Global Cable Assembly Market Size, Share, Industry Analysis Report By Product Type (Power cable assemblies, Data cable assemblies, Signal cable assemblies, Ribbon cable assemblies, Custom cable assemblies, Coaxial cable assemblies, Others), By Industry Vertical (Automotive, Telecommunications, Consumer Electronics, Aerospace & Defense, Healthcare, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156020

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

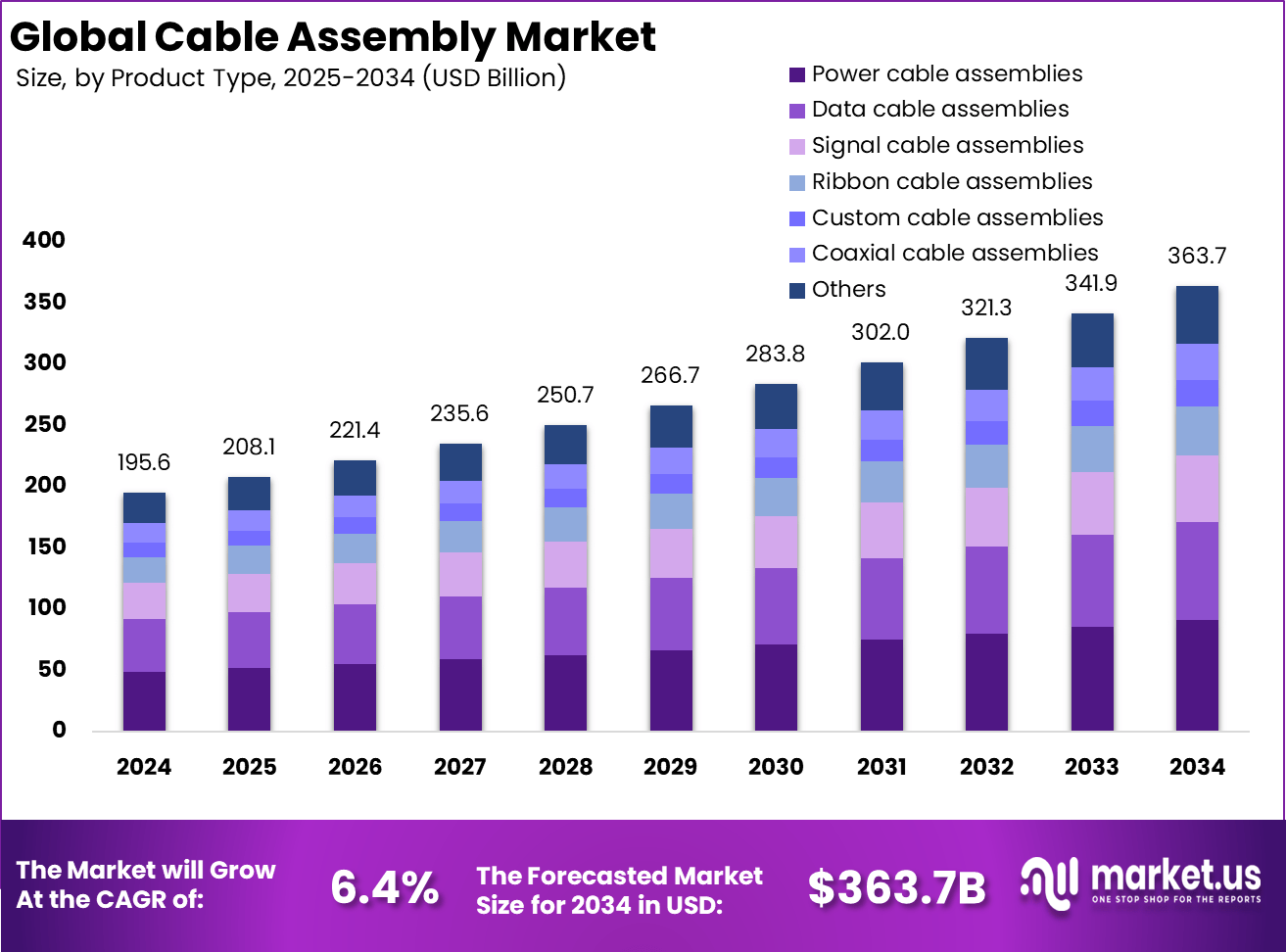

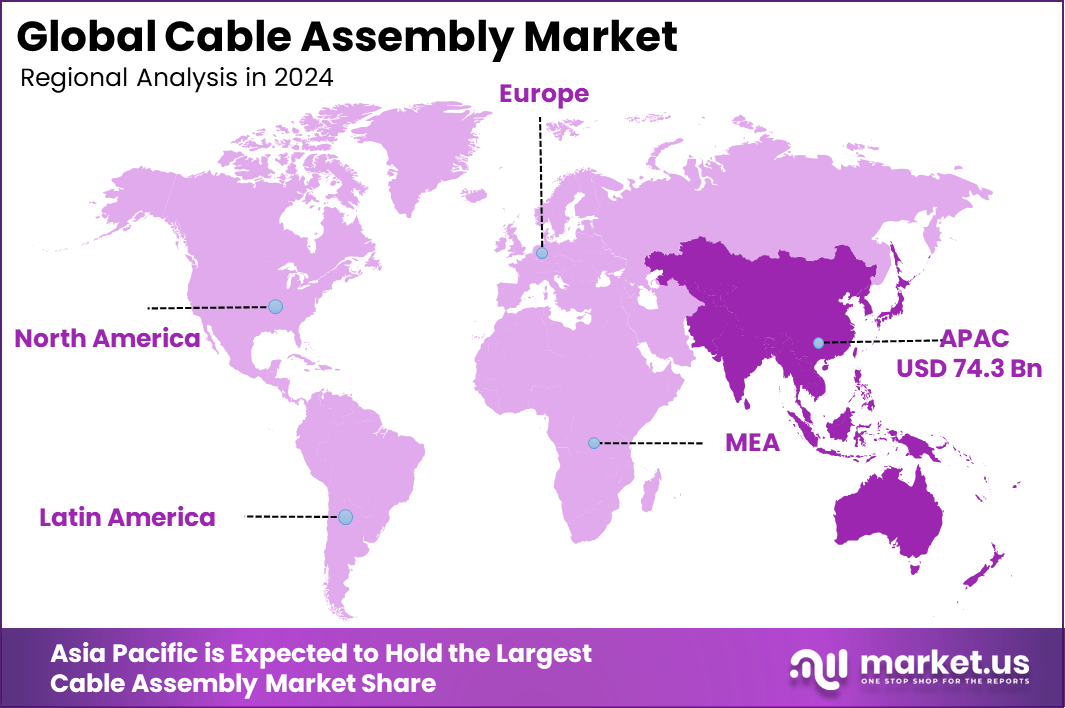

The Global Cable Assembly Market size is expected to be worth around USD 363.7 billion by 2034, from USD 195.6 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 74.3 Billion in revenue.

The Cable Assembly Market involves the manufacturing and supply of cable assemblies, which are combinations of cables, connectors, and other components designed to transmit power or data between different electronic devices. These assemblies are used widely across industries such as automotive, aerospace, telecommunications, healthcare, and consumer electronics, supporting connectivity and efficient communication in advanced systems.

One of the main drivers of this market is the growing demand for reliable connectivity solutions due to increasing automation and the proliferation of IoT-enabled devices. The expansion of 5G networks also plays a significant role by creating the need for high-performance cable assemblies capable of handling faster data transmission and higher bandwidth requirements.

For instance, In February 2025, A recent advancement in cable assembly automation is the development of a memory-updated-based framework for 100% reliable Flexible Flat Cable (FFC) insertion. This innovative approach addresses the challenges of aligning and inserting FFCs accurately, a task that has traditionally been difficult to automate due to its complexity and the need for precise feedback mechanisms.

Key Takeaway

- 25% share was captured by the Power Cable Assemblies segment, showing its critical role in industrial and commercial applications.

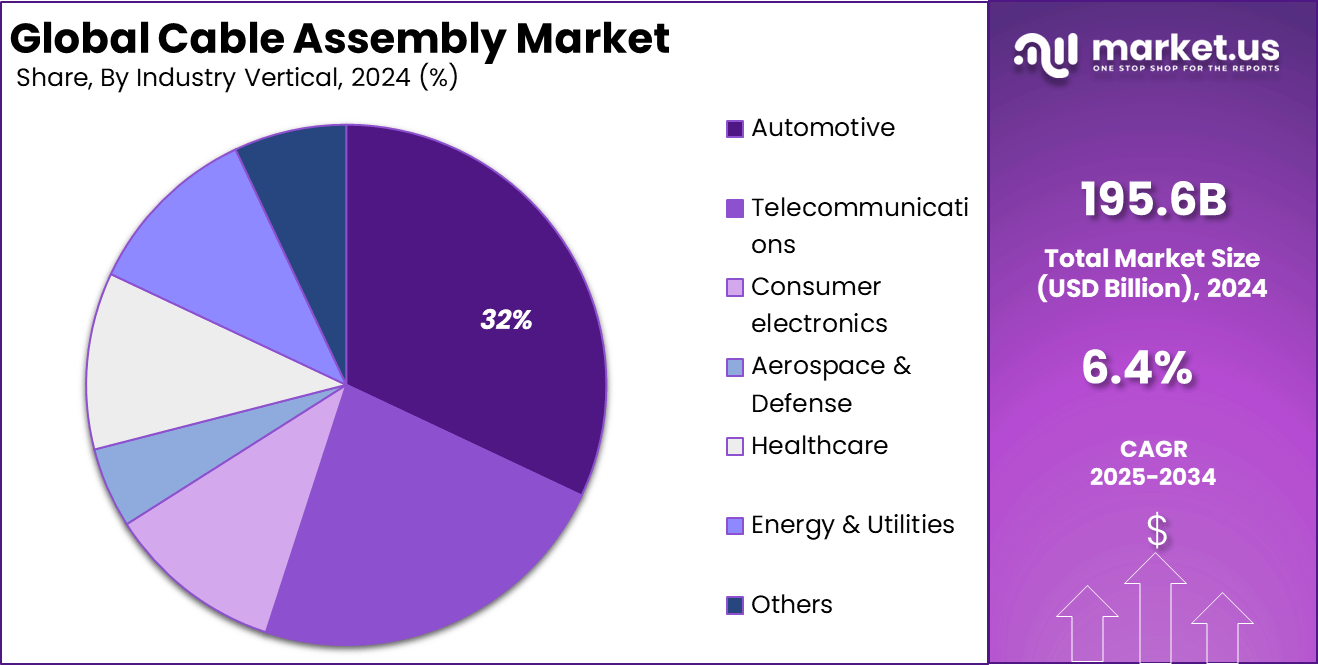

- 32% of the market came from the Automotive segment, driven by rising demand for electric vehicles and connected car technologies.

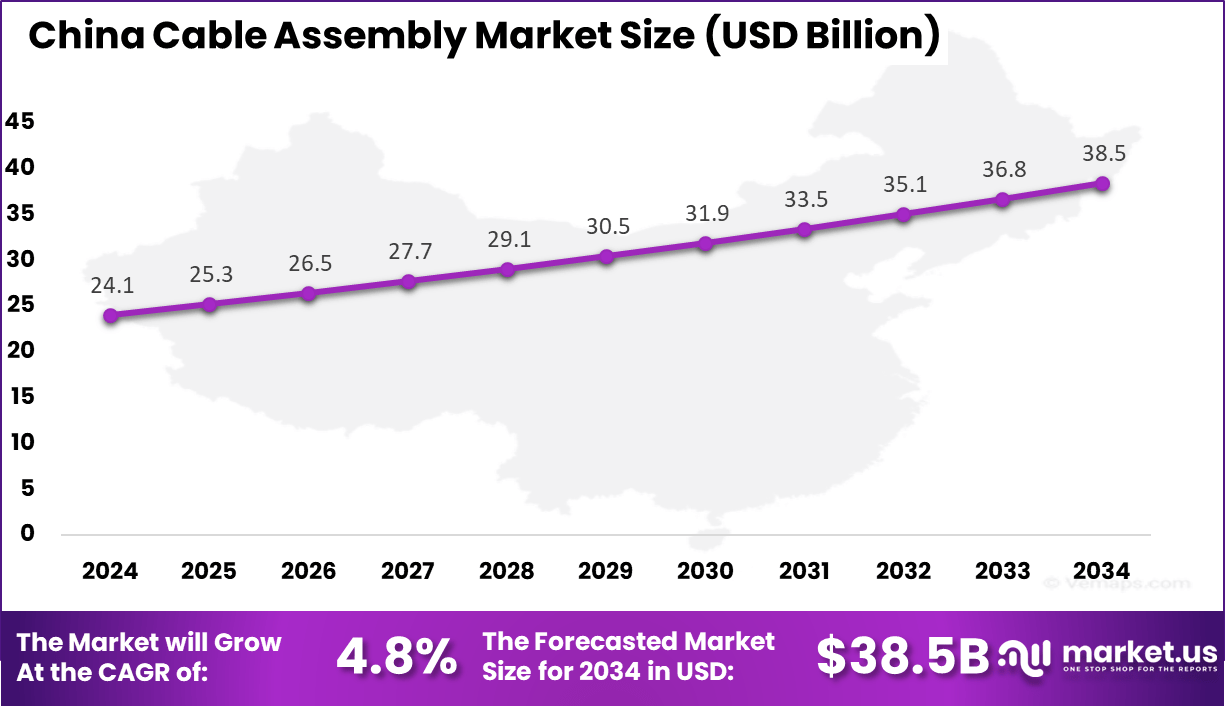

- The China Cable Assembly Market reached USD 24.1 Billion in 2024, supported by a steady 4.8% CAGR, reflecting its strong manufacturing base and export strength.

- Asia Pacific led the global market with 38% share, supported by large-scale electronics production, automotive growth, and expanding telecom infrastructure.

Investment and Business Value

Investment opportunities in this market are abundant, particularly in developing customized and high-performance cable assemblies for emerging technologies. Areas like electric vehicles, smart healthcare devices, and industrial automation are receiving increased focus. Also, regions like Asia Pacific, which have a strong electronics manufacturing base, present attractive growth chances.

Companies innovating in fiber optic and hybrid cable assembly technologies stand to benefit from the demand for faster, more reliable network infrastructure. Businesses utilizing cable assemblies gain efficiency through reliable interconnectivity that supports advanced system functionalities. The use of specialized cable assemblies reduces installation time, cuts maintenance costs, and improves system performance in critical applications.

The regulatory environment around cable assembly emphasizes quality standards and safety compliance, with several industry-specific regulations guiding manufacturing practices. Additionally, environmental and sustainability regulations are becoming more important, pushing for eco-friendly materials and processes. Compliance with these regulatory demands is essential to avoid risks and maintain market access, especially in regulated sectors like aerospace and healthcare.

China Cable Assembly Market Size

The market for Cable Assembly Market within China is growing tremendously and is currently valued at USD 24.1 billion and growing at a CAGR of 4.8%. The market for cable assemblies within China is growing tremendously due to several key factors.

Rapid industrialization and urbanization are driving significant investments in infrastructure, and telecommunications, including the aggressive rollout of 5G networks, expansion of data centers, and manufacturing, all of which require advanced and reliable cable assembly solutions. In January 2025, China announced plans to expand its 5G infrastructure by constructing more than 4.5 million base stations.

This large-scale rollout is intended to strengthen the country’s digital ecosystem, enabling growth in artificial intelligence, smart manufacturing, and other advanced technologies. The Ministry of Industry and Information Technology emphasized that both 5G and 6G innovation would remain strategic priorities, reinforcing China’s ambition to secure a leading role in the global digital economy while accelerating the adoption of next-generation solutions.

In 2024, Asia Pacific held a dominant market position in the global Cable Assembly Market, capturing more than a 38% share, holding USD 74.3 Billion in revenue. The Asia Pacific region, led by countries like China, India, and Japan, holds a dominant position in the global cable assembly market.

This dominance is due to rapid industrialization, urbanization, and significant investments in infrastructure, telecommunications, and renewable energy projects. The expansion of 5G networks and growing demand for consumer electronics fueled the need for advanced and high-performance cable assemblies.

For instance, In November 2024, the Asia Pacific region’s dominance in the cable assembly market was significantly supported by proactive government initiatives such as India’s ‘Make in India’ campaign. This Policy encourages domestic manufacturing, fostering local production of electronics and automotive sectors, which are major consumers of cable assemblies.

Product Type Analysis

In 2025, the Power Cable Assemblies segment held a dominant market position, capturing a 25% share of the Global Cable Assembly Market. This segment is in a dominant position due to the rising demand across power transmission, industrial automation, and infrastructure development projects.

It’s further fueled by increasing investments in the power sector, widespread urbanization, and the expansion of renewable energy initiatives, which require reliable and efficient energy transmission solutions. Power cable assemblies are important for electrical distribution in residential, commercial, and industrial applications, making them an important component of modern infrastructure.

For instance, In April 2025, China launched the General Purpose Media Interface (GPMI), a new cable standard created by the Shenzhen 8K UHD Video Industry Cooperation Alliance of over 50 companies. The GPMI Type-C cable delivers 96 Gbps bandwidth with 240W power, exceeding Thunderbolt 4, while the Type-B version supports up to 192 Gbps and 480W, enabling 8K video transmission and powering high-performance devices at the same time.

Industry Vertical Analysis

In 2025, the Automotive segment held a dominant market position, capturing a 32% share of the Global Cable Assembly Market. The automotive segment held a dominant market position due to the rapid adoption of electric vehicles (EVs), advancements in automotive electronics, and the integration of smart technologies.

The rising demand for electric vehicles (EVs), which require complex cable harnesses for power distribution, battery management, and charging systems, significantly fueled this growth. The increasing integration of advanced electronic systems in vehicles, including infotainment, safety features, and driver-assistance technologies, needs a greater volume and complexity of cable assemblies.

For instance, in 2025, Global Sources featured a gearbox wire harness designed for automotive applications. This custom wire harness is tailored to specific vehicle models, ensuring compatibility and optimal performance. Such specialized components are crucial for the seamless operation of modern vehicles, where precise electrical connections are essential for functions like transmission control and sensor integration.

Growth Drivers

Driver Description 5G Network Expansion Driving demand for high-speed data transmission cables and fiber optic assemblies Adoption of Electric Vehicles Increased cable needs for EVs and hybrids for battery management and infotainment systems IoT and Smart Device Growth Rising interconnectivity demands for sensors, controllers, and networking of devices Miniaturization & High Performance Technological trends necessitating compact, durable, and efficient cable solutions Automation & Robotics Industrial automation boosting demand for reliable cable assemblies Trends & Innovations

Trend Description Customized & Modular Assemblies Flexible designs to reduce installation time and cost Eco-friendly Materials Use of recyclable and sustainable materials responding to environmental regulations Advanced Manufacturing Techniques Automated assembly lines and 3D printing improving precision and production efficiency Higher Data Transmission Rates Innovation in cables supporting 10Gbps+ speeds for telecom and datacenter applications Increased Use of Hybrid Cables Combining fiber optic and copper cables for optimized performance and cost Key Market Segments

By Product Type

- Power cable assemblies

- Data cable assemblies

- Signal cable assemblies

- Ribbon cable assemblies

- Custom cable assemblies

- Coaxial cable assemblies

- Others

By Industry Vertical

- Automotive

- Telecommunications

- Consumer electronics

- Aerospace & Defense

- Healthcare

- Energy & Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Consumer Electronics

The growing use of consumer electronics, which includes smartphones, laptops, and smart home devices, drives the need for high-performance cable assemblies. These devices depend on reliable, fast, and efficient connectivity solutions, fueling steady demand.

As consumers increasingly adopt new technologies, manufacturers are pushed to develop advanced cable assemblies that support high-speed data transfer, durability, and compact form factors, especially in miniaturized electronics.

For Instance, In February 2025, DuPont raised its profit forecast as demand in the electronics sector, especially semiconductors for artificial intelligence, continued to strengthen. The announcement lifted its shares by 5% in premarket trading.

The company’s electronics and industrial unit reported a 10.6% rise in net sales for the fourth quarter, reflecting the rising need for electronic components such as cable assemblies in the fast-growing technology market.

Restraint

Competition from Alternative Technologies

Emerging technologies like wireless charging and fiber optics pose a significant challenge to traditional cable assemblies. As these alternatives offer convenience and high-speed data transmission, they could potentially replace cables, posing a significant threat to the cable assembly market’s future growth and demand.

For instance, In October 2024, Telecom Review Asia highlighted the significant role of national policies and projects in driving fiber optic expansion across the Asia-Pacific (APAC) region. Governments in countries like India, Japan, and South Korea are actively investing in broadband infrastructure to enhance digital access and economic growth.

Opportunities

Expansion Through 5G and IoT Integration

The global digital transformation and expansion of 5G and IoT technologies present opportunities for cable assembly manufacturers. Cable assemblies are critical for ensuring fast, secure, and low-latency data transmission in 5G infrastructure and IoT ecosystems.

Industries such as automotive, healthcare, and manufacturing are adopting these technologies, creating demand for custom, high-speed cable assemblies that support data-heavy applications and integrated smart devices. For instance, In January 2025, Siemens announced a significant expansion of its private 5G infrastructure, enhancing coverage for industrial applications.

The updated solution now supports up to 24 radio units, each covering approximately 5,000 m², allowing manufacturers to deploy scalable, high-performance connectivity tailored to their automation needs. This expanded solution is currently available in Germany, Sweden, the Netherlands, Switzerland, Denmark, Austria, and Brazil, with plans for broader availability in 2025.

Challenges

Fluctuating Raw Material Prices and Tariffs

Volatile prices of key materials like copper, coupled with tariffs (especially on Chinese imports), significantly increase production costs for cable assembly manufacturers. This cost instability impacts pricing strategies and narrows profit margins, particularly in highly competitive markets. Global trade tensions and uncertain supply chains exacerbate the problem, making it difficult for manufacturers to maintain consistent output or scale efficiently in tariffs.

For instance, In April 2025, President Donald Trump introduced a broad tariff policy that placed a 10% baseline duty on imports from 185 countries, with sharp increases for key trade partners. Goods from China were hit with a 145% tariff, combining a 125% reciprocal rate and an extra 20% duty on aluminum. Vietnam and Taiwan faced tariffs of 46% and 32%

Key Players Analysis

The Cable Assembly Market is dominated by global leaders such as Amphenol Corporation, TE Connectivity, and Prysmian Spa. These companies benefit from wide product portfolios and global reach. Their strong focus on fiber optic and coaxial innovations supports demand from automotive, aerospace, and telecom industries. Large contracts and strategic partnerships allow them to influence market direction and set technological benchmarks.

Players like Aptiv, Corning Inc., and Nexans SA are also shaping the industry with advanced manufacturing and innovation. Their efforts in high-performance connectivity solutions are essential for sectors like 5G networks, renewable energy, and defense. These companies emphasize R&D to deliver lightweight, high-density, and reliable assemblies. Their ability to adapt to evolving industry needs helps them secure competitive advantages.

Smaller and specialized firms add to the market’s diversity and competitiveness. Companies such as Carrio Cabling Corp., BizLink Holding Inc., Fischer Connectors, and Minnesota Wire & Cable Co. focus on custom solutions tailored to client requirements. Meanwhile, Samtec Inc., Smiths Group Plc, and W. L. Gore & Associates Inc. stand out with expertise in connectors, RF systems, and high-performance cables.

Top Key Players in the Market

- Amphenol Corporation

- Aptiv

- BizLink Holding Inc

- Carrio Cabling Corp.

- Copartner Tech Corp.

- Corning Inc.

- Dongguan Luxshare Technology Co., Ltd.

- Fischer Connectors Holding SA

- Minnesota Wire & Cable Co.

- Nexans SA

- Prysmian Spa

- RF Industries Ltd.

- Samtec Inc.

- Smiths Group Plc

- TE Connectivity

- L. Gore & Associates Inc.

- Others

Recent Developments

- In April 2025, Pasternack launched new fibre optic cable assemblies available in both standard and custom lengths, targeting sectors such as telecommunications, data centers, military, and aerospace. The products emphasize speed, flexibility, and reliability to address the growing demand for high-performance connectivity.

- In March 2025, Cinch Connectivity Solutions introduced its first commercial off-the-shelf space assemblies manufactured in the United States. These cable assemblies are designed to meet 1% TML and 0.1% CVCM standards, ensuring durability in harsh space environments.

- In March 2024, Amphenol TPC Wire & Cable expanded its Custom Cable Assembly and Solution Center in Macedonia, Ohio, by 60%. The upgrade includes climate-controlled spaces and advanced automated testing equipment, such as a Formlabs SLA printer and Schleuniger Cut & Strip machine, to enhance production capabilities.

- In September 2024, Welltek reported that Luxshare Precision Industry had acquired a 51% stake in German wire harness supplier Leoni AG and a 100% interest in Leoni’s automotive cable unit. This strategic move is expected to enhance Luxshare’s competitiveness in the global automotive cable market.

Report Scope

Report Features Description Market Value (2024) USD 195.6 Bn Forecast Revenue (2034) USD 363.7 Bn CAGR(2025-2034) 6.4% Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type, (Power cable assemblies, Data cable assemblies, Signal cable assemblies, Ribbon cable assemblies, Custom cable assemblies, Coaxial cable assemblies, Others), By Industry Vertical, (Automotive, Telecommunications, Consumer Electronics, Aerospace & Defense, Healthcare, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amphenol Corporation, Aptiv, BizLink Holding Inc, Carrio Cabling Corp., Copartner Tech Corp., Corning Inc., Dongguan Luxshare Technology Co., Ltd., Fischer Connectors Holding SA, Minnesota Wire & Cable Co., Nexans SA, Prysmian Spa, RF Industries Ltd., Samtec Inc., Smiths Group Plc, TE Connectivity, W. L. Gore & Associates Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amphenol Corporation

- Aptiv

- BizLink Holding Inc

- Carrio Cabling Corp.

- Copartner Tech Corp.

- Corning Inc.

- Dongguan Luxshare Technology Co., Ltd.

- Fischer Connectors Holding SA

- Minnesota Wire & Cable Co.

- Nexans SA

- Prysmian Spa

- RF Industries Ltd.

- Samtec Inc.

- Smiths Group Plc

- TE Connectivity

- L. Gore & Associates Inc.

- Others