Global Calendering Resins Market Size, Share, And Industry Analysis Report By Type (PVC Calendering Resins, ABS Calendering Resins, PP Calendering Resins, PS Calendering Resins), By Form (Liquid, Solid, Powder, Granular), By Application (Flooring, Wallcovering, Automotive Parts, Packaging), By End-User (Building and Construction, Automotive, Packaging, Consumer Products), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177280

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

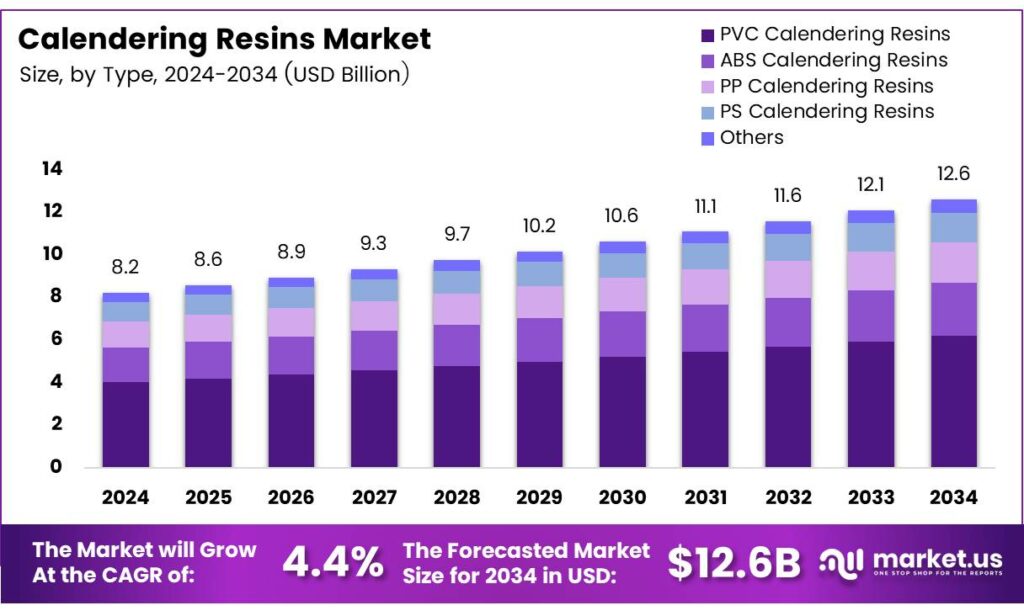

The Global Calendering Resins Market size is expected to be worth around USD 12.6 billion by 2034, from USD 8.2 billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The Calendering Resins Market represents a critical segment of polymer processing, where resins are engineered to deliver uniform thickness, clarity, and mechanical strength in films and sheets. As industries demand higher precision and energy-efficient manufacturing, calendering resins gain importance across packaging, automotive interiors, and industrial laminates, driving consistent market expansion.

Businesses increasingly adopt calendaring-grade PVC, PET, and PP resins to enhance film quality and accelerate throughput. Moreover, regulatory pressure to reduce environmental impact encourages manufacturers to innovate cleaner formulations. Producers invest in better dispersion additives, internal lubricants, and low-VOC modifiers to strengthen compliance while improving operational output in high-volume calendering lines.

- PVC resin used in rigid compounds performs optimally at a viscosity range of 1.7–2.0, ensuring stable calendering behavior, while blending homopolymer PVC with 2%–10% acetate copolymer improves elasticity and processing balance for advanced films.

- The Calendering Films Internal Lubricant—a 20–50-micron,99%-pure granular powder with a 120°C melting point, pH 7, and 0.95 g/cm³ density—further enhances efficiency by reducing friction, improving film uniformity, and providing strong thermal compatibility with PVC, PET, PE, PP, and PS.

The market also benefits from rising industrial automation, which sharpens resin mixing controls and reduces processing variability. This shift opens opportunities for resin suppliers to deliver tailor-made solutions aligned with evolving machinery standards. Simultaneously, government programs promoting sustainable plastics manufacturing further strengthen adoption, particularly in Asia and Europe, where policy incentives support cleaner polymer production.

Key Takeaways

- The Global Calendering Resins Market is valued at USD 8.2 billion in 2024 and projected to reach USD 12.6 billion by 2034, at a steady 4.4% CAGR from 2025 to 2034.

- PVC Calendering Resins dominate the By Type segment with a 52.8% market share in 2025.

- In the By Form segment, Solid resins lead with a 44.9% share in 2025.

- Flooring is the top application, accounting for 39.4% of the market in 2025.

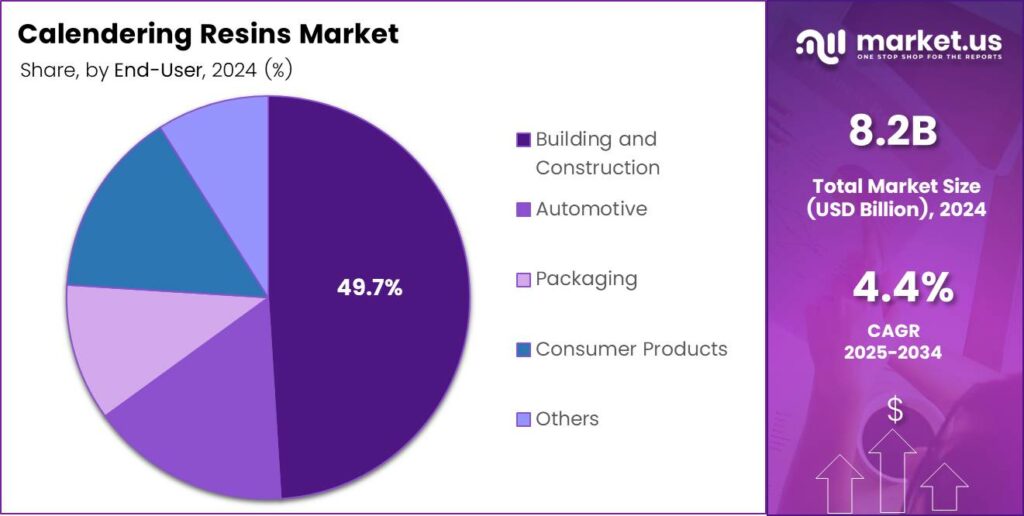

- The Building and Construction end-user segment holds the largest share at 49.7% in 2025.

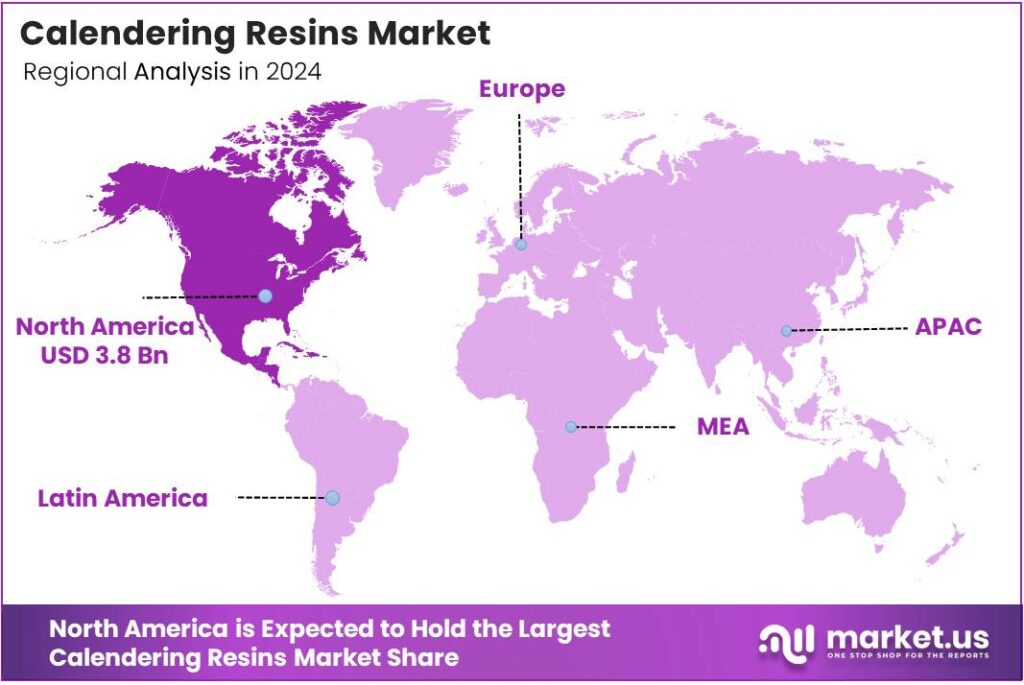

- North America remains the leading region with a 46.2% share valued at USD 3.8 billion.

By Type Analysis

PVC Calendering Resins dominate with 52.8% due to broad industrial adoption and high process compatibility.

In 2025, PVC Calendering Resins held a dominant market position in the By Type segment of the Calendering Resins Market, with a 52.8% share. PVC maintains leadership because it delivers flexibility, strength, and excellent processing behavior during calendering. Industries rely on PVC for flooring, wallcovering, and synthetic leather, supporting consistent demand.

ABS Calendering Resins continued to witness steady use, supported by rising demand for durable and abrasion-resistant sheets. ABS offers balanced rigidity and toughness, making it suitable for automotive interiors and consumer goods. Its adaptability to calendering machines strengthens its presence across engineered product lines.

PP Calendering Resins advanced with improved acceptance due to their lightweight nature and recyclability. PP sheets are increasingly used in packaging and consumer applications. Its thermal performance and lower density make PP a cost-efficient choice for manufacturers seeking sustainable alternatives.

PS Calendering Resins provided value in applications requiring clarity and rigidity. Although less flexible than PVC or ABS, PS resins offer ease of processing and cost benefits. Their role remains visible in low-load decorative items and economical sheet applications.

By Form Analysis

Solid Form dominates with 44.9% owing to higher processing efficiency and industrial preference.

In 2025, the Solid form held a dominant market position in the By Form segment of the Calendering Resins Market, with a 44.9% share. Solid resins benefit producers through easier storage, better handling, and consistent melting behavior. They remain the preferred choice for large-scale calendering operations.

Liquid resins support applications requiring superior dispersion and fast integration with plasticizers. Their use increased in specialty coatings and customized calendered films. The segment continues gaining traction as industries adopt precise formulations.

Powder resins showed moderate adoption because of their controlled flow and blending properties. They are suitable for lightweight sheet manufacturing. Manufacturers choose powder forms when aiming for uniform melt profiles and reduced impurities.

By Application Analysis

Flooring dominates with 39.4% due to strong global demand for durable PVC-based solutions.

In 2025, Flooring held a dominant market position in the By Application segment of the Calendering Resins Market, with a 39.4% share. The segment benefited from rising commercial renovation and residential construction, where calendered sheets provide wear resistance and aesthetic appeal.

Wallcovering applications expanded gradually with rising décor and remodeling trends. Calendered films offer improved printability and surface durability, making them ideal for both commercial and home interiors. Demand increases as consumers prefer long-lasting decorative solutions.

Automotive Parts used calendered resins in dashboards, door panels, and interior trims. Their lightweight and durable nature contributes to improved vehicle efficiency. This segment continues to grow steadily with advancements in material engineering.

By End-User Analysis

Building and Construction dominates with 49.7%, driven by the rising use of flooring, wall panels, and protective sheets.

In 2025, Building and Construction held a dominant market position in the By End-User segment of the Calendering Resins Market, with a 49.7% share. Infrastructure expansion and renovation projects drive the adoption of calendered products due to their durability and cost-efficiency.

Automotive end-users relied on calendered materials for interior trims and protective surfaces. Weight reduction and improved material aesthetics contribute to rising adoption. The shift toward modern cabin designs enhances material demand.

Packaging applications leveraged calendered films for their strength and visual appeal. They support food and consumer product safety. Innovations in recyclable film technologies strengthen this segment further. Consumer Products utilized calendered resins in fashion accessories, household goods, and decorative items.

Key Market Segments

By Type

- PVC Calendering Resins

- ABS Calendering Resins

- PP Calendering Resins

- PS Calendering Resins

- Others

By Form

- Liquid

- Solid

- Powder

- Granular

- Others

By Application

- Flooring

- Wallcovering

- Automotive Parts

- Packaging

- Others

By End-User

- Building and Construction

- Automotive

- Packaging

- Consumer Products

- Others

Emerging Trends

Shift Toward Eco-Friendly and Low-Emission Resin Formulations Shapes Market Trends

One of the strongest trends in the calendering resins market is the move toward eco-friendly resin solutions. Manufacturers are developing low-VOC, recyclable, and bio-based materials to align with environmental regulations. This trend is growing as companies focus on reducing carbon footprints.

- Digitalization and automation are reshaping production techniques. Modern calendering equipment integrates advanced temperature controls, predictive maintenance, and precise thickness management. In Europe, the VinylPlus framework reported 737,645 tonnes of PVC waste recycled, showing how quickly the feedstock base is being organized for real industrial use.

The automotive sector is influencing new material preferences. Lightweight and durable calendered sheets are increasingly used in interior trims, flooring, and insulation layers. This trend accelerates innovation in resin formulations engineered for high performance.

Drivers

Rising Demand for High-Performance Polymer Sheets Drives Market Growth

The calendering resins market is steadily expanding as industries look for stronger, smoother, and more durable polymer sheets. Manufacturers in packaging, automotive, and construction prefer calendered products because they provide consistent thickness and excellent surface finish. This rising industrial demand acts as a major growth driver.

- Calendering resins help companies meet these needs without raising production complexity. This shift enhances market visibility globally. The same EU guidance also requires that at least 55% of the reduction in average primary energy use is achieved through renovating the worst-performing buildings.

Growing consumption of PVC and specialty resins also supports market expansion. These materials offer flexibility, chemical resistance, and broad usability. As manufacturers upgrade equipment and seek efficient processing techniques, calendering resins become essential to improving output quality and reducing defects.

Restraints

High Production Costs Limit Wider Market Adoption

The biggest restraint for the calendering resins market is the high cost of production. Premium raw materials, energy-intensive processes, and frequent equipment maintenance make manufacturing expensive. These higher costs discourage small and mid-scale producers from expanding their operations.

Another challenge comes from price fluctuations in resin feedstocks. Petrochemical-based raw materials are highly sensitive to global supply-demand cycles and geopolitical instability. Sudden price jumps increase the overall production cost and reduce manufacturers’ profit margins, slowing down market growth.

Environmental regulations also act as a restraint, especially in regions with strict emission policies. Calendering processes require high heat and sometimes use additives that must meet new sustainability standards. Complying with regulations requires additional investments, increasing operational burdens for producers.

Growth Factors

Growing Need for Sustainable and Recyclable Polymer Sheets Creates New Opportunities

A major opportunity for the calendering resins market lies in the rising shift toward sustainable and recyclable materials. Many industries aim to reduce plastic waste and adopt eco-friendly alternatives. This encourages manufacturers to develop greener resin formulations suited for calendering.

- Another opportunity emerges from the fast-growing packaging industry. With rising demand for flexible and durable packaging solutions, calendered sheets are becoming more relevant. The same VinylPlus data also notes recycled volumes represented about 24.3% of the total PVC waste generated across the EU-27 plus Norway, Switzerland, and the UK, which signals a scaling supply chain rather than pilot volumes.

The electrical and electronics sector offers additional growth potential. Calendered polymer sheets are used for insulation, protective layers, and decorative panels. As global electronics production increases, demand for specialty resins with heat and chemical resistance also rises.

Regional Analysis

North America Dominates the Calendering Resins Market with a Market Share of 46.2%, Valued at USD 3.8 Billion

North America leads the global calendering resins market, driven by strong demand from construction, automotive interiors, and high-performance packaging applications. The region’s advanced manufacturing ecosystem and continuous shift toward rigid and flexible PVC materials support market expansion. The presence of large-scale production facilities and sustainability-focused investments keeps North America ahead, maintaining its dominant 46.2% share worth USD 3.8 billion.

Europe shows steady growth with rising adoption of eco-friendly and recyclable calendered materials in industrial and consumer applications. The region benefits from strict environmental regulations that push manufacturers toward low-VOC and sustainable resin systems. Demand from automotive OEMs and premium construction solutions continues to support long-term market stability.

Asia Pacific is emerging as one of the fastest-growing regions, supported by rapid industrialization, expanding infrastructure, and strong packaging demand. Countries such as China, India, and Southeast Asia are investing heavily in polymer-processing technologies. The availability of low-cost raw materials and growing domestic manufacturing further accelerates market penetration.

The Middle East & Africa region demonstrates gradual growth, primarily driven by infrastructure development, construction expansion, and rising industrial manufacturing. Demand for durable calendered films and sheets is increasing across packaging and building applications. Government-led diversification initiatives also support new polymer processing capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Calendering Resins Market in 2025 continues to advance as manufacturers respond to rising demand across construction materials, automotive interiors, synthetic leather, and high-strength packaging films. Eastman Chemical Company maintains a strong position by expanding its portfolio of specialty polymers, particularly film-grade additives and engineered resins that enhance melt behavior, clarity, and surface quality in calendered products.

Formosa Plastics Corporation remains one of the most influential contributors due to its extensive PVC production capacity, ensuring a stable supply for companies reliant on suspension-grade resin for calendering. Its materials offer consistent viscosity control and thermal stability, enabling manufacturers to achieve reliable output in flooring, wallcovering, and industrial sheeting.

Westlake Corporation strengthens the market landscape through advancements in PVC resin technologies designed for superior elasticity, durability, and dimensional precision. The company’s commitment to energy-efficient production and material performance enables downstream users to optimize calendering lines while maintaining cost-effective manufacturing.

Occidental Petroleum Corporation continues to play a key role through its fully integrated vinyls chain, providing high-purity PVC resins that support demanding calendering operations. Its internal integration from feedstock to resin ensures security of supply, which is particularly valuable for producers of construction films, non-rigid sheets, and technical laminates.

Top Key Players in the Market

- Eastman Chemical Company

- Formosa Plastics Corporation

- Westlake Corporation

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd.

- Avery Dennison Corporation

- Covestro AG

- Reliance Industries Limited

- LG Chem

- SK Chemicals

Recent Developments

- In 2025, Eastman will focus on advancements in molecular recycling technologies and sustainable plastics, including carbon renewal and polyester renewal processes that incorporate waste plastics (Polyester carpet, rejected mechanical recycling waste, colored strapping, and bottles) to produce “Renew” branded polyester products.

- In 2025, Formosa Plastics Corporation, U.S.A., commissioned the largest horizontal polypropylene reactor in North America at its facility, enhancing production capacity for polypropylene resins used in plastics applications. Westlake strengthened its global compounds portfolio through the acquisition of the ACI Compounding Solutions Business, expanding capabilities in compounded resins and plastics.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Billion Forecast Revenue (2034) USD 12.6 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (PVC Calendering Resins, ABS Calendering Resins, PP Calendering Resins, PS Calendering Resins, Others), By Form (Liquid, Solid, Powder, Granular, Others), By Application (Flooring, Wallcovering, Automotive Parts, Packaging, Others), By End-User (Building and Construction, Automotive, Packaging, Consumer Products, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Eastman Chemical Company, Formosa Plastics Corporation, Westlake Corporation, Occidental Petroleum Corporation, Shin-Etsu Chemical Co., Ltd., Avery Dennison Corporation, Covestro AG, Reliance Industries Limited, LG Chem, SK Chemicals Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Calendering Resins MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Calendering Resins MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Eastman Chemical Company

- Formosa Plastics Corporation

- Westlake Corporation

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd.

- Avery Dennison Corporation

- Covestro AG

- Reliance Industries Limited

- LG Chem

- SK Chemicals