Global Business Jet Market Aircraft Type(Light Jets, Mid-size Jets, Large Jets, Airliner-based VIP Jets), By System (Propulsion System, Aero structure, Avionics, Cabin Interiors, Others ), By End-User (Operator and Private), By Ownership (Preowned, New-Deliveries), By Range (Short Range (< 2000 Nautical Miles), Medium Range (2000-5000 Nautical Miles), Long Range (>5000 Nautical Miles)), by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2023

- Report ID: 30205

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

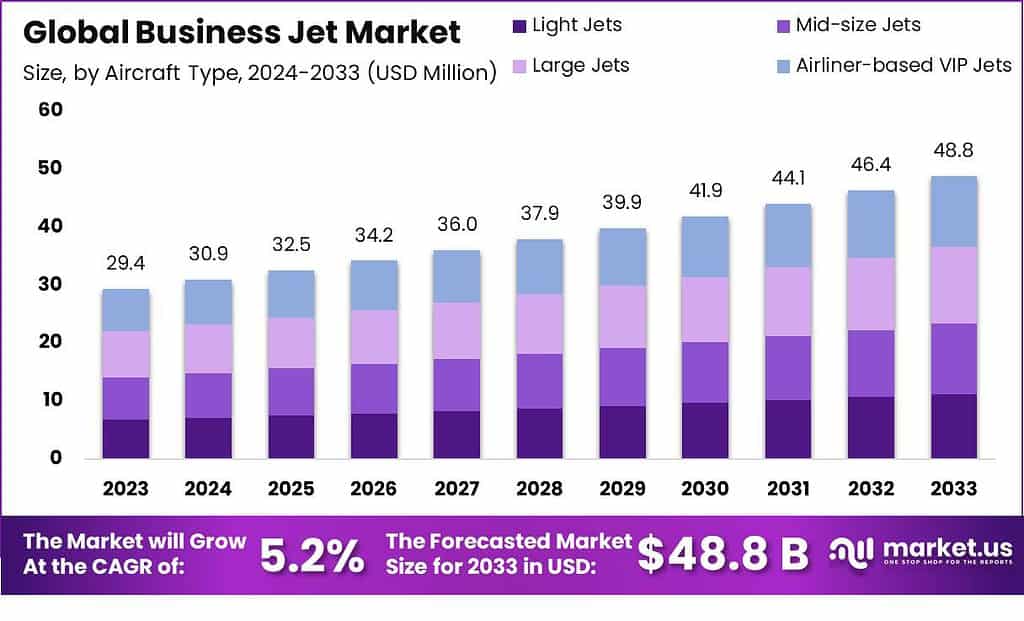

The Global Business Jet Market generated valued at USD 29.4 million in 2023 and is estimated to reach USD 48.8 Million by 2033, witnessing a CAGR of 5.2% from 2024 to 2033.

A business jet, also known as a corporate jet or executive jet, is a type of aircraft designed primarily for private business travel. It is specifically tailored to meet the needs of business executives, high-net-worth individuals, and government officials who require efficient and convenient transportation for their professional endeavors.

Business jets come in various sizes and configurations to meet a range of passenger capacities and travel needs, from light jets or very light jets that can seat 4-8 passengers to mid-size jets or large cabin jets that can hold 10-20 passengers or more. Some jets even boast transcontinental or intercontinental capabilities.

The business jet market refers to the industry involved in the manufacturing, sales, and operation of business jets or private aircraft designed for corporate and executive travel. It encompasses various players, including aircraft manufacturers, suppliers, service providers, and operators.

Note: Actual Numbers Might Vary In Final Report

Aircraft Type

In 2023, the business jet market witnessed a notable dominance of Large Jets, accounting for over 27% of the total market share. Large Jets, also known as heavy jets, emerged as the leading segment within the business jet market.

Large Jets cater to the needs of high-profile individuals, corporations, and government officials who prioritize spaciousness, range, and luxury in their air travel. These jets offer ample cabin space, allowing for comfortable seating arrangements and the inclusion of various amenities to enhance the passenger experience. The generous interior space enables customization options, transforming the cabin into a luxurious and productive environment.

One of the key factors contributing to the dominance of Large Jets is their long-range capabilities. These jets are designed to fly extended distances without the need for frequent refueling stops. This feature is particularly appealing to passengers who frequently travel on intercontinental or transoceanic routes. The ability to cover vast distances non-stop provides executives with time-saving advantages and flexibility in reaching their destinations efficiently.

Moreover, Large Jets often incorporate advanced avionics systems and cutting-edge technology. These features enhance the safety, navigation, and overall performance of the aircraft. Additionally, Large Jets are equipped with state-of-the-art connectivity solutions, enabling seamless communication and access to essential business tools during the flight.

Despite their higher operational costs compared to smaller jet categories, Large Jets offer a compelling value proposition to high-net-worth individuals and corporations that prioritize comfort, range, and prestige. These jets are often associated with a luxurious and exclusive travel experience, aligning with the preferences and requirements of the target market.

Looking ahead, the Large Jets segment is expected to maintain its dominance in the business jet market. The growing demand for long-range travel, the expansion of global business activities, and the desire for enhanced passenger comfort and productivity continue to drive the preference for Large Jets among discerning customers.

However, it is worth noting that the business jet market is diverse and caters to a range of customer preferences. Other segments such as Light Jets, Mid-size Jets, and Airliner-based VIP Jets also play significant roles in meeting the needs of different customer segments within the business jet market. These segments offer unique advantages such as cost-efficiency, versatility, and the ability to access smaller airports with limited infrastructure.

System Type

In 2023, the business jet market witnessed a significant dominance of the Propulsion System segment, which captured over 32% of the total market share. The Propulsion System emerged as the leading segment within the business jet market, reflecting its crucial role in the overall performance and efficiency of these aircraft.

The Propulsion System segment benefits from ongoing research and development efforts by engine manufacturers. These efforts focus on improving engine performance, durability, and reliability, ultimately enhancing the overall safety and operational efficiency of business jets. The continuous advancements in propulsion technology contribute to the market dominance of this segment.

While the Propulsion System segment holds a dominant position, it is important to acknowledge the significance of other segments within the business jet market. These include Aerostructure, Avionics, Cabin Interiors, and Others.

Aerostructures, including the airframe, wings, and other vital structural elements, play a pivotal role in defining an aircraft’s aerodynamic profile and overall durability. Despite facing robust competition, Aerostructures maintained a substantial presence in the market in 2023, signifying their critical role in aircraft design and performance.

Avionics, the high-tech nerve center of modern business jets, encompassing navigation systems, communication devices, and advanced cockpit instrumentation, secured a noteworthy market share. This segment reflects the industry’s dedication to safety, efficiency, and state-of-the-art technology.

The cabin interior is where luxury meets functionality, making it a pivotal factor in the business jet experience. In 2023, the Cabin Interiors segment captured attention, illustrating the importance placed on comfort, aesthetics, and customization by business jet owners.

The “Others” category encapsulates various systems and components vital for aircraft operation, such as fuel systems, landing gear, and auxiliary systems. While not as individually prominent as some other segments, the collective significance of these components cannot be overlooked.

End-User

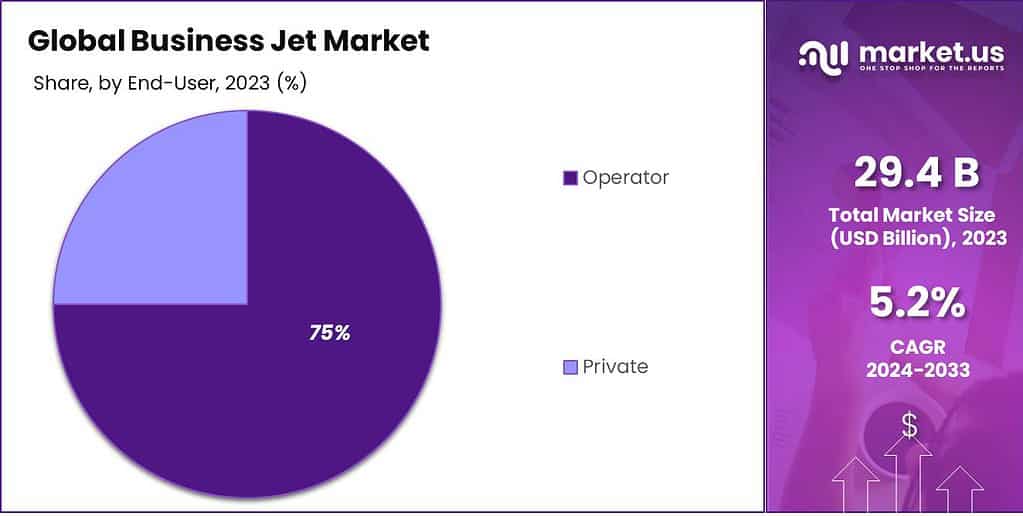

In 2023, the business jet market witnessed a significant dominance of the Operator segment, which captured over 75% of the total market share. The Operator segment emerged as the leading end-use segment within the business jet market, indicating its crucial role in the demand and utilization of these aircraft.

Operators, which encompass charter companies, fractional ownership programs, and air taxi services, played a pivotal role in shaping the market dynamics. Their dominance reflects the growing demand for business jet services, primarily driven by corporate travelers and individuals seeking efficient and flexible air travel solutions. Operators have successfully tapped into this demand, offering access to business jets without the complexities of ownership.

While Operators held the majority share, the Private segment maintained its significance within the Business Jet market. Private ownership of business jets, often preferred by high-net-worth individuals and corporations, continued to be a resilient presence. The allure of private ownership lies in the unparalleled benefits it offers, including complete control over the aircraft and the ability to tailor the travel experience to individual preferences. In 2023, this segment attracted those who valued exclusivity and sought a dedicated, personalized air travel solution.

Note: Actual Numbers Might Vary In Final Report

Ownership

In 2023, the Preowned segment emerged as the dominant force in the Business Jet market, securing a substantial market share of over 60%. Preowned business jets, also known as pre-owned or used jets, gained prominence as a preferred choice among buyers. This dominance can be attributed to several factors, including cost-effectiveness, availability of a wide range of models, and the opportunity for buyers to enter the market with reduced initial investment. The Preowned segment underscores the appeal of well-maintained, previously-owned business jets that continue to provide excellent performance and value.

While Preowned business jets took the lead, the New-Deliveries segment remained a notable part of the market. New-Deliveries refer to brand-new aircraft straight from the manufacturer. These jets appeal to buyers who prioritize the latest technology, customization options, and the assurance of a factory-fresh aircraft. In 2023, this segment maintained its significance, attracting buyers who seek the pinnacle of luxury, innovation, and personalization in their business jet experience.

Range

In 2023, the Medium Range segment asserted its dominance in the Business Jet market, securing a significant market share exceeding 55%. Medium Range business jets, characterized by their ability to cover distances ranging from 2000 to 5000 nautical miles, emerged as the preferred choice for many buyers. This dominance reflects their versatility in catering to a broad spectrum of travel needs, from regional to transcontinental flights. Medium Range jets strike a balance between range and cabin size, making them a pragmatic choice for both corporate and private users.

While Medium Range jets held the majority share, the Short Range segment remained a significant part of the market. These jets are optimized for distances of less than 2000 nautical miles, making them ideal for short-haul and regional travel. Their agility and cost-effectiveness continue to attract buyers who prioritize efficiency and convenience for shorter journeys.

In 2023, the Long Range segment, catering to ultra-long-haul travel needs exceeding 5000 nautical miles, retained its niche appeal. These jets are designed to cover extensive distances without the need for frequent refueling stops. Although their market share may not be as substantial as other segments, Long Range jets are sought after by those who require global connectivity and non-stop intercontinental travel capabilities.

Key Market Segments

Aircraft Type

- Light Jets

- Mid-size Jets

- Large Jets

- Airliner-based VIP Jets

System Type

- Propulsion System

- Aero structure

- Avionics

- Cabin Interiors

- Others

End-User

- Operator

- Private

Ownership

- Preowned

- New-Deliveries

Range

- Short Range (< 2000 Nautical Miles)

- Medium Range (2000-5000 Nautical Miles)

- Long Range (>5000 Nautical Miles)

Regional Analysis

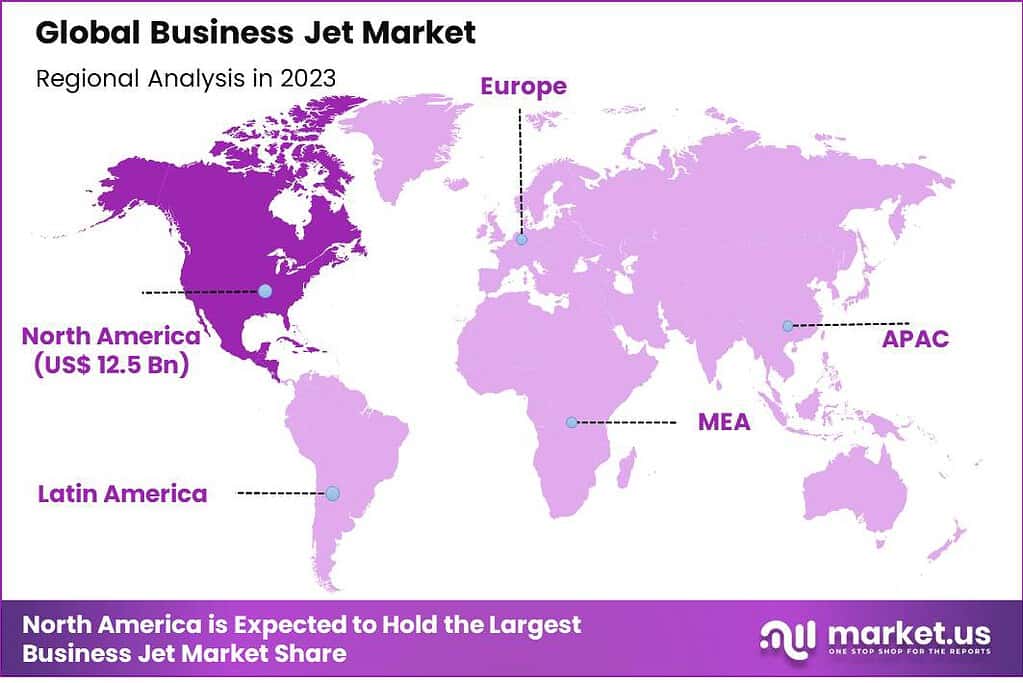

In 2023, North America established itself as the dominant force in the Business Jet market, securing a substantial market share of more than 42.5%. This region’s supremacy can be attributed to its robust economy, a high concentration of affluent individuals and corporations, and a strong culture of business aviation. North America’s continued leadership underscores its position as a key hub for business jet manufacturing, sales, and operations.

Europe remained a significant player in the Business Jet market in 2023, reflecting its affluent business community and extensive air travel infrastructure. While not surpassing North America, Europe maintained a notable market share. The region’s diverse customer base, spanning from Western Europe to emerging markets in the East, contributed to its enduring presence in the industry.

The Asia-Pacific region continued to exhibit promising growth prospects in the Business Jet market. While its market share in 2023 may not have been as substantial as North America and Europe, APAC showcased immense potential. Factors such as the region’s burgeoning economies, rising number of high-net-worth individuals, and increased corporate activities propelled its growth. APAC represented an emerging market, with increasing interest in business aviation.

In 2023, South America maintained its position in the Business Jet market, albeit with a smaller market share compared to the aforementioned regions. This region, characterized by its diverse geography and business landscape, attracted business jet buyers seeking access to its unique destinations and opportunities. South America’s market presence highlighted its relevance within the global business aviation sector.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The business jet market is marked by key players that play an instrumental role in shaping its landscape. These key players in the business jet market are leaders in aircraft manufacturing, innovation, and service provision. Let’s take a closer look at some of them:

Market Key Players

- Airbus SE

- Bombardier Inc.

- Cirrus Design Corporation

- Dassault Aviation

- Embraer

- General Dynamics Corporation

- Honda Motor Co. Ltd.

- Pilatus Aircraft Ltd

- Textron Inc.

- The Boeing Company

- Gulfstream Aerospace

- Spectrum Aeromed

- Other Key Players

Recent Development

- December 2022 – Kochi’s New Luxury Business Jet Terminal: The Indian government unveiled a brand-new luxury business jet terminal in Kochi, Kerala. What sets it apart is its remarkable proximity to the aircraft. Passengers can go from the car porch to the plane’s side in just about 100 meters. Plus, once they complete security and immigration procedures, they can reach their aircraft within two minutes. It’s all about efficiency and convenience.

- December 2022 – Gulfstream Aerospace Corp. and Rolls Royce joined forces to conduct a test flight for a business jet powered by eco-friendly aviation fuel, not only known for its long range capabilities but also for being eco-friendly. The test flight happened right at Gulfstream’s headquarters.

- July 2022 – IAI’s Role in Dassault Aviation’s Falcon 10X: Dassault Aviation chose Israel Aerospace Industries (IAI) to design and produce all-composite wing movable surfaces for their long-range Falcon 10X business jet. IAI is contributing to the design phase and helping meet the high demand for this impressive new aircraft.

- April 2022 – Textron’s Acquisition of Pipistrel: Textron Inc., a US-based aviation company, acquired Pipistrel for a substantial USD 235 million. This move aims to bolster Textron’s manufacturing and product development capabilities, with a focus on sustainable aircraft. Pipistrel, a Slovenian electric aircraft manufacturer, will operate under Textron’s new business segment called Textron eAviation.

Report Scope

Report Features Description Market Value (2023) US$ 29.4 Mn Forecast Revenue (2033) US$ 48.8 Mn CAGR (2023-2032) 5.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Aircraft Type(Light Jets, Mid-size Jets, Large Jets, Airliner-based VIP Jets), By System (Propulsion System, Aero structure, Avionics, Cabin Interiors, Others ), By End-User (Operator and Private), By Ownership (Preowned, New-Deliveries), By Range (Short Range (< 2000 Nautical Miles), Medium Range (2000-5000 Nautical Miles), Long Range (>5000 Nautical Miles)) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Airbus SE, Bombardier Inc., Cirrus Design Corporation, Dassault Aviation, Embraer, General Dynamics Corporation, Honda Motor Co. Ltd., Pilatus Aircraft Ltd, Textron Inc., The Boeing Company, Gulfstream Aerospace, Spectrum Aeromed, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Business Jet Market?The Business Jet Market refers to the industry that manufactures and operates business jets, which are aircraft designed for corporate and executive travel. This market encompasses the production, sale, and service of business jet aircraft.

What drives the demand for business jets?The demand for business jets is primarily driven by the need for efficient and flexible travel for business executives. Factors such as time-saving, privacy, and the ability to access remote airports contribute to this demand.

How big is Business Jet Market?The Global Business Jet Market generated valued at USD 329.4 million in 2023 and is estimated to reach USD 48.8 Million by 2033, witnessing a CAGR of 5.2% from 2024 to 2033.

Who are the major players in the Business Jet Market?Major manufacturers in the business jet market include companies like Airbus SE, Bombardier Inc., Cirrus Design Corporation, Dassault Aviation, Embraer, General Dynamics Corporation, Honda Motor Co. Ltd., Pilatus Aircraft Ltd, Textron Inc., The Boeing Company, Gulfstream Aerospace, Spectrum Aeromed, Other Key Players

What technological advancements have influenced the Business Jet Market?Technological advancements have led to more fuel-efficient engines, advanced avionics, improved cabin amenities, and enhanced safety features in business jets. These innovations cater to the evolving needs of business travelers.

-

-

- Airbus SE

- Bombardier Inc.

- Cirrus Design Corporation

- Dassault Aviation

- Embraer

- General Dynamics Corporation

- Honda Motor Co. Ltd.

- Pilatus Aircraft Ltd

- Textron Inc.

- The Boeing Company

- Gulfstream Aerospace

- Spectrum Aeromed

- Other Key Players