Global Activated Alumina Market By Application (Catalyst, Desiccant, Fluoride Adsorbent, Bio Ceramics, and Other Applications), By End-Use (Water Treatment, Oil & Gas, Plastics, Healthcare, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 21177

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

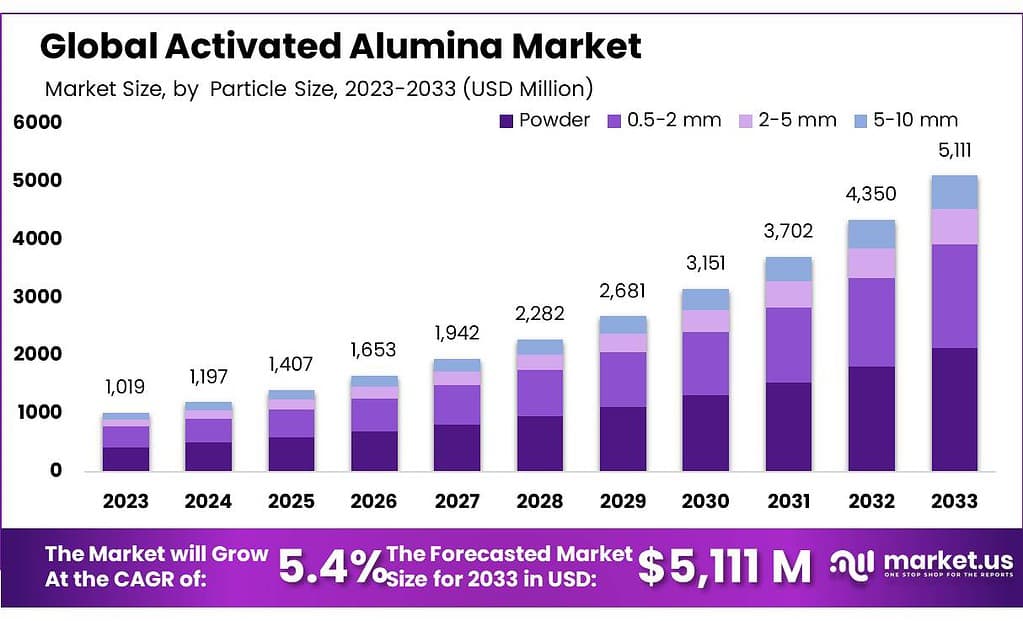

The global activated alumina market size is expected to be worth around USD 5111 Million by 2033, from USD 1018.9 Million in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

Major factors driving the Activated Alumina market include rising water demand, shrinking water resources, and new water treatment plants. To make activated alumina, dihydroxylation of aluminum hydroxide is used to create highly porous material. It can be used for various purposes, including as a catalyst, desiccant, fluoride-adsorbent, bioceramics, and others.

Activated alumina is a form of aluminum oxide that has a wide variety of applications due to its unique combination of physical, chemical, and electrical properties. It is an odorless, white, granular material with a fine powdery texture that is highly porous and has an extremely high surface area. Activated alumina is used industrially in gas drying, water filtration, as an adsorbent for some organic compounds, and in the production of synthetic rubies.

Key Takeaways

- Market Growth Projection: The global activated alumina market is estimated to grow from USD 1018.9 Million in 2023 to approximately USD 5111 Million by 2033, marking a CAGR of 5.4% during this period.

- Diverse Applications: Activated alumina finds extensive usage across various industries due to its versatility. It serves as a catalyst, desiccant, fluoride adsorbent, and is used in bioceramics among other applications.

- Particle Size Variants: Different particle sizes cater to specific industry needs. Segments like powder, 0.5-2 mm, 2-5 mm, and 5-10 mm serve varied purposes, offering specific characteristics and suitability for different applications.

By Particle Size

Powder Segment The powder segment within the activated alumina market holds a notable share owing to its widespread applications across various industries. This segment is characterized by its fine particle size, making it suitable for diverse uses such as adsorbents in gas and liquid phases, catalyst carriers, and desiccants.

0.5-2 mm Segment: The 0.5-2 mm particle size range in the activated alumina market represents a segment known for its balance between surface area and particle size. This segment finds extensive usage in dehydration and purification applications. Its intermediate size offers a good compromise between efficiency in adsorption and pressure drop within systems.

2-5 mm Segment: The 2-5 mm particle size segment in the activated alumina market caters to applications demanding higher mechanical strength alongside adsorption properties. Its larger particle size makes it suitable for applications requiring durability and resistance to attrition.

5-10 mm Segment: The 5-10 mm particle size category within the activated alumina market represents a segment known for its larger granules, offering superior mechanical strength and structural integrity.

Application Analysis

In 2023, the powder form of activated alumina was the big player, grabbing over 33.2% of the market. This type is like super fine dust and works great for sucking up stuff in gases and liquids. People use it a lot in things like cleaning water, making medicines, and keeping the air clean.

It acts as a catalyst for the Claus reaction. It is likely that its demand will increase with the expansion and new construction of refineries in the future. In India, the Saudi Arabian government signed a memorandum with India in 2019 to establish a refinery.

It can also be used for liquid and gas drying. Because of its large surface area, it can dry almost any liquids or gases. The demand for it is likely to be driven by its properties, including resistance to abrasion or thermal shock.

Bioceramics applications are expected to grow strongly between 2023 and 2032. Ceramics made from activated alumina can withstand harsh conditions such as high temperatures and acidic environments. These properties encourage products to be used in dental and bone applications.

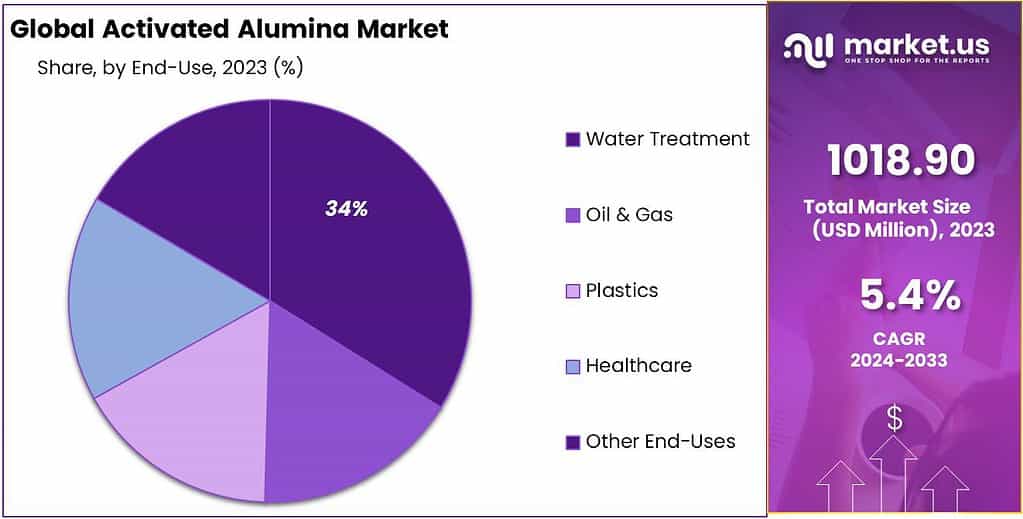

End-Use Analysis

In 2023, water treatment was the big leader, taking up more than 36.9% of the activated alumina market. People use activated alumina a lot for cleaning up water. It’s like a sponge that soaks up bad stuff, making water safe to drink.

From 2023 to 2032, the healthcare sector is expected to experience a healthy growth rate. Activated alumina Bioceramics are an alternative to surgical alloys. They can be used in tooth implants or hip prostheses because of their low friction, anti-corrosion, and hardness.

Other applications include chemical, food, and beverage, as well as nuclear. It can also be used in high vacuum applications such as in charge material in foreline traps to stop oil from rotary pumps from returning into the system.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Particle Size

- Powder

- 0.5-2 mm

- 2-5 mm

- 5-10 mm

By Application

- Catalyst

- Desiccant

- Fluoride Adsorbent

- Bio Ceramics

- Other Applications

By End-Use

- Water Treatment

- Oil & Gas

- Plastics

- Healthcare

- Other End-Uses

Drivers

Increasing demand for alumina beads

The surge in demand for activated alumina beads is driven by the pressing need for water treatment, particularly in developing nations. Governments are taking steps to address water-related issues, fueling the need for these beads. Known for their exceptional porosity and high surface area, activated alumina beads are highly efficient in absorbing substances, finding diverse applications.

Rising usage of gas as alternative fuel

These beads play a crucial role in oil and gas industries, especially in dehydrating compressed gases like compressed natural gas (CNG) and liquid petroleum gas (LPG). The increased adoption of gas, including CNG and LNG, as an alternative fuel source has significantly risen, nearly one and a half times in recent years. To ensure these gases remain free from moisture and contaminants, they’re filtered through activated alumina to eliminate impurities like carbon dioxide and hydrogen sulfide. This necessity for clean gases has escalated the demand for activated alumina and is a key driver propelling market expansion.

Opportunities

Growing usage of activated alumina in oil and gas industry

Activated alumina serves as a crucial desiccant in the oil and gas sector, valued for its ability to absorb substantial volumes of gases and liquids without undergoing any chemical alterations. Its primary role lies in dehydrating various organic liquids like liquid petroleum gas, gasoline, steam-cracked liquids, and aromatic solvents. Particularly in gas dehydration, activated alumina plays a vital part by eliminating moisture traces from gases such as methyl chloride, synthesis gas, and natural gas.

This widespread application of activated alumina within the oil and gas industry is expected to open up lucrative prospects for market growth. As its usage continues to grow in this sector, the demand for activated alumina is poised to witness significant expansion, driven by its indispensable role in maintaining the purity and quality of gases and liquids in various processes.

Increasing government investments in water treatment infrastructure and technologies

Governments worldwide are directing substantial investments towards upgrading water treatment technologies and infrastructure to combat pressing environmental concerns. China, for instance, allocates around US$ 110 billion annually toward environmental protection and pollution control, specifically emphasizing wastewater treatment. Activated alumina stands out as a favored choice for water treatment, employed either at the entry point or within specific usage points. Its efficiency in eliminating contaminants makes it a preferred solution.

The rising governmental commitment to enhancing water treatment facilities is expected to pave the way for significant opportunities in market expansion. As governments globally prioritize addressing water-related challenges, the demand for activated alumina is anticipated to grow, driven by its crucial role in ensuring cleaner and safer water for various applications.

Restraints/ Challenge

Availability of activated alumina substitutes

The activated alumina market faces potential hurdles due to the presence of substitutes like zeolites and activated carbon, which offer similar performance qualities. Additionally, a foreseen decrease in the absorption capacity of activated alumina stands as a significant challenge anticipated during the forecast period.

This report on the activated alumina market covers an array of critical insights, including recent developments, trade regulations, import-export analysis, production assessments, optimization of the value chain, market share analysis, impacts from local and international market players, identification of emerging revenue opportunities, scrutiny of evolving market regulations, strategic analyses for market growth, assessment of market size and category growth, exploration of application niches and dominance, product approvals and launches, expansions across different regions, and technological advancements within the market.

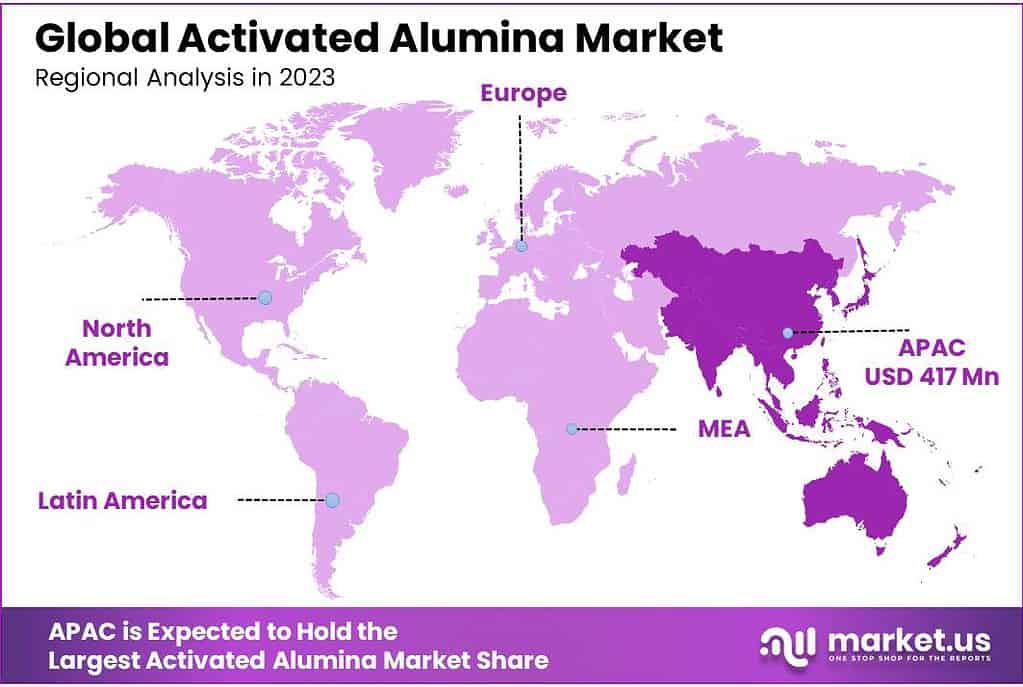

Regional Analysis

In 2023, Asia Pacific accounted for the largest share of global Activated Alumina market revenue. It is expected to account for 36% of the activated alumina market share in 2023 among others. China and India, which are key countries, will see steady growth in refining capacity.

This is expected to increase product demand. The activated alumina market will be driven by the rising demand for freshwater supply from the region’s growing population over the next few years. In 2021, North America was the second-largest regional market. According to the International Energy Agency (IEA), North America was the second-largest regional market in 2023.

Brazil saw a positive growth rate in 2023, owing to the recovery in investment in different sectors. The country’s political and economic reforms are expected to support activated alumina market development by driving the key end-use sector, including pharmaceutical, oil and gas, and water treatment.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Global activated alumina markets are highly competitive due to the present major players such as BASF SE, Sumitomo Chemical Co., Honeywell International Inc., Porocel Industries LLC, and Dynamic Adsorbents Inc. The application and use of activated aluminum in different products are what drive the competition.

Most companies invest heavily in research and development to increase their product ranges, and production capabilities, and maintain their market position. This Activated Alumina market will grow due to the development of technology and increased research investments.

Market Key Players

- BASF SE

- Honeywell International Inc.

- Sumitomo Chemical Co., Ltd

- Axens

- AGC CHEMICALS PVT. LTD.

- Sorbead India

- Shandong Zhongxin New Material Technology Co., Ltd.

- Luoyang Xinghua Chemical Co., Ltd.

- Sialca Industries

- Shayan Corporation

- BeeChems

- Hengye Inc.

- Huber Engineered Materials

Recent Development

February 2023: Evonik announced the investment in the expansion of its fumed aluminum oxide production plant in Yokkaichi, Japan. The facility will be the company’s first alumina plant in Asia. It will focus on making solutions for lithium-ion battery technology, which is used in electric car batteries.The plant is expected to be operational by 2025.

October 2022: Axens signed an Asset Sale Agreement (ASA) with Canada-based Rio Tinto Alcan regarding the sale by Rio Tinto Alcan of its activated alumina business in Brockville, Ontario, Canada. The business will bring growth potential for new markets globally.

Report Scope

Report Features Description Market Value (2023) USD 1018.9 Million Forecast Revenue (2033) USD 1724.0 Million CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum and Steel), By Type (Standard and Bag-In-Valve), By Application (Personal Care, Household, Automotive and industrial, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Honeywell International Inc., Sumitomo Chemical Co., Ltd, Axens, AGC CHEMICALS PVT. LTD., Sorbead India, Shandong Zhongxin New Material Technology Co., Ltd., Luoyang Xinghua Chemical Co., Ltd., Sialca Industries, Shayan Corporation, BeeChems, Hengye Inc., Huber Engineered Materials Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Honeywell International Inc.

- Sumitomo Chemical Co., Ltd

- Axens

- AGC CHEMICALS PVT. LTD.

- Sorbead India

- Shandong Zhongxin New Material Technology Co., Ltd.

- Luoyang Xinghua Chemical Co., Ltd.

- Sialca Industries

- Shayan Corporation

- BeeChems

- Hengye Inc.

- Huber Engineered Materials