Cloud-based EHR Market By Deployment Model (Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS)), By Type (Standalone and Integrated), By End-User (Hospitals, Ambulatory Surgical Centers, and Clinics and Specialty Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152581

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

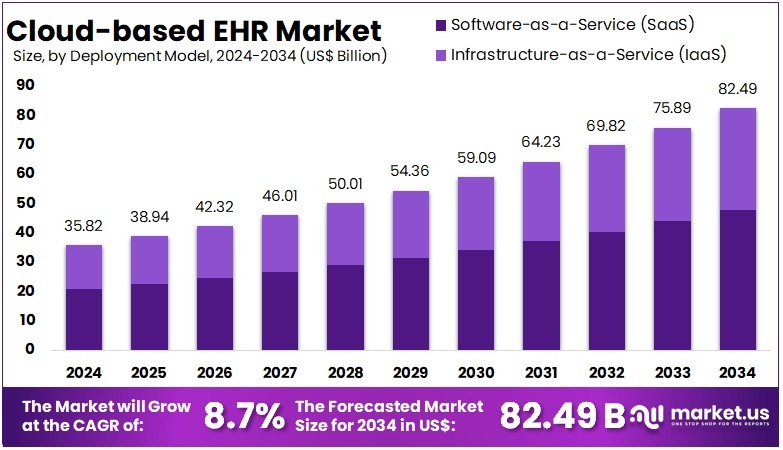

The Cloud-based EHR Market Size is expected to be worth around US$ 82.49 billion by 2034 from US$ 35.82 billion in 2024, growing at a CAGR of 8.7% during the forecast period 2025 to 2034.

Cloud computing, refers to the delivery of hosted services over the internet, which can be either public or private. In the public cloud model, a third-party cloud service provider (CSP) delivers services to an organization. These services are typically sold on a pay-as-you-go basis, with customers paying for the computing power, storage, and bandwidth they use, although long-term contracts may also be available.

Cloud-based EHR systems offer several advantages over traditional in-house systems. One of the primary benefits is the elimination of substantial upfront costs for hardware and infrastructure. Instead of making large initial investments, healthcare organizations typically pay a monthly subscription fee, significantly reducing initial expenses. Some cloud-based systems offer subscriptions as low as US$ 100 per month.

This cost-effective model has made cloud-based EHR systems particularly appealing to small hospitals. According to a survey by Black Book, 83% of small healthcare practices identified cloud-based EHR implementations as one of the most impactful business decisions they had made in recent years.

Furthermore, cloud-based tools enable healthcare organizations to easily scale their health IT infrastructure according to fluctuating demands. Cloud EHRs are particularly advantageous for multi-location healthcare systems, as they allow for seamless access and updates to patient data across different facilities, promoting interoperability.

In October 2024, at the Oracle Health Summit, Oracle announced that it is showcasing its next-generation electronic health record (EHR) to thousands of customers and partners. Developed from the ground up to leverage the high performance and military-grade security of Oracle Cloud Infrastructure (OCI), this EHR is designed to integrate AI throughout the clinical workflow. It aims to automate processes, provide insights at the point of care, and significantly streamline appointment preparation, documentation, and follow-up tasks for physicians and staff.

Key Takeaways

- In 2024, the market for Cloud-based EHR generated a revenue of US$ 82 billion, with a CAGR of 8.7%, and is expected to reach US$ 82.49 billion by the year 2034.

- The Deployment Model segment is divided into Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS) with Software-as-a-Service (SaaS) taking the lead in 2023 with a market share of 57.9%

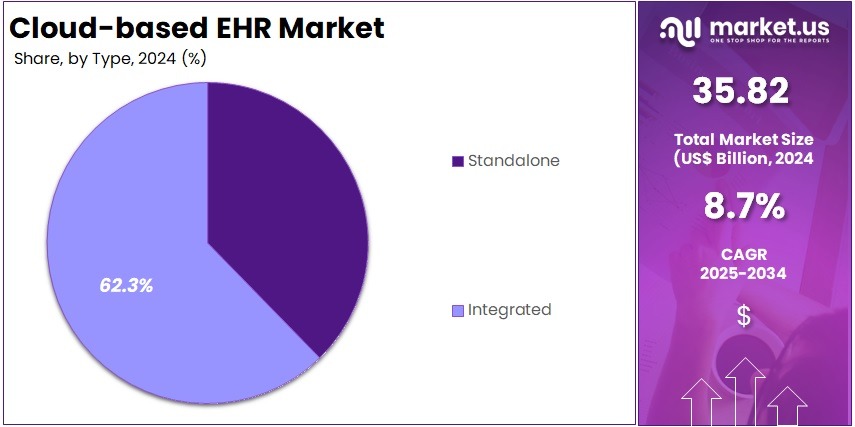

- By Type, the market is bifurcated into Standalone and Integrated with Integrated leading the market with 62.3% of market share.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals, Ambulatory Surgical Centers, and Clinics and Specialty Centers. The Hospitals stands out as the dominant segment, holding the largest revenue share of 52.5% in the Cloud-based EHR market.

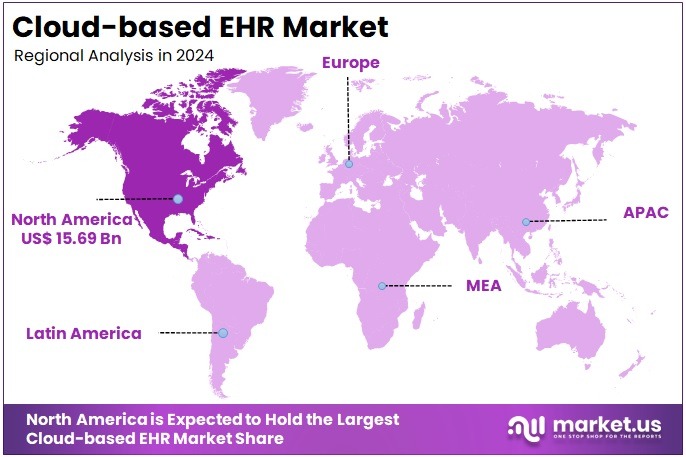

- North America led the market by securing a market share of 43.8% in 2023.

Deployment Model Analysis

The Software-as-a-Service (SaaS) model is the dominant deployment model in the cloud-based Electronic Health Records (EHR) market with 57.9% market share. SaaS EHR systems are hosted on third-party cloud servers and made available to healthcare providers over the internet. This model has gained widespread adoption due to its cost-effectiveness, scalability, and ease of deployment.

Healthcare organizations, especially small and medium-sized practices, prefer SaaS because it requires minimal upfront investment in hardware and infrastructure. Additionally, SaaS solutions provide regular software updates, ensuring compliance with the latest healthcare regulations, such as HIPAA in the U.S. SaaS EHR systems offer flexible pricing models, typically subscription-based, which align with the budgets of healthcare providers without requiring significant capital investment. As a result, SaaS is expected to maintain its dominance in the cloud-based EHR market, particularly as healthcare institutions continue to embrace cloud technologies for streamlined operations and improved data accessibility.

In March 2022, Epic Systems introduced Garden Plot, a new software-as-a-service (SaaS) solution tailored for independent medical groups. This platform offers these groups access to Epic’s core electronic health record (EHR) functionality, similar to that used by large hospitals, but with a simplified, cloud-based approach. This enables smaller practices to utilize Epic’s tools, interoperability, and network, without the need to manage the infrastructure on their own.

Type Analysis

The Integrated EHR segment is the largest segment within the cloud-based EHR market with 62.3% market share. Integrated systems combine electronic health records with other healthcare management tools, such as practice management, billing systems, and patient engagement software, providing a unified platform for healthcare providers. This integration streamlines workflows, reduces administrative burdens, and improves overall efficiency by ensuring that patient data is accessible across various functions within the healthcare system.

Integrated EHR systems are particularly favored by hospitals and large healthcare organizations that need a comprehensive solution to manage clinical, financial, and operational tasks in a seamless manner. These systems also promote interoperability, allowing for easier data sharing between different healthcare providers and institutions, which enhances collaboration and patient care.

In March 2025, eClinicalWorks, the leading ambulatory cloud EHR provider, announced that Contentnea Health has chosen its cloud-based EHR system to optimize workflows at its health centers. The North Carolina-based Federally Qualified Health Center (FQHC), with 35 providers, selected eClinicalWorks for its unified solution that addresses the specific needs of health centers, including medical, dental, behavioral health, vision, and UDS+. By utilizing the AI-powered EHR, Contentnea Health aims to enhance both the quality of care and operational efficiency.

End-User Analysis

The Hospitals segment dominated the cloud-based EHR market accounting for 52.5% market share. Hospitals require advanced, secure, and scalable solutions to manage vast amounts of patient data across multiple departments and specialties. Cloud-based EHR systems offer several advantages for hospitals, including improved data accessibility, interoperability, and the ability to scale as needed. These systems support a wide range of functionalities, from patient registration to clinical decision support, enabling hospitals to streamline operations and improve patient care.

Cloud-based solutions also reduce the burden of managing on-premise IT infrastructure, allowing hospitals to focus resources on patient care and clinical outcomes. Additionally, government incentives for adopting EHRs, such as the U.S. Meaningful Use Program, have driven widespread EHR adoption in hospitals. As healthcare systems continue to digitize, hospitals are expected to maintain their dominant position as the largest segment of cloud-based EHR users.

Key Market Segments

By Deployment Model

- Software-as-a-Service (SaaS)

- Infrastructure-as-a-Service (IaaS)

By Type

- Standalone

- Integrated

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Clinics and Specialty Centers

Drivers

Increased Adoption of Digital Health Solutions

The cloud-based Electronic Health Records (EHR) market is driven by the growing adoption of digital health solutions across the globe. With the increasing emphasis on improving patient care, healthcare providers are turning to cloud-based EHR systems for enhanced data management, security, and accessibility. These solutions allow healthcare providers to access patient records securely from anywhere, improving the speed and efficiency of care delivery.

Cloud-based systems also help in reducing the operational costs associated with maintaining on-premises servers and IT infrastructure. According to a report, in 2024, over 1.3 billion people are expected to use digital health services. This includes the use of fitness trackers, smartwatches, online doctor consultations, and other digital treatment and care services. The adoption of digital health, especially telemedicine, saw a significant surge during the COVID-19 pandemic as alternatives to in-person appointments became essential.

For instance, the U.S. government’s Meaningful Use (MU) incentives and penalties related to EHR adoption have spurred hospitals and practices to invest in cloud-based solutions. Additionally, the COVID-19 pandemic highlighted the importance of accessible digital records for remote consultations and telehealth services, accelerating the shift towards cloud-based EHRs. The scalability and flexibility offered by cloud solutions allow healthcare organizations of all sizes to implement EHR systems, enabling even smaller practices to benefit from these innovations.

Restraints

Data Security and Privacy Concerns

Despite the advantages, data security and privacy concerns remain a significant restraint in the cloud-based EHR market. The sensitive nature of patient data, including medical history, test results, and treatment plans, makes it a prime target for cyberattacks. While cloud providers offer encryption and compliance with regulations like HIPAA in the U.S., healthcare organizations often worry about potential data breaches, unauthorized access, and the overall security of cloud infrastructures.

For example, the 2017 data breach involving the healthcare provider Anthem exposed the personal information of over 78 million individuals, raising concerns about the safety of cloud-based healthcare data. This has led to some hesitance among healthcare providers in transitioning from on-premise solutions to cloud systems. While advancements in cloud security are addressing these issues, healthcare organizations remain cautious about trusting third-party cloud services with their sensitive patient data.

Opportunities

Government Initiatives and Incentives

Government initiatives and incentives represent a major opportunity for the growth of the cloud-based EHR market. Governments around the world are increasingly prioritizing healthcare digitalization as part of broader health system reforms. In the U.S., for example, the HITECH Act provided financial incentives to hospitals and healthcare providers that adopted EHR systems and demonstrated “meaningful use” of the technology. In addition to financial incentives, governments are also creating regulatory frameworks to encourage the implementation of interoperable, cloud-based EHR solutions.

The European Union’s eHealth initiatives, for instance, aim to establish a more connected healthcare system by promoting the adoption of cloud-based health solutions across member states. These initiatives not only provide financial support but also encourage the development of interoperable standards that can connect different EHR systems, further driving the shift to the cloud.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the cloud-based Electronic Health Records (EHR) market. One of the key macroeconomic influences is the economic stability of regions, which directly affects healthcare spending and the adoption of digital health solutions. In economically stable regions, governments and healthcare institutions are more likely to invest in cloud-based EHR solutions as part of their digital transformation initiatives.

For example, the United States, with its robust economy, has seen widespread adoption of cloud-based EHR systems, supported by government incentives such as the Meaningful Use program. Conversely, in developing economies or regions facing economic challenges, budget constraints can limit the ability of healthcare providers to adopt advanced technologies like cloud-based EHR systems. This discrepancy often leads to slower adoption rates in these areas, despite the long-term cost savings and efficiency benefits offered by cloud solutions.

Geopolitical factors also influence the cloud-based EHR market, especially with respect to data privacy regulations and cross-border data flow. Data protection laws such as the General Data Protection Regulation (GDPR) in Europe have significant implications for how cloud-based EHR providers manage and store patient data. In regions with stringent data protection regulations, healthcare organizations must ensure compliance, which can increase costs for adopting cloud-based EHR systems.

Latest Trends

Integration of Artificial Intelligence and Machine Learning

A significant trend in the cloud-based EHR market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies to improve data processing and patient care. AI and ML can help analyze vast amounts of health data stored in EHR systems, identifying patterns and trends that might otherwise go unnoticed. This can enhance clinical decision-making, assist in predictive analytics, and help in early disease detection. For example, cloud-based EHR systems integrated with AI can identify at-risk patients based on their medical history, facilitating earlier interventions.

IBM Watson Health, for instance, uses AI to assist healthcare providers by offering insights into patient treatment options, drug interactions, and potential risks. This trend is transforming EHR systems from simple data repositories to sophisticated tools that support clinical decision-making and improve patient outcomes. The integration of AI also allows for more personalized healthcare by enabling customized treatment plans based on predictive insights derived from patient data.

Regional Analysis

North America is leading the Cloud-based EHR Market

Key drivers of growth include government incentives, such as the U.S. Meaningful Use program, which has accelerated the adoption of EHRs by offering financial incentives. Additionally, the operational efficiency of cloud-based systems, which reduces the need for extensive IT infrastructure and simplifies maintenance, is a significant factor.

Furthermore, these systems enable enhanced interoperability, allowing for seamless data exchange across healthcare entities, which improves care coordination. However, challenges like data security concerns and the complexities of integrating cloud-based EHRs with existing legacy systems continue to pose barriers. In July 2023, Universal Health Services (UHS), a leading provider of hospital and healthcare services, expanded the Oracle EHR across its extensive network of behavioral health facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cloud-based EHR market includes Epic Systems Corporation, Oracle Health (Cerner), eClinicalWorks, Allscripts Healthcare (Veradigm), Athenahealth, NextGen Healthcare, Meditech, GE Healthcare, McKesson Corporation, Greenway Health, CureMD Healthcare, Computer Programs and Systems, Inc. (CPSI), MEDHOST, and Other key players.

Epic Systems is a leading provider of cloud-based Electronic Health Record (EHR) solutions, serving hospitals, outpatient clinics, and other healthcare organizations. Known for its comprehensive, interoperable systems, Epic focuses on improving patient care, reducing costs, and enhancing clinical workflows through advanced technology and integration capabilities.

Oracle Health, through its acquisition of Cerner, provides cloud-based EHR and health information solutions to healthcare organizations worldwide. Cerner’s systems streamline clinical workflows, enhance data interoperability, and support decision-making with advanced analytics. eClinicalWorks is a prominent provider of cloud-based EHR and practice management software, serving healthcare providers across the U.S. With a focus on usability and flexibility, eClinicalWorks offers integrated solutions for patient engagement, scheduling, billing, and electronic charting.

Top Key Players in the Cloud-based EHR Market

- Epic Systems Corporation

- Oracle Health (Cerner)

- eClinicalWorks

- Allscripts Healthcare (Veradigm)

- Athenahealth

- NextGen Healthcare

- Meditech

- GE Healthcare

- McKesson Corporation

- Greenway Health

- CureMD Healthcare

- Computer Programs and Systems, Inc. (CPSI)

- MEDHOST

- Other key players

Recent Developments

- In March 2025: Contentnea Health, a North Carolina-based Federally Qualified Health Center (FQHC) with 35 providers, adopted the cloud-based EHR system from eClinicalWorks. Recognized as the largest ambulatory cloud EHR provider, eClinicalWorks was selected for its comprehensive and AI-powered solution tailored to support various healthcare services, including medical, dental, behavioral health, vision, and UDS+ reporting. The implementation is expected to improve workflow efficiency and enhance the quality of patient care.

- In October 2024: Oracle introduced a new electronic health record (EHR) platform, marking its most significant healthcare innovation since acquiring Cerner for US$28 billion in 2022. The newly unveiled EHR system is designed to serve as a continuously updated digital record of patient health information, maintained by clinicians to support ongoing care delivery.

- In January 2023: Fujitsu and Sapporo Medical University announced the launch of a collaborative project set to begin in April 2023. The initiative focuses on promoting data portability for patients’ healthcare information, including both electronic health records (EHRs) and personal health records (PHRs). Fujitsu plans to develop a mobile application for iPhone users and establish a cloud-based platform that facilitates access to and management of health data by patients.

Report Scope

Report Features Description Market Value (2024) US$ 35.82 billion Forecast Revenue (2034) US$ 82.49 billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Model (Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS)), By Type (Standalone and Integrated), By End-User (Hospitals, Ambulatory Surgical Centers, and Clinics and Specialty Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Epic Systems Corporation, Oracle Health (Cerner), eClinicalWorks, Allscripts Healthcare (Veradigm), Athenahealth, NextGen Healthcare, Meditech, GE Healthcare, McKesson Corporation, Greenway Health, CureMD Healthcare, Computer Programs and Systems, Inc. (CPSI), MEDHOST, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Epic Systems Corporation

- Oracle Health (Cerner)

- eClinicalWorks

- Allscripts Healthcare (Veradigm)

- Athenahealth

- NextGen Healthcare

- Meditech

- GE Healthcare

- McKesson Corporation

- Greenway Health

- CureMD Healthcare

- Computer Programs and Systems, Inc. (CPSI)

- MEDHOST

- Other key players