Global Chipless RFID Market Size, Share and Analysis Report By Component (Tags/Labels, Readers/Interrogators, Software & Middleware), By Frequency Band (Ultra-High Frequency (UHF), Microwave Frequency, Millimeter Wave), By Application (Retail & Supply Chain Management, Aerospace & Defense, Healthcare & Pharmaceuticals, Logistics & Transportation, Smart Cards & Ticketing, Others), By End-User Industry (Retail & E-commerce, Aerospace & Defense, Healthcare, Automotive, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175723

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Component

- By Frequency Band

- By Application

- By End-User Industry

- By Region

- Investment Opportunities

- Business Benefits

- Use Case Analysis

- Investor Type Impact Matrix

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

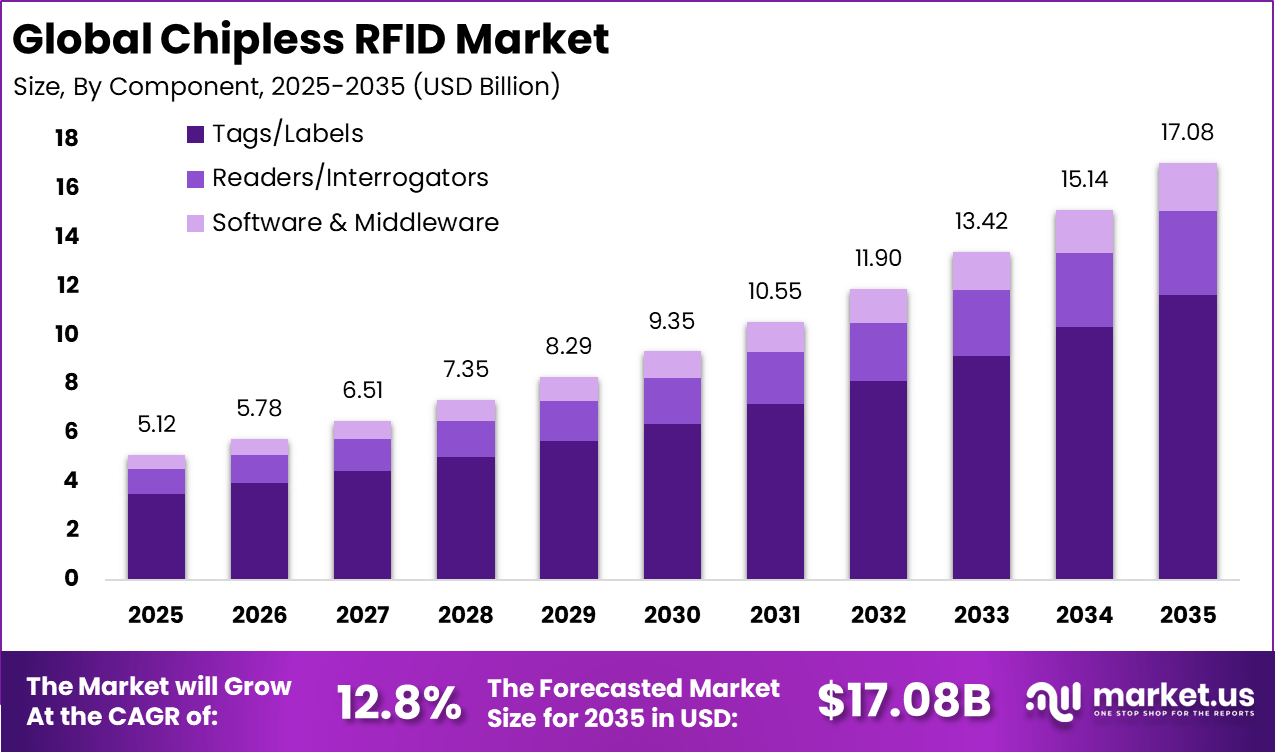

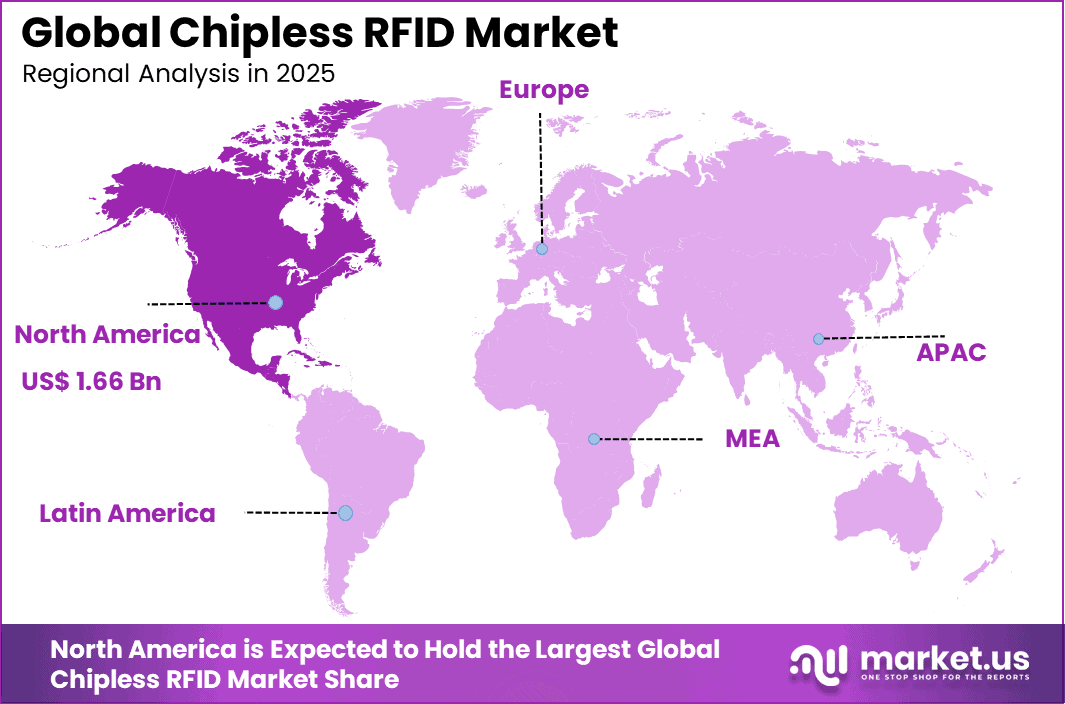

The Global Chipless RFID Market was valued at USD 5.12 billion in 2025 and is projected to expand to approximately USD 17.08 billion by 2035, registering a solid CAGR of 12.8% over the forecast period. North America dominated the market in 2025, capturing more than 32.6% share and generating USD 1.66 billion in revenue, reflecting rising adoption of low-cost, scalable identification and tracking technologies across retail, logistics, and industrial applications.

The Chipless RFID market focuses on radio frequency identification technologies that operate without an embedded silicon chip. Instead of integrated circuits, these tags use printed resonators or material patterns to store and transmit data when exposed to radio signals. Chipless RFID is designed to offer identification and tracking capabilities at significantly lower cost compared to traditional RFID tags. This makes the technology suitable for large scale item tagging where affordability is critical.

Chipless RFID systems are mainly used for identification, authentication, and basic sensing applications. These tags can be printed directly onto packaging, labels, or products using conductive inks. Their simple structure allows for mass production and integration into disposable items. As cost efficiency becomes a priority in tracking and authentication, chipless RFID is gaining attention across several industries.

For instance, in May 2025, HID Global acquired Vizinex RFID to expand high-performance passive RFID tags using printed circuit technology, strengthening asset tracking in logistics and manufacturing from Austin, Texas.

One of the main driving factors for the Chipless RFID market is the demand for ultra low cost identification solutions. Traditional RFID tags can be expensive for tagging billions of low value items. Chipless RFID removes the need for silicon chips, reducing material and manufacturing costs. This enables item level tagging at scale across supply chains.

Advancements in printable electronics are accelerating the adoption of chipless RFID. Improvements in conductive inks and substrate materials have enhanced signal reliability and readability. These innovations allow tags to be produced using standard printing processes. This supports scalable and cost effective manufacturing.

Key Takeaway

- In 2025, the tags and labels segment led the global chipless RFID market, capturing 68.4% share, driven by wide use in inventory tracking and product identification.

- The ultra high frequency (UHF) segment held a dominant 72.8% share in 2025, supported by longer read ranges and higher data capture efficiency.

- Retail and supply chain management accounted for 38.7% of the market in 2025, reflecting strong demand for real time visibility and loss prevention solutions.

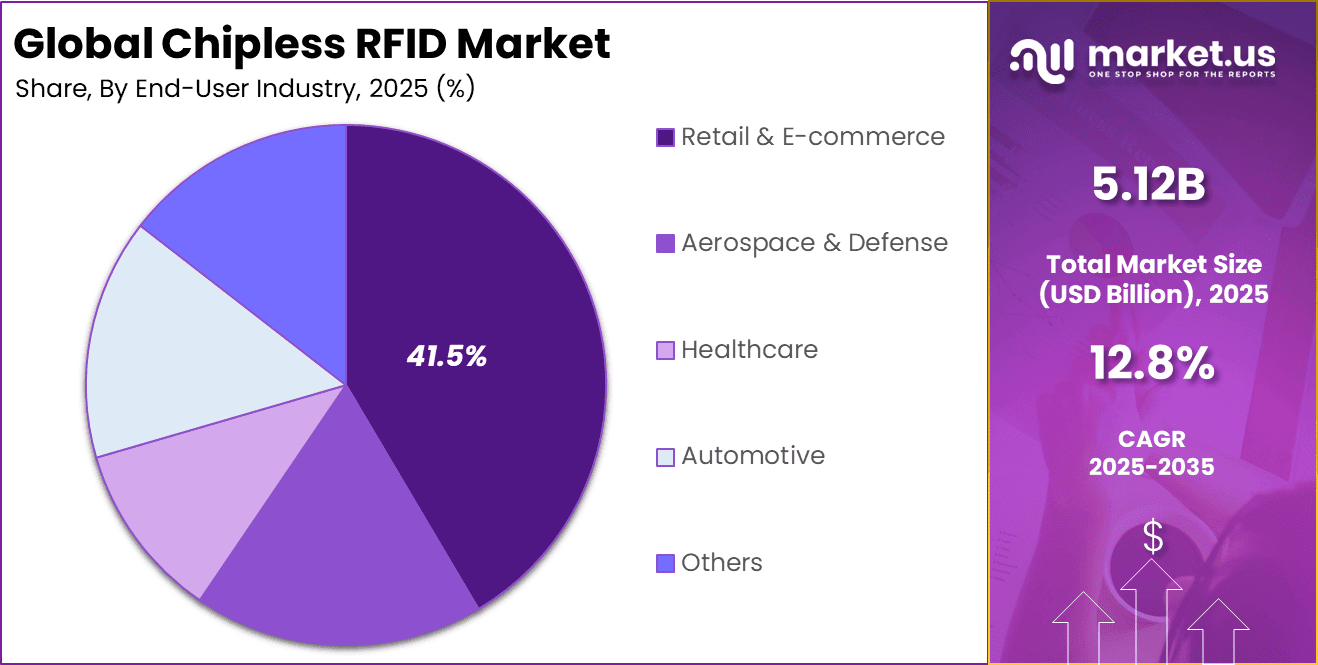

- The retail and e commerce segment led end use with 41.5% share, supported by growing need for accurate stock management and faster order fulfillment.

- The US chipless RFID market was valued at USD 298.7 billion in 2025 and is expanding at a 29.6% CAGR, reflecting rapid adoption across retail and logistics operations.

- North America held a leading position in 2025, capturing more than 32.6% of the global market, supported by advanced retail infrastructure and early adoption of RFID technologies.

Key Insights Summary

Adoption Rates by Sector

- Retail and apparel continue to lead adoption, holding around 28.5% to 30% market share in 2025 to 2026. RFID use in the apparel sector has reached about 40% of the total addressable market, with more than 31 billion tags expected to be deployed in 2025.

- Logistics and transport are emerging as the fastest growing sector through 2032, driven by demand for real time asset tracking and last mile parcel monitoring using low cost chipless tags.

- Healthcare adoption is accelerating at a 29.0% CAGR through 2031, mainly supported by cold chain monitoring needs for vaccines, biologics, and temperature sensitive medicines.

- In European urban markets, chipless RFID already represents over 18% of new loader sales, reflecting a shift toward sustainable and silicon free identification technologies.

Usage and Performance Statistics

- RFID deployment, including chipless variants, improves operational efficiency by reducing cycle count labor by up to 70% and lowering inventory errors by 25%, resulting in an average 10% increase in retail sales.

- Identification accuracy remains high, with RFID success rates ranging from 95% to 99.9%, while manufacturers report around 80% improvement in shipping and picking accuracy.

- Cost efficiency is a key driver for chipless RFID, as removing the silicon chip lowers tag costs, making it suitable for high volume and disposable applications.

- Tags dominate the product mix, accounting for 70.4% of revenue in 2025, while middleware software is the fastest growing segment, expanding at a 26% CAGR.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Demand for low cost identification Replacement of barcodes and traditional RFID ~3.6% Global Short Term Growth of retail automation Inventory accuracy and shrinkage reduction ~3.0% North America, Europe Short Term Expansion of logistics and warehousing High volume asset tracking requirements ~2.4% Global Mid Term Industrial digitalization Traceability and process optimization ~2.1% Global Mid Term Rising adoption in smart packaging Anti counterfeiting and tracking ~1.7% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Read range limitations Lower performance compared to chipped RFID ~2.9% Global Short Term Interference issues Sensitivity to environmental conditions ~2.3% Industrial environments Mid Term Standardization gaps Lack of uniform global protocols ~1.9% Global Mid Term Technology awareness gaps Limited understanding among end users ~1.5% Emerging Markets Long Term Competition from alternative technologies Optical and sensor based tracking ~1.2% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration Performance constraints Limited memory and read distance ~3.1% Global Short to Mid Term Integration complexity Reader infrastructure adaptation ~2.6% Global Mid Term Data accuracy concerns Signal overlap in dense environments ~2.1% Logistics hubs Mid Term Initial system calibration Setup and tuning requirements ~1.7% Global Long Term Limited ecosystem maturity Fewer vendors compared to chipped RFID ~1.3% Global Long Term By Component

Tags and labels account for 68.4%, making them the most significant component in the chipless RFID market. These components enable identification and tracking without embedded chips. They support cost-effective deployment across high-volume use cases. Simpler construction improves scalability and durability. Ease of integration remains an important advantage.

The dominance of tags and labels is driven by affordability and flexibility. Organizations deploy them across large inventories. Printing-based production supports mass usage. Maintenance requirements remain minimal. This sustains strong demand for tag and label components.

For Instance, in January 2026, Avery Dennison Corporation advanced chipless RFID tags for easier production. These tags skip chips to lower costs and fit current setups well. Retailers now print them on paper for quick labeling of clothes and boxes. This move helps factories scale up without big changes, saving money and time on inventory tasks. Demand grows as tags prove reliable in daily use.

By Frequency Band

Ultra-high frequency represents 72.8%, making it the leading frequency band. UHF supports longer read ranges and faster data capture. This improves efficiency in tracking environments. High throughput supports large-scale operations. Signal performance remains consistent.

Adoption of UHF is driven by operational efficiency needs. Warehouses and retail environments benefit from wide coverage. UHF enables bulk scanning of items. Compatibility with existing systems supports deployment. This keeps UHF widely adopted.

For instance, in November 2025, Zebra Technologies Corporation updated RFID readers for UHF bands. The new models boost range and speed for warehouse scans. UHF works great over distances, reading tags through stacks of goods. Logistics teams cut scan times by half, fixing stock issues faster. This fits chipless tech trends, drawing more users to reliable long-range tracking.

By Application

Retail and supply chain management accounts for 38.7%, making it the leading application area. Chipless RFID supports inventory visibility and tracking accuracy. Automation reduces manual counting errors. Real-time data improves replenishment decisions. Operational efficiency remains a priority.

Growth in this application is driven by complex supply chains. Retailers manage large product volumes. Chipless RFID improves item-level tracking. Integration with logistics systems enhances coordination. This sustains strong adoption in supply chain management.

For Instance, in July 2025, Honeywell International, Inc. rolled out RFID tools for supply chains. Their systems track items from the warehouse to store shelves in real time. Retail chains cut out-of-stock problems by 20% with better visibility. This helps managers plan deliveries and reduce losses during busy seasons. Chipless versions add low-cost options for wide rollout.

By End-User Industry

Retail and e-commerce represent 41.5%, making them the largest end-user industry. These sectors require efficient inventory control. Chipless RFID supports fast item identification. Automation improves order fulfillment accuracy. Cost control remains important.

Adoption in retail and e-commerce is driven by omnichannel operations. Businesses manage online and physical inventories. Chipless RFID improves visibility across channels. Reduced operational errors improve customer satisfaction. This sustains steady industry adoption.

For Instance, in September 2025, Impinj, Inc., enhanced RAIN RFID for e-commerce stock control. Platforms now scan hundreds of items at once for fast packing. Online sellers speed up fulfillment and returns with accurate counts. This cuts errors in high-volume orders, boosting customer trust. Chipless tags make it affordable for growing e-tail operations.

By Region

North America accounts for 32.6%, supported by advanced retail infrastructure. Organizations invest in tracking and automation technologies. Supply chain optimization remains a focus. Infrastructure maturity supports adoption. The region remains influential.

North America shows early adoption driven by research activity and pilot implementations in retail and logistics. Organizations in this region focus on innovation and testing of next generation identification technologies. Chipless RFID is explored as a complement to existing tracking systems. These initiatives support gradual market development.

For instance, in November 2025, Impinj, Inc. expanded Gen2X innovations to its M770 and M780 RFID endpoint ICs at the Gen2X Solutions Developers Conference. These enhancements inhibit counterfeit tags, reduce stray reads, and improve tag selection for logistics, manufacturing, and healthcare. Seattle-based Impinj drives North American dominance in advanced RFID solutions, boosting enterprise RAIN RFID adoption with superior performance and reliability.

Asia Pacific is emerging as a key region due to large scale manufacturing and packaging industries. High volume production environments benefit from low cost tagging solutions. Europe demonstrates steady interest, especially in sustainability focused applications. Other regions are gradually exploring adoption as awareness increases.

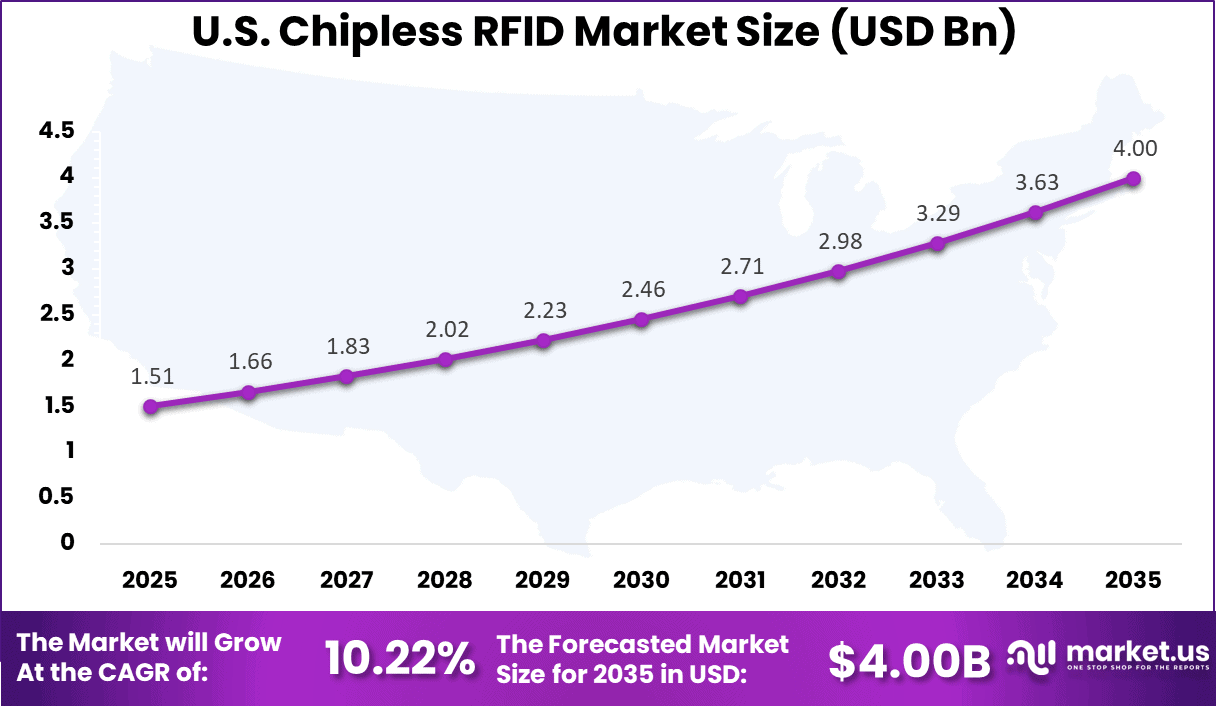

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Retail and logistics automation 32.6% USD 1.66 Bn Advanced Europe Anti counterfeiting and traceability mandates 28.4% USD 1.45 Bn Advanced Asia Pacific Large scale manufacturing and packaging 26.1% USD 1.34 Bn Developing Latin America Supply chain modernization 7.1% USD 0.36 Bn Developing Middle East and Africa Early adoption in industrial tracking 5.8% USD 0.30 Bn Early The United States reached USD 1.51 Billion with a CAGR of 10.22%, reflecting steady growth. Expansion is driven by retail automation initiatives. Businesses invest in cost-effective identification solutions. Demand for real-time tracking continues. Market momentum remains stable.

For instance, in July 2025, Zebra Technologies Corporation announced a strategic investment in Xemelgo, Inc., aimed at advancing its AI-powered RFID visibility and automation solutions for manufacturing and industrial operations. This partnership enhances Zebra’s capabilities in intelligent asset tracking and process optimization.

Investment Opportunities

Investment opportunities in the chipless RFID market are emerging from packaging and labeling applications. Companies developing printable tag solutions can partner with packaging manufacturers and brand owners. These collaborations enable direct integration of RFID functionality into everyday products. This approach creates value without altering existing packaging workflows.

Another opportunity lies in smart authentication and brand protection solutions. Chipless RFID can support secure identification without adding significant cost. Investors may focus on solutions tailored for pharmaceuticals, retail goods, and documents. These applications offer long term growth potential driven by security concerns.

Business Benefits

Chipless RFID offers strong business benefits through cost reduction and scalability. Organizations can tag millions of items without significantly increasing operational expenses. This improves inventory visibility and reduces manual tracking efforts. The technology supports efficient asset identification at a fraction of traditional RFID costs.

Another benefit is ease of integration into existing processes. Chipless tags can be printed using standard industrial equipment. This avoids complex assembly or specialized components. Businesses benefit from faster deployment and minimal infrastructure changes.

Use Case Analysis

A primary use case for chipless RFID is item level tracking in retail and supply chains. Products can be identified individually without expensive electronic tags. This improves inventory accuracy and reduces shrinkage. The use case is especially relevant for fast moving consumer goods.

Another important use case is document and product authentication. Chipless RFID can be embedded into labels or paper to verify authenticity. This is useful for certificates, tickets, and branded goods. The technology helps prevent duplication and fraud.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Retail and logistics enterprises Very High ~46.9% Cost effective tracking Large scale deployments Industrial manufacturers High ~23.7% Process traceability Operational investments Technology vendors High ~17.4% Platform and reader development R&D focused Packaging companies Moderate ~8.1% Smart packaging solutions Pilot driven Government and public sector Low ~3.9% Asset identification Program based Key Market Segments

By Component

- Tags/Labels

- Readers/Interrogators

- Software & Middleware

By Frequency Band

- Ultra-High Frequency (UHF)

- Microwave Frequency

- Millimeter Wave

By Application

- Retail & Supply Chain Management

- Aerospace & Defense

- Healthcare & Pharmaceuticals

- Logistics & Transportation

- Smart Cards & Ticketing

- Others

By End-User Industry

- Retail & E-commerce

- Aerospace & Defense

- Healthcare

- Automotive

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The chipless RFID market is being driven by the demand for cost-effective, high-throughput identification and tracking solutions in industries such as retail, logistics, supply chain management, and manufacturing. Traditional RFID systems require silicon chips that add cost to each tag, which can be a limiting factor for very low-cost applications or high-volume tagging scenarios.

Chipless RFID technology eliminates the need for silicon, using printed or passive materials to encode data, which reduces unit cost and enables broader deployment across disposable or highly distributed use cases. As organisations seek greater visibility into assets, inventory, and product movement, chipless RFID offers an economically scalable option that supports automated tracking and real-time monitoring.

Restraint Analysis

A key restraint in the chipless RFID market is the technical complexity related to data capacity and reliable reading performance. Chipless tags typically store less information and can be more difficult to read under varied environmental conditions compared with chip-based RFID tags.

Factors such as interference, surface material, tag orientation, and reader sensitivity can affect read range and accuracy, which may limit adoption in applications that require high precision or extended range. Overcoming these performance constraints often requires advanced tag design, specialised reader systems, and environmental calibration, which can reduce the anticipated cost advantage.

Opportunity Analysis

Opportunities in the chipless RFID market are linked to emerging applications where ultra-low cost and high volume outweigh the need for large data storage on the tag itself. Industries such as parcel and package tracking, document authentication, supply chain item tagging, and disposable medical or consumer goods can benefit from chipless solutions that reduce tagging expense.

There is also potential for integration with printed electronics and smart packaging technologies, enabling novel functionalities such as environmental sensing, anti counterfeit features, and interactive consumer experiences. Partnerships between material scientists, printer manufacturers, and system integrators can accelerate adoption by creating scalable production methods and standardized formats.

Challenge Analysis

A central challenge confronting this market involves ensuring reliable interoperability among chipless tags, readers, and backend systems. Unlike standard chip-based RFID, which follows established global protocols and middleware standards, chipless RFID technologies can vary in encoding schemes, frequency responses, and tag structures.

Ensuring consistent performance across different systems and equipment vendors requires development of common standards, certification processes, and robust middleware that can interpret diverse chipless signatures. Without interoperability, organisations may hesitate to adopt chipless solutions for mission-critical applications.

Emerging Trends

Emerging trends in the chipless RFID landscape include the advancement of material-based encoding techniques that improve the signal diversity and stability of chipless tags. New approaches use multi-resonant structures, metamaterials, or printed features that enhance read accuracy, broaden frequency responses, and increase environmental robustness.

There is also growing interest in hybrid systems that combine chipless RFID with other sensing modalities or barcodes to provide layered identification and contextual information. Integration of chipless RFID with Internet of Things platforms and cloud analytics is gaining traction, supporting item-level visibility and automated data capture across distributed networks.

Growth Factors

Growth in the chipless RFID market is supported by rising demand for low-cost tracking methods in logistics, retail, and asset management, especially where traditional RFID has been cost prohibitive. Advances in printing technologies, conductive inks, and fabrication processes reduce production cost and improve tag performance, making chipless solutions more viable for mass-market use.

The expansion of ecommerce, automated warehouses, and item-level inventory tracking creates new use cases where chipless RFID can enhance operational efficiency and reduce manual labour. As standardisation efforts progress and read-range performance improves, chipless RFID is expected to expand as a complementary technology within broader automatic identification and data capture ecosystems.

Key Players Analysis

One of the leading players in October 2025, HID Global Corporation enhanced its chipless RFID portfolio by acquiring Vizinex RFID, integrating advanced printed circuit innovations. This acquisition strengthens HID’s position in asset tracking for manufacturing and logistics environments, especially where durable, low-cost, silicon-free tagging is essential.

Top Key Players in the Market

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Alien Technology, LLC

- Impinj, Inc.

- NXP Semiconductors N.V.

- Honeywell International, Inc.

- Invengo Information Technology Co., Ltd.

- GAO RFID, Inc.

- HID Global Corporation

- Smartrac Technology Group

- Tageos

- Checkpoint Systems, Inc.

- SATO Holdings Corporation

- Ascend ID Solutions, LLC

- Datalogic S.p.A.

- Others

Recent Developments

- In August 2025, Impinj, Inc. introduced a new series of RAIN RFID tag chips designed for improved IoT connectivity. These innovations support hybrid chipless applications, helping enterprises connect physical assets to cloud networks more efficiently. Early indicators suggest strong adoption potential in supply chain operations.

- In September 2025, Honeywell International, Inc. collaborated with regional partners to enhance chipless RFID middleware aimed at warehouse automation. These upgrades have achieved approximately 25% faster throughput in high-volume picking processes, offering a powerful response to ongoing labor shortages.

Report Scope

Report Features Description Market Value (2025) USD 5.1 Bn Forecast Revenue (2035) USD 17.0 Bn CAGR(2026-2035) 12.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Tags/Labels, Readers/Interrogators, Software & Middleware), By Frequency Band (Ultra-High Frequency (UHF), Microwave Frequency, Millimeter Wave), By Application (Retail & Supply Chain Management, Aerospace & Defense, Healthcare & Pharmaceuticals, Logistics & Transportation, Smart Cards & Ticketing, Others), By End-User Industry (Retail & E-commerce, Aerospace & Defense, Healthcare, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zebra Technologies Corporation, Avery Dennison Corporation, Alien Technology, LLC, Impinj, Inc., NXP Semiconductors N.V., Honeywell International, Inc., Invengo Information Technology Co., Ltd., GAO RFID, Inc., HID Global Corporation, Smartrac Technology Group, Tageos, Checkpoint Systems, Inc., SATO Holdings Corporation, Ascend ID Solutions, LLC, Datalogic S.p.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Alien Technology, LLC

- Impinj, Inc.

- NXP Semiconductors N.V.

- Honeywell International, Inc.

- Invengo Information Technology Co., Ltd.

- GAO RFID, Inc.

- HID Global Corporation

- Smartrac Technology Group

- Tageos

- Checkpoint Systems, Inc.

- SATO Holdings Corporation

- Ascend ID Solutions, LLC

- Datalogic S.p.A.

- Others