Global Ceramic Armor Market By Material Type (Ceramic Composite, Alumina, Boron Carbide, Silicon Carbide and Others) By Application (Body Armor, Vehicle Armor, Aircraft Armor, Naval Armor and Others) By Platform (Defense, Civilian and Homeland Security) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Jan 2024

- Report ID: 53746

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

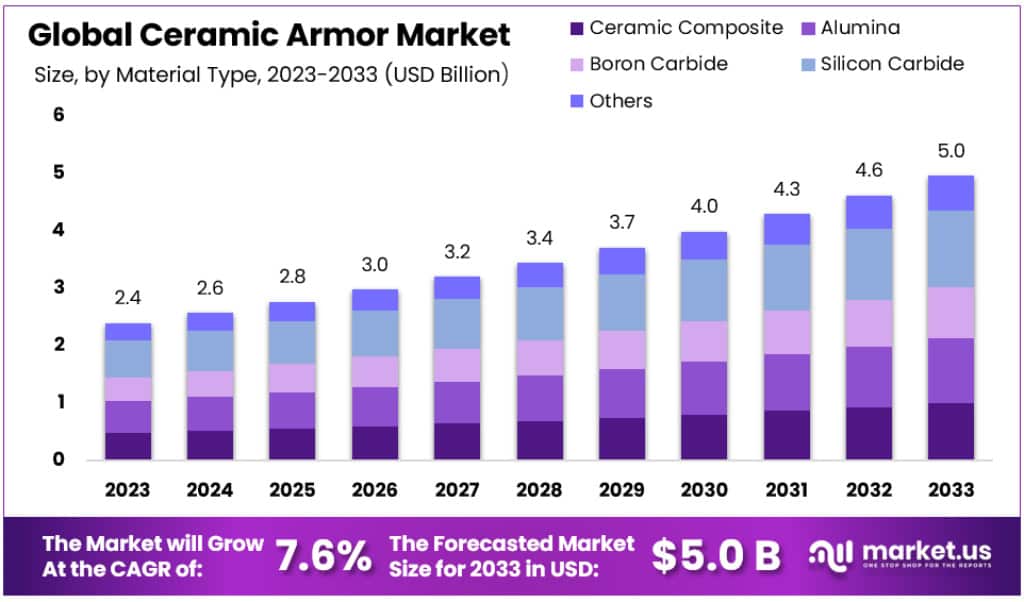

The Global Ceramic Armor Market size is expected to be worth around USD 5 Billion by 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2023 to 2033.

This industry’s growth is driven by a number of factors, including, the emphasis on soldier survival as well as modernization programs by military forces around the globe. Ceramics are a novel type of armor material that provides superior ballistic performance and are being used by a wide range of defense sectors.

The increasing need for combat vehicles and advanced security systems because of clashes among nations, terrorist attacks, and increasing cross-border conflict supports market growth.

Key Takeaways

- The Global Ceramic Armor Market is projected to reach approximately USD 5 billion by 2033, up from USD 2.4 billion in 2023.

- This growth represents a CAGR of 7.6% from 2023 to 2033.

- In 2023, Silicon Carbide held the largest market share at over 27%, mainly due to its role in protective gear for armored helicopters and body armor.

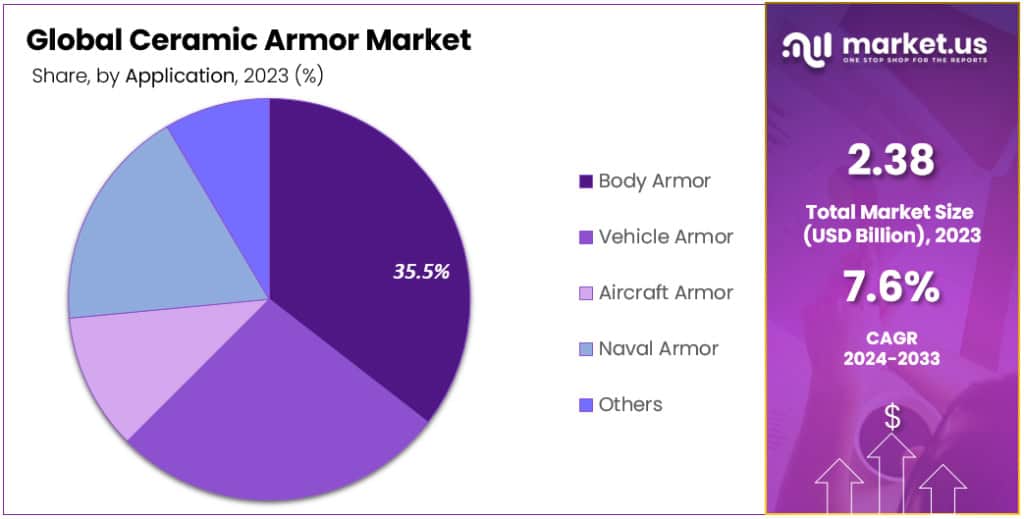

- Body Armor held a dominant market position, accounting for over 40% of the market share, in 2023.

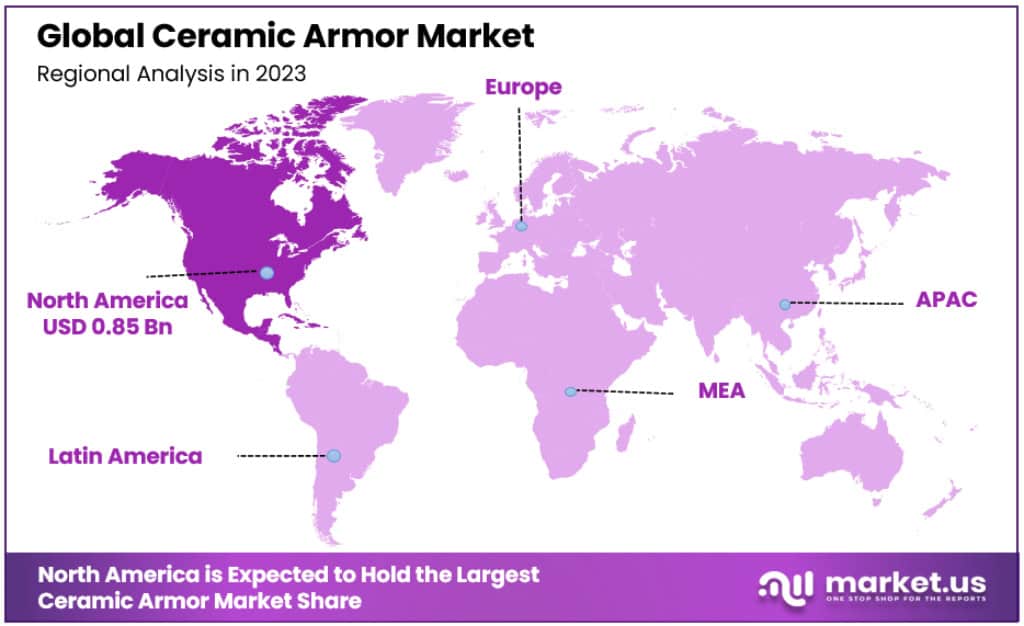

- North America led the Ceramic Armor Market in 2023 with a 35.6% share, driven by significant military spending.

Material Type Analysis

In 2023, Silicon Carbide held a dominant market position, capturing more than a significant 27% share in the ceramic armor market. This segment’s prominence is attributed to its vital role in manufacturing protective gear for armored helicopters and body armors. The material’s intrinsic properties, including high hardness and thermal conductivity, make it a preferred choice among manufacturers, ensuring compliance with stringent regulatory standards, such as those set by the National Institute of Justice (NIJ) in the United States.

Alumina, another key segment, has historically led the market in revenue terms. This material is favored by armor manufacturers for its excellent cost-benefit ratio, high refractoriness, and impressive modulus of elasticity. As the market evolves, alumina is projected to continue its growth trajectory, driven by its advantageous blend of durability and cost-effectiveness.

Boron carbide, primarily utilized in ceramic plates designed to thwart smaller projectiles, is also a critical segment of the market. Its use in specialized applications such as body armors and armored helicopters underlines its importance in providing robust protection solutions. The demand for boron carbide is spurred by its exceptional hardness and lightweight nature, making it an ideal component for advanced armor solutions.

The ceramic metal composite segment, though smaller, represents a key area of innovation within the industry. These composites are increasingly sought after for their unique properties that combine the best aspects of ceramics and metals, offering enhanced protection and durability.

Application Analysis

In 2023, the Body Armor segment held a dominant market position in the ceramic armor market, capturing more than a significant ~40% share. This segment’s dominance is driven by escalating demand from homeland security departments worldwide, aiming to equip personnel with lightweight, corrosion-resistant, and highly protective gear. The body armor’s ability to absorb and dissipate kinetic energy from ballistic strikes makes it a critical component for the safety of soldiers, police officers, and emergency medical service (EMS) personnel.

As the most lucrative markets, the United States, China, and Russia have shown heightened interest in advanced body armor. The U.S. and Europe are notably providing body armor to first responders, reflecting an increasing trend in personal safety measures. This widespread adoption underscores the sector’s substantial growth and the ongoing need for enhanced protective gear.

The Vehicle Armor segment is anticipated to grow significantly, driven by the automotive industry’s demand for lightweight, high-strength armor solutions. The increasing popularity of electric and hybrid vehicles further accentuates this demand, positioning vehicle armor as a key area for innovation and growth.

Aircraft Armor is expected to witness the fastest growth rate in terms of revenue during the forecast period. Investments in defense and aerospace modernization initiatives are propelling the need for sophisticated aircraft armor solutions capable of providing superior protection against high-velocity projectiles and enhancing overall aircraft safety.

Naval Armor, catering to the marine industry, is also set to expand considerably. The sector’s growth is fueled by the demand for armor solutions that offer robust protection while maintaining the lightweight and high-strength characteristics essential for naval warships.

The ‘Others’ category, encompassing diverse industries such as sports, entertainment, construction, and mining, is driven by the rising demand for strong, lightweight materials. For instance, ceramic armor’s use in providing protective gear for athletes underscores its versatility and the broadening scope of its applications.

Platform Analysis

In 2023, the Defense sector held a dominant market position in the Ceramic Armor Market, capturing a substantial share due to its extensive use in protecting soldiers, vehicles, and infrastructure. The defense segment’s prominence is driven by the continuous need for advanced protective solutions in increasingly complex battlefields. The material’s lightweight nature enhances maneuverability and reduces fatigue, making it invaluable for military applications.

The Homeland Security segment, also significant, addresses the rising levels of violence and unexpected attacks in various parts of the world. Ceramic armor’s use in body armors for firefighters and rescue teams is crucial in providing necessary protection against threats. The adoption of ceramic materials in this sector is driven by their proven effectiveness in stopping bullets and the advantage of being much lighter compared to traditional steel armors.

The Civilian segment is expected to witness notable growth over the forecast period. This surge is primarily attributed to the increasing awareness and legal considerations regarding the use of body armor by civilians, especially in the wake of rising terror attacks and public mass shootings. As safety concerns among the general public escalate, the demand for accessible and effective protective gear like ceramic armor is set to increase, driving growth in this segment.

Key Market Segments

By Material Type

- Ceramic Composite

- Alumina

- Boron Carbide

- Silicon Carbide

- Others

By Application

- Body Armor

- Vehicle Armor

- Aircraft Armor

- Naval Armor

- Others

By Platform

- Defense

- Civilian

- Homeland Security

Drivers

- Rising Security Concerns: Increasing crime and terrorism worldwide, particularly in conflict zones like Syria, Ukraine, and India-Pakistan, have heightened the need for protective gear. As a study by [Insert Source] indicates, developing countries such as Brazil, China, India, and Russia are heavily investing in defense due to rising internal conflicts, significantly driving the ceramic armor market.

- Enhancing Soldier Safety: Modern warfare and law enforcement fields necessitate advanced protection. For instance, in July 2019, KDH Defense Systems received a $40 million order from the U.S. Armed Forces for body armor. Countries like China increased their defense budget to $179 billion in 2020. Additionally, for FY 2023-24, India’s Ministry of Defence (MoD) has been allocated a total budget of approximately $712.8 million, which is 13.18% of the total budget, with a capital outlay pertaining to modernization and infrastructure development increased to around $195.6 million. China’s budget for 2023 was announced to be approximately $223.2 billion, reflecting a 7.2% increase over the last year. These figures reflect a growing focus on soldier safety and survivability.

Restraints

- Complex Design Process: Designing ceramic armor involves assessing a range of parameters like chemical and fire resistance, which makes the production process intricate and time-consuming, potentially limiting market growth.

- Stringent Regulations: Compliance with standards from bodies like the National Institute of Justice (NIJ) and international regulations creates a challenging environment for manufacturers, often leading to increased costs and slower innovation.

- National Defense Budget Constraints: Reductions in defense budgets, as seen in countries like India and the Middle East, can significantly impact the demand for ceramic armor. For instance, in March 2022, India reduced its government’s total expenditure by four percent over the last six years due to increasing debts and inflation.

Opportunities

- Lightweight Armor Systems: There’s an increasing need for lightweight armor to enhance the mobility and comfort of military and law enforcement personnel. This demand creates substantial opportunities for innovation and growth in lightweight ceramic armor solutions.

- Non-Defense Sector Adoption: Industries like automotive, aerospace, and sports are beginning to incorporate ceramic armor for enhanced safety, opening new markets beyond traditional defense and security sectors.

- Global Market Expansion: Emerging economies present untapped opportunities with rising defense budgets and security concerns. For example, the U.S., a significant defense spender, is continually looking for advanced armor solutions, contributing to market growth.

Challenges

- Durability and Performance: Developing ceramic armor that can withstand various threat levels without delamination or loss of integrity is challenging, especially as the nature of threats continues to evolve.

- Weight and Bulkiness: While advancements are being made, the weight and bulk of ceramic armor can still hinder mobility and comfort, posing a significant challenge, particularly in dynamic combat situations.

Trends

- Increasing Civilian Use: With rising public safety concerns, there’s a growing trend of civilians adopting body armor for personal protection. This shift is influencing market dynamics and expanding the customer base beyond military and law enforcement.

- Technological Advancements: Continuous progression in technology, like the emergence of advanced ceramics and innovative manufacturing processes, is enhancing the performance and versatility of ceramic armor.

Regional Analysis

North America: Dominating with Innovation and Investment

In 2023, North America is leading the Ceramic Armor Market with a substantial 35.6% share, valued at approximately USD 0.85 billion. The region’s dominance is primarily due to high demand from the U.S. and significant military spending. As per a study, the U.S. Department of Defense allocated a massive $715 billion budget in 2022, underlining the region’s commitment to modernizing military equipment, including ceramic armor. The presence of established players and stringent safety standards further bolster the market. The region is also a hub for research and development, with organizations like DARPA driving innovation in lightweight, high-performance ceramic armor solutions. The U.S. remains the major contributor, with a substantial focus on protecting military personnel and first responders.

Asia Pacific: Rapid Growth Amidst Modernization and Conflicts

The Asia Pacific region held a significant share in 2023 and is poised for considerable growth. The surge is driven by large-scale modernization of traditional systems and rising warfare & border disputes in countries like China, India, and South Korea. In March 2020, India designed bullet-resistant jackets in compliance with national and international standards, reflecting the region’s focus on advanced protective solutions. China’s commitment is also evident from its ~8% increase in military expenditure in 2018, aimed at modernizing its forces. The region’s economic growth and escalating investments in defense and security infrastructure are pivotal in driving demand for ceramic armor.

Europe: Steady Growth with a Focus on Modernization

Accounting for over ~21% of the market share in 2023, Europe’s market growth is driven by the increasing focus on soldier survivability and the demand for lightweight materials. Germany’s commitment to modernizing its defense and security forces with a budget of USD 43.9 billion till 2020 showcases the region’s dedication to advanced protection solutions. However, the region faces legal restrictions, with ballistic protection primarily reserved for military use, limiting civilian access. Despite these challenges, Europe’s expanding automotive sector and the application of ceramic armor in vehicles are contributing to market growth.

Middle East & Africa: Significant Spending and Potential for Growth

In 2019, Saudi Arabia, with the 5th highest military expenditure globally at USD 61.9 billion, highlighted the region’s significant investment in defense. The Middle East’s high spending as a share of its GDP, particularly in Saudi Arabia at 8%, indicates a robust market for ceramic armor, driven by the need to enhance military capabilities and infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Players in this industry are focusing on product development and investing heavily towards R&D endeavors, to create performance products and stay ahead of their respective competitors. The major key players in the ceramic armor industry are Ceradyne, ArmorWorks, Koninklijke Ten Cate B.V., SAAB AB, CeramTec (Germany), KONINKLIJKE DSM N.V.:, BAE Systems, CerCo Corporation, CoorsTek, Inc., Morgan Advanced Materials PLC, and other ceramic armor companies.

To ensure long-term product supply, vendors may also establish contractual relationships with defense agencies. Ceradyne Inc., received a US army contract in March 2018, for the supply of Integrated Head Protection Systems (IHPS) ballistic helmets. This investment brought the IHPS contract value to more than US$52 million.

Key Market Players

- Ceradyne

- ArmorWorks

- Saint-Gobain S.A.

- Morgan Advanced Materials PLC

- CoorsTek, Inc.

- CerCo Corporation

- KONINKLIJKE DSM N.V.

- SAAB AB

- CeramTec Group

- Koninklijke Ten Cate BV

- Olbo & Mehler

- Safariland LLC

- Alpine Armoring

- Point Blank Enterprises

- BAE Systems plc

- Armorworks Enterprises

- Other Key Players

Recent Developments

Acquisitions

- July 2023: Elbit Systems Ltd. (NASDAQ: ELST) acquired Applied Ceramics Inc. (ACI), a leading manufacturer of advanced ceramic armor, for approximately $145 million. This acquisition strengthens Elbit’s position in the body armor market and expands its offerings to include lightweight, high-performance ceramic plates.

New Trends

- 3D Printing: The use of 3D printing to create customized ceramic armor inserts is gaining traction. This technology allows for the creation of complex shapes and geometries that can offer improved protection and comfort. For example, the US Army Research Laboratory is developing 3D-printed ceramic armor inserts that can be tailored to the specific needs of individual soldiers.

- Nanocomposites: Researchers are developing ceramic armor nanocomposites that combine the high strength and hardness of ceramics with the flexibility and toughness of polymers. These nanocomposites have the potential to create lighter and more effective armor.

Company-related News

- June 2023: Honeywell Aerospace (NYSE: HON) announced the development of a new boron carbide-based ceramic armor material called Spectra Shield X™. This material is 20% lighter than traditional boron carbide armor while offering the same level of ballistic protection.

- May 2023: Ceradyne, Inc. (OTC: CRDY) received a $34 million contract from the US Department of Defense to supply its advanced composite armor inserts for the Improved Outer Tactical Vest (IOTV) program.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 5 Billion CAGR (2023-2032) 7.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Ceramic Composite, Alumina, Boron Carbide, Silicon Carbide and Others) By Application (Body Armor, Vehicle Armor, Aircraft Armor, Naval Armor and Others) By Platform (Defense, Civilian and Homeland Security) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ceradyne, ArmorWorks, Saint-Gobain S.A., Morgan Advanced Materials PLC, CoorsTek, Inc., CerCo Corporation, KONINKLIJKE DSM N.V., SAAB AB, CeramTec Group, Koninklijke Ten Cate BV, Olbo & Mehler, Safariland LLC, Alpine Armoring, Point Blank Enterprises, BAE Systems plc, Armorworks Enterprises and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the ceramic armor market in 2023?The ceramic armor market size was USD 2.4 Billion in 2023.

What is the projected CAGR at which the ceramic armor market is expected to grow at?The ceramic armor market is expected to grow at a CAGR of 7.6% (2023-2033).

List the key industry players of the ceramic armor market?Ceradyne, ArmorWorks, Saint-Gobain S.A., Morgan Advanced Materials PLC, CoorsTek, Inc., CerCo Corporation, KONINKLIJKE DSM N.V., SAAB AB, CeramTec Group, Koninklijke Ten Cate BV, Olbo & Mehler, Safariland LLC, Alpine Armoring, Point Blank Enterprises, BAE Systems plc, Armorworks Enterprises and Other Key Players in ceramic armor market

-

-

- Ceradyne

- ArmorWorks

- Saint-Gobain S.A.

- Morgan Advanced Materials PLC

- CoorsTek, Inc.

- CerCo Corporation

- KONINKLIJKE DSM N.V.

- SAAB AB

- CeramTec Group

- Koninklijke Ten Cate BV

- Olbo & Mehler

- Safariland LLC

- Alpine Armoring

- Point Blank Enterprises

- BAE Systems plc

- Armorworks Enterprises

- Other Key Players