Global Cloud-based Printing Market Size Analysis, Decision-Making Report By Component (Solutions, Services), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Office Printing, Label & Barcode Printing, Marketing & Graphic Printing, Document Archiving & Compliance Printing, Education & Public Institutions), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Education, Government & Public Sector, Retail & Logistics, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149524

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- AI’s Role

- US Market Expansion

- North America Growth

- Other Regions

- Component Insights

- Organization Size Insights

- Application Insights

- Industry Vertical Insights

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

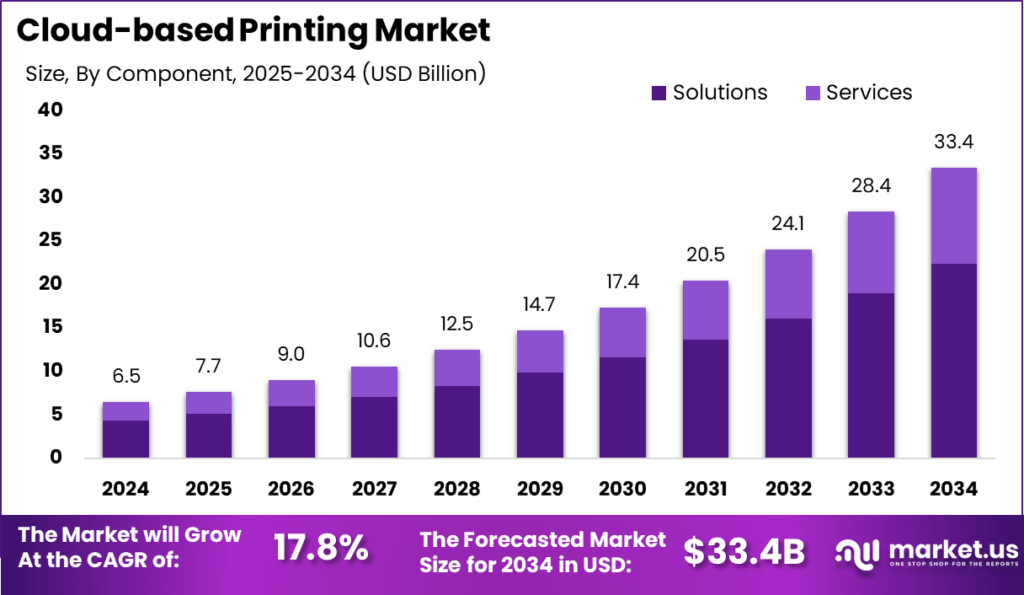

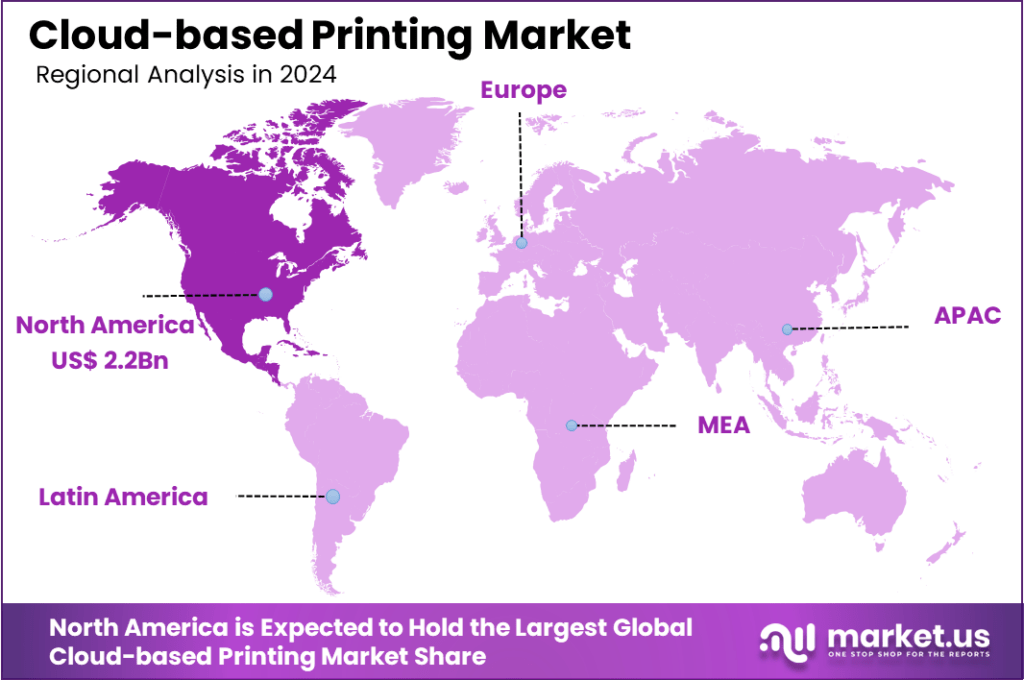

The Global Cloud-based Printing Market size is expected to be worth around USD 33.4 Billion By 2034, from USD 6.5 billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35% share, holding USD 2.2 Billion revenue.

Cloud-based printing is a modern approach that enables users to send print jobs over the internet to remote printers, eliminating the need for direct connections or specific device drivers. This technology allows for seamless printing from various devices – such as laptops, smartphones, or tablets – regardless of the user’s location.

The cloud-based printing market is experiencing significant growth, driven by the increasing demand for remote work solutions and the need for cost-effective printing infrastructure. Several factors are propelling the growth of the cloud-based printing market. The shift towards hybrid work environments necessitates flexible printing solutions that support remote access.

Additionally, the integration of cloud printing with existing enterprise applications, such as Microsoft 365 and Google Workspace, streamlines workflows and improves productivity. The emphasis on sustainability also plays a role, as cloud printing reduces the need for physical infrastructure and minimizes paper waste through better print management.

For instance, in April 2025, Star Micronics Co., Ltd. launched StarIO.Online, a cloud-based service designed to streamline printing for retail stores. By leveraging Star Micronics Cloud Services, the platform allows users to centrally manage printers through Star’s hosted servers, effectively lowering the time and cost required for installing and maintaining traditional print server setups.

The demand for cloud-based printing solutions is escalating, particularly in sectors like healthcare, education, and finance, where secure and efficient document handling is critical. Organizations are seeking solutions that offer centralized management, enhanced security features, and the ability to scale according to their needs. The flexibility to print from any location without compromising on security or quality is becoming a standard requirement in today’s business landscape.

Key Takeaways

- The global cloud-based printing market is projected to grow from USD 6.5 billion in 2024 to around USD 33.4 billion by 2034, advancing at a strong CAGR of 17.8% between 2025 and 2034, driven by enterprise digitization and remote work models.

- North America dominated the global market in 2024, accounting for over 35% of the total revenue and generating approximately USD 2.2 billion, owing to its early cloud adoption and widespread presence of tech-savvy industries.

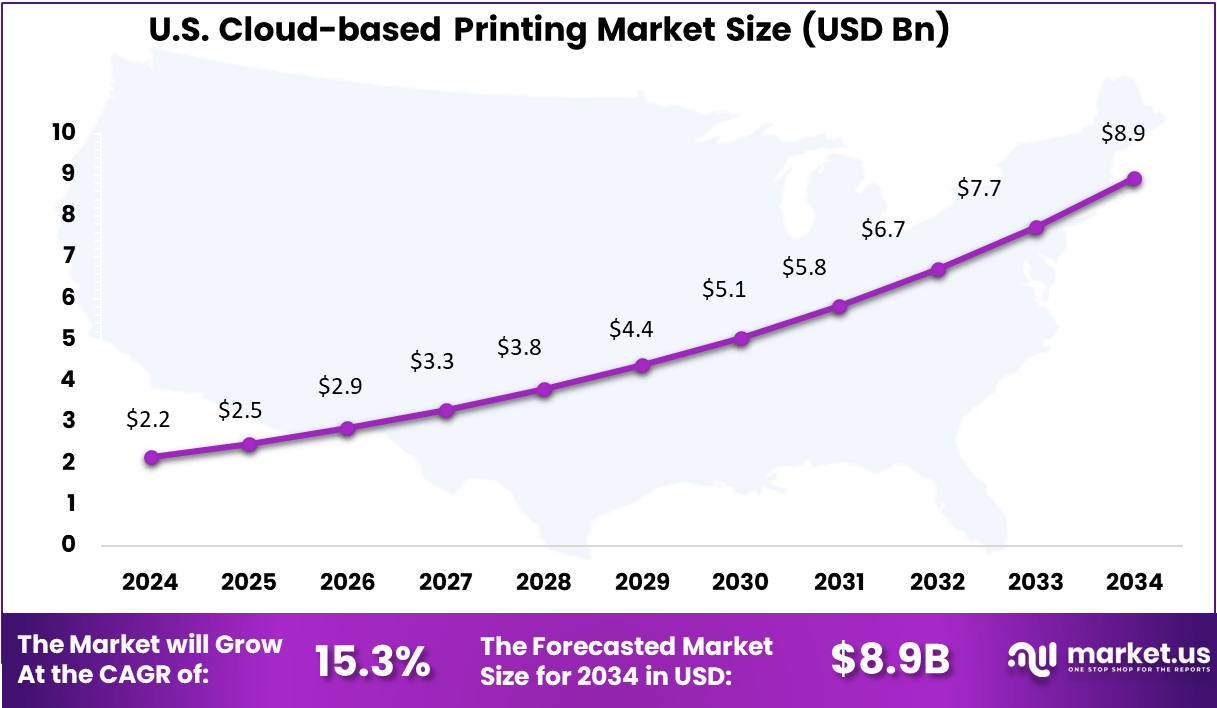

- The U.S. market alone stood at USD 2.2 billion in 2024, projected to reach USD 8.9 billion by 2034, growing at a steady CAGR of 15.3%, driven by increased demand from financial institutions, corporate offices, and educational institutions.

- The Solutions segment held a commanding 67% share in 2024, reflecting strong enterprise demand for end-to-end cloud-managed print services, analytics, and cost control tools.

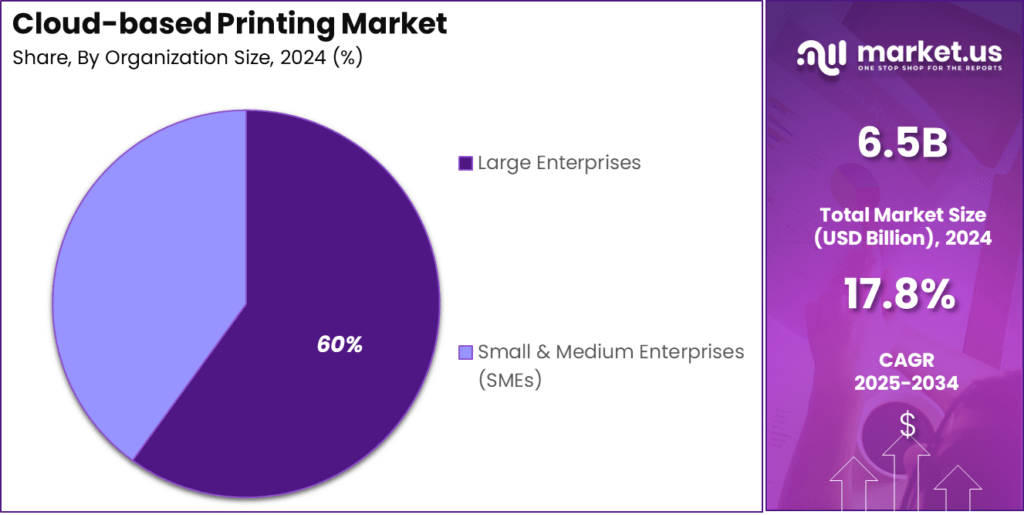

- Large Enterprises captured over 60% of the market share, benefiting from scalable, centralized print management systems that reduce operational overhead and support hybrid workforce models.

- The Office Printing segment led the application share with more than 45%, as organizations prioritize cloud solutions to manage document workflows securely across distributed teams.

- Within the end-use landscape, the BFSI sector emerged as a key driver, holding over 18% share, due to its high-volume printing needs, regulatory compliance requirements, and demand for secure, cloud-based document handling.

Analysts’ Viewpoint

The market presents numerous investment opportunities, particularly for companies offering innovative solutions that address security concerns and integration capabilities. Startups focusing on niche markets, such as mobile printing solutions for field workers or secure printing for legal documents, are attracting attention.

The regulatory environment is evolving to address the challenges associated with cloud printing, particularly concerning data privacy and security. Compliance with standards such as GDPR and HIPAA is essential, especially for organizations handling sensitive information. Vendors are responding by implementing robust encryption protocols and access controls to ensure that data transmitted through cloud printing services remains secure.

Businesses implementing cloud-based printing benefit from streamlined operations, reduced costs, and improved document security. The centralized management of printing resources allows for better monitoring and control, leading to increased efficiency. Employees experience greater flexibility, as they can print documents from various locations without the need for complex setups or configurations.

AI’s Role

Artificial Intelligence (AI) is reshaping the cloud-based printing industry, enhancing efficiency, security, and adaptability. This transformation is particularly evident in the wake of the global shift towards remote work and digital operations.

- Intelligent Workflow Automation: AI streamlines document processing by automating tasks such as job routing, queue management, and error detection. This automation reduces manual intervention, leading to faster turnaround times and minimized errors.

- Predictive Maintenance: By analyzing usage patterns and machine data, AI predicts potential equipment failures before they occur. This proactive approach reduces downtime and maintenance costs, ensuring consistent operational efficiency.

- Enhanced Security Measures: AI bolsters security by monitoring for unusual activities, detecting potential breaches, and enforcing compliance protocols. This is crucial in protecting sensitive information in cloud-based environments.

- Personalized User Experiences: Through machine learning, AI adapts to user preferences, offering tailored printing solutions and recommendations. This personalization enhances user satisfaction and productivity.

US Market Expansion

The US Cloud-based Printing Market is valued at approximately USD 2.2 Billion in 2024 and is predicted to increase from USD 4.4 Billion in 2029 to approximately USD 8.9 Billion by 2034, projected at a CAGR of 15.3% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant market position, capturing more than a 35% share of the global cloud-based printing market, with revenue reaching approximately USD 2.2 billion. This leadership is primarily attributed to the region’s advanced IT infrastructure, widespread adoption of cloud technologies, and a strong presence of key industry players.

Other Regions

Europe Market Trends

The European market is experiencing robust growth, propelled by the region’s emphasis on digital transformation and sustainability. Organizations are increasingly adopting cloud printing solutions to enhance operational efficiency and reduce environmental impact. The integration of cloud services with existing IT infrastructures is facilitating seamless transitions for businesses across various sectors.

Asia Pacific Market Trends

Asia Pacific stands as the fastest-growing region in the cloud printing market. The surge is attributed to the region’s rapid digital transformation, widespread adoption of mobile technologies, and the proliferation of small and medium-sized enterprises seeking cost-effective printing solutions. Countries like China and India are at the forefront, leveraging cloud printing to streamline operations and enhance productivity.

Latin America Market Trends

Latin America’s cloud printing market is on an upward trajectory, driven by the region’s broader adoption of cloud computing technologies. In Mexico, the market is witnessing substantial growth, with projections indicating a near doubling of market size by 2030. The expansion is fueled by the demand for scalable, cloud-based solutions that cater to the diverse needs of businesses across the region.

Middle East & Africa Market Trend

The Middle East & Africa region is experiencing steady growth in the digital and cloud printing sectors. The Gulf Cooperation Council (GCC) countries are leading the charge, with significant investments in digital infrastructure and a focus on technological innovation. The increasing demand for efficient, cloud-based printing solutions is reshaping the market landscape, offering new opportunities for service providers and technology vendors.

Component Insights

In 2024, the Solutions segment held a dominant market position in the global cloud-based printing market, capturing more than a 67% share. This dominance is primarily attributed to the increasing adoption of cloud print management solutions by organizations seeking to enhance operational efficiency, reduce costs, and ensure secure printing practices.

These solutions offer centralized control over printing environments, enabling businesses to manage print jobs, monitor usage, and implement security protocols effectively. The shift towards remote and hybrid work models has further amplified the demand for such solutions, as they facilitate seamless printing operations across diverse locations and devices.

Moreover, the integration capabilities of cloud-based printing solutions with existing IT infrastructures have made them a preferred choice for enterprises aiming to streamline workflows without significant overhauls. Features such as user authentication, secure document release, and real-time analytics contribute to improved data security and compliance with regulatory standards.

Organization Size Insights

In 2024, the Large Enterprises segment held a dominant position in the global cloud-based printing market, capturing more than a 60% share. This leadership is primarily attributed to the substantial demand for scalable, secure, and centralized print infrastructure solutions within large organizations.

These enterprises often operate across multiple locations and manage extensive networks of users and devices, necessitating robust cloud-based printing systems that can efficiently handle complex workflows and ensure data security. The adoption of cloud printing solutions enables large enterprises to streamline operations, reduce reliance on physical infrastructure, and enhance overall productivity.

Furthermore, large enterprises are more inclined to invest in advanced technologies to maintain competitive advantage and comply with stringent regulatory standards. Cloud-based printing offers features such as user authentication, secure document release, and comprehensive audit trails, which are essential for industries dealing with sensitive information, such as finance, healthcare, and legal sectors.

Application Insights

In 2024, the Office Printing segment held a dominant position in the global cloud-based printing market, capturing more than a 45% share. This prominence is primarily attributed to the widespread adoption of cloud printing solutions within corporate environments.

Organizations are increasingly leveraging cloud-based printing to streamline operations, reduce infrastructure costs, and enhance document security. The integration of cloud printing with existing enterprise systems facilitates seamless workflow management and supports digital transformation initiatives.

Furthermore, the shift towards remote and hybrid work models has amplified the demand for flexible and accessible printing solutions. Cloud-based office printing enables employees to print documents securely from various locations and devices, ensuring business continuity and productivity.

The scalability and centralized management offered by cloud printing platforms allow businesses to adapt to changing needs without significant investments in hardware. Consequently, the Office Printing segment’s robust growth is expected to continue, driven by technological advancements and the ongoing evolution of workplace practices.

Industry Vertical Insights

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant position in the global cloud-based printing market, capturing more than an 18% share. This leadership is primarily attributed to the sector’s stringent requirements for data security, regulatory compliance, and operational efficiency.

Financial institutions handle sensitive customer information and are subject to rigorous regulatory standards, necessitating secure and reliable printing solutions. Cloud-based printing offers features such as encrypted data transmission, user authentication, and detailed audit trails, ensuring that sensitive documents are handled in compliance with industry regulations.

Moreover, the scalability and centralized management capabilities of cloud printing solutions enable BFSI organizations to streamline their operations across multiple branches and locations. Additionally, the BFSI sector’s ongoing digital transformation initiatives have accelerated the adoption of cloud technologies, including printing solutions.

The shift towards remote and hybrid work models has further emphasized the need for flexible and accessible printing infrastructure. Cloud-based printing allows employees to securely print documents from various locations and devices, maintaining productivity and continuity of services.

Key Market Segments

By Component

- Solutions

- Services

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Office Printing

- Label & Barcode Printing

- Marketing & Graphic Printing

- Document Archiving & Compliance Printing

- Education & Public Institutions

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Education

- Government & Public Sector

- Retail & Logistics

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Surge in Remote and Hybrid Work Models

The widespread shift to remote and hybrid work arrangements has significantly increased the demand for cloud-based printing solutions. As organizations adapt to flexible work environments, the need for accessible, secure, and efficient printing capabilities from various locations has become paramount.

Cloud printing facilitates seamless document management, allowing employees to print from any device, at any time, without being tethered to a specific location. This flexibility not only enhances productivity but also supports business continuity in dynamic work settings.

Moreover, cloud-based printing reduces the reliance on traditional print infrastructure, leading to cost savings and streamlined IT management. By centralizing print services, organizations can monitor usage, enforce security protocols, and implement sustainable practices more effectively.

Restraint

Data Security and Privacy Concerns

Despite the advantages, data security and privacy remain significant concerns hindering the adoption of cloud-based printing solutions. Organizations are wary of potential vulnerabilities associated with transmitting sensitive documents over the cloud. The risk of unauthorized access, data breaches, and compliance violations poses a substantial barrier, particularly for industries handling confidential information.

Furthermore, the lack of standardized security protocols across different cloud printing services exacerbates these concerns. Companies must ensure that their chosen solutions offer robust encryption, user authentication, and comprehensive audit trails to mitigate risks. Addressing these security challenges is crucial for building trust and encouraging broader adoption of cloud-based printing technologies.

Opportunity

Integration with Digital Transformation Initiatives

The ongoing digital transformation across various sectors presents a significant opportunity for the expansion of cloud-based printing. As businesses modernize their operations, integrating cloud printing into digital workflows enhances efficiency and supports paperless initiatives. This integration enables automated document handling, reduces manual errors, and accelerates information dissemination.

Additionally, cloud printing aligns with sustainability goals by minimizing paper waste and energy consumption. Organizations can leverage analytics from cloud printing services to monitor usage patterns, identify areas for improvement, and implement eco-friendly practices. Embracing cloud printing as part of a comprehensive digital strategy not only optimizes operations but also contributes to environmental responsibility.

Challenge

Integration with Legacy Systems

Integrating cloud-based printing solutions with existing legacy systems poses a considerable challenge for many organizations. Legacy infrastructure often lacks compatibility with modern cloud technologies, leading to operational disruptions and increased implementation costs. The complexity of aligning new solutions with outdated hardware and software can deter businesses from transitioning to cloud printing.

To overcome this hurdle, companies must invest in middleware or hybrid solutions that bridge the gap between legacy systems and cloud services. This approach requires careful planning, resource allocation, and potential restructuring of IT frameworks. Addressing integration challenges is essential for ensuring a smooth transition and maximizing the benefits of cloud-based printing.

Emerging Trends

The cloud-based printing landscape is evolving rapidly, driven by technological advancements and changing business needs. One significant trend is the integration of artificial intelligence (AI) and machine learning into print management systems. These technologies enable predictive maintenance, optimize print workflows, and enhance security protocols, leading to increased efficiency and reduced operational costs.

Another notable trend is the growing emphasis on sustainability within the printing industry. Organizations are increasingly adopting eco-friendly practices, such as implementing print job optimization features and utilizing energy-efficient devices, to reduce their environmental footprint.

Cloud-based printing solutions support these initiatives by providing detailed analytics on print usage, enabling businesses to monitor and manage their printing activities effectively. Furthermore, the expansion of cloud printing services into emerging markets is opening new opportunities for vendors, as businesses in these regions seek cost-effective and scalable printing solutions to support their digital transformation efforts.

Business Benefits

Adopting cloud-based printing solutions offers numerous advantages for businesses aiming to enhance operational efficiency and reduce costs. One primary benefit is the significant reduction in hardware and maintenance expenses. By eliminating the need for on-premise print servers and associated infrastructure, organizations can lower capital expenditures and allocate resources more effectively.

Moreover, cloud-based printing enhances flexibility and accessibility within the workplace. Employees can print documents securely from any location and device, facilitating remote work and improving productivity. Centralized management of print services also enables IT departments to monitor usage, enforce security policies, and implement user authentication protocols, thereby strengthening data protection measures.

Key Player Analysis

Some of the key companies operating in the cloud printing industry include Xerox Corporation, Microsoft Corporation, Ricoh USA, Inc., and PaperCut Software Pty Ltd, among others. As organizations increasingly focus on enhancing service delivery and gaining a competitive edge, leading players are actively engaging in strategic initiatives.

HP Inc. has strategically enhanced its cloud printing capabilities through targeted acquisitions. In 2022, it divested its PrinterOn solution to ePRINTit USA, streamlining its focus on core services. Subsequently, in 2025, HP acquired AI assets from Humane, including the Cosmos platform, to bolster its intelligent ecosystem . These moves signify HP’s commitment to integrating advanced technologies into its cloud printing solutions.

Xerox Corporation has actively pursued growth in the cloud printing sector through significant acquisitions. In 2024, it announced the acquisition of Lexmark for $1.5 billion, aiming to strengthen its core print portfolio and expand global managed print services. Additionally, Xerox acquired ITsavvy, an IT services provider, to enhance its digital offerings. These strategic moves underscore Xerox’s focus on broadening its cloud-based printing and IT service capabilities.

Canon Inc. has consolidated its operations to streamline its cloud printing services. In 2024, Canon Solutions America merged into Canon USA, aiming to unify its sales and service divisions. Earlier, in 2022, Canon acquired Edale, a packaging equipment manufacturer, to enhance its production printing capabilities. These initiatives reflect Canon’s commitment to strengthening its position in the cloud-based printing market through operational efficiency and expanded product offerings.

Top Key Players Covered

- HP Inc.

- Xerox Corporation

- Canon Inc.

- Ricoh Company, Ltd.

- Konica Minolta, Inc.

- Brother Industries, Ltd.

- Lexmark International, Inc.

- Epson America, Inc.

- Kyocera Document Solutions Inc.

- Toshiba Corporation

- Samsung Electronics Co., Ltd.

- Dell Technologies Inc.

- Google LLC

- Others

Recent Developments

- In November 2024, Pharos launched Pharos Cloud, a trusted PrintOps platform tailored for global enterprises seeking scalability, security, and reliability. By removing the need for traditional print servers, it enables a seamless shift to a SaaS-based solution that enhances IT efficiency, strengthens security, and simplifies the overall printing experience.

- Similarly, in October 2024, Tungsten Automation introduced its Hybrid Cloud Print Solution, combining the capabilities of ControlSuite and Printix. This unified platform supports both cloud and on-premises environments, offering users and administrators a flexible, secure, and streamlined print and capture workflow across diverse IT infrastructures.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 33.4 Bn CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Application (Office Printing, Label & Barcode Printing, Marketing & Graphic Printing, Document Archiving & Compliance Printing, Education & Public Institutions), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Education, Government & Public Sector, Retail & Logistics, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HP Inc., Xerox Corporation, Canon Inc., Ricoh Company, Ltd., Konica Minolta, Inc., Brother Industries, Ltd., Lexmark International, Inc., Epson America, Inc., Kyocera Document Solutions Inc., Toshiba Corporation, Samsung Electronics Co., Ltd., Dell Technologies Inc., Google LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud-based Printing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud-based Printing MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HP Inc.

- Xerox Corporation

- Canon Inc.

- Ricoh Company, Ltd.

- Konica Minolta, Inc.

- Brother Industries, Ltd.

- Lexmark International, Inc.

- Epson America, Inc.

- Kyocera Document Solutions Inc.

- Toshiba Corporation

- Samsung Electronics Co., Ltd.

- Dell Technologies Inc.

- Google LLC

- Others