Global Ceramic Tile Adhesive Market By Type(Epoxy, Acrylic, Silicone, Cyanoacrylate, Others), By Application(Wood Floor Pasting, Tiled Floor Pasting, Polyethylene Floor Pasting, Stonefloor Passing), By End-User(Residential, Commercial, Industrial), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: March 2024

- Report ID: 16576

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

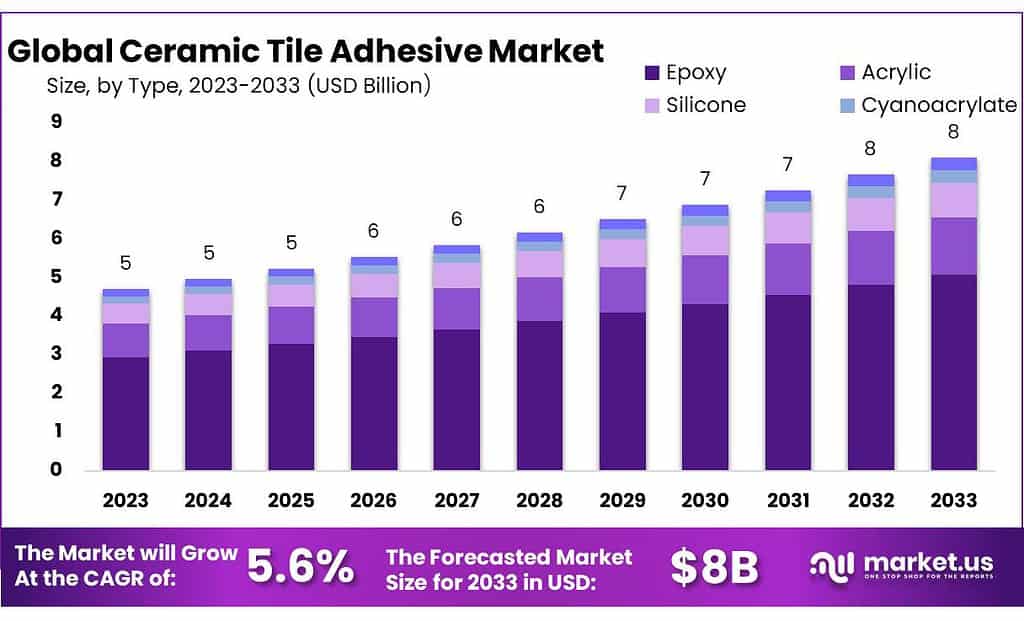

The global Ceramic Tile Adhesive Market size is expected to be worth around USD 8 billion by 2033, from USD 5 billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

The Ceramic Tile Adhesive Market refers to the industry involved in the production, distribution, and utilization of adhesives specifically formulated for the installation of ceramic tiles. Ceramic tile adhesives are essential components in the construction sector, facilitating the bonding of ceramic tiles to various surfaces such as floors, walls, and countertops.

These adhesives are designed to provide strong adhesion, durability, and resistance to moisture, temperature fluctuations, and other environmental factors, ensuring the longevity and stability of tile installations. The market encompasses a range of adhesive products tailored to different applications, including thin-set mortar, epoxy adhesives, and acrylic adhesives, catering to the diverse needs of construction professionals, contractors, and homeowners.

Factors such as urbanization, infrastructure development, and the growing demand for aesthetically pleasing and durable surface materials drive the growth and evolution of the ceramic tile adhesive market.

By Type

In 2023, Epoxy held a dominant market position, capturing more than a 62.7% share. This was attributed to its strong bonding capabilities and excellent resistance to moisture and chemicals, making it ideal for demanding applications such as high-traffic areas and wet environments.

Acrylic adhesives emerged as another significant segment, accounting for a considerable market share due to their versatility, ease of use, and affordability. These adhesives offer good adhesion to various substrates and are commonly used in both residential and commercial tile installations.

Silicone adhesives gained traction in the ceramic tile adhesive market, driven by their exceptional flexibility, weather resistance, and ability to accommodate movement and expansion in tiled surfaces. This segment found applications in areas prone to vibration or thermal expansion, such as exterior tiling and swimming pools.

Cyanoacrylate adhesives, though comprising a smaller market share, are valued for their fast curing time and strong initial bond strength. These adhesives are preferred for quick fixes and small-scale tile installations, where rapid adhesion is critical.

ceramic tile adhesives, including polyurethane and polyvinyl acetate (PVA) adhesives, cater to specific niche applications and preferences. While these segments may have smaller market shares, they offer unique features and benefits, contributing to the overall diversity and innovation in the ceramic tile adhesive market.

By Application

In 2023, Wood Floor Pasting held a dominant market position, capturing more than a 48.3% share. This was attributed to the popularity of wooden flooring in both residential and commercial spaces, driving the demand for ceramic tile adhesives tailored specifically for wood substrates.

Tiled Floor Pasting emerged as another significant application segment, accounting for a substantial market share. The versatility of ceramic tiles and their suitability for various indoor and outdoor flooring projects contributed to the strong demand for tile adhesives in this segment.

Polyethylene Floor Pasting saw steady growth in the ceramic tile adhesive market, fueled by the increasing use of polyethylene-based flooring materials in construction and renovation projects. Adhesives formulated for polyethylene substrates offer excellent bonding strength and compatibility, meeting the needs of modern construction practices.

Stone Floor Pasting, though comprising a smaller market share, witnessed notable demand owing to the enduring popularity of natural stone flooring options. Adhesives designed for stone surfaces prioritize strong adhesion and durability, ensuring long-lasting installations in residential and commercial settings.

These application segments represent key areas of opportunity in the ceramic tile adhesive market, with each catering to specific flooring materials and construction requirements. As construction activities continue to rise globally, the demand for ceramic tile adhesives across diverse applications is expected to remain robust.

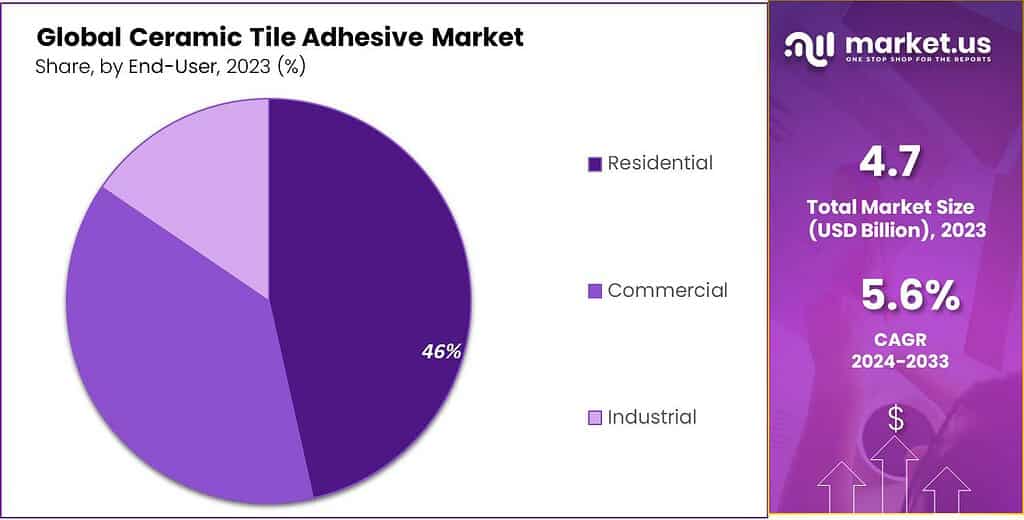

By End-User

In 2023, Residential end-users held a dominant market position, with Wood Residential capturing more than a 47.8% share. The demand for ceramic tile adhesives in residential settings is driven by renovation and remodeling projects, as well as new construction activities in housing developments.

Commercial end-users also represented a significant segment, with applications ranging from retail spaces to office buildings. Adhesives tailored for commercial settings prioritize durability, aesthetics, and ease of installation, meeting the diverse needs of businesses and commercial property owners.

Industrial end-users accounted for a notable portion of the ceramic tile adhesive market, driven by applications in manufacturing facilities, warehouses, and industrial complexes. Adhesives used in industrial settings must withstand heavy foot traffic, machinery vibrations, and harsh operating conditions, necessitating specialized formulations for optimal performance.

These end-user segments reflect the diverse applications and requirements driving the demand for ceramic tile adhesives across residential, commercial, and industrial sectors. As construction and renovation activities continue to expand globally, the market for ceramic tile adhesives is poised for sustained growth across various end-user segments.

Market Key Segments

By Type

- Epoxy

- Acrylic

- Silicone

- Cyanoacrylate

- Others

By Application

- Wood Floor Pasting

- Tiled Floor Pasting

- Polyethylene Floor Pasting

- Stonefloor Passing

By End-User

- Residential

- Commercial

- Industrial

Drivers

Growing Construction Activities:

The surge in construction activities, particularly in residential and commercial sectors, is a key driver for the ceramic tile adhesive market. Rapid urbanization, population growth, and increasing disposable income are fueling demand for modern infrastructure and interior design, thereby boosting the adoption of ceramic tiles and associated adhesives.

Preference for Low-Maintenance Flooring:

Ceramic tiles offer durability, easy maintenance, and a wide range of design options, making them a preferred choice for flooring solutions. As consumers seek low-maintenance and aesthetically pleasing flooring options, the demand for ceramic tile adhesives is expected to escalate, driving market growth.

Advancements in Construction Technologies:

Technological advancements in construction materials and techniques are influencing the ceramic tile adhesive market positively. Innovations such as rapid-setting adhesives, self-leveling compounds, and environmentally friendly formulations are enhancing the efficiency and performance of tile installations, thereby driving market demand.

Restraints

Fluctuating Raw Material Prices:

The ceramic tile adhesive market is susceptible to fluctuations in raw material prices, particularly petroleum-based ingredients such as resins and solvents. Volatile raw material prices can impact manufacturing costs, pricing strategies, and profit margins, posing a challenge for market players.

Stringent Regulatory Standards:

Stringent regulatory standards and environmental regulations governing the use of chemicals in construction materials pose a restraint to the ceramic tile adhesive market. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and VOC limits requires manufacturers to invest in research and development to develop compliant formulations.

Intense Competition:

The ceramic tile adhesive market is highly competitive, with numerous manufacturers vying for market share. Intense competition often leads to price wars, margin pressures, and challenges in product differentiation, especially in commoditized segments of the market, posing a restraint to profitability and growth.

Opportunity

Emerging Markets:

Emerging markets present significant growth opportunities for the ceramic tile adhesive market. Rapid urbanization, infrastructure development, and increasing construction activities in countries such as India, China, Brazil, and Southeast Asian nations offer a fertile ground for market expansion.

Technological Innovations:

Continued technological innovations and product advancements present opportunities for market players to differentiate their offerings and gain a competitive edge. Investing in research and development to develop next-generation adhesives with enhanced performance, sustainability, and ease of use can unlock new growth avenues in the market.

Strategic Partnerships and Collaborations:

Collaborations and strategic partnerships between manufacturers, distributors, and construction companies can facilitate market expansion and penetration into new geographies and customer segments. Joint ventures, licensing agreements, and distribution partnerships can help leverage synergies and strengthen market presence.

Trends

Green Building Practices:

The trend towards sustainable construction practices is impacting the ceramic tile adhesive market. Manufacturers are increasingly focusing on developing eco-friendly adhesives with low volatile organic compound (VOC) emissions and recyclable packaging to align with green building certifications and regulations.

Customization and Personalization:

There’s a growing trend towards customized and personalized tile installations to meet the unique preferences of end-users. As a result, manufacturers are offering a wide variety of adhesive options, including colored, translucent, and patterned adhesives, to cater to diverse design requirements and aesthetic preferences.

Digitalization in Marketing and Distribution:

Digitalization is revolutionizing marketing and distribution channels in the ceramic tile adhesive market. Manufacturers are leveraging online platforms, social media, and e-commerce channels to reach a wider audience, enhance brand visibility, and streamline the distribution process, thereby capitalizing on the growing digitalization trend.

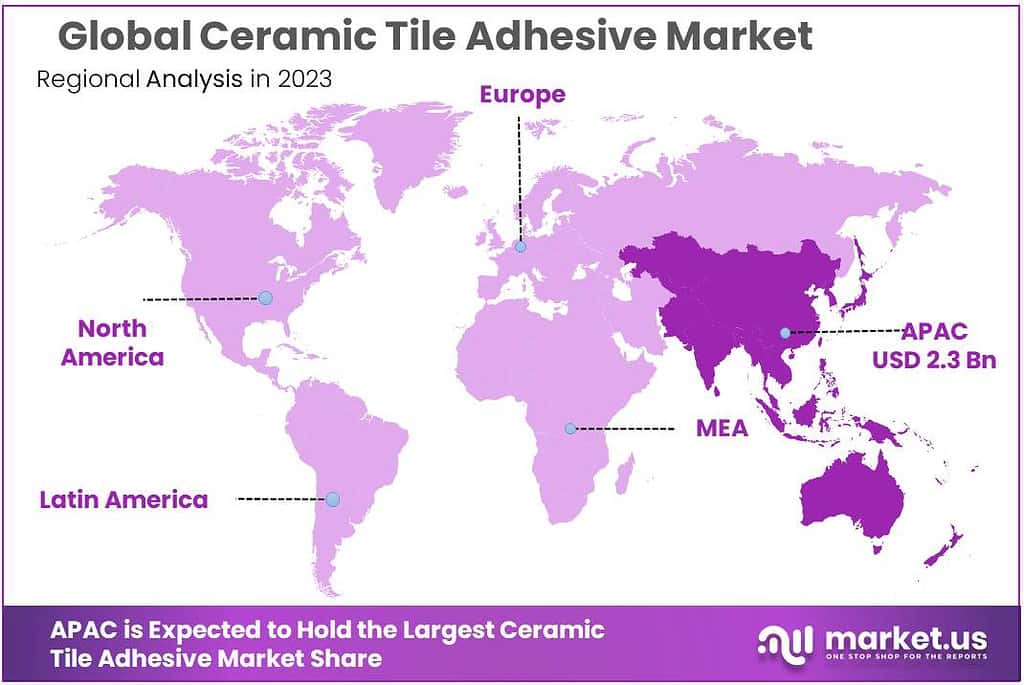

Regional Analysis

In the Ceramic Tile Adhesive Market, the Asia Pacific region dominates with a market share of 49.1%, projected to reach a value of 2.3 billion during the forecast period. This strong market position is attributed to increased consumption of ceramic tile adhesives across critical sectors like construction, automotive, conductive polymers, and packaging.

The remarkable growth in ceramic tile adhesive production in key countries such as China, India, Korea, Thailand, Malaysia, and Vietnam is expected to drive market expansion in the Asia Pacific region throughout the forecast period.

In North America, robust economic growth, particularly in sectors like automotive, polymer, and manufacturing, is fueling significant demand for ceramic tile adhesives. Similarly, Europe is poised for substantial growth in the ceramic tile adhesive market, driven by strong demand in textile industries and construction activities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Ceramic Tile Adhesive Market, several key players play significant roles in shaping industry dynamics. Major companies such as Henkel AG & Co. KGaA, Saint-Gobain Weber, Bostik (Arkema), MAPEI S.p.A., and Laticrete International, Inc., among others, are prominent players driving innovation, product development, and market expansion.

These companies leverage extensive research and development activities to introduce advanced adhesive formulations tailored to meet diverse customer requirements and emerging market trends

Market Key Players

- BASF

- Bostik

- Doborn

- Dunshi

- EasyPlas

- H.B. Fuller Company

- Henkel

- Kaben

- LANGOOD

- Laticrete

- Laticrete International

- Mapei

- Oriental Yuhong

- ParexDavco

- Pidilite Industries

- Ronacrete

- Sika

- TAMMY

- Vibon

- Wasper

- Weber

- Yuchuan

Recent Developments

2024: BASF collaborated with leading ceramic tile manufacturers to develop innovative adhesive solutions tailored to specific application requirements, further strengthening its market position.

2024: Bostik expanded its distribution network in key regions, ensuring greater accessibility to its ceramic tile adhesive products and enhancing customer satisfaction.

Report Scope

Report Features Description Market Value (2023) USD 5 Bn Forecast Revenue (2033) USD 8 Bn CAGR (2023-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Epoxy, Acrylic, Silicone, Cyanoacrylate, Others), By Application(Wood Floor Pasting, Tiled Floor Pasting, Polyethylene Floor Pasting, Stonefloor Passing), By End-User(Residential, Commercial, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF, Bostik, Doborn, Dunshi, EasyPlas, H.B. Fuller Company, Henkel, Kaben, LANGOOD, Laticrete, Laticrete International, Mapei, Oriental Yuhong, ParexDavco, Pidilite Industries, Ronacrete, Sika, TAMMY, Vibon, Wasper, Weber, Yuchuan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Ceramic Tile Adhesive Market?BASF, Bostik, Doborn, Dunshi, EasyPlas, H.B. Fuller Company, Henkel, Kaben, LANGOOD, Laticrete, Laticrete International, Mapei, Oriental Yuhong, ParexDavco, Pidilite Industries, Ronacrete, Sika, TAMMY, Vibon, Wasper, Weber, Yuchuan

What is the size Ceramic Tile Adhesive Market?Ceramic Tile Adhesive Market size is expected to be worth around USD 8 billion by 2033, from USD 5 billion in 2023

What is the CAGR for the Ceramic Tile Adhesive Market?The Ceramic Tile Adhesive Market expected to grow at a CAGR of 5.6% during 2023-2032. Ceramic Tile Adhesive MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Ceramic Tile Adhesive MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Bostik

- Doborn

- Dunshi

- EasyPlas

- H.B. Fuller Company

- Henkel

- Kaben

- LANGOOD

- Laticrete

- Laticrete International

- Mapei

- Oriental Yuhong

- ParexDavco

- Pidilite Industries

- Ronacrete

- Sika

- TAMMY

- Vibon

- Wasper

- Weber

- Yuchuan