Global Carob Chocolate Market Size, Share, And Business Benefits By Product (Bars, Chips, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores and Drug Stores, Healthy and Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157586

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

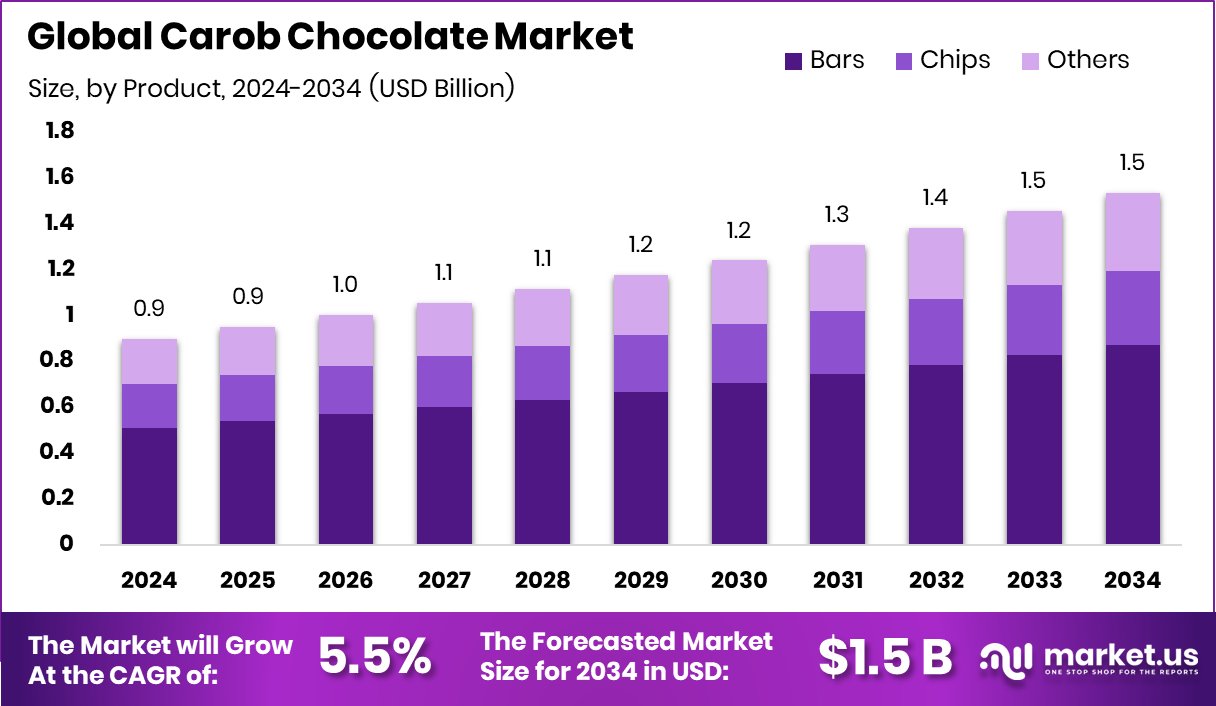

The Global Carob Chocolate Market is expected to be worth around USD 1.5 billion by 2034, up from USD 0.9 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Rising health awareness in North America supports a 45.80% share growth and a USD 0.4 Bn size.

Carob chocolate is a sweet product made from the roasted and ground pods of the carob tree. Unlike traditional chocolate, it is naturally caffeine-free, lower in fat, and has a mild, naturally sweet flavor. Many people use it as a healthier alternative to cocoa-based chocolate, especially those who are sensitive to caffeine or seeking a lower-calorie option. Carob also contains fiber, calcium, and antioxidants, making it appealing to health-conscious consumers. According to an industry report, Win-Win secures $4M funding and teams up with Martin Braun-Gruppe for cocoa-free chocolate.

The carob chocolate market refers to the growing industry built around products made from carob as a substitute for cocoa-based chocolate. This market is shaped by shifting consumer preferences toward healthier, plant-based, and allergen-free food options. With rising awareness about nutrition, sustainability, and alternative diets, carob-based products are gaining popularity in both retail and food service sectors. According to an industry report, Foreverland gains €3.4M to create sustainable chocolate alternatives from carob.

A key growth factor for the carob chocolate market is the global shift toward healthier snacking. Consumers are actively seeking options that offer natural sweetness, reduced sugar, and functional health benefits, which positions carob chocolate as a strong alternative.

Demand for carob chocolate is also fueled by the rise of vegan, lactose-intolerant, and caffeine-sensitive populations. Since carob is naturally vegan and free from stimulants, it easily fits into multiple lifestyles and dietary choices. According to an industry report, A cocoa-free chocolate maker raised US$52M.

Opportunities lie in expanding product innovation and awareness. Carob chocolate can be introduced in various forms such as bars, spreads, baking ingredients, and beverages, allowing manufacturers to diversify offerings. Increased education about carob’s benefits can also unlock new markets, particularly in regions where it remains less well-known.

Key Takeaways

- The Global Carob Chocolate Market is expected to be worth around USD 1.5 billion by 2034, up from USD 0.9 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In 2024, bars dominated the Carob Chocolate Market, capturing 56.8% share due to convenient snacking.

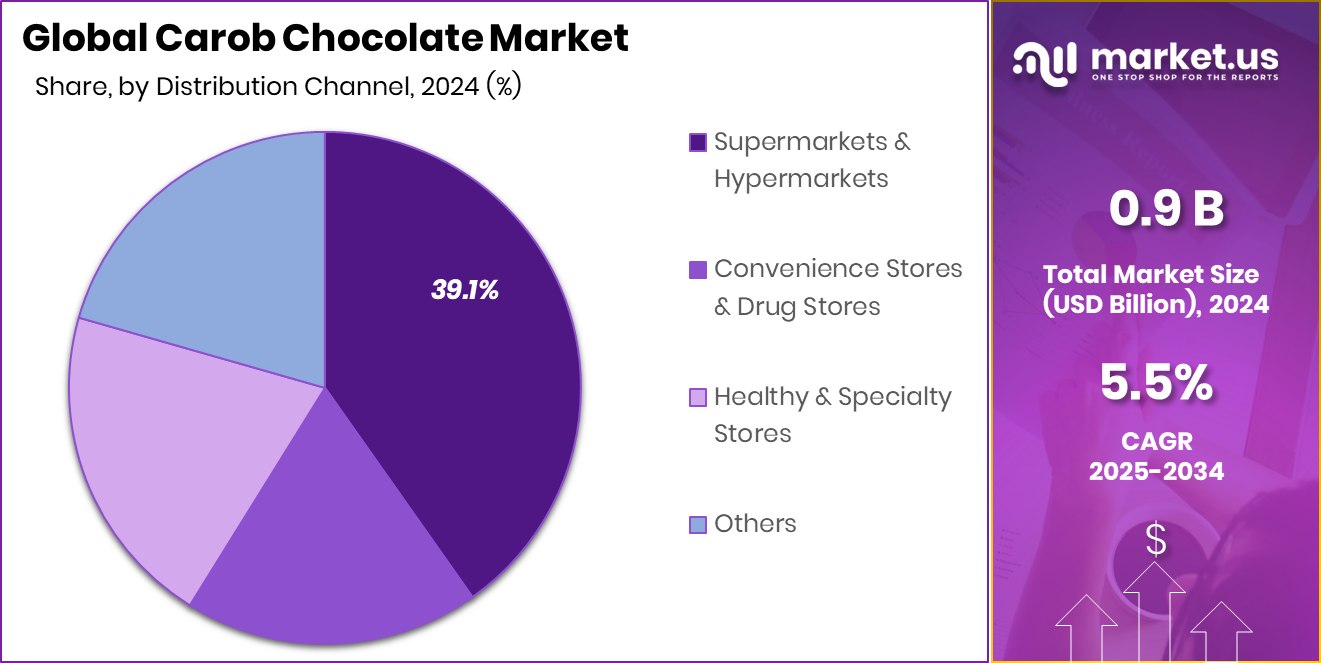

- Supermarkets and Hypermarkets held a 39.1% share in the Carob Chocolate Market, offering wide product availability and visibility.

- The North American market reached USD 0.4 Bn in value, reflecting strong regional consumer demand.

By Product Analysis

In 2024, Carob Chocolate Bars captured 56.8% of the market share.

In 2024, Bars held a dominant market position in By Product segment of the Carob Chocolate Market, with a 56.8% share. This strong performance highlights the growing consumer preference for convenient and ready-to-eat formats, where bars remain the most accessible choice for everyday snacking.

Carob chocolate bars are widely accepted as an alternative to traditional chocolate, offering a naturally sweet taste without added caffeine, making them particularly appealing to health-conscious buyers and those with dietary restrictions. Their portability, portion control, and suitability as an on-the-go snack further strengthen their dominance in the market.

The bar format also benefits from increasing awareness about plant-based and allergen-free products. As consumers prioritize clean labels and nutrient-rich foods, carob bars stand out for their fiber content and natural calcium, which adds a functional edge to indulgence. Growing demand for healthier school snacks and family-friendly options has also contributed to the popularity of this segment.

With rising interest in vegan and low-sugar products, the 56.8% market share of bars reflects how this segment has become a cornerstone of the carob chocolate industry. The trend is expected to continue as brands introduce new flavors, packaging innovations, and targeted marketing campaigns around wellness and convenience.

By Distribution Channel Analysis

Supermarkets and hypermarkets drove 39.1% of the Carob Chocolate Market sales.

In 2024, Supermarkets and Hypermarkets held a dominant market position in By Distribution Channel segment of the Carob Chocolate Market, with a 39.1% share. This dominance reflects the trust and convenience consumers place in large-scale retail formats when purchasing food and confectionery products.

Supermarkets and hypermarkets provide wide product assortments, allowing shoppers to compare varieties, flavors, and packaging of carob chocolate in one place. Their extensive shelf space, organized sections, and frequent promotional activities make them a preferred channel for both regular and impulse purchases.

The ability of supermarkets and hypermarkets to cater to mass demand plays a significant role in strengthening this segment. Carob chocolate, being a niche yet growing category, gains greater visibility in these stores, where consumers are exposed to healthier and alternative snacking options during routine shopping trips. Additionally, strong supply chains and established retail networks ensure consistent availability, which enhances consumer confidence and repeat purchases.

Promotional discounts, attractive displays, and the opportunity to physically inspect products further drive sales in this channel. The 39.1% share demonstrates how supermarkets and hypermarkets remain the backbone of distribution, particularly as they bridge the gap between consumer curiosity and actual adoption of carob chocolate products.

Key Market Segments

By Product

- Bars

- Chips

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores and Drug Stores

- Healthy and Specialty Stores

- Others

Driving Factors

Rising Health Awareness Fuels Demand for Carob

One of the biggest driving factors for the carob chocolate market in 2024 is the rising awareness of health and wellness among consumers. People are increasingly shifting away from products that contain high sugar, caffeine, and artificial additives.

Carob chocolate, being naturally sweet, caffeine-free, and rich in fiber and calcium, fits perfectly into this growing demand for healthier alternatives. It is also suitable for people with lactose intolerance, caffeine sensitivity, or those following vegan diets, which makes it a versatile choice.

With lifestyle-related health issues like obesity and diabetes on the rise globally, consumers are more inclined to explore such functional and natural food options, making carob chocolate a strong alternative to traditional chocolate.

Restraining Factors

Limited Consumer Awareness Restricts Market Growth

A major restraining factor for the carob chocolate market is the limited consumer awareness about carob as a cocoa alternative. While health-conscious buyers may know about its benefits, a large section of consumers still remains unfamiliar with its taste, nutritional value, and differences from traditional chocolate.

Many people associate indulgence with cocoa-based products and may hesitate to try carob, perceiving it as less flavorful or enjoyable. This lack of knowledge slows down adoption and creates challenges for market expansion.

Without strong promotional efforts, educational campaigns, and wider availability, carob chocolate struggles to compete with established chocolate products. As a result, awareness remains a barrier to unlocking the full potential of the carob chocolate market. According to an industry report, Italian startup Foreverland raises €3.4M to reshape the chocolate industry.

Growth Opportunity

Expanding Product Innovation Creates New Market Opportunities

A key growth opportunity for the carob chocolate market lies in expanding product innovation. Carob chocolate is no longer limited to simple bar formats; it can be developed into spreads, baking ingredients, beverages, and even health-focused snacks.

By diversifying into different product categories, companies can reach wider consumer groups, from children needing healthier school snacks to adults seeking low-sugar indulgences. Innovation in flavors, packaging, and portion sizes can also make carob chocolate more appealing and competitive against traditional chocolate.

With the global rise of vegan, plant-based, and allergen-free food trends, there is strong potential to position carob chocolate as a versatile and functional option, unlocking fresh opportunities in both domestic and international markets.

Latest Trends

Growing Popularity of Vegan and Plant-Based Choices

One of the latest trends in the carob chocolate market is the growing popularity of vegan and plant-based products. Consumers are increasingly adopting diets that avoid animal-based ingredients due to health, ethical, and environmental reasons.

Carob chocolate naturally fits into this lifestyle since it is free from dairy, caffeine, and other animal-derived components. This trend is particularly strong among younger consumers who are more open to experimenting with alternative and sustainable food options.

As plant-based eating becomes mainstream, carob chocolate is gaining attention not just as a healthier substitute for cocoa but also as a product that aligns with ethical and eco-friendly living. This trend is expected to significantly shape the market’s growth in the coming years.

Regional Analysis

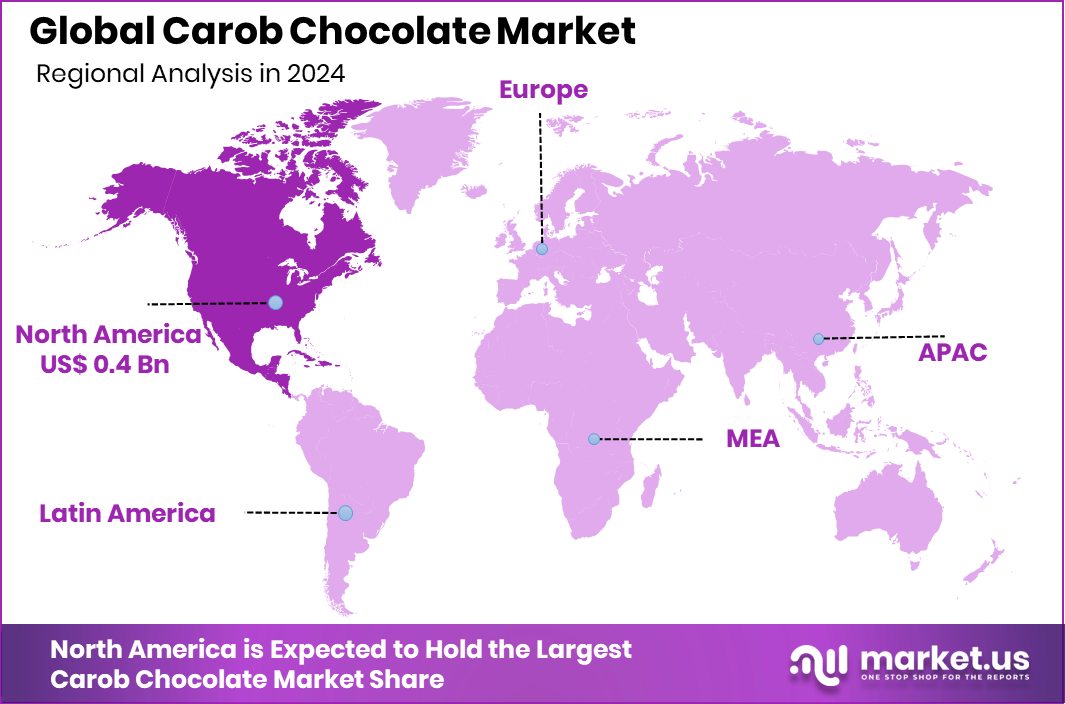

In 2024, North America held a 45.80% share of the Carob Chocolate Market, showcasing dominance.

The Carob Chocolate Market shows a diverse regional landscape, with consumption patterns shaped by lifestyle trends, dietary preferences, and awareness of healthier alternatives to cocoa-based products. In 2024, North America emerged as the leading region, holding a dominant 45.80% share valued at USD 0.4 billion.

This strong position is driven by the region’s rapidly growing health-conscious population and increasing demand for plant-based, vegan, and allergen-free products. Consumers in the U.S. and Canada are actively seeking low-sugar and caffeine-free options, making carob chocolate a natural fit.

The popularity of supermarkets, hypermarkets, and specialty health food stores further ensures strong visibility and availability of carob chocolate across North America.

In Europe, demand is supported by rising awareness of sustainable food choices and the popularity of natural sweeteners. Asia Pacific reflects growth potential due to expanding middle-class populations and shifting dietary preferences in urban markets.

The Middle East & Africa, along with Latin America, present emerging opportunities as awareness spreads and niche health segments expand. While all these regions contribute to global growth, North America’s commanding 45.80% share highlights its role as the key driver of the carob chocolate market, setting the pace for innovation and wider adoption worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Missy J’s has positioned itself as a consumer-friendly brand offering indulgent yet health-focused carob-based products. Its strength lies in appealing to individuals seeking dairy-free, gluten-free, and caffeine-free confectionery. By offering familiar formats like bars and treats, the company bridges the gap between traditional chocolate lovers and health-conscious consumers.

CarobMe emphasizes authenticity and natural ingredients, focusing on producing carob products that highlight the crop’s original flavor profile. This approach builds trust with consumers who value transparency and clean labels. The company plays a crucial role in promoting carob as more than just a substitute, but as a standalone category with its own distinct identity.

The Carob Kitchen differentiates itself with product innovation and premium positioning. By offering a variety of carob-based chocolates, including spreads and snack options, it expands consumer choice and strengthens carob’s visibility in mainstream retail. Its strategy aligns with the growing plant-based trend and appeals to a global audience seeking functional and sustainable indulgence.

Top Key Players in the Market

- Missy J’s

- CarobMe

- The Carob Kitchen

- The Australian Carob Co.

- Foundation Foods

- Iswari

- CarobWorld, Inc.

Recent Developments

- In 2022, The Australian Carob Co. transferred ownership to Nigel and Madeline Young and established U.S. fulfillment centers in Utah and Kentucky, enabling direct sales and faster delivery in North America.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Billion Forecast Revenue (2034) USD 1.5 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bars, Chips, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores and Drug Stores, Healthy and Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Missy J’s, CarobMe, The Carob Kitchen, The Australian Carob Co., Foundation Foods, Iswari, CarobWorld, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Carob Chocolate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Carob Chocolate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Missy J's

- CarobMe

- The Carob Kitchen

- The Australian Carob Co.

- Foundation Foods

- Iswari

- CarobWorld, Inc.