Cardiovascular Diagnostics Market By Type (Electrocardiogram (ECG/EKG), Blood Tests (CK-MB (Creatine Kinase-MB), Troponin, and Others), and Others), By End-User (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153864

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

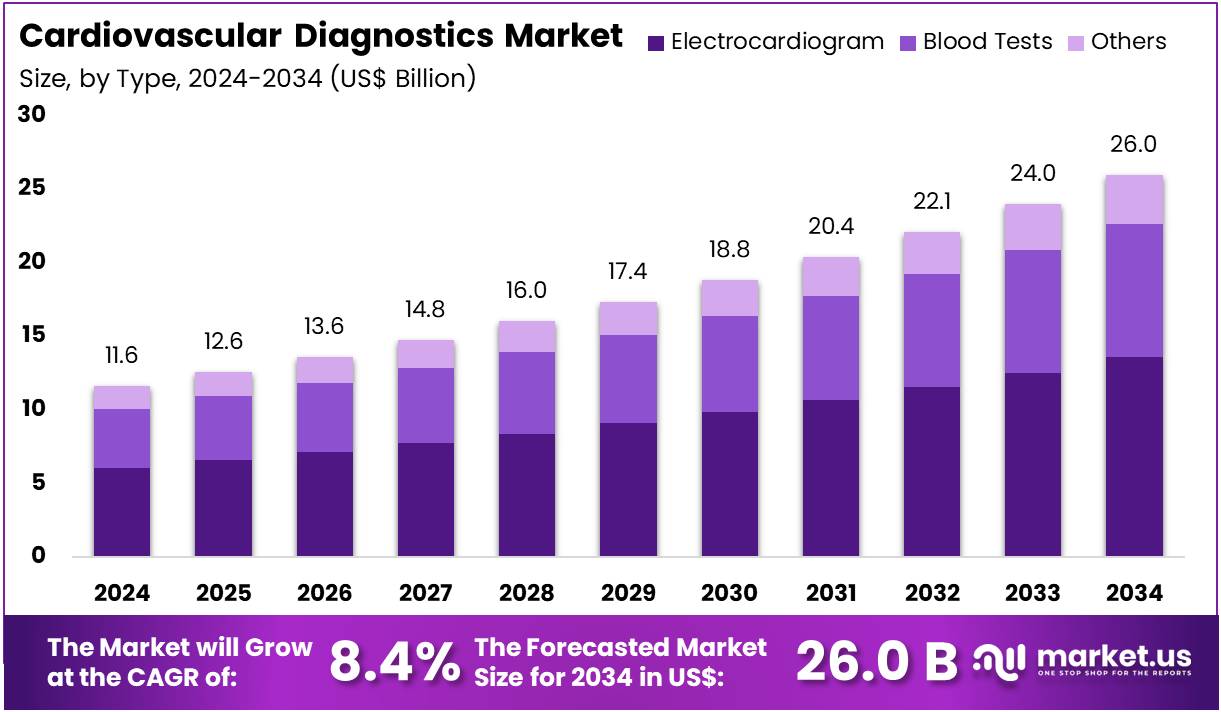

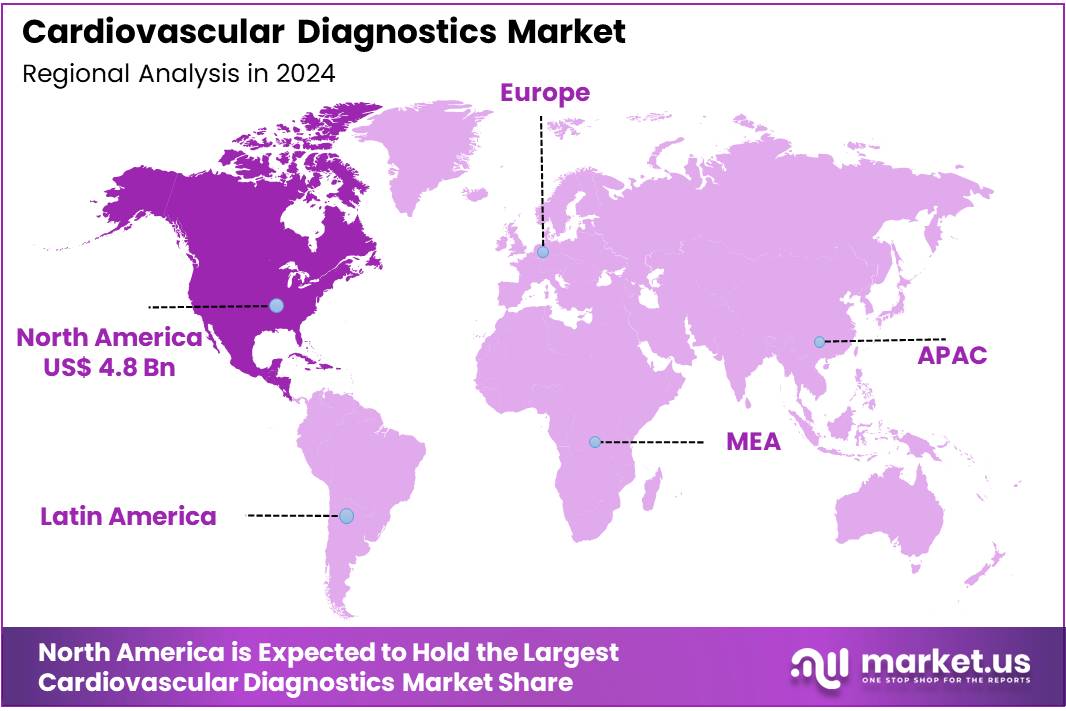

The Cardiovascular Diagnostics Market Size is expected to be worth around US$ 26.0 Billion by 2034 from US$ 11.6 Billion in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034. North America led the market by securing a market share of 41.8% in 2024. In 2024, North America led the market, achieving over 41.8% share with a revenue of US$ 4.8 Billion.

Increasing prevalence of cardiovascular diseases (CVDs) and growing awareness of early detection are driving the expansion of the cardiovascular diagnostics market. CVDs remain a leading cause of death globally, with conditions such as coronary artery disease, heart failure, and arrhythmias requiring timely diagnosis and effective treatment to improve patient outcomes.

The rising adoption of non-invasive diagnostic tools, including echocardiography, electrocardiograms (ECGs), and stress tests, is making cardiovascular diagnostics more accessible and efficient. The demand for point-of-care testing and remote monitoring technologies also plays a critical role in market growth, allowing healthcare providers to detect heart conditions early and manage them proactively.

In June 2022, GE Healthcare introduced Portrait Mobile, a wireless monitoring solution that continuously tracks a patient’s condition throughout their hospital stay. This system enables early detection of potential deterioration, helping clinicians reduce ICU admissions and shorten patient recovery times, ultimately improving outcomes. The rise of wearable devices and mobile health applications further contributes to the market’s growth by allowing continuous monitoring of heart health outside of traditional clinical settings.

Additionally, advancements in artificial intelligence and machine learning are improving the accuracy of diagnostic tools, enabling better risk stratification and personalized treatment plans. The focus on preventive healthcare and the increasing need for cost-effective diagnostics present significant opportunities in the cardiovascular diagnostics market. As the healthcare industry moves toward more personalized and data-driven approaches, the cardiovascular diagnostics market is set to evolve with new technologies that offer quicker, more accurate results for patients and clinicians alike.

Key Takeaways

- In 2024, the market for cardiovascular diagnostics generated a revenue of US$ 11.6 billion, with a CAGR of 8.4%, and is expected to reach US$ 26.0 billion by the year 2034.

- The type segment is divided into electrocardiogram, blood tests, and others, with electrocardiogram taking the lead in 2023 with a market share of 52.3%.

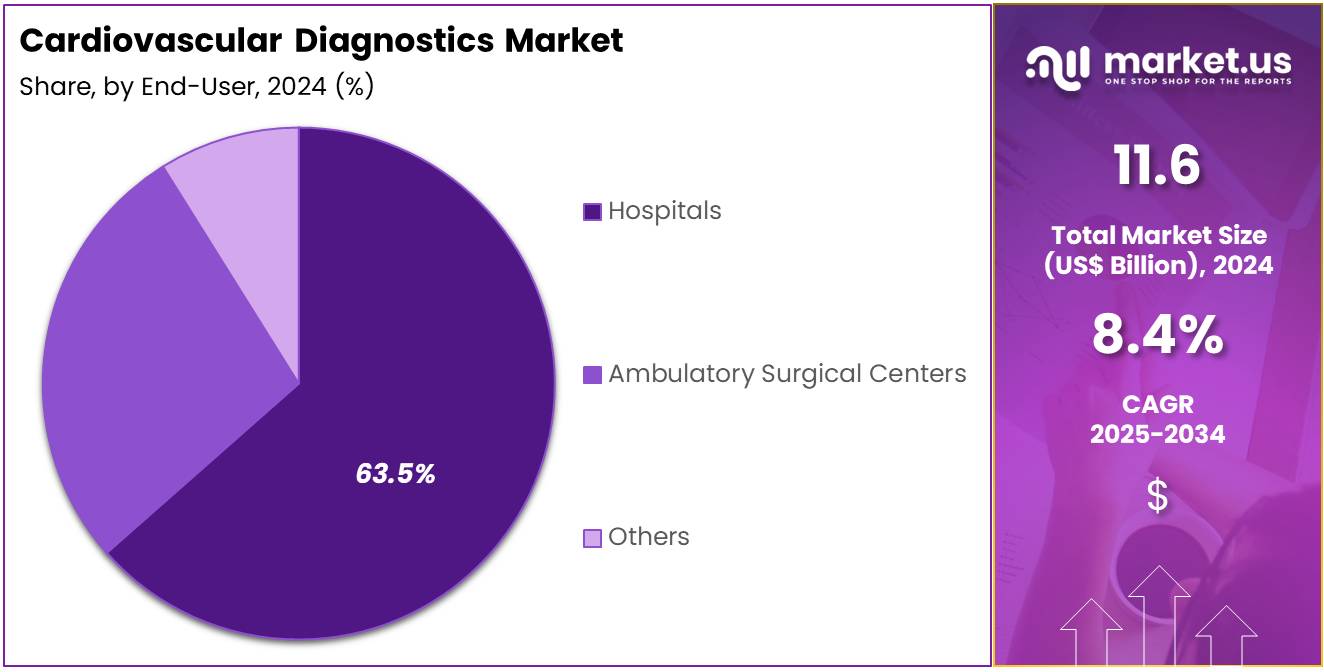

- Considering end-user, the market is divided into hospitals, ambulatory surgical centers, and others. Among these, hospitals held a significant share of 63.5%.

- North America led the market by securing a market share of 41.8% in 2024.

Type Analysis

Electrocardiogram (ECG) holds the largest share of 52.3% in the cardiovascular diagnostics market. This growth is expected to continue as ECG remains the standard, non-invasive diagnostic tool for detecting a range of heart conditions, including arrhythmias, myocardial infarctions, and other cardiovascular diseases. The increasing prevalence of heart disease, driven by factors such as aging populations, sedentary lifestyles, and poor dietary habits, is projected to drive the demand for ECG devices.

Furthermore, advancements in ECG technology, such as portable and wearable devices that allow for continuous monitoring, are likely to enhance their utility in both clinical and home settings. As healthcare providers focus on early detection and preventive care, the adoption of ECG devices in routine check-ups and long-term monitoring is expected to increase. Additionally, the integration of ECG with other diagnostic tools, such as remote monitoring systems, will further contribute to the growth of this segment, providing more accurate and real-time data for healthcare professionals.

End-User Analysis

Hospitals represent the largest end-user segment in the cardiovascular diagnostics market, holding 63.5% of the share. This growth is anticipated to continue as hospitals remain the primary settings for the diagnosis and treatment of cardiovascular diseases. The increasing burden of cardiovascular conditions, particularly in aging populations, is driving hospitals to adopt advanced diagnostic technologies to improve patient outcomes and reduce complications.

Hospitals are expected to increase their investment in cardiovascular diagnostic equipment, such as ECG machines, blood test systems, and imaging tools, to improve early detection and personalized treatment plans. As healthcare systems focus more on reducing healthcare costs and improving efficiency, hospitals are likely to integrate cardiovascular diagnostic tools with their electronic health record (EHR) systems to streamline workflows and enhance patient care.

The growing demand for comprehensive cardiovascular care, combined with advancements in diagnostic technology, will likely ensure the continued dominance of hospitals as the largest end-user segment in the market. Additionally, hospitals are at the forefront of research into innovative cardiovascular diagnostic methods, which is expected to further drive growth in this segment.

Key Market Segments

By Type

- Electrocardiogram (ECG/EKG)

- Blood Tests

- CK-MB (Creatine Kinase-MB)

- Troponin

- Others

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Rising Global Burden of Cardiovascular Diseases is Driving the Market

The escalating global burden of cardiovascular diseases (CVDs), encompassing conditions like heart attack, stroke, and heart failure, is a primary driver propelling the cardiovascular diagnostics market. As populations age and lifestyle factors contribute to higher prevalence of risk factors such as hypertension, diabetes, and obesity, the demand for early and accurate diagnosis intensifies.

Effective diagnostic tools are crucial for timely intervention, disease management, and preventing severe cardiac events. The American Heart Association (AHA) and the Institute for Health Metrics and Evaluation (IHME) collaborated on a “Global Burden of Cardiovascular Diseases Collaboration” report, which stated that global death counts due to CVD increased to 19.8 million in 2022 from 12.4 million in 1990. This significant increase highlights the urgent need for widespread and accessible diagnostic capabilities across the globe.

Furthermore, the US Centers for Disease Control and Prevention (CDC) reported that in 2023, heart disease caused 919,032 deaths in the US, making it the leading cause of death. This translates to approximately one person dying every 34 seconds from cardiovascular disease in the US These alarming statistics underscore the continuous and pressing need for advanced diagnostic technologies, driving investment in and adoption of innovative solutions to identify and monitor cardiac conditions effectively.

Restraints

High Cost of Advanced Diagnostic Equipment and Procedures is Restraining the Market

The substantial cost associated with advanced cardiovascular diagnostic equipment and complex diagnostic procedures represents a significant restraint on the market. High-end imaging modalities like cardiac MRI and CT angiography, along with sophisticated electrophysiology mapping systems and genetic testing, require considerable capital investment for healthcare facilities. This financial burden can limit the adoption of cutting-edge diagnostic technologies, particularly in low and middle-income regions or for smaller healthcare providers.

The American Hospital Association (AHA) indicated in its “2024 Costs of Caring” report that many US hospitals spent much of 2023 struggling to break even financially, following a historically challenging 2022. The report further noted that the average age of capital investments for medical equipment and infrastructure, which includes diagnostic machinery, increased by 7.1% for all hospitals in 2023, following years of remaining relatively flat. This statistic suggests hospitals are delaying new equipment purchases due to financial strain.

Furthermore, the procedures utilizing these advanced diagnostics often incur high patient out-of-pocket costs or face reimbursement challenges from payers, creating access barriers for patients. These economic factors collectively impede the widespread accessibility and full market potential of innovative diagnostic technologies, particularly those with higher acquisition and operational expenses.

Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML) is Creating Growth Opportunities

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into cardiovascular diagnostic platforms is creating significant growth opportunities in the market. AI and ML algorithms can analyze vast amounts of complex data from medical imaging (echocardiograms, CT scans), electrocardiograms (ECGs), and patient records, aiding in earlier and more accurate disease detection, risk stratification, and personalized treatment planning. These technologies enhance the efficiency and diagnostic accuracy of existing tools, reduce human error, and streamline workflows.

The American Heart Association (AHA) published a scientific statement in Circulation in February 2024, emphasizing that AI has the power to analyze vast amounts of data and make predictions for narrowly defined tasks, specifically mentioning its applications in cardiac imaging and electrocardiography. The statement further highlighted that AI has helped to create automatic ECG interpretation by finding subtle results human experts might overlook, suggesting abnormalities not yet evident.

For instance, AI-powered algorithms are being developed and tested to identify early signs of heart failure from routine echocardiograms or to predict stroke risk from standard patient data, improving clinical decision-making. This technological leap offers the potential for more precise, timely, and accessible diagnostic insights, revolutionizing how cardiovascular conditions are identified and managed, and thereby expanding the market’s capabilities.

Impact of Macroeconomic / Geopolitical Factors

Global Economic Conditions and Healthcare Investment Influence the Cardiovascular Diagnostics Market

Global macroeconomic conditions, including inflation and the overall landscape of healthcare investment, significantly influence the cardiovascular diagnostics market by affecting capital expenditure by hospitals and the affordability of advanced diagnostic services for patients. Inflation can increase the costs of manufacturing sophisticated diagnostic equipment, encompassing raw materials for sensors and imaging components, complex electronics, and specialized software, potentially leading to higher product prices. This places financial pressure on healthcare systems seeking to acquire or upgrade their diagnostic capabilities.

However, governments globally recognize cardiovascular health as a critical public health priority due to the significant mortality and morbidity associated with heart diseases, often ensuring a baseline level of investment despite economic headwinds. The US Centers for Medicare & Medicaid Services (CMS) reported in December 2024 that US national health spending increased by 7.5% in 2023, reaching US$4.9 trillion, with projections for continued strong growth in 2024.

This consistent growth in overall health expenditure provides a robust foundation for continued investment in life-saving diagnostic technologies. Geopolitical stability also plays a vital role in ensuring stable supply chains for the complex components and raw materials necessary for the manufacturing of these highly technical devices. Despite economic fluctuations, the fundamental imperative to combat cardiovascular diseases drives sustained investment in diagnostic innovation, fostering resilience and continued growth for the market.

Evolving US trade policies, including the imposition of tariffs on imported medical devices, electronic components, and advanced imaging equipment, are shaping the cardiovascular diagnostics market by influencing the cost of acquisition and the complexity of supply chains. Manufacturers of cardiovascular diagnostic devices often rely on intricate global supply chains for specialized parts, such as high-resolution imaging sensors, complex microprocessors, and precision mechanical components, many of which are manufactured internationally.

Tariffs on these imports can directly increase the manufacturing costs for companies producing or assembling cardiovascular diagnostic systems in or for the US market, potentially resulting in higher prices for hospitals and clinics. The US International Trade Commission (ITC) reported that for certain categories of imported “optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus,” the value of US imports reached US$ 115.8 billion in 2023, with applicable tariffs impacting a portion of these goods.

While not all of these categories are directly cardiovascular diagnostics, the sheer volume demonstrates the potential impact of broad trade measures. These policies, while sometimes aiming to encourage domestic production and enhance supply chain resilience, primarily create a more expensive and complex procurement environment for essential medical technologies. The critical need for advanced and accessible cardiovascular diagnostic tools, however, motivates companies to adapt to these trade dynamics, ensuring continued innovation and availability in the US market.

Latest Trends

Shift Towards Personalized and Precision Medicine in Cardiology is a Recent Trend

A prominent recent trend shaping the cardiovascular diagnostics market in 2024 and continuing into 2025 is the accelerating shift towards personalized and precision medicine in cardiology. This approach moves beyond generalized treatment protocols to tailor diagnostic strategies and interventions based on an individual’s unique genetic makeup, molecular biomarkers, lifestyle, and specific disease characteristics.

Advanced diagnostic tools, including genetic testing, proteomics, and advanced imaging with specific biomarker detection capabilities, are crucial for this personalized stratification and management. The US National Institutes of Health (NIH), specifically the National Heart, Lung, and Blood Institute (NHLBI), continues to fund research aimed at identifying novel biomarkers and genetic predispositions for cardiovascular diseases to advance precision medicine.

For example, the NHLBI’s funding for cardiovascular research totaled approximately US$3.8 billion in fiscal year 2023, supporting numerous projects exploring genetic factors, novel diagnostic targets, and personalized treatment approaches. This focus enables healthcare providers to identify individuals at higher risk more accurately, select the most effective therapies, and monitor treatment responses with greater precision. The drive to deliver highly individualized care based on comprehensive diagnostic data is fundamentally transforming the landscape, pushing the boundaries of what is possible in identifying and treating cardiac conditions.

Regional Analysis

North America is leading the Cardiovascular Diagnostics Market

The cardiovascular diagnostics market in North America, holding a significant 41.8% share, experienced substantial growth in 2024. This expansion was primarily driven by the high and persistent burden of cardiovascular diseases, an aging population, and continuous advancements in diagnostic technologies that allow for earlier and more precise detection of heart conditions.

While age-adjusted heart disease mortality in the US decreased by 66% from 1970 to 2022, age-adjusted mortality for other heart disease subtypes, including heart failure and arrhythmias, increased by 81% over the same period, according to a study published by the American Heart Association in June 2025. This shift in disease patterns highlights the ongoing need for vigilant diagnostics. The widespread adoption of advanced imaging techniques, point-of-care diagnostics, and remote monitoring solutions has significantly enhanced diagnostic capabilities.

Major players in medical technology have seen sustained demand for their offerings in the region. GE HealthCare reported total revenue of US$19.7 billion in 2024, supported by over US$1.3 billion in annual R&D spending in 2024, serving one billion patients annually with its installed base of five million units globally, reflecting the pervasive need for advanced diagnostic tools. Siemens Healthineers also demonstrated robust performance, with its Advanced Therapies segment, which includes solutions for cardiology, being a key contributor to its overall fiscal year 2024 results.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The cardiovascular diagnostics market in Asia Pacific is expected to experience significant growth during the forecast period. This anticipated expansion is fueled by the rapidly increasing prevalence of cardiovascular diseases, growing healthcare expenditure, and efforts by governments to improve access to advanced medical technologies. The Australian Institute of Health and Welfare (AIHW) reported in December 2024 that an estimated 1.3 million Australians aged 18 and over (6.7% of the adult population) were living with one or more conditions related to heart, stroke, and vascular disease in 2022, highlighting the significant burden in the region.

Furthermore, the World Health Organization (WHO) introduced the SEAHEARTS initiative on World Heart Day 2022, aimed at accelerating efforts in South-East Asian countries to prevent and control cardiovascular diseases, underscoring the regional focus on addressing this health challenge. Major global medical technology companies are strategically expanding their presence in Asia Pacific to meet the growing demand.

Philips, a key innovator in diagnostic imaging and image-guided therapy, continues to develop and introduce solutions for cardiovascular care, with its investor relations materials showing sustained global growth and innovation. GE HealthCare and Siemens Healthineers are also investing in the region, recognizing the unmet needs and expanding healthcare infrastructure. These collective efforts are expected to drive significant growth in the cardiovascular diagnostics market across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cardiovascular diagnostics market focus on innovation, partnerships, and geographic expansion to drive growth. Companies invest heavily in research and development to create advanced diagnostic tools, such as AI-driven imaging systems and wearable monitoring devices. Collaborations with healthcare providers and research institutions allow these companies to expand their market presence and improve the efficiency of diagnostics.

Additionally, increasing their footprint in emerging markets where healthcare infrastructure is rapidly improving is a strategic priority. They also prioritize regulatory compliance to meet regional health standards, ensuring the safety and effectiveness of their products. One such company, Medtronic, is a global leader in medical technology.

The company specializes in developing innovative solutions for cardiovascular conditions, including diagnostic devices, minimally invasive procedures, and surgical equipment. With a strong focus on expanding its product portfolio and leveraging AI technologies, Medtronic aims to enhance patient outcomes and reduce healthcare costs. Through continuous innovation and strategic acquisitions, Medtronic strengthens its position in the cardiovascular diagnostics space, meeting the growing demand for reliable diagnostic tools worldwide.

Top Key Players in the Cardiovascular Diagnostics Market

- Welch Allyn Inc

- Toshiba Corporation

- Siemens Healthineers

- Schiller AG

- Midmark Corporation

- Medtronic plc

- Koninklijke Philips NV

- Hitachi Corporation

- GE Healthcare

- F Hoffmann-La Roche Ltd

- Edwards Lifesciences Corporation

- Cardinal Health, Inc.

- Boston Scientific Corporation

- Astrazenca PLC

- Abbott Laboratories

Recent Developments

- In June 2024, Philips unveiled its Cardiac Workstation, designed to transform diagnostic cardiology. This new platform aims to elevate patient care and accelerate clinical decision-making across Europe, the Middle East, and Africa (MEA).

- In April 2024, GE Healthcare launched Caption AI integrated into Vscan Air SL, aimed at expanding the reach of cardiac care. This tool allows a broader range of clinicians to capture high-quality diagnostic cardiac images, increasing accessibility.

Report Scope

Report Features Description Market Value (2024) US$ 11.6 billion Forecast Revenue (2034) US$ 26.0 billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Electrocardiogram (ECG/EKG), Blood Tests (CK-MB (Creatine Kinase-MB), Troponin, and Others), and Others), By End-User (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Welch Allyn Inc, Toshiba Corporation, Siemens Healthineers, Schiller AG, Midmark Corporation, Medtronic plc, Koninklijke Philips NV, Hitachi Corporation, GE Healthcare, F Hoffmann-La Roche Ltd, Edwards Lifesciences Corporation, Cardinal Health, Inc., Boston Scientific Corporation, Astrazenca PLC, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiovascular Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cardiovascular Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Welch Allyn Inc

- Toshiba Corporation

- Siemens Healthineers

- Schiller AG

- Midmark Corporation

- Medtronic plc

- Koninklijke Philips NV

- Hitachi Corporation

- GE Healthcare

- F Hoffmann-La Roche Ltd

- Edwards Lifesciences Corporation

- Cardinal Health, Inc.

- Boston Scientific Corporation

- Astrazenca PLC

- Abbott Laboratories