Global Chloroacetonitrile Market By Type(High Selectivity Catalyst, High Performance Catalyst, Others), By Application(Glycol Ethers, Acrylonitrile, Ethoxylates, Ethanolamine, Others), By End Use Industry(Chemical, Healthcare, Food and Beverages, Automotive, Others), By Distribution Channel(Direct, Indirect), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123448

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

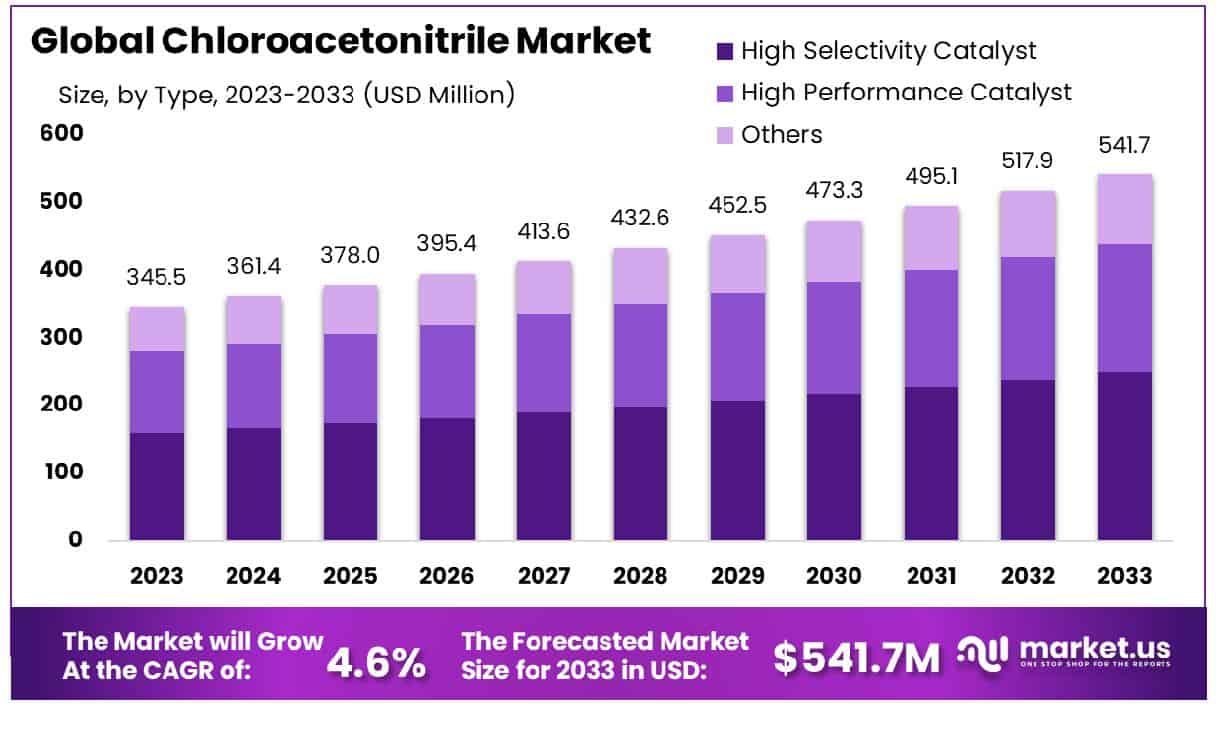

The Global Chloroacetonitrile Market size is expected to be worth around USD 541.7 Million by 2033, From USD 345.5 Million by 2023, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033.

The Chloroacetonitrile Market encompasses the production, distribution, and sale of chloroacetonitrile, a key chemical intermediate used predominantly in the synthesis of pharmaceuticals, agrochemicals, and other organic compounds. This market’s relevance is underscored by its role in enabling efficient manufacturing processes across vital industry sectors.

For strategic leaders such as Product Managers, understanding this market is crucial for identifying supply chain efficiencies, optimizing product development, and mitigating risks associated with raw material procurement. The market’s dynamics are influenced by regulatory frameworks, technological advancements, and shifts in demand within end-user industries.

The Chloroacetonitrile market is positioned to experience significant growth, primarily driven by its essential applications in the synthesis of pharmaceuticals and agrochemicals. As an intermediate compound, chloroacetonitrile plays a pivotal role in the production of various chemical products, benefiting from the expansion in these sectors. The surge in agricultural activities, supported by the robust growth in the Indian agricultural sector, which saw an unprecedented increase of 3.5% in 2022-23, underscores the increasing demand for agrochemicals where chloroacetonitrile is utilized.

Concurrently, the escalating trend towards organic farming, evidenced by the rise in organic food markets globally and a sharp increase in organic producers, particularly in countries like India, Ethiopia, and Mexico, might pose challenges to synthetic agrochemical components like chloroacetonitrile, redirecting focus towards more sustainable alternatives in certain segments.

Key Takeaways

- The Global Chloroacetonitrile Market is projected to grow from USD 345.5 million in 2023 to USD 541.7 million by 2033, at a 4.6% CAGR.

- North America’s Chloroacetonitrile market share is 37.6%, USD 129.9 Mn.

- By Type, High Selectivity Catalyst constitutes 57.5% of the market.

- By Application, Glycol Ethers holds a 38.5% market share.

- By End-use, the Chemical sector dominates with 67.5% usage.

- By Distribution Channel, Direct sales account for 56.4% of distribution.

Driving Factors

Catalyzing Role of Chloroacetonitrile in Pharmaceutical and Agrochemical Synthesis

Chloroacetonitrile serves as a pivotal intermediate in the synthesis of various pharmaceutical and agrochemical products. Its chemical properties make it indispensable for the creation of vitamins, antibiotics, amino acids, and herbicides, among other compounds. The escalating demand within these sectors is a principal driver for the growth of the chloroacetonitrile market.

Similarly, the agrochemical sector, bolstered by the increasing need for high-yield crops due to rising global food demands, further amplifies this growth trajectory. This dual-sector reliance underlines the criticality of chloroacetonitrile in meeting both health and agricultural necessities worldwide.

Technological Innovations Enhancing Chloroacetonitrile Production Efficiency

Advancements in chemical manufacturing technologies have significantly optimized the production process of chloroacetonitrile. Modern techniques such as continuous flow synthesis and micro-reactor technologies have led to more efficient, safer, and cost-effective production methodologies. These innovations not only enhance the yield and purity of chloroacetonitrile but also reduce environmental and operational risks associated with its synthesis.

The integration of automation and data analytics into manufacturing processes further ensures consistent product quality and operational efficiency, thereby strengthening the market’s supply capabilities and supporting scalable growth.

Influence of Specialty Chemicals Industry Expansion on Chloroacetonitrile Demand

The global expansion of the specialty chemicals industry, marked by a projected growth rate of 5% annually through 2027, presents significant opportunities for the chloroacetonitrile market. As specialty chemicals, including pharmaceuticals and agrochemicals, become more complex, the need for specialized intermediates like chloroacetonitrile intensifies.

This trend is particularly pronounced in emerging markets, where industrialization and economic growth spur demand for diverse chemical products. The strategic positioning of chloroacetonitrile as a critical component in specialty chemical formulations makes it indispensable in both established and burgeoning markets, driving its global demand and market expansion.

Restraining Factors

Impact of Stringent Environmental and Safety Regulations on the Chloroacetonitrile Market

The growth of the Chloroacetonitrile market is significantly influenced by stringent environmental and safety regulations. Chloroacetonitrile, a chemical compound used in various industrial applications, is subject to rigorous regulatory scrutiny due to its toxic and potentially hazardous nature. Regulatory bodies across the globe are imposing stricter controls on chemical production, usage, and disposal, particularly focusing on minimizing environmental impact and ensuring worker safety.

These regulations can lead to increased compliance costs for manufacturers, potentially restraining market growth. For example, the requirement for advanced waste treatment chemical systems and the need for safer chemical handling procedures increase operational costs. These factors can deter new entrants into the market and limit the expansion activities of existing players, thereby affecting overall market growth dynamics.

Influence of Volatility in Raw Material Prices on the Chloroacetonitrile Market

Volatility in raw material prices is another crucial factor that poses challenges to the Chloroacetonitrile market. The production of Chloroacetonitrile largely depends on the availability and cost of precursor chemicals and raw materials. Fluctuations in these costs can significantly impact production budgets, leading to inconsistent pricing strategies among manufacturers.

For instance, a sudden increase in the price of acetonitrile, a primary raw material, can squeeze profit margins, forcing manufacturers to adjust prices, which could affect consumer demand and market stability. This volatility not only affects cost structures but also compels companies to strategize inventory management and sourcing practices to hedge against price fluctuations. As a result, the market faces potential disruptions in supply chain operations and financial unpredictability, which can restrain growth and investment in the sector.

By Type Analysis

High-selectivity catalysts account for 57.5% of the market, highlighting their significant role in chemical processes.

In 2023, the “By Type” segment of the global Chloroacetonitrile market is primarily categorized into High Selectivity Catalyst, High Performance Catalyst, and Others. Among these, the High Selectivity Catalyst held a dominant market position, capturing more than a 57.5% share. This significant market share underscores the growing industry demand for catalysts that offer superior selectivity, thereby improving yield and reducing by-products in chemical synthesis processes.

High Selectivity Catalysts are increasingly favored in the production of pharmaceuticals, agrochemicals, and fine chemicals, where precision and efficiency are paramount. Their ability to facilitate reactions under milder conditions and with greater control significantly enhances their application scope, driving their dominance in the market. This segment benefits from ongoing advancements in catalytic science, which are continually improving their effectiveness and environmental sustainability.

Conversely, the High Performance Catalyst segment also plays a crucial role in the Chloroacetonitrile market. These catalysts are designed to exhibit high activity and durability under harsh conditions, making them suitable for large-scale industrial applications that require robust performance. Although they hold a smaller share compared to High Selectivity Catalysts, the demand for High Performance Catalysts is supported by industries that prioritize operational longevity and cost-efficiency.

The “Others” category encompasses a variety of specialized catalysts that cater to niche applications within chemical manufacturing. While this segment captures the smallest market share, it is vital for processes requiring unique catalytic properties that are not addressed by more conventional catalyst types.

By Application Analysis

Glycol ether application constitutes 38.5% of the market, demonstrating its critical importance in various industrial uses.

In 2023, the “By Application” segment of the global Chloroacetonitrile market saw Glycol Ethers holding a dominant market position, capturing more than a 38.5% share. This prominence in the market underscores their critical role across various industrial applications, particularly in solvents for paints, coatings, inks, and cleaners. Glycol ethers’ favorable attributes, such as high solvency and low volatility, make them indispensable in formulations requiring efficient performance and lower environmental impact. The push towards more environmentally friendly solvents has driven the demand for glycol ethers, bolstering their market share.

Following Glycol Ethers, Acrylonitrile constitutes another significant segment, utilized primarily in the manufacture of synthetic fibers, plastics, and rubber. The demand for Acrylonitrile is fueled by its applications in the automotive and textile industries, where it is valued for its strength and durability. Although it commands a smaller market share than Glycol Ethers, its role is pivotal in the production of high-performance polymers.

Ethoxylates and Ethanolamine represent further crucial segments within the Chloroacetonitrile market. Ethoxylates are widely used as surfactants in cleaning products, while Ethanolamine plays a vital role in the production of detergents and pharmaceuticals. Both segments benefit from steady demand in consumer goods and industrial processes.

The “Others” category includes a diverse range of applications like pharmaceuticals and agrochemicals, where Chloroacetonitrile derivatives serve as key intermediates. Although this segment captures the smallest share, its importance is growing with the increasing complexity and specificity of chemical synthesis in these sectors.

By End-use Analysis

The chemical industry represents 67.5% of the end-use market, indicating strong demand for these products.

In 2023, the “By End-use” segment of the global Chloroacetonitrile market was prominently led by the Chemical sector, which held a commanding market share of over 67.5%. This significant share reflects the extensive application of Chloroacetonitrile in various chemical manufacturing processes where it is used as an intermediate or a catalyst. The Chemical sector’s dominance is driven by the ongoing demand for high-purity chemicals used in pharmaceuticals, agrochemicals, and specialty chemicals. These applications highlight the critical role of Chloroacetonitrile in synthesizing complex molecules and enhancing reaction efficiencies, which are pivotal in achieving desired product specifications and yield optimizations.

The Healthcare segment also represents a vital part of the Chloroacetonitrile market, though it commands a smaller share compared to Chemical. Chloroacetonitrile’s role in healthcare revolves around its use in pharmaceutical formulations and as a building block in active pharmaceutical ingredients (APIs). The growth in this segment is fueled by the pharmaceutical industry’s expansion and the increasing complexity of new drug formulations, which require pure and effective intermediates like Chloroacetonitrile.

While the Food and Beverages and Automotive sectors are smaller segments within the Chloroacetonitrile market, they are noteworthy for their specialized applications. In Food and Beverages, Chloroacetonitrile is used in trace amounts for synthesis processes related to additives and flavoring agents. In the Automotive sector, its applications include the production of synthetic rubbers and plastics, crucial for manufacturing various automotive components. The “Others” category encompasses additional end-use sectors like cosmetics

By Distribution Channel Analysis

Direct distribution channels dominate with 56.4%, underscoring their efficiency and preference in the market.

In 2023, the “By Distribution Channel” segment of the global Chloroacetonitrile market was predominantly characterized by Direct distribution methods, capturing more than a 56.4% share. This substantial market share underscores the efficiency and control that manufacturers and primary distributors maintain over the supply chain of Chloroacetonitrile. Direct distribution channels are favored particularly due to the sensitive nature of chemical handling and the need for regulatory compliance, which requires stringent control over the product’s quality and delivery.

The direct method facilitates closer relationships between manufacturers and end users, allowing for more tailored customer service, quicker response times, and customized logistic solutions. This approach not only ensures the integrity and purity of Chloroacetonitrile during transit but also enhances operational efficiencies by reducing lead times and minimizing supply chain disruptions.

The Indirect distribution channel, while holding a smaller share, plays a crucial role in expanding the market reach of Chloroacetonitrile, particularly in regions where direct operations are not feasible or economically viable. Indirect channels include third-party distributors, online platforms, and local traders who can navigate regional market dynamics effectively. These distributors extend the market presence of Chloroacetonitrile into smaller, fragmented markets and provide vital logistics and storage solutions, especially in less accessible areas. Although indirect distribution involves additional layers of cost and complexity, it is instrumental in reaching a broader customer base and fulfilling market demands in diverse geographic areas.

Key Market Segments

By Type

- High Selectivity Catalyst

- High Performance Catalyst

- Others

By Application

- Glycol Ethers

- Acrylonitrile

- Ethoxylates

- Ethanolamine

- Others

By End Use Industry

- Chemical

- Healthcare

- Food and Beverages

- Automotive

- Others

By Distribution Channel

- Direct

- Indirect

Growth Opportunities

Expansion into Emerging Markets: A 2023 Growth Opportunity for the Global Chloroacetonitrile Market

The global Chloroacetonitrile market is poised to capitalize on significant growth opportunities in 2023 by expanding into emerging markets characterized by increasing industrial activities. These regions present a fertile ground for growth due to their rising demand for chemicals used in pharmaceuticals, smart agriculture, and specialty chemicals manufacturing. For instance, countries in Asia-Pacific and Latin America are undergoing rapid industrialization and urbanization, which drives the need for various industrial applications that utilize Chloroacetonitrile.

By establishing a presence in these markets, companies can tap into new customer bases and leverage lower production costs, contributing to increased sales and market share. Moreover, partnerships with local firms and investment in regional production facilities may offer strategic advantages, including improved supply chain efficiencies and closer proximity to growing markets, thus enhancing market penetration and revenue generation.

Development of Environmentally Friendly and Safer Chloroacetonitrile Derivatives: A Strategic Move in 2023

In 2023, the development of environmentally friendly and safer derivatives of Chloroacetonitrile represents a critical growth avenue for the market. As regulatory pressures mount and environmental sustainability becomes a global priority, companies are increasingly motivated to innovate and develop safer chemical variants. These new derivatives could potentially reduce the toxicity and environmental impact associated with traditional Chloroacetonitrile, making them more appealing to industries seeking greener alternatives.

This shift not only aligns with global sustainability trends but also opens up new applications in sectors that are sensitive to environmental and health impacts, such as food and beverage, pharmaceuticals, and consumer products. Investing in research and development to create these safer, eco-friendly derivatives can significantly enhance a company’s competitive edge, attract investment, and expand its customer base, driving market growth in the process.

Latest Trends

Adoption of Green Chemistry Practices in Chloroacetonitrile Production: Embracing Sustainability

The global Chloroacetonitrile market is experiencing a transformative shift with the increased adoption of green chemistry practices in 2023. This trend reflects a broader movement within the chemical industry towards sustainability, driven by environmental concerns and regulatory pressures. Companies are implementing green chemistry techniques to minimize waste and energy consumption during the production of Chloroacetonitrile, enhancing their environmental credentials and reducing operational costs.

The use of alternative, less hazardous solvents and the optimization of reaction conditions are notable examples of such practices. These sustainable methods not only help in complying with stringent global environmental standards but also appeal to environmentally conscious consumers and industries. The shift towards green chemistry is expected to foster innovation, leading to the development of new, sustainable chemical processes and products that could open up additional markets and opportunities for growth within the sector.

Strategic Alliances for Technology Sharing: Strengthening Market Positions

In 2023, strategic alliances for technology sharing have emerged as a pivotal trend in the Chloroacetonitrile market. Major market players are increasingly engaging in partnerships to share technological expertise and resources, which enhances their ability to innovate and streamline production processes. These collaborations allow companies to leverage each other’s strengths in technology development, particularly in the areas of process efficiency and product quality enhancement.

By pooling resources and expertise, companies not only accelerate the pace of innovation but also improve scalability and reduce time-to-market for new and improved Chloroacetonitrile derivatives. Such alliances are proving crucial for staying competitive in a market where technological advancement is key to meeting both regulatory requirements and consumer demands for higher performance and environmentally friendly products.

Regional Analysis

The Chloroacetonitrile market in North America accounts for 37.6%, valued at USD 129.9 million.

The global Chloroacetonitrile market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying distinct market dynamics and growth potentials.

North America dominates the Chloroacetonitrile market, holding a substantial share of 37.6%, translating to a market value of approximately USD 129.9 million. This dominance is attributed to advanced chemical manufacturing infrastructures, stringent regulatory frameworks, and significant investments in research and development. The region’s focus on innovative, safer chemical processes and the presence of major pharmaceutical and agrochemical companies drive demand for Chloroacetonitrile.

Europe follows, with robust growth driven by its mature chemical industry and stringent EU regulations that encourage the adoption of safer and environmentally friendly chemicals. Europe’s emphasis on sustainability and green chemistry practices has spurred the development of new applications of Chloroacetonitrile in various industries, enhancing the region’s market share.

Asia Pacific is identified as a high-growth region due to rapid industrialization, particularly in China and India. The expanding pharmaceutical and specialty chemicals sectors, coupled with increasing regional manufacturing capabilities, are propelling the demand for Chloroacetonitrile. The region benefits from competitive manufacturing costs and growing local markets.

The Middle East & Africa and Latin America regions, while smaller in market size, are emerging as potential growth areas. These regions are witnessing gradual increases in industrial activities and regulatory reforms, which are expected to increase the adoption of Chloroacetonitrile in various applications, particularly in agriculture and industrial solvents.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the landscape of the global Chloroacetonitrile market is significantly shaped by the activities of key players, including industry giants such as Akzo Nobel N.V., BASF, Dow, and Royal Dutch Shell Plc., among others. These companies, with their vast resources and extensive research and development capabilities, are pivotal in driving innovation and sustainability within the market.

Akzo Nobel N.V. and BASF are at the forefront, leveraging their strong focus on sustainable chemical solutions to develop environmentally friendly derivatives of Chloroacetonitrile. Their commitment to green chemistry is not only enhancing their market positions but also aligning with global regulatory trends that favor reduced environmental impact.

Dow and DowDuPont Inc. are distinguished by their technological advancements in chemical manufacturing processes. Their efforts in optimizing the production of Chloroacetonitrile through advanced catalytic methods and efficient resource use are setting industry standards for operational excellence and sustainability.

Companies like Huntsman International LLC, India Glycols Limited, and Formosa Plastics Corporation are capitalizing on geographic expansion into high-growth markets such as Asia Pacific and Latin America. These regions offer new consumer bases and lower production costs, which are strategic for companies looking to enhance their global supply chains and market reach.

Mitsubishi Chemical, SABIC, and Sinopec are integrating vertical operations from raw material acquisition to final product delivery, which provides them with a competitive edge in managing cost fluctuations and ensuring product quality and availability.

Market Key Players

- Akzo Nobel N.V.

- BASF

- CRI

- Dow

- DowDuPont Inc.

- Formosa Plastics Corporation

- Huntsman International LLC.

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Indorama Ventures Public Company Limited

- LOTTE Chemical CORPORATION,

- Mitsubishi Chemical

- Royal Dutch Shell Plc.

- SABIC

- Scientific Design

- Sinopec

Recent Development

- In 2023, Indorama Ventures (IVL) in Q1 2024 reported $366M Adjusted EBITDA, a 32% QoQ increase but a 2% YoY decline, with sales volumes rising 3% QoQ to 3.55MT.

- In 2023, LOTTE Chemical Corporation reported a 2023 sales decline to KRW 19,946 billion, with a net loss of KRW 50,043 million, reflecting continued financial challenges into 2024.

Report Scope

Report Features Description Market Value (2023) USD 345.5 Million Forecast Revenue (2033) USD 541.7 Million CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(High Selectivity Catalyst, High Performance Catalyst, Others), By Application(Glycol Ethers, Acrylonitrile, Ethoxylates, Ethanolamine, Others), By End Use Industry(Chemical, Healthcare, Food and Beverages, Automotive, Others), By Distribution Channel(Direct, Indirect) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Akzo Nobel N.V., BASF, CRI, Dow, DowDuPont Inc., Formosa Plastics Corporation, Huntsman International LLC., India Glycols Limited, Indian Oil Corporation Ltd., Indorama Ventures Public Company Limited, LOTTE Chemical CORPORATION,, Mitsubishi Chemical, Royal Dutch Shell Plc., SABIC, Scientific Design, Sinopec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Chloroacetonitrile Market Size in 2023?The Global Chloroacetonitrile Market Size is USD 345.5 Million in 2023.

What is the projected CAGR at which the Global Chloroacetonitrile Market is expected to grow at?The Global Chloroacetonitrile Market is expected to grow at a CAGR of 4.6% (2024-2033).

List the segments encompassed in this report on the Global Chloroacetonitrile Market?Market.US has segmented the Global Chloroacetonitrile Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(High Selectivity Catalyst, High Performance Catalyst, Others), By Application(Glycol Ethers, Acrylonitrile, Ethoxylates, Ethanolamine, Others), By End Use Industry(Chemical, Healthcare, Food and Beverages, Automotive, Others), By Distribution Channel(Direct, Indirect)

List the key industry players of the Global Chloroacetonitrile Market?Akzo Nobel N.V., BASF, CRI, Dow, DowDuPont Inc., Formosa Plastics Corporation, Huntsman International LLC., India Glycols Limited, Indian Oil Corporation Ltd., Indorama Ventures Public Company Limited, LOTTE Chemical CORPORATION,, Mitsubishi Chemical, Royal Dutch Shell Plc., SABIC, Scientific Design, Sinopec

Name the key areas of business for Global Chloroacetonitrile Market?The US, Canada, Mexico are leading key areas of operation for Global Chloroacetonitrile Market.

-

-

- Akzo Nobel N.V.

- BASF

- CRI

- Dow

- DowDuPont Inc.

- Formosa Plastics Corporation

- Huntsman International LLC.

- India Glycols Limited

- Indian Oil Corporation Ltd.

- Indorama Ventures Public Company Limited

- LOTTE Chemical CORPORATION,

- Mitsubishi Chemical

- Royal Dutch Shell Plc.

- SABIC

- Scientific Design

- Sinopec