Global Centrifugal Pumps Market Report By Type (Overhung Impeller, Vertically Suspended, Between Bearing), By Stage (Single Stage, Multistage), By Flow Type (Axial Flow, Radial Flow, Mixed Flow), By End User (Agriculture, Construction & Building, Water & Wastewater, Oil & Gas, Chemical, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132169

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

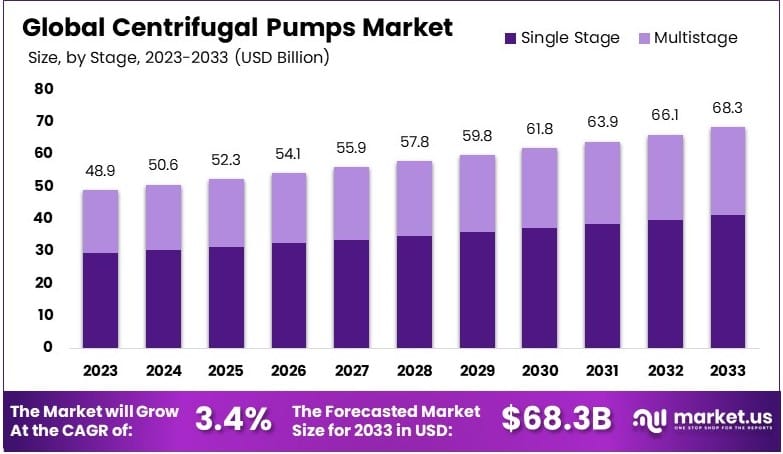

The Global Centrifugal Pumps Market size is expected to be worth around USD 68.3 Billion by 2033, from USD 48.9 Billion in 2023, growing at a CAGR of 3.4% during the forecast period from 2024 to 2033.

Centrifugal pumps are devices designed to move fluids by converting rotational energy, often from an electric motor, into energy within the fluid. These pumps are widely used for their efficiency and adaptability, making them essential in industries such as water treatment, HVAC, and manufacturing, where they ensure consistent fluid transfer.

The centrifugal pumps market includes the production and supply of pumps for applications across industrial, commercial, and municipal sectors. This market supports the infrastructure for water and wastewater treatment, heating, ventilation, and air conditioning systems, as well as other essential fluid transfer operations.

The centrifugal pumps market is driven by several growth factors, including the expansion of renewable energy and increased infrastructure development. Notably, as renewable energy capacity grew by approximately 50% in 2023, the need for robust heat transfer fluid systems surged.

In terms of product variety, single-stage centrifugal pumps are commonly preferred in water treatment and HVAC insulation systems. These pumps manage flow rates between 3 and 1680 m³/h, achieving head pressures up to 152 meters at speeds ranging from 960 to 2900 rpm. Their compact design, corrosion-resistant materials, and low-maintenance requirements make them ideal for demanding environments.

On a broader scale, the market has gained momentum through large-scale investments in clean energy. In the United States, the Inflation Reduction Act spurred $421 billion in clean energy funding as of 2024, according to the World Resources Institute (WRI). These investments have led to the launch or expansion of 113 new renewable manufacturing facilities since 2022, signaling a robust demand for centrifugal pumps in renewable energy and industrial applications.

Locally, centrifugal pumps play a key role in water management, ensuring reliable fluid transfer in municipal and industrial systems. For example, water and wastewater treatment plants rely on these pumps for efficient operation, while HVAC systems in commercial buildings use them for circulation.

Government regulations and investments are also instrumental in market growth. Policies aimed at reducing emissions and improving water and energy infrastructure drive demand for energy-efficient and durable centrifugal pumps.

Key Takeaways

- The Centrifugal Pumps Market was valued at USD 48.9 billion in 2023 and is expected to reach USD 68.3 billion by 2033, with a CAGR of 3.4%.

- In 2023, Single-Stage Pumps dominate the stage segment with 60.1%, driven by their cost-effectiveness and efficiency for various applications.

- In 2023, Radial Flow Pumps lead the flow type segment with 63.7%, supported by their extensive use in industrial settings.

- In 2023, Overhung Impeller type holds the largest market share at 47.6%, valued for its versatility across sectors.

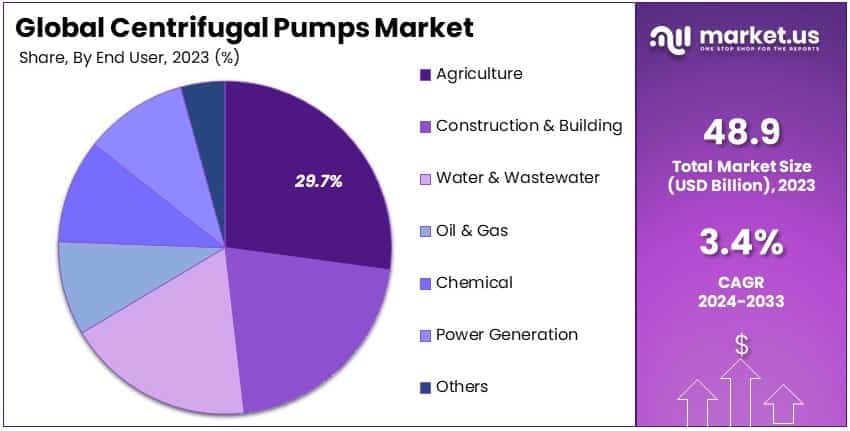

- In 2023, Agriculture is the leading end-use segment, accounting for 29.7%, driven by increasing demand for irrigation solutions.

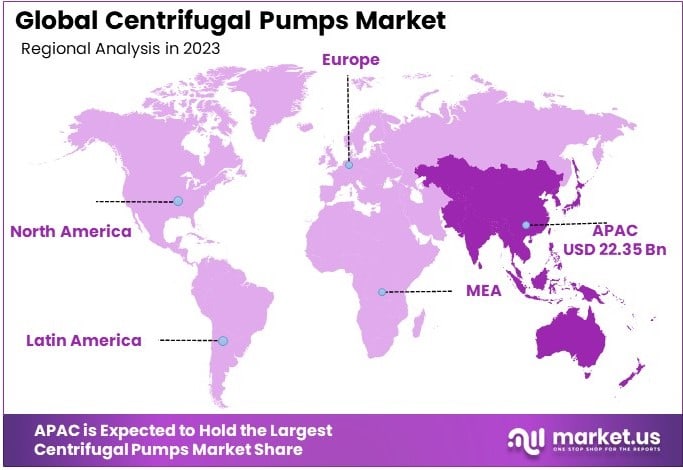

- In 2023, Asia-Pacific leads regionally with 45.7%, supported by strong infrastructure development and industrial activities.

Type Analysis

Overhung Impeller Dominates with 47.6% Due to Compact Design and Cost-Effectiveness

The “Type” segment of the Centrifugal Pumps Market is predominantly led by Overhung Impeller pumps, which hold a significant 47.6% market share. This dominance is attributed to their compact design and cost-effectiveness.

This makes them a preferred choice for a wide range of applications that require moderate head and flow rates. Overhung impeller pumps are widely used because they are less complex to manufacture and maintain, offering a lower total cost of ownership compared to other types.

Vertically Suspended pumps and Between Bearing pumps are other important sub-segments within this category. Vertically suspended pumps are particularly suited for applications where floor space is a constraint, as their vertical design minimizes the footprint.

Between Bearing pumps, on the other hand, are designed for high load applications and offer higher stability and support, making them ideal for heavy-duty operations. Both types play crucial roles in industries that require specific pump characteristics for unique operational needs, thereby supporting the overall growth and diversification of the centrifugal pumps market.

Stage Analysis

Single-Stage Pumps Lead with 60.1% Owing to Simplicity and Lower Costs

In the “Stage” segment, Single-Stage pumps command the market with a 60.1% share, primarily due to their simplicity and lower manufacturing and maintenance costs. Single-stage centrifugal pumps are designed with one impeller and are optimal for low-pressure applications.

This makes them highly versatile and suitable for a wide range of industries, including municipal water services, light agriculture, and residential water systems.

Multistage pumps, while essential for applications requiring high pressures, are used less frequently due to their complexity and higher costs. These pumps contain multiple impellers stacked within a single casing, increasing the pressure available at each stage.

Although they are critical for high-pressure tasks such as boiler feed water and high-rise building water supply, their specialized nature limits their market share compared to single-stage pumps.

Flow Type Analysis

Radial Flow Pumps Dominate with 63.7% Due to Broad Application Versatility

Within the “Flow Type” segment, Radial Flow pumps lead significantly, holding a 63.7% share of the market. This type of pump is preferred for its ability to provide a steady and controllable flow, making it ideal for applications that range from chemicals processing to municipal water treatment.

Radial flow centrifugal pumps are highly effective in generating high heads at moderate flow rates, which is a common requirement in various industrial operations.

Axial Flow and Mixed Flow pumps, while important, have more specialized applications. Axial Flow pumps are best suited for low head, high flow applications, often used in flood dewatering and other bulk water movement tasks.

Mixed Flow pumps combine the traits of radial and axial flow pumps, providing a balance of flow and head that serves well in applications like agriculture irrigation and certain types of HVAC installations.

End User Analysis

Agriculture Leads End-User Segments with 29.7% due to High Dependency on Water Management Systems

In the “End User” segment, Agriculture dominates as the leading market for centrifugal pumps, accounting for 29.7% of the sector. This is primarily because centrifugal pumps are crucial in irrigation and other water management systems that are integral to modern farming operations. The efficiency and reliability of these pumps directly impact agricultural productivity, making them indispensable in this sector.

Other key segments such as Construction & Building, Water & Wastewater, Oil & Gas, Chemical, and Power Generation also rely heavily on centrifugal pumps. Construction and Building use these pumps for managing water supply and dewatering at sites, while Water & Wastewater treatment operations depend on them for their process reliability and flexibility.

In Oil & Gas, centrifugal pumps are used for pipeline transport and petrochemical processing. The Chemical industry values them for their ability to handle corrosive fluids, and Power Generation requires robust pumping solutions for cooling and condensate extraction, making centrifugal pumps fundamental to multiple facets of industrial infrastructure.

Key Market Segments

By Type

- Overhung Impeller

- Vertically Suspended

- Between Bearing

By Stage

- Single Stage

- Multistage

By Flow Type

- Axial Flow

- Radial Flow

- Mixed Flow

By End User

- Agriculture

- Construction & Building

- Water & Wastewater

- Oil & Gas

- Chemical

- Power Generation

- Others

Drivers

Increasing Industrialization in Emerging Economies Drives Market Growth

The surge in industrialization within emerging economies significantly propels the growth of the centrifugal pumps market. As countries expand their industrial sectors, there is a heightened demand for efficient fluid handling systems, where centrifugal pumps play a crucial role.

Additionally, advancements in pump technology enhance performance and reliability, making these pumps more attractive to industries seeking to optimize their operations. Furthermore, the rising demand for energy-efficient solutions aligns with centrifugal pumps’ ability to reduce energy consumption, thereby lowering operational costs for businesses.

Government initiatives supporting infrastructure development also contribute by funding large-scale projects that require extensive use of centrifugal pumps. Collectively, these driving factors create a robust environment for the centrifugal pumps market to thrive, fostering increased sales and market penetration across various industrial applications.

Restraints

High Initial Investment Costs Restrain Market Growth

One of the primary challenges facing the centrifugal pumps market is the high initial investment costs associated with acquiring and installing these systems. The substantial upfront expenditure can deter small and medium-sized enterprises from adopting centrifugal pumps, limiting market expansion.

Additionally, intense market competition intensifies pricing pressures, making it difficult for manufacturers to maintain profit margins while keeping prices competitive. Fluctuating raw material prices further exacerbate financial uncertainties, as manufacturers may struggle to manage costs effectively without compromising on quality.

Moreover, stringent regulatory standards impose additional compliance costs, requiring manufacturers to invest in meeting environmental and safety guidelines. These restraining factors collectively hinder the market’s growth potential by increasing barriers to entry and operational costs for businesses.

Opportunity

Expansion in Renewable Energy Projects Provides Opportunities

The centrifugal pumps market stands to benefit from significant growth opportunities presented by the expansion of renewable energy projects. As the world shifts towards sustainable energy sources, the demand for efficient fluid transfer systems in solar, wind, and hydroelectric power plants rises.

Additionally, the growing water and wastewater treatment sector offers new avenues for centrifugal pump applications, addressing the need for effective water management solutions in urban and industrial settings. The adoption of IoT and smart technologies further enhances pump performance through real-time monitoring and automation, attracting businesses seeking to upgrade their infrastructure.

Increasing demand in residential applications also opens up new market segments, as homeowners invest in efficient water circulation systems. These opportunities collectively provide a fertile ground for centrifugal pump manufacturers to innovate and expand their market presence.

Challenges

Supply Chain Disruptions Challenge Market Growth

Supply chain disruptions pose significant challenges to the centrifugal pumps market, affecting production schedules and delivery timelines. Factors such as geopolitical tensions, natural disasters, and pandemics can lead to delays in the procurement of essential raw materials, hindering manufacturing processes.

Technological obsolescence also presents a hurdle, as rapid advancements in pump technology may render existing models outdated, forcing manufacturers to continually innovate to stay competitive. Additionally, a shortage of skilled labor exacerbates production inefficiencies, limiting the ability to meet increasing demand effectively.

Environmental concerns and sustainability issues further complicate market dynamics, as manufacturers must balance operational efficiency with eco-friendly practices. These challenging factors collectively impede the market’s ability to grow steadily, necessitating strategic solutions to mitigate their impact.

Growth Factors

Expansion in the Oil and Gas Industry Is Growth Factor

The centrifugal pumps market is experiencing robust growth driven by several key factors, including the expansion of the oil and gas industry. As exploration and production activities increase, there is a heightened need for reliable fluid transfer systems to handle crude oil, natural gas, and other petrochemicals efficiently.

Growth in chemical processing applications also contributes to market expansion, as centrifugal pumps are essential for managing the flow of various chemicals in manufacturing processes. Additionally, increasing infrastructure development projects, such as the construction of pipelines and refineries, further boost demand for centrifugal pumps.

The rising global population and urbanization intensify the need for effective water distribution and sanitation systems, driving the adoption of centrifugal pumps in residential and municipal applications. These growth factors collectively enhance market dynamics, fostering increased investment and innovation within the centrifugal pumps sector.

Emerging Trends

Integration of Artificial Intelligence Is Latest Trending Factor

The centrifugal pumps market is witnessing significant trends driven by the integration of artificial intelligence (AI) and other advanced technologies. AI enhances pump performance through predictive maintenance, allowing for the anticipation of potential failures and reducing downtime.

Emphasis on predictive maintenance ensures that pumps operate efficiently, extending their lifespan and minimizing operational costs for businesses. The development of modular pump systems caters to the need for customizable and scalable solutions, enabling industries to adapt to varying fluid handling requirements with ease.

Additionally, the shift towards eco-friendly pump designs aligns with global sustainability goals, attracting environmentally conscious consumers and businesses. These trending factors not only improve the functionality and appeal of centrifugal pumps but also position the market for sustained growth by embracing innovation and addressing contemporary needs.

Regional Analysis

Asia-Pacific Dominates with 45.7% Market Share

Asia-Pacific leads the Centrifugal Pumps Market, capturing a 45.7% share valued at USD 22.35 billion. This dominance stems from rapid industrialization, extensive infrastructure projects, and growing urbanization across countries like China, India, and Japan. Additionally, high demand from sectors like water treatment, agriculture, and oil and gas bolsters the region’s market position.

The market dynamics in Asia-Pacific are shaped by large-scale government investments in infrastructure and robust industrial growth. High population density and increasing urban expansion drive demand for efficient water management and wastewater treatment solutions, where centrifugal pumps are critical. Moreover, the region’s focus on modernizing agricultural irrigation systems further fuels growth.

Regional Mentions:

- North America: North America has a strong presence in the centrifugal pumps market, driven by high demand in water treatment and oil industries. Infrastructure modernization and focus on energy-efficient systems contribute to steady growth, particularly in the United States.

- Europe: Europe remains a key market for centrifugal pumps, supported by stringent environmental regulations and demand for efficient systems in water and wastewater management. Germany and France lead the market with advanced pump technologies aligning with green energy initiatives.

- Middle East & Africa: The Middle East and Africa are emerging markets, with growing demand for centrifugal pumps in sectors like oil and gas, agriculture, and water management. Government initiatives in infrastructure expansion are fostering gradual market growth.

- Latin America: Latin America sees rising demand for centrifugal pumps, particularly in Brazil and Mexico. Infrastructure development and industrialization are key drivers, especially in water treatment and agriculture, as countries aim to improve resource management.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Centrifugal Pumps Market is led by established companies known for their extensive expertise, diverse product offerings, and global reach. The top players—Grundfos, Xylem Inc., KSB Group, and Sulzer Ltd.—dominate this market by leveraging innovation, energy efficiency, and advanced technology to meet the diverse needs of industries such as water treatment, oil and gas, and manufacturing.

Grundfos is a leading player, recognized for its commitment to sustainability and energy-efficient pumping solutions. With a strong focus on innovation, Grundfos designs advanced centrifugal pumps that help reduce environmental impact, making it a preferred choice for industries prioritizing green solutions. The company’s expansive product range and global presence reinforce its leadership in the market.

Xylem Inc. is renowned for its high-performance pumps designed for complex water and wastewater applications. Known for reliability and durability, Xylem provides solutions that support municipal and industrial sectors. Xylem’s continuous investment in smart technology and data-driven solutions distinguishes it in the market, catering to clients looking for both efficiency and innovative water management tools.

KSB Group holds a significant position with its wide array of centrifugal pumps catering to sectors like power, wastewater, and process engineering. KSB’s strength lies in its engineering expertise and customer-centric approach, offering customized solutions for specific industrial requirements. The company’s focus on quality and robust performance solidifies its role as a trusted partner across industries.

These top players drive the centrifugal pumps market by addressing key demands for efficiency, durability, and sustainability. Their technological advancements and dedication to quality set the standards in this competitive landscape, helping industries manage resources effectively while ensuring operational reliability.

Top Key Players in the Market

- Grundfos

- Xylem Inc.

- KSB Group

- Sulzer Ltd.

- Flowserve Corporation

- Wilo SE

- Ebara Corporation

- ITT Goulds Pumps

- Andritz AG

- Weir Group

- Pentair plc

- SPX Flow, Inc.

- Tsurumi Manufacturing Co., Ltd.

- Kirloskar Brothers Limited

- Shakti Pumps

Recent Developments

- Svanehøj: In September 2024, Svanehøj, a marine pump specialist, launched the world’s first high-pressure centrifugal pump designed specifically for ammonia fuel applications. The HP NH3 Fuel Pump provides a fuel injection pressure of up to 100 bar and features a compact footprint of 2,100 x 780 x 1,450 mm, making it ideal for ammonia fuel supply systems.

- Baker Hughes: In June 2024, Baker Hughes introduced a collection of sensor technologies designed to improve hydrogen measurement across sectors like hydrogen production, oil and gas, and power generation. The new technologies include the XMTCpro process gas analyzer, the HygroPro XP moisture transmitter, and the T5MAX transducer, each providing precise hydrogen purity measurements and detecting impurities such as moisture and oxygen.

- KSB Pumps: In April 2024, KSB Pumps launched a new range of agricultural and domestic pumps at a conference in Pune, organized through its distributor, Mahaveer Enterprises. The event showcased KSB Pumps’ dedication to providing efficient, reliable solutions tailored to the needs of farmers and homeowners.

Report Scope

Report Features Description Market Value (2023) USD 48.9 Billion Forecast Revenue (2033) USD 68.3 Billion CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Overhung Impeller, Vertically Suspended, Between Bearing), By Stage (Single Stage, Multistage), By Flow Type (Axial Flow, Radial Flow, Mixed Flow), By End User (Agriculture, Construction & Building, Water & Wastewater, Oil & Gas, Chemical, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grundfos, Xylem Inc., KSB Group, Sulzer Ltd., Flowserve Corporation, Wilo SE, Ebara Corporation, ITT Goulds Pumps, Andritz AG, Weir Group, Pentair plc, SPX Flow, Inc., Tsurumi Manufacturing Co., Ltd., Kirloskar Brothers Limited, Shakti Pumps Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grundfos

- Xylem Inc.

- KSB Group

- Sulzer Ltd.

- Flowserve Corporation

- Wilo SE

- Ebara Corporation

- ITT Goulds Pumps

- Andritz AG

- Weir Group

- Pentair plc

- SPX Flow, Inc.

- Tsurumi Manufacturing Co., Ltd.

- Kirloskar Brothers Limited

- Shakti Pumps