Global Clinical Risk Grouping Solution Market By Product Type (Software (Public Cloud, Private Cloud, and Hybrid Cloud), and Services), By Application (Population Health Management, Fraud Detection And Prevention, Clinical Decision Support, Chronic Disease Management, and Other), By End-user (Hospitals & Clinics, Long Term Care Centers, Ambulatory Surgical Centers, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161227

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

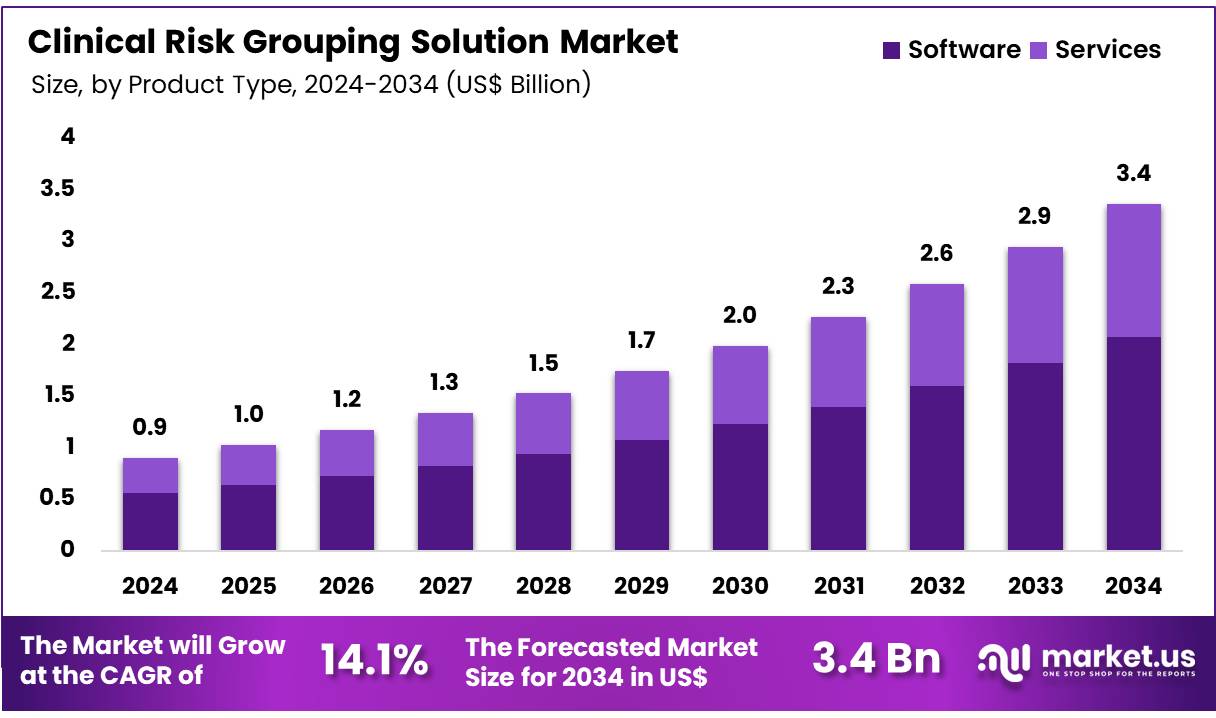

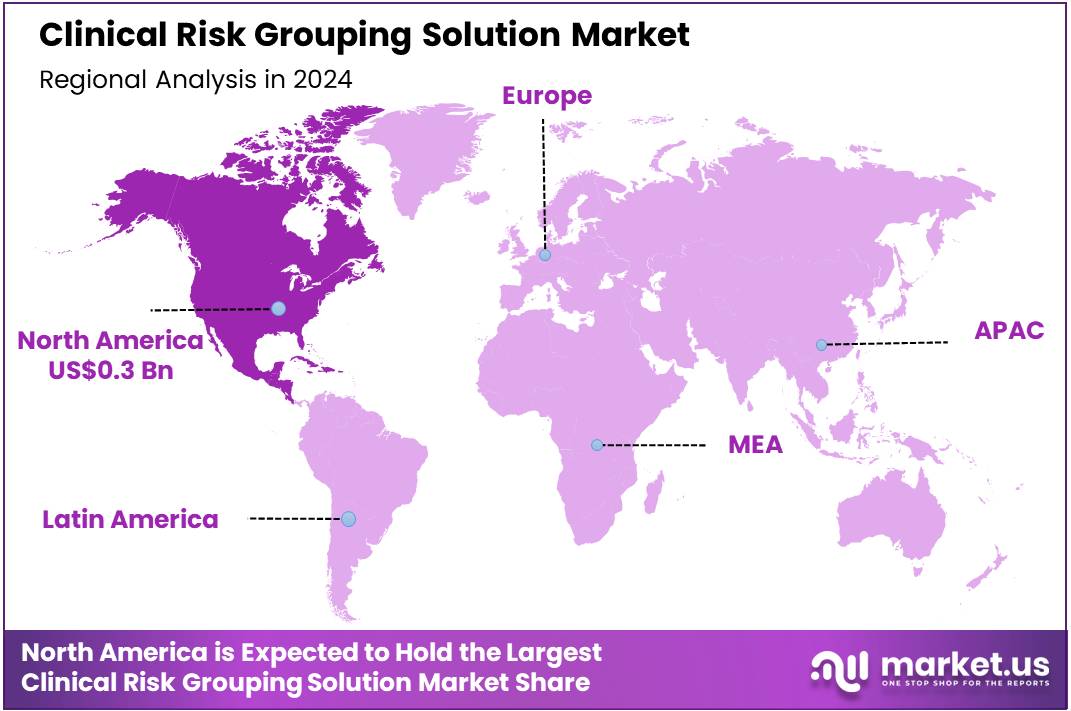

Global Clinical Risk Grouping Solution Market size is expected to be worth around US$ 3.4 Billion by 2034 from US$ 0.9 Billion in 2024, growing at a CAGR of 14.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 0.3 Billion.

Rising prevalence of chronic conditions propels the clinical risk grouping solution market as healthcare organizations seek precise tools for patient stratification and resource allocation. Providers increasingly apply these solutions in chronic disease management, grouping patients by comorbidity profiles to tailor interventions for diabetes complications. This driver intensifies with escalating healthcare costs, where systems enable predictive modeling for heart failure trajectories to optimize care plans.

Payers utilize risk groupings for population health initiatives, identifying high-risk cohorts for preventive screenings in respiratory disorders. In August 2022, Reveleer introduced Risk 2.0, an AI-enabled platform that automates clinical data capture for efficient risk adjustment in health plans. According to the CDC, 6 in 10 adults have at least one chronic disease, emphasizing the need for advanced grouping solutions across clinical applications.

Growing adoption of value-based care models unlocks substantial opportunities in the clinical risk grouping solution market. Innovators develop AI-integrated platforms that refine risk scores for oncology pathways, supporting personalized treatment sequencing based on tumor aggressiveness. Health systems explore these tools for mental health applications, stratifying patients by relapse risks to allocate therapy resources effectively. Opportunities also emerge in post-acute care, where groupings facilitate transition planning for stroke survivors to reduce complications.

In January 2025, Health Catalyst earned recognition as a leader in population health management for its Population Health Suite, providing analytics for risk stratification and outcome enhancements. The CMS reports that 20% of Medicare beneficiaries face 30-day readmissions, highlighting the potential for risk grouping to drive cost-effective, outcome-focused strategies.

Recent trends in the clinical risk grouping solution market highlight AI enhancements and evidence-based criteria to advance decision-making. Developers emphasize interoperable systems for emergency department triage, grouping patients by acuity levels to expedite critical interventions. Trends also include automated auditing features for surgical risk assessments, ensuring compliance in orthopedic procedures.

In March 2025, Optum launched InterQual 2025, incorporating AI-enabled criteria to boost transparency in value-based care workflows. Industry analyses indicate a 23% cost savings for value-based care patients compared to traditional models, reflecting momentum toward integrated risk solutions. These evolutions signal a strategic pivot toward data-driven, equitable healthcare delivery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 Billion, with a CAGR of 14.1%, and is expected to reach US$ 3.4 Billion by the year 2034.

- The product type segment is divided into software and services, with software taking the lead in 2023 with a market share of 61.7%.

- Considering application, the market is divided into population health management, fraud detection and prevention, clinical decision support, chronic disease management, and other. Among these, population health management held a significant share of 44.5%.

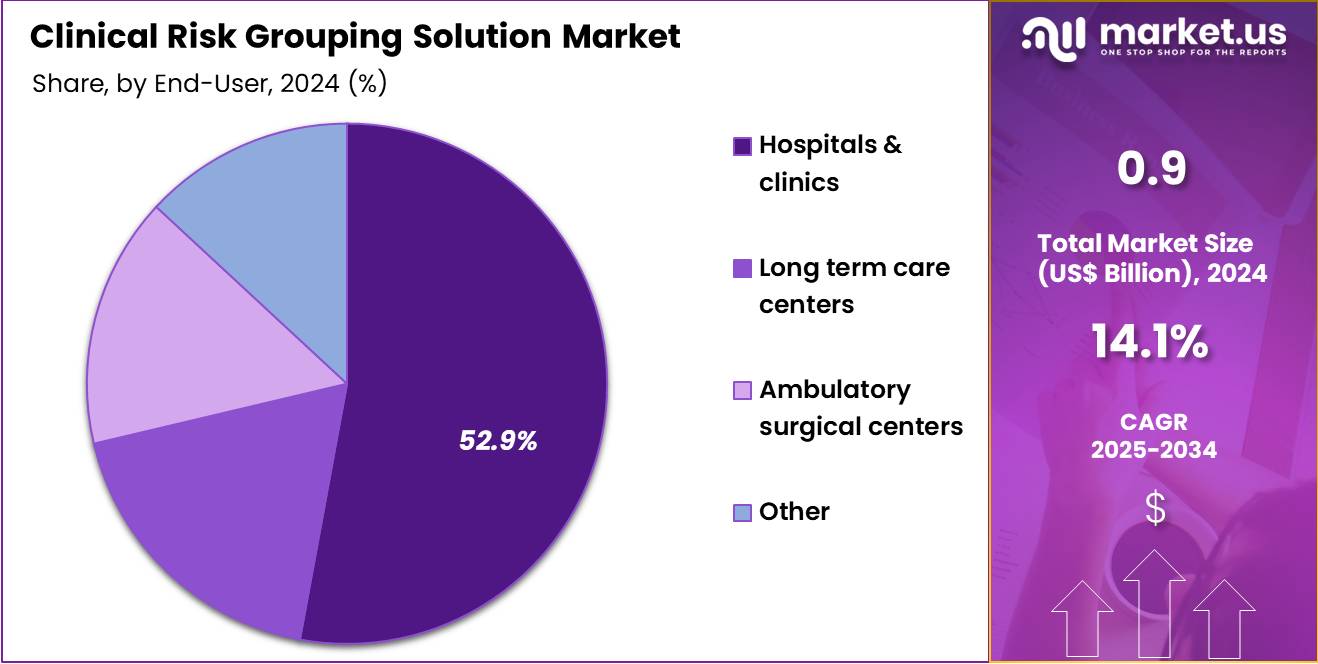

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, long term care centers, ambulatory surgical centers, and other. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 52.9% in the market.

- North America led the market by securing a market share of 38.7% in 2023.

Product Type Analysis

Software holds 61.7% of the Clinical Risk Grouping Solution market and is expected to remain the leading product type due to its critical role in managing and analyzing patient risk data. Software solutions enable healthcare providers to stratify patients based on risk, prioritize care interventions, and optimize resource allocation. The increasing focus on value-based care and the need to reduce healthcare costs are likely to drive adoption of software-based solutions. Integration with electronic health records (EHRs) and other healthcare IT systems allows for real-time data analysis and informed clinical decision-making.

The rise of predictive analytics and machine learning applications in risk assessment is expected to enhance the accuracy and efficiency of software solutions. Hospitals and clinics are increasingly relying on software to identify high-risk populations, manage chronic diseases, and improve patient outcomes. Regulatory initiatives emphasizing population health management and quality reporting are anticipated to further propel growth.

Advancements in cloud-based platforms and user-friendly interfaces are likely to increase accessibility and adoption. The growing demand for scalable, cost-effective, and interoperable software solutions ensures continued market expansion. Continuous innovation in clinical risk algorithms and data visualization tools is expected to maintain the dominance of software in this market.

Application Analysis

Population health management accounts for 44.5% of the application segment and is projected to grow rapidly due to rising healthcare expenditure and the emphasis on preventive care. Healthcare providers are increasingly focusing on proactive patient management, identifying at-risk populations, and implementing targeted interventions to improve health outcomes. Population health management solutions enable the aggregation and analysis of patient data across demographics, helping providers develop personalized care plans. The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory illnesses is expected to drive demand.

Additionally, regulatory requirements, quality reporting mandates, and incentives for value-based care are likely to accelerate adoption. Hospitals and healthcare systems are investing in population health management tools to enhance care coordination and reduce readmissions. Integration with EHRs, predictive analytics, and telehealth platforms is anticipated to improve care delivery efficiency. The rising need for cost-effective healthcare solutions, coupled with advancements in AI-driven risk stratification, is projected to further strengthen the growth of population health management applications. These solutions support better outcomes, reduced costs, and improved patient satisfaction, ensuring sustained adoption in the healthcare market.

End-User Analysis

Hospitals and clinics hold 52.9% of the end-user segment and are expected to continue leading adoption of clinical risk grouping solutions. These facilities require robust systems to manage large volumes of patient data and support risk-based care models. Hospitals are increasingly leveraging these solutions to improve operational efficiency, reduce readmissions, and enhance quality of care. The growing focus on patient safety, preventive care, and chronic disease management is likely to drive demand.

Integration with hospital EHRs and clinical decision support systems ensures that clinicians have timely, actionable insights to inform patient care. Additionally, hospitals face increasing pressure from regulatory bodies and payers to implement population health management strategies and quality reporting measures, which these solutions facilitate. The adoption of predictive analytics and machine learning in hospital settings enhances the accuracy of risk stratification and clinical decision-making.

Hospitals are investing in training and digital infrastructure to maximize the benefits of these solutions. The growing trend of value-based care models, combined with the expansion of hospital networks, is anticipated to further strengthen adoption. Advanced software features, including customizable dashboards and real-time analytics, support hospitals in delivering efficient and high-quality patient care.

Key Market Segments

By Product Type

- Software

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Services

By Application

- Population Health Management

- Fraud Detection And Prevention

- Clinical Decision Support

- Chronic Disease Management

- Other

By End-user

- Hospitals & Clinics

- Long Term Care Centers

- Ambulatory Surgical Centers

- Other

Drivers

The Rising Burden of Chronic Diseases is driving the market

The escalating prevalence and associated financial strain of chronic conditions represent a primary catalyst fueling the demand for Clinical Risk Grouping (CRG) solutions. These sophisticated tools are essential for healthcare systems to efficiently manage large populations of patients with long-term illnesses, enabling proactive intervention and resource optimization. Chronic diseases, such as heart disease, cancer, and diabetes, necessitate continuous medical attention and account for the vast majority of healthcare expenditure in developed nations, forcing a shift towards preventive and risk-stratified care models.

Clinical Risk Grouping software allows providers to accurately categorize patients by complexity and predicted cost, ensuring that high-risk individuals receive the necessary intensive care coordination to prevent costly emergency room visits and hospitalizations. This critical need for cost containment and improved health outcomes is powerfully demonstrated by official figures; for instance, the Centers for Disease Control and Prevention (CDC) reported that 90% of the United States’ US$4.5 trillion in annual healthcare spending in 2022 was for people with chronic physical and mental health conditions.

This enormous financial footprint underscores the absolute necessity for predictive analytics solutions like CRG, as the industry can no longer sustain the cost of reactive, fee-for-service treatment for these prevalent and expensive conditions. The sheer magnitude of this expenditure confirms that healthcare organizations must adopt advanced risk stratification technologies to effectively manage the fiscal and clinical challenges posed by chronic disease.

Restraints

The Complexity of Data Integration and Interoperability is restraining the market

A significant obstacle impeding the full-scale adoption of Clinical Risk Grouping solutions is the pervasive challenge of data integration and interoperability across fragmented healthcare systems. CRG models rely on comprehensive, high-quality patient data—including electronic health records (EHRs), claims data, and demographic information—to accurately assess and predict risk.

However, the lack of standardized data formats and seamless communication between disparate IT systems, even within the same hospital network, often results in incomplete or siloed patient profiles. This inability to compile a holistic view of the patient severely compromises the accuracy and utility of the risk grouping output, ultimately undermining the clinical and financial value proposition of the solution. The administrative and technical overhead required to bridge these gaps and clean the data for consumption by the CRG engine increases implementation costs and time, frustrating end-users.

A study focusing on the technological constraints in healthcare indicates that providers often face hurdles in connecting systems; for example, a report compiled by multiple healthcare stakeholders, including the Centers for Medicare & Medicaid Services (CMS) and large payer groups, found that in their 2022-2024 measurement efforts, organizations reported substantial administrative complexity in implementing alternative payment models (which rely heavily on accurate risk stratification), with approximately US$23.7 billion spent annually in the US health system on billing and insurance-related (BIR) transactions alone, a cost partly driven by fractured data exchange. This massive spending on administrative data processes highlights the underlying systems inefficiency that constrains the adoption and effectiveness of highly analytical solutions.

Opportunities

The Shift to Value-Based Care Models is creating growth opportunities

The ongoing, structural transition within global healthcare from traditional fee-for-service (FFS) reimbursement to value-based care (VBC) models presents a substantial growth avenue for the Clinical Risk Grouping solution market. In VBC frameworks, providers and payers are financially incentivized to improve the quality of care and patient outcomes while simultaneously controlling overall costs. Success in this new paradigm is directly contingent upon a healthcare organization’s ability to accurately identify and manage its patient population’s risk, making CRG software an indispensable tool. These solutions allow organizations to pinpoint high-utilization, high-cost patients for targeted care management programs, a necessity for meeting the clinical and financial benchmarks of VBC contracts.

The measurable expansion of these accountable care structures provides tangible evidence of this opportunity. For instance, the Medicare Shared Savings Program (MSSP) in the US, a flagship VBC initiative, attributed approximately 11 million Medicare beneficiaries to Accountable Care Organizations (ACOs) in 2022, equating to roughly one in every six beneficiaries in the program. This massive shift of patient lives under a financial model that rewards risk stratification and outcome management provides a continuously expanding and non-negotiable end-user base for advanced Clinical Risk Grouping solutions, directly linking their capabilities to the potential for shared savings and financial performance.

Impact of Macroeconomic / Geopolitical Factors

Ongoing economic slowdowns and rising energy costs are pressuring innovators in the patient stratification analytics market, forcing them to limit algorithm improvements and focus on cost-efficient approaches rather than expansive data modeling. Supply chain disruptions from Indo-Pacific tensions and European energy volatility are also restricting access to high-performance computing resources, slowing model training and extending vendor negotiations. To overcome these challenges, companies are partnering with Silicon Valley cloud providers and adopting federated learning, which protects intellectual property while speeding up deployment.

Regulatory emphasis on value-based care is boosting demand for predictive cohorting tools, encouraging integration with payer systems to support more accurate reimbursement decisions. At the same time, the US increase of baseline tariffs to 10% on electronics imports in April 2025 is raising costs for servers and API licenses from overseas providers, reducing flexibility for scaling cloud operations and delaying migration timelines. These factors make multinational data-sharing agreements more cautious, occasionally slowing collaborative benchmarking against global standards.

To adapt, companies are leveraging domestic innovation vouchers to develop edge-computing solutions and privacy-preserving federated models. They are also investing in building skills for scalable inference engines, enabling secure and efficient analytics within local infrastructures. The effective US tariff rate is expected to rise by 16 percentage points in 2025, prompting the industry to adopt a sovereignty-focused approach that balances innovation with operational independence.

Latest Trends

The Integration of Social Determinants of Health (SDOH) Data is a recent trend

A pivotal and recent development reshaping the Clinical Risk Grouping market in 2024 is the accelerating integration of Social Determinants of Health (SDOH) data into risk models. Traditionally, CRG relied exclusively on clinical and claims data, which often failed to capture the full context of a patient’s health, such as factors related to housing stability, food security, transportation access, and education level. Healthcare providers now recognize that these non-clinical factors can account for a significant portion of a person’s health outcomes, often overriding the impact of medical care alone.

The trend involves enriching core CRG algorithms with SDOH information, allowing for a more nuanced, predictive, and equitable assessment of an individual’s total health risk. This is enabling the development of targeted, community-based interventions rather than purely clinical ones. In a significant move reflecting this trend, the Centers for Medicare & Medicaid Services (CMS) has been actively promoting the use of SDOH data, evident in new models like the ACO REACH model. This model, which began its first performance year on January 1, 2023, explicitly allows for payments to Address Health Equity and SDOH needs.

Furthermore, key players are investing heavily in this capability; a key healthcare IT provider, Reveleer, launched its AI-powered Risk 2.0 platform in August 2022, which was explicitly designed to automate clinical data acquisition and coding for health plans, increasingly supporting the aggregation of non-traditional data sources, signaling the market’s transition to a more holistic and data-rich definition of patient risk.

Regional Analysis

North America is leading the Clinical Risk Grouping Solution Market

In 2024, North America held a 38.7% share of the global Clinical Risk Grouping Solution market, fortified by evolving value-based payment models that demand granular patient stratification to optimize resource allocation in Medicare Advantage plans. Health systems deployed sophisticated algorithms to categorize comorbidities accurately, enabling proactive interventions for high-risk cohorts with multiple chronic conditions like diabetes and heart failure. The shift toward predictive analytics integrated with electronic records minimized coding inaccuracies, supporting equitable reimbursement under federal guidelines.

Collaborative frameworks between payers and software vendors enhanced model transparency, addressing disparities in rural versus urban risk assessments. Expanded telehealth integrations facilitated remote data capture for dynamic grouping, aligning with post-discharge monitoring needs. Fiscal pressures from rising elderly populations incentivized adoption of scalable platforms, yielding measurable reductions in avoidable hospitalizations. These adaptations exemplified the region’s emphasis on data-informed clinical governance. The Centers for Medicare & Medicaid Services noted that 608 issuers participated in the HHS-operated risk adjustment program in 2022, decreasing marginally to 605 in 2023, reflecting sustained involvement in risk grouping mechanisms.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries across Asia Pacific project the clinical risk grouping solution sector to advance during the forecast period, as fiscal commitments to universal coverage amplify needs for stratified care in heterogeneous populations. Regulators in China and Indonesia allocate budgets for algorithmic tools that segment vulnerable groups, empowering primary providers to tailor preventive services for metabolic syndromes. Technology alliances with public institutes refine ethnicity-adjusted models, anticipating refined predictions for tuberculosis recurrence in migrant communities.

Administrative leaders in Australia and the Philippines pioneer federated databases, positioning district networks to aggregate anonymized profiles for outbreak prioritization. Authorities estimate integrating mobile inputs for real-time updates, alleviating burdens in archipelago logistics through cloud validations.

Domestic developers cultivate hybrid engines blending socioeconomic factors, synchronizing with national registries to forecast dementia trajectories. These configurations nurture a landscape for judicious, population-centric interventions. The World Bank indicated that domestic general government health expenditure per capita in East Asia and Pacific reached US$

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading providers in the patient stratification analytics market maintain growth by enhancing predictive models that integrate social determinants of health and genomic data, creating sharper risk profiles for targeted interventions. They secure regulatory endorsements through comprehensive validation studies, embedding evidence-based methodologies that accelerate adoption within value-based care networks. Companies are expanding integrations with electronic health records via APIs, enabling smooth data flows that support both actuaries and clinicians.

Decision-makers invest in data science talent, building in-house capabilities for customized algorithm tuning across diverse populations. Providers are also entering emerging European and Middle Eastern markets, collaborating with national health services to tailor frameworks to local epidemiological patterns. On top of core analytics platforms, advisory services guide clients on reimbursement optimization, fostering long-term partnerships and diversified revenue streams.

3M Health Information Systems, a division of the 3M Company founded in 1902 and headquartered in St. Paul, Minnesota, develops analytics engines that assess clinical complexity for payers and providers in over 50 countries. Its Clinical Risk Groups framework forecasts utilization and costs, aiding strategic planning in managed care environments. 3M Health invests in continuous enhancements, combining machine learning with administrative claims data to generate detailed cohort insights.

Executive leadership promotes collaborative ecosystems, engaging with policy influencers to shape population health management standards. The organization equips thousands of clients with scalable tools that optimize resource allocation and support equitable care delivery. By blending technological expertise with consultative guidance, 3M Health helps stakeholders navigate fiscal pressures in an evolving healthcare landscape.

Top Key Players

- Reveleer

- Optum Inc

- Nuance Communications, Inc

- Lightbeam

- Health Catalyst

- HBI Solutions

- Conduent Inc

- Cerner (Oracle)

- 3M

Recent Developments

- On August 6, 2025, Optum announced that its Crimson AI predictive analytics platform is accelerating surgical operations for health systems, which directly boosts Operating Room (OR) efficiency and reduces waste. This development showcases the application of advanced analytics for operational improvements, which complements clinical risk stratification by optimizing resource allocation for high-risk patients.

- On June 25, 2025, Optum introduced its AI Marketplace, a new platform designed to connect healthcare organizations with AI solutions. The stated goal is to reduce costs and eliminate friction in the healthcare ecosystem, providing a centralized resource that can facilitate the adoption of new risk-grouping and predictive models.

- On May 20, 2025, Solventum partnered with Ensemble to advance Autonomous Inpatient Coding with AI. This strategic collaboration focuses on leveraging artificial intelligence to streamline and automate the complex process of inpatient coding, which is a foundational component for accurate Clinical Risk Grouping (CRG) and reimbursement under risk-adjustment programs.

- On February 27, 2025, Solventum reported its financial results for the fourth quarter of 2024 and introduced its full-year 2025 guidance. The Health Information Systems segment reported positive organic sales growth for the year ended 2024, confirming continued performance in its technology portfolio, including its population health and risk analysis tools.

- On April 1, 2024, Solventum officially began trading on the New York Stock Exchange as an independent company following its spin-off from 3M. This event formalized the company’s dedicated focus on the healthcare sector, including its Health Information Systems segment which encompasses its comprehensive population health analytics and grouping solutions, reinforcing its commitment to its core technology offerings.

- In 2024, Health Catalyst achieved HITRUST r2 certification for its main platforms, including its Interoperability and Data and Analytics solutions, and attained SOC 2 Type II compliance. This focus on achieving high-level security accreditations underscores the company’s commitment to safeguarding sensitive patient data, which is a critical operational factor for healthcare organizations adopting clinical risk grouping technologies.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 Billion Forecast Revenue (2034) US$ 3.4 Billion CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software (Public Cloud, Private Cloud, and Hybrid Cloud), and Services), By Application (Population Health Management, Fraud Detection And Prevention, Clinical Decision Support, Chronic Disease Management, and Other), By End-user (Hospitals & Clinics, Long Term Care Centers, Ambulatory Surgical Centers, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Reveleer, Optum Inc, Nuance Communications, Inc, Lightbeam, Health Catalyst, HBI Solutions, Conduent Inc, Cerner (Oracle), 3M Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Risk Grouping Solution MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Risk Grouping Solution MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Reveleer

- Optum Inc

- Nuance Communications, Inc

- Lightbeam

- Health Catalyst

- HBI Solutions

- Conduent Inc

- Cerner (Oracle)

- 3M