Global CBD Beverages Market Type (Marijuana-derived, Hemp-derived, and Other Types), By Product Type (CBD Water, CBD Tea, CBD Coffee, CBD Mocktails, CBD Energy Drinks, CBD Alcoholic Drinks, and Other CBD products), By Grade (Pharmaceutical Grade, Food Grade), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 106289

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

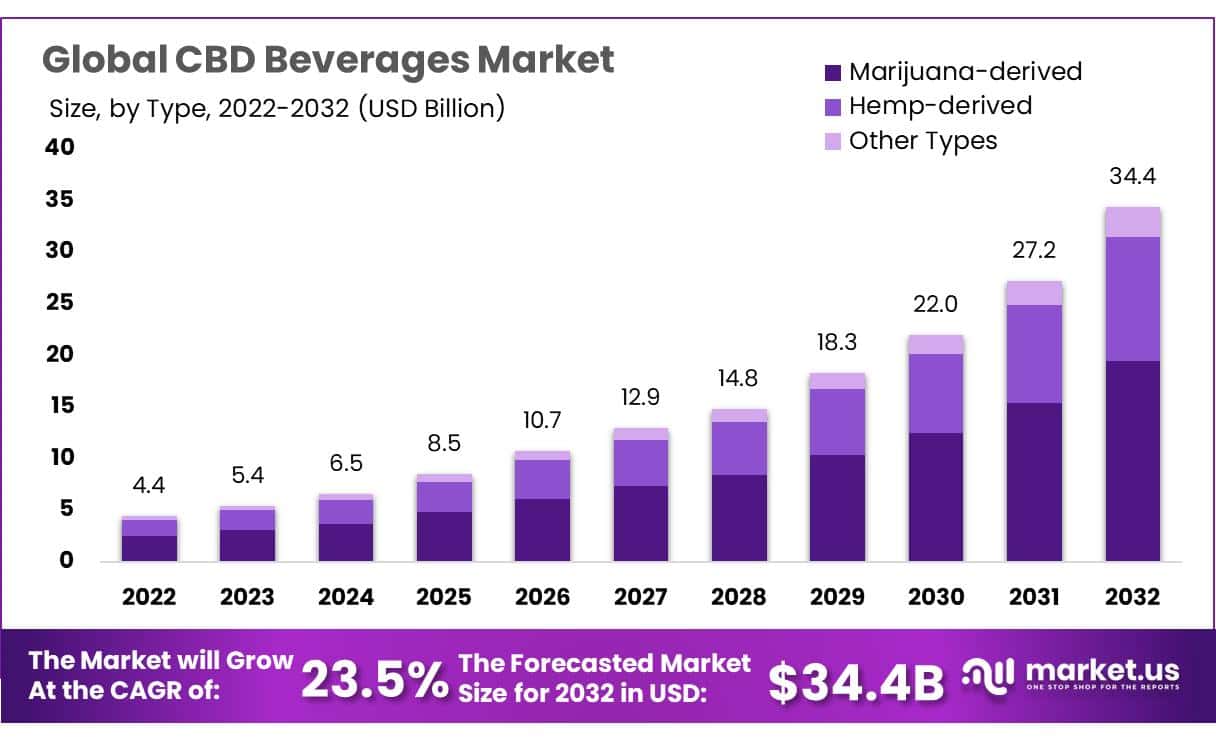

In 2022, the Global CBD Beverages Market was valued at USD 4.4 Billion, and is expected to reach around USD 34.4 Billion by 2032, From 2023 to 2032, this market is estimated to register a CAGR of 23.5%.

CBD (Cannabidiol) beverages are formulated with CBD oils or extracts. These drinks become increasingly popular, including alcoholic carbonated beverages, flavored teas, sparkling waters, and drinks with CBD.

The increasing awareness of CBD’s numerous health benefits, including its capacity to enhance immunity, manage weight, and improve digestion, is driving the market for CBD drinks. Despite being in their early phases, research and clinical studies that support the advantages are very favorable.

They are picking consumer interest, especially in regions where hemp is widely farmed. The growing focus on health and well-being has led to a growth in the market for CBD beverages. The variety of special health advantages, natural flavor profiles, and convenience beverages containing CBD have revolutionized the beverage industry.

These beverages give customers a balanced serving of cannabis in a tasty, convenient manner. Smart business people use this growing trend to expand customers, vary their product offerings, and increase income by developing distinctive CBD-infused beverages.

Actual Numbers Might Vary in the final report

Key Takeaways

- Market Size: It is expected that the global CBD beverage market will experience a compound annual growth rate (CAGR) of 23.5 from 2023-2032.

- Market Trend: CBD beverages have gained tremendous momentum due to the rising interest in wellness products and possible health advantages provided by CBD.

- Product Analysis: CBD Mocktails have become the go-to product in the market due to the health advantages they bring; among these products, they hold most of the revenue share.

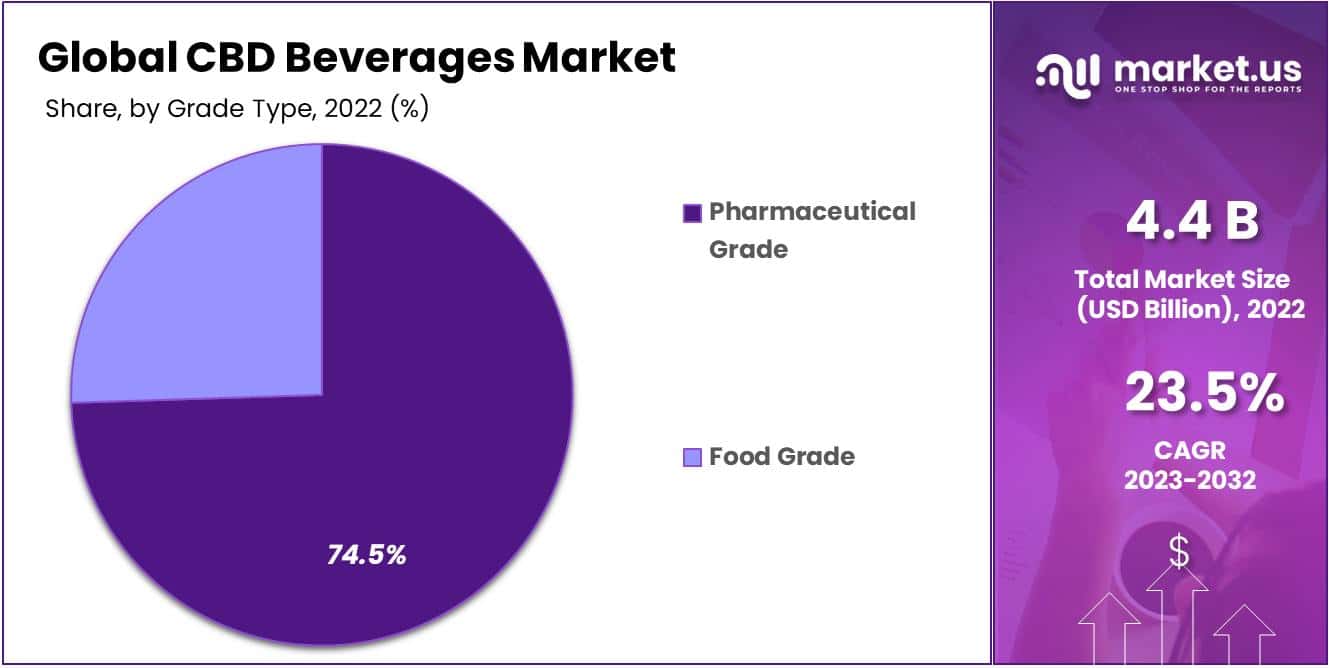

- Grade Analysis: Pharmaceutical-grade CBD had an incredible 74.56% revenue share among various CBD grade types in 2022. CBD-infused beverages have experienced rapid adoption due to their non-psychoactive effects.

- Distribution Channel Analysis: Pharmaceutical stores serve as the main distribution channels for CBD beverages.

- Drivers: Rising awareness of CBD benefits, shifting consumer preferences toward healthier alternatives, and regulatory shifts that facilitate its use are among the major contributors.

- Restraints: Legal and regulatory uncertainties, flavor/formulation challenges, and variable CBD quality/potency are some of the factors to keep in mind when trying out CBD-infused products.

- Opportunities: Expanding product portfolios, conducting research to enhance taste and bioavailability, and forging partnerships for distribution and marketing are among the many potential paths ahead.

- Challenges: Navigating ever-evolving regulations, informing consumers, and assuring consistent product quality and efficacy remain among our greatest hurdles to overcome.

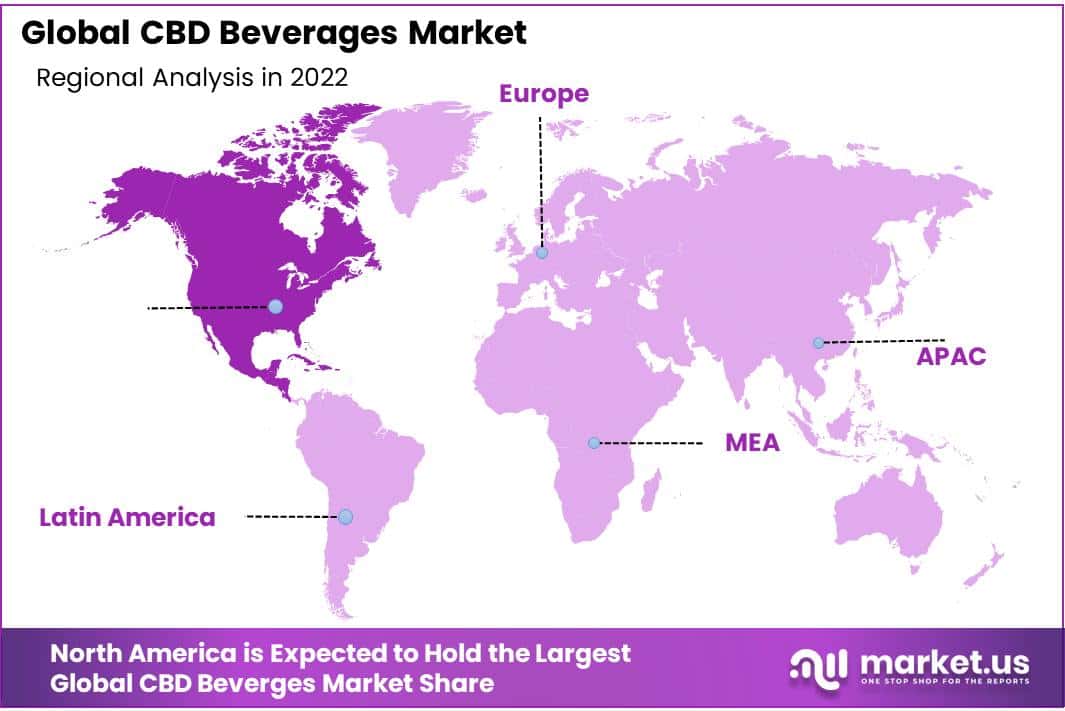

- Regional Analysis: By 2022, North America held the largest revenue share, reaching nearly 79% of worldwide cannabis beverage sales revenue. Cannabis beverages experienced rapid and substantial expansion throughout this region.

- Key Players Analysis: Major players in the CBD beverages market include Canopy Growth Corporation, The Cronos Group, Hexo, CannTrust, Aurora Cannabis Inc., GW Pharmaceuticals plc., VIVO Cannabis Inc., Alkaline88, Ablis CBD, NewAge Inc., Cannara, Other Key Players

Market Scope

Type Analysis

The Increased Demand For Hemp-derived CBD In Medical Applications Due to the Legalization of Medical Hemp And Rising Consumer Awareness.

The global CBD beverages are segmented based on type into Marijuana-derived, Hemp-derived, and Other Types. Among these, Hemp-derived beverages held the majority of revenue share. In 2022, the hemp segment dominated the market with a market share of 56.5% of the overall revenue.

After the federal farm bill legalized industrial hemp, a low-THC form of cannabis. People prefer hemp-derived beverages over other CBD beverages because they help to relieve inflammation, anxiety, and stress. It’s available in powder, oil, or water, and it adds value for money to drinks; because of these reasons, it increases demand for hemp-derived beverages.

Product Type Analysis

The CBD Mocktails dominated The Market Due to their health benefits.

Based on Product type, the market is further divided into CBD water, CBD tea, CBD coffee, CBD mocktails, CBD energy drinks, CBD alcoholic drinks, and Other CBD products. Among these products, CBD Mocktail held the majority of revenue share.

In 2022, the CBD mocktail will be an alcohol-free beverage that consists of CBD. CBD-infused mocktails are preferred over alcoholic beverages due to their health benefits. By replacing traditional alcoholic beverages with CBD-infused beverages, it is possible to reduce the amount of calories consumed and eliminate the potential for a hangover in the morning.

However, the experience of drinking a flavorful beverage remains the same. An increased demand for CBD-infused mocktails in clubs and restaurants leads to the growth of this market.

Grade Analysis

The Rise In Demand For Pharmaceutical Grades With An Increase In Awareness About The Health Benefits Of CBD-Infused Beverages.

The market is further divided into pharmaceutical and food grades based on grade. Among these grades, the pharmaceutical grade held the majority of revenue share. In 2022, Pharmaceutical Grade accounted for the revenue share of 74.5% among other CBD grade types. Beverages made with CBD have become increasingly popular due to their non-psychoactive effects.

They treat various issues, from insomnia to inflammation and chronic pain. People are also turning to CBD-infused drinks to help with depression and anxiety, as well as to help with hyperemesis. With more and more people wanting to use marijuana for medical and recreational purposes, the industry has seen a huge surge in interest in CBD products.

People turn to CBD for various medical purposes, like treating neurological disorders, mental health issues, and cancer. These are the various factors for the growth of pharmaceutical-grade

Distribution Channel Analysis

Pharmaceutical Stores Are Accounted As The Major Distribution Channel For CBD Beverages

The market is further divided into pharmaceutical stores, specialty stores, online platforms, and other distribution channels based on the distribution channel type. Among these channels, pharmaceutical stores held the majority of revenue share as CBD beverage products are widely used for medical purposes.

It is because of the health benefits of that product that it is clear that it is mostly available in pharmaceutical stores. For distribution of CBD beverages, the pharmaceutical store is preferred more by the companies for distribution over other channels. These factors result in a higher majority share of pharmaceutical stores in the CBD beverage market.

Key Market Segments

Type

- Marijuana-derived

- Hemp-derived

- Other Types

By Product Type

- CBD Water

- CBD Tea

- CBD Coffee

- CBD Mocktails

- CBD Energy Drinks

- CBD Alcoholic Drinks

- Other CBD products

By Grade

- Pharmaceutical Grade

- Food Grade

By Distribution Channel

- Pharmaceutical Store

- Specialty Store

- Online Platforms

- Other Distribution Channels

Drivers

Growing Acceptance Of Cannabis As A Medicinal Product And A Recreational Drug.

Customer demand for drinks infused with cannabidiol (CBD) is rising as cannabis is increasingly authorized for medicinal and recreational uses across international borders. Additionally, growing consumer knowledge of the many advantages of cannabidiol (CBD) in managing stress, reducing inflammation, and easing pain is fueling market expansion.

The increasing prevalence of neurological and mental diseases has increased the demand for CBD beverages.

Customers’ preferences for CBD-infused food items, such as drinks, have changed due to the increased incidence of many respiratory disorders brought on by cannabis smoking.

Additionally, the popularity of cannabidiol (CBD) infused beverages is driven by the increase in neurological and mental illnesses because of their non-psychotropic qualities, reducing the chance of consumers experiencing drug-induced experiences.

Cannabidiol (CBD) infused drinks revenue growth is also favorably impacted by potential CBD beverage buyers’ increased willingness to spend money on legal CDB drinks.

Restraints

Complex Regulation Processes For CBD Products Resist CBD Beverage Market Growth.

Regulations for CBD drinks are not well-defined in some areas. This can confuse manufacturers and retailers and resist market growth. The absence of consistent rules on CBD dosage, manufacturing, quality control, and other related practices can lead to variations in product quality and confusion for consumers.

Regulations around CBD products, including drinks, can be complicated and differ from state to state. Keeping up with changing rules, like labeling, THC levels, and licensing, can be tough for businesses that operate in multiple states. Trying to keep up with all these changes adds to the complexity and costs of running your business.

Opportunity

Health Benefits Associated With CBD-Infused Beverages Increase CBD Beverage Market.

More and more people are starting to buy CBD-infused stuff, like drinks. As CBD beverages get more popular and people start to see the health benefits of it, it’s a good time to reach out to more people.

Educating people about CBD, getting rid of any misconceptions, and showing them the benefits can help get more people interested in CBD beverages and help the market grow. Functional and wellness drinks are becoming increasingly popular, and CBD drinks align with that trend.

They can help you relax, reduce stress, and get the necessary therapeutic benefits. There’s a great chance to capitalize on people’s growing interest in functional drinks and make CBD drinks look natural and alternative.

Trends

Increase in CBD Drinks That Replace Regular Painkillers.

CBD beverages are gaining popularity as alternatives to regular painkillers like ibuprofen, aspirin, and others. Drinks containing CBD have been shown to have potent anti-depressant and anti-anxiety effects. Additionally, it has been shown to support neurogenesis (brain cell growth) in critical areas of the brain connected to anxiousness and sadness.

These components will be essential in encouraging industrial expansion in the coming years. During the projection period, the market for beverages infused with cannabidiol (CBD) will have new growth opportunities due to increased research into creating and producing healthier versions of cannabis and its byproducts.

Regional Analysis

North American region accounted for the Maximum Share of the Global CBD Beverages Market.

In 2022, North America had the highest revenue share at almost 79.2%. According to predictions, the cannabis beverage business in North America is growing the quickest and the most. One of the main drivers of development is the legalization of cannabis for pharmaceutical and recreational uses.

The positive benefits of cannabinoids have been noted by several nations in North America, including the United States. Eleven states in the nation, including Alaska, Massachusetts, Michigan, California, Colorado, Illinois, Maine, Massachusetts, Colorado, Nevada, Michigan, Vermont, Nevada, Oregon, Vermont, and Washington, have legalized cannabis for recreational use.

For instance, to regulate the use of cannabis for reasons other than medicinal, the Canadian government and the Ministry of Health invested USD 24.5 million in research and development.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The market’s popular players use a variety of tactics to establish their status as the leading companies in the sector. Acquiring businesses to raise brand value among consumers is a successful method.

Another key strategy is periodically providing ground-breaking products after carefully studying the market and its target market. Leading industry players collaborate with other businesses to stay ahead of the competition.

Market Key Players

Leading industry players collaborate with other businesses to stay ahead of the competition. Many businesses are now investing in introducing new products to diversify their product offerings. One of the main methods participants utilize to increase the scope of their product portfolios is mergers and acquisitions.

- Canopy Growth Corporation

- The Cronos Group

- Hexo

- CannTrust

- Aurora Cannabis Inc.

- GW Pharmaceuticals plc.

- VIVO Cannabis Inc

- Alkaline88

- Ablis CBD

- NewAge Inc.

- Cannara

- Other Key Players

Recent Development

- In March 2023, Canopy Growth Corporation, a world-leading diversified cannabis, hemp, and cannabis device company announced The launch of Deep Space, Canada’s inaugural cannabis-infused beverage, featuring naturally occurring caffeine. Additionally, Canopy is introducing four novel flavors under its Tweed brand in anticipation of the upcoming spring season.

- In Nov 2022, Ablis CBD announced they’re doubling the potency of all their CBD beverages and shooters, making them the first craft CBD drinks made by and for athletes. Double the CBD isolate in each drink gives Ablis CBD drinks even more features without sacrificing their signature flavors.

Report Scope

Report Features Description Market Value (2022) US$ 4.4 Bn Forecast Revenue (2032) US$ 34.4 Bn CAGR (2023-2032) 23.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type (Marijuana-derived, Hemp-derived, and Other Types), By Product Type (CBD Water, CBD Tea, CBD Coffee, CBD Mocktails, CBD Energy Drinks, CBD Alcoholic Drinks, and Other CBD products), By Grade (Pharmaceutical Grade, Food Grade), By Distribution Channel (Pharmaceutical Store, Speciality Store, Online Platforms, Other Distribution Channels) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Canopy Growth Corporation, The Cronos Group Tilray, Hexo, CannTrust, Aurora Cannabis Inc., GW Pharmaceuticals plc., VIVO Cannabis Inc, Alkaline88, Ablis CBD, NewAge Inc., Cannara, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the CBD Beverages Market CAGR During the Forecast Period 2022-2032?The Global CBD Beverages Market size is growing at a CAGR of 23.5% during the forecast period from 2022 to 2032.What is the Size of CBD Beverages Market?CBD Beverages Market was valued at USD 4.4 Billion, and is expected to reach around USD 34.4 Billion by 2032, From 2023 to 2032.

Who are the major players operating in the CBD Beverages Market?Canopy Growth Corporation, The Cronos Group, Tilray., Hexo, CannTrust, Aurora Cannabis Inc., GW Pharmaceuticals plc., VIVO Cannabis Inc, Alkaline88, Ablis CBD, NewAge Inc., Cannara, Other Key Players.

-

-

- Canopy Growth Corporation

- The Cronos Group

- Hexo

- CannTrust

- Aurora Cannabis Inc.

- GW Pharmaceuticals plc.

- VIVO Cannabis Inc

- Alkaline88

- Ablis CBD

- NewAge Inc.

- Cannara

- Other Key Players