Global Cardiac Resynchronization Therapy Market By Product (CRT-Defibrillator and CRT-Pacemaker) By End-use (Hospital, Cardiac Center and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 47673

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

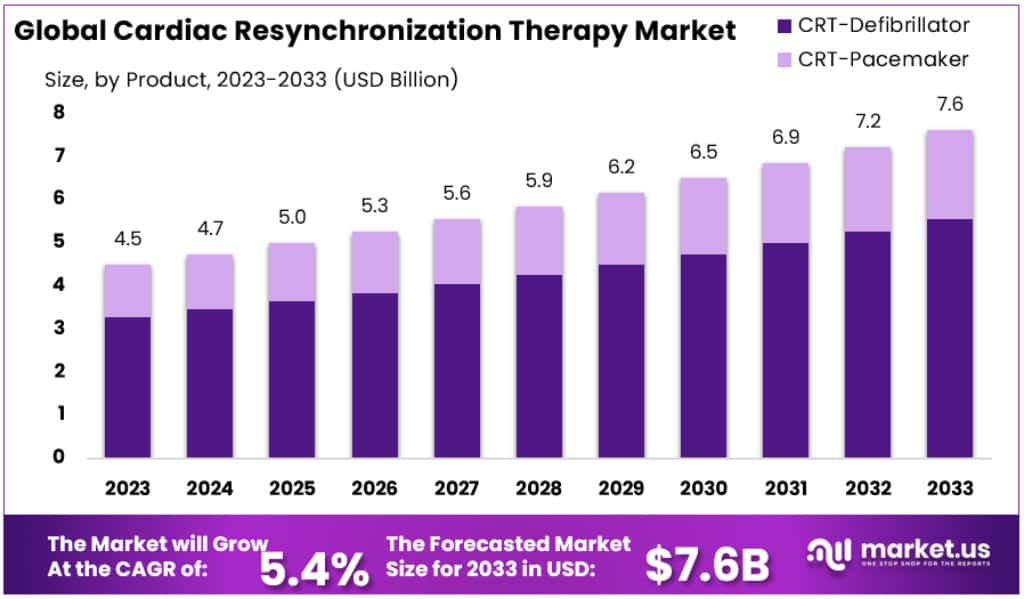

The Global Cardiac Resynchronization Therapy Market size is expected to be worth around USD 7.6 billion by 2032, from USD 4.5 billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Cardiac Resynchronization Therapy, or CRT, is a medical treatment used for patients who are experiencing moderate to severe heart failure and whose heart’s chambers aren’t beating together as they should. This treatment involves placing a special kind of pacemaker under the skin near the collarbone.

This market is driven by product development, increasing aging populations, key companies’ initiatives, and the prevalence of Cardiovascular Diseases. Boston Scientific reported a global cumulative distribution of approximately 389,000 CRT/Ds as of 2021. The company sold approximately 33,000 CRT-Ds in 2020. About 16,500 of these were registered in the United States, which indicates high demand.

Key Takeaways

- Market Size: The global CRT market is valued at approximately USD 4.5 billion in 2023.

- Projected Market Size: The market size is expected to reach around USD 7.6 billion by 2032.

- Compound Annual Growth Rate (CAGR): The market is predicted to grow at a CAGR of 5.4% from 2023 to 2032.

- CRT-Defibrillator Market Share: The CRT-Defibrillator segment holds over 72.8% of the market.

- Hospital Segment Market Share: More than 53.6% of the CRT market is dominated by the hospital segment.

- Cardiac Center Segment Growth: This segment is expected to experience the fastest growth during the forecast period.

- Prevalence of Cardiovascular Diseases in the US: Approximately 6.2 million Americans were reported to have heart conditions as of 2020.

- Sedentary Lifestyle Impact: About one in four Americans were reported to be sedentary for more than 8 hours a day in 2019, influencing heart health negatively.

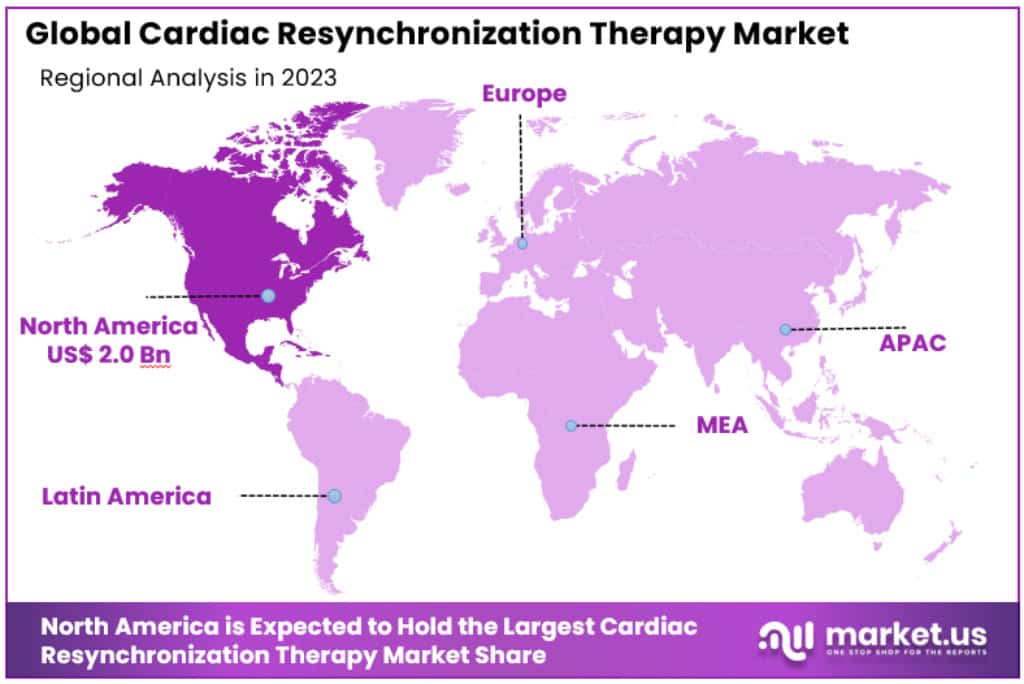

- North America Market Share: North America accounts for over 45.8% of the total CRT market revenue.

- Global Distribution of Boston Scientific’s CRT/Ds: Approximately 389,000 CRT/Ds were distributed globally by Boston Scientific as of 2021.

- Boston Scientific’s CRT-D Sales in 2020: The company sold about 33,000 CRT-Ds in 2020.

- U.S. Sales of CRT-Ds: Around 16,500 CRT-Ds were sold in the United States in 2020.

- ICD and CRT-D Implantations in Japan (10-Year Data): The Japan Cardiac Device Treatment Registry reported 17,564 ICDs, 9,472 CRT-Ds, and 1,088 CRT/Ps implanted over a decade.

Product Analysis

In 2023, the Cardiac Resynchronization Therapy (CRT) market was notably led by the CRT-Defibrillator segment. This segment secured a dominant position, holding over 72.8% of the market share. The CRT-Defibrillator, a device combining a defibrillator and a pacemaker, has been increasingly preferred due to its dual functionality. It not only helps in resynchronizing the heart’s beating but also provides a safety net against potential heart rhythm complications.

On the other hand, the CRT-Pacemaker segment also showed a significant presence in the market. While it holds a smaller share compared to CRT-Defibrillators, its importance cannot be understated. These pacemakers are essential for patients who need assistance with heart rhythm synchronization but are at a lower risk of rapid heartbeats that could require defibrillation.

The differing needs of heart failure patients and the specific benefits of each product type drive the segmentation in the CRT market. As technology evolves and patient awareness increases, the dynamics within these segments are expected to shift, reflecting changes in preferences and medical recommendations.

A 2020 study published by the Journal of Arrhythmia analyzed data from Japan Cardiac Device Treatment Registry. This study showed an increase in de novo implantations of ICDs and CRTaEURDs in patients over 74 years old in Japan. Over a period of 10 years, the number of ICD, CRT-D, and CRT/P patients who received ICD implants, was 17,564, 9,472, and 1,088 respectively.

End-Use Analysis

In 2023, the hospital segment maintained a leading role in the Cardiac Resynchronization Therapy (CRT) market, holding more than a 53.6% share. Hospitals are often the primary choice for patients seeking CRT due to their comprehensive care facilities and advanced technology. Moreover, the presence of specialized cardiac units in hospitals contributes to this segment’s dominance.

Cardiac centers also form a significant part of the CRT market. These specialized centers focus solely on heart-related treatments, including CRT, and offer personalized care. While they hold a smaller market share compared to hospitals, their expertise in cardiac care makes them a preferred choice for many patients.

Other end-users in the CRT market include clinics and outpatient surgery centers. These facilities cater to patients needing less intensive care and follow-up treatments. They play a crucial role in the overall market, particularly for patients seeking more accessible or localized treatment options.

Due to the increase in cardiac specialty centers and the rising prevalence of the cardiovascular disease across the globe, the segment of cardiac center end-users is expected to experience the fastest growth over the forecast period. The CDC estimates that in 2020, approximately 6.2 million Americans suffered from heart disease. According to the American College of Cardiology Foundation (ACCF), the incidence of cardiovascular disease increased from 271 to 523 million between 1990 and 2019.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- CRT-Pacemaker

- CRT-Defibrillator

By End-user

- Cardiac Center

- Hospital

- Other End-users

Driver

Rising Prevalence of Heart Failure

One major factor that is expected to propel the CRT market is the rising incidence of heart failure around the world. Heart failure increases along with aging populations and prevalence of hypertension, diabetes, and obesity and leads to growing need for more sophisticated therapies including CRT. This therapy has been shown to enhance the heart function, decrease the hospitalization risks, and improve the quality of life of patient with severe heart failure.

Trend

Technological Advancements in Device Functionality

The market is also characterized by rapid technological advancements. Modern CRT devices offer enhanced capabilities such as remote monitoring and improved battery life, making them more appealing to healthcare providers and patients. Additionally, the integration of artificial intelligence and machine learning for better patient management and device customization is a significant trend shaping the industry.

Restraint

High Cost and Accessibility Issues

However, the CRT market faces restraints, including the high cost of devices and procedures, which can be prohibitive for patients in low-income regions. Additionally, the need for specialized medical personnel to perform the implantation and manage therapy can limit access to CRT, particularly in underdeveloped healthcare systems.

Opportunity

Expanding Indications for Use

Opportunities in the CRT market lie in expanding the indications for which these devices are approved. Research into broader applications, such as for patients with moderate heart failure or those earlier in their disease progression, could significantly expand the patient base. Furthermore, emerging markets offer new growth avenues, with increasing healthcare investments and improving medical infrastructure contributing to the accessibility of advanced treatments like CRT.

Regional Analysis

North America: A Leading Market with Significant Growth

In 2023, North America was responsible for more than 45.8% of the total revenue, with USD 2 Billion. North America is expected to dominate the cardiac resynchronization therapy market, driven by the rise in heart diseases and supportive government policies. For example, in Canada, over 100,000 new heart failure cases are diagnosed yearly. The American Heart Association predicts that by 2035, over 130 million U.S. adults will have some form of heart disease. These increasing numbers highlight the growing need for CRT in North America.

The region is also witnessing a surge in new product approvals and clinical studies. The Heart Rhythm Society’s recent findings underscore the benefits of conduction system pacing in CRT, further boosting the market. Additionally, acquisitions like Boston Scientific’s purchase of Baylis Medical Company and ongoing clinical studies add to the momentum of CRT advancements in North America.

Asia Pacific: Fastest Growing Region with High Potential

The Asia Pacific market is poised for rapid growth, thanks to improvements in healthcare infrastructure, an aging population, and rising cardiac disease prevalence. Companies like Micro-Port are leading the way in the heart rhythm management market, with a significant annual revenue growth reported in 2020. The region’s growth is also fueled by economic developments and increasing awareness of heart failure and related diseases.

Countries like Japan and Australia are quick to adopt new technological advancements in these devices, with remote monitoring in heart implantable devices gaining traction. This rapid adoption, despite higher costs, signifies the region’s commitment to advanced cardiac care.

Europe: Strong Market Presence with Advanced Healthcare Infrastructure

Europe also holds a significant position in the global CRT market, supported by its advanced healthcare infrastructure and high awareness levels about cardiac care. The region’s well-established healthcare system and the presence of key market players contribute to its steady market growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market will see moderate competition over the forecast period. Market shares are approximately 89% held by the top five companies. These companies also have access to a wide range of resources, market knowledge, and distribution networks, and can participate in strategic initiatives to increase market share. These strategies include mergers and acquisitions, geographical expansion, partnerships, new product launches, R&D, and the launch of new products.

Маrkеt Кеу Рlауеrѕ

- Medtronic

- St. Jude Medical

- Abbott

- Livanova

- Boston Scientific Corp.

- MicroPort Scientific Corp.

- Biotronik SE & Co., KG

- Other Key Players

Recent Development

- Medtronic: In January 2023, Medtronic expanded its cardiac portfolio with the introduction of an advanced CRT device designed to optimize patient response to therapy through more precise electrical impulses. This launch aims to address the varying needs of heart failure patients with tailored therapy options.

- Abbott: Abbott launched the Gallant HF CRT-D in June 2022, which features SyncAV CRT technology, offering an innovative approach to heart failure management. This device provides automatic adjustments to therapy that respond to changes in patient conditions, aiming to improve outcomes in CRT treatment.

- LivaNova: In March 2024, LivaNova announced the release of a new CRT device that incorporates advanced sensors to monitor heart rhythms more accurately, thereby enhancing therapy alignment with patient-specific cardiac demands. This product launch reflects the company’s commitment to innovation in cardiac technology.

- Boston Scientific Corp.: In January 2024, Boston Scientific received FDA approval for its FARAPULSE Pulsed Field Ablation (PFA) System, marking a significant advancement in treatment options for patients with cardiac arrhythmias. This system introduces a non-thermal ablation technology that promises greater safety and efficacy in cardiac procedures.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Billion Forecast Revenue (2032) USD 7.6 Billion CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (CRT-Defibrillator and CRT-Pacemaker) By End-use (Hospital, Cardiac Center and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, St. Jude Medical, Abbott, Livanova, Boston Scientific Corp., MicroPort Scientific Corp., Biotronik SE & Co., KG and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Cardiac Resynchronization Therapy Market in 2023?A: The Cardiac Resynchronization Therapy market size is USD 4.5 billion in 2023.

Q: What is the projected CAGR at which the Cardiac Resynchronization Therapy market is expected to grow at?A: The Cardiac Resynchronization Therapy market is expected to grow at a CAGR of 5.4% (2023-2033).

Q: List the segments encompassed in this report on the Cardiac Resynchronization Therapy market?A: Market.US has segmented the Cardiac Resynchronization Therapy market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into CRT-Pacemaker and CRT-Defibrillator. By End User, the market has been further divided into Cardiac Center and Hospital.

Q: List the key industry players of the Cardiac Resynchronization Therapy market?A: Medtronic, St. Jude Medical, Abbott, Livanova, Boston Scientific Corp., MicroPort Scientific Corp., Biotronik SE & Co., KG, and Other Key Players engaged in the Cardiac Resynchronization Therapy market.

Cardiac Resynchronization Therapy MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Cardiac Resynchronization Therapy MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- St. Jude Medical

- Abbott

- Livanova

- Boston Scientific Corp.

- MicroPort Scientific Corp.

- Biotronik SE & Co., KG

- Other Key Players