Cardiac Biomarkers Market By Type (Troponins (T and I), B-type Natriuretic Peptide (BNP) and NT-proBNP, Creatine Kinase-MB (CK-MB), Myoglobin and Ischemia Modified Albumin (IMA)), By Application (Acute Coronary Syndrome (ACS), Myocardial Infarction (MI), Congestive Heart Failure (CHF), Atherosclerosis and Others), By Location (Laboratory Testing and Point-of-Care (POC) Testing), By End User (Hospitals, Diagnostic Laboratories, Ambulatory Surgery Centers & Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 84380

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

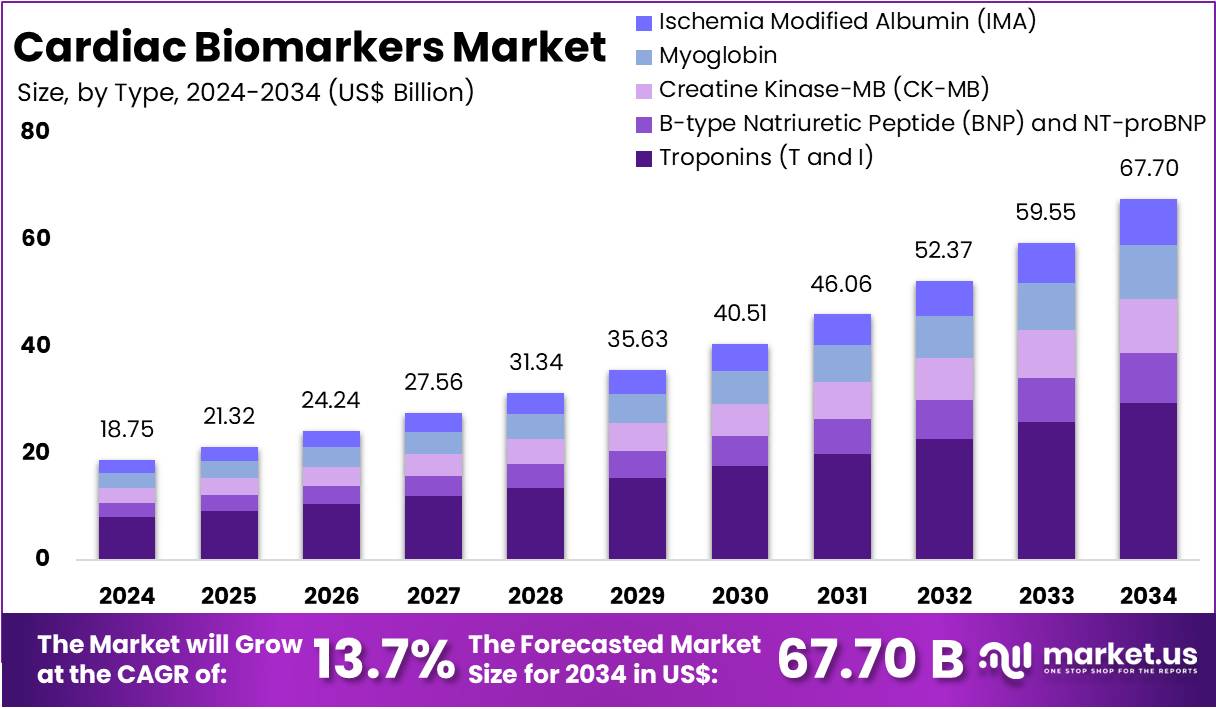

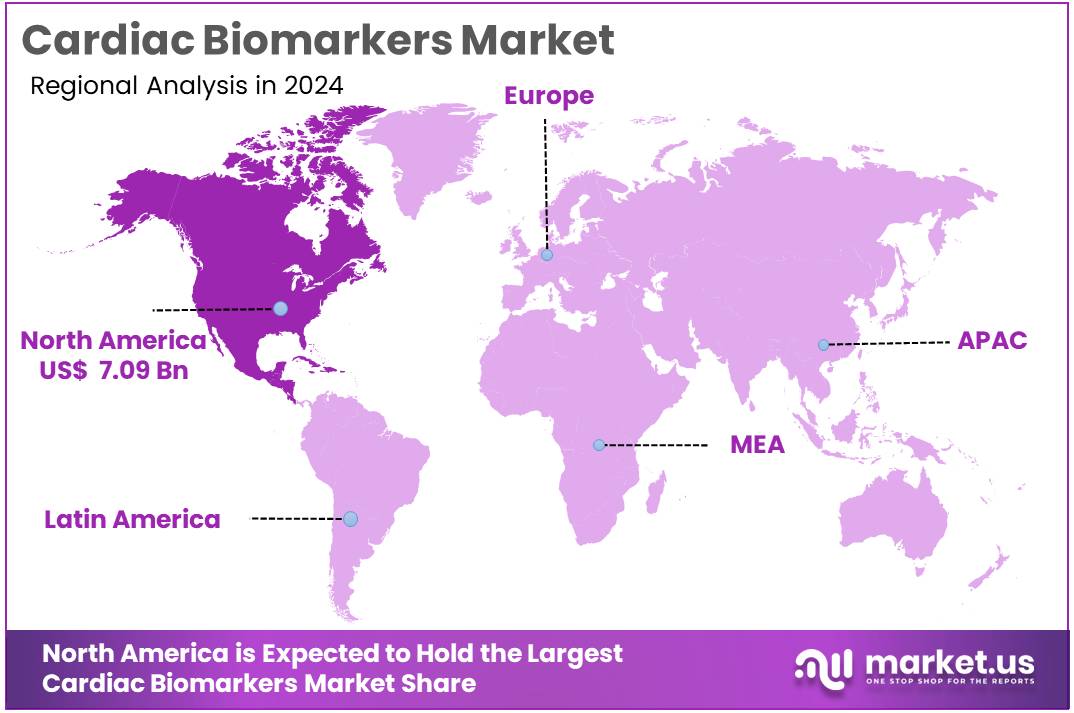

The Cardiac Biomarkers Market Size is expected to be worth around US$ 67.70 billion by 2034 from US$ 18.75 billion in 2024, growing at a CAGR of 13.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 80% share and holds US$ 7.09 Billion market value for the year.

Cardiovascular diseases, including heart attacks, strokes, and heart failure, remain the leading cause of death globally, accounting for nearly 31% of all deaths, according to the World Health Organization (WHO). This creates a high demand for accurate and timely diagnostic tools, with biomarkers like troponins, BNP, and CK-MB playing a crucial role in early detection and disease management.

North America dominates this market, holding over 37.80% of the market share due to its advanced healthcare infrastructure and high adoption of new diagnostic technologies. The rise of point-of-care (POC) testing and portable devices further accelerates market growth, allowing for real-time diagnostics in emergency settings and remote areas. Companies like Abbott and Roche are at the forefront of these innovations, providing accessible, accurate diagnostic tools for cardiac conditions.

Moreover, the increasing focus on personalized medicine is pushing for the development of novel biomarkers that can guide tailored treatment plans, improving patient outcomes and driving market expansion. This trend promises further opportunities for growth in the cardiac biomarkers market.

List of Available Cardiac Biomarkers for Clinical Practice

Biomarker Type Tissue Source Main Use Specificity Increase Time Troponin I/T Protein Heart Diagnose & monitor MI High 3-4 hrs High-sensitivity Troponin Protein Heart Early MI, risk stratification Highest <3 hrs CK (Creatine Kinase) Enzyme Heart, brain, muscle Myocardial/skeletal injury Moderate 3-6 hrs CK-MB Enzyme subtype Heart, muscle MI detection Moderate-High 3-6 hrs Myoglobin Oxygen-storage prot Heart, muscle Early MI detection Low 2-3 hrs BNP (B-type Natriuretic Peptide) Hormone Heart Heart failure diagnosis Moderate Variable NT-proBNP Hormone fragment Heart Heart failure evaluation Moderate Variable hs-CRP (High Sensitivity C-Reactive Protein) Protein Liver Risk stratification & prognosis Low Variable Lactate Dehydrogenase (LDH) Enzyme Various Historical MI marker Low 8-12 hrs Ischemia Modified Albumin (IMA) Modified Protein Blood Ischemia assessment Moderate Immediate Heart-type Fatty Acid Binding Protein (H-FABP) Protein Heart muscle Early MI detection Moderate 1-3 hrs ST2 (Soluble suppression of tumorigenicity 2) Protein Heart, others Heart failure prognosis Moderate – Galectin-3 Protein Heart, others Heart failure prognosis Moderate – Copeptin Protein fragment Various Early MI & HF prognosis Moderate – MicroRNAs Regulatory RNA Blood/heart tissue Emerging diagnostics High (potential) – Key Takeaways

- In 2024, the Cardiac Biomarkers Market generated a revenue of US$ 18.75 billion, with a CAGR of 13.7% and is expected to reach US$ 67.70 billion by the year 2034.

- By Type, the market is bifurcated into Troponins (T and I), B-type Natriuretic Peptide (BNP) and NT-proBNP, Creatine Kinase-MB (CK-MB), Myoglobin, and Ischemia Modified Albumin (IMA), with Troponins (T and I) taking the lead in 2024 with 43.4% market share.

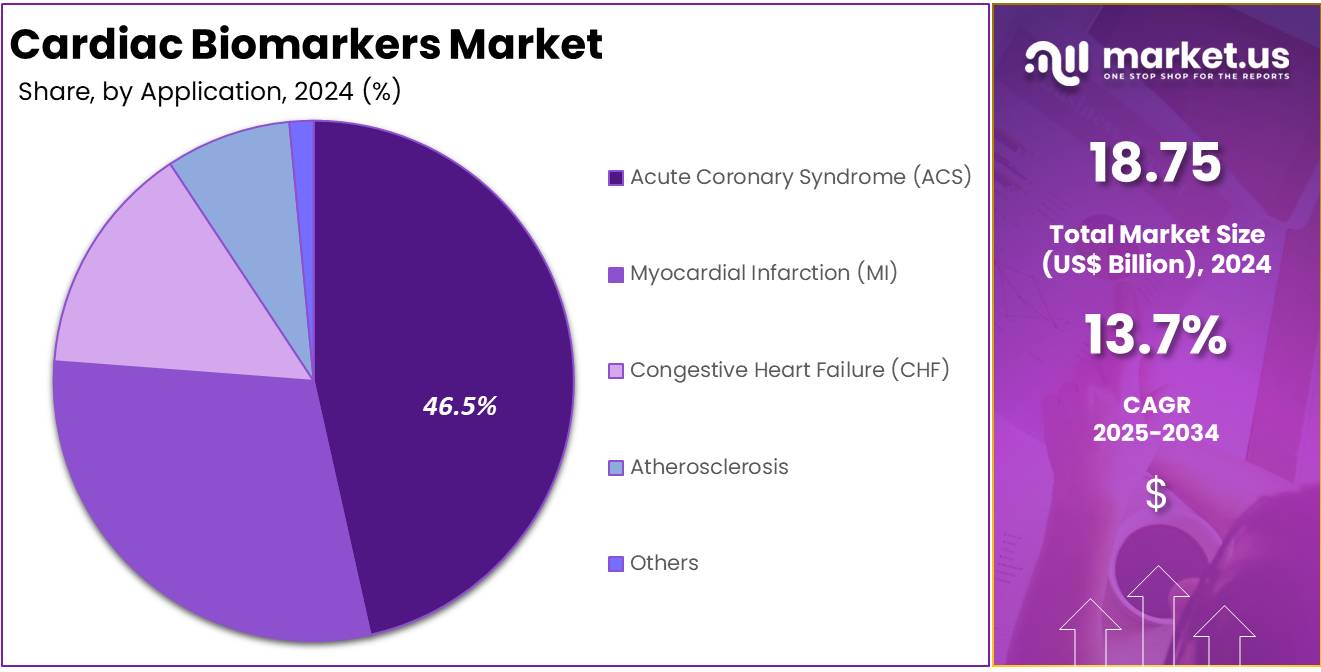

- By Application, the market is classified into Acute Coronary Syndrome (ACS), Myocardial Infarction (MI), Congestive Heart Failure (CHF), Atherosclerosis, and Others, with Acute Coronary Syndrome (ACS) taking the lead market share in 2024 with 46.5%.

- By Location, the market is bifurcated into Laboratory Testing, and Point-of-Care (POC) Testing with Laboratory Testing taking the lead in 2024 with 59.7% market share.

- By End User, the market is bifurcated into Hospitals, Diagnostic Laboratories, Ambulatory Surgery Centers & Clinics, and Others with Diagnostic Laboratories taking the lead in 2024 with 57.4% market share.

- North America led the market by securing a market share of 37.80% in 2024.

Implant Type Analysis

The global cardiac biomarkers market is segmented by type into myoglobin, troponin, BNP and NT-proBNP, CK-MB, and other types. Among these, troponin holds the largest share, accounting for 43.4% of the market revenue. It is expected to maintain the fastest growth throughout the forecast period.

The strong growth of troponin is driven by factors such as its high specificity, diagnostic accuracy, and ability to detect cardiac events early, compared to other biomarkers. The rising incidence of cardiac events, including stroke and myocardial infarction, is further fueling the demand for troponin. Additionally, BNP and NT-proBNP are projected to experience significant growth due to their role in detecting heart stress and damage.

Application Analysis

The global cardiac biomarkers market is classified into myocardial infarction, congestive heart failure, acute coronary syndrome, and other indications on the basis of indications. Out of these indications, acute coronary syndrome leads the indication segment by holding a major revenue share of over 46.5%. Acute Coronary Syndrome (ACS) continues to be a major public health concern, with its prevalence varying across regions and populations. Annually, approximately 1.2 million people in the U.S. are hospitalized due to ACS. Of these, around 30% are for ST-Elevation Myocardial Infarction (STEMI), while the remaining 70% are for Non-ST-Elevation Myocardial Infarction (NSTEMI) or Non-ST-Elevation Acute Coronary Syndrome (NSTE-ACS).

The rapidly rising number of individuals in developing and underdeveloped countries with the acute coronary syndrome is driving the growth of acute coronary syndrome in the indication segment of the global cardiac biomarkers market. Expanding urbanization and sedentary jobs individuals are the major factors in the increase of acute coronary syndrome patients. Also, myocardial infarction is expected to grow significantly during the forecast period. Rising cases of myocardial infarction will propel the growth of myocardial infarction in the indication segment of the global cardiac biomarkers market.

Location Analysis

The global cardiac biomarkers market is segmented based on the location of testing into point of care testing and laboratory testing. Laboratory testing leads the segment, accounting for a dominant revenue share of 59.7%. In April 2025, The World Bank Group announced the launch of the next phase of its Private Sector Investment Lab, focused on implementing proven solutions at scale. This new chapter also expands the Lab’s membership to include industry leaders with experience generating jobs in developing economies, aligning directly with the development in use of cardiac biomarkers in these labs.

The growth of laboratory testing is driven by its advantages such as high specificity, sensitivity, cost-effectiveness, and scalability, which are fueling its demand in the cardiac biomarkers market. On the other hand, point of care testing is expected to witness rapid growth during the forecast period. The increasing adoption of easy-to-use, highly sensitive point of care troponin tests is anticipated to significantly contribute to the expansion of point of care testing in the global cardiac biomarkers market.

End User Analysis

Hospitals held a dominant market position in the cardiac biomarkers market by end-user, with a significant share. This dominance is attributed to the high volume of cardiac events treated in hospitals, where diagnostic and monitoring services for cardiovascular conditions are crucial. Hospitals typically have the necessary infrastructure, such as advanced diagnostic equipment and skilled medical professionals, to handle complex cardiac cases, including acute heart attacks and chronic cardiovascular diseases. The ability to perform rapid, accurate testing and provide immediate treatment options is a key factor in hospitals’ leadership in this market.

Diagnostic laboratories also play a vital role, particularly in routine screenings and follow-up tests, but hospitals remain the primary setting for emergency interventions. The integration of cardiac biomarkers into hospital care systems for early diagnosis, prognosis, and treatment decisions contributes to the segment’s substantial market share. With the increasing prevalence of heart disease, hospitals are expected to maintain their stronghold in the market, driven by advancements in biomarker testing technologies and growing demand for specialized care.

Key Market Segments

By Type

- Troponins (T and I)

- B-type Natriuretic Peptide (BNP) and NT-proBNP

- Creatine Kinase-MB (CK-MB)

- Myoglobin

- Ischemia Modified Albumin (IMA)

By Application

- Acute Coronary Syndrome (ACS)

- Myocardial Infarction (MI)

- Congestive Heart Failure (CHF)

- Atherosclerosis

- Others

By Location

- Laboratory Testing

- Point-of-Care (POC) Testing

By End-User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgery Centers & Clinics

- Others

Drivers

Rising Prevalence of Cardiovascular Diseases (CVDs)

The increasing prevalence of cardiovascular diseases is one of the major drivers for the cardiac biomarkers market. According to the CDC, heart disease is the leading cause of death among men, women, and individuals from most racial and ethnic groups. Every 34 seconds, someone dies from cardiovascular disease. In 2023, cardiovascular disease was responsible for 919,032 deaths, accounting for roughly 1 in every 3 fatalities. Between 2020 and 2021, the total cost of heart disease was approximately US$417.9 billion, covering healthcare expenses, medication costs, and lost productivity due to premature death.

The growing aging population, lifestyle changes, and rising incidence of risk factors like hypertension, diabetes, and obesity are contributing to the surge in cardiovascular diseases. For example, in the U.S., the Centers for Disease Control and Prevention (CDC) reports that nearly 1 in 4 deaths are caused by heart disease, emphasizing the need for effective diagnostic solutions. This rising burden of CVDs drives the demand for advanced cardiac biomarkers to aid in early detection, improve outcomes, and reduce healthcare costs.

Restraints

High Costs of Cardiac Biomarker Testing

Individual cardiac biomarker tests such as troponins, CK-MB, BNP, and others can cost from $50 to several hundred dollars per test, depending on the provider, technology, and test complexity. Implementing routine cardiac biomarker testing in a health plan of 1 million beneficiaries in the US could reduce major cardiac events but also involves high testing costs.

A cost model showed cost savings of over $187 million across 5 years from reduced events, excluding the test costs themselves, which remain a substantial financial consideration. The high costs of cardiac biomarker tests—ranging into hundreds of dollars per test and billions annually at the market level—underscore the challenge of balancing clinical benefits with economic impact, making these tests a costly yet critical component of cardiac care.

Opportunities

Technological Advancements in Diagnostic Solutions

One of the most significant opportunities in the cardiac biomarkers market lies in technological advancements. Innovations such as portable diagnostic devices, point-of-care (POC) testing solutions, and the integration of artificial intelligence (AI) are transforming how cardiac biomarkers are utilized. For example, AI algorithms can help analyze biomarker data more accurately and rapidly, leading to faster and more reliable diagnoses.

Companies like Abbott and Roche are developing portable POC devices that can detect biomarkers such as troponin and BNP at the patient’s bedside or in remote settings, facilitating early diagnosis and management of cardiovascular diseases. This provides significant opportunities for the cardiac biomarkers market to expand its reach and improve patient outcomes, especially in rural and underserved regions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the cardiac biomarkers market, shaping demand, production, and distribution channels. Economic downturns or recessions can reduce healthcare spending, affecting the accessibility of advanced diagnostic tools, including cardiac biomarker tests. For example, in countries facing economic challenges, hospitals and diagnostic centers may delay or reduce the implementation of high-cost diagnostic solutions, including cardiac biomarkers. This can limit market growth in certain regions, particularly in developing economies.

On the geopolitical front, trade policies, tariffs, and international relations also impact the market. Geopolitical tensions and trade barriers can disrupt the supply chains of raw materials and diagnostic equipment required for biomarker testing. For instance, the U.S.-China trade war in recent years disrupted the production of medical devices and diagnostic tools, which affected both the availability and cost of cardiac biomarkers. Additionally, political instability in regions like the Middle East and Africa can hinder market access, especially for point-of-care diagnostic tools, which are in high demand in remote and underserved areas.

Latest Trends

Shift Toward Personalized Medicine in Cardiology

A significant trend in the cardiac biomarkers market is the growing shift toward personalized medicine in cardiology. Personalized medicine uses individual patient data, such as genetic profiles and biomarker levels, to tailor treatments that are more effective for each patient. This trend is gaining momentum as biomarkers play a critical role in identifying patients who are at high risk of cardiovascular diseases and selecting the most appropriate therapy. For example, the use of biomarkers like NT-proBNP in heart failure patients allows clinicians to customize treatment regimens, improving patient outcomes and reducing adverse events.

According to the American Heart Association, personalized treatment approaches have been shown to improve clinical outcomes in heart failure patients by providing more targeted and effective care. The growing trend toward precision medicine is encouraging further investment in developing cardiac biomarkers for personalized treatment plans, enabling the market to expand and cater to a more individualized approach to cardiovascular care.

Regional Analysis

North America is leading the Cardiac Biomarkers Market

North America leads the global cardiac biomarkers market with 37.8% market share, driven by advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and a rising prevalence of cardiovascular diseases (CVDs). The region’s dominance is largely attributed to the U.S., where cardiovascular diseases remain the leading cause of death, accounting for approximately 25% of all deaths, as reported by the Centers for Disease Control and Prevention (CDC). This highlights the critical need for early detection and accurate diagnostics, which cardiac biomarkers provide.

Moreover, the presence of key market players like Abbott, Roche, and Siemens Healthineers in North America further strengthens the region’s leadership. These companies continue to innovate and offer advanced biomarker testing solutions, including point-of-care (POC) devices and portable testing options, catering to the growing demand for rapid diagnostics in emergency and hospital settings.

North America’s healthcare system is also characterized by high spending on medical research, diagnostic tools, and treatments, facilitating the widespread use of cardiac biomarkers. The U.S. Food and Drug Administration (FDA) continues to approve novel cardiac biomarker tests, further encouraging market growth and providing access to cutting-edge diagnostic technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cardiac Biomarkers market includes Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Ortho Clinical Diagnostics, Beckman Coulter (Danaher Corporation), Thermo Fisher Scientific, BioMérieux, SeraCare Life Sciences, Randox Laboratories, Quidel Corporation, F. Hoffmann-La Roche AG, Hologic, Inc., and Other key players.

Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers are key players driving innovation in the cardiac biomarkers market. Roche Diagnostics offers a wide range of cardiac biomarkers, including troponin tests, which are essential for diagnosing myocardial infarction.

Abbott Laboratories provides advanced diagnostic solutions like the i-STAT System for real-time biomarker testing, enhancing point-of-care diagnostics. Siemens Healthineers offers comprehensive cardiac testing platforms, such as the Atellica solution, which supports accurate biomarker analysis in clinical settings. These companies’ continuous advancements in diagnostic technologies, alongside their established market presence, reinforce their pivotal role in improving cardiac disease detection and management globally.

Key Opinion Leaders

Leaders Opinion Roche Diagnostics, Dr. Sarah Mitchell, Cardiologist at St. John’s Medical Center “Roche Diagnostics has been at the forefront of cardiac biomarker innovation. Their troponin assays provide an unmatched level of accuracy in diagnosing myocardial infarction, enabling timely interventions. As a cardiologist, I rely on their diagnostic tools to ensure that patients receive the most accurate and immediate care possible. Roche’s consistent dedication to research and development has made a significant impact in advancing cardiovascular diagnostics.” Abbott Laboratories, Dr. James O’Connor, Emergency Medicine Specialist at City Hospital “Abbott’s i-STAT System has revolutionized point-of-care diagnostics, especially in emergency settings. The ability to get accurate cardiac biomarker results in real time has truly improved patient outcomes. In high-pressure situations, having reliable and fast diagnostic tools like those from Abbott ensures we can quickly make life-saving decisions. Their continued innovation in POC testing has been invaluable in our daily operations.” Siemens Healthineers, Dr. Emily Carter, Director of Cardiology Research at HealthTech Institute “Siemens Healthineers has been instrumental in advancing cardiac biomarker testing. The Atellica solution has transformed how we analyze cardiac biomarkers in our lab, providing high throughput and precision. With their commitment to improving diagnostic workflows, Siemens continues to be a trusted partner in enhancing cardiovascular care. Their innovations help clinicians like me deliver better, faster, and more reliable diagnoses.” Recent Developments

- In January 2025: BioMérieux, a global leader in in vitro diagnostics, announced it has entered into an agreement to acquire SpinChip Diagnostics ASA, a privately held Norwegian diagnostics company. SpinChip has developed a groundbreaking immunoassay diagnostics platform, featuring a small benchtop analyzer designed for near-patient testing. This platform delivers results from whole blood samples within 10 minutes, offering the same high-sensitivity performance as laboratory instruments. bioMérieux has held a minority stake in SpinChip since March 2024.

- In October 2023: Mindray announced the global launch of two new high-sensitivity cardiac biomarkers: troponin I (hs-cTnI) and NT-proBNP. These additions expand Mindray’s comprehensive portfolio of cardiac biomarkers, aimed at improving the diagnosis and management of cardiovascular diseases (CVDs), as stated by the global medical devices and solutions provider. Image courtesy: Mindray.

- In May 2024: Roche announced that its Tina-quant® lipoprotein Lp(a) RxDx assay has received Breakthrough Device Designation from the U.S. Food and Drug Administration (FDA). This designation aims to identify patients who may benefit from innovative Lp(a)-lowering therapies currently under development. Lp(a) is gaining recognition as a significant yet often overlooked risk factor for cardiovascular disease, a major public health concern.

Top Key Players in the Cardiac Biomarkers Market

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Ortho Clinical Diagnostics

- Beckman Coulter (Danaher Corporation)

- Thermo Fisher Scientific

- BioMérieux

- SeraCare Life Sciences

- Randox Laboratories

- Quidel Corporation

- Hoffmann-La Roche AG

- Hologic, Inc.

- Other key players

Report Scope

Report Features Description Market Value (2024) US$ 18.75 billion Forecast Revenue (2034) US$ 67.70 billion CAGR (2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Troponins (T and I), B-type Natriuretic Peptide (BNP) and NT-proBNP, Creatine Kinase-MB (CK-MB), Myoglobin and Ischemia Modified Albumin (IMA)), By Application (Acute Coronary Syndrome (ACS), Myocardial Infarction (MI), Congestive Heart Failure (CHF), Atherosclerosis and Others), By Location (Laboratory Testing and Point-of-Care (POC) Testing), By End User (Hospitals, Diagnostic Laboratories, Ambulatory Surgery Centers & Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Ortho Clinical Diagnostics, Beckman Coulter (Danaher Corporation), Thermo Fisher Scientific, BioMérieux, SeraCare Life Sciences, Randox Laboratories, Quidel Corporation, F. Hoffmann-La Roche AG, Hologic, Inc., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Ortho Clinical Diagnostics

- Beckman Coulter (Danaher Corporation)

- Thermo Fisher Scientific

- BioMérieux

- SeraCare Life Sciences

- Randox Laboratories

- Quidel Corporation

- Hoffmann-La Roche AG

- Hologic, Inc.

- Other key players