Global Caffeinated Beverage Market Size, Share, And Business Benefits By Product (Carbonated Soft Beverage, Energy Beverage, RTD Tea and Coffee, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Retail, Specialty Store, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158365

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

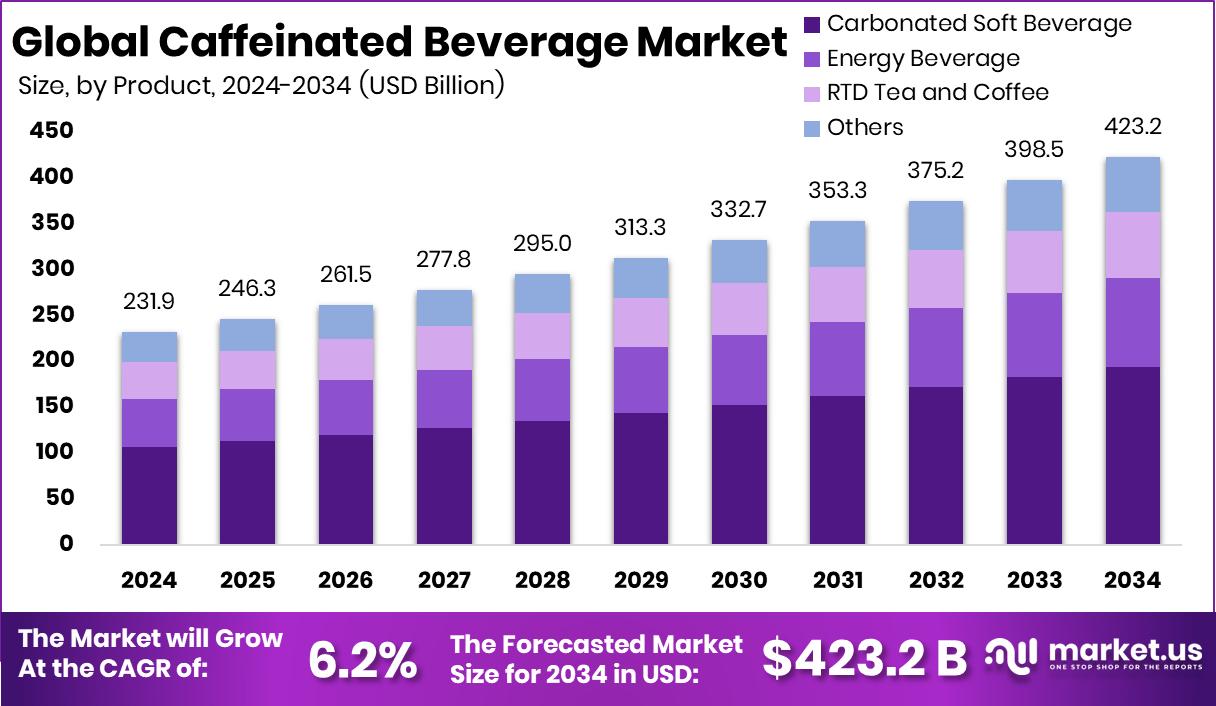

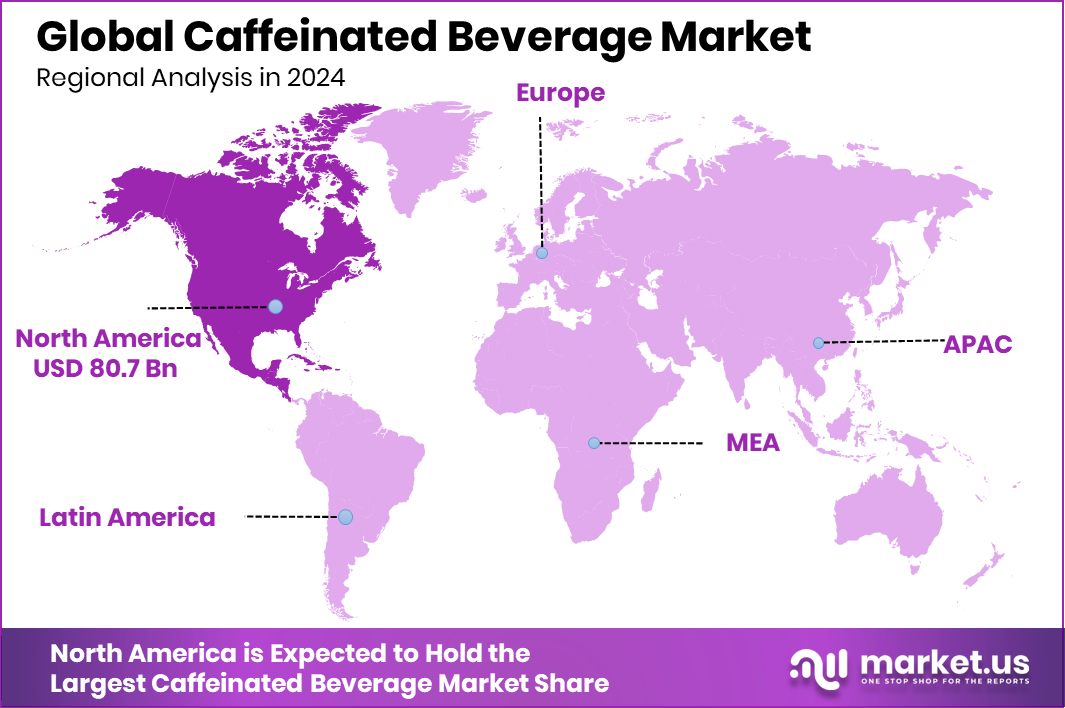

The Global Caffeinated Beverage Market is expected to be worth around USD 423.2 billion by 2034, up from USD 231.9 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. North America dominated with 34.80% market contribution, achieving USD 80.7 Bn in caffeinated beverage revenue.

Caffeinated beverages are drinks that contain caffeine, a natural stimulant most commonly found in coffee beans, tea leaves, and cacao plants. These beverages include coffee, tea, energy drinks, and sodas, all of which are consumed widely to boost alertness and reduce fatigue. Over the years, they have become a part of daily routines, serving not just as a source of energy but also as a cultural and social ritual in many regions.

The caffeinated beverage market refers to the global industry built around producing, distributing, and selling caffeine-based drinks. This market is driven by consumer preferences for convenience, functional benefits, and lifestyle habits. Increasing investments and funding have also contributed to its expansion. For example, Artha Venture Fund invested Rs 1.25 Cr in tea startup Haazri, while India’s Chai Kings secured $3m to expand outlets, showing strong investor interest in this sector.

One of the key growth factors is rising consumer demand for quick energy solutions amid busy lifestyles. Young professionals, students, and shift workers increasingly rely on caffeinated drinks to maintain focus and stamina. This habit, supported by cultural acceptance, continues to push demand upward.

Opportunities in the market are further strengthened by innovation and localized approaches. For instance, Croft Beverages secured $125K pre-seed funding to empower small tea farmers, highlighting a trend toward ethical sourcing and farmer-focused initiatives. Such moves open doors for niche offerings and healthier caffeine alternatives.

Moreover, governments and regions are also recognizing the value of this industry. Ontario welcomed a $33.4 million investment in Mississauga manufacturing, strengthening production capacity and supply chains. With urbanization, rising disposable incomes, and a growing youth population, the caffeinated beverage market is positioned for steady growth worldwide.

Key Takeaways

- The Global Caffeinated Beverage Market is expected to be worth around USD 423.2 billion by 2034, up from USD 231.9 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, Carbonated Soft Beverages captured 45.8% share in the Caffeinated Beverage Market globally.

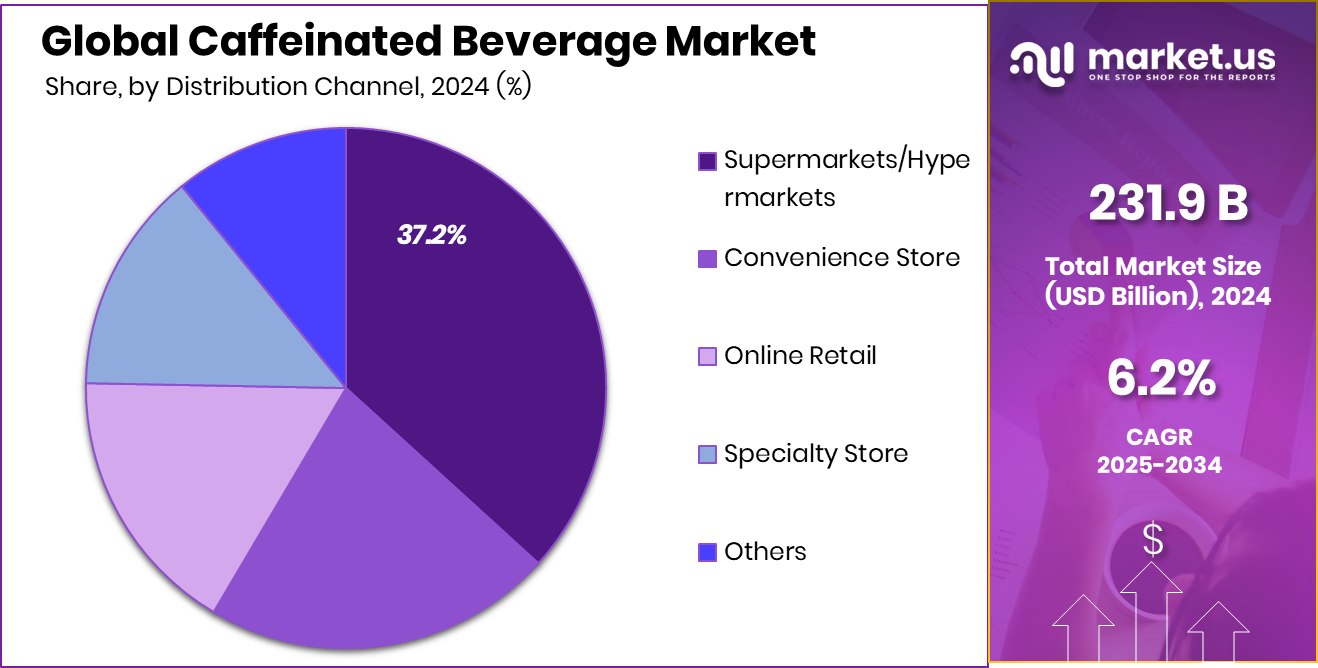

- Supermarkets and hypermarkets led distribution with a 37.2% share, making them dominant channels for the Caffeinated Beverage Market.

- Strong consumer demand in North America drove caffeinated beverage sales to 34.80%, totaling USD 80.7 Bn.

By Product Analysis

Carbonated Soft Beverage held 45.8% of the caffeinated beverage market.

In 2024, Carbonated Soft Beverage held a dominant market position in By Product segment of the Caffeinated Beverage Market, with a 45.8% share. This leadership reflects the widespread consumer preference for refreshing, ready-to-drink options that combine caffeine with fizzy flavors. The category benefits from its long-standing popularity, easy availability, and affordability across both urban and rural areas. Increasing youth consumption, driven by lifestyle trends and a growing café culture, continues to fuel its demand.Moreover, investments in production facilities and outlet expansion have further supported its market strength. With its strong hold on consumer loyalty and consistent innovation in taste profiles, Carbonated Soft Beverages are set to remain a key driver of the caffeinated beverage industry.

By Distribution Channel Analysis

Supermarkets/hypermarkets led with 37.2% in the caffeinated beverage market.

In 2024, Supermarkets/Hypermarkets held a dominant market position in By Distribution Channel segment of the Caffeinated Beverage Market, with a 37.2% share. This dominance is largely attributed to the wide product variety, attractive promotions, and bulk purchasing options that these outlets provide. Consumers prefer supermarkets and hypermarkets for their convenience of one-stop shopping, where caffeinated beverages are easily accessible alongside other daily essentials. The organized retail environment also allows for effective product placement, visibility, and seasonal campaigns that boost sales.

Additionally, rising urbanization and the expansion of large-format retail chains across both developed and emerging regions continue to strengthen this channel’s influence, making it the leading contributor to market growth within distribution networks.

Key Market Segments

By Product

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Store

- Online Retail

- Specialty Store

- Others

Driving Factors

Rising Demand Boosted by Strong Funding Support

One of the biggest driving factors in the caffeinated beverage market is the rising consumer demand for healthier and more exciting drink options, paired with strong financial backing from investors. People today want energy and focus, but also look for natural, clean-label drinks instead of traditional sodas. This change has encouraged new brands and startups to bring innovative caffeinated beverages into the market.

A good example is Chamberlain Coffee, which raised $7 million in funding to expand its product line and reach more customers. Such funding not only helps companies grow faster but also fuels the overall market by bringing fresh products and stronger competition. Together, rising demand and steady funding are powering strong growth in this sector.

Restraining Factors

Health Concerns and Regulations Limit Market Expansion

A key restraining factor in the caffeinated beverage market is the growing concern about health risks and strict regulations. While many people enjoy energy drinks, coffees, and sodas for a quick boost, doctors often warn about problems like anxiety, heart strain, and sleep issues linked to high caffeine intake. Governments in several countries are also tightening labeling rules and limiting caffeine content in certain products, which makes it harder for companies to expand freely.

Interestingly, even with these challenges, companies are still finding ways to innovate. For example, Botrista closed a $65 million Series C funding round led by Jollibee Food Corp, showing that investment continues, but businesses must balance innovation with consumer health and compliance.

Growth Opportunity

Expanding Into Specialty Tea and Coffee Markets

A major growth opportunity for the caffeinated beverage market lies in the rising popularity of specialty teas and coffees. Consumers are moving beyond regular sodas and instant drinks, seeking unique flavors, healthier options, and premium café-style experiences at home or on the go. This shift is opening doors for startups and retail chains that focus on authentic, high-quality beverages.

For example, Chai Kings, a tea retail chain in India, raised $1 million from The Chennai Angels and others to expand its outlets and strengthen its product range. Such funding highlights how regional tea and coffee brands can scale quickly. By focusing on specialty drinks, the market can reach new customers and capture long-term growth.

Latest Trends

Tech-Enabled Cafes and Ready-to-Drink Innovations Rise

One of the latest trends shaping the caffeinated beverage market is the blend of technology with consumer convenience. Cafes and beverage brands are using digital ordering, app-based loyalty programs, and cloud kitchens to serve customers faster while also expanding ready-to-drink (RTD) product lines for at-home use. Consumers today want café-quality drinks delivered easily, whether it’s a cold brew, flavored tea, or functional energy drink.

A strong example is Chaayos, which recently raised ₹414 crore in funding to expand its café network and hire more talent across India. This shows how technology-driven service and new RTD products are becoming a trend, making caffeinated beverages more accessible and personalized for today’s fast-moving lifestyle.

Regional Analysis

In 2024, North America captured a 34.80% share of the caffeinated beverage market, worth USD 80.7 Bn.

The Caffeinated Beverage Market shows varied performance across different regions, shaped by consumer behavior, lifestyle patterns, and distribution reach. North America emerged as the leading region, capturing 34.80% of the market with USD 80.7 billion in 2024, supported by strong demand for both carbonated soft drinks and energy-based beverages. The region benefits from high disposable incomes, a mature retail network, and a strong culture of daily caffeine consumption, particularly among working professionals and younger demographics.Europe follows with steady growth driven by health-conscious consumers opting for tea and coffee-based caffeine formats, while Asia Pacific presents significant expansion potential due to rapid urbanization and a young population adopting modern beverage habits.

Meanwhile, markets in the Middle East & Africa and Latin America are gaining traction, supported by rising awareness of functional drinks and greater availability through expanding supermarket and hypermarket chains. However, it is North America’s established consumption base, brand visibility, and innovative product launches that continue to solidify its top position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global caffeinated beverage market is strongly influenced by the strategic moves and product portfolios of Dr Pepper Snapple Group, Monster Beverage Corporation, and PepsiCo, Inc. Each of these companies demonstrates a distinct market approach, but all play a central role in shaping consumer preferences and expanding product categories within this sector.

Dr Pepper Snapple Group continues to leverage its heritage in soft drinks while diversifying into energy and flavored caffeinated beverages. Its wide distribution network across North America provides strong access to convenience stores and supermarkets, where impulse-driven purchases are most common. By balancing classic soda offerings with newer caffeine-based products, the group has preserved relevance among younger demographics.

Monster Beverage Corporation remains a key innovator in the energy drink category, driving growth through its highly recognizable branding and wide flavor variations. In 2024, the company has pushed harder into international markets, expanding its global footprint while tailoring formulations to local tastes. Its ability to sustain a loyal consumer base, particularly among younger, active, and lifestyle-driven segments, makes it a critical player in the caffeinated beverages landscape.

PepsiCo, Inc. combines the strength of global brand equity with its diverse product line. From carbonated colas to energy drinks and ready-to-drink coffees, PepsiCo leverages its scale and marketing strength to dominate shelf presence. In 2024, it has emphasized functional energy beverages that align with wellness trends, while still holding firm in mainstream caffeinated soda sales. Collectively, these three companies continue to define the competitive pace of the global caffeinated beverage market.

Top Key Players in the Market

- Dr Pepper Snapple Group

- Monster Beverage Corporation

- PepsiCo, Inc.

- Red Bull GmbH

- 5-hour ENERGY

- Rockstar, Inc.

- The Coco-Cola Company

- Starbucks Corporation

Recent Developments

- In July 2025, PepsiCo launched Pepsi Prebiotic Cola, available in Original Cola and Cherry Vanilla flavors. Each 12-oz can has about 30 calories, 5 grams of cane sugar, and 3 grams of prebiotic fiber

- In October 2024, Keurig Dr Pepper acquired a 60% stake in energy drink maker Ghost for US$990 million, with an option to buy the rest in 2028. Ghost will continue under its founders, and this move strengthens KDP’s position in energy drinks.

Report Scope

Report Features Description Market Value (2024) USD 231.9 Billion Forecast Revenue (2034) USD 423.2 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carbonated Soft Beverage, Energy Beverage, RTD Tea and Coffee, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Retail, Specialty Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dr Pepper Snapple Group, Monster Beverage Corporation, PepsiCo, Inc., Red Bull GmbH, 5-hour ENERGY, Rockstar, Inc., The Coca-Cola Company, Starbucks Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Caffeinated Beverage MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Caffeinated Beverage MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dr Pepper Snapple Group

- Monster Beverage Corporation

- PepsiCo, Inc.

- Red Bull GmbH

- 5-hour ENERGY

- Rockstar, Inc.

- The Coco-Cola Company

- Starbucks Corporation