Global Cloud-based Rental Management Platforms Market Size, Share, Industry Analysis Report By Property Type (Residential, Commercial, Vacation Rentals), By End User (Property Managers and Agents, Housing Associations, Property Investors), By Application (Lease and Tenant Management, Accounting and Financial Reporting, Compliance Management, Others), By Organization Size (Large Enterprise, SMEs), By Pricing Model (Subscription-based Pricing, One-time License Fee), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156796

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- U.S. Market Size

- Emerging Trends

- Top Growth Factors

- Property Type Analysis

- End User Analysis

- Application Analysis

- Organization Size Analysis

- Pricing Model Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

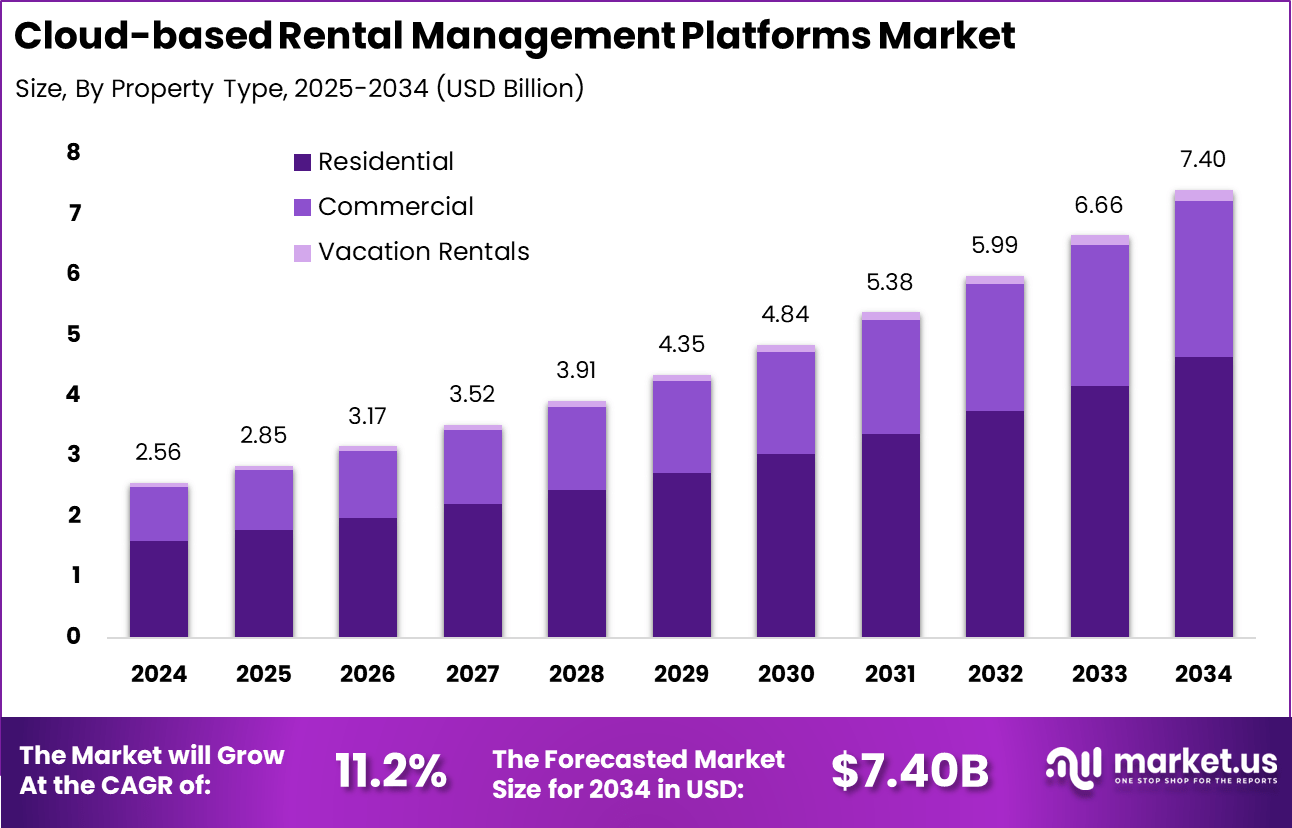

The Global Cloud-based Rental Management Platforms Market size is expected to be worth around USD 7.40 Billion by 2034, from USD 2.56 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 1.07 billion in revenue.

Cloud-based Rental Management Platforms represent a modern approach to managing rental properties and assets through internet-connected software solutions. These platforms allow property managers, landlords, and rental businesses to efficiently handle tasks such as lease management, rent collection, maintenance tracking, tenant screening, and communication.

The market for cloud-based rental management platforms is driven by the accelerating demand for operational efficiency, real-time data access, and scalable digital infrastructure in property management. As landlords and property managers seek to automate leasing, maintenance, and tenant communications, cloud solutions offer agility, cost-effectiveness, and centralized control.

For instance, in February 2025, RMS Cloud announced a collaboration with Boutique Properties, aimed at enhancing guest and property management experiences through its cloud-based platform. The partnership focuses on streamlining operations, improving reservation workflows, and delivering greater flexibility for property managers handling diverse rental portfolios.

The top driving factors behind the adoption of cloud-based rental management platforms include the rising number of rental properties worldwide and the increasing complexity of property management operations. Property owners and managers seek solutions that reduce IT costs, improve operational control, and provide better tenant engagement.

Key Takeaway

- In 2024, the Residential segment led the Global Cloud-based Rental Management Platforms Market with a 62.7% share.

- Property Managers and Agents dominated the user base, accounting for 51.3% share in 2024.

- Lease and Tenant Management was the leading solution area, capturing 38.4% share of the market.

- Large Enterprises held the top position by enterprise size, representing 68.9% share in 2024.

- Subscription-based Pricing was the preferred model, securing 56.2% share of the market.

- The U.S. market was valued at USD 0.97 Billion in 2024, expanding at a 10.7% CAGR.

- North America was the leading region, capturing over 42% share of the global market in 2024.

Analysts’ Viewpoint

Investment opportunities in cloud-based rental management platforms are promising due to the expanding rental property market and the surge in digital transformation initiatives. Investors are attracted by the scalability, cost-effectiveness, and flexibility these platforms offer. Moreover, growing demand in emerging regions tied to urbanization and real estate investment opens new markets.

The business benefits of adopting cloud rental management platforms are extensive. They include improved operational efficiency through automation, better financial management with real-time monitoring and reporting, enhanced tenant satisfaction via transparent and accessible services, and reduced risk from predictive analytics and secure data storage.

The regulatory environment is an important aspect influencing the cloud-based rental management market. Governments worldwide are implementing stricter regulations around data privacy, financial transparency, and sustainable building practices. Cloud platforms help property managers comply with these regulations by offering secure data handling, audit trails, and compliance management features.

U.S. Market Size

The market for Cloud-based Rental Management Platforms within the U.S. is growing tremendously and is currently valued at USD 0.97 Billion, the market has a projected CAGR of 10.7%. The market for cloud-based rental management platforms within the U.S. is growing tremendously due to the rapid adoption of digital solutions across the real estate sector, rising demand for remote property management, and the expansion of short-term rental models such as Airbnb and VRBO.

The expectation of property managers and landlords is for cost-effective platforms that facilitate easy access to tenants, payments, and communication. Additionally, strong cloud infrastructure, regulatory digitization, and increasing investment in proptech innovation are accelerating nationwide adoption and fueling sustained market growth.

For instance, in November 2024, IHG Hotels & Resorts selected HotelKey as its first approved cloud-based property management system across the U.S. and Canada. This strategic move underscores U.S. leadership in adopting cloud-native platforms, supported by advanced digital infrastructure and strong proptech investment.

In 2024, North America held a dominant market position in the Global Cloud-based Rental Management Platforms Market, capturing more than a 42% share, holding USD 1.07 billion in revenue. This dominance is due to its advanced digital infrastructure, early adoption of cloud technologies, and the presence of leading industry players such as AppFolio, Yardi, and CoreLogic.

Strong demand for automation, compliance management, and real-time analytics across both residential and commercial property sectors further fueled growth. Additionally, the expansion of short-term rental markets and sustained investment in proptech innovation reinforced North America’s leadership in driving global adoption.

For instance, in June 2022, Wyndham Hotels & Resorts partnered with Sabre to roll out its SynXis Central Reservation System and Sabre’s cloud-native property management solutions across North America. This large-scale adoption reflects the region’s advanced digital infrastructure, strong demand for scalable platforms, and willingness of major hospitality and property players to invest in cloud transformation.

Emerging Trends

Key Trends Description Cloud Platform Adoption Increasing migration to cloud platforms centralizes data, enhances security, and supports real-time access to property and tenant information. Integration of AI and IoT IoT devices coupled with AI enable predictive maintenance, automated workflows, and enhanced tenant experience through smart management. Data-Driven Decision Making Advanced analytics and AI empower property managers to make informed decisions on pricing, investments, and tenant services. Automated Workflows Systems automate tasks like rent collection, lease renewals, and maintenance requests, reducing manual effort and errors. Enhanced Tenant Self-Service Cloud platforms offer tenant portals for online rent payment, maintenance requests, and access to lease documents, improving satisfaction. Top Growth Factors

Key Factors Description Scalability and Flexibility Cloud platforms allow easy scaling of rental management operations without heavy upfront IT investments. Cost Efficiency Reduces IT infrastructure costs, manual workload, and errors, leading to operational savings. Improved Operational Efficiency Centralized data and automated workflows accelerate processes and reduce delays and miscommunications. Rising Demand for Digital Solutions Increasing preference for cloud and AI-driven tools in real estate propels market adoption and growth. Regulatory and Government Support Initiatives promoting digital infrastructure and smart property management drive uptake of cloud-based solutions. Property Type Analysis

In 2024, the Residential segment held a dominant market position, capturing a 62.7% share of the Global Cloud-based Rental Management Platforms Market. This dominance is due to the rising demand for digital solutions among landlords, property managers, and multifamily operators seeking to streamline leasing, automate rent collection, and improve tenant engagement.

The surge in urban housing demand, growth of multifamily properties, and expansion of short-term rentals further boosted adoption, positioning residential applications as the primary driver of platform utilization worldwide.

For Instance, in June 2025, Elivaas partnered with Hotelogix to enhance luxury property management in India, reflecting the growing role of cloud-based solutions in the residential segment. The collaboration focuses on digitizing operations for high-end vacation and rental properties, integrating automation, guest management, and real-time analytics.

End User Analysis

In 2024, the Property Managers and Agents segment held a dominant market position, capturing a 51.3% share of the Global Cloud-based Rental Management Platforms Market. The demand in this sector has been driven mainly by the need to manage large and diverse property portfolios efficiently, streamline lease and rent collection processes, and enhance tenant communication.

Cloud-based platforms offer real-time analytics, automation, and remote accessibility, enabling agents and managers to reduce operational costs, improve decision-making, and deliver superior tenant experiences at scale.

For instance, in May 2025, RentSpree launched RentEdge, a cloud-enabled solution designed to modernize MLS rental workflows and empower real estate agents. The platform streamlines tenant screening, digital applications, and leasing tasks, allowing agents to save time while improving client service.

Application Analysis

In 2024, the Lease and Tenant Management segment held a dominant market position, capturing a 38.4% share of the Global Cloud-based Rental Management Platforms Market. This dominance is due to the growing need for automated lease workflows, digital tenant onboarding, and streamlined rent collection processes.

Property managers and landlords increasingly rely on cloud-based platforms to handle renewals, compliance tracking, and tenant communication efficiently. The ability to centralize tenant data and provide real-time visibility has made this application segment the core driver of market adoption.

For Instance, in December 2024, RentRedi expanded its partnership with BiggerPockets, offering additional benefits and value for Pro members. The enhanced collaboration strengthens RentRedi’s lease and tenant management capabilities by providing landlords and property investors with tools for digital applications, automated rent collection, and streamlined tenant communication.

Organization Size Analysis

In 2024, the Large Enterprise segment held a dominant market position, capturing a 68.9% share of the Global Cloud-based Rental Management Platforms Market. This dominance is due to companies adopting advanced digital tools that simplify complex, multi-property operations. These enterprises emphasize automation, compliance, and scalability, making cloud-based platforms critical for portfolio optimization and tenant engagement.

With features such as centralized control, real-time analytics, robust security, and customizable solutions, cloud platforms enable large organizations to achieve operational efficiency, reduce costs, and manage diverse assets more effectively, driving their broad adoption in the market.

For Instance, in September 2022, Guesty announced the acquisition of hospitality software companies Kigo and HiRUM, strengthening its position as a leading enterprise-grade property management platform. The move expanded Guesty’s capabilities to serve large property managers and hospitality groups operating multi-property portfolios across global markets.

Pricing Model Analysis

In 2024, the Subscription-based Pricing segment held a dominant market position, capturing a 56.2% share of the Global Cloud-based Rental Management Platforms Market. This dominance is due to the model’s affordability, flexibility, and predictable cost structure, which appeal to both small landlords and large property management firms.

By offering tiered plans and scalable features, subscription-based platforms enable users to align costs with usage needs. This approach supports widespread adoption, ensuring consistent revenues for providers while delivering accessible, value-driven solutions to end users.

For Instance, in March 2025, Evolve Property Management partnered with Yardi to implement the Yardi Multifamily Suite, leveraging its subscription-based cloud model to scale portfolio operations efficiently. The arrangement highlights the appeal of subscription pricing, which provides predictable costs, continuous updates, and access to advanced features without heavy upfront investment.

Key Market Segments

By Property Type

- Residential

- Commercial

- Vacation Rentals

By End User

- Property Managers and Agents

- Housing Associations

- Property Investors

By Application

- Lease and Tenant Management

- Accounting and Financial Reporting

- Compliance Management

- Others

By Organization Size

- Large Enterprise

- SMEs

By Pricing Model

- Subscription-based Pricing

- One-time License Fee

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Adoption of Cloud Technology

The increasing shift toward cloud-based solutions enables property managers and landlords to streamline operations, improve data accessibility, and enhance collaboration across teams and stakeholders. Real-time data synchronization supports proactive decision-making, while scalable infrastructure reduces IT overhead. This technological agility improves operational efficiency and aligns with the broader digital transformation trends across the real estate sector, significantly fueling the growth.

For instance, in May 2024, Qatari Investors Group selected RISE with SAP to accelerate its transition to cloud infrastructure, underscoring the global momentum toward cloud-based enterprise solutions. This move reflects a broader trend where firms across real estate and investment sectors prioritize digital agility, operational efficiency, and real-time data access.

Restraint

Data Security & Privacy Concerns

Cloud-based rental management systems consolidate sensitive data, including financial and tenant information, making them attractive targets for cyberattacks. Breaches can result in reputational damage and regulatory penalties. Moreover, the need to comply with varying data privacy laws (e.g., GDPR, CCPA) across regions adds to operational complexity.

These concerns can slow adoption, particularly among enterprise clients, and showcase the need for robust cybersecurity frameworks, data encryption, and ongoing compliance monitoring to build trust in cloud-based rental solutions.

For instance, in March 2023, France’s data protection authority (CNIL) fined an e-scooter rental company €125,000 for violations related to excessive data retention and inadequate security safeguards. This enforcement highlights growing regulatory scrutiny over digital platforms that collect and store personal data.

Opportunities

Growth in Short-Term Rental Markets

The rise of short-term rental websites such as Airbnb and VRBO has presented a significant opportunity for rental management systems that can cater to this busy market. Added features like automatic pricing, adjustable occupancy options, and better guest communication are indispensable.

Considering the combination of the hotel industry and home renting, platforms that can accommodate both short-term and long-term stays will be advantageous for property owners and managers in areas with a high concentration of tourists or cities.

For instance, in May 2024, Guesty acquired Rentals United to significantly expand its capabilities in the short-term rental property management market. This strategic move strengthens Guesty’s position by integrating advanced channel management and dynamic pricing tools, catering to a growing demand for scalable, multi-platform operations.

Challenges

Competitive Intensity and Product Differentiation

The cloud-based rental management systems are highly competitive in the market. Companies such as AppFolio (Entrata), Yardi, and CoreLogic are expanding their services at a fast pace. With the standard features of these systems, companies must find ways to differentiate themselves from competitors.

This is achieved by integrating their services, providing unique features, or improving the user experience. Without clear value propositions or industry-specific customization, market saturation may lead to pricing pressure and customer churn, making strategic innovation and positioning critical for sustained growth.

For instance, in July 2023, RentRedi introduced advanced customization features to its cloud-based property management platform, enabling landlords to tailor dashboards, workflows, and tenant interactions. This move reflects increasing competitive intensity in the market, where differentiation hinges on delivering personalized, scalable solutions.

Key Players Analysis

In the cloud-based rental management platforms market, companies such as Yardi Systems, AppFolio, and RealPage hold strong positions due to their wide product portfolios and established customer base. These players focus on offering scalable solutions that cover property accounting, tenant communication, and lease management.

Mid-tier companies such as Entrata, MRI Software, and Rentec Direct are gaining attention by addressing specific customer needs with flexible deployment models. Their focus on usability and data-driven insights appeals to property owners seeking simplified workflows. These platforms are expanding across diverse property types, from residential units to commercial buildings.

Smaller players, including TenantCloud, DoorLoop, Condo Control Central, RMS Cloud, and Easy Storage Solutions, are expanding their presence by targeting niche applications such as condo management or storage facilities. Their agility allows them to respond quickly to client demands and introduce specialized tools.

Top Key Players in the Market

- Yardi Systems, Inc.

- AppFolio, Inc.

- TenantCloud

- DoorLoop

- Rentec Direct

- RealPage, Inc.

- Entrata

- MRI Software

- Condo Control Central

- RMS Cloud

- Easy Storage Solutions

- Others

Recent Developments

- In June 2025, MRI Software launched its AI Agent and Page Assistant, designed to transform property management operations by embedding intelligent automation directly into its cloud-based platform. These AI tools streamline leasing workflows, accelerate tenant communications, and provide contextual insights in real time, reducing manual effort for property managers.

- In May 2025, Yardi introduced Acquisition Manager, a cloud-based solution designed to automate real estate deal workflows. The platform centralizes investment documents, streamlines underwriting, and integrates seamlessly with Yardi’s Voyager and Matrix systems, enabling real-time collaboration across acquisition teams.

Report Scope

Report Features Description Market Value (2024) USD 2.56 Bn Forecast Revenue (2034) USD 7.4 Bn CAGR(2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Property Type (Residential, Commercial, Vacation Rentals), By End User (Property Managers and Agents, Housing Associations, Property Investors), By Application (Lease and Tenant Management, Accounting and Financial Reporting, Compliance Management, Others), By Organization Size (Large Enterprise, SMEs), By Pricing Model (Subscription-based Pricing, One-time License Fee) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Yardi Systems, Inc., AppFolio, Inc., TenantCloud, DoorLoop, Rentec Direct, RealPage, Inc., Entrata, MRI Software, Condo Control Central, RMS Cloud, Easy Storage Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud-based Rental Management Platforms MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud-based Rental Management Platforms MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Yardi Systems, Inc.

- AppFolio, Inc.

- TenantCloud

- DoorLoop

- Rentec Direct

- RealPage, Inc.

- Entrata

- MRI Software

- Condo Control Central

- RMS Cloud

- Easy Storage Solutions

- Others