Global Bulk Aseptic Packaging Market Size, Share, Growth Analysis By Product Type (Aseptic Bags, Aseptic Cartons, Aseptic Containers, Aseptic Pouches), By Application (Dairy Products, Juices and Beverages, Soups and Sauces, Prepared Foods, Pharmaceuticals), By Material Type (Paperboard, Plastic, Aluminum, Composites), By End-User (Food Industry, Beverage Industry, Pharmaceutical Industry, Cosmetics Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170266

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

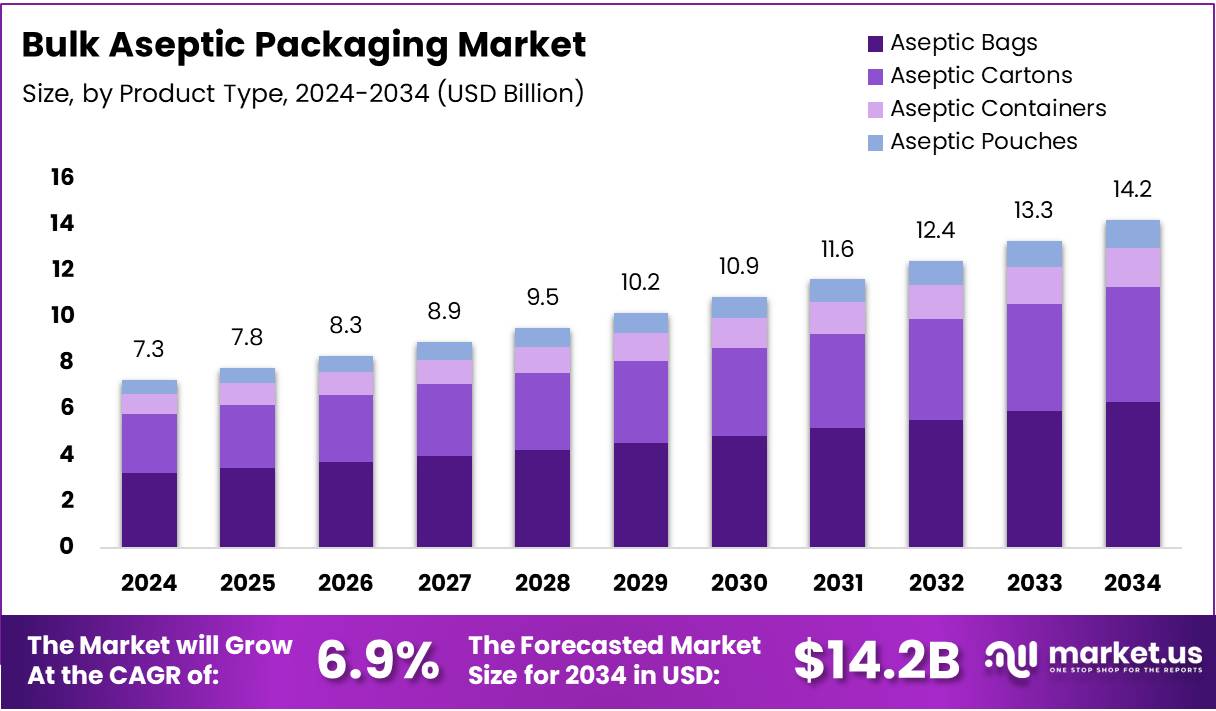

The Global Bulk Aseptic Packaging Market size is expected to be worth around USD 14.2 Billion by 2034, from USD 7.3 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

Bulk aseptic packaging refers to large-volume, sterilized containers designed to keep liquid foods, dairy, beverages, and pharmaceutical solutions safe without preservatives. It prevents microbial exposure during filling and transport, enabling long shelf life. This system supports efficient global supply chains where reliability, food protection, and ambient storage are increasingly expected by manufacturers.

The bulk aseptic packaging market continues expanding as companies prioritize safety, sustainability, and low-cost logistics. Moreover, rising demand for long-life dairy, plant-based beverages, and processed liquid foods accelerates adoption. The market benefits from sterile filling upgrades, material innovation, and stronger cross-border food distribution networks that depend on consistent product stability and packaging performance.

Growth strengthens as producers shift from refrigeration-dependent systems toward ambient-stable offerings. Additionally, expanding retail penetration in emerging markets drives demand for packaging that supports extended distribution cycles. Governments are also promoting modernization of food infrastructure, encouraging investments that upgrade aseptic processing capacity while reducing storage expenses and cold-chain dependency.

Opportunities rise as regulatory bodies emphasize food quality, waste reduction, and sustainable packaging. Consequently, manufacturers invest in renewable substrates, high-barrier materials, and enhanced temperature-resistant formats. Policy incentives supporting clean manufacturing and food safety certification also stimulate capital inflow, enabling more companies to adopt bulk aseptic packaging for higher efficiency and environmental compliance.

Regulatory momentum further supports adoption as authorities stress sterile standards and eco-friendly material usage. Therefore, markets experience a shift toward lighter, recyclable structures that improve operational efficiency. Sustainability commitments across food processors also influence demand, driving interest in solutions aligned with reduced carbon footprint, stronger safety protocols, and long-term material resilience.

According to research, Ultra-High-Temperature (UHT) treated products in aseptic packaging remain shelf-stable for ~6–9 months, compared with 7–14 days for refrigerated milk. Furthermore, 75–80% of standard aseptic carton packs come from renewable resources. Sector data also shows material composition includes 70% paper, 6% aluminum, and 24% low-density polyethylene, supporting sustainability goals.

Key Takeaways

- Global Bulk Aseptic Packaging Market size expected to reach USD 14.2 Billion by 2034 from USD 7.3 Billion in 2024, at a CAGR of 6.9%.

- Aseptic Bags lead the product segment with 44.6% market share due to flexibility and cost-effectiveness.

- Dairy Products dominate applications with 38.8% market share, driven by rising global milk consumption and extended shelf life needs.

- Paperboard is the leading material type with 42.7% market share for sustainability and barrier performance.

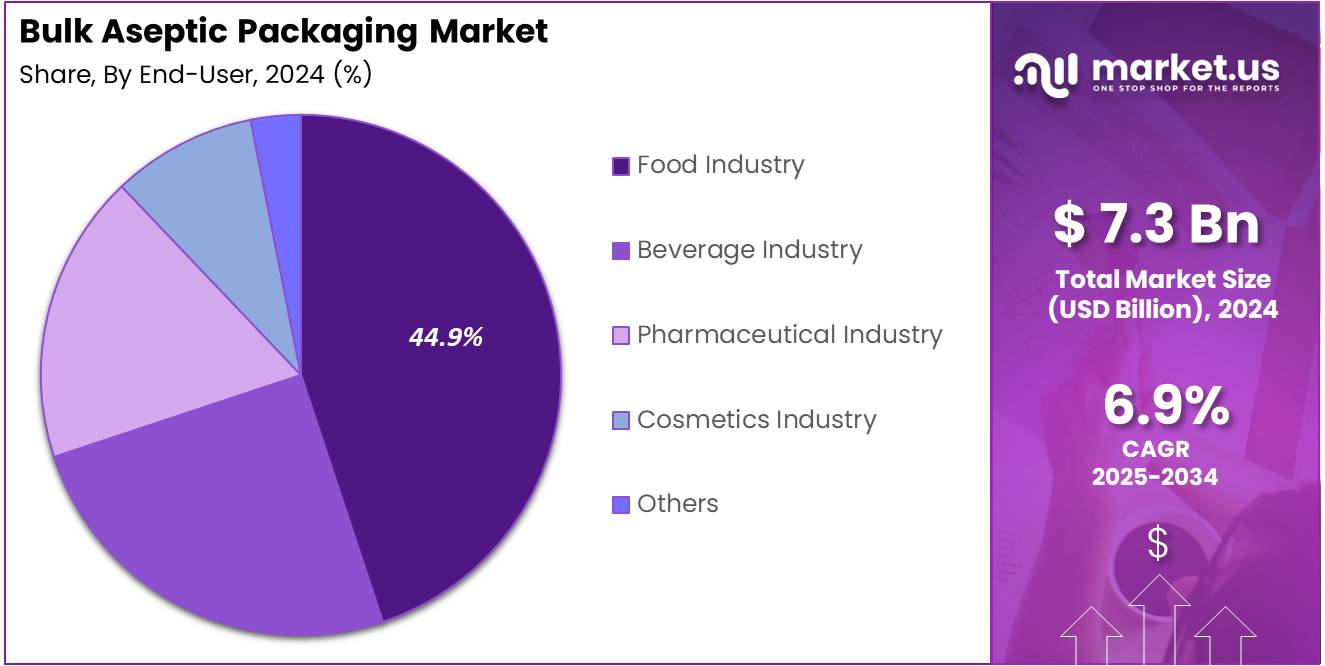

- Food Industry is the top end-user with 44.9% market share, reflecting broad adoption across multiple product categories.

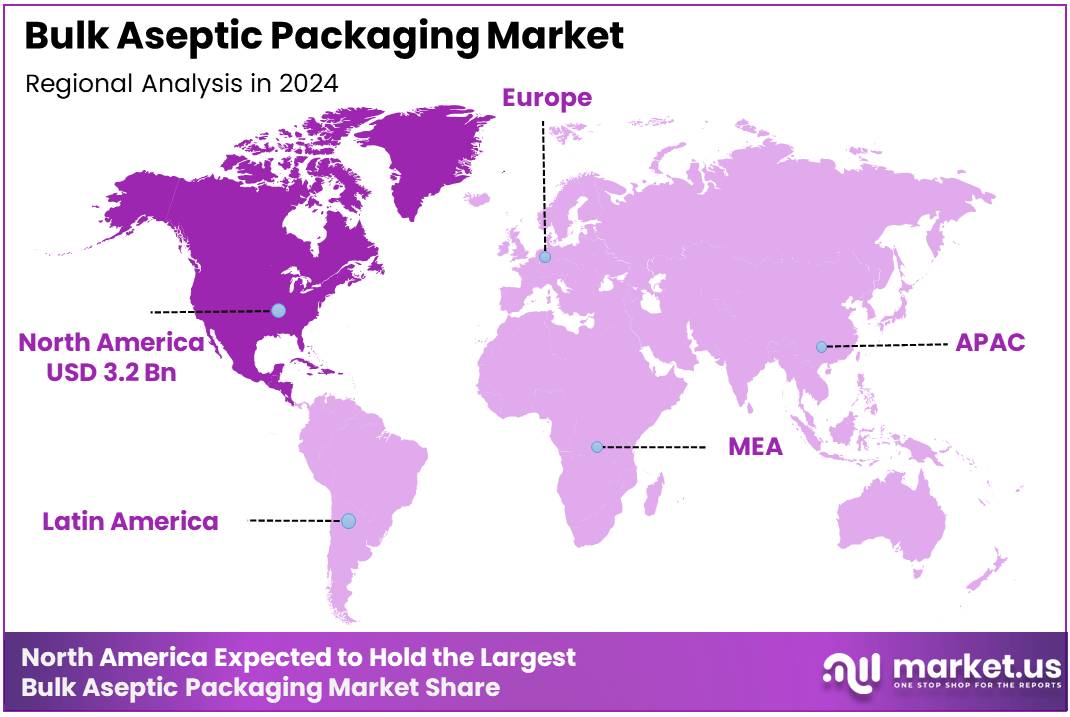

- North America holds a 44.8% market share, valued at USD 3.2 Billion, due to strong food and beverage industries and regulations.

Product Type Analysis

Aseptic Bags dominate with 44.6% due to their superior flexibility and cost-effectiveness in bulk storage solutions.

Aseptic Bags continue leading the bulk aseptic packaging market, capturing 44.6% market share in 2024. These bags offer exceptional versatility for storing liquid and semi-liquid products while maintaining sterility. Manufacturers prefer aseptic bags for their lightweight design, reduced transportation costs, and efficient space utilization during storage. The growing demand from dairy and beverage industries further strengthens their market position significantly.

Aseptic Cartons represent a significant segment, particularly favored for consumer-ready packaging solutions. These cartons provide excellent barrier properties against light, oxygen, and contamination, ensuring extended shelf life for sensitive products. The eco-friendly nature and recyclability of paperboard-based aseptic cartons appeal to environmentally conscious consumers and brands. Their convenient rectangular shape facilitates efficient distribution and retail display across various markets.

Aseptic Containers serve specialized industrial applications requiring rigid packaging solutions. These containers offer enhanced durability and protection for products during long-distance transportation and extended storage periods. Industries dealing with high-value products particularly appreciate the tamper-evident features and robust construction of aseptic containers. Their reusability potential also contributes to cost savings for large-scale operations.

Aseptic Pouches have gained traction in single-serve and portion-controlled packaging applications. These lightweight pouches provide convenience for on-the-go consumption while maintaining product integrity. The pharmaceutical and nutraceutical sectors increasingly adopt aseptic pouches for precise dosing and contamination prevention. Their compact design reduces packaging waste and appeals to sustainability-focused market segments.

Application Analysis

Dairy Products dominate with 38.8% due to increasing global milk consumption and extended shelf-life requirements.

Dairy Products hold the leading position with 38.8% market share in 2024, driven by rising demand for milk, yogurt, and cream products worldwide. Aseptic packaging technology enables dairy manufacturers to extend product shelf life without refrigeration, significantly reducing distribution costs. The ability to preserve nutritional value and taste without preservatives makes aseptic packaging ideal for dairy applications. Emerging markets particularly benefit from this technology, facilitating dairy product distribution in regions with limited cold chain infrastructure.

Juices and Beverages constitute a substantial application segment, experiencing steady growth across global markets. Consumers increasingly prefer naturally preserved juices without artificial additives, making aseptic packaging the perfect solution for maintaining freshness. The technology effectively protects sensitive vitamins and nutrients from degradation during storage and transportation. Premium juice brands leverage aseptic packaging to differentiate their products and command higher market prices.

Soups and Sauces benefit significantly from aseptic packaging technology, enabling ambient storage of ready-to-eat products. The convenience factor drives consumer adoption, particularly among busy urban populations seeking quick meal solutions. Aseptic processing maintains the authentic flavor profiles and textures that consumers expect from quality soup and sauce products. Foodservice operations increasingly utilize bulk aseptic packaging for efficient kitchen management and reduced waste.

Prepared Foods represent a growing application area as consumer lifestyles shift toward convenience-oriented meal solutions. Aseptic packaging allows manufacturers to offer chef-prepared quality products with extended shelf stability. The technology supports product innovation in ethnic cuisines and gourmet ready meals for diverse consumer preferences. Restaurant chains and catering services adopt aseptic packaging for consistent quality and operational efficiency.

Pharmaceuticals utilize aseptic packaging for maintaining sterility in liquid medications, nutritional supplements, and intravenous solutions. The stringent regulatory requirements for pharmaceutical packaging make aseptic technology essential for product safety and efficacy. This segment demands the highest quality standards, driving continuous innovation in packaging materials and processing techniques. The growing biopharmaceutical sector further expands opportunities for specialized aseptic packaging applications.

Material Type Analysis

Paperboard dominates with 42.7% due to its sustainability profile and excellent barrier properties when properly laminated.

Paperboard commands 42.7% market share in 2024, favored for its renewable nature and consumer appeal as an environmentally responsible packaging material. When combined with appropriate barrier coatings and laminates, paperboard provides exceptional protection against moisture, oxygen, and light contamination. Manufacturers appreciate its printability for vibrant branding and product information display on retail shelves. The established recycling infrastructure for paperboard materials further enhances its market attractiveness across developed economies.

Plastic materials remain essential for aseptic packaging applications requiring superior flexibility and puncture resistance. Polyethylene and polypropylene variants offer excellent chemical resistance and maintain integrity during thermal processing and storage. The lightweight nature of plastic packaging reduces transportation costs and carbon footprint throughout the supply chain. However, environmental concerns drive innovation toward bio-based and recyclable plastic alternatives in this segment.

Aluminum provides unmatched barrier properties, offering complete protection against light, oxygen, and moisture penetration. This material proves particularly valuable for products highly sensitive to oxidation and requiring extended shelf life. The premium positioning of aluminum packaging appeals to high-end product manufacturers seeking superior quality assurance. Its complete recyclability without quality degradation supports circular economy initiatives within the packaging industry.

Composites combine multiple material layers to optimize barrier performance, strength, and functionality for specific applications. These hybrid solutions balance the advantages of different materials while minimizing individual material limitations. Advanced composite technologies enable thinner packaging designs with maintained or improved protective properties. The pharmaceutical and specialty food sectors particularly benefit from customized composite formulations meeting stringent preservation requirements.

End-User Analysis

Food Industry dominates with 44.9% due to extensive applications across multiple product categories and global market expansion.

Food Industry leads with 44.9% market share in 2024, encompassing diverse product categories from dairy to prepared meals. The industry’s focus on food safety, extended shelf life, and reducing food waste drives widespread aseptic packaging adoption. Global population growth and changing dietary patterns create sustained demand for conveniently packaged food products. Manufacturers leverage aseptic technology to expand distribution networks into previously inaccessible markets without refrigeration infrastructure.

Beverage Industry represents a significant end-user segment, particularly for juices, plant-based drinks, and functional beverages. Consumer preferences for natural, preservative-free beverages align perfectly with aseptic packaging capabilities. The industry benefits from reduced production costs through ambient storage and extended distribution windows. Innovation in beverage formulations drives continued investment in advanced aseptic packaging technologies and equipment.

Pharmaceutical Industry demands the highest sterility standards, making aseptic packaging critical for liquid medications and biological products. Regulatory compliance requirements ensure consistent quality and safety throughout the product lifecycle. The growing biologics and biosimilars market expands opportunities for specialized pharmaceutical aseptic packaging solutions. Single-dose and pre-filled packaging formats gain popularity for improving patient compliance and reducing medication errors.

Cosmetics Industry increasingly adopts aseptic packaging for premium skincare and beauty products requiring preservative-free formulations. Consumers demand natural cosmetic products with extended stability, driving innovation in aseptic packaging applications. The technology enables brands to market clean beauty products while maintaining product efficacy and safety. Travel-sized and sample packaging formats benefit particularly from aseptic technology for maintaining product integrity.

Others include emerging applications in nutraceuticals, industrial chemicals, and specialty ingredients requiring contamination-free handling. These niche segments drive technological innovation and customized packaging solutions for unique product requirements. The expanding scope of aseptic packaging applications reflects its versatility and reliability across diverse industries. Cross-industry technology transfer accelerates development of novel packaging solutions addressing specific preservation challenges.

Key Market Segments

By Product Type

- Aseptic Bags

- Aseptic Cartons

- Aseptic Containers

- Aseptic Pouches

By Application

- Dairy Products

- Juices and Beverages

- Soups and Sauces

- Prepared Foods

- Pharmaceuticals

By Material Type

- Paperboard

- Plastic

- Aluminum

- Composites

By End-User

- Food Industry

- Beverage Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Others

Drivers

Strong Industry Push for Reduced Cold-Chain Dependence in Large-Volume Liquid Distribution

The bulk aseptic packaging market is growing as manufacturers seek to reduce expensive cold-chain logistics costs. Aseptic packaging keeps liquid products stable at room temperature for extended periods, eliminating refrigeration needs during storage and transportation. This makes operations more cost-effective and environmentally friendly.

Rising consumption of dairy and plant-based alternatives like almond milk and oat milk is driving demand for bulk aseptic solutions. These packages preserve freshness without preservatives while extending shelf life significantly, ensuring consistent product quality from production to end-users.

Manufacturing industries are increasingly prioritizing contamination-free transport of high-value liquid ingredients. Pharmaceutical, nutraceutical, and specialty food sectors require sterile packaging to protect sensitive materials during transit. Bulk aseptic packaging provides sealed, sterile environments that prevent microbial contamination and oxidation, maintaining ingredient integrity and meeting strict quality standards essential for premium liquid products.

Restraints

High Operational Complexity in Maintaining Large-Scale Sterile Processing Environments Restrains Market Expansion

The bulk aseptic packaging market faces significant challenges due to the complicated nature of running large sterile facilities. Companies must maintain extremely clean environments where no bacteria or germs can enter the packaging process. This requires expensive equipment, specially trained workers, and constant monitoring systems. Even small mistakes can ruin entire batches of products, leading to major financial losses.

Setting up these sterile processing areas demands substantial initial investment. Businesses need to install advanced filtration systems, temperature controls, and pressure monitoring devices. Regular maintenance and upgrades add to ongoing costs. Many small and medium-sized companies struggle to afford these requirements, which limits market participation.

Another major restraint is the lack of uniform global standards for aseptic packaging materials and compliance rules. Different countries have different regulations about what materials are safe and how packaging should be tested. This creates confusion for manufacturers operating in multiple markets. Companies must spend extra time and money to meet varying requirements across regions.

The absence of standardization also slows down innovation. Manufacturers hesitate to develop new packaging solutions because approval processes differ everywhere. This regulatory complexity increases production costs and delays product launches, ultimately restricting the bulk aseptic packaging market’s growth potential.

Growth Factors

Rapid Expansion of Aseptic Packaging in Bulk Nutraceutical and Functional Beverage Manufacturing Fuels Market Growth

The bulk aseptic packaging market is growing rapidly as nutraceutical and functional beverage manufacturers adopt these solutions to preserve sensitive ingredients like vitamins and probiotics without refrigeration. This packaging extends shelf life while maintaining product quality, making it ideal for health-focused products.

Global foodservice chains and industrial buyers increasingly demand long-shelf-life ingredients to optimize inventory and reduce waste. Bulk aseptic packaging enables safe storage and transport of liquid concentrates and beverage bases over extended periods, supporting efficient supply chain management.

High-volume production facilities are implementing automation-enabled bulk filling lines to boost efficiency and reduce contamination risks. These advanced systems integrate sterile filling and quality control, lowering labor costs while increasing output. This convergence creates substantial opportunities for packaging suppliers and food processors to develop innovative bulk aseptic solutions.

Emerging Trends

Rising Popularity of Lightweight Aseptic Bulk Containers to Reduce Logistics Costs Shapes Market Trends

The bulk aseptic packaging sector is shifting toward lightweight containers that significantly reduce transportation expenses. Flexible bag-in-box systems weigh less than traditional rigid containers while maintaining sterility, enabling larger volumes per shipment and improving profit margins.

Digital traceability tools are becoming standard for sterility validation. IoT sensors and blockchain technology now track temperature and seal integrity in real-time, providing complete transparency and ensuring regulatory compliance across international markets.

Sustainability concerns are driving adoption of high-barrier, mono-material aseptic films that simplify recycling. Unlike traditional multi-layer laminates, these single-material solutions maintain excellent barriers while meeting environmental regulations. The market is evolving toward smarter, more sustainable, and cost-effective bulk aseptic packaging solutions.

Regional Analysis

North America Dominates the Bulk Aseptic Packaging Market with a Market Share of 44.8%, Valued at USD 3.2 Billion

North America maintains its position as the dominant region in the bulk aseptic packaging market, commanding a substantial market share of 44.8% and accounting for USD 3.2 billion in market value. The region’s leadership is primarily driven by the robust presence of food and beverage processing industries, stringent food safety regulations, and high consumer demand for convenient, preservative-free products. The United States stands as the primary contributor, supported by advanced packaging infrastructure and strong investments in innovative aseptic packaging solutions.

Europe Bulk Aseptic Packaging Market Trends

Europe represents a significant market for bulk aseptic packaging, driven by the region’s well-established dairy industry and stringent EU regulations regarding food safety standards. The market growth is supported by substantial investments in sustainable packaging technologies and increasing consumer preference for organic and natural food products with extended shelf life across key countries including Germany, France, and the United Kingdom.

Asia Pacific Bulk Aseptic Packaging Market Trends

The Asia Pacific region is experiencing rapid growth in the bulk aseptic packaging market, fueled by expanding food and beverage industries, rising disposable incomes, and increasing urbanization across developing economies. Countries like China, India, and Japan are witnessing significant demand due to changing consumer lifestyles, growing awareness about food safety, and the region’s large population base coupled with expanding dairy and beverage sectors.

Middle East and Africa Bulk Aseptic Packaging Market Trends

The Middle East and Africa region demonstrates moderate but steady growth in the bulk aseptic packaging market, primarily driven by the expanding food processing industry and harsh climatic conditions that necessitate packaging solutions maintaining product quality without continuous refrigeration. The Gulf Cooperation Council countries and South Africa are leading the regional adoption, supported by growing retail infrastructure and government initiatives to reduce food import dependency.

Latin America Bulk Aseptic Packaging Market Trends

Latin America presents emerging opportunities in the bulk aseptic packaging market, driven by the region’s strong agricultural base and growing food processing capabilities. Countries such as Brazil, Mexico, and Argentina are leading market development, with the region’s tropical climate and inadequate cold chain infrastructure making aseptic packaging an attractive solution for maintaining product quality during distribution and export activities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bulk Aseptic Packaging Company Insights

Smurfit Kappa Group PLC maintains a dominant position in the bulk aseptic packaging sector, leveraging its extensive geographical footprint and integrated business model to serve diverse industries including food and beverage. The company’s commitment to sustainable packaging solutions and continuous investment in research and development have enabled it to meet evolving customer demands while maintaining operational efficiency across its global network.

DS Smith Plc has emerged as a formidable competitor through its focus on circular economy principles and innovative packaging designs that prioritize recyclability and resource optimization. The company’s strategic partnerships with major brands and its ability to provide customized bulk aseptic solutions have strengthened its market positioning, particularly in the European region where sustainability regulations continue to tighten.

Aran Group distinguishes itself through specialized expertise in flexible packaging solutions for the bulk aseptic segment, offering advanced barrier technologies that ensure product integrity and extended shelf life. The company’s agile manufacturing capabilities and customer-centric approach have facilitated strong relationships with pharmaceutical and nutraceutical industries seeking reliable aseptic packaging systems.

Goglio S.p.A. has carved a niche in the market through its proprietary technologies and decades of experience in aseptic packaging applications. The company’s emphasis on automation and smart packaging solutions positions it well to capitalize on growing demand from emerging markets where bulk aseptic packaging adoption is accelerating across various industrial applications.

Top Key Players in the Market

- Smurfit Kappa Group PLC

- DS Smith Plc

- Aran Group

- Goglio S.p.A.

- Liqui-Box Corporation

- Vine valley Ventures LLC

- CDF Corporation

- TPS Rental Systems Ltd.

- Amcor Plc

Recent Developments

- In July 2025, SIG launched the world’s first 1-liter aseptic carton using its Terra Alu-free + Full Barrier material. This innovation eliminates the aluminum layer to further reduce the carbon footprint and promote sustainability in packaging.

- In March 2025, Corvaglia Group presented the SabreCap, its first closure designed specifically for aseptic carton packaging. This new product aims to enhance sealing efficiency and extend the shelf life of packaged beverages.

- In April 2024, Baldwin Richardson Foods (BRF) acquired Pennsauken Packing Company, significantly expanding its aseptic beverage manufacturing capabilities. The acquisition provides BRF with a state-of-the-art facility to boost production efficiency and product quality.

- In June 2024, Syntegon announced the acquisition of Telstar, strengthening its capabilities in pharmaceutical processing and packaging. The deal focuses on enhancing expertise in lyophilized vial filling and high-precision pharmaceutical solutions.

Report Scope

Report Features Description Market Value (2024) USD 7.3 Billion Forecast Revenue (2034) USD 14.2 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Aseptic Bags, Aseptic Cartons, Aseptic Containers, Aseptic Pouches), By Application (Dairy Products, Juices and Beverages, Soups and Sauces, Prepared Foods, Pharmaceuticals), By Material Type (Paperboard, Plastic, Aluminum, Composites), By End-User (Food Industry, Beverage Industry, Pharmaceutical Industry, Cosmetics Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Smurfit Kappa Group PLC, DS Smith Plc, Aran Group, Goglio S.p.A., Liqui-Box Corporation, Vine valley Ventures LLC, CDF Corporation, TPS Rental Systems Ltd., Amcor Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bulk Aseptic Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bulk Aseptic Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smurfit Kappa Group PLC

- DS Smith Plc

- Aran Group

- Goglio S.p.A.

- Liqui-Box Corporation

- Vine valley Ventures LLC

- CDF Corporation

- TPS Rental Systems Ltd.

- Amcor Plc