Global Calcium Hypochlorite Market By Process(Calcium Process, Sodium Process), By Form(Powder, Granular, Pellets), By Application(Detergent, Agrochemicals, House Cleaners, Water Treatment, Pools and Spas, Others, Food and Beverages, Textile, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 15722

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

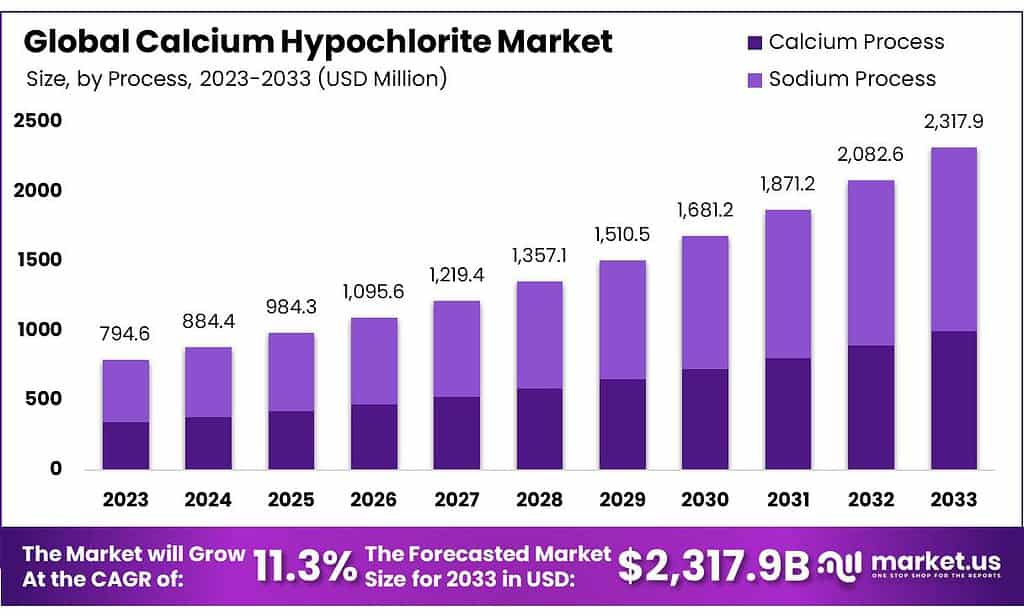

The Calcium Hypochlorite Market size is expected to be worth around USD 2317.9 Million by 2033, from USD 794.6 Mn in 2023, growing at a CAGR of 11.3% during the forecast period from 2023 to 2033.

This market is driven by rising demand for products in various end-user markets, including detergents, cleaning products, food & beverage, pulp & papers, water treatment, and other related applications. These applications use the product to disinfect and purify their systems effectively.

Consumers are becoming more aware of the importance of maintaining hygiene and quality in products, which drives product demand. It is used in offices, hospitals, and homes to kill bacteria or viruses. It is widely used to purify water.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth Projection: The Calcium Hypochlorite Market is expected to surge to approximately USD 2317.9 Million by 2033, from its standing at USD 794.6 Mn in 2023, indicating a remarkable CAGR of 11.3% during 2023-2033.

- Market Drivers: Demand Surge Rising demand across multiple sectors like detergents, cleaning products, food & beverage, pulp & paper, and water treatment propels market growth.

- Forms: Powder leads (36.8%) owing to its versatility; granular form highly effective in water disinfection

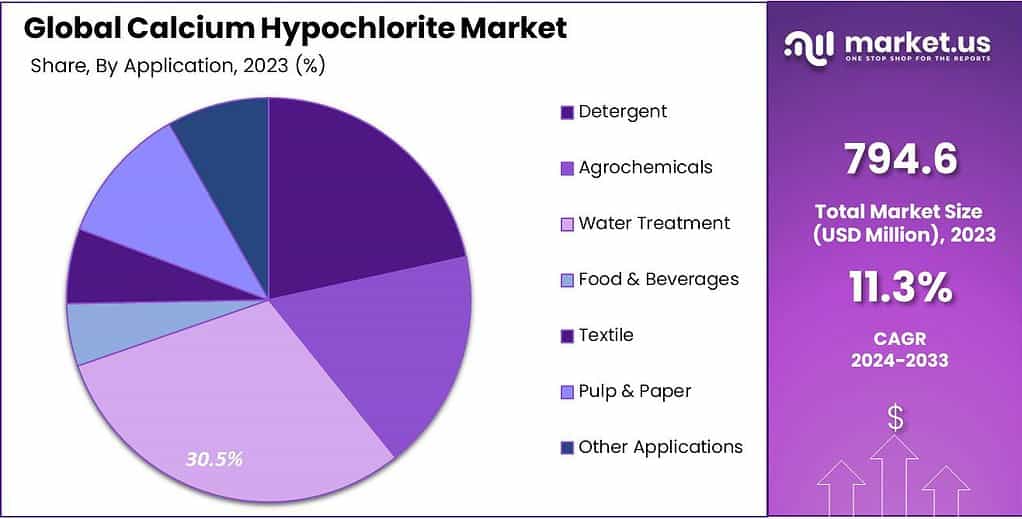

- Applications: Water Treatment (30.5%) and Detergent use stand out, while other sectors like pools & spas, food & beverage, textiles, and pulp & paper contribute significantly.

- Processes: Dominance of the Sodium Process (56.9%) due to efficiency, but the Calcium Process is also widely used, especially in water treatment applications.

- Market Challenges: Safety Concerns: Handling and storing Calcium Hypochlorite poses safety challenges, leading to increased operational costs and regulatory burdens.

- Market Opportunities: Water Treatment Focus Increasing global emphasis on efficient water treatment and sanitation provides growth avenues

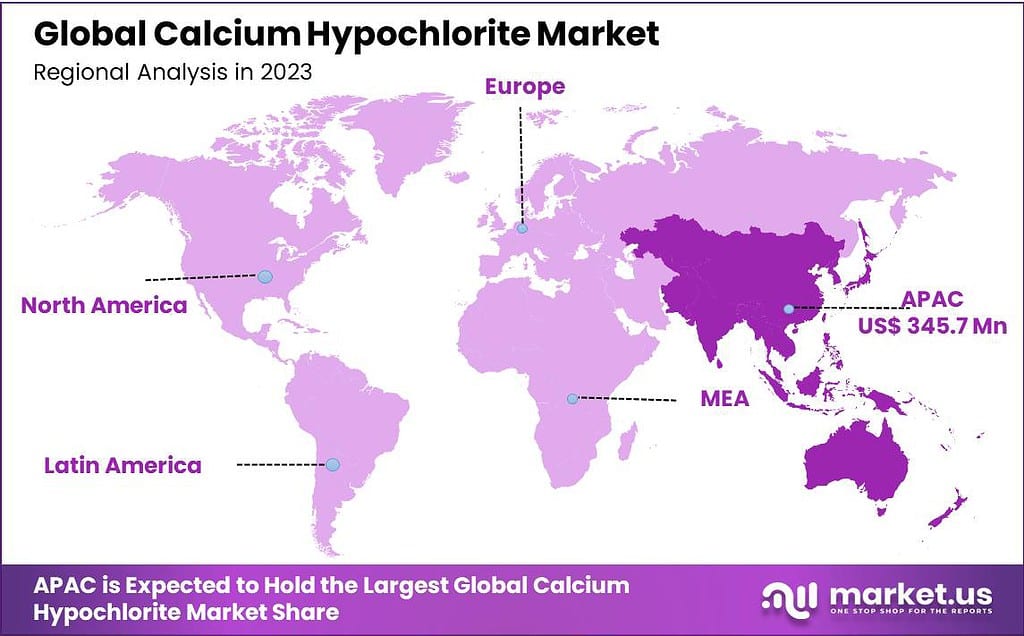

- Regional Analysis: Asia Pacific Leads the Highest revenue share in 2023, with the fastest CAGR, driven by demand in sectors like water treatment, cleaning products, and agrochemicals.

- Key Players: Market players striving for innovation and market expansion; significant initiatives by established players like Hawkins Chemical, Aditya Birla Chemicals, and Sinopec.

Process Analysis

In 2023, the Sodium Process led the way in the calcium hypochlorite market, holding a significant 56.9% share. This method involves sodium as a key element in the production process. It’s preferred due to its efficiency and high-quality output.

It can be made from both the sodium and calcium processes. These processes differ because chlorine has greater thermal stability than calcium hypochlorite. Calcium hypochlorite is made from the calcium process and is used primarily for bleaching cloths, fiber, wood pulp, silk, and other fabrics.

The sodium process product is used extensively in environments with higher water quality, such as disinfection and swimming pools. It is kept in steel drums or plastic bags, with a plastic bag inside. This packaging is less likely to be decomposed and more leak-proof.

The sodium process works in the same way as the calcium process. It is used for water treatment, sanitation, and aquaculture applications. The calcium process products are also widely used in water treatment applications to promote aquaculture and epidemic prevention. Water treatment applications increasingly use calcium hypochlorite from the calcium process, leading to faster segment growth.

Form Analysis

In 2023, Powder emerged as the frontrunner in the calcium hypochlorite market, securing a substantial 36.8% share. This form is favored for its versatility and ease of use across various applications, driving its dominance in the market.

This explains the high share. It combines calcium chloride and lime and is also known as chlorine or bleach powder. It is used in water treatment and bleaching. It can also be used in bleaching powders for bleaching cotton and linen.

To disinfect water, granular calcium hypochlorite can be used. It is a strong disinfectant that kills 99.8% of microorganisms, including bacteria and viruses. Potable water is also made safe and clean by it. You can also purchase it in tablet or pellet form around the globe. This product form is easy to use and safe, which will help boost segment growth in the forecasted period.

Application Analysis

In 2023, Water Treatment took the lead in the calcium hypochlorite market, securing a significant 30.5% share. This sector relies heavily on calcium hypochlorite for its effective disinfection properties in purifying water for various purposes.

Detergent applications followed closely behind, holding a substantial market share. Calcium hypochlorite’s role in enhancing cleaning efficiency within the detergent industry contributed to its notable presence in this segment.

It is used as a sanitizer in tanks to prevent mold growth. It is used in many dishwashing products, including bleaches, scouring powders, and dishwashing compounds. Because it contains more chlorine than any other substitute, its use in house cleaners is increasing rapidly.

It is used in higher amounts to disinfect and sanitize swimming pools. These factors drive the pool & spas market demand. It can also disinfect water treatment plants smaller than those equipped with gas chlorination equipment. It is useful in controlling algae growth in water treatment plants.

Because it is an economical and reliable sanitizing device that maintains the quality and taste of carbonated beverages, the product demand in the food and beverage industry is increasing. It can also prevent and disinfect wineries and maintain the product’s quality. It is used in the textile industry as a bleaching agent. It removes impurities from the linen and surfaces of equipment. It is used widely in the textile industry because it is safer than sodium hypochlorite and is a possible substitute for calcium hypochlorite.

Actual Numbers Might Vary in the Final Report

Key Market Segments

By Process

- Calcium Process

- Sodium Process

By Form

- Powder

- Granular

- Pellets

By Application

- Detergent

- Agrochemicals

- House Cleaners

- Water Treatment

- Pools & Spas

- Others

- Food & Beverages

- Textile

- Pulp & Paper

- Others

Drivers

The calcium hypochlorite market is being propelled by several key drivers that are shaping its growth trajectory. One of the primary factors is the increasing demand for clean water across various industries and for domestic purposes.

The need for effective water treatment solutions to ensure safe drinking water, wastewater treatment, and sanitation practices in industries like municipal water treatment, manufacturing, and healthcare is a significant driver. Calcium hypochlorite’s effectiveness as a disinfectant and its ability to eliminate contaminants contribute to its rising demand in the water treatment sector.

Another driving force is the expanding applications of calcium hypochlorite across diverse industries. Its use in the production of various chemicals, detergents, and agrochemicals underscores its versatility. Moreover, its role in maintaining hygiene standards in the food and beverage industry and its significance in the textile, pulp & paper industries further drive market growth.

The emphasis on public health and hygiene, especially amplified by global health crises, acts as a catalyst for the calcium hypochlorite market. Heightened awareness regarding the importance of disinfection and sanitization in healthcare facilities, hospitality, and households fuels the demand for calcium hypochlorite-based products.

Technological advancements and innovations in manufacturing processes also fuel market expansion. A range of research and development initiatives geared at increasing efficiency, safety, and cost-effectiveness in calcium hypochlorite production positively influence market expansion.

Calcium hypochlorite-based solutions have become an integral component of modern water treatment due to stringent regulations imposed by governments globally that govern water quality, sanitation, and hygiene practices. The cumulative effect of these drivers signifies a robust trajectory for the calcium hypochlorite market, with sustained demand across various industries, driven by the critical need for effective disinfection, sanitation, and water treatment solutions.

Restraints

The calcium hypochlorite market, despite its promising growth prospects, faces certain restraints that temper its expansion. One of the significant challenges revolves around safety concerns associated with handling and storing calcium hypochlorite.

As a strong oxidizing agent, it requires careful handling to prevent accidents or mishaps, necessitating specialized storage and transportation methods. These safety requirements increase operational costs and regulatory compliance burdens for manufacturers and users alike, which can hinder market growth.

Environmental considerations also pose challenges to the calcium hypochlorite market. The by-products generated during its use, such as chlorinated organic compounds, raise environmental concerns due to their potential adverse impact on ecosystems and human health.

Stricter environmental regulations and the need for sustainable, eco-friendly alternatives drive efforts to explore and adopt greener disinfection technologies, which could limit the growth of calcium hypochlorite in certain applications.

Market volatility in raw material prices, particularly for chlorine and calcium hydroxide, influences the overall production cost of calcium hypochlorite. Fluctuations in these raw material costs can affect the profitability of manufacturers and subsequently impact product pricing, potentially restraining market growth.

The emergence of alternative disinfection and water treatment technologies poses a challenge to the calcium hypochlorite market. Competing solutions that offer similar or improved disinfection efficacy, lower safety risks, or reduced environmental impact might divert market share away from calcium hypochlorite-based products.

The stringent regulations and standards imposed by governing bodies, while driving market demand, also pose a challenge. Compliance with evolving regulatory frameworks demands continuous investment in research and development to meet updated standards, which could strain smaller manufacturers or lead to product reformulations, impacting market dynamics.

Addressing these restraints requires concerted efforts by industry stakeholders to innovate safer handling practices, develop more environmentally friendly formulations, manage raw material costs, and invest in research for sustainable alternatives. Overcoming these challenges will be crucial in sustaining the growth momentum of the calcium hypochlorite market amidst evolving market dynamics and demands.

Opportunities

The calcium hypochlorite market presents several compelling opportunities that pave the way for its continued expansion and diversification. One significant avenue lies in the escalating global focus on water treatment and sanitation.

With growing populations and increasing industrialization, the demand for efficient and reliable water treatment solutions continues to surge. Calcium hypochlorite’s efficacy in disinfection and its ability to address waterborne diseases position it as a key player in meeting these pressing needs.

Due to increasing public concern and awareness surrounding hygiene and sanitation issues caused by global health crises, calcium hypochlorite-based products present an ideal opportunity for growth. Their role in upholding rigorous hygiene standards across sectors like healthcare, hospitality and households makes this an attractive growth prospect.

The expanding applications of calcium hypochlorite in diverse industries offer avenues for market penetration and product innovation. Industries such as agriculture, where calcium hypochlorite is used in agrochemicals for crop protection and soil treatment, represent untapped potential for market growth.

Additionally, the food and beverage industry’s increasing focus on hygiene and safety standards augurs well for calcium hypochlorite adoption in disinfecting and preserving food products.

Technological advancements present an opportunity for innovation within the calcium hypochlorite market. Research and development efforts aimed at enhancing the product’s safety, efficiency, and sustainability could unlock new applications and markets.

Innovations in manufacturing processes that reduce environmental impact, improve product stability, or streamline handling procedures can bolster market competitiveness.

Calcium hypochlorite-based solutions have gained prominence due to increasingly stringent regulations regarding water quality, sanitation, and disinfection. Their compliance with evolving standards opens new avenues of market expansion as industries search for reliable disinfection methods that adhere to changing standards.

Harnessing these opportunities requires collaboration among industry stakeholders, who must combine efforts in research and development, market outreach expansion, and sustainable solution creation. By capitalizing on emerging trends and meeting evolving market needs, the calcium hypochlorite market stands poised for significant expansion and diversification.

Challenges

The calcium hypochlorite market encounters several challenges that impede its seamless growth. One of the foremost hurdles is the stringent safety requirements associated with handling and storing calcium hypochlorite.

Its potent oxidizing properties necessitate careful handling to prevent accidents, which calls for specialized storage, transportation, and usage protocols. Meeting these safety standards adds operational complexities and costs for manufacturers and end-users, posing a significant challenge to widespread adoption.

Environmental concerns also pose a challenge to the calcium hypochlorite market. The by-products resulting from its use, such as chlorinated organic compounds, raise environmental alarms due to their potential adverse effects on ecosystems and human health.

Stricter environmental regulations and the increasing demand for sustainable alternatives drive the exploration of greener disinfection technologies, posing a challenge to the market’s growth. Raw material price volatility, particularly chlorine and calcium hydroxide prices, directly impacts production costs for calcium hypochlorite production. Fluctuations in these raw material costs can drastically impact profitability as well as product pricing – creating further instability within markets.

The emergence of alternative disinfection and water treatment technologies presents a competitive challenge for calcium hypochlorite. Technologies offering similar or enhanced disinfection efficacy, lower safety risks, or reduced environmental impact can divert market share away from calcium hypochlorite-based products.

The demanding regulatory landscape, while driving market demand, also presents challenges. Adhering to evolving regulatory standards requires ongoing investment in research and development to meet updated requirements. This continuous adaptation can strain smaller manufacturers or necessitate product reformulations, impacting market dynamics.

Overcoming these challenges demands collaborative efforts among industry stakeholders to innovate safer handling practices, develop more environmentally friendly formulations, manage raw material costs, invest in research for sustainable alternatives, and enhance product efficacy. Addressing these challenges effectively will be pivotal in ensuring the sustained growth and relevance of the calcium hypochlorite market amidst evolving market dynamics and demands.

Regional Analysis

The Asia Pacific had the highest revenue share of 43.5% in 2023. It is expected to grow at the fastest CAGR between 2023 and 2032. Asia Pacific’s market will be driven by the growing demand from end-use sectors such as water treatment, cleaning products, and agrochemicals. calcium hypochlorite Market growth will also be supported by the increasing use of products in industrial applications in countries like China, Japan, and India.

The forecasts for North America show significant growth. Product demand is aided by the increasing number of American households with swimming pools. The North American market is also being driven by the rapid growth of the product demand for textile and disinfectant applications in Canada and Mexico.

Due to the increasing use of water treatment plants to disinfect drinking water, the U.S. sees increased product demand. Agrochemicals have seen positive changes in Central & South America due to the rising demand for land management and increased food productivity.

Due to increasing product demand in the disinfectants and household segments, Europe’s market is growing rapidly. The region is also seeing an increase in the use of products to purify drinking water. Market growth is expected to be driven by increasing water treatment system product consumption.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Market players continue to take new initiatives to improve product quality and strengthen their global market position. New manufacturers are being attracted to the market by rising product demand. To gain significant market share, existing manufacturers are expanding into new markets.

Market Key Players

- Hawkins Chemical, Inc.

- Aditya Birla Chemicals

- Sigura

- Sinopec

- Westlake Chemical Corp.

- American Elements

- Haviland USA

- Tosoh Corp.

- Nippon Soda Co. Ltd

- Other Key Players

Recent Developments

In February 2023, American Elements’ new division AE Fusion Energy in Los Angeles will add new production facilities to meet the growing demand for advanced materials used for research and scale production at their fusion energy partner customers. Production of certain high-purity oxides, stable isotopes, refractory metals and alloys, high-temperature ceramics, laser crystal raw materials and molten salts will increase through this division; currently, these materials can be found inside Tokamaks and other fusion reaction assemblies.

Report Scope

Report Features Description Market Value (2023) US$ 794.6 Mn Forecast Revenue (2033) US$ 2317.9 Mn CAGR (2023-2032) 11.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Process(Calcium Process, Sodium Process), By Form(Powder, Granular, Pellets), By Application(Detergent, Agrochemicals, House Cleaners, Water Treatment, Pools & Spas, Others, Food & Beverages, Textile, Pulp & Paper, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Hawkins Chemical, Inc., Aditya Birla Chemicals, Sigura, Sinopec, Westlake Chemical Corp., American Elements, Haviland USA, Tosoh Corp., Nippon Soda Co. Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is calcium hypochlorite?Calcium hypochlorite is a chemical compound used for water treatment and disinfection. It's a solid substance, often found in powder or tablet form, and contains chlorine that helps kill bacteria, viruses, and algae in water.

Where is calcium hypochlorite used?It's commonly used for disinfecting swimming pools, treating drinking water, wastewater treatment, and sanitizing surfaces in various industries like healthcare and food processing.

How does calcium hypochlorite work for water treatment?When added to water, calcium hypochlorite releases chlorine, which acts as a powerful disinfectant. It kills harmful microorganisms by oxidizing them, making water safe for drinking or recreational use.

Where can calcium hypochlorite be sourced?It's available through chemical suppliers, water treatment companies, and distributors specializing in sanitation and disinfection products. It's often sold in bulk quantities for industrial use or in smaller quantities for residential pool maintenance.

Calcium Hypochlorite MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Calcium Hypochlorite MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Hawkins Chemical, Inc.

- Aditya Birla Chemicals

- Sigura

- Sinopec

- Westlake Chemical Corp.

- American Elements

- Haviland USA

- Tosoh Corp.

- Nippon Soda Co. Ltd

- Other Key Players