Global Clinical Nutrition Market- By Route of Administration (Oral, Parental, and Enteral), By Application (Metabolic Disorders, Malnutrition, Gastrointestinal Diseases), By End-User (Adult, Pediatric, and Geriatric), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 97087

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

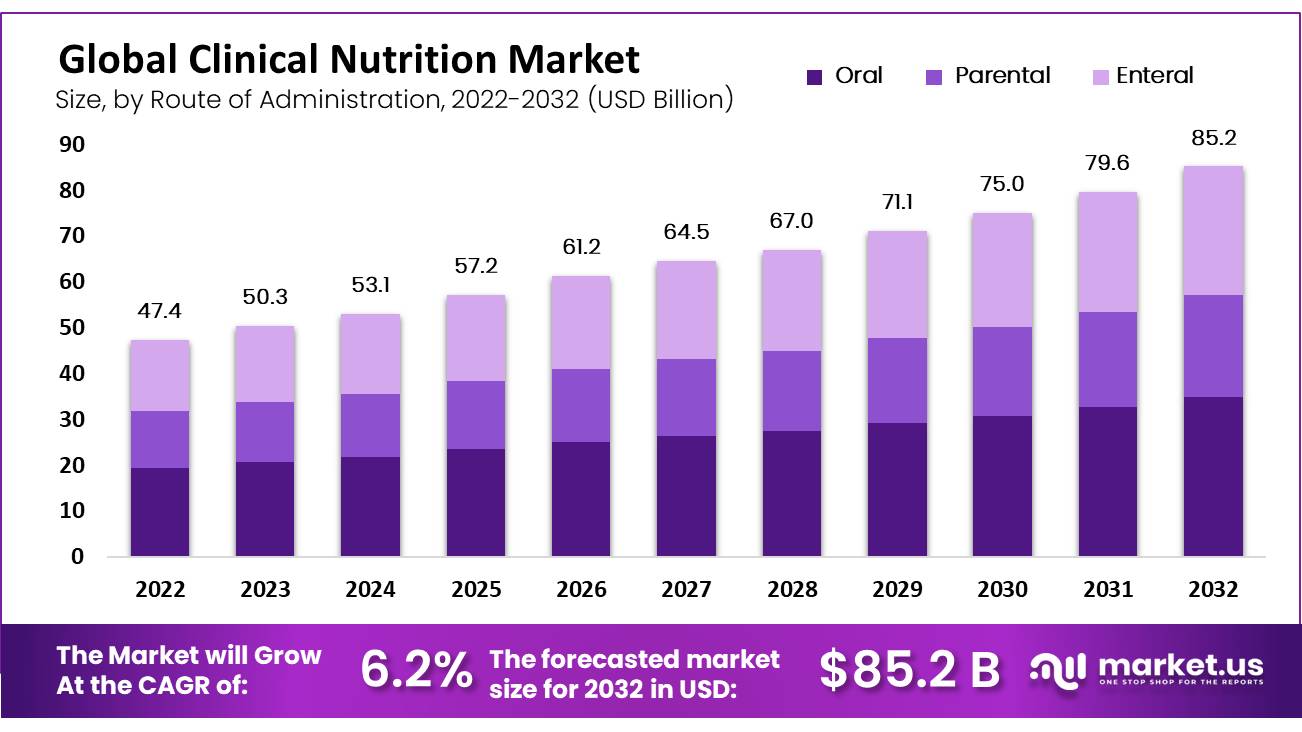

The global clinical nutrition market size is expected to be worth around USD 85.2 billion by 2032 from USD 47.4 billion in 2022, growing at a CAGR of 6.2% during the forecast period from 2022 to 2032.

Clinical nutrition is a type of pharmaceutical product that aids in the maintenance of a patient’s health. Providing sufficient vitamins, minerals, and other supplements enhances the metabolic system.

Through the prevention of diet-related diseases, clinical nutrition aids in the promotion of health and helps diagnose and treat diseases that have an impact on the intestinal absorption, intake, and metabolism of diet components.

It works in both ambulatory and acute care settings, such as wellness centers, nutrition support, trauma, cardiac rehabilitation, diabetes, pediatrics, cancer, and community-based intervention programs.

Key Takeaways

- Market Growth: The clinical nutrition market is set to reach USD 85.2 billion by 2032, with a 6.20% annual growth rate.

- Route of Administration: The oral segment leads due to increasing chronic disease cases, enteral segment grows fast.

- Applications: The cancer segment is driven by the diabetes and the geriatric population, experiencing the highest CAGR.

- End-User Segments: Pediatric nutrition holds the largest market share and the highest forecasted CAGR.

- Market Drivers: The aging population worldwide necessitates clinical nutrition for chronic disease management.

- Market Restraints: Limited product penetration in developing nations due to healthcare resource constraints and affordability.

- Market Trends: Online retail gains importance as consumers prefer convenience and interaction, boosting clinical nutrition sales.

- Market Opportunities: Rising metabolic disorders and COVID-19 impact fuel demand for clinical nutrition products.

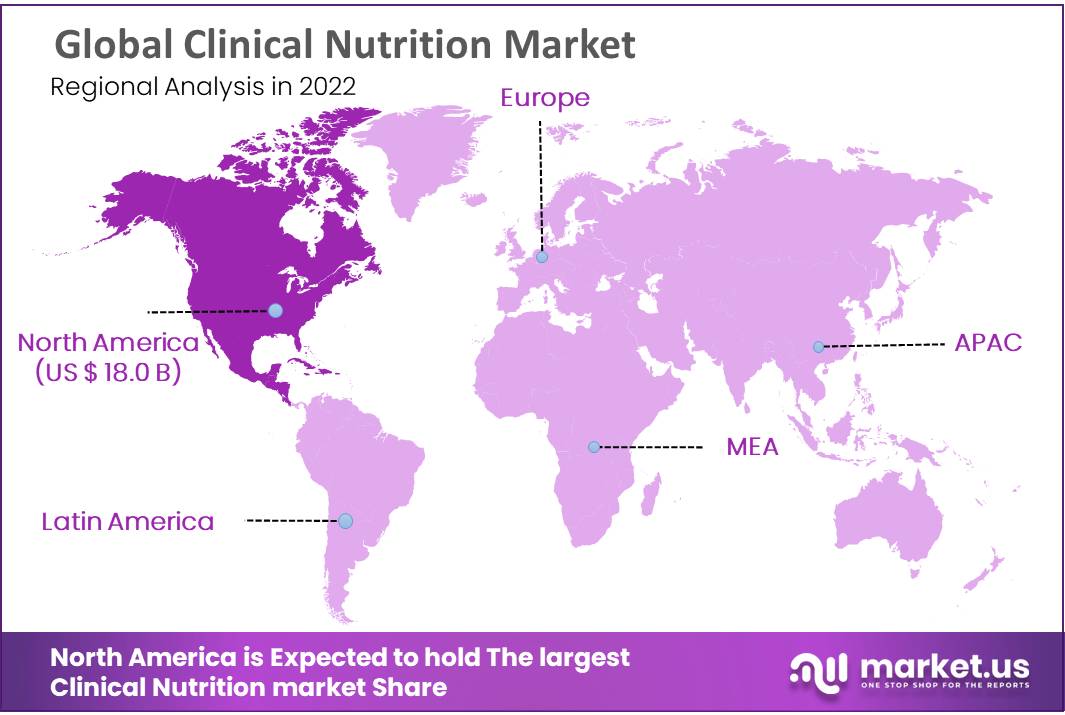

- In 2022, North America dominated the market with the highest revenue share of 38%.

- Asia Pacific will grow at the fastest CAGR from 2023-2032.

Route of Administration Analysis

The Oral Segment held the Largest Share of the Market Because of the Increasing Incidence of Chronic Diseases.

Due to an increase in the incidence of chronic diseases such as gastrointestinal disorders, cancer, and metabolic disorders, which presents lucrative growth opportunities for the oral clinical nutrition market, the oral segment held the largest share and is anticipated to maintain its dominance throughout the forecast period. In addition, it is anticipated that the enteral market will expand at the fastest rate during the forecast period.

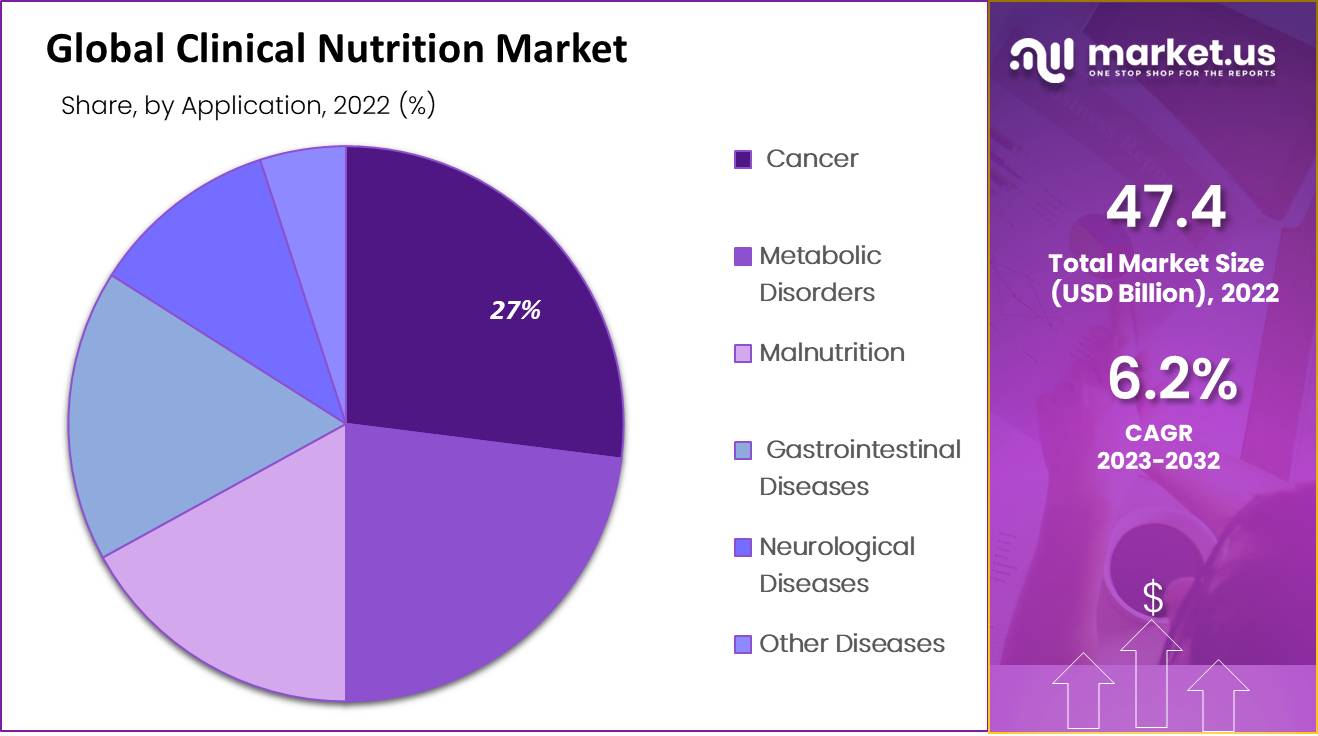

Application Analysis

The Cancer Segment Accounted for the Largest Share of the Global Clinical Nutrition Market.

Due to an increase in the number of people suffering from chronic conditions like diabetes and cancer as well as a growing geriatric population base, which is expected to drive the market over the forecast period, the cancer segment is expected to register the highest CAGR during the forecast period.

Clinical nutrition prescriptions have increased as a result of rising rates of chronic diseases, in which patients are deprived of a small number of essential nutrients. In addition, the industry’s expansion will be driven by the growing number of obese people and people who don’t exercise enough.

End-User Analysis

Pediatric Nutrition Segment Estimating the Highest Share in the Market.

During the forecast period, the pediatric nutrition segment is anticipated to expand at a higher CAGR and hold the largest market share.

The nutritional needs of infants are referred to as infant nutrition. Insufficient nutrients, calories, vitamins, or fluids are provided by an inadequate diet. Compared to infant formula, breast milk provides superior nutrition for these crucial first months of growth.

Breastfeeding helps prevent conditions like obesity, anemia, and sudden infant death syndrome in addition to promoting immunity, intelligence, digestive health, and dental development.

The American Academy of Pediatrics recommends iron-fortified formula or exclusively feeding infant breast milk for the first six months of life and for a year or longer if the mother and baby so choose. Infants typically begin eating solid foods between the ages of four and six months.

As a result, infant nutrition was limited to breastfeeding. As a result, the market is anticipated to hold the largest market share during the forecast period due to the aforementioned factors.

Key Market Segments

By Route of Administration

- Oral

- Parental

- Enteral

By Applications

- Metabolic Disorders

- Malnutrition

- Gastrointestinal Diseases

- Cancer

- Neurological Diseases

- Other Diseases

By End-User

- Adult

- Pediatric

- Geriatric

Drivers

An Increasing Geriatric Population is a Major Factor Responsible for Driving the Market’s Growth.

Global clinical nutrition market share growth is largely driven by an expanding geriatric population. The world’s population is rapidly expanding. The primary factors contributing to the increase in the geriatric population are longevity and a decline in fertility rates.

The elderly make up a significant portion of the population in both developed and developing nations. The aging population is also expanding in nations like the United States, China, Italy, Australia, South Korea, Japan, Russia, Taiwan, Germany, Poland, Canada, and Ukraine. This will push the global clinical nutrition market to expand during the forecast period.

Chronic diseases are more likely with age. The elderly cannot absorb the necessary nutrients from their diet because of the growing number of diseases that affect them.

As a result, clinical nutrition is necessary for the geriatric population. Enteral nutrition is not always an option for elderly patients. As a result, medical professionals recommend giving them nutrition through the stomach.

People who receive home care and those who are admitted to hospitals frequently use parenteral nutrition. As a result, the demand for clinical nutrition will rise as the geriatric population grows, propelling the global clinical nutrition market’s expansion.

Restraints

Inconsistent Product Penetration Hindered the Growth of the Market.

During the forecast period, irregular product penetration will be a major impediment to the expansion of the global clinical nutrition market share. These products are not widely used or readily available in developing nations, particularly in rural areas.

This is because there aren’t enough skilled medical professionals and healthcare facilities. A major obstacle to the expansion of the market and the growth of customers who are seriously ill is the lack of paramedical staff, nutritionists, healthcare practitioners, and food consultants. Despite the growing interest in clinical nutrition, the market’s expansion is hampered by a lack of affordability and availability.

Given that the majority of the world’s population lives in underdeveloped and developing nations, vendors who ignore these crucial factors run the risk of losing market share. The market’s expansion is also impacted by the low online retail penetration in developing nations due to limited Internet access.

As a result, vendors are not making significant investments to upgrade their manufacturing facilities, distribution channels, and warehouses. As a result, the global clinical nutrition market’s expansion may be hindered by inconsistent product penetration.

Trends

Online retail is One of the Important Sources which is Responsible for the Expansion of the Market.

Another factor supporting the expansion of the global clinical nutrition market share is online retail. All retail products, including clinical nutrition products, are seeing shifts in consumer behavior as a result of the growing popularity of the Internet.

Almost every product is now available online. Customers now prefer to buy these products from online stores as a result of the growing popularity of online shopping and the Internet.

Customers can shop more conveniently online. Previously unavailable live chat options are now available on many websites to answer questions right away. In order to raise consumers’ awareness and motivate them to concentrate on preserving their health and wellness, vendors are frequently interacting with customers.

Customers can select the product that best suits their needs by comparing products, vendors, prices, and pack sizes. Product sales in online stores are rising as a result of these value additions.

Clinical nutrition products are also seeing an increase in sales through online stores as a result of the expanding use of the Internet in developing nations. The global market for clinical nutrition will essentially expand due to the rise of online shopping.

Opportunities

The Prevalence of Metabolic Disorders Facilitates the Expansion of the Market.

COVID-19 infection is extremely common in diabetics and other metabolic disorders. The International Diabetes Federation says that people who already have obesity or diabetes are more likely to get the SARS-CoV-2 virus because their immune systems are less strong.

Due to the virus’s propensity to multiply rapidly in response to elevated blood sugar levels, treating diabetic patients who are infected with COVID-19 can be challenging.

In the treatment of COVID-19-infected patients, keeping blood sugar levels under control is of the utmost importance. As a result, nutritional support plays a crucial role in this setting, facilitating the expansion of the market.

Clinical nutrition is also in high demand as the prevalence of metabolic disorders continues to rise. Over 425 million people worldwide currently suffer from diabetes, and this number is expected to rise to 700 million by 2045, according to the International Diabetes Federation.

As a result, this market is anticipated to be fueled by the rising prevalence of metabolic disorders and the introduction of new products. Additionally, the market expansion is anticipated to be sped up by increasing product launches.

Regional Analysis

North America Dominates the Global Clinical Nutrition Market During the Forecast Period.

Due to high R&D spending, the well-established healthcare infrastructure, and the presence of major players & the availability of their products, in the region, North America is anticipated to maintain its dominance throughout the forecast period with a revenue share of 38%.

As the senior population’s health issues continue to rise, there has been an increase in the need for clinical nutritionists in the United States. Nearly 35% of American children regularly consume junk food, which puts them at risk for diabetes, obesity, and cardiovascular issues, according to the Centers for Disease Control (CDC).

Clinical nutrition may become even more in demand as a result of the above-mentioned factors. The growth of the clinical nutrition industry is also influenced by the United States government’s initiative to support cancer patients with comprehensive nutrition care.

Due to investments in healthcare infrastructure made by Asian governments, the Asia-Pacific region is anticipated to experience the highest CAGR. An increase in metabolic disorders, patient awareness of clinical nutritional products, malnutrition-related diseases, and an increase in the number of elderly people are the primary causes of the expansion.

According to research conducted by the world hunger education service, diabetes prevalence is also significantly rising in China. Diabetes is a serious issue for people who are overweight and is increasing the demand for clinical nutrition products.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

NutiFood and BASF have combined and Developed NultiFood (HMO).

NutiFood and BASF formed a partnership to produce products containing Human Milk Oligosaccharides (HMO) in April 2021.

NutiFood is the first Vietnamese dairy company to incorporate HMO into its nutritional products through a partnership with a European company. By the oral route, these products can be consumed.

A few key market players in the clinical nutrition market are Baxter International Inc., Nestle SA, Mead Johnson Nutrition Company, Danone S.A., AYMES International Ltd, Medifood International Ltd, Lonza Ltd, H.J. Heinz Company, American Home Patient Inc., Mead Johnson & Company, Baxter Healthcare, Lonza Group Ltd., KGaA, Lonza Group Ltd., B. Braun SE, and others.

Listed below are some of the most prominent global clinical nutrition market players.

Market Key Players

- Braun Melsungen AG

- Perrigo Company plc

- Hero Nutritionals Inc.

- Fresenius Kabi AG

- Pfizer Inc.

- Hospira Inc.

- Abbott Laboratories Inc.

- Reckitt Benckiser Group PLC

- Other Key Players.

Recent Developments

- June 2022- ObvioHealth, the leading virtual research organization (VRO) in the world, has extensive expertise in clinical, biotechnology, pharmaceutical, and healthcare6. It is developing end-to-end remote clinical trial solutions. It has announced the formation of a prestigious business group as an advisory council.

- May 2022– After 18 months of bootstrapping expansion in the practice of 20 doctors who have already held more than 18,000 sessions, registered dietitians Steven Kuyan and Vanessa Rissetto launched Culina Health, which has received $ 4.75 million in early funding.

Report Scope

Report Features Description Market Value (2022) US$ 47.4 Bn Forecast Revenue (2032) US$ 85.2 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Route of Administration- Oral, Parental, and Enteral; By Application- Metabolic Disorders, Malnutrition, Gastrointestinal Diseases, Cancer, Neurological Diseases, and Other Diseases; By End-User- Adult, Pediatric, and Geriatric. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape B. Braun Melsungen AG, Perrigo Company plc, Hero Nutritionals Inc., Fresenius Kabi AG, Pfizer Inc., Hospira Inc., Abbott Laboratories Inc., Reckitt Benckiser Group PLC, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Which are the top companies hold the market share in Clinical Nutrition Market?The top companies that hold the market share in Clinical Nutrition Market are Braun Melsungen AG Perrigo Company plc Hero Nutritionals Inc. Fresenius Kabi AG Pfizer Inc. Hospira Inc. Abbott Laboratories Inc. Reckitt Benckiser Group PLC Other Key Players.

What is the Projected Value of the Clinical Nutrition Market by 2032?The clinical nutrition market is projected to reach a valuation of USD 85.5 billion by 2032.

How much is the Clinical nutrition market?The Clinical nutrition market size was valued at USD 47.4 Billion in 2022

-

-

- Braun Melsungen AG

- Perrigo Company plc

- Hero Nutritionals Inc.

- Fresenius Kabi AG

- Pfizer Inc.

- Hospira Inc.

- Abbott Laboratories Inc.

- Reckitt Benckiser Group PLC

- Other Key Players.