Global Cast Polymer Market By Type(Solid Surface, Engineered Stone, Cultured Marble), By Material Type(Engineered Stone, Solid Surface, Cultured Marble, Others), By Application(Residential, Commercial, Industrial), and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 61206

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

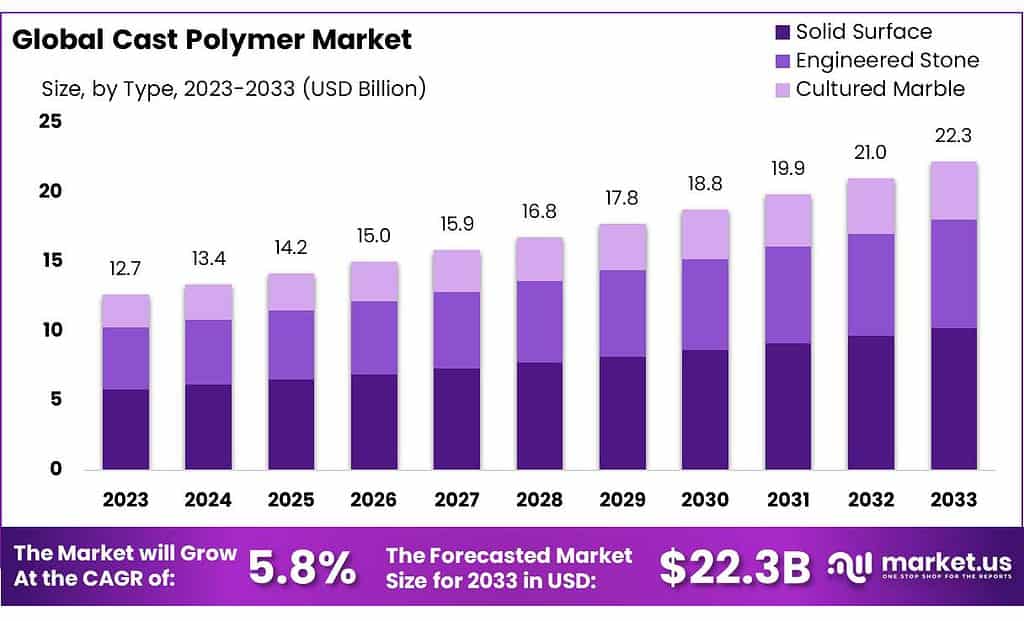

The global Cast Polymer Market size is expected to be worth around USD 22.3 billion by 2033, from USD 12.7 billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The Cast Polymer Market refers to a specialized segment within the broader materials industry, focused on the production and distribution of cast polymer products. Cast polymers, which include materials such as solid surface, engineered stone (quartz), and cultured marble, are manufactured through a process that involves the casting of a mixture of polymer resin with natural minerals, pigments, and other additives. This process yields a wide array of finished products that find applications in residential and commercial construction, primarily for countertops, vanities, shower surrounds, and other similar surfaces.

The market’s growth can be attributed to several factors, including the increasing demand for durable, aesthetically pleasing materials in the construction and renovation of homes and commercial spaces. Additionally, advancements in manufacturing technologies have enabled the production of cast polymers in a variety of colors, patterns, and finishes, further driving their popularity among consumers and designers.

Key segments within the Cast Polymer Market are often categorized by the type of material (e.g., solid surface, engineered stone, cultured marble), application (e.g., kitchen and bathroom countertops, wall panels, flooring), and geography. Market dynamics are influenced by trends in construction, consumer preferences, and technological innovations, as well as economic factors that affect construction and renovation spending.

Industry reports on the Cast Polymer Market typically provide insights into market size, growth projections, competitive landscape, key players, and investment opportunities. These reports may also explore challenges facing the market, such as environmental concerns related to the production process or the competitive pressure from alternative materials.

Key Takeaways

- Market Growth: Projected to reach USD 22.3 billion by 2033, with a 5.8% CAGR from 2023.

- Segment Dominance: Solid Surface holds 45.8% share, while Engineered Stone follows with over 37.6% in 2024.

- Material Preferences: Engineered Stone leads with 37.6% market share, followed by Solid Surface.

- Application Areas: Residential sector leads with significant market share, especially in countertops (45.9%).

- Regional Dynamics: Asia Pacific leads with 41.7% market share, followed by North America and Europe.

- The automotive industry is the largest consumer of Cast Polymer, accounting for approximately 32% of the global demand.

- The flexural strength of Cast Polymer can range from 80 to 200 MPa.

By Type

In 2024, Solid Surface held a dominant market position, capturing more than a 45.8% share. This segment benefited from its versatility and ability to mimic natural stone at a lower cost. Solid surface materials are known for their durability and ease of maintenance, making them a preferred choice for residential and commercial applications, particularly in kitchen countertops, bathroom vanities, and healthcare facilities. Their non-porous nature also contributes to their popularity, providing resistance against stains, moisture, and bacterial growth.

Engineered Stone followed, with its market share growing due to its aesthetic appeal and superior properties. Engineered stone, primarily composed of quartz, combines the beauty of natural stone with enhanced durability. It’s highly resistant to scratches, chips, and stains, which has elevated its preference for high-traffic areas in both residential and commercial settings. The increasing interest in luxurious and custom-designed interiors has further propelled the demand for engineered stone products.

Cultured Marble, though holding a smaller portion of the market, experienced steady growth, particularly in budget-conscious renovation projects. Known for its ability to replicate the appearance of natural marble, cultured marble offers a cost-effective solution for bathroom installations, including vanity tops, shower surrounds, and bathtubs. Its seamless construction and ease of customization have made it a popular choice for both new construction and remodeling projects, particularly in hospitality and residential sectors.

Each segment of the Cast Polymer Market reflects distinct consumer preferences and technological advancements. While solid surface and engineered stone cater to a demand for durability and design versatility, cultured marble continues to find its niche in cost-sensitive projects, highlighting the market’s diversity in meeting various consumer needs.

By Material Type

In 2024, Engineered Stone held a dominant market position, capturing more than a 37.6% share. This segment’s strength lies in its blend of natural beauty and robust performance. Engineered stone, particularly quartz, offers a compelling alternative to natural stone, providing high resistance to scratches, stains, and heat. Its consistent color and pattern have made it a favorite among homeowners and designers for use in kitchens and bathrooms. The segment’s growth is also fueled by its appeal in commercial projects, where its durability and aesthetic versatility are highly valued.

Solid Surface followed closely, appealing to a broad audience with its practical and aesthetic attributes. This material type is known for its ability to seamlessly integrate sinks and backsplashes, offering a uniform and clean look. Its non-porous nature, resistance to stains, and ease of repair have solidified its position in both residential and commercial spaces. The adaptability of solid surface materials to a wide range of designs and colors has further contributed to their market share.

Cultured Marble maintained its relevance in the market, particularly appreciated for its cost-effectiveness and ability to mimic more expensive materials like natural marble. It is a popular choice for bathroom applications, including vanity tops, shower walls, and bathtubs, due to its seamless construction and ease of maintenance. Despite facing strong competition from other materials, cultured marble remains a go-to option for projects with tight budgets, offering elegance without the high price tag.

The “Others” category encompasses a variety of emerging materials and composite blends that cater to niche markets seeking unique characteristics, such as enhanced eco-friendliness or specific aesthetic qualities not found in the main segments. This category represents innovation within the cast polymer industry, highlighting the continuous evolution of materials to meet diverse consumer preferences and environmental standards.

Overall, the Cast Polymer Market in 2024 demonstrated a dynamic landscape, with each material type catering to specific user needs and applications. Engineered stone led the market with its premium qualities, while solid surface and cultured marble offered versatility and cost-effectiveness, respectively. The “Others” category indicated a growing interest in sustainable and innovative materials, pointing towards future trends in the industry.

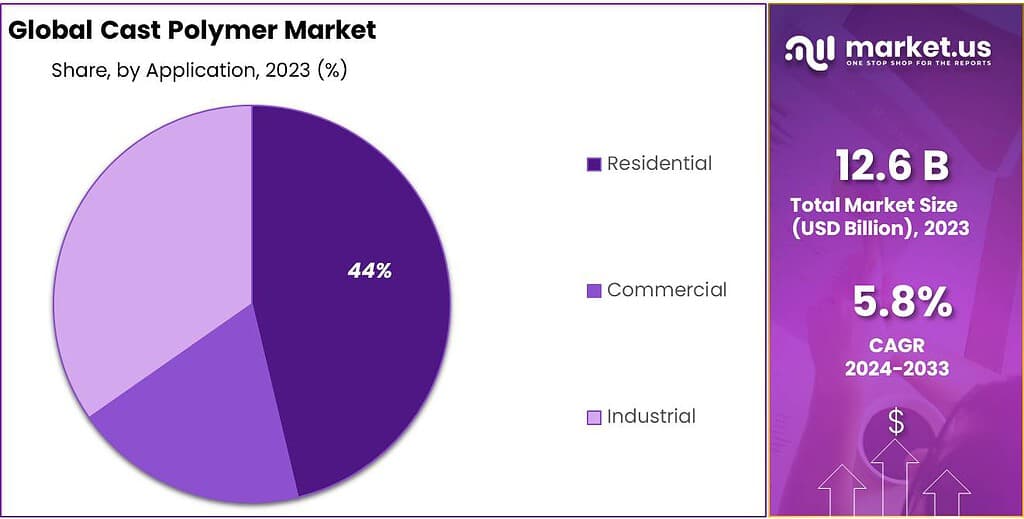

By Application

In 2024, the Residential sector emerged as the largest application area for cast polymers, capturing a significant market share. Countertops, as a product category across these sectors, held a dominant market position, capturing more than a 45.9% share. This dominance is largely due to the increasing demand for high-quality, durable materials in home construction and renovation projects.

Cast polymers, known for their aesthetic appeal and resilience, are widely used in residential settings for countertops, bathroom vanities, and shower surrounds. The growth in this segment is propelled by the rising homeowner interest in upgrading living spaces with materials that offer both beauty and longevity.

The Commercial sector followed, with cast polymers finding extensive use in various facilities, including hospitality, healthcare, and retail. In these settings, cast polymers are favored for their ability to withstand heavy use while maintaining an attractive appearance. Applications in commercial spaces often include countertops, reception desks, and wall cladding. The segment benefits from the material’s versatility and the growing trend towards creating inviting and durable commercial interiors.

Industrial applications of cast polymers, though a smaller segment, are driven by specific requirements for durable and resistant materials in harsh environments. This includes use in laboratories, industrial facilities, and certain manufacturing processes where the properties of cast polymers, such as chemical resistance and ease of maintenance, are particularly valued. This can be attributed to the widespread preference for cast polymers in both new constructions and renovations due to their aesthetic flexibility, durability, and the value they add to properties.

Key Market Segments

By Type

- Solid Surface

- Engineered Stone

- Cultured Marble

By Material Type

- Engineered Stone

- Solid Surface

- Cultured Marble

- Others

By Application

- Residential

- Commercial

- Industrial

Drivers

Increasing Demand for Aesthetic and Durable Materials in Construction and Renovation

A pivotal driver propelling the growth of the Cast Polymer Market is the surging demand for materials that combine aesthetic appeal with long-lasting durability, particularly in the construction and renovation industries. This demand is rooted in a global trend towards not only beautifying living spaces but also ensuring these enhancements are sustainable and durable over time.

Cast polymers, encompassing materials such as engineered stone, solid surface, and cultured marble, have emerged as premier choices for architects, interior designers, and homeowners alike, thanks to their unique ability to offer both the elegance of natural stone and the resilience required for high-use areas.

The appeal of cast polymers lies in their versatility and the wide array of designs, colors, and finishes they can emulate, enabling customization that can suit any interior design theme or architectural requirement.

Unlike natural stone, which can vary in quality and is subject to availability constraints, cast polymers provide a consistent quality and are readily available, making them a reliable choice for large-scale projects. Additionally, their manufacturing process allows for the integration of features such as integrated sinks and backsplashes, further enhancing their appeal by offering seamless and hygienic solutions for kitchens and bathrooms.

Moreover, the construction and renovation sectors are increasingly focused on materials that offer enhanced performance characteristics such as resistance to stains, scratches, and moisture. Cast polymers excel in these areas, providing surfaces that are not only visually appealing but also inherently more durable and easier to maintain than many natural materials. This is particularly important in commercial settings such as hotels, hospitals, and retail spaces, where the longevity of interior fittings is paramount to reducing maintenance costs and ensuring the longevity of the investment.

The environmental aspect of cast polymers also plays a significant role in their growing popularity. With an increasing emphasis on sustainable construction practices, the industry is moving towards materials that have a lower environmental impact.

The production of cast polymers, which can include recycled materials and requires less energy compared to the quarrying and transport of natural stone, aligns with these sustainability goals. Furthermore, their durability means that they need to be replaced less frequently than less durable materials, contributing to waste reduction.

This driver is underpinned by a broader cultural shift towards personalized and high-quality living spaces. As consumers become more involved in the design and renovation of their homes and workplaces, the demand for materials that can be tailored to individual tastes and requirements has risen.

Cast polymers meet this need perfectly, offering an almost limitless range of options that can be customized to fit any space, style, or function. This has been further amplified by social media and home renovation shows, which have increased public awareness of the possibilities for home improvement and interior design, fueling the desire for unique and high-quality finishes.

Restraints

High Cost of Raw Materials and Production Processes

One of the major restraints facing the Cast Polymer Market is the high cost associated with the raw materials and the production processes required to manufacture these products. Cast polymers, which include engineered stone, solid surfaces, and cultured marble, rely on a combination of high-quality resin, natural minerals, pigments, and other additives to create their unique properties and aesthetic appeal.

The procurement of these materials, particularly high-quality resins and specialty minerals, can be costly, affecting the overall price of the final product. This challenge is compounded by the need for advanced manufacturing technologies to mix, cast, cure, and finish the products to meet industry standards and consumer expectations.

The production process for cast polymers is sophisticated and energy-intensive, requiring significant investment in equipment, technology, and skilled labor. The casting process must be carefully controlled to ensure the uniformity and quality of the product, involving precise mixing, molding, and curing stages.

Additionally, the finishing process, which may include polishing, sealing, or applying additional decorative elements, adds further costs and complexity to the production line. These factors contribute to a higher price point for cast polymers compared to some alternative materials, which can limit their marketability, especially in cost-sensitive segments.

Moreover, fluctuations in the prices of key raw materials, influenced by global market dynamics, supply chain disruptions, or geopolitical factors, can lead to unpredictability in the cost structure of cast polymer products.

Manufacturers may find it challenging to absorb these cost increases, leading to higher prices for end-users or reduced margins for producers. This volatility can deter potential customers, particularly in large-scale construction or renovation projects with tight budgets, from choosing cast polymer products over less expensive alternatives.

Environmental regulations and sustainability considerations also play a role in the cost structure of cast polymer production. As governments and environmental organizations impose stricter regulations on the use of chemicals and waste management, manufacturers are required to invest in cleaner production technologies and waste recycling processes.

While these investments are crucial for reducing the environmental impact of cast polymer production, they also add to the overall cost of manufacturing, further challenging the market’s growth.

Additionally, the high cost of cast polymers can restrict their adoption in emerging economies, where the market potential is significant, but price sensitivity remains a critical factor. In these regions, the preference may lean towards more affordable construction and finishing materials, limiting the penetration of cast polymers in high-growth markets.

Opportunity

Expansion into Emerging Markets and Sustainable Construction Practices

A significant opportunity for the Cast Polymer Market lies in its expansion into emerging markets and the integration of sustainable construction practices. As economies in Asia, Africa, and South America continue to grow, the demand for construction and renovation materials in these regions is experiencing a notable increase.

This growth is driven by rapid urbanization, a rising middle class, and an increasing focus on infrastructure development. Emerging markets present a vast, untapped potential for cast polymers, particularly in countries where the construction sector is booming, but the availability of high-quality, durable, and aesthetically pleasing materials is still evolving.

The appeal of cast polymers in these markets is multifaceted. These materials offer superior qualities, such as durability, ease of maintenance, and aesthetic versatility, making them ideal for a wide range of applications, from residential to commercial and industrial construction projects.

Additionally, as consumer awareness of sustainable living and green building practices grows globally, the inherent attributes of cast polymers—such as their potential for incorporating recycled materials and their longevity—align well with these values. This alignment not only positions cast polymers as a material of choice for environmentally conscious consumers but also opens doors for their inclusion in green building projects, which are becoming increasingly prevalent in emerging economies.

Moreover, the ongoing development and innovation in the production of cast polymers can further enhance their attractiveness in these markets. Advances in manufacturing technologies not only improve the efficiency and reduce the cost of production but also enable the creation of new and improved types of cast polymers.

These innovations can lead to materials with enhanced performance characteristics, such as greater resistance to wear and tear, improved environmental sustainability, or even self-cleaning properties. Such advancements can significantly increase the competitive edge of cast polymers in emerging markets, where such features are highly valued.

Another opportunity lies in the increasing global focus on sustainable construction practices. The construction industry is under growing pressure to reduce its environmental footprint, driving the demand for materials that are durable, require less energy to produce, and can be recycled at the end of their life cycle.

Cast polymers, with their potential for incorporating recycled components and their long service life, are well-positioned to meet these demands. By highlighting and enhancing these attributes, manufacturers and suppliers of cast polymers can tap into the growing market for sustainable construction materials, further expanding their reach and market share.

Furthermore, the global push towards sustainable development goals encourages the construction industry to adopt practices and materials that contribute to energy efficiency, waste reduction, and the lowering of greenhouse gas emissions.

Cast polymers can play a pivotal role in this transition, offering solutions that not only meet the aesthetic and functional requirements of modern construction but also align with environmental sustainability goals. This opens up opportunities for collaboration with green building initiatives and participation in projects that aim to set new standards for sustainable construction worldwide.

Trends

Technological Advancements and Customization in Cast Polymer Products

A prevailing trend shaping the Cast Polymer Market is the significant technological advancements and the increasing demand for customization in cast polymer products. This trend is being driven by evolving consumer preferences, with a growing emphasis on unique, tailor-made solutions that cater to individual design and functional needs.

Technological innovations have enabled manufacturers to offer an unprecedented level of customization in terms of colors, textures, and finishes, allowing cast polymers to mimic natural stone materials like marble and granite with remarkable accuracy, or to present entirely novel aesthetics that cater to contemporary design trends.

The push towards customization is not just about aesthetics; it also encompasses functionality. Advances in manufacturing technology have made it possible to integrate features such as integrated sinks, drainage grooves, and bespoke shapes into cast polymer products.

This level of customization is particularly appealing in both residential and commercial projects where differentiation and brand identity are important. For instance, in the hospitality industry, unique and visually striking surfaces can contribute significantly to a property’s overall ambiance and guest experience.

Moreover, technological advancements are not limited to the design and customization capabilities of cast polymers. They also extend to the enhancement of the material’s performance characteristics. Today, cast polymers can be engineered to offer improved durability, stain resistance, and ease of maintenance, making them more appealing than ever to sectors where longevity and hygiene are paramount, such as healthcare and food service industries.

Another aspect of this trend is the integration of digital technologies into the production and design process. The use of digital fabrication techniques, such as 3D printing and CNC machining, has opened up new possibilities for complex shapes and designs that were previously difficult or expensive to achieve.

This technological integration facilitates the creation of prototypes and custom designs at a faster pace and lower cost, significantly reducing the time from concept to completion. It also allows for more experimental designs, pushing the boundaries of what can be achieved with cast polymers.

Sustainability is also a critical factor driving innovation within the cast polymer industry. Technological advancements are enabling the production of more eco-friendly cast polymers through the use of recycled materials and more energy-efficient manufacturing processes. Consumers and commercial clients alike are increasingly seeking out sustainable material options, and the ability to offer cast polymer products that are both beautiful and environmentally responsible is becoming a significant competitive advantage.

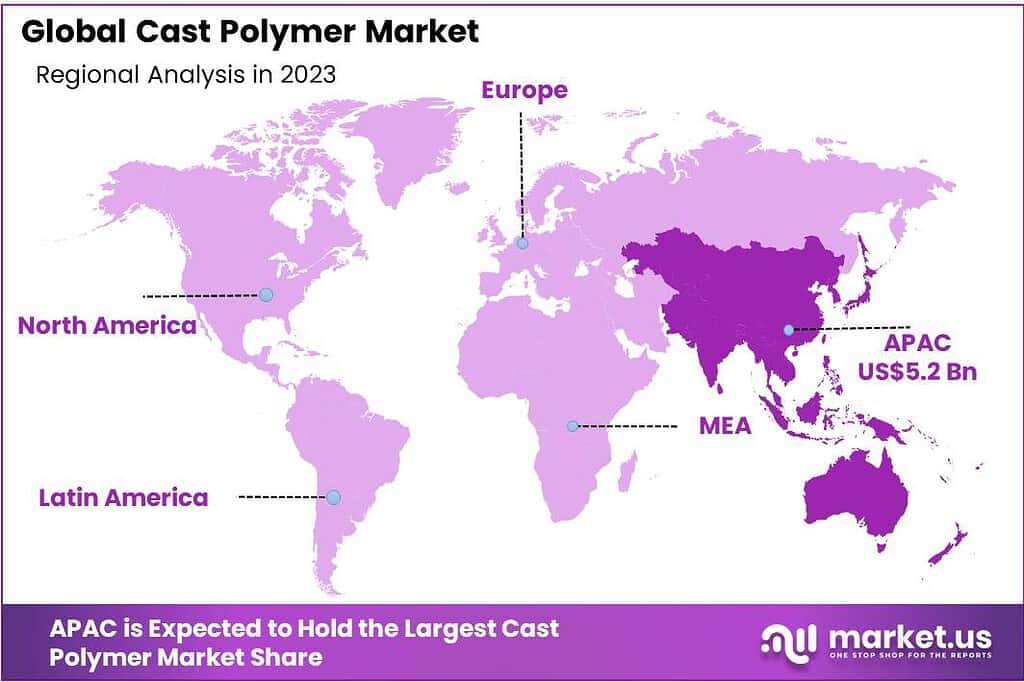

Regional Analysis

The Asia Pacific region is poised to lead the Cast Polymer Market, achieving an impressive market share of 41.7%. This remarkable growth is driven by a surge in demand for cast polymers across essential applications such as residential construction, commercial interiors, and architectural enhancements, particularly in countries like China, India, and several Southeast Asian nations, including Korea, Thailand, Malaysia, and Vietnam.

The region’s market expansion is supported by its rapidly expanding construction industry, growing economic prosperity, and increasing consumer inclination towards modern and visually appealing construction materials.

In North America, the vitality of the construction and design sectors is set to significantly boost the demand for cast polymers. The region’s commitment to pioneering product innovation, coupled with a rising preference for sustainable and environmentally friendly construction materials, further propels this demand, making North America a key market for cast polymers.

Europe is also expected to witness substantial growth in the Cast Polymer Market. This growth is fueled by escalating consumer demand for architectural and interior design solutions that offer both aesthetic appeal and practical benefits, along with heightened demand from the construction, commercial, and residential sectors. Europe’s strict standards for the quality and sustainability of building materials play a crucial role in increasing the adoption of cast polymers in a variety of applications.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The cast polymer market is witnessing steady growth attributed to various factors such as increasing demand for durable and aesthetically pleasing construction materials, rising preference for low-maintenance products, and the surge in residential and commercial construction activities worldwide. This analysis focuses on the key players shaping the dynamics of the cast polymer market.

Market Key Players

- AGCO, Inc.

- Breton S.p.A.

- Caesarstone

- Cambria

- Cosentino Group (Dekton, Sensa)

- DuPont

- Eastern Surfaces

- Formica

- Hanwha L&C (Hanex)

- LG Hausys

- Silestone

- Swanstone

- US Marble, Inc.

- Viatera

- Wilsonart

Recent Development

In January 2023, Breton, a global leader in advanced industrial machinery for stone, ceramics, metals, and engineered stone, continues its commitment to innovation.

Report Scope

Report Features Description Market Value (2023) USD 12.7 Bn Forecast Revenue (2033) USD 22.3 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Solid Surface, Engineered Stone, Cultured Marble), By Material Type(Engineered Stone, Solid Surface, Cultured Marble, Others), By Application(Residential, Commercial, Industrial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AGCO, Inc., Breton S.p.A., Caesarstone, Cambria, Cosentino Group (Dekton, Sensa), DuPont, Eastern Surfaces, Formica, Hanwha L&C (Hanex), LG Hausys, Silestone, Swanstone, US Marble, Inc., Viatera, Wilsonart Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Cast Polymer Market?Cast Polymer Market size is expected to be worth around USD 22.3 billion by 2033, from USD 12.7 billion in 2023

What CAGR is projected for the Cast Polymer Market?The Cast Polymer Market is expected to grow at 5.8% CAGR (2023-2032).Name the major industry players in the Cast Polymer Market?AGCO, Inc., Breton S.p.A., Caesarstone, Cambria, Cosentino Group (Dekton, Sensa), DuPont, Eastern Surfaces, Formica, Hanwha L&C (Hanex), LG Hausys, Silestone, Swanstone, US Marble, Inc., Viatera, Wilsonart

-

-

- AGCO, Inc.

- Breton S.p.A.

- Caesarstone

- Cambria

- Cosentino Group (Dekton, Sensa)

- DuPont

- Eastern Surfaces

- Formica

- Hanwha L&C (Hanex)

- LG Hausys

- Silestone

- Swanstone

- US Marble, Inc.

- Viatera

- Wilsonart