face higher regulatory and compliance requirements. Advanced protection platforms support continuous monitoring and detailed reporting. The strong presence of this segment highlights how cloud workload security has become a core requirement for enterprises managing sensitive data and mission-critical applications.

Workload Type Analysis

Container workloads account for 41.3%, making them the most protected workload type. Containers support modern application development and microservices architecture. Their dynamic nature increases security challenges. Protection tools help monitor container behavior. This improves workload security.

Growth in this segment is driven by widespread container adoption. Organizations use containers for faster deployment and scalability. Cloud workload protection ensures secure container operations. Continuous monitoring reduces vulnerabilities. This drives consistent usage.

End-User Industry Analysis

The BFSI sector holds 34.6%, making it the leading end-user industry. Financial institutions rely heavily on cloud services for digital operations. Protecting workloads is critical for transaction integrity and data security. Cloud workload protection helps manage cyber risk. Compliance requirements further increase demand.

Adoption in BFSI is driven by strict regulatory oversight. Institutions must ensure continuous security across cloud environments. Workload protection tools support risk management and audit readiness. They also reduce potential financial loss. This supports ongoing investment.

Increasing Adoption Technologies

Cloud workload protection solutions use technologies such as runtime threat detection, behavioral analytics, and machine learning. These technologies help identify abnormal activity within workloads by analyzing patterns over time. Automation enables rapid response to potential threats without manual intervention. This improves security effectiveness in fast-moving cloud environments.

Container security and serverless protection technologies also support adoption. As organizations use microservices and container orchestration platforms, workload-level security becomes essential. Integration with cloud-native tools and DevOps pipelines strengthens adoption. These technologies allow security to be embedded throughout the application lifecycle.

One key reason for adopting cloud workload protection is improved visibility into cloud operations. Organizations gain insight into workload behavior, vulnerabilities, and compliance status. This helps security teams detect risks early and respond effectively. Improved visibility also supports stronger governance and control.

Another reason is the need to reduce security complexity. Cloud workload protection platforms consolidate multiple security functions into a single framework. This reduces reliance on fragmented tools and manual processes. Adoption also supports secure innovation by enabling teams to deploy workloads faster with confidence.

Benefits

- Faster threat detection and response that limits downtime and business impact

- Better visibility across virtual machines, containers, and serverless workloads in one view

- Lower risk of misconfiguration by using baseline policies and continuous drift checks

- Improved compliance readiness through clear logs, alerts, and reporting for audits

- Higher security consistency across hybrid and multi cloud environments

Usage

- Monitoring workload behavior to detect abnormal activity and suspicious processes

- Scanning images and workloads for known vulnerabilities and risky libraries

- Enforcing runtime policies that block unauthorized access, privilege misuse, and malware

- Segmenting workloads to limit lateral movement and isolate compromised assets

- Supporting incident response with forensics, alert triage, and remediation guidance

Emerging Trends

Key Trend Description AI Threat Detection AI spots cyber attacks in real time across containers and virtual machines. Zero Trust Runtime Zero trust rules are enforced continuously on all cloud workloads. CNAPP Convergence Cloud workload protection merges with cloud security posture tools into one stack. eBPF Deep Visibility Kernel level technology provides deep visibility into cloud processes. Serverless Protection Functions and containers are secured without installing agents. Growth Factors

Key Factors Description Multi Cloud Spread Organizations use AWS, Azure, and GCP and require a unified security platform. Container Boom Growth of Docker and Kubernetes increases the need for runtime protection. Ransomware Rise Cloud data attacks push adoption of strong workload protection solutions. Compliance Push Regulations such as GDPR and PCI require proof of workload security. DevSecOps Shift Security is built into development pipelines from the start. Key Market Segments

By Component

- Solutions

- Services

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Workload Type

- Virtual Machines

- Containers

- Serverless Functions

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Government & Defense

- Others

Regional Analysis

North America accounted for 38.5% share, supported by widespread cloud adoption and strong focus on securing hybrid and multi cloud environments. Enterprises across banking, healthcare, retail, and technology have adopted cloud workload protection solutions to secure virtual machines, containers, and serverless workloads.

Demand has been driven by increasing cloud complexity, rising cyber threats, and stricter compliance requirements. Organizations in the region have prioritized workload level visibility and continuous protection to reduce risk across dynamic cloud infrastructures.

The U.S. market reached USD 2.87 Bn and is projected to grow at a 21.03% CAGR, reflecting rapid expansion of cloud based applications and digital services. Adoption has been particularly strong among large enterprises and cloud first organizations that manage complex and distributed workloads. Cloud workload protection solutions help U.S. companies reduce attack surfaces, improve compliance posture, and maintain business continuity in highly dynamic environments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

The Cloud Workload Protection Market is being influenced by the rise of unified security platforms that consolidate protection across compute, storage, and container workloads. These platforms apply consistent security policies across virtual machines, containers, and serverless functions to ensure seamless threat prevention.

As cloud environments grow more complex, the need for unified visibility and control has become increasingly important. Organizations are adopting integrated solutions to reduce security gaps and simplify administration. Another emerging trend is the integration of machine learning and behavioral analytics into workload protection tools.

Security systems are now able to detect anomalous patterns by analyzing historical activity, user behavior, and workload interactions. This capability enables earlier detection of sophisticated threats that would otherwise evade static rule-based defenses. With these advanced analytics, security teams can prioritize risks and respond more effectively to potential breaches.

Driver Analysis

A primary driver of market growth is the rapid shift to cloud infrastructure by enterprises seeking scalability and operational flexibility. As workloads migrate from on-premises data centers to public and hybrid cloud environments, exposure to new and diverse threat vectors increases.

Organizations are investing in workload protection to secure sensitive applications, data, and services deployed across dynamic cloud environments. This investment is seen as essential to maintaining operational continuity and protecting business-critical assets. Another driver is the expanding regulatory landscape that mandates stronger data protection and cybersecurity practices.

Compliance requirements in industries such as finance, healthcare, and public sector compel enterprises to demonstrate effective controls over cloud workloads. Cloud Workload Protection solutions provide the needed safeguards and audit trails to meet these standards. As regulatory scrutiny deepens, demand for robust cloud security solutions continues to grow.

Restraint Analysis

A key restraint is the complexity involved in deploying and managing Cloud Workload Protection across multi-cloud and hybrid environments. Organizations often operate diverse cloud platforms with varied security models, interfaces, and integration challenges. This heterogeneity increases administrative overhead and can lead to inconsistent policy enforcement.

Resource constraints and limited cloud security expertise further compound implementation hurdles. Another restraint stems from the performance overhead associated with real-time security monitoring and scanning. Advanced protection features, such as deep process inspection and continuous vulnerability assessment, can consume compute resources and affect workload performance.

This trade-off between security and efficiency can deter adoption, especially for performance-sensitive applications. Enterprises must balance protection needs with operational requirements to avoid service degradation.

Opportunity Analysis

There is significant opportunity in extending Cloud Workload Protection to address emerging technologies, including edge computing and distributed IoT workloads. As applications and data processing shift closer to the network edge, security solutions must adapt to protect decentralized workloads. This extension can open new markets for providers that tailor protections to edge-centric environments.

Edge workload security is positioned to become a critical component of broader enterprise defense strategies. Another opportunity lies in offering managed security services that combine Cloud Workload Protection with expert monitoring and response capabilities.

Many organizations lack the internal resources to maintain around-the-clock threat detection and remediation. Managed offerings can provide continuous oversight, reduce response times, and free internal teams to focus on strategic initiatives. This service-oriented model is expected to attract enterprises seeking outcomes rather than tool ownership.

Challenge Analysis

A major challenge for the market is maintaining consistent security posture amid rapidly evolving threats. Attack techniques targeting cloud workloads, such as supply chain exploitation and zero-day vulnerabilities, continue to advance in sophistication. Security solutions must adapt quickly to address new tactics, which requires continuous updates and threat intelligence integration. Keeping pace with threat evolution is demanding for vendors and adopters alike.

Another challenge is ensuring effective integration with existing DevOps and CI/CD pipelines. Cloud Workload Protection needs to align with development workflows to prevent disruptions and support secure software delivery. However, embedding security controls early in the development lifecycle requires cultural change and cross-functional collaboration. Without seamless integration, security may be perceived as a bottleneck rather than an enabler of innovation.

Competitive Analysis

Palo Alto Networks, Inc., Microsoft Corporation, and CrowdStrike Holdings, Inc. lead the cloud workload protection market with platforms that secure workloads across public cloud, hybrid, and containerized environments. Their solutions cover vulnerability management, runtime protection, and threat detection for virtual machines, containers, and serverless workloads. These companies focus on unified visibility, automation, and policy driven security.

VMware, Inc., Trend Micro, Incorporated, Check Point Software Technologies, Ltd., Qualys, Inc., and Rapid7, Inc. strengthen the market with integrated workload security, vulnerability assessment, and compliance monitoring. Their platforms help enterprises reduce attack surfaces and meet regulatory requirements. These providers emphasize agent and agentless coverage, continuous scanning, and risk prioritization. Growing compliance pressure supports wider adoption.

Sophos, Ltd., McAfee Corp, Fortinet, Inc., Aqua Security Software, Ltd., Sysdig, Inc., Lacework, Inc., and Orca Security, Ltd. expand the landscape with container focused security, cloud posture management, and runtime intelligence. Their offerings prioritize ease of deployment and real time risk insights. Increasing complexity of cloud environments continues to drive steady growth in cloud workload protection.

Top Key Players in the Market

- Palo Alto Networks, Inc. (Prisma Cloud)

- Microsoft Corporation (Microsoft Defender for Cloud)

- CrowdStrike Holdings, Inc. (Falcon Cloud Security)

- VMware, Inc. (Carbon Black)

- Trend Micro, Incorporated

- Check Point Software Technologies, Ltd.

- Qualys, Inc.

- Rapid7, Inc.

- Sophos, Ltd.

- McAfee Corp

- Fortinet, Inc.

- Aqua Security Software, Ltd.

- Sysdig, Inc.

- Lacework, Inc.

- Orca Security, Ltd.

- Others

Future Outlook

The future outlook for the Cloud Workload Protection market is expected to remain strong as organizations expand their use of cloud, containers, and microservices. Protecting workloads across public, private, and hybrid cloud environments is becoming a priority due to rising security threats and complex cloud architectures.

These solutions help secure applications, data, and workloads throughout their lifecycle, from development to runtime. In the coming years, closer integration with DevSecOps practices, automation, and centralized security management is likely to improve visibility and reduce response time to threats.

Recent Developments

- In May 2025, Palo Alto Networks introduced Prisma AIRS for Red Hat OpenShift, adding runtime segmentation to prevent lateral movement in containerized AI workloads.

- In June 2025, Rubrik reported 38% year over year subscription ARR growth to USD 1.19 billion and announced partnerships with Google Cloud and Mandiant to launch isolated recovery solutions that strengthen cyber resilience through air gapped backups.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 65.8 Bn CAGR (2025-2034) 23.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Workload Type (Virtual Machines, Containers, Serverless Functions, Others), By End-User Industry (IT & Telecommunications, Banking, Financial Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Palo Alto Networks, Inc. (Prisma Cloud), Microsoft Corporation (Microsoft Defender for Cloud), CrowdStrike Holdings, Inc. (Falcon Cloud Security), VMware, Inc. (Carbon Black), Trend Micro, Incorporated, Check Point Software Technologies, Ltd., Qualys, Inc., Rapid7, Inc., Sophos, Ltd., McAfee Corp, Fortinet, Inc., Aqua Security Software, Ltd., Sysdig, Inc., Lacework, Inc., Orca Security, Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Workload Protection MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Workload Protection MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Palo Alto Networks, Inc. (Prisma Cloud)

- Microsoft Corporation (Microsoft Defender for Cloud)

- CrowdStrike Holdings, Inc. (Falcon Cloud Security)

- VMware, Inc. (Carbon Black)

- Trend Micro, Incorporated

- Check Point Software Technologies, Ltd.

- Qualys, Inc.

- Rapid7, Inc.

- Sophos, Ltd.

- McAfee Corp

- Fortinet, Inc.

- Aqua Security Software, Ltd.

- Sysdig, Inc.

- Lacework, Inc.

- Orca Security, Ltd.

- Others