Global Car Phone Holder Market Size, Share, Growth Analysis By Type (Rotable Flexible, Fixed), By Mounting Location (Dashboard, Air Vents, Windshield, Cup Holder, Others), By Material (Plastic, Rubber, Glass, Others), By Distribution Channel (Online, Manufacturers Website, Car Accessories Shops, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172074

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

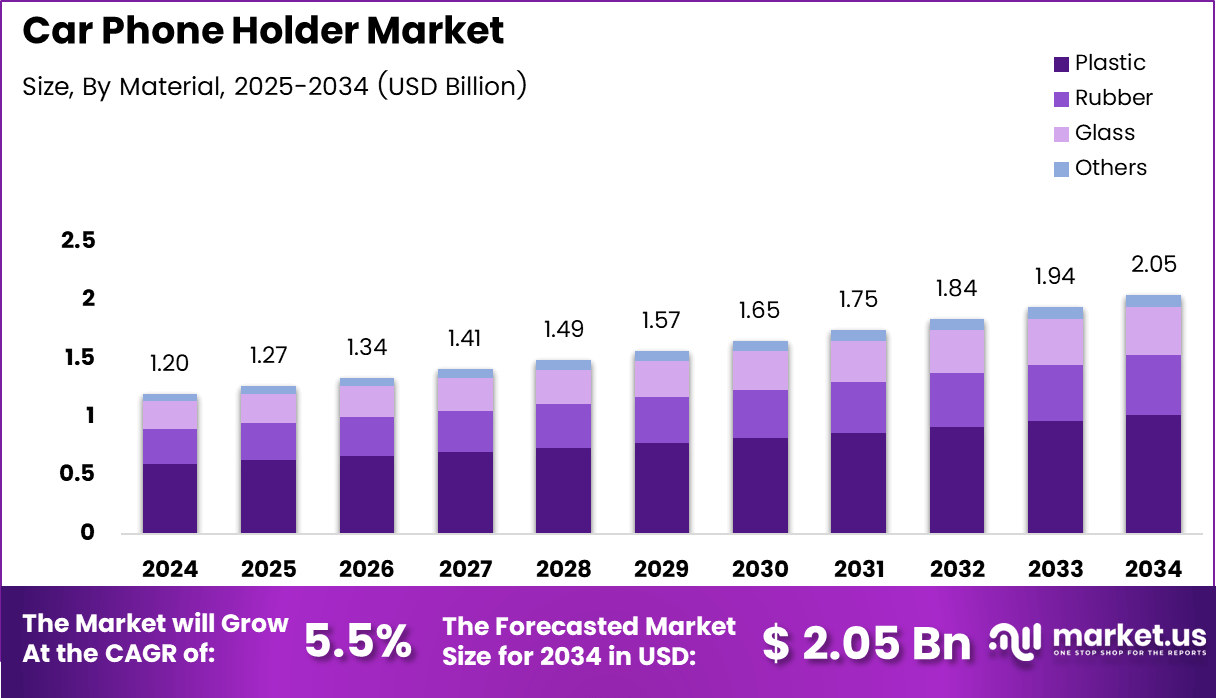

The Global Car Phone Holder Market size is expected to be worth around USD 2.05 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Car Phone Holder Market refers to automotive accessories designed to securely mount smartphones within vehicles for safe visibility and hands free usage. This market supports navigation, communication, and infotainment needs, while aligning with road safety awareness. As smartphone dependence increases, demand for reliable in car phone mounting solutions continues to expand steadily.

The market is experiencing consistent growth driven by rising daily commute times and app based driving assistance usage. Moreover, increased enforcement of distracted driving regulations is encouraging drivers to adopt compliant mounting accessories. As a result, car phone holders are becoming a practical necessity rather than an optional convenience.

In terms of opportunity, expanding vehicle ownership across urban and semi urban regions is strengthening aftermarket demand. Additionally, electric and connected vehicles with minimalist dashboards are creating space for adaptable mounting solutions. Consequently, manufacturers are focusing on adjustable, compact, and dashboard friendly designs to capture long term growth potential.

Government initiatives promoting road safety and hands free driving are indirectly supporting market expansion. Regulations limiting handheld phone usage while driving are accelerating consumer awareness. Meanwhile, infrastructure investments in smart transportation and digital navigation ecosystems are reinforcing smartphone usage in vehicles, thereby supporting sustained adoption of phone holders.

From a product innovation perspective, design flexibility and ergonomic placement are shaping buying decisions. Features such as multi axis rotation, adjustable arms, and strong suction stability enhance user confidence. Therefore, car phone holder market trends increasingly emphasize driver visibility, easy adjustment, and minimal distraction during navigation.

According to manufacturer specifications, advanced models now feature a double 80mm windshield suction pedestal designed for enhanced grip stability. The integrated 3 inch adjustable arm allows vertical positioning, while a full 360 degree rotating base enables precise alignment. These attributes improve safety by keeping devices within the driver’s natural line of sight.

Furthermore, according to product testing documentation, the 360 degree rotating arm mechanism supports quick angle adjustments without manual repositioning. This functionality enhances real time navigation usability and reduces driver distraction. As a result, premium adjustable car phone holders are increasingly positioned as safety enhancing automotive accessories within the broader car phone holder market.

Key Takeaways

- The global Car Phone Holder Market was valued at approximately USD 0.9 billion in 2024.

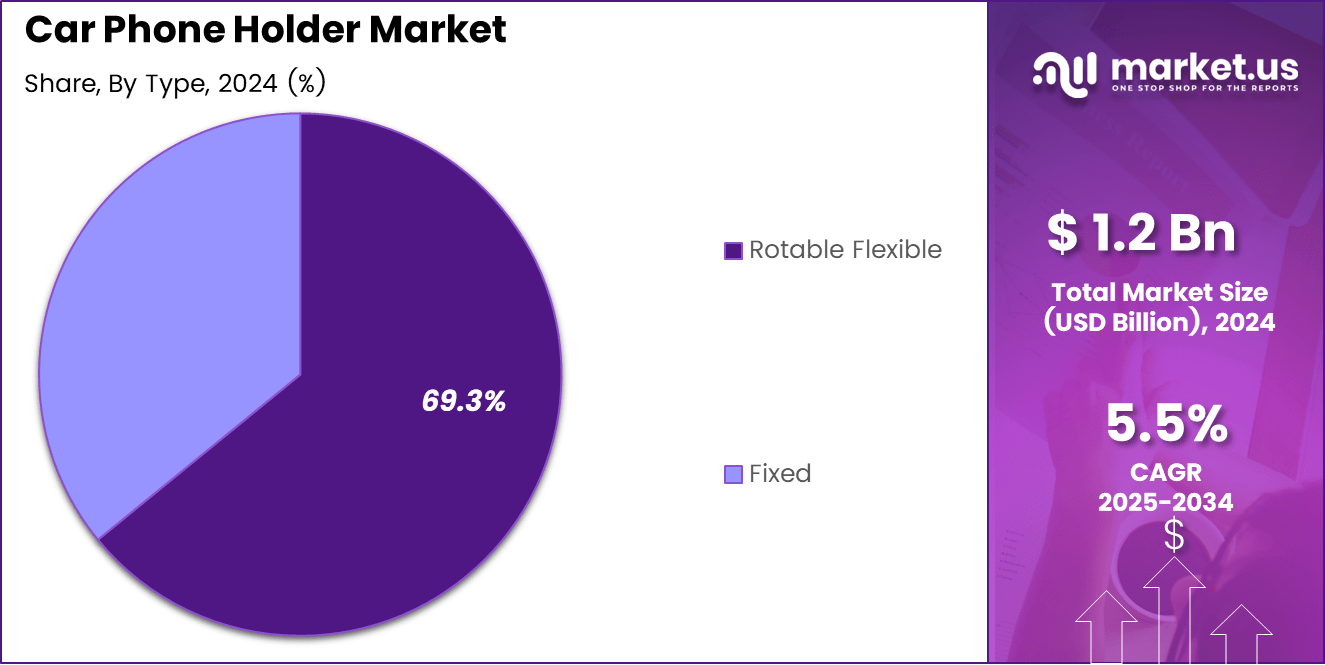

- Rotable flexible holders dominated the product segment with a market share of 69.3%.

- Air vent mounting led the mounting location segment, accounting for 37.2% of total demand.

- Plastic emerged as the leading material segment with a share of 49.6%.

- Online channels dominated distribution with a contribution of 44.7%.

- North America remained the leading region, holding a market share of 32.7% and valued at USD 0.3 billion in 2024.

By Type Analysis

Rotable Flexible dominates with 69.3% due to its adjustability, ergonomic design, and suitability for diverse driving preferences.

In 2024, Rotable Flexible held a dominant market position in the By Type Analysis segment of Car Phone Holder Market, with a 69.3% share. This dominance is supported by rising demand for hands-free navigation and adaptable viewing angles. Additionally, flexible arms enhance driver convenience across vehicle categories.

Fixed car phone holders continue to maintain relevance due to their stable structure and lower price positioning. These products appeal to users seeking minimal adjustments and long-term mounting solutions. Moreover, fixed holders are often preferred in commercial fleets where durability and consistency outweigh flexibility requirements.

By Mounting Location Analysis

Air Vents dominates with 37.2% owing to easy installation, driver visibility, and compatibility with compact vehicle interiors.

In 2024, Air Vents held a dominant market position in the By Mounting Location Analysis segment of Car Phone Holder Market, with a 37.2% share. This growth is driven by demand for non-intrusive mounting solutions. Furthermore, air vent holders support quick attachment without permanent dashboard modifications.

Dashboard-mounted holders remain widely used as they offer stable support and broad phone compatibility. These holders benefit from larger surface areas and enhanced suction technologies. Consequently, they are frequently adopted in personal vehicles requiring fixed line-of-sight positioning.

Windshield-mounted holders continue to attract users prioritizing elevated visibility during navigation. However, regulatory concerns in certain regions influence adoption. Meanwhile, cup holder mounts and other locations serve niche users seeking alternative placements without adhesive or vent-based attachments.

By Material Analysis

Plastic dominates with 49.6% due to its lightweight nature, cost efficiency, and design flexibility.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of Car Phone Holder Market, with a 49.6% share. Plastic materials support mass production and ergonomic shaping. Additionally, manufacturers leverage plastic for integrating rotating joints and adjustable clamps.

Rubber-based holders are gaining attention for their enhanced grip and vibration resistance. These materials improve phone stability, especially on uneven roads. As a result, rubber components are often used in premium or hybrid material designs.

Glass and other materials remain limited to specialized designs and aesthetic-focused products. Glass-based elements enhance visual appeal, while other materials address niche performance needs. However, higher costs restrict widespread adoption across mass-market segments.

By Distribution Channel Analysis

Online dominates with 44.7% driven by convenience, product variety, and growing consumer trust in e-commerce platforms.

In 2024, Online held a dominant market position in the By Distribution Channel Analysis segment of Car Phone Holder Market, with a 44.7% share. Consumers increasingly prefer online channels for price comparison and access to customer reviews. Moreover, digital promotions accelerate purchasing decisions.

Manufacturers websites play a strategic role by offering authentic products and direct warranty benefits. These platforms strengthen brand loyalty and enable customized product education. As a result, direct-to-consumer sales continue to expand steadily.

Car accessories shops and specialty stores remain important for hands-on product evaluation. Physical retail supports impulse buying and professional installation advice. However, limited inventory range compared to online platforms constrains faster growth within these channels.

Key Market Segments

By Type

- Rotable Flexible

- Fixed

By Mounting Location

- Dashboard

- Air Vents

- Windshield

- Cup Holder

- Others

By Material

- Plastic

- Rubber

- Glass

- Others

By Distribution Channel

- Online

- Manufacturers Website

- Car Accessories Shops

- Specialty Stores

Drivers

Rising Dependence on Smartphones for Real Time Navigation Drives Market Growth

The growing use of smartphones for real time navigation and traffic guidance is a major driver for the car phone holder market. Drivers increasingly rely on map applications, live traffic alerts, and route optimization tools during daily travel. As a result, stable phone placement within the driver’s line of sight has become essential for safe and convenient navigation.

At the same time, consumers are paying more attention to hands free driving and in car safety compliance. Regulations and awareness campaigns encourage drivers to avoid holding phones while driving. Car phone holders help reduce distraction by keeping devices secure and visible, supporting safer driving behavior.

In addition, the expansion of ride hailing, delivery, and fleet based driving activities is boosting demand. Drivers working long hours depend on phones for order management, navigation, and communication. This creates consistent replacement and upgrade demand for durable holders.

Moreover, the growing integration of infotainment systems with mobile based vehicle applications supports market growth. Many drivers still prefer smartphone based apps over built in systems, increasing the need for reliable mounting solutions across vehicle types.

Restraints

Safety Regulations Limiting Accessory Placement Restrain Market Expansion

Safety regulations that restrict windshield and dashboard mounted accessories are a key restraint in the car phone holder market. In several regions, strict visibility and distraction rules limit where holders can be installed. This reduces product flexibility and may discourage some buyers.

Another challenge is inconsistent compatibility across vehicle interiors and smartphone sizes. Differences in dashboard shapes, air vent designs, and phone dimensions make universal fit difficult. Consumers often face trial and error, which affects satisfaction and repeat purchases.

The risk of device instability during sudden braking or poor road conditions also acts as a restraint. Low quality holders may fail to hold phones securely, leading to safety concerns and negative reviews. These issues increase return rates and reduce consumer trust.

Additionally, price sensitivity in budget segments limits adoption of premium holders. Many users prefer low cost options even if durability is compromised, affecting overall product performance perceptions in the market.

Growth Factors

Rising Electric Vehicle Adoption Creates New Growth Opportunities

The increasing adoption of electric vehicles with minimalist interior designs presents strong growth opportunities. EV interiors often have fewer physical controls, encouraging accessory use for smartphone integration. This opens space for innovative holder designs that match modern aesthetics.

There is also rising demand for premium mounts that support wireless charging and fast charging. Consumers expect convenience and clutter free setups, especially during long drives. Holders that combine mounting and charging functions are gaining attention.

Growing vehicle ownership in emerging urban and semi urban markets further supports opportunity. As first time car buyers increase, demand for basic driving accessories, including phone holders, continues to rise steadily.

Custom designed holders tailored for commercial and fleet vehicles offer another opportunity. Fleet operators seek durable, standardized solutions that improve driver efficiency and safety, creating demand for bulk and customized products.

Emerging Trends

Shift Toward Magnetic and Compact Designs Shapes Market Trends

A key trend in the car phone holder market is the shift toward magnetic and gravity based mechanisms. These designs allow quick one hand operation and cleaner installation, improving daily usability for drivers.

There is also a growing preference for air vent mounted and compact holder designs. Consumers favor products that do not block visibility and blend with vehicle interiors, especially in smaller cars and urban driving conditions.

Integration of smart features such as auto locking and rotation control is becoming more common. These features improve stability and viewing flexibility, enhancing the overall driving experience.

Finally, the use of sustainable and high durability materials is gaining attention. Manufacturers are focusing on long lasting plastics and recycled materials to meet quality expectations and align with environmental awareness trends.

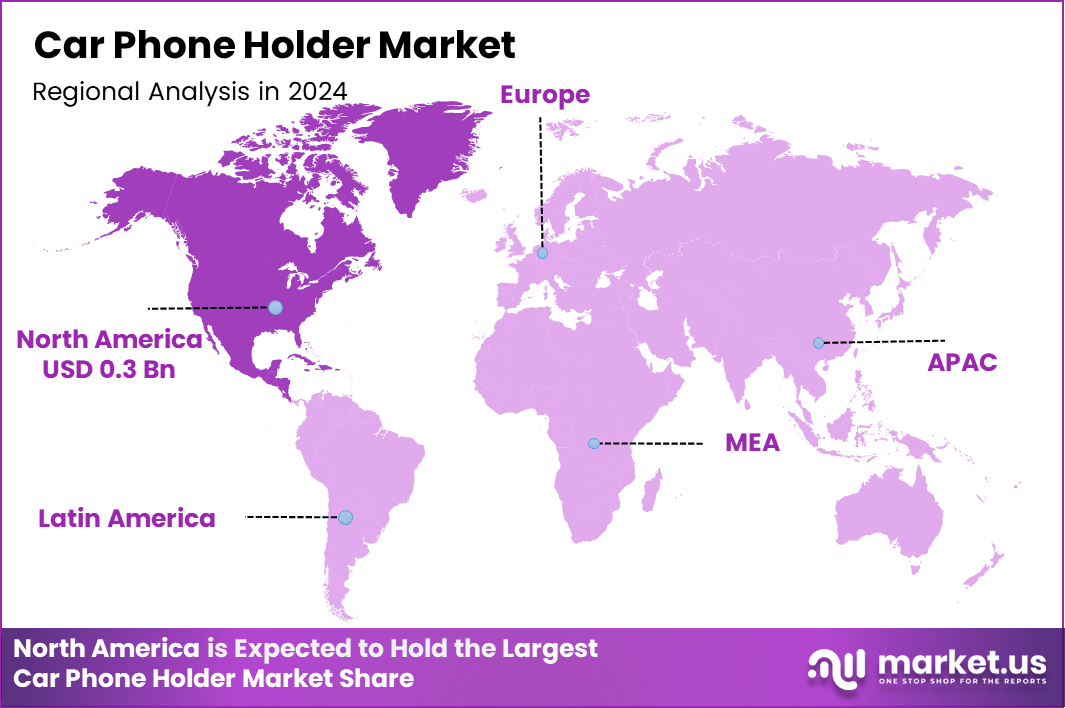

Regional Analysis

North America Dominates the Car Phone Holder Market with a Market Share of 32.7%, Valued at USD 0.3 Billion

North America leads the Car Phone Holder Market due to high smartphone penetration and strong adoption of in-car navigation solutions. In 2024, the region accounted for a dominant 32.7% share, with the market valued at USD 0.3 billion. Moreover, strict road safety awareness continues to encourage hands-free device usage.

Additionally, rising sales of passenger vehicles equipped with advanced infotainment systems support consistent demand. Growth is further supported by consumer preference for convenience-oriented automotive accessories. As a result, replacement and upgrade cycles remain favorable across the region.

Europe Car Phone Holder Market Trends

Europe represents a mature market supported by strong regulatory emphasis on road safety and distracted driving prevention. Consequently, demand for compliant phone mounting solutions remains stable. Moreover, the region benefits from high vehicle ownership rates across both urban and semi-urban areas.

Furthermore, increasing adoption of navigation and ride-sharing applications sustains aftermarket demand. Design-focused and compact holders are particularly preferred, reflecting European consumer emphasis on aesthetics and interior vehicle integration.

Asia Pacific Car Phone Holder Market Trends

Asia Pacific shows strong growth potential due to rising vehicle sales and expanding middle-class populations. Increasing smartphone dependency for navigation and communication supports market expansion. Additionally, rapid urbanization continues to increase daily commuting needs.

Moreover, cost-effective and multifunctional phone holders witness higher acceptance in emerging economies. E-commerce penetration further accelerates product accessibility across diverse consumer segments.

Middle East and Africa Car Phone Holder Market Trends

The Middle East and Africa market is supported by growing vehicle parc and improving road infrastructure. Demand is largely driven by long-distance travel needs and increasing smartphone usage during navigation. Consequently, windshield and dashboard-mounted holders remain popular.

Additionally, rising awareness of road safety regulations contributes to gradual adoption. However, market growth remains moderate due to price sensitivity in several countries.

Latin America Car Phone Holder Market Trends

Latin America demonstrates steady growth supported by expanding urban mobility and increasing reliance on mobile navigation. Consumers increasingly adopt affordable aftermarket accessories to enhance driving convenience. As a result, entry-level and mid-range holders perform well.

Furthermore, growth in online retail platforms improves product availability. Economic recovery trends across key countries are expected to support gradual market expansion.

U.S. Car Phone Holder Market Trends

The U.S. market benefits from a strong culture of daily commuting and extensive use of navigation applications. High awareness of hands-free driving practices supports consistent demand. Additionally, frequent vehicle upgrades sustain replacement purchases.

Moreover, consumer preference for adjustable and durable holders influences product innovation. The market remains driven by convenience, safety compliance, and evolving driving behavior patterns.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Car Phone Holder Company Insights

Arkon Mounts maintains a strong position in the global Car Phone Holder Market through its focus on durability and wide product compatibility. In 2024, the company continues to address professional and everyday users by offering holders designed for long driving hours and varied vehicle interiors. Its emphasis on functional design supports steady demand across consumer segments.

Aukey Official leverages its broader consumer electronics ecosystem to strengthen visibility in the car phone holder category. The brand benefits from value-driven pricing and multifunctional designs that appeal to cost-conscious buyers. In 2024, Aukey’s approach aligns well with online-first purchasing behavior and growing demand for compact, travel-friendly accessories.

Belkin is recognized for its premium positioning and strong focus on build quality and safety compliance. The company’s car phone holders are designed to integrate seamlessly with modern vehicle interiors and smartphones. In 2024, Belkin’s strategy reflects growing consumer willingness to invest in reliable, long-lasting accessories that support hands-free driving.

Brodit AB differentiates itself through vehicle-specific mounting solutions that prioritize precision fit and stability. Its product philosophy targets users seeking customized installations without compromising dashboard aesthetics. In 2024, this tailored approach continues to resonate with customers valuing long-term usability and secure phone placement.

Top Key Players in the Market

- Arkon Mounts

- Aukey Official

- Belkin

- Brodit AB

- Ottie

- Kenu

- Mpow

- Nite Ize

- Portronics

- Scosche Industries

Recent Developments

- In Nov 2024, Thule Group announced the acquisition of Quad Lock, the global market leader in performance phone mount solutions. The transaction strengthens Thule’s active lifestyle portfolio by expanding into premium mobile mounting solutions for cyclists, motorcyclists, and outdoor enthusiasts.

Report Scope

Report Features Description Market Value (2024) USD 1.2 billion Forecast Revenue (2034) USD 2.05 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Arkon Mounts, Aukey Official, Belkin, Brodit AB, Ottie, Kenu, Mpow, Nite Ize, Portronics, Scosche Industries Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape By Type (Rotable Flexible, Fixed), By Mounting Location (Dashboard, Air Vents, Windshield, Cup Holder, Others), By Material (Plastic, Rubber, Glass, Others), By Distribution Channel (Online, Manufacturers Website, Car Accessories Shops, Specialty Stores) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkon Mounts

- Aukey Official

- Belkin

- Brodit AB

- Ottie

- Kenu

- Mpow

- Nite Ize

- Portronics

- Scosche Industries