Global Cloud Printing Services Market Size, Share, Industry Analysis Report By Type (Public, Private, Hybrid), By Connectivity (Wi-Fi, TCP-IP, Bluetooth, Others), By Industry (BFSI, Government, Education, IT & Telecommunications, Manufacturing, Healthcare, Retail & E-commerce, Media & Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160496

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

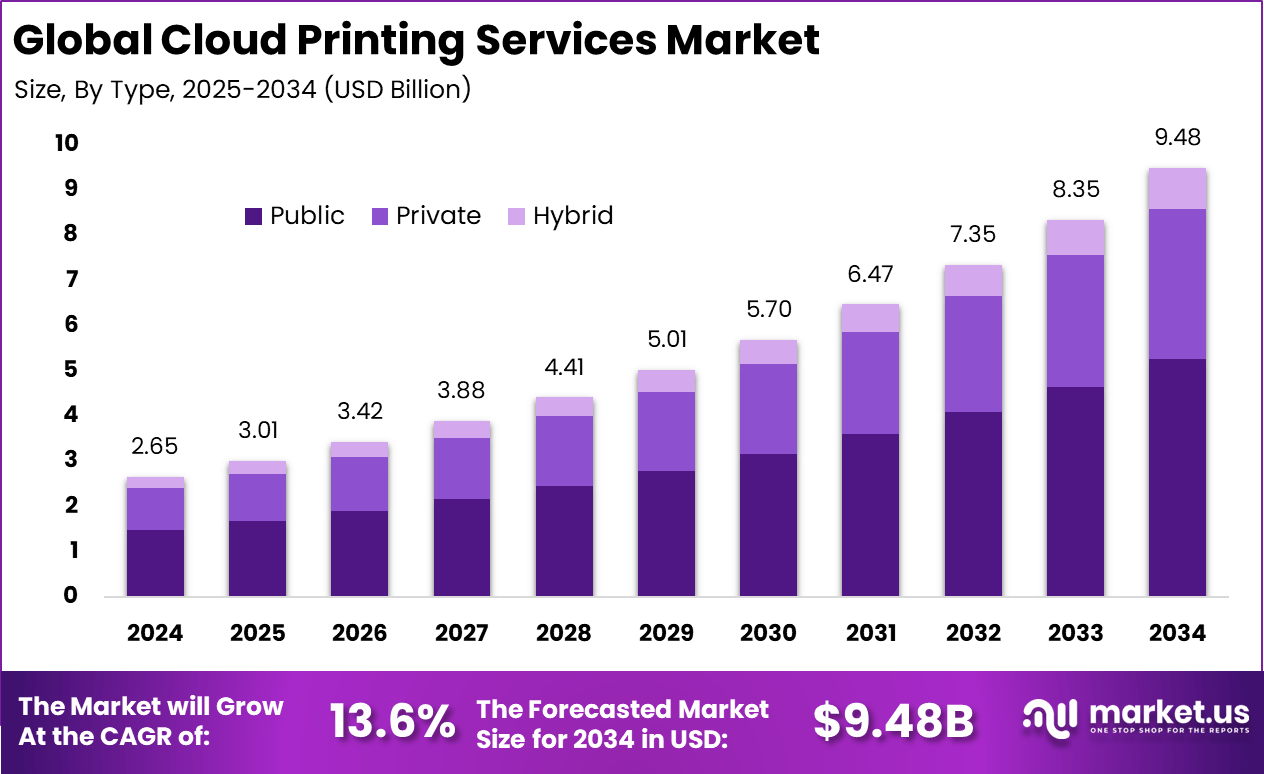

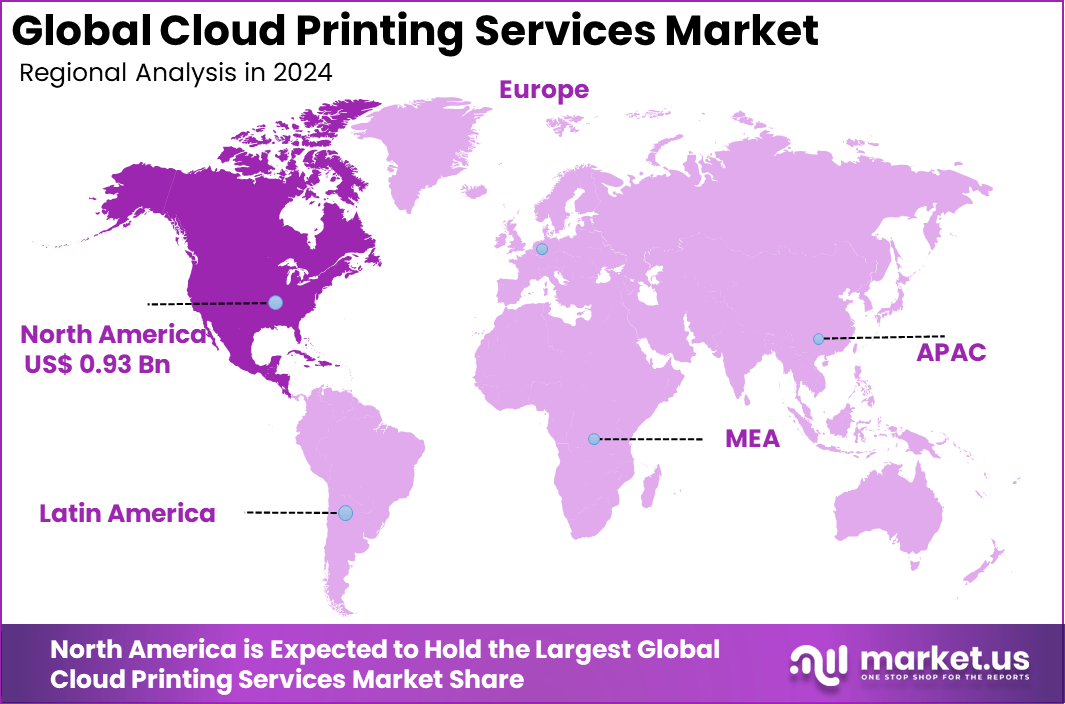

The Global Cloud Printing Services Market size is expected to be worth around USD 9.48 billion by 2034, from USD 2.65 billion in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.1% share, holding USD 0.93 billion in revenue.

The Cloud Printing Services Market has been growing steadily as organizations move away from traditional, hardware-heavy print setups toward more flexible, digital workflows. This market benefits from the rise in workforce mobility and the increasing adoption of remote and hybrid work models, which make printing from anywhere and any device necessary.

The cloud infrastructure behind these services allows users to print securely without dedicated on-premise servers, cutting costs and simplifying management. Recently, about 75% of organizations use hybrid print management systems, highlighting how cloud printing bridges on-premise and remote printing needs effectively.

For instance, in February 2024, HP emphasized the role of its Managed Print Services (MPS) in helping enterprises transition to secure, cloud-enabled print environments. The service is designed to streamline document workflows, reduce costs, and enhance sustainability while ensuring compliance with security and data protection standards.

The growth of cloud printing services is supported by several consistent forces. One major driver is the continued shift to hybrid and remote work models, which mandates that users be able to print from home offices, branch offices, or hot desks in a seamless manner. Relatedly, demand for mobility and BYOD (bring your own device) environments pushes organizations to adopt printing that is agnostic of local network constraints.

Another driver is the desire to reduce on-premises infrastructure burden: eliminating local print servers, drivers management, firmware updates, and hardware maintenance reduces operational complexity. Environmental and sustainability goals also encourage the adoption of print monitoring and reduction features inherent in cloud printing systems. Finally, cost pressure and need for centralized control, especially in distributed organizations, push adoption.

Top Market Takeaway

- Public cloud printing leads with 55.6%, favored for its cost efficiency and ease of access.

- Wi-Fi connectivity holds 40.0%, reflecting its dominance in enabling seamless remote and mobile printing.

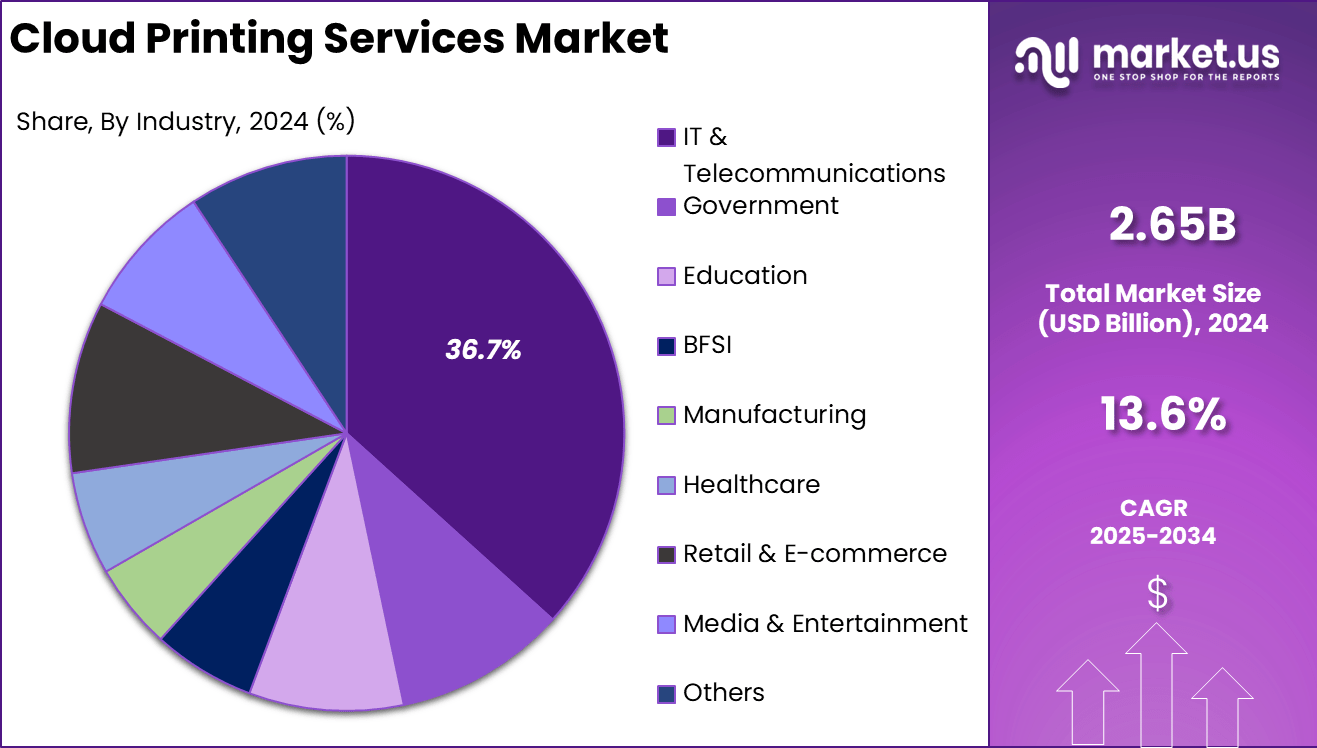

- IT & Telecommunications industry accounts for 36.7%, driven by high-volume printing needs and digital transformation initiatives.

- North America captures 35.1%, supported by enterprise adoption and strong digital infrastructure.

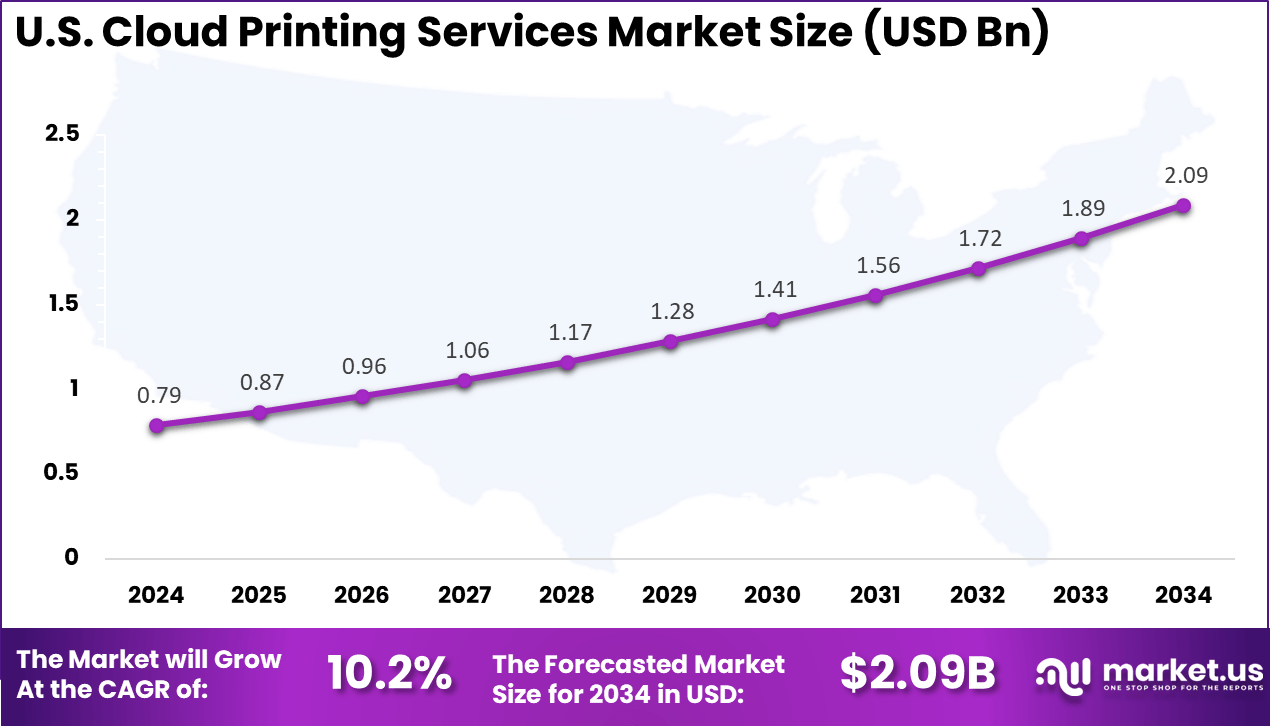

- The US market reached USD 0.79 billion and is expanding at a CAGR of 10.2%, underscoring steady growth in managed and cloud-enabled printing services.

Analysts’ Viewpoint

Demand for cloud printing services continues to expand due to the rise in mobile device usage and the trend toward bring-your-own-device (BYOD) policies in enterprises. This makes seamless and secure printing solutions a priority. The scalability of cloud printing means businesses can adjust capacity dynamically, ensuring efficient resource use without the need for large up-front investments.

Additionally, growing interest in sustainability promotes cloud printing since it helps cut paper waste through print quotas and pull printing, contributing to greener practices embraced by about 60% of IT budgets focusing on environmental goals. Technological adoption pushing the market forward includes Internet of Things (IoT) enabled printers, AI-driven print management, and integration with enterprise SaaS platforms.

Businesses choose cloud printing because it reduces operational complexities by eliminating the need for on-site print servers and extensive IT support. It allows access to printing everywhere, supporting hybrid and remote work, and aligns with modern digital transformation goals. Cloud print management solutions provide automated driver updates, user self-service features, and compatibility across varied printer hardware, making them highly adaptable.

Role of Generative AI

The role of generative AI in cloud printing services is becoming increasingly vital as it introduces a new level of automation and intelligence to printing workflows. Generative AI employs advanced algorithms to analyze user behavior, predict maintenance needs, and optimize print job scheduling. This not only reduces downtime but also enhances efficiency by dynamically adjusting prints to maintain quality while minimizing resource use.

In fact, up to 84% of organizations in related tech sectors plan to increase AI spending, signaling rapid adoption of AI-driven solutions, including cloud printing optimization. These AI capabilities allow businesses to streamline operations, personalize printing tasks, and anticipate equipment issues before they disrupt services, supporting more reliable and responsive print environments.

Generative AI also improves security and workflow automation in cloud printing by automating document recognition and routing, which is critical for sectors with sensitive data like healthcare and finance. For example, AI-driven optical character recognition (OCR) quickly identifies and directs documents to appropriate destinations, reducing manual errors and improving data protection.

Furthermore, voice-activated printing enabled by AI provides hands-free convenience, which is valuable for modern hybrid workplaces. By embedding AI throughout cloud printing systems, vendors empower businesses to enhance productivity and reduce operational costs, marking generative AI as a transformative force in the print industry.

U.S. Market Size

The market for Cloud Printing Services within the U.S. is growing tremendously and is currently valued at USD 0.79 billion, the market has a projected CAGR of 10.2%. The market is growing tremendously due to the widespread adoption of hybrid work environments, strong cloud infrastructure, and increasing digital transformation across industries.

U.S. enterprises are prioritizing operational efficiency, cost reduction, and IT flexibility, driving demand for scalable, serverless print solutions. Additionally, stringent data security regulations are pushing organizations toward secure, compliant cloud-based printing. The country’s mature technology ecosystem, high mobile device penetration, and demand for sustainability-aligned solutions further reinforce this rapid market expansion.

In 2024, North America held a dominant market position in the Global Cloud Printing Services Market, capturing more than a 35.1% share, holding USD 0.93 billion in revenue. This dominance is due to its advanced IT infrastructure, early adoption of cloud technologies, and strong presence of leading technology vendors.

The region’s rapid shift toward hybrid and remote work models accelerated demand for flexible, cloud-based print solutions. Additionally, high awareness of cybersecurity, strong regulatory frameworks, and robust investments in digital transformation across sectors such as education, healthcare, and finance further strengthened North America’s leadership.

Type Analysis

In 2024, Public cloud printing dominates the market with a strong 55.6% share. Its popularity stems from its cost efficiency and scalability, allowing businesses to avoid large upfront investments in infrastructure. Instead, they can easily access printing services via the cloud, making it an attractive option for organizations aiming to reduce IT complexity while supporting flexible work environments.

This segment particularly benefits small and medium enterprises that prefer simplified printer management and easy deployment. The public cloud’s ability to integrate with various devices and offer continuous updates contributes to its strong adoption, especially as hybrid and remote working models become more common across industries.

For Instance, in September 2025, Y Soft announced the launch of SAFEQ Cloud Pro and SAFEQ Cloud Breeze, expanding its next-generation public cloud printing and scanning portfolio. Designed to support organizations of all sizes, the solutions are fully cloud-native and aligned with zero-trust security principles.

Connectivity Analysis

In 2024, Wi-Fi connectivity holds a commanding 40.0% share in the cloud printing services market. Its ability to provide high-speed, wireless connectivity makes it ideal for office environments and remote work setups where multiple devices require seamless access to printing without physical cable connections. Wi-Fi enables users to print from laptops, smartphones, and tablets conveniently, boosting productivity and collaboration.

Moreover, Wi-Fi’s compatibility with enterprise networks simplifies the management and scalability of printing infrastructure, allowing organizations to remotely control and secure print jobs more effectively. Its wide adoption is reinforced by the growing trend of bring-your-own-device (BYOD) policies in workplaces, where wireless flexibility is key.

For instance, in April 2024, Maribyrnong Libraries in Victoria, Australia, introduced Wi-Fi printing services, allowing patrons to securely send documents from their personal devices directly to library printers. The initiative enhances accessibility and convenience, particularly for mobile and remote users who rely on cloud-connected services.

Industry Analysis

In 2024, The IT and telecommunications sector commands a significant 36.7% share of the cloud printing services market. This industry’s reliance on efficient and secure document workflows makes cloud printing essential for managing remote teams, global operations, and high-volume printing needs. Cloud printing supports the sector’s drive toward digital transformation by enabling smooth integration with enterprise tools and enhancing collaboration.

Security concerns, compliance, and the need for scalable print solutions are fueling adoption in this vertical. IT and telecommunications firms increasingly outsource print management to cloud services to reduce infrastructure costs while meeting stringent data protection standards, a critical factor in this fast-evolving industry.

For Instance, in February 2025, Mopria released insights on the future of mobile and cloud printing, emphasizing key considerations for IT and telecommunications decision makers. The report highlighted how cloud printing services are becoming integral to managing complex, multi-device environments, especially in hybrid work models.

Emerging trends

Emerging trends in cloud printing services revolve around increased mobility, multi-device ecosystems, and stronger security protocols. The ongoing shift toward flexible work environments has pushed cloud printing to support seamless remote access and mobile-friendly solutions. Android devices, in particular, dominate the market with a 39% revenue share in cloud printing platforms, reflecting the global prevalence of mobile printing needs.

Additionally, integration of cloud print services with enterprise software and broader IT infrastructure is becoming standard, enabling unified management and improved print workflows across organizations. Security enhancements also stand out as a major trend, with AI-backed threat detection and improved encryption becoming fundamental for protecting sensitive print data.

The adoption of hybrid cloud models accelerates market fragmentation, but it also drives innovation by allowing businesses to choose flexible, mixed deployment strategies. Sustainability is another rising focus, as cloud printing solutions incorporate features like print quotas and analytics to reduce waste, contributing to greener office practices.

Growth factors

Growth factors driving the cloud printing services market include the rise in remote work, bring-your-own-device policies, and strong demand for scalable print solutions. The market growth is supported by increased adoption among small and medium-sized enterprises, who favor public cloud printing for its low upfront costs and ease of use.

Over 56% of total revenue in 2025 comes from public cloud services, underscoring their popularity. The IT sector, accounting for about 21% of market revenue, leads the adoption due to its need for secure, efficient document workflows amid expanding global operations. Enhanced data protection features and ongoing service upgrades boost trust in cloud printing, encouraging wider enterprise use.

Additionally, expanding mobile device penetration and better internet connectivity worldwide make cloud printing more accessible and practical for businesses and consumers alike. These growth factors, combined with digital transformation efforts, make cloud printing a key component of modern document management strategies.

Key Market Segments

By Type

- Public

- Private

- Hybrid

By Connectivity

- Wi-Fi

- TCP-IP

- Bluetooth

- Others

By Industry

- BFSI

- Government

- Education

- IT & Telecommunications

- Manufacturing

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Remote Work Adoption

The increasing shift to remote work has been a key driver for the growth of cloud printing services. Organizations are adopting these services to support a distributed workforce by enabling employees to print documents securely from any location. This flexibility helps companies maintain productivity regardless of where employees are working, making cloud printing an essential tool in hybrid and remote work environments.

The rise in mobile device usage further complements this trend, allowing printing directly from smartphones and tablets. This demand for remote and mobile-friendly printing solutions is expected to continue, pushing companies to invest more in cloud printing infrastructure. Cloud printing eliminates the need for physical presence near printers, reducing operational complexity and supporting seamless workflows.

For instance, in February 2024, Microsoft highlighted how its Universal Print solution enables seamless and secure cloud-based printing for organizations embracing hybrid work. By eliminating the need for on-premise print servers, Universal Print simplifies management while providing employees with reliable access to printers across distributed environments.

Restraint

Data Security and Privacy Concerns

A major restraint hindering the full adoption of cloud printing services is the concern over data security and privacy. Since documents are transmitted and processed through cloud platforms, there is a risk of unauthorized access and data breaches. Sensitive information, especially in regulated industries like healthcare and finance, requires stringent protection, making organizations hesitant to fully rely on cloud printing.

Furthermore, regulatory compliance around personal data, such as the GDPR, adds complexity to cloud printing deployments. Companies must ensure that their cloud printing solutions meet strict data protection standards, which can increase implementation costs and slow adoption. Security worries are compounded by the reliance on third-party cloud providers and potential vulnerabilities in internet-based connectivity.

For instance, in October 2024, a new report revealed that organizations across Australia and New Zealand faced significant print security breaches, exposing sensitive business data and creating compliance risks. The findings underscore the ongoing challenges of protecting documents in cloud and networked printing environments.

Opportunities

Hybrid Cloud Printing Solutions

Hybrid cloud printing presents a promising opportunity within the market by combining on-premises and cloud-based printing systems. This approach allows organizations to maintain control over sensitive data by keeping it on-premise while leveraging the cloud for less critical printing tasks. The flexibility of hybrid solutions addresses security concerns while still providing the benefits of cloud accessibility and scalability.

As more businesses move towards hybrid cloud infrastructures, demand for hybrid cloud printing is set to rise. This trend is further supported by the growth of remote workforces and the need for secure, flexible printing options. Healthcare and financial sectors, in particular, are likely to adopt hybrid models to meet both regulatory demands and operational efficiency.

For instance, in March 2025, Case Western Reserve University announced the installation of 40 Wēpa cloud-enabled printers across its campus to enhance accessibility for students, faculty, and staff. The deployment supports mobile and remote printing needs, offering a flexible, user-friendly solution aligned with modern digital workflows.

Challenges

Technology Compatibility and Infrastructure

One significant challenge for cloud printing services is ensuring compatibility with existing legacy printing infrastructure and maintaining reliable internet connectivity. Integrating cloud printing with traditional on-premise printers and systems can be complex, requiring detailed planning and investment. This transition phase can lead to operational disruptions and slower adoption rates.

Additionally, cloud printing performance heavily depends on stable and high-speed internet access. In regions where network infrastructure is weak or inconsistent, users may face delays or service interruptions, limiting the effectiveness of cloud printing solutions. These infrastructure challenges can hamper user experience and confidence in the technology, making it a critical hurdle for widespread deployment.

For instance, in May 2025, Konica Minolta introduced free CloudPrint integration for its bizhub multifunction devices, providing 12 months of seamless, native cloud printing. This initiative directly addresses the challenge of technological fragmentation, where multiple proprietary protocols and diverse device ecosystems complicate print workflows.

Key Players Analysis

The Cloud Printing Services Market is driven by leading technology and document management providers such as Xerox Corporation, Microsoft Corporation, and HP Development Company, L.P. These companies offer comprehensive cloud-based printing platforms that support remote access, centralized print management, and secure document delivery.

Specialized printing and output management firms including Ricoh USA, Inc., Konica Minolta Business Solutions Europe GmbH, Apogee Corporation, and LRS Output Management focus on managed print services, print analytics, and hybrid cloud deployment. Their tools enable automated routing, print cost tracking, and device monitoring across large distributed networks.

Software-based players such as PaperCut Software Pty Ltd, ezeep GmbH, and ThinPrint Cloud Services, Inc. contribute with lightweight cloud print management platforms designed for SMEs, co-working spaces, and mobile users. Their solutions emphasize cross-device compatibility, serverless printing, and easy integration with Microsoft 365, Google Workspace, and virtual desktop environments.

Top Key Players in the Market

- Xerox Corporation

- Microsoft Corporation

- Ricoh USA, Inc.

- PaperCut Software Pty Ltd

- ezeep GmbH

- LRS Output Management

- Konica Minolta Business Solutions Europe GmbH

- Apogee Corporation

- HP Development Company, L.P

- ThinPrint Cloud Services, Inc.

- Others

Recent Developments

- In May 2025, Xerox was once again recognized as a Leader in Quocirca’s Cloud Print Services Landscape Report for the fourth consecutive year. The recognition highlights Xerox’s continued innovation in cloud print management, integration of AI-driven automation, and a strong portfolio supporting hybrid and remote work environments.

- In August 2025, Microsoft announced the general availability of Universal Print Anywhere, an enhancement to its cloud-based Universal Print service. The feature introduces secure pull-print functionality, allowing users to send documents to a cloud print queue and release them from any compatible printer after authentication.

Report Scope

Report Features Description Market Value (2024) USD 2.65 Bn Forecast Revenue (2034) USD 9.48 Bn CAGR(2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Public, Private, Hybrid), By Connectivity (Wi-Fi, TCP-IP, Bluetooth, Others), By Industry (BFSI, Government, Education, IT & Telecommunications, Manufacturing, Healthcare, Retail & E-commerce, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xerox Corporation, Microsoft Corporation, Ricoh USA, Inc., PaperCut Software Pty Ltd, ezeep GmbH, LRS Output Management, Konica Minolta Business Solutions Europe GmbH, Apogee Corporation, HP Development Company, L.P., ThinPrint Cloud Services, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Printing Services MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Printing Services MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Xerox Corporation

- Microsoft Corporation

- Ricoh USA, Inc.

- PaperCut Software Pty Ltd

- ezeep GmbH

- LRS Output Management

- Konica Minolta Business Solutions Europe GmbH

- Apogee Corporation

- HP Development Company, L.P

- ThinPrint Cloud Services, Inc.

- Others