Global Caps and Closure Market Product Type (Screw Caps and Closures, Dispensing Caps and Closures, Crown Caps and Closures Metal Lug Caps and Closures, Corks, Other), Material Type (Metal, Plastic, Other Material Types), By Application (Food, Healthcare, Beverages, Personal Care and Cosmetics, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 48717

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

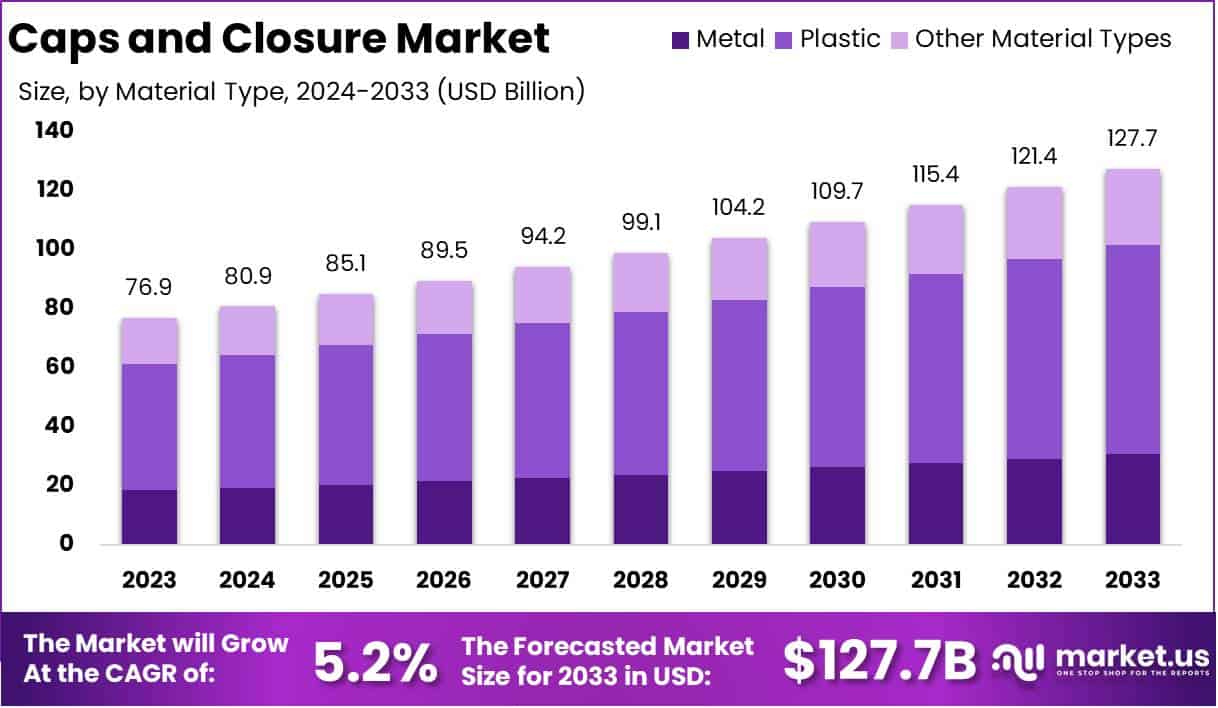

The Global Caps and Closure Market size is expected to be worth around USD 127.7 Billion by 2032 from USD 76.9 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Caps and closures are essential packaging components used to seal containers, such as bottles, jars, and tubes. They help preserve the contents, prevent contamination, and extend product shelf life. Made from materials like plastic, metal, or rubber, caps and closures are vital for industries like food & beverage, pharmaceuticals, personal care, and household goods.

Beyond functionality, these components also serve as branding tools, contributing to consumer experience through convenience features like tamper-evidence, child-resistance, and easy dispensing.

The market’s scope includes raw materials, production technologies, distribution channels, and end-use industries. It is a vital segment of the broader packaging industry, contributing significantly to product safety, quality, and consumer appeal.

Several factors are propelling growth in the caps and closure market. One of the primary drivers is the expanding food and beverage sector, driven by changing consumer lifestyles and increased demand for convenience foods. Additionally, the rising consumption of bottled water and ready-to-drink beverages supports the demand for innovative closures that enhance user experience.

Growing pharmaceutical and personal care industries, driven by urbanization, rising incomes, and increased healthcare awareness, are also significant contributors. The shift towards sustainable packaging materials, including recyclable and biodegradable closures, further fuels market expansion as companies aim to meet regulatory requirements and consumer preferences for eco-friendly products.

Demand for caps and closures is closely tied to overall trends in the packaging industry. The increasing adoption of single-use packaging, primarily in the food and beverage sector, is a major demand driver. Additionally, the surge in e-commerce is influencing the demand for secure, tamper-evident packaging solutions to ensure product integrity during transit.

The pharmaceutical sector’s demand for child-resistant closures, driven by stringent safety regulations, is another crucial factor. Meanwhile, personal care products are witnessing a shift towards pump dispensers and flip-top caps, as consumers seek convenience in everyday products. The diversification in end-user industries, coupled with innovation in closure designs, suggests sustained demand growth across multiple sectors.

The caps and closure market offers several opportunities, particularly in emerging markets where rising disposable incomes and changing consumer habits are leading to increased demand for packaged goods. There is also a significant opportunity for manufacturers to invest in sustainable and smart packaging solutions, such as closures with integrated technology for anti-counterfeiting measures or improved recycling compatibility.

Furthermore, the growing trend toward customization and aesthetic appeal in packaging provides potential for innovative designs that align with brand identity and consumer preferences. Companies that focus on R&D to develop advanced materials, such as bio-based plastics and lightweight closures, stand to gain competitive advantages in this evolving market landscape.

According to Bottled Water, Americans consumed an average of 46.5 gallons of bottled water in 2022, compared to 36 gallons of soda, reflecting a 30% growth since 2012. This surge is propelled by consumers’ preference for a healthier, zero-calorie, caffeine-free beverage, with 91% wanting bottled water widely available.

Bottled water containers use 252% less PET plastic than soda, making them more eco-friendly, with a minimal environmental footprint requiring only 1.39 liters of water and 0.21 mega joules of energy per liter produced. Packaged in universally recyclable PET #1 and HDPE #2 plastics, they ensure effective recycling across the U.S.

According to Silgan Holdings Inc., the company has agreed to acquire Weener Plastics Holdings B.V., a key producer of dispensing solutions, for €838 million. This acquisition strengthens Silgan’s capabilities across personal care, food, and healthcare segments, expanding its global footprint to 19 facilities in Europe and the Americas, with approximately 4,000 employees and advanced clean-room manufacturing technologies.

Key Takeaways

- The global caps and closure market is set to expand from USD 76.9 billion in 2023 to approximately USD 127.7 billion by 2032, driven by a 5.2% CAGR over the forecast period (2024-2033).

- Screw Caps and Closures led the market with a 36.5% share in 2023, attributed to their versatility across multiple sectors, including beverages, pharmaceuticals, and household products.

- Plastic held a dominant position with a 55.8% share in 2023, due to its lightweight, cost-effective nature, and growing advancements in recyclable plastics.

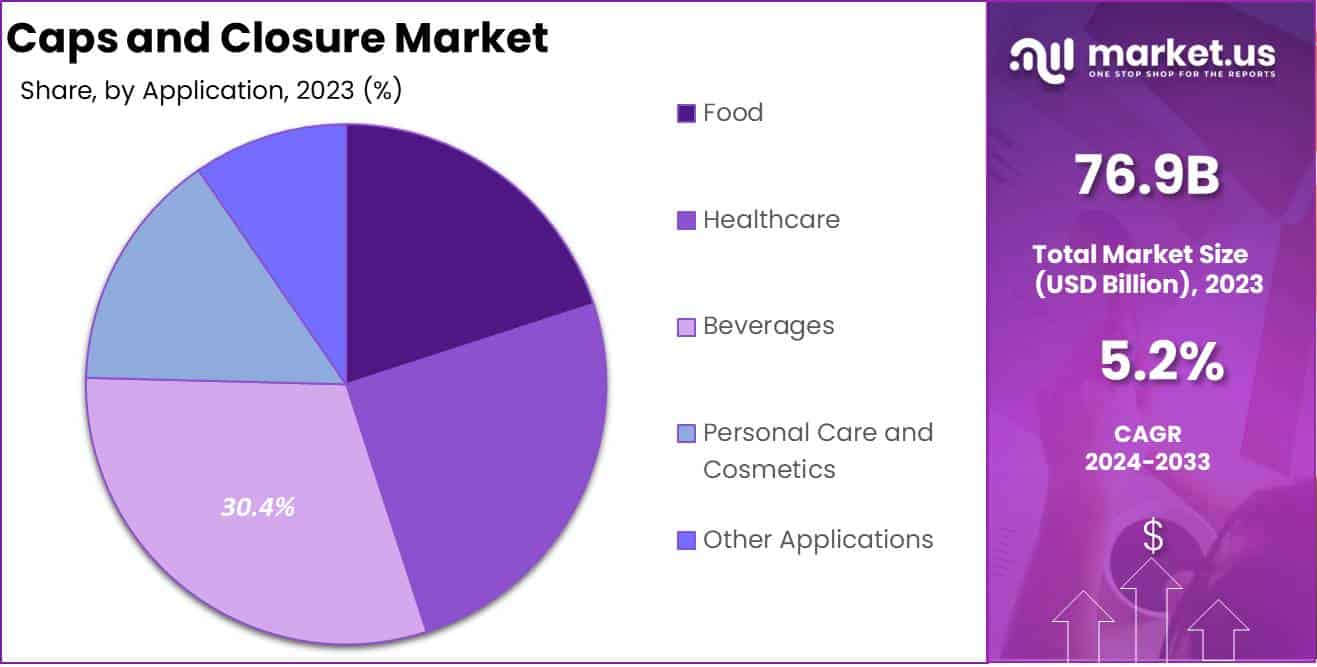

- The Beverages segment was the largest application, capturing 30.4% of the market share in 2023, driven by demand for on-the-go and tamper-evident packaging solutions.

- The Asia-Pacific region accounted for 38.1% of the market share in 2023, led by strong demand from the FMCG sector and growing middle-class consumer base.

- Asia-Pacific offers a growth opportunity, driven by expanding middle-class incomes and rising consumption of packaged goods, projected to reach USD 29.2 billion.

By Product Analysis

Screw Caps and Closures Segment Dominates the Caps and Closure Market with Over 36.5% Share in 2023

In 2023, Screw Caps and Closures held a dominant market position by product type in the Caps and Closure Market, capturing more than a 36.5% share. This dominance is largely attributed to their widespread application across the beverage, food, pharmaceutical, and household sectors, where they offer convenience, cost-effectiveness, and strong sealing properties.

Their versatility and ease of use have made screw caps a preferred choice, particularly in the packaging of bottled water, carbonated drinks, juices, and edible oils. Innovations in design, such as tamper-evident and child-resistant features, have further strengthened their position in the market, appealing to both manufacturers and end-users.

Dispensing caps and closures accounted for a significant share of the market in 2023, driven by increasing demand in personal care, cosmetics, and food sectors. These closures are favored for products like shampoos, lotions, sauces, and condiments, where controlled product dispensing is essential.

The rising popularity of user-friendly packaging that enhances consumer convenience, combined with the trend towards sustainable dispensing solutions, is propelling growth in this segment. Additionally, the integration of innovative designs like flip-top, pump, and trigger-based closures has enhanced their functional appeal, contributing to their expanding market share.

Crown caps and closures maintained a stable market presence in 2023, particularly within the beverage industry. These caps are commonly used for sealing glass bottles, primarily in the beer, soft drinks, and specialty beverage sectors. Known for their reliable sealing capabilities and tamper-proof features, crown caps ensure product freshness and safety.

Despite growing competition from alternative closures, the segment remains strong due to its cost-efficiency and established compatibility with traditional bottling lines, maintaining relevance among brewers and beverage manufacturers worldwide.

Metal lug caps, also known as twist-off closures, are widely used in the food industry, especially for packaging jars containing jams, pickles, sauces, and preserves. In 2023, this segment benefited from sustained demand for packaged foods that require a secure, airtight seal to maintain shelf stability and product quality.

Metal lug caps are preferred due to their durability and ability to withstand high temperatures during pasteurization processes, which is critical for food preservation. The segment’s growth is supported by ongoing developments in the customization of designs and sizes, catering to diverse packaging needs.

In 2023, corks continued to be an essential segment within the caps and closure market, especially in the wine and spirits industries. Natural corks, along with synthetic and agglomerated variants, are highly valued for their sealing properties, which allow wines to age properly.

Despite the increasing adoption of screw caps in the wine sector, corks retain a strong market presence due to consumer perception of quality and tradition associated with cork-sealed bottles. The rise in premium wine consumption, coupled with innovations in cork sustainability and recycling, has further reinforced this segment’s demand.

The other product types category encompasses a range of closures, including snap-on caps, valve closures, and stopper closures, among others. In 2023, this segment witnessed steady growth, driven by its application across niche packaging needs in industries like pharmaceuticals, cosmetics, and household goods.

The increasing focus on custom closures that offer unique functionalities such as spray caps, child-resistant closures, and tamper-evident solutions is driving innovation in this segment. Additionally, the ongoing shift towards sustainable materials and designs is shaping the demand for specialized closure solutions in diverse end-use applications.

By Material Type Analysis

Plastic Segment Dominates the Caps and Closure Market with Over 55.8% Share in 2023

In 2023, Plastic held a dominant market position in the material type segment of the Caps and Closures Market, capturing more than a 55.8% share. This leadership is driven by plastic’s lightweight properties, cost-effectiveness, and versatility in molding processes, making it suitable for diverse packaging applications across the food, beverage, and pharmaceutical sectors.

The adaptability of plastics, coupled with advancements in sustainable and recyclable plastic materials, continues to reinforce its stronghold in the market. Metal ranked as the second most prominent material type, accounting for approximately 30.4% of the market share in 2023.

Metal closures are particularly favored in the beverage industry, where their robustness and ability to maintain product integrity play critical roles. The demand for metal caps is further supported by their use in high-end packaging, such as spirits and specialty foods, where premiumization and tamper-evident features are key purchasing drivers.

Other Material Types, including glass, rubber, and composite materials, held a smaller share, collectively accounting for nearly 13.8% of the market in 2023. These materials find niche applications in specific packaging needs, such as glass for luxury cosmetics and rubber for medical vials.

The share of these materials is primarily influenced by their limited versatility and higher costs compared to plastic and metal, although they are essential for certain specialized applications that require unique properties.

By Application Analysis

Beverages Segment Dominates the Caps and Closure Market with Over 30.4% Share in 2023

In 2023, Beverages held a dominant market position in the application segment of the Caps and Closures Market, capturing more than a 30.4% share. This stronghold is attributed to the extensive use of caps and closures in the packaging of bottled water, carbonated soft drinks, juices, and alcoholic beverages.

The increasing consumer preference for on-the-go beverages and the growing demand for tamper-evident and spill-proof solutions drive the adoption of caps and closures in this segment.

The Food segment accounted for approximately 25.6% of the market share in 2023, making it the second-largest application. Rising consumer demand for packaged and processed foods, combined with the need for longer shelf-life and freshness preservation, is fueling growth.

The segment benefits from innovations in closures that improve convenience, such as easy-open lids and resealable features, making them ideal for sauces, condiments, and ready-to-eat meals.

Healthcare applications held about 18.9% of the market share in 2023. The demand for safe, secure, and sterile packaging solutions for pharmaceuticals, medical devices, and over-the-counter drugs has been a key driver. The growing emphasis on child-resistant caps, tamper-evident features, and dose-control closures has supported this segment’s expansion.

The Personal Care and Cosmetics segment captured a 14.2% share of the market in 2023. The demand for innovative and aesthetic packaging solutions that offer both convenience and premium appeal is boosting growth. Popular products such as shampoos, lotions, and skincare creams often use customized closures that enhance user experience and brand value.

Other Applications, including chemicals, household cleaning products, and industrial use, accounted for about 10.9% of the total market in 2023. Although smaller in share, these applications are crucial for industries where safety, secure handling, and product integrity are essential.

Key Market Segments

By Product Type

- Screw Caps and Closures

- Dispensing Caps and Closures

- Crown Caps and Closures Metal Lug Caps and Closures

- Corks

- Other Product Types

By Material Type

- Metal

- Plastic

- Other Material Types

By Application

- Food

- Healthcare

- Beverages

- Personal Care and Cosmetics

- Other Applications

Driver

Escalating Demand for Packaged Food and Beverages

The global caps and closures market is experiencing significant growth, primarily driven by the increasing consumption of packaged food and beverages. This surge stems from evolving consumer lifestyles that prioritize convenience and product safety.

Caps and closures are vital in maintaining the integrity and freshness of packaged goods, thereby extending their shelf life. The food and beverage sector, being the largest end-user, significantly propels the demand for these packaging components.

Additionally, the rise of on-the-go consumption trends and the preference for single-serve packaging formats have further amplified the need for caps and closures. Innovations such as resealable and tamper-evident closures enhance consumer trust and convenience, contributing to market expansion.

The increasing urbanization and changing dietary habits are expected to continue driving this demand, solidifying the food and beverage industry’s role as a key driver in the caps and closures market.

Restraint

Environmental Concerns and Regulatory Challenges

Despite the upward trajectory, the caps and closures market faces challenges due to environmental concerns and regulatory pressures. The widespread use of plastic materials in caps and closures has raised alarms over environmental sustainability, leading to increased scrutiny and calls for reducing plastic usage.

Governments and regulatory bodies are enforcing stringent rules to promote sustainable practices, compelling manufacturers to seek eco-friendly alternatives and invest in recycling initiatives. For instance, the European Union has introduced regulations aimed at reducing single-use plastic products, including certain types of caps and closures, to mitigate environmental impact.

Moreover, the volatility in raw material prices, especially for plastic resins and metals, adds complexity to the market dynamics. Fluctuating costs can impact profit margins and pose challenges in maintaining consistent pricing strategies.

Manufacturers are increasingly exploring alternative materials and innovative designs to comply with environmental regulations and address consumer concerns, but these efforts can lead to increased production costs and require significant investment in research and development.

Opportunity

Growth in the Pharmaceutical Sector

The expanding pharmaceutical industry presents a significant opportunity for the caps and closures market. With an aging global population and the increasing prevalence of chronic diseases, the demand for medications is on the rise. Caps and closures are critical in ensuring the safety, efficacy, and integrity of pharmaceutical products.

The need for secure, child-resistant, and tamper-evident packaging solutions is paramount, driven by stringent regulatory requirements.Furthermore, the growth of over-the-counter (OTC) medications and supplements market amplifies the demand for appropriate caps and closures.

Manufacturers have the opportunity to innovate and cater to the specific needs of the pharmaceutical sector, thereby expanding their market presence. The increasing focus on patient safety and regulatory compliance in pharmaceutical packaging is expected to drive the adoption of advanced caps and closures in the industry.

Trends

Shift Towards Sustainable and Eco-Friendly Packaging

A notable trend influencing the caps and closures market is the shift towards sustainable and eco-friendly packaging solutions. Consumers are increasingly aware of environmental issues, demanding packaging that is recyclable or made from renewable resources.

Manufacturers are responding by developing caps and closures from biodegradable materials and incorporating post-consumer recycled content.

Technological advancements are also paving the way for innovative designs that reduce material usage and enhance recyclability. This trend aligns with global sustainability goals and offers manufacturers a competitive edge in the market.

Companies like the Coca-Cola Company have pledged to use 100% recycled or renewable materials in their packaging by 2030, reflecting a commitment to sustainability that is influencing the caps and closures market.

In summary, the global caps and closures market is navigating a dynamic landscape shaped by increasing demand in the food and beverage sector, environmental and regulatory challenges, opportunities within the pharmaceutical industry, and a consumer-driven shift towards sustainability. Stakeholders who strategically address these factors are poised to lead in the evolving market.

Regional Analysis

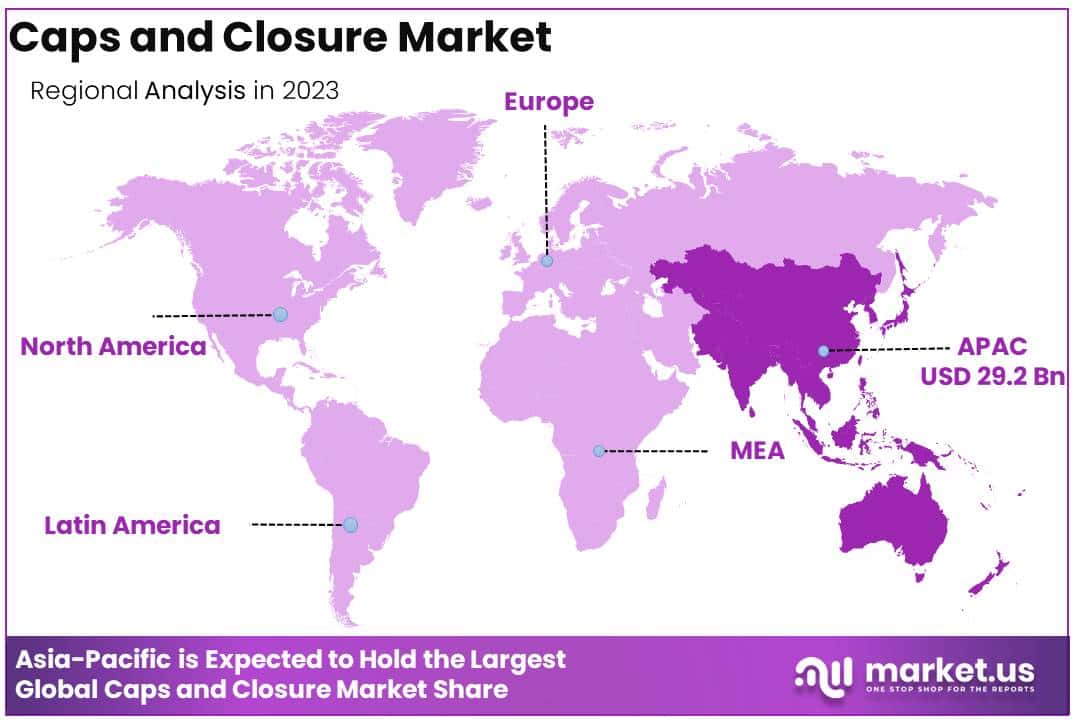

Asia-Pacific Leads Caps and Closure Market with Largest Market Share at 38.1% in 2023

The Asia-Pacific region dominates the global caps and closure market, holding a 38.1% share in 2023, driven by growing demand from the food & beverage, pharmaceutical, and personal care sectors.

The region’s thriving FMCG sector and expanding middle-class population, especially in countries like China, India, and Indonesia, are contributing to a substantial surge in demand for caps and closures. With market size reaching USD 29.2 billion, the region’s growth is further fueled by the rising consumption of packaged products and beverages.

Additionally, increasing urbanization, rising disposable incomes, and a shift towards more convenient and sustainable packaging solutions are bolstering market dynamics. Innovations in packaging design and material, coupled with expanding e-commerce penetration, are further solidifying Asia-Pacific’s position as the leading market.

North America is a key market for caps and closures, driven by strong demand across the food & beverage and healthcare sectors. The region benefits from a well-established manufacturing base and high consumption rates of packaged goods, particularly in the United States, which remains a pivotal market.

The increasing focus on sustainable and recyclable packaging materials, coupled with a robust regulatory framework supporting safety and hygiene standards, boosts the adoption of innovative caps and closure solutions. Additionally, the demand for personalized packaging solutions from the cosmetics sector further supports market growth.

Europe holds a substantial share in the global caps and closure market, primarily driven by strong demand in the food & beverage and pharmaceutical industries. Countries like Germany, France, and the United Kingdom are at the forefront of this growth, supported by stringent packaging regulations, especially in food safety and pharmaceutical packaging.

The region’s emphasis on sustainability and circular economy initiatives is propelling the adoption of eco-friendly materials and designs in caps and closures. Moreover, consumer preferences for premium packaging, particularly in the cosmetics and personal care sector, further contribute to steady demand.

The Middle East & Africa region is witnessing a rising demand for caps and closures, primarily fueled by expanding food and beverage consumption and increasing pharmaceutical activities.

The growing focus on improved healthcare infrastructure and the increasing need for safe and secure packaging solutions in the pharmaceutical industry are key factors driving market growth.

Additionally, rising disposable incomes, especially in countries like Saudi Arabia, the UAE, and South Africa, contribute to higher consumption of packaged goods, thereby boosting the demand for caps and closures.

Latin America is experiencing steady growth in the caps and closure market, led by the food & beverage and personal care sectors. Countries like Brazil, Mexico, and Argentina are at the forefront, driven by rising demand for packaged foods, beverages, and personal care products.

The region’s increasing urbanization and a shift towards convenient packaging are supporting this trend. Moreover, the adoption of sustainable packaging solutions is gradually gaining momentum, aligning with global trends and consumer demand for eco-friendly products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global caps and closures market in 2024 is marked by intense competition among established players who are driving innovation, sustainability, and strategic expansions to secure a stronger market position. Berry Global Inc.

continues to leverage its broad product portfolio and global footprint to enhance its competitive advantage, focusing on sustainable packaging solutions to meet increasing consumer demand for environmentally friendly options.

Amcor plc is making strategic strides by investing in R&D and promoting circular packaging solutions, aiming to increase its share in both mature and emerging markets. AptarGroup, Inc. is distinguished by its innovation in dispensing technologies and active closures, emphasizing customization and high functionality to cater to the pharmaceutical, food, and beverage sectors.

Silgan Holdings Inc. maintains a strong market presence through strategic acquisitions and a diverse product range, particularly in metal closures for food and beverage applications. Crown Holdings, Inc. capitalizes on its expertise in metal packaging, promoting sustainability and lightweight solutions to address regulatory requirements and consumer preferences.

Guala Closures S.p.A remains a notable player, focusing on security and premium closures, especially for the spirits industry, where tamper-evidence and aesthetics are critical. ALPLA Group and Weener Plastics Group BV are driving growth through strategic expansions and a focus on recycled materials, aligning with global sustainability trends.

HQC Incorporated and United Caps emphasize product innovation and adaptability, responding to diverse end-user needs across industries. Additionally, other key players are pursuing niche innovations and strategic partnerships to capture market share, underscoring the dynamic and evolving nature of this global market.

Top Key Players in the Market

- Berry Global Inc.

- Amcor plc

- AptarGroup, Inc.

- Silgan Holdings Inc.

- Crown Holdings, Inc.

- Guala Closures S.p.A

- ALPLA Group

- Weener Plastics Group BV

- HQC Incorporated

- United Caps

- Other Key Players

Recent Developments

- In 2024, Fitch Ratings assigned a ‘BBB-‘/’RR2’ rating to Berry Global, Inc.’s proposed 10-year first lien senior secured notes. The proceeds from this issuance will be directed toward reducing a portion of the company’s existing first lien secured term loans, which are due in 2026. Fitch maintained Berry’s Long-Term Issuer Default Rating at ‘BB+’ with a Stable Outlook, signaling confidence in the company’s financial stability and outlook.

- In 2024, Silgan Holdings Inc. (NYSE: SLGN), a prominent provider of sustainable rigid packaging solutions, announced a definitive agreement to acquire Weener Plastics Holdings B.V. for €838 million. Weener Plastics, a leader in dispensing solutions for personal care, food, and healthcare, operates 19 facilities primarily in Europe and the Americas, employing around 4,000 people. The acquisition is expected to enhance Silgan’s product offerings and expand its market presence in high-demand regions, aligning with Silgan’s focus on innovation and sustainability.

- In July 3, 2024, the EU implemented new regulations mandating tethered caps for single-use plastic beverage containers. Although this legislation initially faced resistance from major brands, the industry has rapidly adapted, leading to new innovations in the caps and closures sector. These developments include the use of sustainable materials and eco-friendly designs that align with the broader push towards sustainable packaging.

- In 2023, Blue Ocean Closures introduced a groundbreaking fiber-based cap designed for aseptically packaged products like long-life dairy, juices, plant-based beverages, and soups. This recyclable cap, designed to be disposed of like paper, marks a significant step towards sustainability in the packaging industry, offering an alternative that meets both functionality and eco-conscious goals.

Report Scope

Report Features Description Market Value (2023) US$ 76.9 Bn Forecast Revenue (2033) US$ 127.7 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Screw Caps and Closures, Dispensing Caps and Closures, Crown Caps and Closures Metal Lug Caps and Closures, Corks, Other), Material Type (Metal, Plastic, Other Material Types), By Application (Food, Healthcare, Beverages, Personal Care and Cosmetics, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, and rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Berry Global Inc., Amcor plc, AptarGroup, Inc., Silgan Holdings Inc., Crown Holdings, Inc., Guala Closures S.p.A, ALPLA Group, Weener Plastics Group BV, HQC Incorporated, United Caps, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Berry Global Inc.

- Amcor plc

- AptarGroup, Inc.

- Silgan Holdings Inc.

- Crown Holdings, Inc.

- Guala Closures S.p.A

- ALPLA Group

- Weener Plastics Group BV

- HQC Incorporated

- United Caps

- Other Key Players