Global Cleanroom Technology Market By Product (Equipment and Consumables), By End-use (Pharmaceutical Industry, Medical Device Industry, Biotechnology Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 60916

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

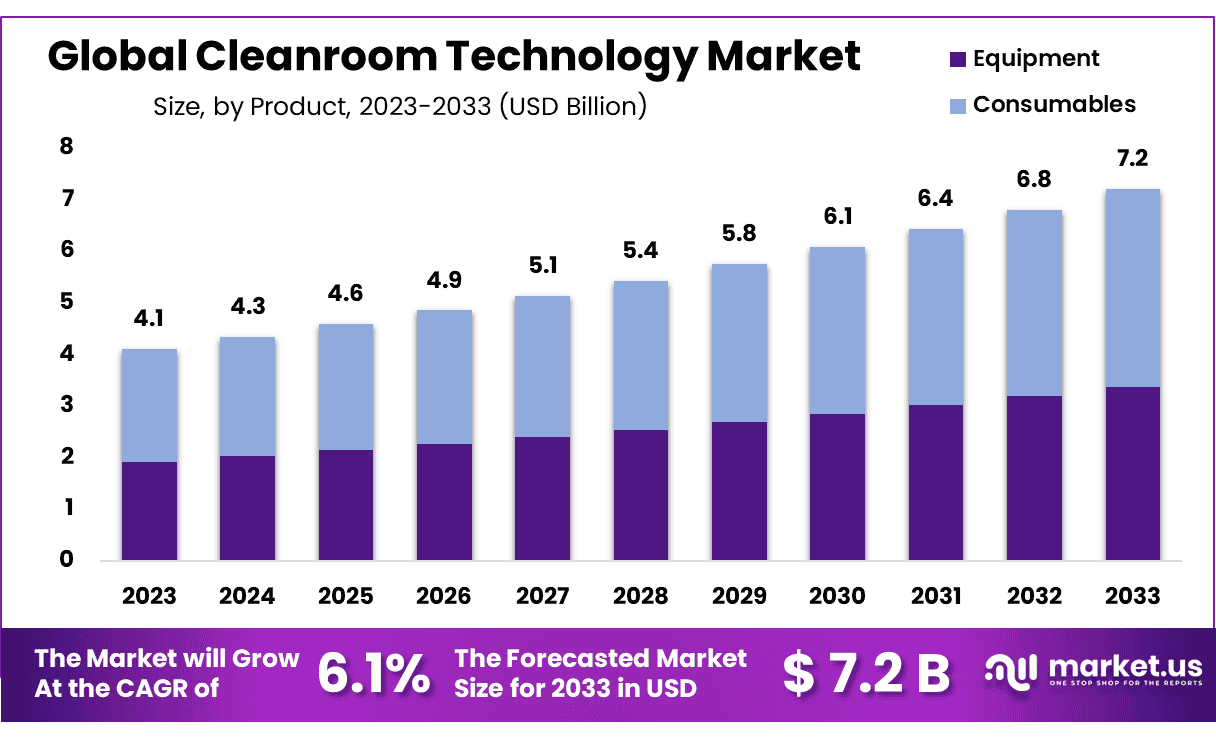

Global Cleanroom Technology Market size was valued at around USD 4.1 Billion in 2023 and is projected to reach over USD 7.2 Billion by 2033, growing at a compound annual growth rate (CAGR) of over 4.8% during the forecast period from 2024-2033.

The superior ranking is possible due to increased demand for products that meet regulatory standards. The key factors driving the market are customized solutions, reduced time and costs, and an improvement in product flow between cleanrooms. The market for cleanroom technologies will be boosted by technological advances, such as HEPA technology, unidirectional airflow systems, and modular cleanroom technologies.

Cleanrooms are designed to limit particle absorption, production, and retention by maintaining optimal levels of temperature, humidity, pressure, and temperature. Cleanroom technology has experienced rapid expansion due to an increasing need for approved items such as sterilized pharmaceutical products as well as its many uses in aseptic manufacturing of medical implants and devices aseptically.

Market for cleanroom technology has also experienced growth due to tightening regulations regarding packaging manufacturing distribution packaging of high quality products while an emphasis on protecting people participating in these activities further drove expansion in this market.

Key Takeaways

- Market Growth: The Cleanroom Technology Market size is estimated to reach USD 7.2 Billion.

- Product Analysis: Consumables make up 53.2% of the cleanroom technology market.

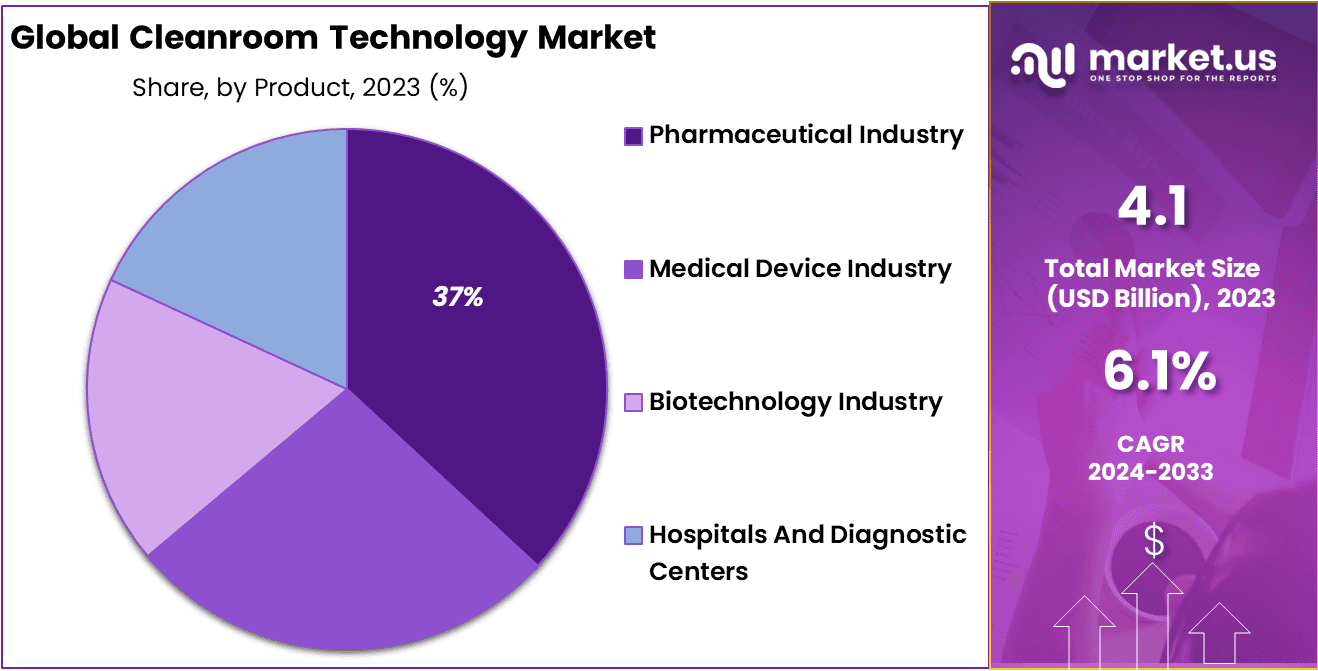

- End Use Analysis: pharmaceutical sector dominated by 36.9 % cleanroom technology market

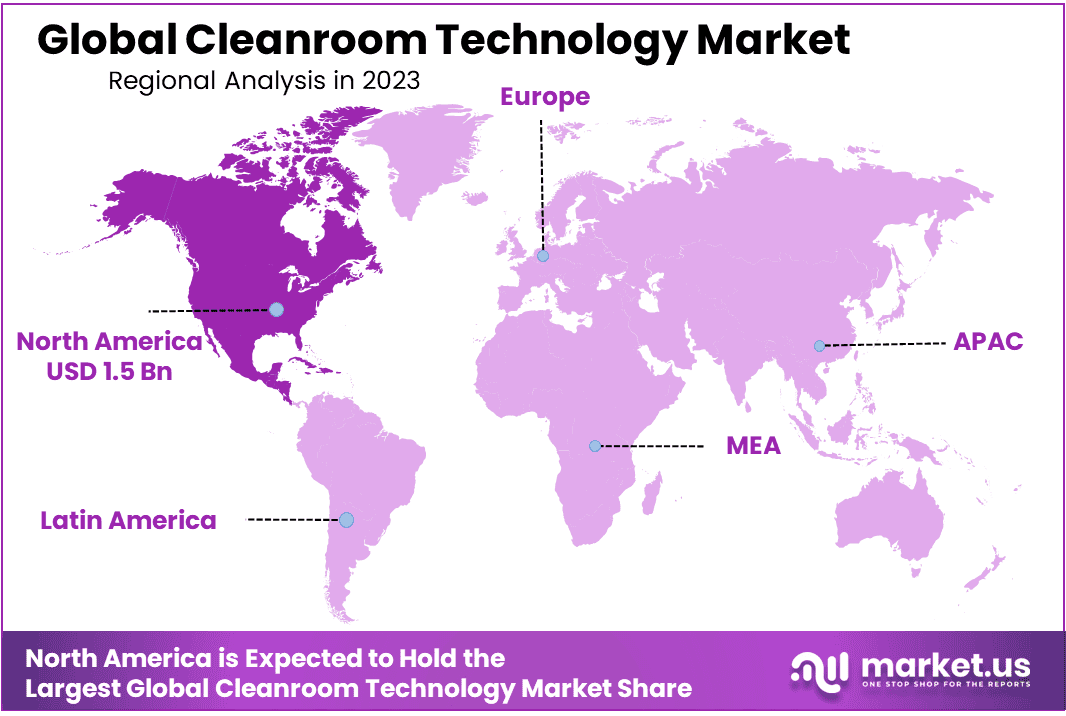

- Regional Dominance: North America holds over 36.6 % of revenue share in 2023.

- Low Dewpoint Cleanroom Demand Increase: Low dewpoint cleanrooms are increasingly necessary in the production of semiconductors and pharmaceutical products; their rising popularity fueling increased interest for low dewpoint cleanrooms.

- Rising Adoption of Robotic Cleaning Systems: Robotic cleaning systems have grown increasingly popular within cleanroom environments due to their ability to deliver consistent and efficient cleaning performance.

- Cleanroom technology demand increases in emerging economies: Cleanroom technology demand is rising dramatically in emerging economies like China and India due to rapid healthcare and pharmaceutical industry development in these nations.

Product Analysis

The consumables segment was the dominant market for cleanroom tech in 2023. It accounted for 53.2% of the total revenue. This segment holds the largest share due to its high usage and high sales of cleanroom supplies, particularly gloves. The consumables used in cleanrooms are either disposable or reusable and are required for production in many end-use sectors, such as hospitals and biotech companies.

At this market, there are various products designed to ensure the space remains ultra clean. First of all, there are cleanroom air filters – special filters designed to capture even minute particles floating through the air – while heating ventilation and air conditioning system (HVAC) controls temperature and air movement.

The growth of this segment can also be attributed to bulk purchase by manufacturing firms, high demand for preventing contamination from personnel, convenience, as well as various other factors such as the development of alternative options by the key players.

Equipment is expected to grow the fastest due to increased use of equipment, including heating ventilation and air conditioning system (HVAC), laminar units, laminar water flow units, air diffusers, and fume hoods. Key players offer cost-effective customized products. Additionally, innovations such as the flexibility of facility construction are driving the demand for equipment in different industrial sectors.

End Use Analysis

In 2023, the pharmaceutical sector dominated the cleanroom technology market. It accounted for 36.9 % of total revenue. This growth can be attributed to the strict approvals of pharmaceutical products which have led to an increased demand for cleanroom technology. It is essential to have low-particulate air for pharmaceutical production. The installation of cleanroom technology equipment like HVAC, air showers, and diffusers will ensure the highest quality product with minimal wastage, maximize yield, and optimize the production process. Cleanroom technologies market has a high potential to grow the pharmaceutical industry because of the above-mentioned factors.

Cleanroom technology is of vital importance in biotechnology. It serves as an arena where sensitive tasks, like research, controlling contamination, pilot studies, and producing products can take place safely and securely. People working there must follow certain rules and wear special attire while on duty.

Hospitals and places where doctors diagnose illnesses rely heavily on cleanliness. Labs dealing with samples like urine, blood, and tissue require instruments that are extremely clean in order to provide accurate results. As more hospitals in the U.S. rely on cleanroom technology to combat infection spread, this aspect of cleanroom technology has seen increased growth.

Due to greater acceptance of biotechnology products around the world, however, the industry segment will experience the fastest growth rate at 6.9%. Due to the high sensitivity of biotechnology-based processes, cleanroom technology plays a critical role in R&D and bio-contamination control as well as pilot studies and production facilities. The global growth of the biotechnology industry is forecast to lead to an increase in cleanroom technology demand.

Key Market Segments

Product Type

Equipment

- Heating Ventilation and Air Conditioning System (HVAC)

- Cleanroom Air Filters

- Air Shower And Diffuser

- Laminar Air Flow Unit

- Other Equipment

Consumables

- Gloves

- Wipes

- Disinfectants

- Apparels

- Cleaning Products

End-use

- Pharmaceutical Industry

- Medical Device Industry

- Biotechnology Industry

- Hospitals And Diagnostic Centers

Drivers

The cleanroom technology market is primarily driven by the stringent regulatory standards imposed by health and safety authorities, particularly in the pharmaceutical, biotechnology, and medical device industries. Regulatory bodies such as the FDA and EMA mandate stringent contamination control protocols, necessitating the adoption of advanced cleanroom technologies. Additionally, the increasing demand for high-quality products in the healthcare and manufacturing sectors drives market growth.

The rise in chronic diseases and the consequent increase in drug production further fuel the demand for cleanrooms. Furthermore, advancements in nanotechnology and the growing semiconductor industry also contribute significantly to the market’s expansion, as these sectors require controlled environments for precision manufacturing.

Trends

One significant trend in the cleanroom technology market is the growing adoption of modular cleanrooms. These prefabricated structures offer flexibility, ease of installation, and cost-effectiveness compared to traditional cleanrooms. The integration of automation and smart technologies, such as IoT and AI, is also gaining traction, enabling real-time monitoring and control of environmental parameters.

Sustainable cleanroom solutions are becoming increasingly popular, driven by the global emphasis on energy efficiency and reducing carbon footprints. Additionally, the development of advanced filtration systems and materials that enhance contamination control is a notable trend shaping the market.

Restraints

Despite the positive outlook, the cleanroom technology market faces several restraints. High initial costs associated with the design, construction, and maintenance of cleanrooms can be a significant barrier, especially for small and medium-sized enterprises (SMEs).

Additionally, the complexity of complying with various regulatory standards across different regions can be challenging for manufacturers. The need for continuous personnel training and the risk of human error in maintaining cleanroom standards also pose challenges. Moreover, the long approval processes for cleanroom products and technologies can delay market entry and impact growth.

Opportunities

The cleanroom technology market offers numerous opportunities for innovation and expansion. The rapid growth of the biotechnology and pharmaceutical sectors in emerging markets, particularly in Asia-Pacific, presents significant opportunities for cleanroom technology providers. Increasing investments in research and development (R&D) activities and the establishment of new production facilities in these regions drive market demand. The growing trend of personalized medicine and advanced therapeutics necessitates highly controlled manufacturing environments, further boosting the need for cleanrooms.

Additionally, the rising focus on improving air quality and contamination control in various industries, including food and beverage and aerospace, opens new avenues for market growth. Companies that can offer innovative, cost-effective, and sustainable cleanroom solutions are well-positioned to capitalize on these opportunities.

Regional Analysis

North America was the leading market for cleanroom technologies in 2023 with a 36.6% revenue share. This can be explained by the region’s well-established healthcare system, the presence of important pharmaceutical and medical device companies, an increase in the prevalence of non-communicable illnesses, and a greater awareness of cosmeceuticals. Additionally, strict regulations in this region regarding the approval and use of healthcare products, such as those from the U.S. have resulted in a rise in cleanroom technology demand.

The market for the Asia Pacific is expected, however, to grow quickly over the forecast period. Asia Pacific’s pharmaceutical market is the third largest after Europe and North America. In this region, investments in healthcare are also increasing. The main factors behind the rapid growth of Asia Pacific’s pharmaceutical sector are patent expirations and growing geriatric populations.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

This market displays significant levels of fragmentation, as evidenced by its increased prevalence of regional players versus larger entities. Major companies are employing strategies such as mergers and acquisitions as well as research and development initiatives dedicated to cleanroom technology to expand their market shares.

Key Market Players

These are the major players in the cleanroom technology market

- Clean Air Products

- Kimberley-Clark Corporation

- DuPont

- Terra Universal, Inc.

- Labconco

- Clean Room Depot

- ICLEAN Technologies

- Abtech

- ExyteGmbH

Recent Developments

January 2023

- ABN Cleanroom Technology introduced Europe’s inaugural ready-to-use low dewpoint cleanroom solution on January 20, 2023, designed specifically to meet the demands of pharmaceutical, semiconductor and electronic industries that rely on precise humidity regulation for production purposes.

April 2023

- Merck announced plans in April 2023 to invest $1 billion into building a pharmaceutical manufacturing facility in North Carolina that will produce vaccines and cancer therapies, among others. This new facility will produce drugs like influenza vaccine and cancer therapy treatments.

- Pfizer recently unveiled plans to invest $500 million in expanding their manufacturing capabilities in Michigan, including building a cleanroom facility dedicated to vaccine production.

July 2023

- Thermo Fisher Scientific, an industry leader in analytical instruments and life science diagnostics, announced plans for an investment of $1 billion into expanding their US manufacturing facilities with cleanroom facilities to produce various medical devices, diagnostic tests, and research reagents. This expansion also involves opening additional locations worldwide.

- Danaher Corporation, an industry-leader in life sciences and environmental & applied solutions, announced plans to invest $400 million in the creation of a bioprocessing facility in North Carolina that will include various cleanroom suites to enable production of biologic medicines.

Report Scope

Report Features Description Market Value (2023) USD 4.1 Billion Forecast Revenue (2033) USD 7.2 Billion CAGR (2024-2033) 4.8 % Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type-Equipment(Heating Ventilation and Air Conditioning System (HVAC), Cleanroom Air Filters, Air Shower And Diffuser, Laminar Air Flow Unit, Other Equipment), Consumables(Gloves, Wipes, Disinfectants, Apparels, Cleaning Products) End-use(Pharmaceutical Industry, Medical Device Industry, Biotechnology Industry, Hospitals And Diagnostic Centers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Clean Air Products, Kimberley-Clark Corporation, DuPont, Terra Universal, Inc., Labconco, Clean Room Depot, ICLEAN Technologies, Abtech, ExyteGmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Cleanroom Technology?Cleanroom technology involves creating and maintaining controlled environments with low levels of pollutants to ensure precision manufacturing or research processes.

How big is the Cleanroom Technology Market?The global Cleanroom Technology Market size was estimated at USD 4.1 Billion in 2023 and is expected to reach USD 7.2 Billion in 2033.

What is the Cleanroom Technology Market growth?The global Cleanroom Technology Market is expected to grow at a compound annual growth rate of 4.8% From 2024 To 2033

Who are the key companies/players in the Cleanroom Technology Market?Some of the key players in the Cleanroom Technology Markets are Clean Air Products, Kimberley-Clark Corporation, DuPont, Terra Universal, Inc., Labconco, Clean Room Depot, ICLEAN Technologies, Abtech, ExyteGmbH

Why are Cleanrooms Important?Cleanrooms are crucial for industries like pharmaceuticals, electronics, and biotechnology to prevent contamination, ensuring the quality and reliability of products.

What Industries Use Cleanroom Technology?Cleanroom technology is widely used in pharmaceuticals, semiconductor manufacturing, biotechnology, aerospace, and healthcare.

What are Key Components of Cleanroom Technology?Components include HEPA/ULPA filters, HVAC systems, gowning rooms, cleanroom furniture, and monitoring systems for temperature, humidity, and particle levels.

How is Cleanroom Contamination Controlled?Contamination is controlled through air filtration, strict gowning procedures, controlled airflow, and regular monitoring and maintenance.

Cleanroom Technology MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Cleanroom Technology MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Clean Air Products

- Kimberley-Clark Corporation

- DuPont

- Terra Universal, Inc.

- Labconco

- Clean Room Depot

- ICLEAN Technologies

- Abtech

- ExyteGmbH